Professional Documents

Culture Documents

Segregation of Duties

Uploaded by

Shailendra SinghOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Segregation of Duties

Uploaded by

Shailendra SinghCopyright:

Available Formats

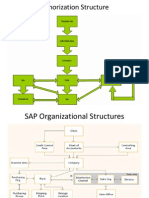

The following figures summarize ways in which dut:es could be segregated with two, three and four people.

Segregation of Duties- Two people

Accountant or other financial personnel

11,

, :',"

...

'

,. Rec()rdpl~dges -,.MallcheckfH-

<L

'. -"writ~ch~pks,:, ", ,'_ ,. Reconcil~bankstatement Record credit/debits -,.Approve payroll ;..Disburse petty cash :;... Authorize purchase orders ;-Authorize check requests :;.. Authorize invoices for payment

Executive Director

,' ... : .. ;L;":r: .. :;;;d~:::t':f':{

-. ,,:~:.:."-""-_'/:-""::: .,'~":.'

";Regeiv~ <,tri~()pen b~~~,st<~ments'

,',~ ~~k3~r;~i~Y',!\;;:""..'' . '.",., .. '

':;"Perform interbank transfers. :;"Distributepaych~cks~ ' , ;;..Reviewpetty cash ", > Review bank reconciliations ;..Approve vendor invoices ;..Perform analytical procedures ;-Sign important contracts :;"'Makecompensation adjustments ;..Discuss matters with BOD or audit committee

A receptionist or administrative employee could open mail and create a deposit log

In addition, non accounting personnel such as a receptionist, program personnel etc can be trained to perform some of the less technical duties. Board members can be used to further segregate duties.

Segregation of Duties - Three people

Accounting Staff ,. Record pledges ., Write checks ,r Reconcile bank statement ;, Record credit/debits :..Reconcile petty cash :"-Distribute payroll

1&1

Executive Director

Accountant or other financial personnel ~ Approve payroll rProcess vendor invoices ~Mail checks ,. Perform analytical procedures :;.Approve invoices for payment ;;.. Disburse petty cash .".. Open mail and log cash ;, Receive bank statements

,.Sign importaritcontractS':-; , . ,. :.-Make comperu;ation adjustments . > Dis2uss matte'is with BOD ' , ' or audit committee rSign checks ';;Complete deposit slips ;;"Perform interbank transfers rPerform analytical procedures ;;.. Review bank reconciliation

In addition, non accounting personnel such as a receptionist, program personnel etc can be trained to perform some of the less technical duties. Board members can be used to further segregate duties.

Segregation of Duties - Four people

Accounting Staff ;;.Record pledges ;-Write checks ,. Reconcile bank statement ;..Record credit/debits

>-

Executive Director

Reconcile petty cash

Accountant

I other

:;.. Sign' importtmtcontracts' ; ;. Ma~~ compensation~i . adjustm~nts .. > Discuss matters with BOD' or audit committee :>Sign checks ;- Perform analytical procedures Accountant

;;.Distribute payroll >Open mairand log cash ;..Disburse petty cash ;v Mail checks ;- Review bank reconciliation

I other

')-Approve vendor invoi<:es Perform interbank transfers ;..Approve payroll :'--Complete deposit slips

>-

Non accounting personnel such as a receptionist, program personnel etc can be trained to perform some of the less technical duties. Board members can be used to further segregate duties.

Segregation

of Duties Helps to

eceivable rsements) r be posting to g, he ody receiving, cash of cash or nitiating at person d ailed by by persons a plates should

Kickbacks checks Fictitious invoices or or write-offs False Credits/ Void sales and return should be than the person who functions as Person olle cashier initiating who or different posts signs purchases, tochecks accounts approving should receivable. be different than the Person who Segregation opens mail prevent and of Duties logs in purchases, cash receipts inflating Skimming Lapping altering fraud receivables. checks schemes scheme altering reconciles with cash in register drawer. shipping, purchasing receiving, cash receipts, accounts payable takes independent cash register readings and Excess Lock box Customer follow-up oncash complaints isshould independent of Credit memes are handled by those who handle cash Persons who operate register be Stealing

Cycle Property

Segregation of Duties Those who maintain fixed asset records should not have access to movable assets

Helps to prevent fraud scheme Stealing assets Personal capital improvements Stealing investments Diverting interest/gains

Investments

The person initiating, evaluating and approving transactions should be different than the ones who maintain accounting records and the general ledger.

The person than with the responsibility for investments should I Stealing be different record keeper. investments Accounts Payable/ purchasing

Purchasing be separate from requisitioning, I Excess shipping andshould receiving purchasing Requisitioning, purchasing and receiving should be different from those who process invoices, accounts payable, cash receipts and disbursements, and the general ledger functions Personal capital improvements Fictitious or inflating invoices or altering checks

Duplicate Invoice processing and accounts payable should be I payments separate from the general ledger function Persons who are independent of purchasing and receiving should follow-up on unmatched open purchase orders, receiving reports and invoices. Fictitious or inflating invoices or altering checks Persons who prepare payroll should be independent of Fictitious time keeping, distribution of checks and hiring. They employees should not have access to other payroll data or cash. Overpayments Payroll should be separate from the general ledger of wages/ function stealing payroll checks Diverting wages or payroll taxes Embezzling withholdings Keeping terminated employees on payroll

Payroll

You might also like

- Segregation of Duties QuestionnaireDocument25 pagesSegregation of Duties QuestionnaireManna MahadiNo ratings yet

- Segregation of Duties OverviewDocument1 pageSegregation of Duties OverviewKarthik EgNo ratings yet

- Segregation of Duties MatrixDocument10 pagesSegregation of Duties MatrixAnonymous c1nF8A100% (1)

- Segregation of DutiesDocument8 pagesSegregation of DutiesmanishmestryNo ratings yet

- Segregation of DutiesDocument1 pageSegregation of DutiesjadfarranNo ratings yet

- Adequate Segregation of DutiesDocument3 pagesAdequate Segregation of DutiesdddibalNo ratings yet

- C23 - Segregation of DutiesDocument16 pagesC23 - Segregation of Dutieskannie_bNo ratings yet

- Segregation of Duties MatrixDocument13 pagesSegregation of Duties MatrixForumnoj100% (1)

- Segregation of DutiesDocument46 pagesSegregation of DutiesYai Ibrahim100% (2)

- Segregation of Duties MatrixDocument1 pageSegregation of Duties MatrixSandeep BajajNo ratings yet

- Procurement and Accounts PayableDocument4 pagesProcurement and Accounts PayableHazel Cabarrubias MacaNo ratings yet

- SOD EvaluatorDocument1 pageSOD Evaluatoralejandroctay100% (1)

- SOD MatrixDocument1 pageSOD MatrixAjai SrivastavaNo ratings yet

- Sap R 3 Accounts Payable MatrixDocument19 pagesSap R 3 Accounts Payable Matrixpaichowzz100% (1)

- Apps Segregation of DutiesDocument31 pagesApps Segregation of DutiesMahmoud Fawzy100% (1)

- Fixed Assets PolicyDocument19 pagesFixed Assets PolicyLouieNo ratings yet

- Segregation of Duties Framework OverviewDocument2 pagesSegregation of Duties Framework OverviewChinh Lê ĐìnhNo ratings yet

- SAP Sales Business Objectives Risk & Control MatrixDocument4 pagesSAP Sales Business Objectives Risk & Control Matrixmani197100% (3)

- Fixed Asset VeificationDocument12 pagesFixed Asset Veificationnarasi64No ratings yet

- WIP IA Manual - Audit Program - Sales and ReceivablesDocument10 pagesWIP IA Manual - Audit Program - Sales and ReceivablesMuhammad Faris Ammar Bin ZainuddinNo ratings yet

- BDO Segregation of Duties ChecklistDocument34 pagesBDO Segregation of Duties Checklisthaseebahmed999100% (2)

- Module1 Internal Control Checklist en 0Document12 pagesModule1 Internal Control Checklist en 0Mohammad Abd Alrahim ShaarNo ratings yet

- Segregation of Duties Template2Document5 pagesSegregation of Duties Template2are2007No ratings yet

- Purchasing Card Policy 07-08Document9 pagesPurchasing Card Policy 07-08Anonymous ZRsuuxNcCNo ratings yet

- Risk Matrix ProcurementDocument3 pagesRisk Matrix ProcurementmynameiszooNo ratings yet

- Close ChecklistDocument6 pagesClose ChecklistShifan Ishak100% (1)

- GRC RulesetDocument6 pagesGRC RulesetDAVIDNo ratings yet

- Procurement Audit SampleDocument13 pagesProcurement Audit SampleCyrile Dianne Therese Ablir-BaliolaNo ratings yet

- K AP 3 Capital Work in ProgressDocument5 pagesK AP 3 Capital Work in Progresssibuna151No ratings yet

- Audit Planning MemoDocument15 pagesAudit Planning MemoabellarcNo ratings yet

- Process Accounts Payable RCM - RevdDocument24 pagesProcess Accounts Payable RCM - RevdSandeep ShenoyNo ratings yet

- Deloitte SODDocument25 pagesDeloitte SODSPMeher100% (2)

- Audit Programme - Manufacturing - Procure To PayDocument23 pagesAudit Programme - Manufacturing - Procure To PayJessmin DacilloNo ratings yet

- Best Practices SOD Remediation ISACA V2 06.12.15Document12 pagesBest Practices SOD Remediation ISACA V2 06.12.15Norman AdimoNo ratings yet

- Internal Control: A Tool For The Audit CommitteeDocument18 pagesInternal Control: A Tool For The Audit CommitteeVieNo ratings yet

- Segregation of Duties MatrixDocument1 pageSegregation of Duties MatrixAbubakar Siddique100% (6)

- CISA Segregation of DutiesDocument5 pagesCISA Segregation of Dutiesktahil75% (4)

- Control Matrix - Premiums (PC)Document9 pagesControl Matrix - Premiums (PC)Jose SasNo ratings yet

- Control Risk MatrixDocument7 pagesControl Risk Matrixmuhammad andri lowe100% (1)

- Audit Program 1 PDFDocument3 pagesAudit Program 1 PDFHimanshu GaurNo ratings yet

- Sarbanes-Oxley Compliance: A Checklist For Evaluating Internal ControlsDocument22 pagesSarbanes-Oxley Compliance: A Checklist For Evaluating Internal ControlsEthicaNo ratings yet

- Financial Close Process Controls QuestionnaireDocument8 pagesFinancial Close Process Controls Questionnairesaurabhmjn100% (1)

- Audit Program Bank and CashDocument4 pagesAudit Program Bank and CashFakhruddin Young Executives0% (1)

- Audit CheclistDocument34 pagesAudit CheclistYoga Guru100% (1)

- ITG-Internal Control MatrixDocument14 pagesITG-Internal Control Matrixbladexdark67% (3)

- Internal Control Document 1Document25 pagesInternal Control Document 1hossainmzNo ratings yet

- Working Papers - Top Tips PDFDocument3 pagesWorking Papers - Top Tips PDFYus Ceballos100% (1)

- Auditing in An ERP Environment Chapter 3: Automated Application ControlsDocument39 pagesAuditing in An ERP Environment Chapter 3: Automated Application Controlssrinathaladi shilpa100% (1)

- TheProcure To PayCyclebyChristineDoxeyDocument6 pagesTheProcure To PayCyclebyChristineDoxeyrajus_cisa6423No ratings yet

- Internal Audit and Budget Department - Cash ReceiptsDocument13 pagesInternal Audit and Budget Department - Cash ReceiptsMarineth Monsanto100% (1)

- Audit WorksheetDocument7 pagesAudit WorksheetEricXiaojinWangNo ratings yet

- Manual Accounts PayableDocument134 pagesManual Accounts Payablesrinivas0731No ratings yet

- Audit Accounts PayableDocument7 pagesAudit Accounts PayableMacmilan Trevor Jamu0% (1)

- Accounts Payable Sox TestingDocument2 pagesAccounts Payable Sox TestingStephen JonesNo ratings yet

- Procure To Pay Lifecycle - MarkedDocument15 pagesProcure To Pay Lifecycle - MarkedYogesh SalviNo ratings yet

- Procurement To PAY Audit by ProtivitiDocument24 pagesProcurement To PAY Audit by ProtivitiAjay UpadhyayNo ratings yet

- Chapter 7Document22 pagesChapter 7Genanew AbebeNo ratings yet

- BOOKKEEPINGDocument6 pagesBOOKKEEPINGsserugo dodovicNo ratings yet

- Cash Receipts CycleDocument4 pagesCash Receipts CycleYenNo ratings yet

- SAP Authorization & Organizational StructuresDocument2 pagesSAP Authorization & Organizational StructuresShailendra SinghNo ratings yet

- Segregation of DutiesDocument5 pagesSegregation of DutiesShailendra Singh100% (1)

- PP Batch Management PresentationDocument20 pagesPP Batch Management PresentationsunilveerthinenisapNo ratings yet

- Segregation of DutiesDocument5 pagesSegregation of DutiesShailendra Singh100% (1)

- SAP GRC 99411GRCAC - InstallationsDocument36 pagesSAP GRC 99411GRCAC - Installationsakeel377No ratings yet

- LSMW Screen Shots For Vendor CodeDocument93 pagesLSMW Screen Shots For Vendor CodeHarikrishnaraj Mohanasundaram100% (2)

- GRC Basic-1 PDFDocument42 pagesGRC Basic-1 PDFsupriyacnaikNo ratings yet

- GRC Basic-1 PDFDocument42 pagesGRC Basic-1 PDFsupriyacnaikNo ratings yet

- ProgrammingInExcelVBA AnIntroductionDocument83 pagesProgrammingInExcelVBA AnIntroductionJim Hanson100% (2)

- Business Model FInancial Model SlidsDocument16 pagesBusiness Model FInancial Model SlidsChintan GosarNo ratings yet

- Modified Put Butterfly - FidelityDocument6 pagesModified Put Butterfly - FidelityNarendra BholeNo ratings yet

- Powers of Trust Formed by ARC Under Sarfasei ActDocument3 pagesPowers of Trust Formed by ARC Under Sarfasei ActNidhi BothraNo ratings yet

- Ecodal - A.M. No. 05-11-04-SC - Rules of Procedure in Cases of Civil ForfeitureDocument34 pagesEcodal - A.M. No. 05-11-04-SC - Rules of Procedure in Cases of Civil ForfeitureKyle LuNo ratings yet

- Forwards FuturesDocument29 pagesForwards FuturesAmeen ShaikhNo ratings yet

- Accounting PrimerDocument21 pagesAccounting PrimerSarith SagarNo ratings yet

- Discussion 4 FinanceDocument5 pagesDiscussion 4 Financepeter njovuNo ratings yet

- Chapter 3Document8 pagesChapter 3Nigussie BerhanuNo ratings yet

- Mancosa Mid Year Undergraduate Fee 2023Document2 pagesMancosa Mid Year Undergraduate Fee 2023John-ray HendricksNo ratings yet

- Summary of Account: Invoice/Statement of Account Service Tax REG. NO:B16-1808-31031789Document4 pagesSummary of Account: Invoice/Statement of Account Service Tax REG. NO:B16-1808-31031789NKNo ratings yet

- Introduction To Depository Institutions Info Sheet 2 2 1 f1Document5 pagesIntroduction To Depository Institutions Info Sheet 2 2 1 f1api-296017752No ratings yet

- Lec 1 After Mid TermDocument9 pagesLec 1 After Mid TermsherygafaarNo ratings yet

- Reimbursement Expense ReceiptDocument2 pagesReimbursement Expense ReceiptCheryl AquinoNo ratings yet

- Thermalnet Methodology Guideline On Techno Economic AssessmentDocument25 pagesThermalnet Methodology Guideline On Techno Economic Assessmentskywalk189No ratings yet

- Persoanl Account Opening Form English A1edbfb2bdDocument8 pagesPersoanl Account Opening Form English A1edbfb2bdsubhsarki4No ratings yet

- Financial Statements 2, ModuleDocument4 pagesFinancial Statements 2, ModuleSUHARTO USMANNo ratings yet

- Ch3 - test bank: corporate finance (ةقراشلا ةعماج)Document25 pagesCh3 - test bank: corporate finance (ةقراشلا ةعماج)sameerNo ratings yet

- The Following Data Pertain To Lincoln Corporation On December 31Document8 pagesThe Following Data Pertain To Lincoln Corporation On December 31Jhianne Mae Albag100% (1)

- Tax Quiz 4Document61 pagesTax Quiz 4Seri CrisologoNo ratings yet

- Chyna's Dreamland Chase SeptDocument5 pagesChyna's Dreamland Chase SeptJonathan Seagull Livingston100% (1)

- RiskDocument3 pagesRiskChaucer19No ratings yet

- Green Shoe OptionDocument34 pagesGreen Shoe OptionAbhishek GuptaNo ratings yet

- Financial Statement Analysis and Security Valuation: Stephen H. PenmanDocument24 pagesFinancial Statement Analysis and Security Valuation: Stephen H. PenmanodvutNo ratings yet

- NorQuant Multi-Asset Fund White Paper 2023Document24 pagesNorQuant Multi-Asset Fund White Paper 2023oscar.haukvikNo ratings yet

- A Study On Equity Analysis With Respect To Banking Sector at INDIABULLSDocument20 pagesA Study On Equity Analysis With Respect To Banking Sector at INDIABULLSNationalinstituteDsnr0% (1)

- Complete Kota FibresDocument13 pagesComplete Kota FibresSiti NadhirahNo ratings yet

- A Senior Essay Submitted To The Department of in The Partial Fulfillment of The Requirement For The Degree of Bachelor of Art (B.A) OFDocument48 pagesA Senior Essay Submitted To The Department of in The Partial Fulfillment of The Requirement For The Degree of Bachelor of Art (B.A) OFmubarek oumerNo ratings yet

- The Coinage of Two Hundred Rupees and Ten Rupees Coins To Commemorate The Occasion of 200 H BIRTH ANNIVERSARY of TATYA TOPE Rules, 2015.Document6 pagesThe Coinage of Two Hundred Rupees and Ten Rupees Coins To Commemorate The Occasion of 200 H BIRTH ANNIVERSARY of TATYA TOPE Rules, 2015.Latest Laws TeamNo ratings yet

- Solution - Problems 1-8 Cash and Cash EquivalentsDocument3 pagesSolution - Problems 1-8 Cash and Cash Equivalentsanon_965241988No ratings yet

- Cim B ClicksDocument13 pagesCim B ClicksFirdaus NoorNo ratings yet