Professional Documents

Culture Documents

Hud Program Hud

Uploaded by

craigscCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hud Program Hud

Uploaded by

craigscCopyright:

Available Formats

U.S.

DEPARTMENT OF HOUSING AND URBAN DEVELOPMENT

WASHINGTON, DC 20410-8000

ASSISTANT SECRETARY FOR HOUSINGFEDERAL HOUSING COMMISSIONER

AUGUST 22, 2011 MORTGAGEE LETTER 2011-30

To

ALL APPROVED MORTGAGEES ALL FHA ROSTER APPRAISERS

Subject

The Uniform Appraisal Dataset (UAD) and appraisal reporting forms

Purpose of this Mortgagee Letter

The Federal Housing Administration (FHA) will adopt the Uniform Appraisal Dataset (UAD) and two of the UAD compliant appraisal reporting forms, which further define specific data fields in these industry standard appraisal reporting forms.

Effective Date

To allow Mortgagees sufficient time to make any necessary data system changes, the requirements of this Mortgagee Letter are mandatory for all case numbers assigned on or after January 1, 2012 and for all appraisals performed on HUD real estate owned (REO) and Pre-Foreclosure Sale (PFS) properties with an effective date on or after January 1, 2012. Prior to the effective date, Mortgagees, at their discretion, may accept and submit for loan endorsement an appraisal in either a UAD compliant format or a non-UAD compliant reporting format.

Continued on next page

www.hud.gov

espanol.hud.gov

Background

The UAD is the result of collaboration between the Government Sponsored Enterprises (GSEs), Fannie Mae and Freddie Mac, at the direction of the Federal Housing Finance Agency (FHFA) to standardize data reporting quality and improve the collection of electronic appraisal data. The UAD is part of the Uniform Mortgage Data Program (UMDP), which includes the: Uniform Collateral Data Portal (UCDP) and, Uniform Loan Delivery Dataset (ULDD) The UCDP is a web application that will enable lenders to submit appraisal report forms electronically. The ULDD is a standardization of loan delivery data that will leverage the use of MISMO (Mortgage Industry Standards Maintenance Organization) in delivering loan data electronically. FHA is not adopting or requiring the use of the UCDP or the ULDD at this time. In an effort to enhance appraisal data quality and consistency and to promote the collection of electronic appraisal data, the GSEs have developed the UAD to standardize the input values for certain data elements. For example: Specific date Dollar amounts Property condition Quality of construction Fannie Mae and Freddie Mac have modified the Uniform Residential Appraisal Report and the Individual Condominium Unit Appraisal Report forms, which are forms currently required by FHA, to include UAD requirements. Appraisal software vendors have also incorporated the UAD requirements into their form software that is currently available on an industry wide basis. Information that was never explicitly required in the GSEs appraisal reporting forms before includes: Days on market for the subject property and each comparable sale Updating or repairs to kitchen and bathrooms in the subject property Sale type for the subject property and each comparable sale

Continued on next page

New FHA appraisal reporting requirements

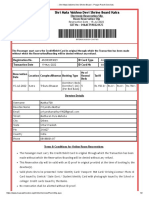

The following table identifies which appraisal reporting forms have been modified by the UAD and which modified forms will be required and/or accepted by FHA. UAD Modified Appraisal Form Uniform Residential Appraisal Report Individual Condominium Unit Appraisal Report Exterior-Only Inspection Residential Appraisal Report Exterior-Only Inspection Individual Condominium Unit Appraisal Report Fannie Mae/ Freddie Mac Form # Fannie Mae 1004 Freddie Mac 70 Fannie Mae 1073 Freddie Mac 465 Fannie Mae 2055 Freddie Mac 2055 Fannie Mae 1075 Freddie Mac 466 FHA Required Yes Yes Not accepted Not accepted

1 2 3 4

UAD Field Specific Requirements and FHA Compliance

FHA Roster appraisers must become familiar with the modified appraisal forms, including the UAD field specific requirements detailed in Appendix D of the Uniform Mortgage Data Program and which is posted on the web sites of Fannie Mae and Freddie Mac. Except for the cases listed below, FHA Roster appraisers must comply with the instructions and requirements as provided by the GSEs in Appendix D. The following table identifies FHA specific compliance requirements: UAD Field Specific Requirement Select relevant subject condition rating Input room count and finished/unfinished basement areas Appraisal made asis, subject to Enter Appraiser Trainee and Supervisory Appraiser Information Appraisal Form Section Improvements Sales Comparison Grid Basement & Finished Rooms Below Grade Reconciliation Section Appraiser Certification Section (Pg. 6) FHA Requirement Subject to select the as-repaired condition Enter only verifiable data and cite source in the addendum As-is only for HUD REO or PFS properties Supervisory appraisers and trainees are not permitted

Continued on next page

FHA Appraisal Reporting Requirements Remain in Effect

FHA Roster appraisers are reminded that all FHA appraisal reporting requirements remain in effect and are cautioned to continue to perform the research necessary and exercise the due diligence to produce a credible and accurate appraisal. The UAD field specific requirements are not a substitute for, and do not exempt FHA Roster appraisers from the requirement to provide adequate explanations in the addendum of the reporting form regarding methodology, anomalies, property deficiencies and other conditions that may have an impact upon the value of a property and its marketability. In all cases, a propertys compliance with Minimum Property Standards (new construction) and Minimum Property Requirements (existing construction) must be thoroughly addressed by the appraiser. FHA Roster appraisers are reminded that the Statement of Insurability is also required for all appraisals performed on HUD REO properties.

Information Collection Requirements

Paperwork reduction information collection requirements contained in this document are pending determination by the Office of Management and Budget (OMB) under the Paperwork Reduction Act of 1995 (44 U.S.C. 35013520) and assigned OMB Control Number 2502-0538. In accordance with the Paperwork Reduction Act, HUD may not conduct or sponsor, and a person is not required to respond to, a collection of information unless the collection displays a currently valid OMB Control Number.

Questions

If you have questions concerning this Mortgagee Letter, please call the FHA Resource Center at 1-800-CALLFHA (1-800-225-5342). Persons with hearing or speech impairments may access this number via TTY by calling the Federal Information Relay Service at (800) 877-8339.

Signature

___________________________________________________ Carol J. Galante Acting Assistant Secretary for Housing-Federal Housing Commissioner

You might also like

- U.S. Department of Housing and Urban Development: WASHINGTON, D.C. 20410-8000Document5 pagesU.S. Department of Housing and Urban Development: WASHINGTON, D.C. 20410-8000sudhirparihar07No ratings yet

- HUD FHA Mortgagee Letter ML 2011-02Document4 pagesHUD FHA Mortgagee Letter ML 2011-02Enforcement DefenseNo ratings yet

- Processing FHA TOTAL and VA MortgagesDocument38 pagesProcessing FHA TOTAL and VA MortgagesMakarand LonkarNo ratings yet

- HUD Homeownership Guide Chapter 1 SummaryDocument43 pagesHUD Homeownership Guide Chapter 1 Summarymohammed el erianNo ratings yet

- Fha Total VA LoanDocument48 pagesFha Total VA Loanvineet71No ratings yet

- FNL Responsibilities For Lenders WP 2014Document7 pagesFNL Responsibilities For Lenders WP 2014Andrew ArmstrongNo ratings yet

- Residential Loan Data 1003 Integration Guide 1003 1001Document68 pagesResidential Loan Data 1003 Integration Guide 1003 1001Genus SumNo ratings yet

- PR Covid PlanDocument6 pagesPR Covid PlanAlyssa RobertsNo ratings yet

- Huddoc Feb 2012 Valuation ProtocolDocument27 pagesHuddoc Feb 2012 Valuation ProtocolLori NobleNo ratings yet

- HUD Handbook 4000 PDFDocument559 pagesHUD Handbook 4000 PDFJoe LongNo ratings yet

- Center 800Document224 pagesCenter 800Ryan SloanNo ratings yet

- Virginia Tab W Attorney Letters 11Document4 pagesVirginia Tab W Attorney Letters 11Gilgoric NgohoNo ratings yet

- ENCLOSURE 1 - 1131PL20RDM11237 Combined Synopsis SolicitationDocument8 pagesENCLOSURE 1 - 1131PL20RDM11237 Combined Synopsis SolicitationbigpoelNo ratings yet

- HUD FHA Approval Lists 121609Document7 pagesHUD FHA Approval Lists 121609404365No ratings yet

- FMSVC 1106Document5 pagesFMSVC 1106DinSFLANo ratings yet

- Federal Register / Vol. 76, No. 245 / Wednesday, December 21, 2011 / Proposed RulesDocument28 pagesFederal Register / Vol. 76, No. 245 / Wednesday, December 21, 2011 / Proposed RulesMarketsWikiNo ratings yet

- Underwriting Collateral ReviewDocument60 pagesUnderwriting Collateral ReviewHimani SachdevNo ratings yet

- HUD FHA Mortgagee Letter ML 2010-20Document6 pagesHUD FHA Mortgagee Letter ML 2010-20Enforcement DefenseNo ratings yet

- RFQ012-2023-24 (RFQ Document)Document42 pagesRFQ012-2023-24 (RFQ Document)david selekaNo ratings yet

- Freddie Selling Guide 9.14.17Document864 pagesFreddie Selling Guide 9.14.17timlegNo ratings yet

- PARCC Support Services RFPDocument81 pagesPARCC Support Services RFPcgewertzNo ratings yet

- United States Securities and Exchange Commission Washington, D.C. 20549 Form 1-K General Instructions A. Rules As To Use of Form 1-KDocument6 pagesUnited States Securities and Exchange Commission Washington, D.C. 20549 Form 1-K General Instructions A. Rules As To Use of Form 1-KJavier JRNo ratings yet

- Final Rule Federal Register For Hud On What Constitutes A Qualified Mortgage (QM) For BorrowersDocument8 pagesFinal Rule Federal Register For Hud On What Constitutes A Qualified Mortgage (QM) For Borrowers83jjmackNo ratings yet

- POL 1223 Vendor Code RequestDocument2 pagesPOL 1223 Vendor Code Requestplainnuts420No ratings yet

- BAA Powering Agriculture An Energy Grand Challenge For Development (PAEGC) - Second Global Innovation CallDocument48 pagesBAA Powering Agriculture An Energy Grand Challenge For Development (PAEGC) - Second Global Innovation CallMiguel QuispeNo ratings yet

- Fannie Mae Useful Life TablesDocument19 pagesFannie Mae Useful Life Tablesakamola52No ratings yet

- OCC Feb 2010 Home Mortgage Disclosure HandbookDocument30 pagesOCC Feb 2010 Home Mortgage Disclosure Handbook83jjmackNo ratings yet

- Sam GovDocument3 pagesSam Govheffsworld440No ratings yet

- BLL 1210Document4 pagesBLL 1210Foreclosure FraudNo ratings yet

- Moody's Assigns Aa2 Bond Rating To Lakewood, OHDocument4 pagesMoody's Assigns Aa2 Bond Rating To Lakewood, OHlkwdcitizenNo ratings yet

- 2012 08 20 MoodysBaa1GOA BDocument5 pages2012 08 20 MoodysBaa1GOA BEmily RamosNo ratings yet

- CFPB 2020 Mortgage Market Activity Trends Report 2021 08Document61 pagesCFPB 2020 Mortgage Market Activity Trends Report 2021 08David RedwoodNo ratings yet

- Chapter 10: Credit AnalysisDocument34 pagesChapter 10: Credit AnalysisgyistarNo ratings yet

- Uniform Loan Delivery Data - Set FaqsDocument4 pagesUniform Loan Delivery Data - Set FaqsraghuNo ratings yet

- Registration Statement On Form S-1Document210 pagesRegistration Statement On Form S-1venturebeathkNo ratings yet

- Bid EvaluationDocument21 pagesBid Evaluationpuvitta sudeshilaNo ratings yet

- Brochure New Dealer Selection Guidelines 2014Document63 pagesBrochure New Dealer Selection Guidelines 2014Anonymous gud2poNo ratings yet

- VT Contractor Qualification QuestionnaireDocument14 pagesVT Contractor Qualification QuestionnaireDeibi Gp GpNo ratings yet

- Loan Product Advisor Documentation Matrix: Freddie Mac Single-Family Seller/Servicer Guide (Guide)Document37 pagesLoan Product Advisor Documentation Matrix: Freddie Mac Single-Family Seller/Servicer Guide (Guide)nour abdallaNo ratings yet

- DOT Proposes Changes to DBE Program ImplementationDocument160 pagesDOT Proposes Changes to DBE Program Implementationsarr rossNo ratings yet

- Howard ManorDocument295 pagesHoward ManorRyan SloanNo ratings yet

- BLL 1205Document4 pagesBLL 1205DinSFLANo ratings yet

- Ferncliff SouthDocument256 pagesFerncliff SouthRyan SloanNo ratings yet

- London OaksDocument235 pagesLondon OaksRyan SloanNo ratings yet

- Hopewood: in Bowling Green, VirginiaDocument168 pagesHopewood: in Bowling Green, VirginiaRyan SloanNo ratings yet

- 2010 TC Summary 87Document15 pages2010 TC Summary 87taxcrunchNo ratings yet

- FormcDocument20 pagesFormc420deepakNo ratings yet

- Coventry Apartments - 2009 VADocument147 pagesCoventry Apartments - 2009 VADavid LayfieldNo ratings yet

- Forensic Loan Audit Report - Sample Report 4-2009Document47 pagesForensic Loan Audit Report - Sample Report 4-2009boufninaNo ratings yet

- OxfordDocument186 pagesOxfordRyan SloanNo ratings yet

- Top 10 Audit Findings in Post-Payment Audits (2022)Document5 pagesTop 10 Audit Findings in Post-Payment Audits (2022)William MhekelaNo ratings yet

- United States Securities and Exchange Commission Washington, D.C. 20549 Form 1-U Current Report Pursuant To Regulation ADocument8 pagesUnited States Securities and Exchange Commission Washington, D.C. 20549 Form 1-U Current Report Pursuant To Regulation AAnthony ANTONIO TONY LABRON ADAMSNo ratings yet

- NADB Pre Qualification Model DocumentDocument39 pagesNADB Pre Qualification Model DocumentSeamus CassidyNo ratings yet

- SEC Provides Filing Guidance for Form ADV AmendmentsDocument2 pagesSEC Provides Filing Guidance for Form ADV AmendmentsSandeep PatilNo ratings yet

- Spruce HillDocument196 pagesSpruce HillRyan SloanNo ratings yet

- Colony Village - 2009 VADocument257 pagesColony Village - 2009 VADavid LayfieldNo ratings yet

- Secondary Market Financing Revenues World Summary: Market Values & Financials by CountryFrom EverandSecondary Market Financing Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Single-Family Builder Compensation Study, 2022 EditionFrom EverandSingle-Family Builder Compensation Study, 2022 EditionNo ratings yet

- Sales Financing Revenues World Summary: Market Values & Financials by CountryFrom EverandSales Financing Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Dell SC2080 DeploymentGuideDocument98 pagesDell SC2080 DeploymentGuidecraigsc100% (1)

- HP High Performance Servers ChoicesDocument32 pagesHP High Performance Servers ChoicescraigscNo ratings yet

- How To Guide Performance Review PDFDocument80 pagesHow To Guide Performance Review PDFcraigscNo ratings yet

- Chronology of Beauty PageantsDocument4 pagesChronology of Beauty PageantscraigscNo ratings yet

- Message Based Load Balancing WPDocument9 pagesMessage Based Load Balancing WPcraigscNo ratings yet

- Specification Latitude D810Document2 pagesSpecification Latitude D810Erica LindseyNo ratings yet

- DMV NyDocument106 pagesDMV NyLucas BiaginiNo ratings yet

- DL 600Document116 pagesDL 600Rommel Heredia TejadaNo ratings yet

- Dell D400 SpecificationsDocument2 pagesDell D400 SpecificationscraigscNo ratings yet

- Loan Guidelines Us BankDocument12 pagesLoan Guidelines Us BankcraigscNo ratings yet

- College Funding Information Sheet: BooksDocument2 pagesCollege Funding Information Sheet: BookscraigscNo ratings yet

- Load Balancing TechniquesDocument12 pagesLoad Balancing TechniquescraigscNo ratings yet

- Calculating Net Income: To Calculate Your Annual Net Income, You Need To Answer The Following QuestionsDocument1 pageCalculating Net Income: To Calculate Your Annual Net Income, You Need To Answer The Following QuestionscraigscNo ratings yet

- Raghuram Rajan - Fin Devt and RiskDocument20 pagesRaghuram Rajan - Fin Devt and Riska65b66incNo ratings yet

- UGRD Risk Management and Crisis Planning QuizDocument12 pagesUGRD Risk Management and Crisis Planning QuizKenneth EsguerraNo ratings yet

- Genesee County EDC Response To Orleans County LawsuitDocument6 pagesGenesee County EDC Response To Orleans County LawsuitThe Livingston County NewsNo ratings yet

- An Institutional Theory of CSRDocument23 pagesAn Institutional Theory of CSRfjar4442No ratings yet

- Handbook For Returning Officers (Council Elections)Document473 pagesHandbook For Returning Officers (Council Elections)bskc_sunilNo ratings yet

- Marketbeats Indonesia Jakarta Landed Residential H2 2022Document4 pagesMarketbeats Indonesia Jakarta Landed Residential H2 2022SteveNo ratings yet

- Chennai Dealers Contact DetailsDocument1 pageChennai Dealers Contact DetailsAbhishek ANo ratings yet

- Shri Mata Vaishno Devi Shrine Board - Poojan Parchi Services 2Document1 pageShri Mata Vaishno Devi Shrine Board - Poojan Parchi Services 2Shreyash mathurNo ratings yet

- CIAC Jurisdiction Over Construction DisputeDocument3 pagesCIAC Jurisdiction Over Construction DisputeRoland Joseph MendozaNo ratings yet

- Charge GSTDocument70 pagesCharge GSTHARSHNo ratings yet

- EthicsJustice-And-Fairness Finals ReportingDocument38 pagesEthicsJustice-And-Fairness Finals ReportingannahsenemNo ratings yet

- Pak StudiesDocument1 pagePak StudiesAbduuulNo ratings yet

- Disinformation 2009 CatalogDocument48 pagesDisinformation 2009 CatalogThe Disinformation Company100% (1)

- Ethical Nursing Practice: An IntroductionDocument5 pagesEthical Nursing Practice: An IntroductionFOOTBALL IQNo ratings yet

- Tax Invoice Cum Delivery ChallanDocument1 pageTax Invoice Cum Delivery Challanranjitbhakta100% (1)

- Standard Request For Proposals (RFP) - Selection of ConsultantsDocument126 pagesStandard Request For Proposals (RFP) - Selection of ConsultantsAccess to Government Procurement Opportunities100% (5)

- Monopoly CityDocument8 pagesMonopoly CityAnvesh ReddyNo ratings yet

- Constitution Law Project Ba LLBDocument7 pagesConstitution Law Project Ba LLBManishNo ratings yet

- Law On Public OfficersDocument23 pagesLaw On Public OfficersMary May NavarreteNo ratings yet

- Drugs Case 2021-1Document8 pagesDrugs Case 2021-1dyosaNo ratings yet

- Httpdocshare01 Docshare Tipsfiles11700117009983 PDFDocument366 pagesHttpdocshare01 Docshare Tipsfiles11700117009983 PDFTram DickersonNo ratings yet

- Final-G9-WEEK-8 FOR TEACHERDocument24 pagesFinal-G9-WEEK-8 FOR TEACHERAngelica Cumapon EsmeresNo ratings yet

- विश्व के प्रमुख संगठनDocument8 pagesविश्व के प्रमुख संगठनPradhuman Singh RathoreNo ratings yet

- G.R. No. 105002Document9 pagesG.R. No. 105002Samuel John CahimatNo ratings yet

- Nationalized Electronic Funds TransferDocument1 pageNationalized Electronic Funds Transfergulam khanNo ratings yet

- PERSONAL ID TECHNIQUESDocument15 pagesPERSONAL ID TECHNIQUESGrant David Amahin100% (2)

- Abortion in The Philippines-Reasons and ResponsibilitiesDocument10 pagesAbortion in The Philippines-Reasons and ResponsibilitiesAileen Grace Delima100% (60)

- Court Affirms Validity of Substituted ServiceDocument48 pagesCourt Affirms Validity of Substituted ServiceDee JacutinNo ratings yet

- Profit Motive and EthicsDocument8 pagesProfit Motive and EthicsJona ResuelloNo ratings yet

- Airworthiness Directive: Design Approval Holder's Name: Type/Model Designation(s)Document4 pagesAirworthiness Directive: Design Approval Holder's Name: Type/Model Designation(s)Raymond ZamoraNo ratings yet

- Propaganda in The Information Age - Still Manufacturing Consent (PDFDrive)Document154 pagesPropaganda in The Information Age - Still Manufacturing Consent (PDFDrive)Budi Sumartoyo100% (2)