Professional Documents

Culture Documents

Bank Treasury Operations Competency Matrix

Uploaded by

Amber AJCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bank Treasury Operations Competency Matrix

Uploaded by

Amber AJCopyright:

Available Formats

0 = None

5 = Expert

1 = Low / Very Basic

Competency Levels

4 = Highly Competent

3 = Reasonably Competent

2 = Under Training or Needs Refresher

Ideal Number of Skilled Staff

Existing Number of Skilled Staff

Prepared by :

Name Skill Shortages (To Handle Workload) Job / Position Join Date FX Spot FX Forwards FX Swaps Money Market Loans & Deposits Certificates of Deposit (CDs)

FX

(Ideal minus Existing)

Count Staff at Levels 3, 4 & 5

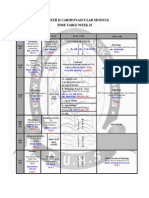

XYZ BANK - TREASURY OPERATIONS - DEPARTMENTAL COMPETENCY ANALYSIS (XYZ2)

Reviewed by : Date: DD/MM/YYYY

Money Markets

Government Bonds & Treasury Bills Eurobonds Floating Rate Notes (FRNs) Euro Medium Term Notes (EMTNs) Asset Backed Securities (eg Fannie Maes) Bond Lending Tri-Party Repos

Capital Markets

Interest Rate Futures (Exchange Traded) Interest Rate Options (Over-the-Counter) Bond Options Forward Rate Agreements (FRAs) Cross Currency Swaps Interest Rate Swaps (IRS) Caps / Floors / Collars Asset Swaps (Bonds with an Embedded Swap) Swaptions

Derivatives

0 = None

5 = Expert

Name

1 = Low / Very Basic

Competency Levels

4 = Highly Competent

3 = Reasonably Competent

2 = Under Training or Needs Refresher

Ideal Number of Skilled Staff

Existing Number of Skilled Staff

Prepared by :

Skill Shortages Typing / Keyboard Skills MIDAS System Knowledge MS Windows (inc. File Management) MS Word MS Excel (Using Existing Spreadsheets) MS Excel (Creating New Spreadsheets) Up-to-date Knowledge of Effective Back-Office Technology Solutions used by Other Banks Management & Supervisory Skills Time Management / Organisation of Own Work Self Development / Enthusiasm to Learn Adaptability / Flexibility Cooperation & Teamwork within Department Relationships with Internal Customers & Suppliers Relationships with External Customers & Suppliers Assertion & Influencing Skills One-to-One Training Skills Presentation Skills Negotiation Skills Business Writing Skills Problem Analysis & Decision Making Process, Productivity & Quality Improvement Project Management Skills Market Risk Awareness & Understanding Credit Risk Awareness & Understanding Operational Risk Awareness & Understanding Prevention of Money Laundering

Computer Skills Personal & Communication Skills

XYZ BANK - TREASURY OPERATIONS - DEPARTMENTAL COMPETENCY ANALYSIS (XYZ2)

Reviewed by : Date: DD/MM/YYYY

Risk Awareness Comments

XYZ BANK TREASURY OPERATIONS - DEPARTMENTAL COMPETENCY ANALYSIS (XYZ2)

FX

Money Markets

Capital Markets

Derivatives

Competency Levels Asset Backed Securities (eg Fannie Maes) Interest Rate Futures (Exchange Traded) 5 = Expert Government Bonds & Treasury Bills Euro Medium Term Notes (EMTNs) Money Market Loans & Deposits 4 = Highly Competent 3 = Reasonably Competent 2 = Under Training or Needs Refresher FX Forwards 1 = Low / Very Basic FX Spot 0 = None Interest Rate Options (Over-the-Counter)

Asset Swaps (Bonds with an Embedded Swap) 3 4 4 3 0 0 0 4 4

Forward Rate Agreements (FRAs)

Certificates of Deposit (CDs)

Floating Rate Notes (FRNs)

Interest Rate Swaps (IRS)

Cross Currency Swaps

Caps / Floors / Collars 3

Tri-Party Repos

Bond Lending

Bond Options

Eurobonds

Name John Manager

Job / Position

Join Date

1985

Helen Ashok Rachel

Assistant Manager Senior Clerk Clerk

1988 1996 2000

4 3 0

4 3 0

4 3 0

4 3 0

4 2 0

3 2 2

4 4 3

4 4 3

4 4 2

3 4 0

0 2 0

0 2 0

2 4 1

1 2 0

0 2 0

4 4 1

4 4 3

4 4 3

4 4 2

Emma Martin Susan

Senior Clerk Clerk Clerk

1992 2000 1994

3 3 2

3 3 2

3 3 2

4 3 3

4 3 3

0 0 0

0 0 1

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

Existing Number of Skilled Staff Ideal Number of Skilled Staff Skill Shortages

Count Staff at Levels 3, 4 & 5 (To Handle Workload) (Ideal minus Existing)

5 5

5 5

5 5

6 5

5 4

2 4 2

4 4

4 4

3 4 1

3 4 1

0 3 3

0 3 3

1 3 2

0 3 3

0 3 3

3 4 1

4 4

4 4

3 4 1

Prepared by : John (Manager)

Reviewed by : Vanessa (Head of Operations)

Date: 15/09/200x

Swaptions 1 3 3 0 0 0 0 2 3 1

FX Swaps

John

Helen

Martin Name

Ashok

Susan

Emma

Rachel

0 = None

5 = Expert

1 = Low / Very Basic

Competency Levels

4 = Highly Competent

3 = Reasonably Competent

2 = Under Training or Needs Refresher

Ideal Number of Skilled Staff 7 5 4 4 4 5 4 3 7 Typing / Keyboard Skills MIDAS System Knowledge MS Windows (inc. File Management) MS Word MS Excel (Using Existing Spreadsheets) MS Excel (Creating New Spreadsheets) Up-to-date Knowledge of Effective Back-Office Technology Solutions used by Other Banks

Existing Number of Skilled Staff

Skill Shortages

Prepared by : John (Manager)

2 3 2 3 2 4 4 4 2 3 1 2 2 4 2 2 1 4 1 3 4 4 3 3 6 1 0 2 1 4 2 2 2 0 0 1 1 4 1 1 n/a n/a n/a 3 0 1 0 1 n/a 4 n/a 1 n/a 2 n/a 3 2 2 2 4 2 3 4 4 4 2 1 3 2 4 2 3 2 2 3 2 4 3 2 3 2 4 3 4 2 4 2 1 4 1 4 3 2 1 4 2 4 3 2 n/a n/a n/a 1 1 n/a n/a n/a 1 1 3 2 2 2 2 2 1 1 0 3 1 4 2 5 3 1 2 n/a 2 0 1 0 n/a 2 0 2 1 2 2 0 n/a 4 3 7 3 1 1 n/a n/a 2 1 1 n/a 7 4 3 4 3 2 1 3 3 2 n/a 7 3 2 3 2 2 1 1 3 2 1 1 7 5 7 4 7 3 4 4 5 3 4 3 4 2 2 4 4 4 1 7 5 3 1 3 0 3 1 Negotiation Skills Business Writing Skills Problem Analysis & Decision Making Process, Productivity & Quality Improvement Project Management Skills 7 1 Presentation Skills 7 6 Adaptability / Flexibility Cooperation & Teamwork within Department Relationships with Internal Customers & Suppliers Relationships with External Customers & Suppliers Assertion & Influencing Skills One-to-One Training Skills 4 2 7 5

Computer Skills

Management & Supervisory Skills Time Management / Organisation of Own Work Self Development / Enthusiasm to Learn

Personal & Communication Skills

XYZ BANK TREASURY OPERATIONS - DEPARTMENTAL COMPETENCY ANALYSIS (XYZ2)

Reviewed by : Vanessa (Head of Operations)

2 2 3 5 3 3 5 7 1 1 2 2 0 0 0 0 0 0 0 0 0 0 2 2 0 0 1 0 1 1 3 2 1 1 2 3 3 3 4 4

Market Risk Awareness & Understanding Credit Risk Awareness & Understanding Operational Risk Awareness & Understanding Prevention of Money Laundering

Risk Awareness Comments

Date: 15/09/200x

You might also like

- Literature Review Guide FormDocument2 pagesLiterature Review Guide FormMAPNo ratings yet

- Change in Management From "Manpower Based Contract" To "Scope of Work Based Contract"Document55 pagesChange in Management From "Manpower Based Contract" To "Scope of Work Based Contract"pb143mbNo ratings yet

- PGS 100 - Academic Writing on Directed ReadingsDocument19 pagesPGS 100 - Academic Writing on Directed ReadingsGretchen TajaranNo ratings yet

- Lecturing 5 Eoq and RopDocument8 pagesLecturing 5 Eoq and RopJohn StephensNo ratings yet

- Guide Writing JobdescriptionsDocument32 pagesGuide Writing JobdescriptionsAnonymous 8jBVkiH4MxNo ratings yet

- HSBC Remuneration Practices and GovernanceDocument11 pagesHSBC Remuneration Practices and GovernanceBhaktiNo ratings yet

- Ladder Level Pay Grade ChartDocument1 pageLadder Level Pay Grade ChartDePaul CareerCtrNo ratings yet

- Calculate The Compa-Ratio of The Various Pay LevelsDocument4 pagesCalculate The Compa-Ratio of The Various Pay LevelsAbhijit PandaNo ratings yet

- Government Pay ScaleDocument2 pagesGovernment Pay ScaleGovernment Pay Scale58% (12)

- Code of Conduct ADCBDocument24 pagesCode of Conduct ADCBHany A AzizNo ratings yet

- Employee Compensation Research 92 26Document161 pagesEmployee Compensation Research 92 26Karen Claire DenNo ratings yet

- CEO Compensation Factors and Trends in IndiaDocument22 pagesCEO Compensation Factors and Trends in IndiaRano JoyNo ratings yet

- Organisation Structure of en Engineering FirmDocument47 pagesOrganisation Structure of en Engineering FirmBadulla M. TwaahaNo ratings yet

- Performance Based Bonus InfographicDocument1 pagePerformance Based Bonus InfographicDBM CALABARZONNo ratings yet

- HR Manager or Sr. HR Generalist or HR Business Partner or Sr. emDocument2 pagesHR Manager or Sr. HR Generalist or HR Business Partner or Sr. emapi-121342565100% (1)

- Human Resource ManagementDocument16 pagesHuman Resource Managementsumit_rockNo ratings yet

- LDM PresentationDocument48 pagesLDM PresentationFeroze Ali ShahNo ratings yet

- 120 Workforce Sourcing, Deployment, and Talent Management GuideDocument480 pages120 Workforce Sourcing, Deployment, and Talent Management Guidezain.siddiquiNo ratings yet

- Job Evaluation & Grading - PPT Hrm2Document9 pagesJob Evaluation & Grading - PPT Hrm2Monica ReyesNo ratings yet

- Organizational Structure & Design of Confidence Group PDFDocument20 pagesOrganizational Structure & Design of Confidence Group PDFMd Sharfuddin AhmedNo ratings yet

- Employee Satisfaction Survey 165Document4 pagesEmployee Satisfaction Survey 165Penchala SumanNo ratings yet

- Why HR Governance MattersDocument7 pagesWhy HR Governance MattersShraddha ChhapoliaNo ratings yet

- UNIDO Competency Model Part 1Document28 pagesUNIDO Competency Model Part 1Pratik ArunNo ratings yet

- Pay Equity: Internal and External ConsiderationsDocument9 pagesPay Equity: Internal and External ConsiderationsOnline AccessNo ratings yet

- NATURE and Scope of PlanningDocument3 pagesNATURE and Scope of Planningp.sankaranarayananNo ratings yet

- Strategicplanning 130620173622 Phpapp02Document77 pagesStrategicplanning 130620173622 Phpapp02JOCELYN DE CASTRONo ratings yet

- Audit Evidence PresentationDocument24 pagesAudit Evidence PresentationShuaib AdebayoNo ratings yet

- Understanding and Managing Organizational Behavior, 6e (George/Jones) Chapter 2 Individual Differences: Personality and AbilityDocument45 pagesUnderstanding and Managing Organizational Behavior, 6e (George/Jones) Chapter 2 Individual Differences: Personality and AbilityStanley HoNo ratings yet

- Mapping EmployeesDocument39 pagesMapping EmployeesJanani IyerNo ratings yet

- Performance Management Chapter 7-12Document80 pagesPerformance Management Chapter 7-12ElizabethNo ratings yet

- Job EvaluationDocument24 pagesJob EvaluationPriti JariwalaNo ratings yet

- Pay Structures: Proprietary Content. ©great Learning. All Rights Reserved. Unauthorized Use or Distribution ProhibitedDocument23 pagesPay Structures: Proprietary Content. ©great Learning. All Rights Reserved. Unauthorized Use or Distribution ProhibitedaahanaNo ratings yet

- Competency Level 1 - Structural Level 2 - Strategic Level 3 - Integration Level 4 - EMERGENTDocument4 pagesCompetency Level 1 - Structural Level 2 - Strategic Level 3 - Integration Level 4 - EMERGENTBader JNo ratings yet

- UN Salary System GuideDocument47 pagesUN Salary System Guideruby_kakkar9796No ratings yet

- Full Competency Model 11 2 - 10 1 2014Document39 pagesFull Competency Model 11 2 - 10 1 2014Arees UlanNo ratings yet

- Talent Acquisition 2014 Aberdeen Group 2014Document17 pagesTalent Acquisition 2014 Aberdeen Group 2014whatNo ratings yet

- The Way Forward 2013 Perak Region: Presented by Zolpakar HJ Mahat Head of Perak RegionDocument21 pagesThe Way Forward 2013 Perak Region: Presented by Zolpakar HJ Mahat Head of Perak RegionMuhd AkmalNo ratings yet

- PAD214 Introduction To Public Personnel Administration: Lesson 3 Job Analysis and DesignDocument18 pagesPAD214 Introduction To Public Personnel Administration: Lesson 3 Job Analysis and Designnsaid_31No ratings yet

- DEPED RPMS Form - For Teachers - 1Document11 pagesDEPED RPMS Form - For Teachers - 1Sen AquinoNo ratings yet

- SHRM Bock Final4Document52 pagesSHRM Bock Final4Teuku YusufNo ratings yet

- Understanding and Managing Organizational BehaviorDocument193 pagesUnderstanding and Managing Organizational BehaviorRam PhaniNo ratings yet

- Marketing and Product Development CVDocument3 pagesMarketing and Product Development CVashifNo ratings yet

- Mathis 12e Ch01 SHDocument18 pagesMathis 12e Ch01 SHGuidoNo ratings yet

- Role of HR in Managing Workforce Diversity-FinalDocument5 pagesRole of HR in Managing Workforce Diversity-FinalTanmay SaykhedkarNo ratings yet

- Performance Appraisal Form Version 2Document5 pagesPerformance Appraisal Form Version 2asd dsaNo ratings yet

- Creating A Business-Focused HR Function With Analytics and Integrated Talent ManagementDocument7 pagesCreating A Business-Focused HR Function With Analytics and Integrated Talent ManagementAshutoshNo ratings yet

- AdjectivesDocument1 pageAdjectivesEve NgewNo ratings yet

- Developing Performance Improvement PlanDocument3 pagesDeveloping Performance Improvement PlanFidel EstebanNo ratings yet

- PD For Salary Scale ProjectDocument5 pagesPD For Salary Scale ProjectAdjoa V VickerNo ratings yet

- Trends in TalentDocument10 pagesTrends in TalentKevin J RuthNo ratings yet

- For Assignment For JanDocument10 pagesFor Assignment For JanGinu Anna GeorgeNo ratings yet

- Guide On Developing A HRM Plan: Civil Service Branch June 1996Document28 pagesGuide On Developing A HRM Plan: Civil Service Branch June 1996udarapriyankaraNo ratings yet

- HR HelpdeskDocument6 pagesHR HelpdeskHaytham El MardiNo ratings yet

- PI-KPI Conference DubaiDocument9 pagesPI-KPI Conference DubaiTeodoraNo ratings yet

- Job Description Doc Download Job Evaluation Job GradeDocument15 pagesJob Description Doc Download Job Evaluation Job GradePrateik BhatnaggarNo ratings yet

- Job Description - NOC EngineerDocument2 pagesJob Description - NOC EngineerMd ShujauddinNo ratings yet

- Individual Assessment Form - Sample Grading SystemDocument1 pageIndividual Assessment Form - Sample Grading SystemrazvanNo ratings yet

- Morgan Stanley - 14th April - UpdatedDocument4 pagesMorgan Stanley - 14th April - UpdatedShubhangi VirkarNo ratings yet

- Resume - Sneha ChandakDocument3 pagesResume - Sneha ChandakSnehaNo ratings yet

- BibliographyDocument3 pagesBibliographyAmber AJNo ratings yet

- A Virtual Private NetworkDocument7 pagesA Virtual Private NetworkAmber AJNo ratings yet

- DP 07061Document44 pagesDP 07061Amber AJNo ratings yet

- EviewsDocument1 pageEviewsAmber AJNo ratings yet

- Final Report of EntrepreuershipDocument19 pagesFinal Report of EntrepreuershipAmber AJNo ratings yet

- ACCOUNTING COMPETENCY EXAM SAMPLEDocument12 pagesACCOUNTING COMPETENCY EXAM SAMPLEAmber AJNo ratings yet

- Mailing Address: Block B, North Nazimabad Karachi, Pakistan PTCL: +9221-36675295, Cell: +03133080329Document1 pageMailing Address: Block B, North Nazimabad Karachi, Pakistan PTCL: +9221-36675295, Cell: +03133080329Amber AJNo ratings yet

- MBA Tax Assignment AnalysisDocument73 pagesMBA Tax Assignment AnalysisAmber AJNo ratings yet

- Public Relations in Islam: Class: M.A Previous, Submitted To: Ma Am FatimaDocument13 pagesPublic Relations in Islam: Class: M.A Previous, Submitted To: Ma Am FatimaAmber AJNo ratings yet

- Case Study Pink RibbonDocument8 pagesCase Study Pink RibbonAmber AJNo ratings yet

- Banking Industry Volatility and GrowthDocument1 pageBanking Industry Volatility and GrowthAmber AJNo ratings yet

- J.K Rowling : Syeda Sahar Fatemah Farheen Aslam Khan Madiha Raees Sana Abedi Presenting OnDocument10 pagesJ.K Rowling : Syeda Sahar Fatemah Farheen Aslam Khan Madiha Raees Sana Abedi Presenting OnAmber AJNo ratings yet

- Internship Report UblDocument103 pagesInternship Report UblAngel Best100% (4)

- Development Theater SkillsDocument1 pageDevelopment Theater SkillsAmber AJNo ratings yet

- Advertising Strategy: A Presentation Presented To Ms. Sobia FarooqDocument6 pagesAdvertising Strategy: A Presentation Presented To Ms. Sobia FarooqAmber AJNo ratings yet

- PTCLDocument30 pagesPTCLsadafjafriNo ratings yet

- Lit Review of MBRDocument10 pagesLit Review of MBRAmber AJNo ratings yet

- A Virtual Private NetworkDocument7 pagesA Virtual Private NetworkAmber AJNo ratings yet

- 14 PR Tips From Known Journalists Martin KellerDocument6 pages14 PR Tips From Known Journalists Martin KellerAmber AJNo ratings yet

- Advertising Strategy: A Presentation Presented To Ms. Sobia FarooqDocument6 pagesAdvertising Strategy: A Presentation Presented To Ms. Sobia FarooqAmber AJNo ratings yet

- Cardiovascular Module Time Table Week-IIDocument1 pageCardiovascular Module Time Table Week-IIAmber AJNo ratings yet

- PHARMA Macrolids & QunolonesDocument4 pagesPHARMA Macrolids & QunolonesAmber AJNo ratings yet

- Internship Report UblDocument103 pagesInternship Report UblAngel Best100% (4)

- Internship Report On UBL 3Document13 pagesInternship Report On UBL 3M umarNo ratings yet

- Bank Treasury Operations Competency MatrixDocument4 pagesBank Treasury Operations Competency MatrixAmber AJNo ratings yet

- PHARMA Macrolids & QunolonesDocument4 pagesPHARMA Macrolids & QunolonesAmber AJNo ratings yet

- Cost Benefit AnalysisDocument11 pagesCost Benefit AnalysisAmber AJNo ratings yet

- Internship Report On UBL 3Document13 pagesInternship Report On UBL 3M umarNo ratings yet

- Understanding Cellular Abnormalities and Down SyndromeDocument2 pagesUnderstanding Cellular Abnormalities and Down SyndromeAmber AJNo ratings yet

- Stanley Funds ResearchDocument115 pagesStanley Funds ResearchWaleed TariqNo ratings yet

- 1.5 Financial Securities and The Cost of Money: Self-TestDocument1 page1.5 Financial Securities and The Cost of Money: Self-Testadrien_ducaillouNo ratings yet

- A Study On Trading Financial Instruments111Document19 pagesA Study On Trading Financial Instruments111Rajendra NishadNo ratings yet

- Chapter 9: Foreign Exchange Market: MortgageDocument3 pagesChapter 9: Foreign Exchange Market: MortgageJustine JaymaNo ratings yet

- Credit Default SwapDocument12 pagesCredit Default SwapHomero García AlonsoNo ratings yet

- DerivativesDocument130 pagesDerivativesPavithran ChandarNo ratings yet

- BSAD 183 Fall 2018 SyllabusDocument4 pagesBSAD 183 Fall 2018 SyllabusConstantinos ConstantinouNo ratings yet

- An Introduction To Fuel HedgingDocument5 pagesAn Introduction To Fuel HedgingMercatus Energy AdvisorsNo ratings yet

- Derivatives Interview QuestionsDocument14 pagesDerivatives Interview Questionsanil100% (3)

- Disclaimer eDocument1 pageDisclaimer eshivom bhatiyaNo ratings yet

- Final Exam 10 PDF FreeDocument12 pagesFinal Exam 10 PDF FreeMariefel OrdanezNo ratings yet

- ABM MODULE D OliveboardDocument114 pagesABM MODULE D OliveboardASHUTOSHNo ratings yet

- Financial Instrument ClassificationDocument43 pagesFinancial Instrument ClassificationShah KamalNo ratings yet

- Financial MarketsDocument13 pagesFinancial MarketschidanandckmNo ratings yet

- Capital Market ReformsDocument6 pagesCapital Market ReformsPoonam SwamiNo ratings yet

- Project ReportDocument29 pagesProject ReportKallu Kallu100% (1)

- IFRS 9 Part 1Document49 pagesIFRS 9 Part 1ErslanNo ratings yet

- Pimco BondDocument128 pagesPimco BondmorrisonkevindNo ratings yet

- A Comprehensive Guide To Investing in GoldDocument27 pagesA Comprehensive Guide To Investing in GoldBrian BarrettNo ratings yet

- Vanguard FTSE All-World UCITS ETF: (USD) Distributing - An Exchange-Traded FundDocument4 pagesVanguard FTSE All-World UCITS ETF: (USD) Distributing - An Exchange-Traded FundFranco CalabiNo ratings yet

- CHAPTER 2 Mechanics of Futures MarketsDocument3 pagesCHAPTER 2 Mechanics of Futures MarketsAishwarya RajeshNo ratings yet

- TRM ResumeDocument8 pagesTRM ResumeJustin PageNo ratings yet

- Cash ReviewerDocument35 pagesCash ReviewerAprile AnonuevoNo ratings yet

- Tut Topic 1 QADocument3 pagesTut Topic 1 QASiow WeiNo ratings yet

- Forward Contract Futures Contract: Structured Notes and Collateral Mortgage ObligationsDocument10 pagesForward Contract Futures Contract: Structured Notes and Collateral Mortgage ObligationsAlelie dela CruzNo ratings yet

- The Collapse of Metallgesellschaft UnhedDocument54 pagesThe Collapse of Metallgesellschaft UnhedJuanNo ratings yet

- Mira: An On-Chain Passive Investment Vehicle: 208311130BENZINGAFULLNGTH12290408 Makers#Document13 pagesMira: An On-Chain Passive Investment Vehicle: 208311130BENZINGAFULLNGTH12290408 Makers#ThanasisNo ratings yet

- Unit 1: Derivatives - FuturesDocument90 pagesUnit 1: Derivatives - Futuresseema mundaleNo ratings yet

- Prutech Introductions New PDocument21 pagesPrutech Introductions New PPotluri Phani Ratna KumarNo ratings yet

- International Financial Management: by Jeff MaduraDocument48 pagesInternational Financial Management: by Jeff MaduraBe Like ComsianNo ratings yet