Professional Documents

Culture Documents

Xxxpi5752x Itrv

Uploaded by

Ingole DeepakOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Xxxpi5752x Itrv

Uploaded by

Ingole DeepakCopyright:

Available Formats

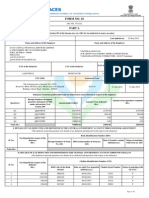

Assessment Year

ITR-V

[Where the data of the Return of Income in Benefits in Form (ITR-1 (SAHAJ), ITR-2, ITR-3, ITR-4, ITR-4S (SUGAM), ITR-5, ITR-6 transmitted electronically without digital signature]

(Please see Rule 12 of the Income-tax Rules, 1962)

2013 - 14

Name DEEPAK DIGAMBAR INGOLE

PAN ABQPI5752G Name Of Premises/Building/Village Form No. which has been electronically transmitted

Flat/Door/Block No MATOSHRI LONS , Road/Street/Post Office YASHODEEP NAGAR , Town/City/District JALANA

ITR-1

Area/Locality AMBAD ROAD , State MAHARASHTRA Pin 431213

Status

Individual

Designation of AO (Ward / Circle) ITO WARD-1(3), JALNA E-filing Acknowledgement Number 1 2 3

4

Original or Revised Date(DD-MM-YYYY) 1 2 3 3a 4 5 6 7a 7b 7c 7d 0 15404 0 7e 8 9

ORIGINAL 31-07-2013 154033 0 154030 0 0 0 0

711423340310713

Gross Total Income Deductions under Chapter-VI-A Total Income a Current Year loss, if any Net Tax Payable Interest Payable Total Tax and Interest Payable Taxes Paid a Advance Tax b c d TDS TCS Self Assessment Tax

5 6 7

8 9

e Total Taxes Paid (7a+7b+7c +7d) Tax Payable (6-7e) Refund (7e-6) VERIFICATION

15404 0 15400

ABQPI5752G

I, DEEPAK DIGAMBAR INGOLE

son/ daughter of DIGAMBAR DAGADU INGOLE , holding permanent account number

solemnly declare to the best of my knowledge and belief, the information given in the return and the schedules thereto which have been transmitted electronically by me vide acknowledgement number mentioned above is correct and complete and that the amount of total income/ fringe benefits and other particulars shown therein are truly stated and are in accordance with the provisions of the Income-tax Act, 1961, in respect of income and fringe benefits chargeable to income-tax for the previous year relevant to the assessment year 2013-14. I further declare that I am making this return in my capacity as and I am also competent to make this return and verify it. Sign here Date 31-07-2013 Place PUNE

If the return has been prepared by a Tax Return Preparer (TRP) give further details as below: Identification No. of TRP Name of TRP Counter Signature of TRP

For Office Use Only Receipt No Date Seal and signature of receiving official

Filed from IP address

117.228.132.163

ABQPI5752G017114233403107135ABB2C18CB913C065D6BCD1E6CED6EBDCABC2946

Please furnish Form ITR-V to Income Tax Department - CPC, Post Bag No - 1, Electronic City Post Office, Bengaluru - 560100, Karnataka, by ORDINARY POST OR SPEED POST ONLY, within 120 days from date of transmitting the data electronically. Form ITR-V shall not be received in any other office of the Income-tax Department or in any other manner. The receipt of this ITR-V at ITD-CPC will be sent to you at e-mail address dingole21@yahoo.in

You might also like

- Public FiscalDocument26 pagesPublic FiscalRojanie Estuita73% (22)

- Reseller Agreement Template-1Document18 pagesReseller Agreement Template-1David Jay Mor75% (8)

- Form No. 16: Part ADocument5 pagesForm No. 16: Part APunitBeriNo ratings yet

- Form IiibDocument2 pagesForm Iiibvishnucnk25% (4)

- Form 16Document2 pagesForm 16SIVA100% (1)

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionFrom EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo ratings yet

- Business Plan For A Beauty SalonDocument38 pagesBusiness Plan For A Beauty SalonRamsha Khalid80% (10)

- Chapter 005Document30 pagesChapter 005Yinan Lu100% (2)

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Manogya SharmaNo ratings yet

- XXXPH2966X ITRV - UnlockedDocument1 pageXXXPH2966X ITRV - UnlockedVivek HaldarNo ratings yet

- XXXPD3353X Itrv PDFDocument1 pageXXXPD3353X Itrv PDFDaljeet KaurNo ratings yet

- Sudha Singh Itr V 13Document1 pageSudha Singh Itr V 13Anurag SinghNo ratings yet

- Acknowledgement UnlockedDocument1 pageAcknowledgement UnlockedcachandhiranNo ratings yet

- Kondala Rao Sankarasetty 06-Aug-2016 398914990Document1 pageKondala Rao Sankarasetty 06-Aug-2016 398914990Venkatesh BandaruNo ratings yet

- 2015 10 16 13 40 48 407 - 1444983048407 - XXXPP3489X - ITRV - Unlocked PDFDocument1 page2015 10 16 13 40 48 407 - 1444983048407 - XXXPP3489X - ITRV - Unlocked PDFMadhabi MohapatraNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formbha_goNo ratings yet

- Paramjit 2016 ITR RevisedDocument1 pageParamjit 2016 ITR Revisedkulbir5No ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formbha_goNo ratings yet

- Form ITR-VDocument2 pagesForm ITR-VSumit ManglaniNo ratings yet

- Form ITR-VDocument1 pageForm ITR-VSanjeev BansalNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageSudeshNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormNishant VermaNo ratings yet

- AMUxxxxx3A G11Document1 pageAMUxxxxx3A G11ishandutta2007No ratings yet

- Indian Income Tax Return Verification Form 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Verification Form 2021-22: Assessment YearHarsha vardhan ReddyNo ratings yet

- Gross Total Income (1+2c) 4: Import Previous VersionDocument4 pagesGross Total Income (1+2c) 4: Import Previous Versionbalajiv_mailNo ratings yet

- PDF 919198870310723Document1 pagePDF 919198870310723sunil jadhavNo ratings yet

- AMUxxxxx3A G11Document1 pageAMUxxxxx3A G11ishandutta2007No ratings yet

- DSCN - Shree AutomotiveDocument24 pagesDSCN - Shree AutomotiveNikhilesh BhattacharyyaNo ratings yet

- E-Receipt For Central Service Tax PaymentsDocument1 pageE-Receipt For Central Service Tax Paymentsabhijith sureshNo ratings yet

- Ahrpv0731f 2013-14Document2 pagesAhrpv0731f 2013-14Shiva KumarNo ratings yet

- 2018-19 Itr Narasimha RaoDocument8 pages2018-19 Itr Narasimha RaoprasannaNo ratings yet

- PDF 147397690310723Document1 pagePDF 147397690310723Rashi SrivastavaNo ratings yet

- Income Tax ReturnDocument1 pageIncome Tax ReturnalharamislamicfoundationNo ratings yet

- Ahspy8053e 2014-15Document2 pagesAhspy8053e 2014-15kzx08110No ratings yet

- Itr-V Adyps7344c 2023-24 149225400310723Document1 pageItr-V Adyps7344c 2023-24 149225400310723taxindia610No ratings yet

- QUA05242 Form16Document5 pagesQUA05242 Form16saurabhNo ratings yet

- PDF 334657210280923Document1 pagePDF 334657210280923Manish NirwanNo ratings yet

- Income Tax Pan Services Unit: ACKNOWLEDGEMENT NO.881035292293111Document1 pageIncome Tax Pan Services Unit: ACKNOWLEDGEMENT NO.881035292293111MSEB WalujNo ratings yet

- PDFDocument5 pagesPDFdhanu1434No ratings yet

- Cfupm8774e 2016-17Document2 pagesCfupm8774e 2016-17Sukanta ParidaNo ratings yet

- A 40029127 Part-ADocument2 pagesA 40029127 Part-Adeepak_cool4556No ratings yet

- 2015 Itr1 PR3Document18 pages2015 Itr1 PR3shubham sharmaNo ratings yet

- Balibago WaterDocument9 pagesBalibago WaterJeffrey MacalinoNo ratings yet

- Pak Telecom Mobile Limited: 339.71 Three Hundred Thirty-Nine Rupees Seventy-One PaisasDocument1 pagePak Telecom Mobile Limited: 339.71 Three Hundred Thirty-Nine Rupees Seventy-One Paisasengrmech2009No ratings yet

- Form 16 PDFDocument5 pagesForm 16 PDFJoshua Hicks100% (1)

- Application Form For The Post of Project Engineers On Fixed Tenure BasisDocument3 pagesApplication Form For The Post of Project Engineers On Fixed Tenure BasisAravindan KrishnamoorthyNo ratings yet

- LetterDocument2 pagesLetterShiv Kiran SademNo ratings yet

- Form 16Document22 pagesForm 16Ajay Chowdary Ajay ChowdaryNo ratings yet

- Gross Total Income (1+2+3) 4: System CalculatedDocument8 pagesGross Total Income (1+2+3) 4: System CalculatedShunmuga ThangamNo ratings yet

- Certificate No.:: Tax Deduction Account No. of The DeductorDocument8 pagesCertificate No.:: Tax Deduction Account No. of The DeductorcmtssikarNo ratings yet

- Income Tax Pan Services Unit: ACKNOWLEDGEMENT NO.881036279775761Document1 pageIncome Tax Pan Services Unit: ACKNOWLEDGEMENT NO.881036279775761surinderNo ratings yet

- 15 G Form (Pre-Filled)Document8 pages15 G Form (Pre-Filled)pankaj_electricalNo ratings yet

- 255 PartA PDFDocument2 pages255 PartA PDFRamyaMeenakshiNo ratings yet

- Service Tax Registration - Form ST-2Document2 pagesService Tax Registration - Form ST-2benedictprasadNo ratings yet

- Indian Income Tax Return Verification FormDocument1 pageIndian Income Tax Return Verification FormRahul BhanNo ratings yet

- Form Itr-V Indian Income Tax Return Verification Form 2021-22Document1 pageForm Itr-V Indian Income Tax Return Verification Form 2021-22Chetanya VigNo ratings yet

- Itr-V Asnpp1028l 2023-24 448120190130723Document1 pageItr-V Asnpp1028l 2023-24 448120190130723harsh sethiNo ratings yet

- Form ITR-1Document3 pagesForm ITR-1Rajeev PuthuparambilNo ratings yet

- Income Tax Pan Services Unit: ACKNOWLEDGEMENT NO.091019703743452Document1 pageIncome Tax Pan Services Unit: ACKNOWLEDGEMENT NO.091019703743452Sumanth RNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- 0604 PDFDocument6 pages0604 PDFIngole DeepakNo ratings yet

- Real-Time Optimization and Nonlinear Model Predictive Control of Processes Governed by Differential-Algebraic EquationsDocument9 pagesReal-Time Optimization and Nonlinear Model Predictive Control of Processes Governed by Differential-Algebraic EquationsIngole DeepakNo ratings yet

- Ifacconf SampleDocument3 pagesIfacconf SampleIngole DeepakNo ratings yet

- Predictive Control AlgorithmDocument7 pagesPredictive Control AlgorithmIngole DeepakNo ratings yet

- Implementation of Matlab-SIMULINK Based Real Time Temperature Control For Set Point ChangesDocument8 pagesImplementation of Matlab-SIMULINK Based Real Time Temperature Control For Set Point ChangesIngole DeepakNo ratings yet

- Interior-Point Methods in Model Predictive Control: Stephen WrightDocument30 pagesInterior-Point Methods in Model Predictive Control: Stephen WrightIngole DeepakNo ratings yet

- DeKalb FreePress: 06-14-19Document24 pagesDeKalb FreePress: 06-14-19Donna S. SeayNo ratings yet

- Oracle Accounts PayableDocument84 pagesOracle Accounts PayableNitya PriyaNo ratings yet

- Slides 8Document31 pagesSlides 8Erico MatosNo ratings yet

- Assam Professions Trades Callings and Employments Taxation Act19471Document68 pagesAssam Professions Trades Callings and Employments Taxation Act19471Latest Laws TeamNo ratings yet

- BUSN 6020 - Midterm - Moodle - REVIEW PDFDocument24 pagesBUSN 6020 - Midterm - Moodle - REVIEW PDFAmit GuptaNo ratings yet

- 9708 s02 Er 1+2+3+4Document14 pages9708 s02 Er 1+2+3+4Hana DanNo ratings yet

- Tio Vs Videogram Regulatory BoardDocument1 pageTio Vs Videogram Regulatory BoardIsh100% (1)

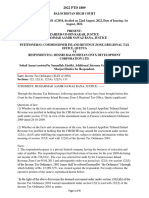

- 2022 PTD 1889Document4 pages2022 PTD 1889Your AdvocateNo ratings yet

- Tax - Talusan Vs TayagDocument1 pageTax - Talusan Vs TayagthedoodlbotNo ratings yet

- TAXATION 2 Chapter 14 VAT Payable and Compliance RequirementsDocument4 pagesTAXATION 2 Chapter 14 VAT Payable and Compliance RequirementsKim Cristian MaañoNo ratings yet

- IFRS 2 - Share Based Payment1Document7 pagesIFRS 2 - Share Based Payment1EmmaNo ratings yet

- Sworn Statement of The True Current and Fair Market Value of Real PropertiesDocument2 pagesSworn Statement of The True Current and Fair Market Value of Real PropertiesYvez Bolinao100% (1)

- Personal Income TaxDocument31 pagesPersonal Income TaxRenese LeeNo ratings yet

- Wrong Condition Amount in Sales Document When Using Price Per Multiple QuantityDocument3 pagesWrong Condition Amount in Sales Document When Using Price Per Multiple QuantityOwlie AquilaNo ratings yet

- Cafr 2008Document268 pagesCafr 2008Kristina AndersonNo ratings yet

- KPMG Wells Fargo Lies and FraudDocument10 pagesKPMG Wells Fargo Lies and Fraudkpmgtaxshelter_kpmg tax shelter-kpmg tax shelterNo ratings yet

- Marathon Batch Final With Cover and Index PDFDocument106 pagesMarathon Batch Final With Cover and Index PDFChandreshNo ratings yet

- Dimple Is Not A Dealer in SecuritiesDocument2 pagesDimple Is Not A Dealer in SecuritiesQueen ValleNo ratings yet

- Income Tax Parent Disable Form EFMB1CS - ES2120220303110030WMUDocument5 pagesIncome Tax Parent Disable Form EFMB1CS - ES2120220303110030WMUDaniel SohNo ratings yet

- Greater Visakhapatnam Municipal Corporation: I. Location DetailsDocument1 pageGreater Visakhapatnam Municipal Corporation: I. Location DetailsggNo ratings yet

- De 231 EpDocument5 pagesDe 231 Epvijaybhaskar damireddyNo ratings yet

- Bir Form 1701 2022Document1 pageBir Form 1701 2022Clay MaaliwNo ratings yet

- Quiz No. 2 Chapter 3-4Document17 pagesQuiz No. 2 Chapter 3-4Mitchie FaustinoNo ratings yet

- Employee Retention Credit For Employers Subject To Closure Due To COVID-19 CrisisDocument6 pagesEmployee Retention Credit For Employers Subject To Closure Due To COVID-19 CrisisBill BagleyNo ratings yet

- Bank Alfalah2011Document211 pagesBank Alfalah2011amuandrabiNo ratings yet

- Tax Ordinance Sub Section 114 and 115Document4 pagesTax Ordinance Sub Section 114 and 115faiz kamranNo ratings yet