Professional Documents

Culture Documents

An Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022

Uploaded by

Muralis MuralisOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

An Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022

Uploaded by

Muralis MuralisCopyright:

Available Formats

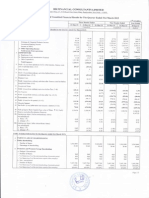

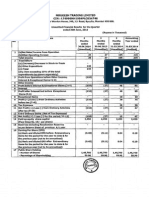

AN ISO 9001:2008 AND ISO 22000 ACCREDITED COMPANY Registered Office : D-19-20, Panki Industrial Area, Kanpur - 208

022 website: www.kanplas.com UNAUDITED FINANCIAL RESULTS FOR THE QUARTER ENDED 30TH JUNE, 2013

Sl. No.

(` in Lacs)

QUARTER ENDED

Particulars

YEAR ENDED

30.06.2013 31.03.2013 30.06.2012 31.03.2013 (Unaudited) (Audited) (Unaudited) (Audited)

1 Income from Operations (a) Net Sales / Income from Operations (Net of Excise Duty) (b) Other Operating Income Total Income from operations (net) 2 Expenses (a) Cost of materials consumed (b) Purchase of stock-in-trade (c) Change in inventory of finished goods, work in progress and stock-in-trade (d) Employee benefit expenses (e) Depreciation and amortisation expenses (f) Other Expenditure Total Expenses 3 Profit/ (Loss) from Operations before other income, finance costs and exceptional items (1-2) 4 Other Income 5 Profit/ (Loss) from ordinary activities before finance cost and exceptional items (3 + 4) 6 Finance costs (Refer Note No. 5) 7 Profit/ (Loss) from ordinary activities after finance cost but before exceptional items (5 - 6) 8 Exceptional Items 9 Profit/(Loss) from Ordinary activities before Tax (7- 8) 10 Tax Expenses 11 Net Profit/(Loss) from Ordinary Activities after Tax (9- 10) 12 Extraordinary Item (net of tax expense ) 13 Net Profit/ (Loss) for the period (11- 12) 14 Paid-up Equity Share Capital (Face Value:` 10/- each) 15 Reserves (excluding Revaluation Reserves as per Balance sheet of previous accounting year) 16 Earning per Share - Basic & Diluted (of `10/-each) (not annualised) A PARTICULARS OF SHAREHOLDING 1 Public Shareholding -- No. of Shares -- Percentage of Shareholding 2 Promoters and Promoter Group shareholding a) Pledged / Encumbered -- No. of Shares -- Percentage of Shares (as a % of the total shareholding of promoter & promoter group) -- Percentage of Shares (as a % of the total share capital of the company) b) Non-encumbered -- No. of Shares -- Percentage of Shares (as a % of the total shareholding of promoter & promoter group) -- Percentage of Shares (as a % of the total share capital of the company) B

4,539.09 41.64 4,580.73 2,822.47 (116.29) 254.95 85.80 967.38 4,014.31 566.42 566.42 189.05 377.37 377.37 102.00 275.37 275.37 795.92 3.46

4,341.63 55.24 4,396.87 2,529.39 249.78 215.37 79.27 901.34 3,975.15 421.72 421.72 347.25 74.47 0.45 74.02 (34.00) 108.02 108.02 795.92 1.36

5,033.09 30.03 5,063.12 2,831.03 210.76 22.95 249.48 75.77 993.81 4,383.80 679.32 679.32 174.50 504.82 504.82 102.00 402.82 402.82 795.92 5.06

17,518.42 162.51 17,680.93 10,509.80 345.03 (221.19) 977.16 297.92 3,757.59 15,666.31 2,014.62 2,014.62 856.24 1,158.38 0.45 1,157.93 280.00 877.93 877.93 795.92 2,718.53 8.75

2452155 30.81%

2452155 30.81%

2452155 30.81%

2452155 30.81%

Nil 5507092 100%

Nil 5507092 100%

Nil 5507092 100%

Nil 5507092 100%

69.19% 69.19% 69.19% 69.19% INVESTOR COMPLAINTS AS ON 30.06.2013 Pending at the beginning of the quarter- NIL ; Received during the quarter- NIL ; Disposed off during the quarter- NIL ; Remaining unresolved at the end of the quarter- NIL

Notes: 1- The above results of the Company were reviewed by Audit Committee and approved by the Board of Directors at their respective meetings held on 13.08.2013. The Limited Review as required under Clause 41 of the Listing Agreement has been carried out by the Statutory Auditors. 2- The Company operates in two primary business segments viz. Manufacturing of Fabrics & Woven Sacks etc. and Consignment Stockist. In terms of provisions of Accounting Standard 17, Consignment Stockist activity, presently, is not a reportable segment. 3- The figures of previous period/year have been re-grouped/ re-arranged and /or recast wherever found necessary. 4- The figures of the quarter ended 31.03.2013 are the balancing figures between audited financial results for the entire financial year and published year to date results of the third quarter of the relevant financial year. 5- Finance Cost includes an expense of `17 Lacs (` 140 Lacs for the Quarter ended March, 2013) which is a part of Foreign Exchange Difference on rollover of Foreign Currency Term Loan.

Place: Kanpur Date : 13/08/2013

For Kanpur Plastipack Ltd. Sd/(Manoj Agarwal) Managing Director

You might also like

- BND 0817 MTSA and SOW Copy-2Document13 pagesBND 0817 MTSA and SOW Copy-2BenNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Acctng ProcessDocument4 pagesAcctng ProcessElaine YapNo ratings yet

- Regd. Office: B-214, Phase II, Distt. Gautam Budh Nagar, Noida - 201305 (U.P.)Document1 pageRegd. Office: B-214, Phase II, Distt. Gautam Budh Nagar, Noida - 201305 (U.P.)nitin2khNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- SEBI Results Mar13Document2 pagesSEBI Results Mar13Mansukh Investment & Trading SolutionsNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Jaihind Synthetics Limited: S BusDocument4 pagesJaihind Synthetics Limited: S BusShyam SunderNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Company Update)Document7 pagesFinancial Results & Limited Review For June 30, 2015 (Company Update)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Audited Result 2010 11Document2 pagesAudited Result 2010 11Priya SharmaNo ratings yet

- Financial Results & Limited Review Report For December 31, 2015 (Result)Document2 pagesFinancial Results & Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Colgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Document4 pagesColgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Aditya MishraNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document8 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2012 (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2012 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2012 (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2012 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document2 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- PDF - 1369822739 - True - 1369822739 - Annual Results 2012-13Document1 pagePDF - 1369822739 - True - 1369822739 - Annual Results 2012-13Rakesh BalboaNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Results Q1FY11 12Document1 pageResults Q1FY11 12rao_gsv7598No ratings yet

- FY11 - Investor PresentationDocument11 pagesFY11 - Investor Presentationcooladi$No ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Document11 pagesStandalone & Consolidated Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Shyam SunderNo ratings yet

- DLF Fy010Document4 pagesDLF Fy010Anonymous dGnj3bZNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- PTC India Limited: Registered Office:2nd Floor, NBCC Tower, 15 Bhikaji Cama Place New Delhi - 110 066 (CINDocument3 pagesPTC India Limited: Registered Office:2nd Floor, NBCC Tower, 15 Bhikaji Cama Place New Delhi - 110 066 (CINDeepak GuptaNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document6 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- India BullsDocument2 pagesIndia Bullsrajesh_d84No ratings yet

- 2 PDocument238 pages2 Pbillyryan1100% (3)

- Financial Results For June 30, 2013 (Result)Document2 pagesFinancial Results For June 30, 2013 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- q1 DEVIS LABORATORYDocument3 pagesq1 DEVIS LABORATORYNaman KaushikNo ratings yet

- Indiabulls Securities Limited (As Standalone Entity) : Unaudited Financial Results For The Quarter Ended December 31, 2010Document1 pageIndiabulls Securities Limited (As Standalone Entity) : Unaudited Financial Results For The Quarter Ended December 31, 2010hk_warriorsNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For March 31, 2015 (Result)Document5 pagesFinancial Results & Limited Review For March 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Result)Document5 pagesFinancial Results & Limited Review For Sept 30, 2014 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document2 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document6 pagesFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document8 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For Dec 31, 2013 (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2013 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- GRP LTD (Gujarat Reclaim) Annual Report 12-13Document76 pagesGRP LTD (Gujarat Reclaim) Annual Report 12-13bhavan123No ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Management & Decision MakingDocument19 pagesManagement & Decision MakingMuralis MuralisNo ratings yet

- Why Should You Use Goal Setting?Document30 pagesWhy Should You Use Goal Setting?aadham100% (1)

- Basics of Intellectual Property LawDocument50 pagesBasics of Intellectual Property LawMuralis MuralisNo ratings yet

- Basics of Intellectual Property LawDocument50 pagesBasics of Intellectual Property LawMuralis MuralisNo ratings yet

- An Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022Document1 pageAn Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022Muralis MuralisNo ratings yet

- An Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022Document1 pageAn Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022Muralis MuralisNo ratings yet

- Wipo Ip Dam 07 2Document36 pagesWipo Ip Dam 07 2Muralis MuralisNo ratings yet

- Quantitative Easing: Public FinanceDocument10 pagesQuantitative Easing: Public FinanceMuralis MuralisNo ratings yet

- Quantitative and QualitativeDocument1 pageQuantitative and QualitativeMuralis MuralisNo ratings yet

- Financial Markets: A Beginner's ModuleDocument2 pagesFinancial Markets: A Beginner's Moduledavidd121No ratings yet

- Karnataka Cabinet Ministers: Raggi MuddeDocument62 pagesKarnataka Cabinet Ministers: Raggi MuddeMuralis MuralisNo ratings yet

- Blue Chip CompanyDocument12 pagesBlue Chip CompanyMuralis MuralisNo ratings yet

- Financial RatiosDocument15 pagesFinancial RatiosValentinorossiNo ratings yet

- Student Achievement Goal Setting:: An Option For Connecting Teacher Performance To Academic ProgressDocument54 pagesStudent Achievement Goal Setting:: An Option For Connecting Teacher Performance To Academic ProgressMuralis MuralisNo ratings yet

- Goa 04092012Document53 pagesGoa 04092012Muralis MuralisNo ratings yet

- Coal Ind PPT Prathap CosDocument17 pagesCoal Ind PPT Prathap CosMuralis MuralisNo ratings yet

- Himachal Pradesh 04092012Document57 pagesHimachal Pradesh 04092012Muralis Muralis0% (1)

- Blueprint of Hospital 20Document25 pagesBlueprint of Hospital 20Muralis MuralisNo ratings yet

- Cairn IndiaDocument16 pagesCairn IndiaMuralis Muralis100% (1)

- Vinay MDocument16 pagesVinay MMuralis MuralisNo ratings yet

- Thesis Topics For AccountingDocument7 pagesThesis Topics For Accountingerikanelsonwashington100% (2)

- Panduan Pengguna: Prepared BY: Marketing & Business Development Division Suruhanjaya Syarikat MalaysiaDocument27 pagesPanduan Pengguna: Prepared BY: Marketing & Business Development Division Suruhanjaya Syarikat MalaysiaRavindran RamanNo ratings yet

- CA Intermediate Auditing & Assurance November 2022 Suggested AnswersDocument8 pagesCA Intermediate Auditing & Assurance November 2022 Suggested AnswersLegends CreationNo ratings yet

- Chap7 QuestionsDocument12 pagesChap7 QuestionsAnonymous Gyq1CrZNo ratings yet

- Unit 2. CashDocument8 pagesUnit 2. CashDaphne100% (1)

- What Are The Benefits of Performance Measurement?Document12 pagesWhat Are The Benefits of Performance Measurement?Faan Waliporn CheawchanNo ratings yet

- PFA-Government Agencies (Final Presentation)Document42 pagesPFA-Government Agencies (Final Presentation)TinNo ratings yet

- DISA Mod 1 Day 1 Quiz 2Document3 pagesDISA Mod 1 Day 1 Quiz 2Jackson Abraham ThekkekaraNo ratings yet

- Tania Das: Work HistoryDocument2 pagesTania Das: Work HistoryShivanshi ThakurNo ratings yet

- Sharada Mandir ISC 12 Accounts Term1 2017Document3 pagesSharada Mandir ISC 12 Accounts Term1 2017Manish SainiNo ratings yet

- Second Surveillance Audit Report: Agrasen Engineering Industries LTD.Document3 pagesSecond Surveillance Audit Report: Agrasen Engineering Industries LTD.Jamil VoraNo ratings yet

- Aj PDFDocument81 pagesAj PDFAnonymous reGip9JdnNo ratings yet

- Singer Annual Report 2021Document122 pagesSinger Annual Report 2021Kowshik Singha Chowdhury 2025020660No ratings yet

- Group 1 Handout RectifiedDocument11 pagesGroup 1 Handout RectifiedNe BzNo ratings yet

- Group 3 Midterm Case Studies EnronDocument14 pagesGroup 3 Midterm Case Studies EnronWiln Jinelyn NovecioNo ratings yet

- I-03 07problemDocument1 pageI-03 07problemmnrk 1997No ratings yet

- Investigating Effects of Accounting Ethics On Quality of Financial Reporting of An Organization: Case of Selected Commercial Banks in South SudanDocument15 pagesInvestigating Effects of Accounting Ethics On Quality of Financial Reporting of An Organization: Case of Selected Commercial Banks in South SudanXhaNo ratings yet

- Sample MOA and ByelawsDocument18 pagesSample MOA and Byelawspoonam kambojNo ratings yet

- Certified Compliance Officer-CCODocument4 pagesCertified Compliance Officer-CCOamyhashemNo ratings yet

- L12 Problem On Profitability Measures For Profit CenterDocument8 pagesL12 Problem On Profitability Measures For Profit Centerapi-3820619No ratings yet

- Problems For Marginal CostingDocument6 pagesProblems For Marginal CostingPramod Bhardwaj100% (1)

- An Introduction To Assurance and Financial Statement AuditingDocument23 pagesAn Introduction To Assurance and Financial Statement AuditingNaeemNo ratings yet

- Unit - Ii Creativity and Entrepreneurial Plan Idea Generation, Screening and Project IdentificationDocument9 pagesUnit - Ii Creativity and Entrepreneurial Plan Idea Generation, Screening and Project Identificationmba departmentNo ratings yet

- 6 Rectification of ErrorsDocument33 pages6 Rectification of Errorsniraj jainNo ratings yet

- ISO QS9000 9001: Audit Observation SheetDocument1 pageISO QS9000 9001: Audit Observation SheetSanjay MalhotraNo ratings yet

- Particulars Amount Particulars Amount: Trading Account FormatDocument4 pagesParticulars Amount Particulars Amount: Trading Account FormatSaravananSrvnNo ratings yet

- f8 RQB 15 Sample PDFDocument98 pagesf8 RQB 15 Sample PDFChandni VariaNo ratings yet

- City of Boise Idaho Checks 73Document33 pagesCity of Boise Idaho Checks 73Mark ReinhardtNo ratings yet