Professional Documents

Culture Documents

Process Mapping For Banking Processing

Uploaded by

smartbilal5338Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Process Mapping For Banking Processing

Uploaded by

smartbilal5338Copyright:

Available Formats

164972377.xls.

ms_office

Anjum Asim Shahid Rehman Chartered Accountants CLIENT : Gul Ahmed Textile Mills Ltd

Process Flows

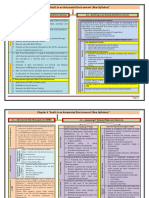

Process Process No. Process Description BANKING

S. No

Activity

Process Description Centre RECONCILIATION Banking Department Treasury Department Treasury Department Banking Department

Responsibility HOD (Yousuf Godil) HOD (Yousuf Godil) HOD (Yousuf Godil) Irfan and Ausaf

Document Account statements

Frequency

IT Phone/ Email Phone/ Email Phone/ Email Phone/ Email

Banking department obtain bank statements from Inquire about the balances all banks to ascertain all transactions made during in all the banks the previous business day. Obtain Forex List Banking department obtains from treasury department, details of the export proceeds, which will be credited in different bank accounts. Banking department also obtain details from treasury department about the payments to be made in respect of imports. Banking Department arranges debit & credit advices related to all departments from all banks. Advices are verified through supporting documents provided by different departments. Further banking department also contacts the banks if any clarification is needed. Preparation of reconciliation of all the banks

Daily

Forex sheet

Daily

Obtain Import List

Import sheet

Daily

Investigate advices

Daily

Advices Reconciliation

Banking Department Banking Department

Irfan and Ausaf

Status of Advices

Daily

Bank Reconcilitions

Mustafa Hussain

Monthly

Page 1 of 4

164972377.xls.ms_office

Process Process No. Process Description

BANKING

S. No 7

Activity Inform the HOD

Process Description Centre Responsibility IN CASE OF DIFFERENCES IN RECONCILIATION The person responsible for bank reconciliation, Banking Mustafa Hussain informs the HOD for any unreconcilied item. Department

Document -

Frequency Monthly

IT -

Banking department after every 7 days, prepares the status of advices which has been received from Prepares status of advices the bank and which have been posted in Oracle. Banking department collects outstanding advices on weekly basis.

Banking Department

Irfan and Ausaf

Status of Advices

Weekly

Funds Transfer

FUND MANAGEMENT HOD after evaluation of different Account balances, decides to transfer funds from one bank Banking account to another concerning future payments, department interest rates etc. Requisition are raised and after obtaining approval from HOD, sent for preparation of cheque. Authorized signatories before signing the cheque verify the requisition. Cheque is obtained from the accounts department and deposits it in the respective bank account. Banking Department Banking Department

HOD (Yousuf Godil)

Daily

10

Approval

Ausaf

Daily

11

Cheque

Ausaf

Cheque

Daily

Page 2 of 4

164972377.xls.ms_office

Process Process No. Process Description

BANKING

S. No

Activity

Process Description OTHER

Centre

Responsibility

Document Mark-up Calculation Sheet

Frequency

IT

12

Calculation of Mark-up

Banking Department prepares monthly mark-up Banking accruals, payments and record keeping of all banks. Department

Irfan and Ausaf

Monthly

13

14

15

Banking Department enters Export proceeds advices in Oracle Finance A/P module and A/R Export proceeds advices module after thorough scrutiny, accruals payment and record keeping of agent commission rebate and R&D Banking Department enters Import and other Import & other Payment payment advices in Oracle Finance through A/P advices module. If payment is made through Foreign Currency Account (Dollar, Euro, etc.), Banking Department checks the approval of director and obtain Payment in Foreign approval from Finance manager. Banking Currency department after approval, instructs the bank to dispatch Telegraphic Transfer. Maintain Records Banking Department maintain records of LTFF, LTL,LTF -EOP,and Payments made.

Banking Department

Muhammad Irfanuddin

Daily

Oracle

Banking Muhammad Faraz Department

Daily

Oracle

Banking Department

HOD (Yousuf Godil)

Adhoc

16

Banking Department

Usman

Daily

Page 3 of 4

164972377.xls.ms_office

Process Process No. Process Description

BANKING

S. No 17 18 19 20 21

Activity Review Of Offer letter Record Keeping Borrowers basic fact sheet Preparation of bank Positions Stock Positions Insurance Premium Records

Process Description Review of offer letter and Mark up agreement of all the banks.

Centre Banking Department

Responsibility Usman Usman HOD (Yousuf Godil) Usman Usman HOD (Yousuf Godil) Usman

Document -

Frequency Adhoc Daily Adhoc Monthly Monthly

IT -

Keeping the records of long term loans ERF (LTL, Banking LTF-EOP, LTFF). Department Preparations of Borrowers basic fact sheet is also done by banking department. Preparation of bank positions , receipts and payment statements. Issuing monthly stock positions to all the banks. Maintaining the insurance premium payments records and all other adhoc assignments related to banks. Banking Department Banking Department Banking Department Banking Department

22

Adhoc

Documentation :

1 2 3 4 5 6 Account statements Forex sheet Import sheet Status of Advices Cheque Mark-up Calculation Sheet

Page 4 of 4

You might also like

- Analyst GuideDocument825 pagesAnalyst GuideBearvillaNo ratings yet

- Information technology audit The Ultimate Step-By-Step GuideFrom EverandInformation technology audit The Ultimate Step-By-Step GuideNo ratings yet

- Gait1 PDFDocument41 pagesGait1 PDFRaulonPFNo ratings yet

- FATCADocument57 pagesFATCAsudeman50% (2)

- المالية الاسلاميةjkbDocument86 pagesالمالية الاسلاميةjkbAyoub JelloulNo ratings yet

- Chapter 4 - Audit in An Automated Environment by CA - Pankaj GargDocument4 pagesChapter 4 - Audit in An Automated Environment by CA - Pankaj GargAnjali P ANo ratings yet

- How Artificial Intelligence Will Impact The GLOBAL EconomyDocument20 pagesHow Artificial Intelligence Will Impact The GLOBAL EconomyPiyush AntilNo ratings yet

- Resume Financial AnalystDocument2 pagesResume Financial AnalystIshaq KhanNo ratings yet

- R346C Upgrade RunbookDocument45 pagesR346C Upgrade RunbookshtummalaNo ratings yet

- 33400Document74 pages33400bandusamNo ratings yet

- Risk Management and Basel II: Bank Alfalah LimitedDocument72 pagesRisk Management and Basel II: Bank Alfalah LimitedtanhaitanhaNo ratings yet

- How The IT Auditor Can Make Substantive Contributions To A Financial AuditDocument3 pagesHow The IT Auditor Can Make Substantive Contributions To A Financial AuditAdam ShawNo ratings yet

- Presented By: Viraf Badha 101 Saurabh Bahuwala 102 Subodh Bhave 103 Sonia Bose 105 Hashveen Chadha 106 Preeti Deshpande 107 Priya Deshpande 108Document31 pagesPresented By: Viraf Badha 101 Saurabh Bahuwala 102 Subodh Bhave 103 Sonia Bose 105 Hashveen Chadha 106 Preeti Deshpande 107 Priya Deshpande 108Lalitha RamaswamyNo ratings yet

- Basel II Operational RiskDocument36 pagesBasel II Operational Riskangelwings79100% (1)

- US DFC Due Diligence ChecklistDocument2 pagesUS DFC Due Diligence ChecklistCitizen KoumNo ratings yet

- Services and Banking Products ProvidedDocument21 pagesServices and Banking Products ProvidedpoddaranilshrutiNo ratings yet

- Auditing Oracle E-Business Suite Primer For Internal AuditorsDocument35 pagesAuditing Oracle E-Business Suite Primer For Internal AuditorsAli xNo ratings yet

- Segregation of Duties MatrixDocument48 pagesSegregation of Duties MatrixMariano SanchezNo ratings yet

- Kabu Linux Project ProposalDocument7 pagesKabu Linux Project ProposalEmmanuel NyachokeNo ratings yet

- Sarbanes-Oxley Walkthrough ChecklistDocument1 pageSarbanes-Oxley Walkthrough Checklistmehmet aliNo ratings yet

- Segregration of DutiesDocument30 pagesSegregration of Dutiesafzallodhi736No ratings yet

- Core Banking System FAQDocument38 pagesCore Banking System FAQsandeep62No ratings yet

- 3632 US Opics Plus TMS FinalDocument4 pages3632 US Opics Plus TMS FinalPriya srinivasanNo ratings yet

- Agent Bank Presentation PilotDocument111 pagesAgent Bank Presentation Pilotchimdesa TolesaNo ratings yet

- Deloitte Financial Services Regulatory Outlook 2017Document36 pagesDeloitte Financial Services Regulatory Outlook 2017CrowdfundInsiderNo ratings yet

- Ephesoft Alfresco Based Enterprise Integrated Document CaptureDocument18 pagesEphesoft Alfresco Based Enterprise Integrated Document CaptureCIGNEXNo ratings yet

- Basel - 1,2,3Document40 pagesBasel - 1,2,3Golam RamijNo ratings yet

- IT Security Audit and ControlDocument1 pageIT Security Audit and ControljbascribdNo ratings yet

- Application FoundationDocument273 pagesApplication FoundationVINEETHNo ratings yet

- ERP Systems: Audit and Control Risks: Jennifer Hahn Deloitte & ToucheDocument37 pagesERP Systems: Audit and Control Risks: Jennifer Hahn Deloitte & Toucheapi-3805445No ratings yet

- Chapter-6 Information System AuditingDocument39 pagesChapter-6 Information System AuditingNusrat JahanNo ratings yet

- 104 2020 011 KPMG LLPDocument28 pages104 2020 011 KPMG LLPJason Bramwell100% (2)

- About goAMLDocument5 pagesAbout goAMLMarin Licina100% (1)

- Brief Analysis of Some Merchant Banks in IndiaDocument6 pagesBrief Analysis of Some Merchant Banks in IndiaParul PrasadNo ratings yet

- Ffp-English-Finance and Accounting Manual - v3 PDFDocument78 pagesFfp-English-Finance and Accounting Manual - v3 PDFTin Zaw ThantNo ratings yet

- Empowering Audit With ACL - LindaDocument17 pagesEmpowering Audit With ACL - LindaHidayat KampaiNo ratings yet

- Swift Platform Readiness Webinars Jul Aug 2021 Full Deck SDCDocument30 pagesSwift Platform Readiness Webinars Jul Aug 2021 Full Deck SDCJordan FouassierNo ratings yet

- PWC It AuditDocument2 pagesPWC It AuditHoàng MinhNo ratings yet

- Credit Risk Management ChecklistDocument6 pagesCredit Risk Management ChecklistrekemonNo ratings yet

- Gökhan Özcan: Finance Manager AssistantDocument5 pagesGökhan Özcan: Finance Manager AssistantGokhan OzcanNo ratings yet

- What Are IT General Controls? - ITGC: Access To Programs and DataDocument4 pagesWhat Are IT General Controls? - ITGC: Access To Programs and DataAtulOsaveNo ratings yet

- Ifrs BankingDocument11 pagesIfrs Bankingsharanabasappa1No ratings yet

- Information Technology InfrastructureDocument25 pagesInformation Technology InfrastructureArunim SharmaNo ratings yet

- Sr. No. Attribute Activity Description Process ReferenceDocument21 pagesSr. No. Attribute Activity Description Process ReferenceWajahat AliNo ratings yet

- King III Compliance Checklist: 1. Ethical and Corporate CitizenshipDocument14 pagesKing III Compliance Checklist: 1. Ethical and Corporate CitizenshipNgqabutho NdlovuNo ratings yet

- Network Audit Bash Script Using Netbios and NmapDocument2 pagesNetwork Audit Bash Script Using Netbios and Nmapadmin870No ratings yet

- Guidelines On Ict and Security Risk ManagementDocument22 pagesGuidelines On Ict and Security Risk ManagementJuan Ruíz100% (1)

- CIPMADocument31 pagesCIPMAReza HikamatullohNo ratings yet

- Sample Report II - Card System Forensic Audit ReportDocument24 pagesSample Report II - Card System Forensic Audit ReportArif AhmedNo ratings yet

- Managing Core Risks in Banking: Internal ControlDocument54 pagesManaging Core Risks in Banking: Internal ControlatiqultitoNo ratings yet

- Hrms RFP Guide UpdateDocument17 pagesHrms RFP Guide UpdateManzoor HusainNo ratings yet

- Accounts Payable ReviewDocument36 pagesAccounts Payable ReviewMuditNo ratings yet

- Risk-Based Internal Prescription For Audit FunctionDocument7 pagesRisk-Based Internal Prescription For Audit FunctionnitinNo ratings yet

- COBITDocument19 pagesCOBITAshraf Abdel HamidNo ratings yet

- WP1053 Decision MakingDocument13 pagesWP1053 Decision Makingsmartbilal5338No ratings yet

- SQL Reporting ServicesDocument3 pagesSQL Reporting Servicessmartbilal5338No ratings yet

- ADT - Lecture 4Document23 pagesADT - Lecture 4smartbilal5338No ratings yet

- ADT - Lecture 11 (Security)Document53 pagesADT - Lecture 11 (Security)smartbilal5338No ratings yet

- WP1085 Root Cause AnalysisDocument4 pagesWP1085 Root Cause Analysissmartbilal5338No ratings yet

- Final Exam Course Outline OODBMSDocument2 pagesFinal Exam Course Outline OODBMSsmartbilal5338No ratings yet

- Chap 14Document32 pagesChap 14smartbilal5338No ratings yet

- WP1024 NegotiatingDocument10 pagesWP1024 Negotiatingsmartbilal5338No ratings yet

- WP1032 Win-Win NegotiatingDocument4 pagesWP1032 Win-Win Negotiatingsmartbilal5338No ratings yet

- Quiz # 1 CourseDocument1 pageQuiz # 1 Coursesmartbilal5338No ratings yet

- Attention Students: Course Add/DropDocument2 pagesAttention Students: Course Add/Dropsmartbilal5338No ratings yet

- WP1008 Emotional IntellegenceDocument7 pagesWP1008 Emotional Intellegencesmartbilal5338100% (1)

- OODBMS - ConceptsDocument9 pagesOODBMS - Conceptssmartbilal5338No ratings yet

- Issues CMS 23jan2014Document3 pagesIssues CMS 23jan2014smartbilal5338No ratings yet

- PHP e CommerceDocument1 pagePHP e Commercesmartbilal5338No ratings yet

- CSS LinksDocument1 pageCSS Linkssmartbilal5338No ratings yet

- Unit 1.7Document12 pagesUnit 1.7Laxman Naidu NNo ratings yet

- Java CourseDocument37 pagesJava CourseZahabiya SheikhNo ratings yet

- Java CourseDocument37 pagesJava CourseZahabiya SheikhNo ratings yet

- Chapter 05Document37 pagesChapter 05smartbilal5338No ratings yet

- Assignment Media PlanningDocument1 pageAssignment Media Planningsmartbilal5338No ratings yet

- Unit 1.7Document12 pagesUnit 1.7Laxman Naidu NNo ratings yet

- Lab 1 Layout1Document1 pageLab 1 Layout1smartbilal5338No ratings yet

- LovDocument1 pageLovsmartbilal5338No ratings yet

- THE Scrum Primer: An Introduction To Agile Project Management With ScrumDocument16 pagesTHE Scrum Primer: An Introduction To Agile Project Management With Scrumsmartbilal5338No ratings yet

- PHPDocument18 pagesPHPsmartbilal5338No ratings yet

- Change Management LogDocument2 pagesChange Management Logsmartbilal5338No ratings yet

- Accountid Loan - Number Install - No Markup - Amt Principal - AmtDocument53 pagesAccountid Loan - Number Install - No Markup - Amt Principal - Amtsmartbilal5338No ratings yet

- Al Safi PlatformDocument15 pagesAl Safi PlatformbadrishNo ratings yet

- Alrajhi-0 45121040829159Document1 pageAlrajhi-0 45121040829159Marwan AlqurashiNo ratings yet

- Credit Card Error CodesDocument4 pagesCredit Card Error Codescurbstone Security ServicesNo ratings yet

- Fined IncomeDocument15 pagesFined IncomeAvid HikerNo ratings yet

- Account Statement From 1 Jul 2021 To 31 Jul 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument6 pagesAccount Statement From 1 Jul 2021 To 31 Jul 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceAJNo ratings yet

- UNFFD Case Study Ethiopia PDFDocument13 pagesUNFFD Case Study Ethiopia PDFGondelcar1No ratings yet

- 15 Chapter 8Document66 pages15 Chapter 8Prabhu MoorthyNo ratings yet

- PDFDocument14 pagesPDFBeboy Paylangco EvardoNo ratings yet

- Marketing Strategy of Axis Bank ( General Management) NewDocument39 pagesMarketing Strategy of Axis Bank ( General Management) NewrohitNo ratings yet

- Performance Evaluation of Bancassurance - Bankers POV PDFDocument10 pagesPerformance Evaluation of Bancassurance - Bankers POV PDFcrescidaNo ratings yet

- 0 - Key To Bank VivaDocument54 pages0 - Key To Bank VivaTariqul IslamNo ratings yet

- Rbi ThesisDocument51 pagesRbi ThesisAnil Anayath100% (8)

- Assured Savings Plan 1Document12 pagesAssured Savings Plan 1DnGNo ratings yet

- 213 Keppel Cebu Vs Pioneer InsuranceDocument3 pages213 Keppel Cebu Vs Pioneer InsuranceHarry Dave Ocampo PagaoaNo ratings yet

- TheUpticks Round1 ExcelDocument66 pagesTheUpticks Round1 ExcelDewashish RaiNo ratings yet

- Updates On Buy Back Offer (Company Update)Document52 pagesUpdates On Buy Back Offer (Company Update)Shyam SunderNo ratings yet

- Handouts PDICDocument3 pagesHandouts PDICKhiara Jansz P. BeltranNo ratings yet

- Dealer Application Form (En)Document2 pagesDealer Application Form (En)Dca EvolutionNo ratings yet

- Iso 8583 PDFDocument10 pagesIso 8583 PDFkartik300881100% (2)

- HDFC Bank Credit Card ChargesDocument12 pagesHDFC Bank Credit Card ChargesKumar RockyNo ratings yet

- JMGS1 - Recollected Questions of Exam Held in Feb-2016Document4 pagesJMGS1 - Recollected Questions of Exam Held in Feb-2016Anonymous Ey8uMU5nNo ratings yet

- BCOM V Sem - Principles of Insurance Business - Unit II NotesDocument3 pagesBCOM V Sem - Principles of Insurance Business - Unit II NotesMona Sharma DudhaleNo ratings yet

- Board of Director Fiduciary DutiesDocument3 pagesBoard of Director Fiduciary DutiesShan WsNo ratings yet

- Employment Offer 'Salahudin'Document6 pagesEmployment Offer 'Salahudin'knight1729No ratings yet

- Project Report On Bank of Baroda Marketing PlanDocument11 pagesProject Report On Bank of Baroda Marketing PlanAshish CyrusNo ratings yet

- UML DiagramDocument29 pagesUML DiagramDIVAGARRAJANo ratings yet

- Financial Management Service Contact Directory 2008Document4 pagesFinancial Management Service Contact Directory 2008api-19731109100% (4)

- Stocks On The MoveDocument9 pagesStocks On The MoveGauriGanNo ratings yet

- Merchant Banking and Financial ServicesDocument42 pagesMerchant Banking and Financial Servicesanita singhalNo ratings yet

- English - RESOLUTION - CASH FUND USAGE NEWS EVENTDocument4 pagesEnglish - RESOLUTION - CASH FUND USAGE NEWS EVENTUN Swissindo100% (3)