Professional Documents

Culture Documents

IAS 11 - Construction Contracts

Uploaded by

m2mlckOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IAS 11 - Construction Contracts

Uploaded by

m2mlckCopyright:

Available Formats

IAS 11 - Construction Contracts

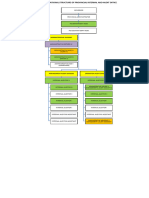

A construction contract is a contract specifically negotiated for the construction of an asset, (or combination of assets), that are closely interrelated or interdependent in terms of their design, technology and function or their ultimate purpose or use. A fixed price contract is a construction contract in which the contractor agrees to a fixed contract price, or a fixed rate per unit of output, which in some cases is subject to cost escalation clauses. A cost plus contract is a construction contract in which the contractor is reimbursed for allowable or otherwise defined costs, plus a percentage of these costs or a fixed fee. Accounting: Contract Revenue: Initial agreed contract amount; and variations, claims, and incentive payments to the extent that it is probable that these will result in revenue and are capable of being measured. Two or more contracts (same or different customers) should be accounted for as a single contract, if; i) negotiated together, ii) work is interrelated, and iii) performed concurrently. Contract Costs: Direct contract costs (e.g. materials, labour, depreciation of site equipment) General contract costs (e.g. insurance, overheads etc.) Costs specifically chargeable to the customer in terms of the contract (e.g. admin) Outcome can be estimated reliably: Outcome can be reliably estimated if the entity can make an assessment of the revenue, the stage of completion and the costs to complete the contract. If the outcome can be measured reliably - revenue and costs on the contract should be measured with reference to stage of completion basis. Under this basis, contract revenue is matched with the contract costs incurred in reaching the stage of completion, resulting in the reporting of revenue, expenses and profit which can be attributed to the proportion of work completed. When it is probable that the total contract costs will exceed contract revenue, the expected loss is recognized as an expense immediately. Outcome cannot be estimated reliably: No profit recognized. Revenue recognized only to the extent costs are recoverable. Costs recognized as an expense when incurred. An expected loss should be recognized as an expense in full as soon as the loss is probable. Separating Contracts If the contract covers multiple assets, the assets should be accounted for separately if: a) Separate proposals were submitted for each asset; b) The contract for each asset were negotiated separately; and c) The costs and revenues of each asset can be identified. Otherwise the contract should be accounted for in its entirety. If the contract provides an option to the customer to order additional assets, the additional assets can be accounted for separately if: a) The additional asset differs significantly from the original asset; and b) The price of the additional asset is negotiated separately.

Copyright 2012 EruditeApe.com - All rights reserved - E&OE 06-12

You might also like

- IFRS 8 Operating Segments Mind MapDocument1 pageIFRS 8 Operating Segments Mind Mapm2mlckNo ratings yet

- IAS 1 Presentation of Financial StatementsDocument1 pageIAS 1 Presentation of Financial Statementsm2mlckNo ratings yet

- Retirement Benefit PlansDocument1 pageRetirement Benefit Plansm2mlckNo ratings yet

- IAS 2 InventoriesDocument1 pageIAS 2 Inventoriesm2mlckNo ratings yet

- IAS 7 Cash Flow StatementsDocument1 pageIAS 7 Cash Flow Statementsm2mlckNo ratings yet

- Retirement Benefit PlansDocument1 pageRetirement Benefit Plansm2mlckNo ratings yet

- IAS 27 Consolidated and Separate Financial StatementsDocument1 pageIAS 27 Consolidated and Separate Financial Statementsm2mlckNo ratings yet

- IAS 2 Inventories Mindmap UpdateDocument1 pageIAS 2 Inventories Mindmap Updatem2mlckNo ratings yet

- IAS 16 Property Plant EquipmentDocument1 pageIAS 16 Property Plant Equipmentm2mlckNo ratings yet

- IAS 20 Government GrantsDocument1 pageIAS 20 Government Grantsm2mlckNo ratings yet

- Acca F6 UkDocument60 pagesAcca F6 Ukm2mlckNo ratings yet

- IAS 2 InventoriesDocument1 pageIAS 2 Inventoriesm2mlckNo ratings yet

- IAS 16 Property Plant EquipmentDocument1 pageIAS 16 Property Plant Equipmentm2mlckNo ratings yet

- IAS 10 - Events After The Reporting PeriodDocument1 pageIAS 10 - Events After The Reporting Periodm2mlckNo ratings yet

- IAS 1 - Presentation of Financial StatementsDocument1 pageIAS 1 - Presentation of Financial Statementsm2mlckNo ratings yet

- IAS 7 Cash Flow StatementsDocument1 pageIAS 7 Cash Flow Statementsm2mlckNo ratings yet

- Doctoral Study at The Institute of Education: Frequently Asked Questions (Faqs)Document16 pagesDoctoral Study at The Institute of Education: Frequently Asked Questions (Faqs)m2mlckNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Advanced Accounting WK 1,2,3,4 (Midterm), 6,7 QuizesDocument16 pagesAdvanced Accounting WK 1,2,3,4 (Midterm), 6,7 QuizesFrank Gene Hogue67% (3)

- Piao Proposed Structure 2023Document5 pagesPiao Proposed Structure 2023me.I.onlyNo ratings yet

- CCP104Document9 pagesCCP104api-3849444No ratings yet

- Policy ScheduleDocument1 pagePolicy ScheduleDinesh nawaleNo ratings yet

- Acuity Knowledge Partners - Company OverviewDocument25 pagesAcuity Knowledge Partners - Company OverviewSaubhagya SuriNo ratings yet

- Wa0005.Document1 pageWa0005.Shuvo DasNo ratings yet

- Capital Gains Tax For Onerous Transfer of Real Property Classified As Capital AssetsDocument11 pagesCapital Gains Tax For Onerous Transfer of Real Property Classified As Capital AssetsGrace G. ServanoNo ratings yet

- The Influence of Tax and Financial Literacy With Business Management of Micro Enterprises in Barangay DologonDocument120 pagesThe Influence of Tax and Financial Literacy With Business Management of Micro Enterprises in Barangay Dologonf.rickallen.balandraNo ratings yet

- Christopher Burns WarrantDocument5 pagesChristopher Burns WarrantNick PapadimasNo ratings yet

- RemittanceDocument2 pagesRemittancePankaj NagarNo ratings yet

- Kansas City Property Management AgreementDocument23 pagesKansas City Property Management AgreementJustin ScerboNo ratings yet

- Forex Trading For BeginnersDocument13 pagesForex Trading For BeginnersChiedozie Onuegbu100% (2)

- Local Purchase Order: Amount in WordsDocument1 pageLocal Purchase Order: Amount in WordsTina MillerNo ratings yet

- ASM 2 Nguyen Gia Phong 5060Document51 pagesASM 2 Nguyen Gia Phong 5060duyhhagbs210636No ratings yet

- Advocates of Truth V BSPDocument2 pagesAdvocates of Truth V BSPAhmed GakuseiNo ratings yet

- Lista de Empresas Bolivianas Vinculadas en El Caso Panamá PapersDocument6 pagesLista de Empresas Bolivianas Vinculadas en El Caso Panamá PapersLos Tiempos DigitalNo ratings yet

- 2006 s2 SolutionsDocument22 pages2006 s2 SolutionsVinit DesaiNo ratings yet

- Vetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Document2 pagesVetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Arjun VermaNo ratings yet

- Renewal of Contract of Lease of Asia Pacific 2022Document6 pagesRenewal of Contract of Lease of Asia Pacific 2022Marichu NavarroNo ratings yet

- Review of Related Literature and StudiesDocument3 pagesReview of Related Literature and StudiesApril ManjaresNo ratings yet

- IAS 19 Employee BenefitsDocument56 pagesIAS 19 Employee BenefitsziyuNo ratings yet

- PL AA S17 Exam PaperDocument7 pagesPL AA S17 Exam PaperIsavic Alsina100% (1)

- Srivastava Et AlDocument18 pagesSrivastava Et Alsanyam016No ratings yet

- Iraisers 2018Document50 pagesIraisers 2018Donatus Kumah100% (2)

- Corporate Presentation 2020Document18 pagesCorporate Presentation 2020Shaikh Moonirul HaqueNo ratings yet

- Audit I - Chapter 2.1Document5 pagesAudit I - Chapter 2.1Cece LiNo ratings yet

- Sample Term Sheet PDFDocument4 pagesSample Term Sheet PDFrajiveacharyaNo ratings yet

- Audit of Cash and Cash Equivalents: Problem No. 20Document6 pagesAudit of Cash and Cash Equivalents: Problem No. 20Robel MurilloNo ratings yet

- BUSINESS STUDIES PUC 2nd YEAR QUESTION BANKDocument25 pagesBUSINESS STUDIES PUC 2nd YEAR QUESTION BANKVikas R Gaddale100% (2)

- ValueDocument6 pagesValuemeranaamfakeNo ratings yet