Professional Documents

Culture Documents

Monitoring The Perception of Future International Liquidity

Uploaded by

Eduardo PetazzeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Monitoring The Perception of Future International Liquidity

Uploaded by

Eduardo PetazzeCopyright:

Available Formats

Monitoring the Perception of Future International Liquidity

by Eduardo Petazze Central banks are responsible for providing adequate levels of money supply In fact, since the beginning of the subprime mortgage crisis, and the crisis over sovereign debt levels in some euro area countries, central banks unconventional policy designed as quantitative easing (QE), significantly reducing the impact recessive such events. Although monetary policy objectives of the major central banks (including the U.S. Federal Reserve) has not changed in terms of keeping monetary growth rates above the growth rates of gross domestic product, the ads of possible future reductions rates of monetary expansion (via reduced levels of central banks' investment in secondary markets, or by lower credit support requirements of financial institutions to the central bank) has had and may continue to have a negative impact on perception of economic agents about future levels of international liquidity.

A first effect of this perception on future levels of international liquidity, is the reversal of hot

money flows, as can be seen in the statistics on US-CFTC Commitment of Trades, for positions in International Markets Currency futures contracts for speculative investors . Certainly a deficit in the capital account in a country, caused by an apparent flight to quality, must be offset by a surplus in the current account of the balance of payments, or the sale of its central bank reserves or covered by swap agreements that keep each other major central banks. In the first alternative will increase the volatility of currencies, affecting international trade in goods and services, the second alternative would lead to an unsustainable policy interventions over time or to oppose longer-term trends, the third alternative requires swaps periods significantly exceeding the 1-year-long, in order to build an anti-cyclical mechanism to stabilize international currencies, subject to meet short-term movements.

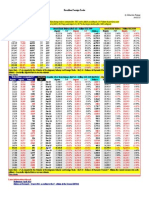

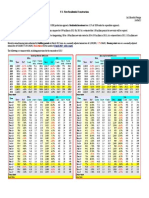

A second effect of a change in the perception of future levels of liquidity risk is the growth of noncompliance can be monitored through the evolution of the prices of credit default swaps for major credit takers in international markets : countries and international financial institutions. The table on the following page shows a summary of the evolution of the CDS for an average of 60 countries and 18 international financial institutions, during the months of July and August 2013. For the first half of 2013 can be found the following documents: Sovereign Credit Default Swaps (5 Year) - 2Q2013 Pricing Report Global Financial Risk Monitor

Credit default swaps Summary 60 Weekly CDS 5 yr. (bps) sovereigns chg. 1 Jul 13 199.8 -24.8 2 Jul 13 198.1 -17.9 3 Jul 13 205.7 -2.2 4 Jul 13 203.0 -1.0 5 Jul 13 201.4 -1.2 8 Jul 13 202.2 2.4 9 Jul 13 199.6 1.6 10 Jul 13 199.5 -6.3 11 Jul 13 196.4 -6.6 12 Jul 13 193.9 -7.5 15 Jul 13 190.2 -12.0 16 Jul 13 192.2 -7.4 17 Jul 13 191.7 -7.7 18 Jul 13 184.5 -11.9 19 Jul 13 185.9 -7.9 22 Jul 13 181.4 -8.8 23 Jul 13 181.3 -10.9 24 Jul 13 184.5 -7.2 25 Jul 13 187.4 2.9 26 Jul 13 187.0 1.1 29 Jul 13 188.4 7.0 30 Jul 13 189.6 8.3 31 Jul 13 190.9 6.3 1 Aug 13 188.6 1.2 2 Aug 13 187.9 0.9 5 Aug 13 187.1 -1.4 6 Aug 13 188.2 -1.3 7 Aug 13 190.0 -0.9 8 Aug 13 189.5 0.9 9 Aug 13 188.4 0.5 12 Aug 13 187.7 0.6 13 Aug 13 185.3 -3.0 14 Aug 13 187.2 -2.7 15 Aug 13 190.2 0.7 16 Aug 13 192.1 3.6 19 Aug 13 198.4 10.7 20 Aug 13 199.6 14.4 60 Monthly CDS 5 yr. (bps) sovereigns chg. June average 193.2 32.8 July average 192.8 -0.4 August, avg. to date 190.0 -2.8 Provisional estimate data

18 Int. Weekly Banks chg. 161.5 -17.8 159.2 -14.2 166.0 2.6 162.9 3.8 163.2 -0.6 159.9 -1.6 154.2 -5.0 157.5 -8.5 154.1 -8.8 155.6 -7.5 151.3 -8.7 151.8 -2.4 151.1 -6.4 145.0 -9.0 142.1 -13.5 137.5 -13.8 139.7 -12.2 138.4 -12.7 141.5 -3.5 141.7 -0.4 142.5 5.0 140.2 0.5 139.3 0.9 133.9 -7.7 134.0 -7.7 133.8 -8.7 132.7 -7.5 134.1 -5.2 131.1 -2.8 131.3 -2.6 131.4 -2.4 129.2 -3.5 129.5 -4.6 134.7 3.6 136.7 5.4 139.0 7.6 140.3 11.1 18 Int. Monthly Banks chg. 150.5 26.8 150.3 -0.2 133.7 -16.6

Sovereign Weekly Vs. Banks chg. 38.3 -7.1 38.8 -3.7 39.8 -4.9 40.1 -4.8 38.2 -0.6 42.3 4.0 45.4 6.6 42.0 2.2 42.3 2.1 38.2 0.0 39.0 -3.3 40.4 -5.1 40.6 -1.4 39.4 -2.8 43.8 5.6 43.9 4.9 41.6 1.3 46.2 5.5 45.9 6.4 45.4 1.5 45.9 2.0 49.4 7.8 51.5 5.4 54.8 8.9 53.9 8.6 53.3 7.4 55.5 6.1 55.9 4.3 58.4 3.6 57.1 3.2 56.3 3.0 56.1 0.6 57.7 1.9 55.5 -3.0 55.3 -1.8 59.4 3.2 59.3 3.2 Sovereign Monthly Vs. Banks chg. 42.7 6.0 42.5 -0.2 56.3 13.8

The increase in average risk and expanding the spread between countries and between international financial institutions, exacerbating volatility in international capital flows and unnecessarily expensive the cost of servicing the public debt, too difficult for international banks achieve goals capital adequacy established by Basel III. Curiously, financial sector regulators and central banks in the stress tests that monitor for major financial institutions, analyze the additional capital buffer that an entity should be a result of illiquidity risk, a risk that is ultimately decided monetary policy by the central bank itself. (see on this point the recommendations of the Federal Reserve in the paper on capital planning at large bank holding companies Capital Planning at Large Bank Holding Companies (PDF 48 pages) The third effect (not officially recognized) Interest rates have been defined as the price of money, that is affected by supply and demand for money. As in commodities, the spot market prices relate to prices in the futures markets, which in turn are affected by expectations or perceptions of economic agents on the evolution of supply and global demand of that "commodity" If the yield curve represents the expected future supply and demand for money, a change in the expectation (by reduction in the rate of monetary expansion) impact the yield curve increasing the medium and long-term interest rate Eventually such a change could be neutralized by the Fed by an Operation Twist program (sell short-bonds to buy long-bonds), although this has not been too much firepower It has always been a challenge for monetary policy, to establish appropriate mechanisms for transmission of this policy to the market While the inflation rate remains below the inflation targeting central banks, steepening of the yield curve of bonds, further hinder transmission mechanisms of monetary policy. In summary of this point, interest rates of medium and long term could again escape the scope of monetary policy of central banks. Two final comments The encouraging return to a previous situation of normality, when the world has changed, it should not be a dogma. Perceptions do matter and impact (at least in economics). 3

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Dispersion Trade Option CorrelationDocument27 pagesDispersion Trade Option Correlationmaf2014100% (2)

- Securities Analysis and Portfolio Management PDFDocument64 pagesSecurities Analysis and Portfolio Management PDFShreya s shetty100% (1)

- Group 3 - Deutsche Bank and The Road To Basel IIIDocument14 pagesGroup 3 - Deutsche Bank and The Road To Basel IIIAmit Meshram0% (1)

- About Fibonacci RetracementDocument26 pagesAbout Fibonacci RetracementLcm Tnl100% (2)

- Merchant Banking in BangladeshDocument23 pagesMerchant Banking in BangladeshNazim Uddin Mahmud67% (3)

- This Study Resource Was: Case SummaryDocument2 pagesThis Study Resource Was: Case SummaryAde AdeNo ratings yet

- Ch06, Money Market Jeff MaduraDocument28 pagesCh06, Money Market Jeff Madurasarah_devinaNo ratings yet

- Bbva Compass - Digital MarketingDocument10 pagesBbva Compass - Digital Marketingꀭꀤꌗꃅꀎ ꀘꍏꋪꂵꍏꀘꍏꋪNo ratings yet

- Statement of Axis Account No:918010074619958 For The Period (From: 08-07-2020 To: 25-01-2021)Document11 pagesStatement of Axis Account No:918010074619958 For The Period (From: 08-07-2020 To: 25-01-2021)MOHAMMAD IQLASHNo ratings yet

- China - Price IndicesDocument1 pageChina - Price IndicesEduardo PetazzeNo ratings yet

- México, PBI 2015Document1 pageMéxico, PBI 2015Eduardo PetazzeNo ratings yet

- WTI Spot PriceDocument4 pagesWTI Spot PriceEduardo Petazze100% (1)

- Brazilian Foreign TradeDocument1 pageBrazilian Foreign TradeEduardo PetazzeNo ratings yet

- Retail Sales in The UKDocument1 pageRetail Sales in The UKEduardo PetazzeNo ratings yet

- Euro Area - Industrial Production IndexDocument1 pageEuro Area - Industrial Production IndexEduardo PetazzeNo ratings yet

- U.S. New Residential ConstructionDocument1 pageU.S. New Residential ConstructionEduardo PetazzeNo ratings yet

- The Term Structure of Interest Rates: InvestmentsDocument29 pagesThe Term Structure of Interest Rates: InvestmentssesiliaNo ratings yet

- Fast Graph Howtoknowpart1Document9 pagesFast Graph Howtoknowpart1Sww WisdomNo ratings yet

- Test Bank For Introduction To Finance 17th Edition Ronald W MelicherDocument36 pagesTest Bank For Introduction To Finance 17th Edition Ronald W Melichereleve.agendum9is96100% (44)

- FEBRUARY 23, 2023 Don Sunshine S. Neri Block B Actg 27Document3 pagesFEBRUARY 23, 2023 Don Sunshine S. Neri Block B Actg 27Donn NeriNo ratings yet

- Marwadi Shares Finance LTDDocument100 pagesMarwadi Shares Finance LTDashokNo ratings yet

- Mastering Met A Stock ManualDocument82 pagesMastering Met A Stock ManualTei YggdrasilNo ratings yet

- Unit 4Document14 pagesUnit 4wubeNo ratings yet

- Introduction (UNIT.1) : Investment Analysis and Portfolio ManagementDocument24 pagesIntroduction (UNIT.1) : Investment Analysis and Portfolio Managementramesh.kNo ratings yet

- CFPL PDFDocument15 pagesCFPL PDFManisha SinghNo ratings yet

- Quiz 3Document4 pagesQuiz 3Sameer AsifNo ratings yet

- Mohamed - The Effect of Capital Structure On Stock Returns at Nairobi Securities Exchange A Sectoral AnalysisDocument53 pagesMohamed - The Effect of Capital Structure On Stock Returns at Nairobi Securities Exchange A Sectoral AnalysisdeimamhambaliNo ratings yet

- Seminar 04Document15 pagesSeminar 04api-3695734No ratings yet

- 1.0 Ratio Analysis: Five Years Financial Analysis of Southeast Bank Limited (SEBL)Document2 pages1.0 Ratio Analysis: Five Years Financial Analysis of Southeast Bank Limited (SEBL)Tanjimun NaharNo ratings yet

- Securitization Guidelines RevisedDocument32 pagesSecuritization Guidelines RevisedMAJU70No ratings yet

- FI - M Lecture 3-What Do Interest Rates Mean - What Is Their Role in ValuationDocument25 pagesFI - M Lecture 3-What Do Interest Rates Mean - What Is Their Role in ValuationMoazzam ShahNo ratings yet

- Ipo 2Document99 pagesIpo 2Abhilash Mishra100% (1)

- SN 112105Document8 pagesSN 112105wduslnNo ratings yet

- Cryptocurrency: Risk Management Overview: A Level of CautionDocument3 pagesCryptocurrency: Risk Management Overview: A Level of Cautiondaniella maliwatNo ratings yet

- Chapter 2 Review of Financial Statement Preparation Analysis InterpretationDocument46 pagesChapter 2 Review of Financial Statement Preparation Analysis InterpretationMark DavidNo ratings yet

- Syed Shoaib Finance AssignmentDocument7 pagesSyed Shoaib Finance AssignmentDeeplex dopeNo ratings yet

- Clifford Clark Is A Recent Retiree Who Is Interested in PDFDocument1 pageClifford Clark Is A Recent Retiree Who Is Interested in PDFAnbu jaromiaNo ratings yet