Professional Documents

Culture Documents

Offer Price Premium

Uploaded by

imtehan_chowdhuryCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Offer Price Premium

Uploaded by

imtehan_chowdhuryCopyright:

Available Formats

MALEK SPINNING MILLS LIMITED

/MALEK SPINNING MILLS LIMITED MALEK SPINNING MILLS LIMITED _

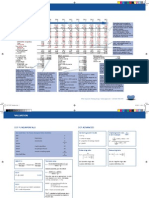

ii) Earning Based Value per share (iv) Projected Book Value Based Price Per Share Section The company's operational performance and financial results reflect its growth, financial strength, earning and Accounting year end date Projected Book per Price X ofValue Offering prospects that help investors in makingDetermination informed investment decision. The operational and financial results are share summarized as follows:

(in Taka) The issue price at Tk 25.00 (including premium of Tk 15.00 each) is justified as per the guidelines of the Securities and 301" June 2010 (9 months' period) 30.14 Exchange Commission as detailed below: Financial Years Turnover Net Profit Paid-up EPS (Tk) 1 30 " - June 2011 29.84 (mn Tk) AfterTax Capital Tk 10 1 (Position on 30Asset " - June 2012per Share 30.02 Net Value 30th June) (mn Tk) (mn Tk) basis 1 30 - June 2013 stock of Malek Spinning Mills 30.64 The offering of"the common Ltd has been determined by assessing the Net Asset Value (NAV). The 1 financial calculations below are from the audited accounts of 30 " September 2009. Average presented NAV 30.16

(i)

(v) Si No

2004-05 904.09 Average market price of similar stocks Particulars

29.45

Company Name Rahim Textile Apex Spinning Current Assets 2005-06 1,869.35 65.22 Cash and Bank balances 2006-07 1,996.43 Same 75.59 Basis of selecting company Same management product line 'A' Category Turnover 260.977 close to Advances and Deposits company MSML 0 2 Receivables 700.620 2007-08 2,349.81 113.80100.00 70 1.6 Face value (a) 100.00 100.00 10.00 Raw materials and Finished goods Inventories, Stores and A 673.609 0 3 Closing Prices spares etc 2008-09 2,369.93 183.99 70 2.6 Investments Jun '09 NetJuly' Fixed Assets Ave ra ge 5 Yea rs (2004 09of Aug '09 Sep '09 05 To 2008-09) 1231.00 1350.00 1,897.92 1287.75 593.25

30 0.9 Amount in million 0 8 Taka Prime Textile Square Textile 30 2.1 95.853 0 7 30 2.5

93.61625.50 955.00

322.25 1.9 Total 360.50 Assets 9

231.50 3

380.017 95.90 1,736.462 92.30 3,847.538 91.20

1749.75 1206.75 422.25 96.90 Current Liabilities Oct 109 1536.25 993.25 418.00 111.40 776.146 Short Term Bank loan Nov '09 1874.25 1132.00 418.75 108.50 The weighted average net profit after tax for the last 5 (five) years 2004-05 To 2008-09 stands at Tk 93.611 million Income tax payable 48.109 Average and theclosing weighted price average (b) EPS stands at Tk. 1.99. 1505.83 The Price Earning 917.62 Multiple (PE) at issue 362.21 price of Tk. 25.00 99.37 each B Workersof Profit Participation Fund 43.485 (including a multiplier premium Tk. 15.00 per share) stands at PE 12.56 as against the overall DSE PE of 25.00 in November Market value (a/b) 15.06 9.18 3.62 9.94 2009. Accounts and expenses payable 508.034 Average Market value 9.45 If we consider the share price on the basis of DSE overall price earning multiple of 25.00, the earning based41.813 value Long Term Bank Loan multiplier of shares of the Company at average EPS of 1.99 stands at Tk. 49.75, a price much higher than the price offered. Total Liabilities 1,417.587 From the above it is clear that market price of prospective similar companies of textile sector are on average 9.45 times higher iii) Projected Earning Based Value Per Share than that of its face value. Based on this, we may assume that share prices of Malek Spinning Mills Ltd. would be Tk 94.50. C Net Assets (A-8) 2,429.951 D No. of Shares 70,000,000 Period Projected Earnings per share From the foregoing as summed up below the determination of the offer price Tk.25.00 each is quite justified. (in Taka) E Net Asset Value per Share (C/D) 34.71 Justification of offering price under different methods 2009-10 (9 months) 1.27 Amount (Taka)

2010-11 0.98 We have examined the above calculation of Net Asset Value (NAV) of Malek Spinning Mills Limited which appears to be correct 01 Net asset Value (NAV) per share 34.71 2011-12 1.92 02 Earning Based Value per Share 51.04 2012-13 2.62 03 Projected Earning Based Value Per Share 46.42 Dhaka EPS of 3 yrs and 9 months 1.81 04 Projected Average Book Value Per Share 30.16

05 Average Market Price of Similar Shares 94.50 29"' 2010 (M.A. Malek Siddique Wali & Co) Chartered TheMarch weighted average EPS of the Company for next 3 (three) years and 9 (nine) months, 2009-10 (Oct '09 to Jun '10) Accountants to Average 51.36 2012-13 stands at Tk. 1.81. If we consider the share price of the Company on the basis of DSE overall price earning multiple of 25.65 (DSE Monthly Review, December 2009), the earning based value per share of the Company stands Sd/

at Tk. 46.42, a price much higher than the price

offered. From the above analysis, it appears that the ordinary share of Tk.10.00 being offered at Tk.25.00 each (including a premium of Tk. 15.00 per share) by the Company is quite justified. (Md. Waliullah, FCA)

Prospectus

You might also like

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Ashok LeylandDocument13 pagesAshok LeylandNeha GuptaNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Equity Valuation: Capital and Money Markets AssignmentDocument5 pagesEquity Valuation: Capital and Money Markets AssignmentSudip BainNo ratings yet

- Balance Sheet of GTL: Unsecured LoansDocument7 pagesBalance Sheet of GTL: Unsecured LoansMeryl FernsNo ratings yet

- Hero Motocorp: Previous YearsDocument11 pagesHero Motocorp: Previous YearssalimsidNo ratings yet

- KFA Published Results March 2011Document3 pagesKFA Published Results March 2011Abhay AgarwalNo ratings yet

- Questions For Advanced AccountingDocument3 pagesQuestions For Advanced AccountingHelena ThomasNo ratings yet

- Share Price: Rs.3024.80Document8 pagesShare Price: Rs.3024.80Anshul BansalNo ratings yet

- Tata Steel Vs JSW SteelDocument12 pagesTata Steel Vs JSW SteelAshok NkNo ratings yet

- Oman Cement Company (OCC) : Global Research Result Update Equity - Oman Cement Sector 29 May, 2012Document5 pagesOman Cement Company (OCC) : Global Research Result Update Equity - Oman Cement Sector 29 May, 2012Venkatakrishnan IyerNo ratings yet

- East African Breweries Ltd. (EABL) - A Business & Financial AnalysisDocument16 pagesEast African Breweries Ltd. (EABL) - A Business & Financial AnalysisPatrick Kiragu Mwangi BA, BSc., MA, ACSINo ratings yet

- EMSCFIN-FARDocument37 pagesEMSCFIN-FARPuwanachandran KaniegahNo ratings yet

- Tata Steel 1Document12 pagesTata Steel 1Dhwani ShahNo ratings yet

- CA Ipcc AssignmentDocument17 pagesCA Ipcc AssignmentjesurajajosephNo ratings yet

- Macro Perspective: Pakistan Leasing Year Book 2009Document7 pagesMacro Perspective: Pakistan Leasing Year Book 2009atifch88No ratings yet

- Concept Questions: Chapter Five Accrual Accounting and Valuation: Pricing Book ValuesDocument41 pagesConcept Questions: Chapter Five Accrual Accounting and Valuation: Pricing Book Valuesamina_alsayegh50% (2)

- FM Ceat CompanyDocument13 pagesFM Ceat CompanyManu K AnujanNo ratings yet

- Trend Analysis of Ultratech Cement - Aditya Birla Group.Document9 pagesTrend Analysis of Ultratech Cement - Aditya Birla Group.Kanhay VishariaNo ratings yet

- CAPMDocument5 pagesCAPMpraveenbtech430No ratings yet

- RP - CF1 - Financial Analysis and PlanningDocument22 pagesRP - CF1 - Financial Analysis and PlanningSamyu KNo ratings yet

- Inancing Ecisions: Unit - I: Cost of Capital Answer Weighted Average Cost of CapitalDocument15 pagesInancing Ecisions: Unit - I: Cost of Capital Answer Weighted Average Cost of Capitalanon_672065362No ratings yet

- ICICI Financial AnalysisDocument13 pagesICICI Financial AnalysisAkhil MahajanNo ratings yet

- DCF TakeawaysDocument2 pagesDCF TakeawaysvrkasturiNo ratings yet

- Fundamental Analysis-BHEL - Equity Research ReportDocument5 pagesFundamental Analysis-BHEL - Equity Research ReportChrisNo ratings yet

- Steel Industry: A Project ReportDocument13 pagesSteel Industry: A Project ReportVijendra SinghNo ratings yet

- Ratio Analysis Tata MotorsDocument8 pagesRatio Analysis Tata Motorssadafkhan21No ratings yet

- Bajaj Auto Financial Analysis: Presented byDocument20 pagesBajaj Auto Financial Analysis: Presented byMayank_Gupta_1995No ratings yet

- Paper 11Document51 pagesPaper 11eshwarsapNo ratings yet

- Aditya Aggarwal Metal, Metal Products & Mining Naveen Tanvi Nitin Ganapule 11020841151 Shruti Mehta 11020841110Document15 pagesAditya Aggarwal Metal, Metal Products & Mining Naveen Tanvi Nitin Ganapule 11020841151 Shruti Mehta 11020841110Nitin R GanapuleNo ratings yet

- Financial Analysis of Tata Steel & Steel Authority of India Ltd. (Sail)Document12 pagesFinancial Analysis of Tata Steel & Steel Authority of India Ltd. (Sail)Simran SethiNo ratings yet

- Advanced Financial Accounting & Reporting AnswerDocument13 pagesAdvanced Financial Accounting & Reporting AnswerMyat Zar GyiNo ratings yet

- FCFE Analysis of TATA SteelDocument8 pagesFCFE Analysis of TATA SteelJobin Jose KadavilNo ratings yet

- Rakon Announcement 14 Feb 08Document6 pagesRakon Announcement 14 Feb 08Peter CorbanNo ratings yet

- Accounts AssignmentDocument7 pagesAccounts AssignmentHari PrasaadhNo ratings yet

- SFMSOLUTIONS Master Minds PDFDocument10 pagesSFMSOLUTIONS Master Minds PDFHari KrishnaNo ratings yet

- CMM Assignment - 2Document36 pagesCMM Assignment - 2Mithilesh SinghNo ratings yet

- Cost of Capital of ITCDocument24 pagesCost of Capital of ITCMadhusudan PartaniNo ratings yet

- KFA - Published Unaudited Results - Sep 30, 2011Document3 pagesKFA - Published Unaudited Results - Sep 30, 2011Chintan VyasNo ratings yet

- Shree Cement: Performance HighlightsDocument10 pagesShree Cement: Performance HighlightsAngel BrokingNo ratings yet

- 120 Resource November 1991 To November 2006Document174 pages120 Resource November 1991 To November 2006Bharat MendirattaNo ratings yet

- Automotive Axles 2Q SY 2013Document10 pagesAutomotive Axles 2Q SY 2013Angel BrokingNo ratings yet

- Rambling Souls - Axis Bank - Equity ReportDocument11 pagesRambling Souls - Axis Bank - Equity ReportSrikanth Kumar KonduriNo ratings yet

- By Investing Primarily in Equity Oriented Securities.: Fund TypeDocument5 pagesBy Investing Primarily in Equity Oriented Securities.: Fund TypeAjaya SharmaNo ratings yet

- Unaudited Condensed Consolidated Income Statements For The Second Quarter Ended 30 June 2009Document4 pagesUnaudited Condensed Consolidated Income Statements For The Second Quarter Ended 30 June 2009James WarrenNo ratings yet

- Tanjung Offshore: Turning Attractive Upgrade To BuyDocument4 pagesTanjung Offshore: Turning Attractive Upgrade To Buykhlis81No ratings yet

- SIEMENS Analysis of Financial StatementDocument16 pagesSIEMENS Analysis of Financial StatementNeelofar Saeed100% (1)

- Ratio Analysis (Group 5-Glc - Ib)Document53 pagesRatio Analysis (Group 5-Glc - Ib)Nikam PranitNo ratings yet

- Prosperity Weaving Mills LTDDocument3 pagesProsperity Weaving Mills LTDumer165No ratings yet

- Financial Management 1Document36 pagesFinancial Management 1nirmljnNo ratings yet

- 395 37 Solutions Case Studies 4 Time Value Money Case Solutions Chapter 4 FMDocument13 pages395 37 Solutions Case Studies 4 Time Value Money Case Solutions Chapter 4 FMblazeweaver67% (3)

- AuditedStandaloneFinancialresults 31stmarch, 201111121123230510Document2 pagesAuditedStandaloneFinancialresults 31stmarch, 201111121123230510Kruti PawarNo ratings yet

- Indian Oil Corporation Project 2Document30 pagesIndian Oil Corporation Project 2Rishika GoelNo ratings yet

- Bil Quarter 2 ResultsDocument2 pagesBil Quarter 2 Resultspvenkatesh19779434No ratings yet

- Combined Factsheet Nov11Document17 pagesCombined Factsheet Nov11friendrocks20079017No ratings yet

- Lec 5.1Document4 pagesLec 5.1sqshah080No ratings yet

- HKICPA QP Exam (Module A) Sep2004 AnswerDocument14 pagesHKICPA QP Exam (Module A) Sep2004 Answercynthia tsuiNo ratings yet

- MArcentile Bank Full Review AssignmentDocument5 pagesMArcentile Bank Full Review AssignmentJonaed Ashek Md. RobinNo ratings yet

- CapStrTheo&Policy Assignment PiyushDocument28 pagesCapStrTheo&Policy Assignment PiyushPiyush ChandakNo ratings yet

- BWFF 2023Document21 pagesBWFF 2023Skuan TanNo ratings yet

- Meeting Minutes 24.03.13Document2 pagesMeeting Minutes 24.03.13imtehan_chowdhuryNo ratings yet

- D TestDocument11 pagesD Testimtehan_chowdhuryNo ratings yet

- RecepieDocument1 pageRecepieimtehan_chowdhuryNo ratings yet

- APC311 January 2013 AssignmentDocument5 pagesAPC311 January 2013 Assignmentimtehan_chowdhuryNo ratings yet

- Determination of Offering PriceDocument1 pageDetermination of Offering Priceimtehan_chowdhuryNo ratings yet

- Tangible AssetsDocument1 pageTangible Assetsimtehan_chowdhuryNo ratings yet

- Assignment On BaringsDocument10 pagesAssignment On Baringsimtehan_chowdhuryNo ratings yet

- Vocabs Practice2Document8 pagesVocabs Practice2imtehan_chowdhuryNo ratings yet

- Letter of Transmittal: Subject: Submission of Term PaperDocument5 pagesLetter of Transmittal: Subject: Submission of Term Paperimtehan_chowdhuryNo ratings yet

- Vocabs Practice3Document2 pagesVocabs Practice3imtehan_chowdhuryNo ratings yet

- Research ProposalDocument2 pagesResearch Proposalimtehan_chowdhuryNo ratings yet

- Students Helpline BD. COM: Gantt ChartDocument1 pageStudents Helpline BD. COM: Gantt Chartimtehan_chowdhuryNo ratings yet

- Manager To IssueDocument1 pageManager To Issueimtehan_chowdhuryNo ratings yet

- Assignments Presentation Slides Term Paper Case Studies Solution Research Proposal Abstract Writing Internship Report Avrb HVMV HVM KiybtDocument1 pageAssignments Presentation Slides Term Paper Case Studies Solution Research Proposal Abstract Writing Internship Report Avrb HVMV HVM Kiybtimtehan_chowdhuryNo ratings yet

- Tele MarketingDocument17 pagesTele Marketingimtehan_chowdhuryNo ratings yet

- Et - 1Document7 pagesEt - 1imtehan_chowdhuryNo ratings yet

- Tutorials: English For Admission Tests & Competitive ExamsDocument1 pageTutorials: English For Admission Tests & Competitive Examsimtehan_chowdhuryNo ratings yet

- AnalogyDocument4 pagesAnalogyimtehan_chowdhury100% (2)

- Pin Pointing ErrorsDocument5 pagesPin Pointing Errorsimtehan_chowdhuryNo ratings yet

- Special Topics Zone: Monetary PolicyDocument6 pagesSpecial Topics Zone: Monetary Policyimtehan_chowdhuryNo ratings yet

- Content BooksDocument5 pagesContent Booksimtehan_chowdhuryNo ratings yet

- Williams, 2002 SolutionDocument16 pagesWilliams, 2002 Solutionimtehan_chowdhury0% (3)

- FIN 508 Textbook August 2016 PDFDocument281 pagesFIN 508 Textbook August 2016 PDFSyed Hurr0% (1)

- Corporations Law Tort LiabilityDocument11 pagesCorporations Law Tort Liabilitysoccer_nz7No ratings yet

- Credit Rating in BangladeshDocument74 pagesCredit Rating in BangladeshHussainul Islam SajibNo ratings yet

- Unit I - Working Capital PolicyDocument16 pagesUnit I - Working Capital Policyjaskahlon92No ratings yet

- Finacc 3 Question Set BDocument9 pagesFinacc 3 Question Set BEza Joy ClaveriasNo ratings yet

- Cash FlowDocument12 pagesCash FlowalguienNo ratings yet

- Strong Vs Repide Case DigestDocument3 pagesStrong Vs Repide Case DigestHariette Kim TiongsonNo ratings yet

- Disini StartUpGuide InteractiveDocument19 pagesDisini StartUpGuide InteractiveDammy VegaNo ratings yet

- Atkins 2014Document188 pagesAtkins 2014rajeshNo ratings yet

- Banking MCQsDocument20 pagesBanking MCQsWaqar Nisar100% (2)

- Filed Complaint - OcoroDocument36 pagesFiled Complaint - OcoroAnonymous Pb39klJNo ratings yet

- EDP Renewaldes North America Tax Equity Financial Asset Rotation UVAF1757Document28 pagesEDP Renewaldes North America Tax Equity Financial Asset Rotation UVAF1757Kryon CloudNo ratings yet

- Srilanka Position PaperDocument6 pagesSrilanka Position PaperSibiya Zaman AdibaNo ratings yet

- India Aerospace & Defence Sector ReportDocument132 pagesIndia Aerospace & Defence Sector ReportManish KayalNo ratings yet

- Superseding IndictmentDocument25 pagesSuperseding Indictmentjmaglich1No ratings yet

- BRC (Company Law - Group 6)Document13 pagesBRC (Company Law - Group 6)UditaNo ratings yet

- Case 2 AuditDocument8 pagesCase 2 AuditReinhard BosNo ratings yet

- Ais CH5Document30 pagesAis CH5MosabAbuKhater100% (1)

- Project in Birla Sun LifeDocument27 pagesProject in Birla Sun LifeRenny M PNo ratings yet

- Preliminary Topic Five - Financial MarketsDocument12 pagesPreliminary Topic Five - Financial MarketsBaro LeeNo ratings yet

- Peachtree Plumbing Valuation ReportDocument40 pagesPeachtree Plumbing Valuation ReportBobYu100% (1)

- SMEDA Polo T-Shirts Stitching UnitDocument24 pagesSMEDA Polo T-Shirts Stitching UnitMuhammad Noman0% (1)

- 2019 Level 1 CFASDocument8 pages2019 Level 1 CFASMary Angeline LopezNo ratings yet

- BKM9e-Answers-Chap003-Margin and Short Extra QuestionsDocument3 pagesBKM9e-Answers-Chap003-Margin and Short Extra QuestionsLê Chấn PhongNo ratings yet

- Gujarat Textile Policy 2012Document15 pagesGujarat Textile Policy 2012Michael KingNo ratings yet

- PRELIM EXAM - International BusinessDocument3 pagesPRELIM EXAM - International BusinessVel June100% (2)

- Macroeconomics Debate Final - Keynes Fiscal Stimulus PresentationDocument24 pagesMacroeconomics Debate Final - Keynes Fiscal Stimulus Presentationapi-438130972No ratings yet

- Baji Rout BrochureDocument12 pagesBaji Rout Brochureparul vyasNo ratings yet

- Managerial Theories of FirmDocument12 pagesManagerial Theories of Firmkishorereddy_btech100% (1)

- Fundamentals of Accounting 1 and 2Document8 pagesFundamentals of Accounting 1 and 2CPALawyer01286% (7)

- The Ruler's Guide: China's Greatest Emperor and His Timeless Secrets of SuccessFrom EverandThe Ruler's Guide: China's Greatest Emperor and His Timeless Secrets of SuccessRating: 4.5 out of 5 stars4.5/5 (14)

- Artificial Intelligence: The Insights You Need from Harvard Business ReviewFrom EverandArtificial Intelligence: The Insights You Need from Harvard Business ReviewRating: 4.5 out of 5 stars4.5/5 (104)

- HBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)From EverandHBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)Rating: 4.5 out of 5 stars4.5/5 (11)

- Scaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0From EverandScaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0Rating: 5 out of 5 stars5/5 (1)

- Sales Pitch: How to Craft a Story to Stand Out and WinFrom EverandSales Pitch: How to Craft a Story to Stand Out and WinRating: 4.5 out of 5 stars4.5/5 (2)

- Generative AI: The Insights You Need from Harvard Business ReviewFrom EverandGenerative AI: The Insights You Need from Harvard Business ReviewRating: 4.5 out of 5 stars4.5/5 (2)

- How to Grow Your Small Business: A 6-Step Plan to Help Your Business Take OffFrom EverandHow to Grow Your Small Business: A 6-Step Plan to Help Your Business Take OffRating: 5 out of 5 stars5/5 (61)

- The Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerFrom EverandThe Toyota Way (Second Edition): 14 Management Principles from the World's Greatest ManufacturerRating: 4 out of 5 stars4/5 (121)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsFrom EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsRating: 5 out of 5 stars5/5 (48)

- Elevate: The Three Disciplines of Advanced Strategic ThinkingFrom EverandElevate: The Three Disciplines of Advanced Strategic ThinkingRating: 4.5 out of 5 stars4.5/5 (3)

- Summary of Richard Rumelt's Good Strategy Bad StrategyFrom EverandSummary of Richard Rumelt's Good Strategy Bad StrategyRating: 5 out of 5 stars5/5 (1)

- Small Business For Dummies: 5th EditionFrom EverandSmall Business For Dummies: 5th EditionRating: 4.5 out of 5 stars4.5/5 (10)

- Create the Future: Tactics for Disruptive ThinkingFrom EverandCreate the Future: Tactics for Disruptive ThinkingRating: 5 out of 5 stars5/5 (1)

- Lean Thinking: Banish Waste and Create Wealth in Your Corporation, 2nd EdFrom EverandLean Thinking: Banish Waste and Create Wealth in Your Corporation, 2nd EdRating: 4.5 out of 5 stars4.5/5 (17)

- Learn and Understand Business AnalysisFrom EverandLearn and Understand Business AnalysisRating: 4.5 out of 5 stars4.5/5 (31)

- Blue Ocean Strategy, Expanded Edition: How to Create Uncontested Market Space and Make the Competition IrrelevantFrom EverandBlue Ocean Strategy, Expanded Edition: How to Create Uncontested Market Space and Make the Competition IrrelevantRating: 4 out of 5 stars4/5 (387)

- HBR's 10 Must Reads on AI, Analytics, and the New Machine AgeFrom EverandHBR's 10 Must Reads on AI, Analytics, and the New Machine AgeRating: 4.5 out of 5 stars4.5/5 (69)

- How to Grow Your Small Business: A 6-Step Plan to Help Your Business Take OffFrom EverandHow to Grow Your Small Business: A 6-Step Plan to Help Your Business Take OffRating: 4 out of 5 stars4/5 (1)

- 2022-2023 Price Action Trading Guide for Beginners in 45 MinutesFrom Everand2022-2023 Price Action Trading Guide for Beginners in 45 MinutesRating: 4.5 out of 5 stars4.5/5 (4)

- Strategic Analytics: The Insights You Need from Harvard Business ReviewFrom EverandStrategic Analytics: The Insights You Need from Harvard Business ReviewRating: 4.5 out of 5 stars4.5/5 (46)

- Your Creative Mind: How to Disrupt Your Thinking, Abandon Your Comfort Zone, and Develop Bold New StrategiesFrom EverandYour Creative Mind: How to Disrupt Your Thinking, Abandon Your Comfort Zone, and Develop Bold New StrategiesRating: 4 out of 5 stars4/5 (10)

- The 10X Rule: The Only Difference Between Success and FailureFrom EverandThe 10X Rule: The Only Difference Between Success and FailureRating: 4.5 out of 5 stars4.5/5 (289)

- Strategy Skills: Techniques to Sharpen the Mind of the StrategistFrom EverandStrategy Skills: Techniques to Sharpen the Mind of the StrategistRating: 4 out of 5 stars4/5 (5)

- Systems Thinking: A Guide to Strategic Planning, Problem Solving, and Creating Lasting Results for Your BusinessFrom EverandSystems Thinking: A Guide to Strategic Planning, Problem Solving, and Creating Lasting Results for Your BusinessRating: 4.5 out of 5 stars4.5/5 (80)

- The 22 Laws of Category Design: Name & Claim Your Niche, Share Your POV, And Move The World From Where It Is To Somewhere DifferentFrom EverandThe 22 Laws of Category Design: Name & Claim Your Niche, Share Your POV, And Move The World From Where It Is To Somewhere DifferentNo ratings yet