Professional Documents

Culture Documents

Cebupac To Raise Fares On 11 International, Domestic Routes: News Article

Uploaded by

Grazelle GiducosOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cebupac To Raise Fares On 11 International, Domestic Routes: News Article

Uploaded by

Grazelle GiducosCopyright:

Available Formats

Name: Giducos, Grazelle Marie M.

Section: 3DAC

News Article Analysis

Aug. 20, 2013 Prof. Jackqui Moreno

CebuPac to raise fares on 11 international, domestic routes

News Article: MANILA, Philippines - Budget airline Cebu Air Inc. (Cebu Pacific) is set to raise fares for certain international and domestic routes as rising aviation jet fuel prices continue to eat up into the companys earnings. Cebu Pacific is seeking the green light from the Civil Aeronautics Board (CAB) to raise the fuel surcharge imposed on passengers of seven international routes and four domestic destinations. The low cost carrier has filed a petition seeking to impose an eight percent increase in fuel surcharge imposed on passengers of Manila to Incheon, Manila to Busan, Cebu to Incheon, and Cebu to Busan flights to $54 per passenger from the current $50 per passenger. It also filed a separate petition for authority to impose upward adjustment of fuel surcharge ranging between 20 percent and 48 percent on its international passenger tickets for five other international routes. It intends to raise the fuel surcharge on passengers of Manila to Shanghai flights by 48 percent to $37 per passenger from $25; Manila to Beijing flights by 43 percent to $50 from $35; Manila to Giangshou flights by 40 percent to $35 from $25; Manila to Xiamen flights by 30 percent to $26 from $20; and Manila to Siam Rep flights by 20 percent to $30 from $25. Cebu Pacific is also set to raise the fare imposed on passengers of four domestic destinations as it is seeking an increase in fuel surcharge by as much as 25 percent. The budget airline is seeking a 12.5 percent increase in fuel surcharge for its Manila to Pagadian flights (P450 from P400), a 17 percent increase for its Cebu to Clark (P350 from P300), a 20 percent increase for its Cebu to Cagayan de Oro flights (P300 from P250), and a 25 percent increase of its Cebu to Bacolod flights (P250 from P200). On the other hand, Cebu Pacific decided to cut the fuel surcharge on Manila to Dipolog flights by 11 percent to P400 from P450 and the Manila to Zamboanga flights by 25 percent to P300 from P400. The CAB allows airlines to impose fuel surcharge on international and domestic passengers as a temporary relief to help them recover losses arising from the increase in jet fuel prices in the world market. Latest results of the Jet Fuel Price Monitor of the International Air Transportation Association (IATA) showed that average price of jet fuel rose one percent to $123.8 per barrel from a month ago level nearing the full year target of $124 per barrel set by IATA. Source: http://www.philstar.com/business/2013/08/17/1099011/cebupac-raise-fares-11-international-domesticroutes

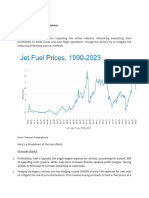

Summary: Cebu Pacific plans to raise fares for certain international and domestic flights because of continuous rise in aviation jet fuel. Cebu Pacific is set to raise prices on seven international routes and four domestic destinations. The low cost carrier has filed a petition seeking to impose an 8% increase in fuel surcharge imposed on passengers of seven international routes mainly Manila to Incheon, Manila to Busan, Cebu to Incheon and Cebu to Busan. The airline is also seeking a 12.5% increase in fuel surcharge for its Manila to Pagadian flights (P450 from P400), a 17% increase for its Cebu to Clark (P350 from P300), a 20% increase for its Cebu to Cagayan de Oro flights (P300 from P250), and a 25% increase of its Cebu to Bacolod flights (P250 from P200). On the other hand, Cebu Pacific decided to cut the fuel surcharge on Manila to Dipolog flights by 11% to P400 from P450 and the Manila to Zamboanga flights by 25% to P300 from P400. Nature of Transaction: The business transaction that I find relevant in this article is the raising of prices. Since Financial Management is clearly about management and control of money, Cebu Pacifics move is clearly related to our subject. Financial Effect: The effect in Cebu Pacifics accounts would be an increase in their assets such as cash and a decrease in liability such as payables. The intention of Cebu Pacific to raise prices is for the fact that they want to maximize their profit since the raise of aviation jet fuel price continues. As we have discussed last time about the low cost strategy of the company, they store of fuel for future use and sell tickets at a very low price. Now that aviation jet fuel prices increase, they have no other choice but to put a raise on their ticket prices to minimize their operating expenses. Justifications for the Decision: I think that Cebu Pacific made a good decision regarding the raise of fares due to the fact that they might incur a heavy loss if ever they dont recover the expenses of their company on aviation jet fuel. 1 gallon of jet fuel is equal to P118.66 (as of June 2013) which increased by P6 in one month and constitutes over 40% of the airlines operating costs. This indicates that price increases unfortunately stimulate an almost inverse correlation relationship, where costs increase on one side and yields soften as discretionary spending slows. One knee-jerk response to these increases is to insert fuel surcharges, even where this runs the risk of dampening demand. This becomes a tipping point for the company and will progressively force more changes in the way CebuPac operate. Up to a certain level, incremental fuel price changes can be met by similarly incremental pricing adaptation. Reflection: If the rise in prices of jet fuel continues, flight prices will also increase. Negative effects may occur because of this. One is that fewer tourists may book a flight because of higher fares. Second is that some routes or destinations may be terminated and thus fewer tourists will visit in certain places (as mentioned above). Jet fuel prices have risen dramatically over the last few years, driven by strong global demand, limited spare oil production capacity, and continuing political instability in certain oil producing regions. In short, our economy may not recover fully if fuel price increases continue.

You might also like

- Paper 2 Home WorkDocument16 pagesPaper 2 Home WorkJason NamNo ratings yet

- PORTERS Analysis Cebu PacificDocument4 pagesPORTERS Analysis Cebu PacificMarijo Magallanes100% (1)

- Name: Faiq Khalid Registration No: 46006 Subject: Strategic ManagementDocument4 pagesName: Faiq Khalid Registration No: 46006 Subject: Strategic ManagementFAIQ KHALIDNo ratings yet

- Jet Airways Ipo AnalysisDocument16 pagesJet Airways Ipo AnalysisJijo JCNo ratings yet

- JBLU-Hawkshaw Special Sits Report-12!23!14Document7 pagesJBLU-Hawkshaw Special Sits Report-12!23!14CanadianValue100% (1)

- Rescuing The Airline Industry - What's The Government's Role - Business LineDocument2 pagesRescuing The Airline Industry - What's The Government's Role - Business Lineswapnil8158No ratings yet

- Airline Pilot Labor SupplyDocument35 pagesAirline Pilot Labor SupplyestimloverNo ratings yet

- 2009 H1 CS Q1Document4 pages2009 H1 CS Q1panshanren100% (1)

- Coping Up of Local Commercial Airlines in Fuel Cost: A StudyDocument6 pagesCoping Up of Local Commercial Airlines in Fuel Cost: A StudyAngel ValdezNo ratings yet

- Pakistan Air Lines Word FileDocument47 pagesPakistan Air Lines Word FileAsif HafeezNo ratings yet

- A Case Study On Cost Estimation and Pro - Tability Analysis at Continental Airlines PDFDocument21 pagesA Case Study On Cost Estimation and Pro - Tability Analysis at Continental Airlines PDFTangi Simamora0% (1)

- The Factors Effecting Airline BusinessDocument5 pagesThe Factors Effecting Airline BusinessnajumNo ratings yet

- Chapter 1 PID - Youssef AliDocument15 pagesChapter 1 PID - Youssef Alianime brandNo ratings yet

- Competition and Strategy Indigo AirlinesDocument15 pagesCompetition and Strategy Indigo AirlinesSuraj DubeyNo ratings yet

- Cost Delay EstimatesDocument2 pagesCost Delay EstimatesKhang DoNo ratings yet

- Eco Assignment 2Document6 pagesEco Assignment 2Sanjeevani HanjuraNo ratings yet

- FINAL PW Press Release March 2016Document10 pagesFINAL PW Press Release March 2016Mroki MrokiNo ratings yet

- Accounting For Airline FFPDocument20 pagesAccounting For Airline FFPPaula Andrea GarciaNo ratings yet

- Thinking About AirlinesDocument5 pagesThinking About AirlinesChoi MinriNo ratings yet

- Top 10 Airline Industry ChallengesDocument5 pagesTop 10 Airline Industry Challengessaif ur rehman shahid hussain (aviator)No ratings yet

- Return On Assets For The 12 Months Ending June 30th For Each YearDocument5 pagesReturn On Assets For The 12 Months Ending June 30th For Each Yearshahwal92No ratings yet

- Improving Profitability in A Dynamic Financial Environment: HedgingDocument1 pageImproving Profitability in A Dynamic Financial Environment: HedgingJimmy Lim Teng JiangNo ratings yet

- Philippine Airlines Marketing Plan: Submitted To: Sir Edwin AgujetasDocument10 pagesPhilippine Airlines Marketing Plan: Submitted To: Sir Edwin AgujetasLester Mojado100% (1)

- Indian Institute of Management IndoreDocument2 pagesIndian Institute of Management Indorenaman chauhanNo ratings yet

- Aviation Industry Covid ImapctDocument4 pagesAviation Industry Covid ImapctPARUL SINGH MBA 2019-21 (Delhi)No ratings yet

- Salem Municipal Airport - Master Plan Executive SummaryDocument2 pagesSalem Municipal Airport - Master Plan Executive SummaryStatesman JournalNo ratings yet

- EconomyDocument12 pagesEconomyRayZa Y MiralNo ratings yet

- PWC Tailwinds Airline Industry Trends Issue 1Document12 pagesPWC Tailwinds Airline Industry Trends Issue 1getoboyNo ratings yet

- Indian Aviation IndustryDocument30 pagesIndian Aviation IndustryRaj MalhotraNo ratings yet

- Airline Revenue MGMT Coursework ADocument8 pagesAirline Revenue MGMT Coursework ADanny ToligiNo ratings yet

- Faqs For "Resolving The Crisis in Air Traffic Control Funding"Document5 pagesFaqs For "Resolving The Crisis in Air Traffic Control Funding"reasonorgNo ratings yet

- Swot PiaDocument5 pagesSwot Piacuteterror19No ratings yet

- Group 4 - TPDocument5 pagesGroup 4 - TPdeath kidNo ratings yet

- Write PaperDocument13 pagesWrite Paperapi-252318788No ratings yet

- Accounting For Airline FFPDocument20 pagesAccounting For Airline FFParabianlightNo ratings yet

- Airline 2013 - JCR ReportDocument4 pagesAirline 2013 - JCR ReportnchaudhryNo ratings yet

- Union Budget 2011Document12 pagesUnion Budget 2011Naynish MahadikNo ratings yet

- Analysis of The Airline Pilot Shortage: Victoria CrouchDocument12 pagesAnalysis of The Airline Pilot Shortage: Victoria CrouchLin CYNo ratings yet

- The Crisis of The Pakistan International Airlines P.I.ADocument13 pagesThe Crisis of The Pakistan International Airlines P.I.Amba 2019No ratings yet

- Competition & Strategy: Indigo AirlinesDocument21 pagesCompetition & Strategy: Indigo AirlinesAhmed Dam100% (1)

- 28 Vasigh Erfani Aircraft ValueDocument4 pages28 Vasigh Erfani Aircraft ValueW.J. ZondagNo ratings yet

- For Domestic Airlines, Employee Costs Considerably LowerDocument5 pagesFor Domestic Airlines, Employee Costs Considerably Lowergogana93No ratings yet

- The Impact of COVID-19 On Airports:: An AnalysisDocument8 pagesThe Impact of COVID-19 On Airports:: An Analysispepe pecasNo ratings yet

- Pia Case StudyDocument3 pagesPia Case Studyvinaychughani100% (1)

- CC 62 - EPIA Capital Improvement PlanDocument26 pagesCC 62 - EPIA Capital Improvement PlanErika EsquivelNo ratings yet

- Cbmec Final Strama PaperDocument94 pagesCbmec Final Strama PaperKent Leo Batuigas100% (1)

- The Impact of COVID-19 On Airports:: An AnalysisDocument6 pagesThe Impact of COVID-19 On Airports:: An AnalysisBruce VillarNo ratings yet

- Kasarda ReportDocument37 pagesKasarda ReportTarmimi Aziz100% (1)

- Southwest InvestorRelations TaoFengDocument20 pagesSouthwest InvestorRelations TaoFengFeng TaoNo ratings yet

- Southwest Airlines AnalysisDocument6 pagesSouthwest Airlines Analysisdocmund100% (1)

- PAL To Trim Costs With New Planes in 2014Document5 pagesPAL To Trim Costs With New Planes in 2014Michael Leo Dela CruzNo ratings yet

- Report On Civil AviationDocument14 pagesReport On Civil AviationEr Gaurav Singh SainiNo ratings yet

- WestJet Charles ProjectDocument27 pagesWestJet Charles Projectinderdhindsa100% (2)

- How Airline Industry Responded Towards CovidDocument4 pagesHow Airline Industry Responded Towards Covidkartik singhNo ratings yet

- Second SubsidiaryDocument3 pagesSecond SubsidiaryNiyati ShahNo ratings yet

- Airlines Case StudyDocument2 pagesAirlines Case StudyGiorgi DjagidiNo ratings yet

- Research Paper On Airline IndustryDocument6 pagesResearch Paper On Airline Industryhyxjmyhkf100% (1)

- The Industry Handbook: The Airline Industry: Printer Friendly Version (PDF Format)Document21 pagesThe Industry Handbook: The Airline Industry: Printer Friendly Version (PDF Format)Gaurav JainNo ratings yet

- Reaching Zero with Renewables: Biojet FuelsFrom EverandReaching Zero with Renewables: Biojet FuelsNo ratings yet

- Module 2 - SumsDocument4 pagesModule 2 - SumsShubakar ReddyNo ratings yet

- The True Impact of TRIDDocument2 pagesThe True Impact of TRIDDanRanckNo ratings yet

- MercantilismDocument30 pagesMercantilismadeel499No ratings yet

- First Draft of The 2012 City of Brantford Budget DocumentsDocument1,181 pagesFirst Draft of The 2012 City of Brantford Budget DocumentsHugo Rodrigues100% (1)

- Multiplier - All SectorDocument15 pagesMultiplier - All SectorSaurabh MishraNo ratings yet

- CS Harley - May 2013Document16 pagesCS Harley - May 2013Neil CalvinNo ratings yet

- SSS Required Online RegistrationDocument2 pagesSSS Required Online RegistrationTin AvenidaNo ratings yet

- Endless BountyDocument14 pagesEndless BountyAnonymous C0q7LDwSNo ratings yet

- Nafta: North American Free Trade AggrementDocument16 pagesNafta: North American Free Trade Aggrementanant saxena100% (8)

- Challenges and Opportunities For Regional Integration in AfricaDocument14 pagesChallenges and Opportunities For Regional Integration in AfricaBOUAKKAZ NAOUALNo ratings yet

- Birla Institute of Technology and Science, Pilani Pilani Campus Instruction DivisionDocument2 pagesBirla Institute of Technology and Science, Pilani Pilani Campus Instruction DivisionAstitva AgnihotriNo ratings yet

- Case Study 4Document8 pagesCase Study 4Lyka NaboaNo ratings yet

- Fish Farm ProposalDocument14 pagesFish Farm ProposalMichael Odiembo100% (1)

- F15F16Document1 pageF15F16MinamPeruNo ratings yet

- Electronic Challan .1.9Document27 pagesElectronic Challan .1.9Soumya BisoiNo ratings yet

- Class Activity - Bus685Document7 pagesClass Activity - Bus685bonna1234567890No ratings yet

- Toyota STP StrategiesDocument25 pagesToyota STP Strategiesvmk005100% (1)

- Chapter 5 Notes On SalesDocument5 pagesChapter 5 Notes On SalesNikki Estores GonzalesNo ratings yet

- ZZZZDocument14 pagesZZZZMustofa Nur HayatNo ratings yet

- Account StatementDocument4 pagesAccount StatementDure ShehwarNo ratings yet

- Spy Gap StudyDocument30 pagesSpy Gap StudyMathias Dharmawirya100% (1)

- Su20190112134159x149 962494304 2331465324 PDFDocument5 pagesSu20190112134159x149 962494304 2331465324 PDFazizatulNo ratings yet

- Cyber US Port SecurityDocument50 pagesCyber US Port SecurityLaurent de HasardNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearSagar GargNo ratings yet

- Seven FridayDocument15 pagesSeven FridayRoshan Acharya0% (1)

- Brochure MisdevDocument2 pagesBrochure MisdevyakubmindNo ratings yet

- 1st Barcelona Metropolitan Strategic PlanDocument42 pages1st Barcelona Metropolitan Strategic PlanTbilisicds GeorgiaNo ratings yet

- Research ProposalDocument2 pagesResearch ProposalDinuka Malintha86% (7)

- Law As A Social SystemDocument20 pagesLaw As A Social SystemcrmollNo ratings yet

- Rex 3e Level 4 - Unit 6Document10 pagesRex 3e Level 4 - Unit 677No ratings yet