Professional Documents

Culture Documents

RICS Real Estate Workshop Series V

Uploaded by

JnanamCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RICS Real Estate Workshop Series V

Uploaded by

JnanamCopyright:

Available Formats

----- Forwarded Message ----From: Shagun Kaushal <indiaevents@rics.org> To: soham_1809@yahoo.

com Sent: Friday, July 5, 2013 11:01 AM Subject: RICS workshop on Real Estate Investment & Finance - 24 to 29 July across Delhi, Mumbai & Bengaluru Register now!

Tata Housing presents RICS Real Estate Workshop Series V

Analytical concepts for real estate investment and finance decisions

One day workshop with practical case studies on private equity investment, asset management and commercial leased asset evaluation 24 July - Mumbai I 25 July - Bangalore I 29 July - New Delhi

Overview

Year 2005 became a milestone for the Indian real estate market, as the government announced the opening of private equity investments. Since then there have been mixed experiences. While a large part of finance and investments in real estate is still HNI driven and is relatively unorganized, there has been a large cashflow into the sector from 2006 onwards. A lot of capital is still waiting to be invested in Indian realty (both domestic and foreign), however there are challenges. These include not only market complexity and investment climate, but also the lack of a deeper understanding of the evaluation process and development challenges. With the markets expected to see a revival in the next 3-4 years, the realty sector should be ready to take its fair share of organized capital. Keeping this in view, this workshop is designed to provide exposure to nuances of evaluation and appraisal of a private equity investment in the market, asset management in the context of pre-investments and commercial leased asset evaluation. The workshop uses a practical and case study based approach to educate participants on analyzing prevailing market conditions, investment climate, key learning's from market complexities in India, and their impact on investment scenarios.

What will you learn?

How to analyse and evaluate PE investments in real estate

Understand key decision influencers (beyond excel sheet) and challenges of structuring a transaction Basic principles of valuation into a development and stabilized asset What roles professionals can play - as accountants, project managers, business development executives, facilities managers - in investment and prudent asset management Understanding of key roles & departments in development firms and fund houses so as to make any investment and development successful Besides the technical aspects, this workshop will also focus on soft aspects such as partner management in deal making and asset management Sunil Agarwal FRICS Adjunct Professor, RICS School of Built Environment, Amity University and Managing Director - Black Olive Ventures Pvt. Ltd Puneet Bhatia MRICS Senior Vice President - Real Estate Asia - Wells Fargo Kinshuk Saurabh Assistance Professor of Finance and Real Estate Economics, RICS School of Built Environment, Amity University City Mumbai Venue Hilton Mumbai International Airport Fee* RICS Members - INR 4000 Non - Members - INR 5000

Faculty

Dates, Venue and Participation Fee

Date 24 July 2013 25 July 2013 29 July 2013

Bengaluru The Park Hotel New Delhi Metropolitan Hotel

*Fee mentioned is exclusive of 12.36% service tax

Register Now! - To participate in the workshop, please download the registration form and submit it to: RICS India Pvt. Ltd. 48-49 Centrum Plaza Sector Road, Sector 53

Gurgaon Haryana 122002 T: +91 124 459 5400 F: +91 124 459 5402 For more information, please write to us at indiaevents@rics.org or call Dibyendu Choudhury - +91 9958811820 Shagun Kaushal - +91 8800966400

Sponsors and Partners

----- Forwarded Message ----From: Dibyendu Choudhury <dchoudhury@rics.org> To: soham_1809@yahoo.com Sent: Friday, July 5, 2013 8:22 AM Subject: RICS workshop on Real Estate Investment and Finance - 24 to 29 July across Delhi, Mumbai & Bengaluru Register now! Dear Mr. Shah , In our continued endeavor to bring professionalism and standards in the real estate and construction sector, RICS (Royal Institution of Chartered Surveyors) is organizing the next workshop in its Workshop Series on 24 th July 2013 ( Mumbai ) , 25th July 2013 ( Bangalore ) & 29th July 2013 ( Delhi ). I am writing to seek the participation of your staff. We do hope to get nominations from your organization for the workshop and believe that those who attend it will find it very useful.

Tata Housing presents

RICS Real Estate Workshop Series V Analytical concepts for real estate investment and finance decisions One day workshop with practical case studies on private equity investment, asset management and commercial leased asset evaluation

24 July - Mumbai I 25 July - Bangalore I 29 July New Delhi

Overview

Year 2005 became a milestone for the Indian real estate market, as the government announced the opening of private equity investments. Since then there have been mixed experiences--

While a large part of finance and investments in real estate is still HNI driven and is relatively unorganized, there has been a large cash-flow into Indian Real Estate from 2006 onwards. A lot of capital is still waiting to be invested in the sector (both domestic and foreign), however there are challenges. These include not only market complexity, investment climate but also lack of a deeper understanding of the evaluation process and development challenges. While the markets are expected to see a revival in the next 3-4 years, real estate sector should be ready to take its fair share of organized capital. Keeping this in view, this workshop is designed to provide exposure to nuances of evaluation and appraisal of a private equity investment in the market, asset management in the context of pre-investments and commercial leased asset evaluation. The workshop uses a practical and case study based approach to educate participants on analyzing prevailing market conditions, investment climate, key learnings from market complexities in India , and their impact on investment scenarios.

What will you learn?

How to analyse and evaluate PE investments in real estate Understand key decision influencers (beyond excel sheet) and challenges of structuring a transaction Basic principles of valuation into a development and stabilized asset What roles professionals can play - as accountants, project managers, business development executives, facilities managers - in investment and prudent asset management Understanding of key roles & departments in development firms and fund houses so as to make any investment and development successful Besides the technical aspects this workshop will focus on the soft aspects such as partner management, in deal making and asset management

Dates, Venue and Participation Fee

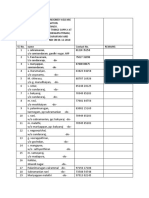

Date 24 July 2013 25 July 2013 29 July 2013 City Mumbai Bengalur New Delhi Venue Hilton Mumbai International Airport The Park Hotel Metropolitan Hotel Fee* RICS Members INR 4,000 Non Members INR 5,000

*Fee mentioned is exclusive of 12.36% service tax

Register Now!

Kind Regards, Dibyendu Choudhury Senior Manager Business Development T +91 124 459 5400 M + 91 9958811820 + 91 9910907673 F +91 124 459 5402 Contact Centre +44 (0)870 333 1600 E dchoudhury@rics.org W rics.org W rics.org/india RICS - The mark of property professionalism worldwide 48-49 Centrum Plaza , Sector Road , Sector 53,Gurgaon -122002, INDIA NEW YORK LONDON BRUSSELS DUBAI NEW DELHI HONG KONG BEIJING SYDNEY Please consider the environment before printing this email

This message is intended only for the use of the individual or entity to which it is addressed and may contain information that is privileged, confidential and exempt from disclosure. It is strictly prohibited to disseminate, distribute or copy this communication if you are not the intended recipient, or an employee or agent responsible for delivering the message. If you have received this communication in error, please accept our apology. Please telephone the sender on the above number, +44(0)20 7222 7000, or email them by return. Royal Institution of Chartered Surveyors (RICS) Registered office: RICS, Parliament Square, London SW1P 3AD Registered Company no. 000487 VAT No. GB 584940013

You might also like

- Hay Al Rahbah Trad. and Contracting LLCDocument41 pagesHay Al Rahbah Trad. and Contracting LLCkhurshidoman123No ratings yet

- Key Roles of RICSDocument5 pagesKey Roles of RICSFiloch MaweredNo ratings yet

- Iaaf TF ManualDocument158 pagesIaaf TF ManualFabiano HenriqueNo ratings yet

- Approved DocumentDocument37 pagesApproved Documentcloud6521No ratings yet

- Housing Markets and Housing Policies in IndiaDocument35 pagesHousing Markets and Housing Policies in IndiaADBI PublicationsNo ratings yet

- pp1 ReportDocument14 pagespp1 Reportapi-339788639No ratings yet

- Market: StudiesDocument13 pagesMarket: StudiesM-NCPPCNo ratings yet

- Cube Method EstimatingDocument3 pagesCube Method EstimatingAzam DeenNo ratings yet

- The Importance of Procurement in The Project Management ProcessDocument4 pagesThe Importance of Procurement in The Project Management Processtpitts250% (1)

- Building SpecificationDocument71 pagesBuilding SpecificationmmmpppsssNo ratings yet

- Project On Bid ProcessDocument13 pagesProject On Bid ProcessPushkar Fegade100% (1)

- RFP 6518 Solid Waste - Recycling Services - 2010Document16 pagesRFP 6518 Solid Waste - Recycling Services - 2010Abeer ArifNo ratings yet

- Contruction Routes FinalDocument16 pagesContruction Routes FinalAsjad KhanNo ratings yet

- Resource Costs: Labour, Materials and PlantDocument7 pagesResource Costs: Labour, Materials and PlantmohamedNo ratings yet

- Project Management Notes (UNIT - 3)Document29 pagesProject Management Notes (UNIT - 3)DEV BHADANANo ratings yet

- The Construction IndustryDocument18 pagesThe Construction Industryahtin618No ratings yet

- Risk Response Plan: VH H M L X VL VL L M H VH ImpactDocument1 pageRisk Response Plan: VH H M L X VL VL L M H VH Impactsampath_priyashanthaNo ratings yet

- Realising Sustainable Construction Through Procurement Strategies PDFDocument371 pagesRealising Sustainable Construction Through Procurement Strategies PDFTheGimhan123No ratings yet

- Project Planning, Appraisal and Execution: Project: Can Be Defined Thus AsDocument69 pagesProject Planning, Appraisal and Execution: Project: Can Be Defined Thus Asbarkath_khanNo ratings yet

- Public Private Partnership (PPP) - Group DDocument31 pagesPublic Private Partnership (PPP) - Group Ddevdattam100% (1)

- BOD - Final Rates StandardizationDocument35 pagesBOD - Final Rates StandardizationRai RiveraNo ratings yet

- NIQS BESMM 4 BillDocument85 pagesNIQS BESMM 4 BillAliNo ratings yet

- Chapter - 3: Geometric DesignDocument90 pagesChapter - 3: Geometric DesignANup GhiMire100% (1)

- Project Feasibility Studies.Document12 pagesProject Feasibility Studies.Ali Raza JuttNo ratings yet

- Quotation Air Curtains EI-2019!5!596241Document2 pagesQuotation Air Curtains EI-2019!5!596241Ratnakar SeethiniNo ratings yet

- Application of Value Management in Project BriefingDocument16 pagesApplication of Value Management in Project Briefingregio122No ratings yet

- 15-Cvbwembya C. Chikolwa PDFDocument4 pages15-Cvbwembya C. Chikolwa PDFmuhammadkamaraNo ratings yet

- Architectural ServicesDocument3 pagesArchitectural ServicesAnna AmirianNo ratings yet

- Bid Docs For Construction of Elevator Shaft at The Administration BuildingDocument141 pagesBid Docs For Construction of Elevator Shaft at The Administration BuildingRhea Villavelez-CladoNo ratings yet

- HotelDocument36 pagesHotelKishore Badigunchala100% (1)

- Delivery Types 1387397104Document4 pagesDelivery Types 1387397104Mendana PwekaNo ratings yet

- Benefits of Bill of QuantitiesDocument7 pagesBenefits of Bill of QuantitiesMuhammad ImranNo ratings yet

- Role of Public and Private Sector in Economic Development of IndiaDocument13 pagesRole of Public and Private Sector in Economic Development of IndiaAseem175% (8)

- Personalities in ConstructionDocument7 pagesPersonalities in ConstructionMicaela Cruz100% (1)

- 1494 The Roles of Construction Management in Super High Rise Building ProjectsDocument7 pages1494 The Roles of Construction Management in Super High Rise Building Projectsvin ssNo ratings yet

- DLS - Quarterly Construction Cost Review 1st 2011Document15 pagesDLS - Quarterly Construction Cost Review 1st 2011Nguyen Hoang TuanNo ratings yet

- Contractor Method For ValuationDocument2 pagesContractor Method For Valuationpschil100% (1)

- Students Reports Foreman Delay SurveyDocument18 pagesStudents Reports Foreman Delay Surveyvalkiria112No ratings yet

- Srestimationservices - Blogspot.in-Quantity Surveying ConsultantsDocument3 pagesSrestimationservices - Blogspot.in-Quantity Surveying ConsultantsmalanicombinespuneNo ratings yet

- Government Construction Strategy 2016-20 March 2016: Reporting To HM Treasury and Cabinet OfficeDocument19 pagesGovernment Construction Strategy 2016-20 March 2016: Reporting To HM Treasury and Cabinet OfficeMark Aspinall - Good Price CambodiaNo ratings yet

- Guidelines For Procurement of PPP Projects Through Swiss Challenge RouteDocument54 pagesGuidelines For Procurement of PPP Projects Through Swiss Challenge Routecream_zjNo ratings yet

- Construction Cost Flow ForecastDocument11 pagesConstruction Cost Flow ForecastBspeedman17564100% (1)

- Macaraig, Ryan M., 2016-02810-MN-0, CM600 Assignment No. 3Document12 pagesMacaraig, Ryan M., 2016-02810-MN-0, CM600 Assignment No. 3RyanNo ratings yet

- Gaja Puyal ListDocument9 pagesGaja Puyal ListVijayssc SivaNo ratings yet

- RFP For Soil Testing - NDocument16 pagesRFP For Soil Testing - NAbhishek Kumar SinhaNo ratings yet

- Course Outline TQMDocument12 pagesCourse Outline TQMMuhammad Bilal GulfrazNo ratings yet

- The Factors Influencing Procurement Strategy Construction EssayDocument5 pagesThe Factors Influencing Procurement Strategy Construction EssayDivina Teja Rebanal-GlinoNo ratings yet

- A Job Description of A Quantity SurveyorDocument4 pagesA Job Description of A Quantity Surveyorjoe1256No ratings yet

- Advanced Practice Individual AssignmentDocument8 pagesAdvanced Practice Individual AssignmentJay SayNo ratings yet

- A Financial Decision Making Framework For Construction Projects Based On 5D Building Information Modeling (BIM)Document19 pagesA Financial Decision Making Framework For Construction Projects Based On 5D Building Information Modeling (BIM)CPittman100% (1)

- Impact of FDI On Indian Economy: Term Paper On Financial SystemDocument19 pagesImpact of FDI On Indian Economy: Term Paper On Financial SystempintuNo ratings yet

- Balaju BuildingDocument60 pagesBalaju BuildingSurendra MaharjanNo ratings yet

- Analisis of The Process For Traditional General Contracting in Sarawak MalaysiaDocument24 pagesAnalisis of The Process For Traditional General Contracting in Sarawak MalaysiaYau Wen JaeNo ratings yet

- AspirePMC ProfileDocument35 pagesAspirePMC ProfileAspire PmcNo ratings yet

- Impacts of Multi-Layer Chain Subcontracting On ProjectDocument10 pagesImpacts of Multi-Layer Chain Subcontracting On ProjectPradeep GsNo ratings yet

- Universiti Teknologi Mara Assignment 3 Project Delivery MethodDocument9 pagesUniversiti Teknologi Mara Assignment 3 Project Delivery MethodBICHAKA MELKAMUNo ratings yet

- 2000 CHP 3 Political Economy and DevelopmentDocument25 pages2000 CHP 3 Political Economy and Developmentoutkast32No ratings yet

- Ethics Reading ListDocument4 pagesEthics Reading Listrainbird7No ratings yet

- DPTI Tender Evaluation GuidelinesDocument7 pagesDPTI Tender Evaluation GuidelinesSyed ShahNo ratings yet

- Preface: Submitted in Partial Fulfillment of Bachelor of Business AdministrationDocument18 pagesPreface: Submitted in Partial Fulfillment of Bachelor of Business AdministrationAtul GargNo ratings yet

- KUL Commercial Project - Bandra (E) - QTN Dt. 30.05.13Document8 pagesKUL Commercial Project - Bandra (E) - QTN Dt. 30.05.13JnanamNo ratings yet

- 00 List of ContractsDocument12 pages00 List of ContractsJnanamNo ratings yet

- KUL NEST", 137 Pantnagar, Ghatkopar (E), Mumbai - Rev 02Document8 pagesKUL NEST", 137 Pantnagar, Ghatkopar (E), Mumbai - Rev 02JnanamNo ratings yet

- KUL NEST", 137 Pantnagar, Ghatkopar (E), Mumbai - Rev 02Document8 pagesKUL NEST", 137 Pantnagar, Ghatkopar (E), Mumbai - Rev 02JnanamNo ratings yet

- KUL Comml Project - Bandra (E) - Exc Qtty + Soil DetailsDocument2 pagesKUL Comml Project - Bandra (E) - Exc Qtty + Soil DetailsJnanamNo ratings yet

- "KUL NEST", 153 Pantnagar, G'par (E) - QTN - 29.6.13Document8 pages"KUL NEST", 153 Pantnagar, G'par (E) - QTN - 29.6.13JnanamNo ratings yet

- Container Handling Cranes and Bulk Material Handling EquipmentDocument11 pagesContainer Handling Cranes and Bulk Material Handling EquipmentJnanam100% (1)

- KUL Commercial Project - Bandra (E) - Excavation Qtty With Soil Details - EmailDocument1 pageKUL Commercial Project - Bandra (E) - Excavation Qtty With Soil Details - EmailJnanamNo ratings yet

- KUL Commercial Project - Bandra (E) - QTN Dt. 30.05.13Document8 pagesKUL Commercial Project - Bandra (E) - QTN Dt. 30.05.13JnanamNo ratings yet

- Chandak - Dahisar - QTN Dt. 25-06-2013Document7 pagesChandak - Dahisar - QTN Dt. 25-06-2013JnanamNo ratings yet

- 2013 05 22 Office BLDG BMC Plan - EmailDocument1 page2013 05 22 Office BLDG BMC Plan - EmailJnanamNo ratings yet

- RCC JW5 PDFDocument1 pageRCC JW5 PDFJnanamNo ratings yet

- KUL Commercial Project - Bandra (E) - QTN Dt. 30.05.13 Rate AnalysisDocument1 pageKUL Commercial Project - Bandra (E) - QTN Dt. 30.05.13 Rate AnalysisJnanamNo ratings yet

- "KUL NEST", 153 Pantnagar, G'par (E) - QTN - 29.6.13Document8 pages"KUL NEST", 153 Pantnagar, G'par (E) - QTN - 29.6.13JnanamNo ratings yet

- Mahesh Rajaram Patil.: Career ObjectiveDocument4 pagesMahesh Rajaram Patil.: Career ObjectiveJnanamNo ratings yet

- Anupam - TowerCrane - A794Document6 pagesAnupam - TowerCrane - A794JnanamNo ratings yet

- PODEM ANUPAM Brochure CraneComponentDocument28 pagesPODEM ANUPAM Brochure CraneComponentJnanamNo ratings yet

- Priya FinalDocument3 pagesPriya FinalJnanamNo ratings yet

- Summary & Career Objective:: Curriculum VitaeDocument3 pagesSummary & Career Objective:: Curriculum VitaeJnanamNo ratings yet

- Curriculum Vitae: ObjectiveDocument2 pagesCurriculum Vitae: ObjectiveJnanamNo ratings yet

- 001 Shailendra Chakravarty 11062013Document5 pages001 Shailendra Chakravarty 11062013JnanamNo ratings yet

- Corporate Report - Readymade SteelDocument2 pagesCorporate Report - Readymade SteelDev SinhaNo ratings yet

- Ready Made R HP FinalDocument314 pagesReady Made R HP FinalJnanamNo ratings yet

- PMC Offer Letter - Sudhama Sadan, MulundDocument2 pagesPMC Offer Letter - Sudhama Sadan, MulundJnanamNo ratings yet

- Interview Schedule For Site Engineer and SR - Site EngineerDocument1 pageInterview Schedule For Site Engineer and SR - Site EngineerJnanamNo ratings yet

- TR TR TR: of Reinforcement ANDDocument1 pageTR TR TR: of Reinforcement ANDJnanamNo ratings yet

- Typical OF at ENE: Rein - Resting OnDocument1 pageTypical OF at ENE: Rein - Resting OnJnanamNo ratings yet

- Section Through Basement 3Document1 pageSection Through Basement 3JnanamNo ratings yet

- RCC JW1Document1 pageRCC JW1JnanamNo ratings yet

- Section Through Basement 4Document1 pageSection Through Basement 4JnanamNo ratings yet

- Financial Analysis - WalmartDocument3 pagesFinancial Analysis - WalmartLuka KhmaladzeNo ratings yet

- Homework: Working Capital Management 2021coardbulji: ActivityDocument3 pagesHomework: Working Capital Management 2021coardbulji: ActivityMa Teresa B. CerezoNo ratings yet

- The Franchisor Feasibility StudyDocument12 pagesThe Franchisor Feasibility StudyLeighgendary CruzNo ratings yet

- PFM3063 - Advanced Financial Management Quiz 2 and 3 (Dec 2023)Document5 pagesPFM3063 - Advanced Financial Management Quiz 2 and 3 (Dec 2023)Putri YaniNo ratings yet

- Ife761 Final AssessmentDocument12 pagesIfe761 Final AssessmentElySya SyaNo ratings yet

- Ali HaiderDocument68 pagesAli HaiderManamNo ratings yet

- Accounting II BBA 3rdDocument9 pagesAccounting II BBA 3rdTalha GillNo ratings yet

- Balance Sheet of Eicher Motors For MonicaDocument4 pagesBalance Sheet of Eicher Motors For MonicaBBA SFNo ratings yet

- Week 1 - Don - Optimizing Your Real Estate Investment in 2023Document4 pagesWeek 1 - Don - Optimizing Your Real Estate Investment in 2023Don J AsuncionNo ratings yet

- Micro Lit Review AssignmentDocument19 pagesMicro Lit Review AssignmentVidhi GhadiNo ratings yet

- COOPERATIVEDocument15 pagesCOOPERATIVEGiann Lorrenze Famisan RagatNo ratings yet

- Frequently Asked Questions For Branch BankingDocument3 pagesFrequently Asked Questions For Branch BankingEMBA KUBSNo ratings yet

- Fintech and TechfinDocument13 pagesFintech and TechfinMaryam IraniNo ratings yet

- Chap 018Document27 pagesChap 018Xeniya Morozova Kurmayeva100% (3)

- Muntiariani - NTUC Income-Security BondDocument2 pagesMuntiariani - NTUC Income-Security BondSyscom PrintingNo ratings yet

- Working Capital ParleDocument95 pagesWorking Capital Parlesanjaywasan100% (1)

- Analysis On Foreign Exchange and Stock ReturnDocument64 pagesAnalysis On Foreign Exchange and Stock ReturnTeng Yee JingNo ratings yet

- Assessing The Effect of Financial Literacy On SavingDocument7 pagesAssessing The Effect of Financial Literacy On SavingMarinette Valencia MedranoNo ratings yet

- 2021 - MSMT (McDonald's) - Promo Mechanics - 0620Document4 pages2021 - MSMT (McDonald's) - Promo Mechanics - 0620kheriane veeNo ratings yet

- The Economics of Tourism and HospitalityDocument38 pagesThe Economics of Tourism and HospitalityStraichea Mae TabanaoNo ratings yet

- Credit Risk PlusDocument14 pagesCredit Risk PlusAliceNo ratings yet

- Why Use LINK in Selling Your Business by Matt Maypa Business BrokerDocument4 pagesWhy Use LINK in Selling Your Business by Matt Maypa Business BrokerMatt MaypaNo ratings yet

- 341gl-Cash CountDocument1 page341gl-Cash CountLyran TayaotaoNo ratings yet

- Top 50 RulesDocument53 pagesTop 50 RulesShaji HakeemNo ratings yet

- Book Economics Organization and ManagementDocument635 pagesBook Economics Organization and ManagementHoBadalaNo ratings yet

- Pac App A0000839186 20191016024434 Gcc96syfcqjshlahqyxyzrcjkgsevds2xk5attrpqsDocument4 pagesPac App A0000839186 20191016024434 Gcc96syfcqjshlahqyxyzrcjkgsevds2xk5attrpqsJonas DanielNo ratings yet

- Handout 018Document1 pageHandout 018Caryl May Esparrago MiraNo ratings yet

- TA 22 Deposit Register 150222Document1 pageTA 22 Deposit Register 150222Priya DharshiniNo ratings yet

- Chapter 1: Introduction To The Study of GlobalizationDocument80 pagesChapter 1: Introduction To The Study of GlobalizationAshton Travis HawksNo ratings yet

- Hima16 SM 11Document53 pagesHima16 SM 11vahid teymooriNo ratings yet