Professional Documents

Culture Documents

Institute of Cost and Management Accountants of Pakistan Summer (May) 2011 Examinations

Uploaded by

Haseeb KhanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Institute of Cost and Management Accountants of Pakistan Summer (May) 2011 Examinations

Uploaded by

Haseeb KhanCopyright:

Available Formats

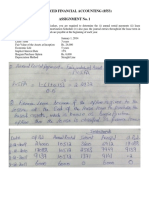

INSTITUTE OF COST AND MANAGEMENT ACCOUNTANTS OF PAKISTAN Summer (May) 2011 Examinations Sunday, the 29th May 2011

FINANCIAL ACCOUNTING (S-301) STAGE 3

Time Allowed: 02 Hours 45 Minutes

(i) (ii) (iii) (iv) (v) (vi) (vii) (viii)

Maximum Marks: 90

Roll No.:

Attempt all questions. Answers must be neat, relevant and brief. In marking the question paper, the examiners take into account clarity of exposition, logic of arguments, effective presentation, language and use of clear diagram/ chart, where appropriate. Read the instructions printed inside the top cover of answer script CAREFULLY before attempting the paper. Use of non-programmable scientific calculators of any model is allowed. DO NOT write your Name, Reg. No. or Roll No. anywhere inside the answer script. Question No.1 Multiple Choice Question printed separately, is an integral part of this question paper. Question Paper must be returned to invigilator after finishing/ writing the exam.

Q. 2

Mr. A, B and C entered into a joint venture by investing Rs.60,000, Rs.80,000 and Rs.100,000 respectively. The sum is deposited in a separate joint bank account. Goods were purchased for Rs.200,000 from Mr. X and paid him by cheque. The amount of Rs.3,600 was paid by cheque as storage expenses of goods purchased. A part of good was sold for Rs.280,000 to Mr. P on cash. The cash was deposited into bank. The unsold goods were taken by Mr. A at an agreed price of Rs.10,000. They share profit in ratio of their investments. Parties settled their accounts at end of the venture.

Marks

Required: Prepare: (i) (ii) Joint Bank Account. Joint Venture Account. 06 06 06

(iii) Personal Account of Mr. A, B and C. Q. 3 MHA Private Ltd., is the provider of specialised liquid used as a raw material in the pharma industry. The product is given to consignee for selling it to other cities of the country. During the month of January 2011, MHA consigned 1000 litres of liquid @ Rs.10 per litre to Mr. Arshad on consignment basis and paid Rs.700 as freight charges. 10% of the liquid gets evaporated which is considered to be the normal loss during transit. Mr. Arshad took the delivery and paid unloading charges @ Rs.2 per litre. Commission is agreed to be given @ 5% on gross sale. During the month 750 litres were sold by Mr. Arshad for Rs.12,000. Required: Suppose an abnormal loss of 25 litres occurred at consignees godown; (i) (ii) Calculate value of abnormal loss. Calculate value of closing stock.

02 02 04 02 02

(iii) Prepare consignment account (iv) Prepare abnormal loss account (v) Prepare consignee account

PTO 1 of 3

Marks

Q. 4

Zaman & Shehroze are in partnership and make up their accounts on December 31, each year. It was agreed that Farhad, a loyal and talented employee of the company be admitted as partner from January 1, 2011 without requiring him to infuse any capital. Following is agreed in the revised partnership agreement: (1) There will be no goodwill adjustment. (2) Partners were to receive 5% on balance of their capital account as at January 1, each year as interest on capital. (3) Zaman and Shehroze were to receive a salary of Rs.15,000 and Rs.27,000 respectively. (4) Farhad's share of profit was to be higher of: (i) A salary of Rs.21,000 plus 1/10th of profit after charging interest on capital and salaries to all partners. OR (ii) 1/6th of profit after charging interest on capital. Any excess amount to Farhad due to the above clause was to be charged specifically to Zaman. (5) The profit after charging interest on capital and partners salaries, were to be divided between Zaman & Shehroze in the ratio of 2 : 1. Additional Information: (a) Capital Account as at January 1, 2011: Zaman Rs. 204,000 Shehroze Rs. 162,000 (b) During the year following amounts had been debited to the partners capital account on account of drawings: Zaman Rs. 40,000 Shehroze Rs. 30,000

(c) Profit for the year ended December 31, 2011 before charging interest on capital and partners salaries was Rs.252,000. Required: Prepare: (i) (ii) Statement showing distribution of profit for the year to partners account. Partners capital account. 12 11

Q. 5

(a)

During year ended on December 31, 2010, Sajid Limited performed the following transactions: (i) Purchased building for Rs.11,000,000 against issuing of 1,000,000 shares of Rs.10 each.

(ii) Issued a suitable number of shares against the purchase of furniture Rs.500,000. The market value of share is Rs.50 each. (iii) Issued 1,000, 10% debenture at Rs.110 each (par value Rs.100 each) redeemable after 5 years at Rs.120. Required: Pass general entries of the above transactions. (b) Define the following as per IAS 16: (i) Carrying amount 02 02 02 2 of 3 (ii) Depreciable amount (iii) Useful life 06

Marks

Q. 6

The trial balance of Vital Industries Limited as on December 31, 2010 is as follows:

DEBIT Building - at cost Plant & machinery - at cost Vehicle - at cost Deferred cost Stock Account receivables Cash and bank balances Wages/ Direct labour Purchases Manufacturing overheads Administrative and selling expenses Financial charges Rs. in 000 40,000 60,000 12,400 1,800 26,490 26,680 1,720 247 225,993 46,880 12,490 9,420 464,120 CREDIT Rs. in 000 Sales 324,860 Share capital 30,000 Share premium 6,000 General reserves 4,000 Accumulated profit / retained earnings 3,870 Long term loan (01/12/2010) 40,000 Short term running finance 18,960 Account payables 12,640 Accrued expenses 4,590 Accumulated depreciation - building 4,900 Accumulated depreciation - plant & machinery Accumulated depreciation - vehicle 12,500 1,800 464,120

Additional Information: (1) The company has an authorised capital of 4,000,000 ordinary shares of Rs.10 each. (2) Details of purchases and inventories(stocks) are as follows: Purchases For The Year 214,900 11,093 Dec 31, 2010 7,526 1,284 4,262 9,878 Rs. in 000 Dec 31, 2009 8,475 1,425 5,630 10,960

Raw material Stores & spares Work in process Finished goods

(3) Interest will be charged on long term loan @ 15% per annum. (4) Depreciation to be charged as follows: Rate Per Annum 5% 10% 20% Apportionment Manufacturing Admin 75% 25% 100% 50% 50%

Building Machine Vehicle

(5) Deferred cost to be amortised Rs.600,000 per annum and to be charged as administrative expenses. (6) Cash dividend @ 30% is to be paid. (7) Transfer to general reserve Rs.2,000,000. (8) Tax rate is 35% of profit before tax. Required: Prepare the following financial statements in accordance with International Accounting Standards IAS-1 (revised): (a) (b) (c) Income Statement for the year ended December 31, 2010 (showing classification of expenses by functions). Statement of Changes in Equity for the year ended December 31, 2010. Statement of Financial Position as at December 31, 2010. THE END 10 05 10

3 of 3

You might also like

- Institute of Cost and Management Accountants of Pakistan New Fall (E) 2011, April 2012 ExaminationsDocument3 pagesInstitute of Cost and Management Accountants of Pakistan New Fall (E) 2011, April 2012 ExaminationsAli SheikhNo ratings yet

- 7 Af 301 Fa - QPDocument5 pages7 Af 301 Fa - QPMuhammad BilalNo ratings yet

- Institute of Cost and Management Accountants of Pakistan Winter (November) 2011 ExaminationsDocument4 pagesInstitute of Cost and Management Accountants of Pakistan Winter (November) 2011 ExaminationsHaseeb KhanNo ratings yet

- Questions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingDocument27 pagesQuestions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingcasarokarNo ratings yet

- Caf-01 Far-I (Mah SS)Document4 pagesCaf-01 Far-I (Mah SS)Abdullah SaberNo ratings yet

- Appendix Scanner Gr. I GreenDocument25 pagesAppendix Scanner Gr. I GreenMayank GoyalNo ratings yet

- 01 s303 CmapaDocument3 pages01 s303 Cmapaimranelahi3430No ratings yet

- Allama Iqbal Open University, Islamabad Warning: (Department of Commerce)Document7 pagesAllama Iqbal Open University, Islamabad Warning: (Department of Commerce)Ubedullah DahriNo ratings yet

- CBSE Class 12 Accountancy Sample Paper With Marking Scheme 2013Document5 pagesCBSE Class 12 Accountancy Sample Paper With Marking Scheme 2013Manish SahuNo ratings yet

- ICMAP Past PaperDocument4 pagesICMAP Past PaperNoman Qureshi100% (2)

- Accounting For ManagersDocument6 pagesAccounting For ManagerskartikbhaiNo ratings yet

- P5 Syl2012 Set2Document22 pagesP5 Syl2012 Set2JOLLYNo ratings yet

- Test Series: August, 2018 Mock Test Paper - 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws & International TaxationDocument6 pagesTest Series: August, 2018 Mock Test Paper - 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws & International TaxationRobinxyNo ratings yet

- 438Document6 pages438Rehan AshrafNo ratings yet

- CBSE Class 12 Accountancy Sample Paper-01 (For 2013)Document7 pagesCBSE Class 12 Accountancy Sample Paper-01 (For 2013)cbsestudymaterialsNo ratings yet

- SFMDocument29 pagesSFMShrinivas PrabhuneNo ratings yet

- Financial Accounting and Reporting-IIDocument7 pagesFinancial Accounting and Reporting-IIRochak ShresthaNo ratings yet

- Part - A Partnership, Share Capital and Debentures: General InstructionsDocument7 pagesPart - A Partnership, Share Capital and Debentures: General InstructionsGaurav JaiswalNo ratings yet

- Al-Umar College of Lahore: ABC Co. Ltd. Rs. XYZ Co. Ltd. RsDocument3 pagesAl-Umar College of Lahore: ABC Co. Ltd. Rs. XYZ Co. Ltd. RsXaXim XhxhNo ratings yet

- Term Test 2Document5 pagesTerm Test 2lalshahbaz57No ratings yet

- Intermediate Group I Test Papers FOR 2014 DECDocument88 pagesIntermediate Group I Test Papers FOR 2014 DECwaterloveNo ratings yet

- MTP 2 AccountsDocument8 pagesMTP 2 AccountssuzalaggarwalllNo ratings yet

- E-14 AfrDocument5 pagesE-14 AfrInternational Iqbal ForumNo ratings yet

- Hi-Aims College of Commerce and Management Sargodha: ST TH ST ST STDocument6 pagesHi-Aims College of Commerce and Management Sargodha: ST TH ST ST STMozam MushtaqNo ratings yet

- Institute of Cost and Management Accountants of Pakistan Fall (Winter) 2010 ExaminationsDocument4 pagesInstitute of Cost and Management Accountants of Pakistan Fall (Winter) 2010 ExaminationsIrfanNo ratings yet

- The Figures in The Margin On The Right Side Indicate Full MarksDocument16 pagesThe Figures in The Margin On The Right Side Indicate Full MarksJatin GalaNo ratings yet

- Corporate Accounting QUESTIONSDocument4 pagesCorporate Accounting QUESTIONSsubba1995333333100% (1)

- AssigmentDocument8 pagesAssigmentnonolashari0% (1)

- XII - Accy. QP - Revision-15.2.14Document6 pagesXII - Accy. QP - Revision-15.2.14devipreethiNo ratings yet

- P5 Syl2012 InterDocument12 pagesP5 Syl2012 InterVimal ShuklaNo ratings yet

- Mock Paper-4 (With Answer)Document18 pagesMock Paper-4 (With Answer)RNo ratings yet

- 1 Af 101 Ffa Icmap 2013 PaperDocument4 pages1 Af 101 Ffa Icmap 2013 PaperZulfiqar AliNo ratings yet

- XII AccountancyDocument4 pagesXII AccountancyAahna AcharyaNo ratings yet

- CAF 1 FAR1 Autumn 2022Document6 pagesCAF 1 FAR1 Autumn 2022QasimNo ratings yet

- Accounting Solve AssignmentDocument8 pagesAccounting Solve AssignmentDanyal ChaudharyNo ratings yet

- 185f8question BankDocument18 pages185f8question Bank55amonNo ratings yet

- Accountancy EngDocument8 pagesAccountancy EngBettappa Patil100% (1)

- CBSE Class 12 Accountancy Sample Paper-03 (For 2014)Document17 pagesCBSE Class 12 Accountancy Sample Paper-03 (For 2014)cbsestudymaterialsNo ratings yet

- Financial Accounting Mock Test PaperDocument7 pagesFinancial Accounting Mock Test PaperBharathFrnzbookNo ratings yet

- Pccquestionpapers (2008)Document20 pagesPccquestionpapers (2008)Samenew77No ratings yet

- Prac 1 Final PreboardDocument10 pagesPrac 1 Final Preboardbobo kaNo ratings yet

- IPCC MTP2 AccountingDocument7 pagesIPCC MTP2 AccountingBalaji SiddhuNo ratings yet

- FAR-2 Mock September 2021 FinalDocument8 pagesFAR-2 Mock September 2021 FinalMuhammad RahimNo ratings yet

- 19696ipcc Acc Vol2 Chapter14Document41 pages19696ipcc Acc Vol2 Chapter14Shivam TripathiNo ratings yet

- ACC 201-Review Questions FIDocument3 pagesACC 201-Review Questions FIAlbert AcheampongNo ratings yet

- 6104 - Accounting For Managers MBA FT 2021Document4 pages6104 - Accounting For Managers MBA FT 2021akshitapaul19No ratings yet

- CA2A2Document5 pagesCA2A2Shanntha JoshittaNo ratings yet

- Gujarat Technological University: InstructionsDocument4 pagesGujarat Technological University: InstructionsMuvin KoshtiNo ratings yet

- Adjusting EntiresDocument9 pagesAdjusting EntiresIqra MughalNo ratings yet

- 108 QP 1100Document4 pages108 QP 1100Rewa ShankarNo ratings yet

- SAMPLE PAPER-4 (Solved) Accountancy Class - XII: General InstructionsDocument5 pagesSAMPLE PAPER-4 (Solved) Accountancy Class - XII: General InstructionsDeepakPhalkeNo ratings yet

- Institute of Cost and Management Accountants of Pakistan Spring (Summer) 2010 ExaminationsDocument4 pagesInstitute of Cost and Management Accountants of Pakistan Spring (Summer) 2010 ExaminationsIrfanNo ratings yet

- Financial ReportingDocument7 pagesFinancial ReportingDivyesh TrivediNo ratings yet

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportFrom EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsNo ratings yet

- Commercial Banking Revenues World Summary: Market Values & Financials by CountryFrom EverandCommercial Banking Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- 14 Valuation Summary PDFDocument10 pages14 Valuation Summary PDFHaseeb KhanNo ratings yet

- Af 602Document2 pagesAf 602Haseeb KhanNo ratings yet

- Af 602Document2 pagesAf 602Haseeb KhanNo ratings yet

- Af 602Document2 pagesAf 602Haseeb KhanNo ratings yet

- 10 Af 401 MaDocument4 pages10 Af 401 MaHaseeb KhanNo ratings yet

- Management AccountingDocument7 pagesManagement AccountingAyaz AkhtarNo ratings yet

- Grippin IFRS Questions Chapter 26 Part 2 of 2Document6 pagesGrippin IFRS Questions Chapter 26 Part 2 of 2Haseeb Ullah KhanNo ratings yet

- Ma0907 13 NewDocument120 pagesMa0907 13 NewHaseeb KhanNo ratings yet

- Ma Q PDFDocument4 pagesMa Q PDFHaseeb KhanNo ratings yet

- Financial April 2012 AnsDocument8 pagesFinancial April 2012 AnsHaseeb KhanNo ratings yet

- April 2financial Accounting012 QustionDocument4 pagesApril 2financial Accounting012 QustionHaseeb KhanNo ratings yet

- MisDocument3 pagesMisHaseeb KhanNo ratings yet

- Grippin IFRS Questions Chapter 10 Part 3 of 4Document7 pagesGrippin IFRS Questions Chapter 10 Part 3 of 4Haseeb KhanNo ratings yet

- Isa 315Document13 pagesIsa 315Haseeb KhanNo ratings yet

- AssertionsDocument2 pagesAssertionsHaseeb KhanNo ratings yet

- Grippin IFRS Questions Chapter 25 Part 1 of 2Document5 pagesGrippin IFRS Questions Chapter 25 Part 1 of 2Haseeb KhanNo ratings yet

- 2871f Ratio AnalysisDocument24 pages2871f Ratio AnalysisHaseeb KhanNo ratings yet

- P14-5A. Selected Financial Data For Black & Decker and Snap-On Tools For 2003 Are Presented HereDocument6 pagesP14-5A. Selected Financial Data For Black & Decker and Snap-On Tools For 2003 Are Presented HereEvie ASMRNo ratings yet

- ACC1ILV - Chapter 1 Solutions PDFDocument3 pagesACC1ILV - Chapter 1 Solutions PDFMegan Joye McFaddenNo ratings yet

- Drills - Keep or DropDocument4 pagesDrills - Keep or DropKHAkadsbdhsgNo ratings yet

- AE231Document6 pagesAE231Mae-shane SagayoNo ratings yet

- Solution Manual03Document68 pagesSolution Manual03yellowberries100% (2)

- JonaDocument4 pagesJonaDecilyn JapinanNo ratings yet

- Advanced Accounting PDFDocument14 pagesAdvanced Accounting PDFMarie Christine RamosNo ratings yet

- Grier, Waymond A. - Credit Analysis of Financial Institutions-Euromoney Books (2012) - 151-300Document150 pagesGrier, Waymond A. - Credit Analysis of Financial Institutions-Euromoney Books (2012) - 151-300HILDA IDANo ratings yet

- Home Assignment Ch.1Document6 pagesHome Assignment Ch.1Sausan SaniaNo ratings yet

- 2008-07-14 214355 Eh 2Document4 pages2008-07-14 214355 Eh 2Vetri Indah LestariNo ratings yet

- 1 AssignmentDocument4 pages1 AssignmentHammad Hassan AsnariNo ratings yet

- BRSDocument18 pagesBRSSunandaNo ratings yet

- 01 x01 Basic ConceptsDocument10 pages01 x01 Basic ConceptsXandae MempinNo ratings yet

- Notes: True or False - Accounting Policies, Changes in Estimates & ErrorsDocument2 pagesNotes: True or False - Accounting Policies, Changes in Estimates & Errorskim cheNo ratings yet

- Tilbrook Rasheed Chartered AccountantsDocument47 pagesTilbrook Rasheed Chartered Accountantsvasilica888No ratings yet

- Chapter 1 AnswerDocument11 pagesChapter 1 Answerelainelxy2508No ratings yet

- Introduction To Accounting: Discussion QuestionsDocument3 pagesIntroduction To Accounting: Discussion QuestionsOfelia RagpaNo ratings yet

- Understanding Cash Flows StaDocument30 pagesUnderstanding Cash Flows StaAshraf GeorgeNo ratings yet

- Tulip Me Qs 2021Document10 pagesTulip Me Qs 2021Jacqueline Kanesha JamesNo ratings yet

- Dunning: SAP - Financial AccountingDocument12 pagesDunning: SAP - Financial AccountingJit GhoshNo ratings yet

- Report On Financial Management in SchoolsDocument60 pagesReport On Financial Management in SchoolsMisheck MusyaniNo ratings yet

- Introduction To AccountancyDocument5 pagesIntroduction To AccountancyVipin Mandyam KadubiNo ratings yet

- BDO Unibank 2020 Annual Report Financial SupplementsDocument236 pagesBDO Unibank 2020 Annual Report Financial SupplementsDanNo ratings yet

- FORM TP 2017101 Test Code 01239010 MAY/JUNE 2017: Paper 01 - General ProficiencyDocument14 pagesFORM TP 2017101 Test Code 01239010 MAY/JUNE 2017: Paper 01 - General ProficiencyChelsea BynoeNo ratings yet

- June 2014Document1 pageJune 2014Deepak GuptaNo ratings yet

- Essentials of Accounting For Governmental and Not For Profit Organizations 11th Edition by Copley ISBN Solution ManualDocument9 pagesEssentials of Accounting For Governmental and Not For Profit Organizations 11th Edition by Copley ISBN Solution Manualbeatrice100% (24)

- Agenda Item 4-G: ISA 300 (Redrafted) Planning An Audit of Financial StatementsDocument16 pagesAgenda Item 4-G: ISA 300 (Redrafted) Planning An Audit of Financial StatementsHusseinNo ratings yet

- Accounting Assignment 1Document2 pagesAccounting Assignment 1Hamna FarooqNo ratings yet

- IRS Publication Form 8594Document2 pagesIRS Publication Form 8594Francis Wolfgang UrbanNo ratings yet

- Cash Flow in Capital Budgeting KeownDocument37 pagesCash Flow in Capital Budgeting Keownmad2kNo ratings yet