Professional Documents

Culture Documents

Tax - Cta Cases

Uploaded by

Marife Tubilag ManejaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax - Cta Cases

Uploaded by

Marife Tubilag ManejaCopyright:

Available Formats

G.R. No. 163445 December 18, 2007 Asia International Auctioneers, Inc. vs.

Parayno Facts: Petitioners Asia International Auctioneers, Inc. (AIAI) and Subic Bay Motors Corporation are corporations organized under Philippine laws with principal place of business within the SSEZ. They are engaged in the importation of mainly secondhand or used motor vehicles and heavy transportation or construction equipment which they sell to the public through auction. Petitioners filed a complaint before the RTC of Olongapo City, praying for the nullification of RMC No. 31-2003 for being unconstitutional and an ultra vires act. RMC No. 31-2003 was issued on June 3, 2003 by then CIR Guillermo L. Parayno, Jr., setting the "Uniform Guidelines on the Taxation of Imported Motor Vehicles through the Subic Free Port Zone and Other Freeport Zones that are Sold at Public Auction." The complaint was docketed as Civil Case No. 275-0-2003 and raffled to Branch 74. Subsequently, petitioners filed their "First Amended Complaint to Declare Void, Ultra Vires, and Unconstitutional [RMC] No. 31-2003 dated June 3, 2003 and [RMC] No. 32-2003 dated June 5, 2003, with Application for a Writ of Temporary Restraining Order and Preliminary Injunction" to enjoin respondents from implementing the questioned RMCs while the case is pending. On August 1, 2003, the trial court issued its order granting the application for a writ of preliminary injunction. Consequently, respondents CIR, the BIR Regional Director of Region III, the BIR Revenue District Officer of the SSEZ, and the OSG filed with the CA a petition for certiorari under Rule 65 of the Rules of Court with prayer for the issuance of a Temporary Restraining Order and/or Writ of Preliminary Injunction to enjoin the trial court from exercising jurisdiction over the case. The CA granted the petition and declared the RTC bereft of jurisdiction to take cognizance of the civil case filed by petitioners. Issue: Whether the trial court has jurisdiction to hear a case to declare RMCs uncostitutional and against an existing law where the challenge does not involve rate and figures of the imposed taxes. Held: The trial court has no jurisdiction. R.A. No. 1125, as amended, states: Sec. 7. Jurisdiction.The Court of Tax Appeals shall exercise exclusive appellate jurisdiction to review by appeal, as herein provided (1) Decisions of the Commissioner of Internal Revenue in cases involving disputed assessments, refunds of internal revenue taxes, fees or other charges, penalties imposed in relation thereto, or other matters arising under the National Internal Revenue Code or other laws or part of law administered by the Bureau of Internal Revenue; x x x We have held that RMCs are considered administrative rulings which are issued from time to time by the CIR. In the case at bar, the assailed revenue regulations and revenue memorandum circulars are actually rulings or opinions of the CIR on the tax treatment of motor vehicles sold at public auction within the SSEZ to implement Section 12 of R.A. No. 7227 (Bases Conversion and Development Act) which provides that "exportation or removal of goods from the territory of the

[SSEZ] to the other parts of the Philippine territory shall be subject to customs duties and taxes under the Customs and Tariff Code and other relevant tax laws of the Philippines." They were issued pursuant to the power of the CIR under Section 4 of the National Internal Revenue Code (Power of the Commissioner to Interpret Tax Laws and to Decide Tax Cases). Petitioners failure to ask the CIR for a reconsideration of the assailed revenue regulations and RMCs is another reason why the instant case should be dismissed. It is settled that the premature invocation of the court's intervention is fatal to one's cause of action. If a remedy within the administrative machinery can still be resorted to by giving the administrative officer every opportunity to decide on a matter that comes within his jurisdiction, then such remedy must first be exhausted before the court's power of judicial review can be sought. The party with an administrative remedy must not only initiate the prescribed administrative procedure to obtain relief but also pursue it to its appropriate conclusion before seeking judicial intervention in order to give the administrative agency an opportunity to decide the matter itself correctly and prevent unnecessary and premature resort to the court.

COMMISSIONER OF INTERNAL REVENUE, Petitioner, -versus- MANILA ELECTRIC COMPANY, Respondent. G.R. No. 121666 October 10, 2007

Facts:

Manila Electric Company (Meralco) had been paying a 2% franchise tax based on its gross receipts, in lieu of all other taxes and assessments of whatever nature. Upon the effectivity of Executive Order No. 72 on February 10, 1987, however, respondent became subject to the payment of regular corporate income tax.

Meralco filed on April 15, 1988 its tentative income tax reflecting a refundable amount of P101,897,741, but only P77,931,812 was applied as tax credit.

An investigation was conducted by Revenue Officer Frederick Capitan which showed that Meralco was liable for 1.deficiency income tax in the amount of P2,340,902.52; and 2. deficiency franchise tax in the amount of P2,838,335.84.

On April 17, 1989, Meralco filed an amended final corporate Income Tax Return reflecting a refundable amount of P107,649,729. Meralco thus filed a letter-claim for refund or credit. CIR not having acted on its request, Meralco filed a judicial claim for refund or credit with the CTA.

It is gathered that respondent paid the deficiency franchise tax in the amount of P2,838,335.84. It protested the payment of the alleged deficiency income tax and claimed as an alternative remedy the deduction thereof from its claim for refund or credit.

CTA found for Meralco. It ordered petitioner to refund or, in the alternative, issue a tax credit certificate in favor of respondent the sum of P107,649,729.00 representing overpaid income taxes for the years 1987 and 1988.

Petitioner thus elevated the case to the CA which affirmed the CTAs decision.

Issue:

Whether or not the appellate court failed to consider respondents failure to substantiate by positive evidence its entitlement to a tax refund or credit in the amount of P107,649,729, and merely relied on the tax courts decision.

Held:

Section 69 provides, if the sum of the quarterly tax payments made during a taxable year is not equal to the total tax due on the entire taxable income of that year as shown in its final adjustment return, the corporation has the option to either: (a) pay the excess tax still due, or (b) be refunded the excess amount paid. The returns submitted are merely pre-audited which consist mainly of checking mathematical accuracy of the figures in the return. After such checking, the purpose of which being to insure prompt action on corporate annual income tax returns showing refundable amounts arising from overpaid quarterly income taxes, the refund or tax credit is granted.

As found by the tax court, however, the deficiency franchise tax was already paid by meralco, whereas the deficiency income tax was protested by meralco which wanted the same to be

deducted from its present claim. settled.

It appears that the deficiency income tax had already been

The issue of whether respondent adduced sufficient evidence to prove its entitlement to a refund is a question of fact. The tax court and the appellate court found respondents claim for tax refund or credit meritorious on the basis of the testimonial and documentary evidence adduced by the parties.

CIR did not dispute the validity and authenticity of Meralcos quarterly income tax returns as well as the final adjustment returns for the years 1987 and 1988 and proofs of payment of its tax liabilities. Neither did CIR refute Meralcos assertion that CIR failed to cross-examine Meralcos accountant who testified on the returns, and to object to Meralcos offer of evidence which included its quarterly and final adjustment returns and proofs of payment of its tax liabilities.

It is doctrinal that the factual findings of the CTA, when supported by substantial evidence, will not be disturbed on appeal, unless it is shown that it committed gross error in the appreciation of facts. Hence, SC will not set aside the conclusion reached by the said court, especially if affirmed by the CA.

The petition is dismissed.

Filinvest Development Corp. vs. CIR and CTA No. 146941 August 9, 2007 Facts:

G.R.

Petitioner Filinvest filed with respondent CIR a claim for refund, or in the alternative, the issuance of a tax credit certificate (TCC), in the amount of P 4,178,134.00 representing excess creditable withholding taxes for taxable years 1994, 1995 and 1996. The CIR had not resolved petitioners claim. When the 2-year prescriptive period was about to lapse, the latter filed a Petition for Review with the CTA praying for said refund or the issuance of a TCC, except for 1994 as it was already barred by prescription. On August 13, 1999, the CTA dismissed the petition for insufficiency of evidence because petitioner failed to present its 1997 Income tax return (ITR), which would help the court determine if petitioner indeed applied or credited the refundable amount to its 1997 tax liability, if there were any. MR was also denied. Subsequently, petitioner filed for a Petition for Review before the CA but

was also dismissed for failure to attach the proof of authority of Efren Reyes, who executed the Certification of non-forum shopping, to sign for the corporation. On August 18, 2000, the CA denied the petitioner for lack of merit. Petitioner filed a petition for review before the SC but was denied. MR is subsequently filed which the SC granted. Hence, this petition for review.

Issue: Whether or not petitioner is entitled to the tax refund or tax credit it seeks.

Held: The SC ruled in the affirmative. The CA erred in ruling that petitioner failed to discharge the burden of proving that it is entitled to the refund because of the latters failure to attach its 1997 ITR as the appellate court itself acknowledged that petitioner had complied with the requirements to sustain a claim for tax refund or credit, in accordance to RR No. 12-94, sec. 10. By exercising CIRs power to examine and verify petitioners claim for tax exemption as granted by law, respondent CIR could have easily verified petitioners claim by presenting the latters 1997 ITR, the original of which it has in its files. However, records show that in the proceedings before the CTA, CIR failed to comment on petitioners formal offer of evidence, waived its right to present its own evidence, and failed to file its memorandum. No one shall unjustly enrich itself at the expense of another. Hence, the harsh power of taxation must be tempered with evenhandedness. Hence, under the principle of solution indebiti, the Government has to restore to petitioner the sums representing erroneous payments of taxes. Petition is GRANTED.

CTA Case # 4

PHILIPPINE NATIONAL BANK, petitioner, vs. COMMISSIONER OF INTERNAL REVENUE, respondent. G.R. No. 158175. October 18, 2007

FACTS: For the eight taxable quarters for the period June 30, 1994 up to March 31, 1996, petitioner filed its Quarterly Percentage Tax Returns and paid the corresponding 5% gross receipts tax (GRT) on

its gross receipts, inclusive of interest income derived from investments, deposits and loans which were already subjected to the 20% final withholding tax (FWT).

On July 19, 1996, petitioner filed amended Quarterly Percentage Tax Returns for the said taxable quarters excluding the 20% FWT resulting to overpayment of P17,504,775.48, invoking CTA Case No. 4720, entitled Asian Bank Corporation v. Commissioner of Internal Revenue, promulgated on January 30, 1996, wherein the tax court ruled that the 20% FWT on interest income should not form part of the bank's taxable gross receipts for GRT purposes [Note: The CTA held in this case that the ruling is in accord with the interpretation of the SC in the case entitled CIR vs Manila Jockey Club, 108 Phil 821].

Petitioner filed a written claim for tax refund or credit of P17,504,775.48 with the CIR and a petition for review with the CTA in order to toll the running of the two-year prescriptive period to judicially claim for the refund of overpaid GRT for the taxable quarters ending June 30, 1994 and September 30, 1994. The CTA granted the refund that was reversed by the CA on appeal. The CA held that the 20% FWT on interest income should be included in petitioner's taxable gross receipts for GRT purposes.

ISSUE: What is the weight of authority of CTA rulings?

HELD: The highest court ruled that the general rule is that CTA rulings will not be disturbed on appeal as long as the CTA does not commit gross error in the appreciation of facts. But in this case, the CTA relied erroneously on Manila Jockey Club, Inc., thus, its pronouncement that the 20% FWT on interest income of banks should not form part of the taxable gross receipts subject to GRT cannot be sustained.

In Manila Jockey Club, Inc., it was held that the term "gross receipts" shall not include money which, although delivered, has been especially earmarked by law or regulation for some person other than the taxpayer. What happened in Manila Jockey Club, Inc. is earmarking and not withholding. Earmarking is different from withholding. Amounts earmarked, whether delivered or received, do not form part of gross receipts, because these are by law or regulation reserved for some person other than the taxpayer. On the contrary, amounts withheld form part of gross

receipts because these are in the constructive possession of the income earner and not subject to any reservation, the withholding agent, being merely, a conduit in the collection process.

In a catena of cases, the court categorically ruled that the 20% FWT on a bank's interest income forms part of the taxable gross receipts for purposes of computing the 5% GRT. The 5% GRT, as imposed by Section 119 (now Section 121) of the Tax Code, by its nature applies to all the receipts without any deduction, unless otherwise provided by law. Any deduction, exemption or exclusion from gross receipts is inconsistent with the policy of the law and is not normally allowed in a gross receipts tax, to maintain simplicity in tax collection, and to assure a steady source of state revenue even during periods of economic slowdown. It also changes the result and meaning of gross receipts to net receipts.

RIZAL COMMERCIAL BANKING CORPORATION vs. COMMISSIONER OF INTERNAL REVENUE 522 SCRA 144 April 24, 2007

FACTS:

For resolution is petitioners Motion for Reconsideration of our Decision1 dated June 16, 2006 affirming the Decision of the Court of Tax Appeals En Banc dated June 7, 2005 in C.T.A. EB No. 50, which affirmed the Resolutions of the Court of Tax Appeals Second Division dated May 3, 2004 and November 5, 2004 in C.T.A. Case No. 6475, denying petitioners Petition for Relief from Judgment and Motion for Reconsideration, respectively.

Petitioner claimed that its former counsels failure to file petition for review with the Court of Tax Appeals within the period set by Section 228 of the National Internal Revenue Code of 1997 (NIRC) was excusable. It alleged that the counsels secretary misplaced the Resolution hence the counsel was not aware of its issuance and that it had become final and executory. Petitioner also argued that, in the interest of substantial justice, the instant case should be re-opened considering that it was allegedly not accorded its day in court when the Court of Tax Appeals dismissed its petition for review for late filing. It claimed that rules of procedure are intended to help secure, not override, substantial justice. Petitioner also raised the issue of prescription for the first time in the instant motion for reconsideration. Although the same was raised in the petition for review, it was dismissed for late filing. No motion for reconsideration was filed.

ISSUES: 1. 2. Whether or not the failure of petitioners counsel to file a petition for review was excusable. Whether or not the petitioner timely filed its petition for review before the CTA.

HELD:

First Issue

Relief cannot be granted on the flimsy excuse that the failure to appeal was due to the neglect of petitioners counsel. Otherwise, all that a losing party would do to salvage his case would be to invoke neglect or mistake of his counsel as a ground for reversing or setting aside the adverse judgment, thereby putting no end to litigation.

Negligence to be "excusable" must be one which ordinary diligence and prudence could not have guarded against and by reason of which the rights of an aggrieved party have probably been impaired. Petitioners former counsels omission could hardly be characterized as excusable, much less unavoidable.

The Court has repeatedly admonished lawyers to adopt a system whereby they can always receive promptly judicial notices and pleadings intended for them. Apparently, petitioners counsel was not only remiss in complying with this admonition but he also failed to check periodically, as an act of prudence and diligence, the status of the pending case before the CTA Second Division. The fact that counsel allegedly had not renewed the employment of his secretary, thereby making the latter no longer attentive or focused on her work, did not relieve him of his responsibilities to his client. It is a problem personal to him which should not in any manner interfere with his professional commitments.

Second Issue

It is clear that the jurisdiction of the Court of Tax Appeals has been expanded to include not only decisions or rulings but inaction as well of the Commissioner of Internal Revenue. The decisions, rulings or inaction of the Commissioner are necessary in order to vest the Court of Tax Appeals with jurisdiction to entertain the appeal, provided it is filed within 30 days after the receipt of such

decision or ruling, or within 30 days after the expiration of the 180-day period fixed by law for the Commissioner to act on the disputed assessments. This 30-day period within which to file an appeal is jurisdictional and failure to comply therewith would bar the appeal and deprive the Court of Tax Appeals of its jurisdiction to entertain and determine the correctness of the assessments. Such period is not merely directory but mandatory and it is beyond the power of the courts to extend the same.

In case the Commissioner failed to act on the disputed assessment within the 180-day period from date of submission of documents, a taxpayer can either: 1) file a petition for review with the Court of Tax Appeals within 30 days after the expiration of the 180-day period; or 2) await the final decision of the Commissioner on the disputed assessments and appeal such final decision to the Court of Tax Appeals within 30 days after receipt of a copy of such decision. However, these options are mutually exclusive, and resort to one bars the application of the other.

In the instant case, the Commissioner failed to act on the disputed assessment within 180 days from date of submission of documents. Thus, petitioner opted to file a petition for review before the Court of Tax Appeals. Unfortunately, the petition for review was filed out of time, i.e., it was filed more than 30 days after the lapse of the 180-day period. Consequently, it was dismissed by the Court of Tax Appeals for late filing. Petitioner did not file a motion for reconsideration or make an appeal; hence, the disputed assessment became final, demandable and executory.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Legal and Judicial FormsDocument1,531 pagesLegal and Judicial FormsMarife Tubilag Maneja67% (3)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Advance Legal WritingDocument563 pagesAdvance Legal WritingMarife Tubilag Maneja100% (5)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Brondial NotesDocument48 pagesBrondial NotesMarife Tubilag Maneja100% (2)

- Motion To Compel DiscoveryDocument4 pagesMotion To Compel DiscoveryRoy WardenNo ratings yet

- SababanMagicNotes TaxationLaw1Document46 pagesSababanMagicNotes TaxationLaw1Marife Tubilag Maneja100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Civil ProcedureDocument150 pagesCivil ProcedureMarife Tubilag Maneja100% (4)

- Civil ProcedureDocument150 pagesCivil ProcedureMarife Tubilag Maneja100% (4)

- Order of Detention: in The United States District Court For The District of Puerto RicoDocument2 pagesOrder of Detention: in The United States District Court For The District of Puerto RicoMetro Puerto RicoNo ratings yet

- Juv & Dom Rel Dist Ct ProcDocument208 pagesJuv & Dom Rel Dist Ct ProcRobert GermanoNo ratings yet

- A.M. No. 09-6-8-SC Rules of Procedure For Environmental CasesDocument8 pagesA.M. No. 09-6-8-SC Rules of Procedure For Environmental CasesMarife Tubilag ManejaNo ratings yet

- A.M. No. 09-6-8-SC Rules of Procedure For Environmental CasesDocument8 pagesA.M. No. 09-6-8-SC Rules of Procedure For Environmental CasesMarife Tubilag ManejaNo ratings yet

- Order of Intestate SuccessionDocument3 pagesOrder of Intestate Successiondiyesa100% (2)

- Razon JR vs. TagitisDocument6 pagesRazon JR vs. Tagitisgianfranco0613100% (1)

- Razon JR vs. TagitisDocument6 pagesRazon JR vs. Tagitisgianfranco0613100% (1)

- Contracts Case DigestsDocument29 pagesContracts Case DigestsMarife Tubilag ManejaNo ratings yet

- Dutch Mover's owners liable for illegal dismissalDocument5 pagesDutch Mover's owners liable for illegal dismissalLex CabilteNo ratings yet

- People v. Callao and AmadDocument18 pagesPeople v. Callao and AmadNeil SubacNo ratings yet

- Bar Exam Questions on Special Writs of Amparo and Habeas DataDocument3 pagesBar Exam Questions on Special Writs of Amparo and Habeas DataMarife Tubilag Maneja100% (1)

- Brondial Notes - Rule 39 - Provisional Remedies - Special Civil ActionsDocument63 pagesBrondial Notes - Rule 39 - Provisional Remedies - Special Civil ActionsMarife Tubilag Maneja100% (1)

- Appellate Handbook 1Document290 pagesAppellate Handbook 1Anqous Cosby100% (1)

- Report On Legal Medicine PowerpointDocument31 pagesReport On Legal Medicine PowerpointMarife Tubilag Maneja100% (1)

- Carlos Paulo Bartolome y Ilagan Et Al V People of The PhilDocument1 pageCarlos Paulo Bartolome y Ilagan Et Al V People of The PhilAlexir MendozaNo ratings yet

- StatConDigest - Amadora vs. CA, GR L-47745 (15 April 1988)Document1 pageStatConDigest - Amadora vs. CA, GR L-47745 (15 April 1988)Lu CasNo ratings yet

- Cancellation of Civil Status Entries Under Rule 108 When No Marriage Took PlaceDocument2 pagesCancellation of Civil Status Entries Under Rule 108 When No Marriage Took PlaceRenzErwinGozum50% (2)

- Judaff - Alice SantosDocument5 pagesJudaff - Alice SantosbananayellowsharpieNo ratings yet

- CoverletterDocument22 pagesCoverletterMarife Tubilag ManejaNo ratings yet

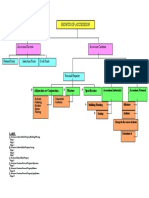

- Right of AccessionDocument1 pageRight of AccessionMarife Tubilag ManejaNo ratings yet

- Property 455 and 453Document1 pageProperty 455 and 453Marife Tubilag ManejaNo ratings yet

- Landowner Rights Building Materials Own LandDocument1 pageLandowner Rights Building Materials Own LandMarife Tubilag ManejaNo ratings yet

- 1 - Habeas Corpus Lecture 2015-11-27Document5 pages1 - Habeas Corpus Lecture 2015-11-27Marife Tubilag ManejaNo ratings yet

- Consolidated Cases For Contracts - 2.0Document27 pagesConsolidated Cases For Contracts - 2.0Marife Tubilag ManejaNo ratings yet

- MarriageDocument1 pageMarriageMarife Tubilag ManejaNo ratings yet

- @WPC vs. JMCDocument7 pages@WPC vs. JMCMarife Tubilag ManejaNo ratings yet

- WillsDocument13 pagesWillsMarife Tubilag ManejaNo ratings yet

- Rem 2 - Latest CasesDocument10 pagesRem 2 - Latest CasesMarife Tubilag ManejaNo ratings yet

- Civ2 2013 DigestsDocument29 pagesCiv2 2013 DigestsMarife Tubilag ManejaNo ratings yet

- Update On Remedial LawDocument24 pagesUpdate On Remedial Lawjojitus0% (1)

- List of Legal Documents and MotionsDocument22 pagesList of Legal Documents and MotionsMarife Tubilag ManejaNo ratings yet

- Outline in PersonsDocument30 pagesOutline in PersonsAices SalvadorNo ratings yet

- Plaza vs. LustivaDocument6 pagesPlaza vs. LustivaMarife Tubilag ManejaNo ratings yet

- Judge disciplined for probating forged will in English of illiterate testatrixDocument4 pagesJudge disciplined for probating forged will in English of illiterate testatrixRonz RoganNo ratings yet

- Monfort Hermanos Agricultural Development Corp. v. Antonio Monfort III, 2004Document6 pagesMonfort Hermanos Agricultural Development Corp. v. Antonio Monfort III, 2004Randy Sioson100% (1)

- Labor dispute over cancelled seafarer contractDocument7 pagesLabor dispute over cancelled seafarer contractBernadetteNo ratings yet

- HOA Attorneys Crush Opposition With Fees: Bodine A v. Harris Village Property Owners AssociationDocument10 pagesHOA Attorneys Crush Opposition With Fees: Bodine A v. Harris Village Property Owners Association"Buzz" AguirreNo ratings yet

- ABS-CBN Broadcasting Corporation vs. Court of AppealsDocument39 pagesABS-CBN Broadcasting Corporation vs. Court of Appealsrachelle baggaoNo ratings yet

- Schwab v. Herskowitz, Klein, SharabyDocument26 pagesSchwab v. Herskowitz, Klein, SharabyRise Up Ocean CountyNo ratings yet

- Rubie Charles Jenkins v. United States, 389 F.2d 765, 10th Cir. (1968)Document2 pagesRubie Charles Jenkins v. United States, 389 F.2d 765, 10th Cir. (1968)Scribd Government DocsNo ratings yet

- Gicano Vs Gegato Full TextDocument3 pagesGicano Vs Gegato Full TextFai MeileNo ratings yet

- Gumaua Vs ESPINODocument3 pagesGumaua Vs ESPINOYeshua TuraNo ratings yet

- Sevilla v. PeopleDocument2 pagesSevilla v. Peoplebernadeth ranolaNo ratings yet

- Trump Attorney Letter To JudgeDocument3 pagesTrump Attorney Letter To JudgeLaw&CrimeNo ratings yet

- Article 5 LITO CORPUZ, Petitioner, vs. People of The Philippines, Respondent. FactsDocument2 pagesArticle 5 LITO CORPUZ, Petitioner, vs. People of The Philippines, Respondent. FactsJhay CarbonelNo ratings yet

- (Syllabus) AdrDocument3 pages(Syllabus) AdrJam HechanovaNo ratings yet

- Rosales VS Casterlltort (GR No 157044, Oct 5, 2005)Document12 pagesRosales VS Casterlltort (GR No 157044, Oct 5, 2005)Gladys Laureta GarciaNo ratings yet

- Ned S. Skinner, Captain, Etc. v. Raymond F. Spellman, 480 F.2d 539, 4th Cir. (1973)Document3 pagesNed S. Skinner, Captain, Etc. v. Raymond F. Spellman, 480 F.2d 539, 4th Cir. (1973)Scribd Government DocsNo ratings yet

- Francisco v. CA, 122 SCRA 538 (1983)Document10 pagesFrancisco v. CA, 122 SCRA 538 (1983)Shiela BrownNo ratings yet

- Case Digest 1-4Document10 pagesCase Digest 1-4Patricia Ann Sarabia ArevaloNo ratings yet

- Mueller Response To Manafort Request To Dismiss VA IndictmentDocument282 pagesMueller Response To Manafort Request To Dismiss VA IndictmentsonamshethNo ratings yet

- CONS Assignment 11.25.2019Document90 pagesCONS Assignment 11.25.2019Jema LonaNo ratings yet

- Florida Child Custody FormDocument5 pagesFlorida Child Custody FormDorian TaylorNo ratings yet