Professional Documents

Culture Documents

Excel Format

Uploaded by

Saad QureshiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Excel Format

Uploaded by

Saad QureshiCopyright:

Available Formats

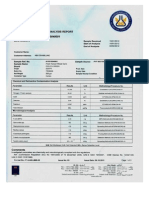

Call us toll free at (877) 888-0858 Local (704) 227-0786

Full Details for Fixed and Multi-Year Guaranteed Annuities

1st year Company Effective Date Rate Lock SPDA/ FPDA Product Commission Current Rate premium/ interest rate bonus

Average Annual Yield

Min Guar Rate MVA

Issue Ages

Min/Max Premium

Liquidity

Surrender Charges

Death Benefit

Waivers

Annuitization Options

Commission Chargeback Rules

Allianz Life

2/7/2012

45 days from date app is received in home office

SPDA

Dominator Plus 5 & 7 year terms

5 Year Term: 3.00% 0-75 2.00% 76-80 1.00% 81-85 10 Year Term: 4.00% 0-75 3.00% 76-80 2.00% 81-85

5-year term: 1.50% $100,0001.50% $100,000+ 10-year term: 1.90% $100,0002.00% $100,000+ None

5-year term: $100,0001.50% $100,000+ 1.50% 10-year term: $100,0001.90% $100,000+ 2.00%

90% of premium @ 3%

Guar rate will never fall below 1.5% while contract is in deferral

Yes

0-85

$25,000

Loan Provision (Up to 50% of contract's cash surrender Full account value available for value ($50,000 max). Annuitization after one year if taken over 10+ years. Nursing Home (owner) (Can take accelerated distribution of the Full accumulation value is Optional rider allows you to take the full 10% beginning in the first contracts accumulation value through 100% chargeback on surrenders in *On 5-year term: available immediately as account value over less than 10 years. year of total premiums payments over a period as short as 5 first 6 months, 50% in second six 30-day window after 5th year to withdraw funds a lump sum or via a paid. years.) policy months without penalty or MVA. payout over 5 yrs RMD qualify as free withdraws, if taken annually lump in Dec.or monthly Income Plus Benefit RMDs can be taken free of charge if taken annually through year. Age 60 - 91 in December, or monthly throughout the year. Up to 10 years, DB is increased by Call us for details. greater of AV or Treasury Benchmark Rate 5 or 10 years 9, 8.1, 7.2, 6.3,5.4, 4.5, 3.6, 2.7, 1.8, 0.9

$10,000

2.60% for 5 years American Equity 8/1/2013 None SPDA Guarantee 5 3.00% to 75 2.00% 76-80 2.10% in CA,DE,MN,PA,WA None 2.60% 2% after 5th year Yes 0-80

$1,500,000 0-69 $1,000,000 70-74 $750,000 75-80 maximum

Interest withdrawals or RMD allowed in the first year if taken systematically. After first year, there is a 30-day window at the end of the year to remove the prior year's interest without penalty.

5 years 9,8,7,6,5 No surrender charges 30-day PRIOR to the end of the guarantee period for funds to be moved or surrendered.

Nursing Home Rider Full account value at death of owner or annuitant

Contract Value option A: life payout 5-25 yrs. Available for annuitants thru age 74. Allows penalty-free w/d of 20% of Option B: period certain (must be contract value after 90-day confinement. double remaining on it surrender Confinement must start after first charge period). contract anniversary.

Death or Suicide is charged back 100% in the first month and reduced by 1/12 each month thereafter.

$10,000

Interest withdrawals allowed in the first year if taken systematically. After first year, there is a 30-day window at the end of the year to remove the prior year's interest without penalty.

3.00% for 7 years American Equity 8/1/2013 None SPDA Guarantee 7 2.50% to 75 1.50% 76-80 2.50% in CA,DE,MN,PA, WA None 3.00% 2% after 7th year Yes 0-80

$1,500,000 0-69 $1,000,000 70-74 $750,000 75-80 maximum

7 years 9,8,7,6,5,4,3 No surrender charges 30-day PRIOR to the end of the guarantee period for funds to be moved or surrendered.

Nursing Home Rider Full account value at death of owner or annuitant

Contract Value option A: life payout 5-25 yrs. Available for annuitants thru age 74. Allows penalty-free w/d of 20% of Option B: period certain (must be contract value after 90-day confinement. double remaining on it surrender Confinement must start after first charge period). contract anniversary.

Death or Suicide is charged back 100% in the first month and reduced by 1/12 each month thereafter.

6.05% first year 2.05% base rate American General 8/12/2013 90 days from application signed date SPDA Horizon Plus SPDA (Form #04362) 2.75% to 75 1.70% 76-80 1.20% 81-85 not available in following states: AK, MN, MO, NY, OH, NJ,OR,PA,UT,WA. 4.00% 2.72% 1.00% Yes 0-85 $5,000

10% each year including the first GMW (87.5%@1.%)

9 years 9,8,7,6,5,4,3,2,1

Withdraw Value without MVA if lump sum Surrender value at death of owner (full account value if annuitized for 5+ years.)

Nursing Home (Terminates at age 86 no matter when the policy was issued. Owner driven, one-year wait, 90 day confinement.) Annuitize after 5th year for at least 60 months using full account value

100% chargeback during the first 12 months for any full or partial withdrawals, excluding any penaltyfree amounts. No chargeback at death

American General

8/12/2013

90 days from application signed date

SPDA

Horizon MYG (Form #04370)

4.00% to 75 2.20% 76-80 1.70% 81-85

5.10% first year 2.10% years 2-6 3.00% Not Available in AK,NJ,NY,UT 2.60% 1.00% Yes 0-85 $5,000

10% each year including the first GMW (87.5%@1%)

10 years 10,9,8,7,6,5,4,3,2,1 SC Modified Charges: 9,8,7,6,5,4,3,2,1

Nursing Home Full Account Value at death of owner (Terminates at age 86 no matter when the policy was issued. Owner driven, one-year wait, 90 day confinement.) Annuitize after 5th year for at least 60 months using full account value

100% chargeback during the first 12 months for any full or partial withdrawals, excluding any penaltyfree amounts. No chargeback at death

American General

8/12/2013

90 days from application signed date

SPDA

Horizon Select (Form #05377)

5 year: 2.20% 0-80 1.70% 81-85 7&10 year: 3.50% 0-80 2.50% 81-85

5 years: 2.05% 7 years: 2.25% 10 years: 2.85% None 10 yr not availabe in SC Call our office for details. N/A 1.00% Yes 0-85 $5,000

10% each year including the first GMW (87.5%@1%)

5, 7 or 10 years 10,9,8,7,6,5,4,3,2,1 Free out at end of initial guarantee period SC Modified Charges: 9,8,7,6,5,4,3,2,1

Nursing Home Full Account Value at death of owner (Terminates at age 86 no matter when the policy was issued. Owner driven, one-year wait, 90 day confinement.) Annuitize after 5th year for at least 60 months using full account value

100% chargeback during the first 12 months for any full or partial withdrawals, excluding any penaltyfree amounts. No chargeback at death

American General

8/12/2013

90 days from application signed date

SPDA

Horizon Secure (Form #05376)

5 year: 1.70% 0-80 1.20% 81-85 7 year: 3.00% 0-80 2.20% 81-85

5 years: 1.90% 7 years: 2.30% None Not Availabe in AK,CA,NY,UT N/A 1.00% No 0-85 $5,000

10% each year including the first GMW (87.5%@1.%)

Nursing Home 5 or 7 years 10,9,8,7,6,5,4,3,2,1 Free out at end of initial guarantee period Full Account Value at death of owner (Terminates at age 86 no matter when the policy was issued. Owner driven, one-year wait, 90 day confinement.) Annuitize after 5th year for at least 60 months using full account value

100% chargeback during the first 12 months for any full or partial withdrawals, excluding any penaltyfree amounts. No chargeback at death

2.20% to 75 1.70% 76-80 1.20% 81-85 Commission for premiums in yrs 2-5: FPDA Horizon Flex (Form #04371) 1.20% ages 0-80 1.20% ages 81-85 Subsequent commissions based on attained age at time premium is paid. 4.15% first year 2.15% base rate 2% on all first year premiums. 2.40% 1.00% No 0-85

$5,000+ EFT min. $100/month (optional) <$5,000 EFT min. $300/month (required) $2,000 min. nonEFT additional deposit 10% each year including the first

8 years 8,8,8,7,6,5,3,1 Contract Surrender Charges - No rolling surrender charges. SC Modified Charges: 8,7,6,6,5,4,3,1 Full Account Value at death of owner

Nursing Home (Terminates at age 86 no matter when the policy was issued. Owner driven, one-year wait, 90 day confinement.) Annuitize after 5th year for at least 60 months using full account value

American General

8/12/2013

90 days from application signed date

100% chargeback during the first 12 months for any full or partial withdrawals, excluding any penaltyfree amounts. No chargeback at death

Last updated 8/30/2013

www.Adams-Moore.com

For agent use only. Not all annuities approved in all states. Not responsible for errors.

Call us toll free at (877) 888-0858 Local (704) 227-0786

Full Details for Fixed and Multi-Year Guaranteed Annuities

1st year Company Effective Date Rate Lock SPDA/ FPDA Product Commission Current Rate premium/ interest rate bonus

Average Annual Yield

Min Guar Rate MVA

Issue Ages

Min/Max Premium

Liquidity

Surrender Charges

Death Benefit

Waivers

Annuitization Options

Commission Chargeback Rules

American General

8/12/2013

90 days from application signed date

SPDA

Horizon Achiever (Form#05377)

3.00% to 80 2.00% 81-85

2.05% years 1-6

None

1.95%

1.00%

Yes

0-85

$5,000 NQ or Q

10% each year including the first GMW (87.5%@1%)

10 years 10,9,8,7,6,5,4,3,2,1 30 Day Window after 6 years to withdraw funds without charge or MVA SC Modified Charges: 9,8,7,6,5,4,3,2,1 Full Account Value at death of owner

Nursing Home (Terminates at age 86 no matter when the policy was issued. Owner driven, one-year wait, 90 day confinement.) Annuitize after 5th year for at least 60 months using full account value

100% chargeback during the first 12 months for any full or partial withdrawals, excluding any penaltyfree amounts. No chargeback at death

American National

8/1/2013

60 days from app signed date

FPDA

Palladium Century FPDA

5.00% 0-74 2.50% 75-90

$5,000 NQ $100 Q $100 monthly EFT minimum afterwards 1.70% None N/A 1.00% Yes 0-90 Additional premiums accepted in first 7 years $1MM maximum

10% per year including first year

7 years 9,8,7,6,5,4,2 Contract Surrender Charges - No rolling surrender charges.

Full Account Value at death of owner

Nursing Home Disability (owner)

Annuitization before the annuity maturity date is not allowed under any circumstances.

*100% 1st year, 50% second year for any surrenders, including death. No chargeback to withdrawals that are made outside surrender charges.

**$5,000 NQ $4,000 Q 60 days from app signed date Palladium Century 1 7.00% 0-74 4.50% 75-90 Additional premiums accepted in the first contract year only $1MM maximum 10% per year including first year 10 years 10,9,8,7,6, 5,4,3,2,1 Full Account Value at death of owner Nursing Home Disability (owner) Annuitization before the annuity maturity date is not allowed under any circumstances. *100% 1st year, 50% second year for any surrenders, including death. No chargeback to withdrawals that are made outside surrender charges.

American National

8/1/2013

SPDA

2.70% first year

1.00%

N/A

1.00%

Yes

0-90

**$5,000 NQ $4,000 Q 60 days from app signed date Palladium Century 3 6.00% 0-74 3.50% 75-85 4.70% first year Additional premiums accepted in the first contract year only $1MM maximum 10% per year including first year 10 years 11,10,9,8,7, 6,5,4,3,2 Full Account Value at death of owner Nursing Home Disability (owner) Annuitization before the annuity maturity date is not allowed under any circumstances. *100% 1st year, 50% second year for any surrenders, including death. No chargeback to withdrawals that are made outside surrender charges.

American National

8/1/2013

SPDA

3.00%

N/A

1.00%

Yes

0-85

**$5,000 NQ $4,000 Q 60 days from app signed date Palladium Century 5 5.00% 0-74 2.50% 75-80 Additional premiums accepted in the first contract year only $1MM maximum **$5,000 NQ $4,000 Q 60 days from app signed date Palladium Century 7 4.00% 0-74 2.00% 75-80 Additional premiums accepted in the first contract year only $1MM maximum 10% per year including first year 10 years 12,12,11,11, 10,9,8,6,4,2 Full Account Value at death of owner Nursing Home Disability (owner) Annuitization before the annuity maturity date is not allowed under any circumstances. *100% 1st year, 50% second year for any surrenders, including death. No chargeback to withdrawals that are made outside surrender charges. 10% per year including first year 10 years 12,12,11,10, 9,8,6,4,3,2 Full Account Value at death of owner Nursing Home Disability (owner) Annuitization before the annuity maturity date is not allowed under any circumstances. *100% 1st year, 50% second year for any surrenders, including death. No chargeback to withdrawals that are made outside surrender charges.

American National

8/1/2013

SPDA

6.70% first year

5.00%

N/A

1.00%

Yes

0-80

American National

8/1/2013

SPDA

8.70% first year

7.00%

N/A

1.00%

Yes

0-80

American National

8/1/2013

60 days from app signed date

SPDA

Palladium MYG 5 SPDA

5 year term: 2.50% to 79 0.05% 80-85

$100,000+ 2.50% 1st year 1.50% years 2-5 <$100,000 2.40% 1st year 1.40% years 2-5

None

$100,000+ 1.60% <$100,000 1.50%

1.00%

Yes

0-85

$5,000 NQ or Q $1MM maximum

10 years 8,8,8,7,6,5,4,3,2,1 30-day window after initial guarantee period to Interest after 30 days, and surrender without penalty. 10% after first year (If surrender is not initiated, the contract will renew at an annual interest rate for the remainder of the initial 10-year term with surrender charges and MVA through the 10th year.)

Full account value at death of owner

Confinement (Available to age 80 at time of issue. 90day wait. 60-day confinement) Annuitization is allowed after the 3rd contract year without surrender Disability Waiver charges as long as the payout is at (If client is not receiving disability least 60+ months. MVA would still payments at time of issue, and is age apply. No surrender charges or MVA 65+ at time of disability) apply if annuitized during the 30-day window at the end of the initial Terminal Illness guarantee period. (If client is diagnosed as terminally ill after the date of issue.)

100% chargeback in the first 12 policy months for any withdrawal that incurs a surrender charge.

American National

8/1/2013

60 days from app signed date

SPDA

Palladium MYG 6 SPDA

6 year term: 2.50% to 79 .50% 80-85

$100,000+ 1.90% for 6 years <$100,000 1.80% for 6 years

None

$100,000+ 1.90% <$100,000 1.80%

1.00%

Yes

0-85

$5,000 NQ or Q $1MM maximum

10 years 8,8,8,7,6,5,4,3,2,1 30-day window after initial guarantee period to Interest after 30 days, and surrender without penalty. 10% after first year (If surrender is not initiated, the contract will renew at an annual interest rate for the remainder of the initial 10-year term with surrender charges and MVA through the 10th year.)

Full account value at death of owner

Confinement (Available to age 80 at time of issue. 90day wait. 60-day confinement) Annuitization is allowed after the 3rd contract year without surrender Disability Waiver charges as long as the payout is at (If client is not receiving disability least 60+ months. MVA would still payments at time of issue, and is age apply. No surrender charges or MVA 65+ at time of disability) apply if annuitized during the 30-day window at the end of the initial Terminal Illness guarantee period. (If client is diagnosed as terminally ill after the date of issue.)

100% chargeback in the first 12 policy months for any withdrawal that incurs a surrender charge.

Last updated 8/30/2013

www.Adams-Moore.com

For agent use only. Not all annuities approved in all states. Not responsible for errors.

Call us toll free at (877) 888-0858 Local (704) 227-0786

Full Details for Fixed and Multi-Year Guaranteed Annuities

1st year Company Effective Date Rate Lock SPDA/ FPDA Product Commission Current Rate premium/ interest rate bonus

Average Annual Yield

Min Guar Rate MVA

Issue Ages

Min/Max Premium

Liquidity

Surrender Charges

Death Benefit

Waivers

Annuitization Options

Commission Chargeback Rules

American National

8/1/2013

60 days from app signed date

SPDA

Palladium MYG 7 SPDA

7 year term: 2.50% to 79 .50% 80-85

$100,000+ 3.50% first year 2.50% years 2-7 <$100,000 3.40% first year 2.40% years 2-7

None

$100,000+ 2.64% <$100,000 2.54%

1.00%

Yes

0-85

$5,000 NQ or Q $1MM maximum

10 years 8,8,8,7,6,5,4,3,2,1 30-day window after initial guarantee period to Interest after 30 days, and surrender without penalty. 10% after first year (If surrender is not initiated, the contract will renew at an annual interest rate for the remainder of the initial 10-year term with surrender charges and MVA through the 10th year.)

Full account value at death of owner

Confinement (Available to age 80 at time of issue. 90day wait. 60-day confinement) Annuitization is allowed after the 3rd contract year without surrender Disability Waiver charges as long as the payout is at (If client is not receiving disability least 60+ months. MVA would still payments at time of issue, and is age apply. No surrender charges or MVA 65+ at time of disability) apply if annuitized during the 30-day window at the end of the initial Terminal Illness guarantee period. (If client is diagnosed as terminally ill after the date of issue.)

100% chargeback in the first 12 policy months for any withdrawal that incurs a surrender charge.

American National

8/1/2013

60 days from app signed date

SPDA

Palladium MYG 8 SPDA

8 year term: 2.50% to 79 0.05% 80-85

$100,000+ 2.70% 8 years <$100,000 2.60% 8 years

None

$100,000+ 2.70% <$100,000 2.60%

1.00%

Yes

0-85

$5,000 NQ or Q $1MM maximum

10 years 8,8,8,7,6,5,4,3,2,1 30-day window after initial guarantee period to Interest after 30 days, and surrender without penalty. 10% after first year (If surrender is not initiated, the contract will renew at an annual interest rate for the remainder of the initial 10-year term with surrender charges and MVA through the 10th year.)

Full account value at death of owner

Confinement (Available to age 80 at time of issue. 90day wait. 60-day confinement) Annuitization is allowed after the 3rd contract year without surrender Disability Waiver charges as long as the payout is at (If client is not receiving disability least 60+ months. MVA would still payments at time of issue, and is age apply. No surrender charges or MVA 65+ at time of disability) apply if annuitized during the 30-day window at the end of the initial Terminal Illness guarantee period. (If client is diagnosed as terminally ill after the date of issue.)

100% chargeback in the first 12 policy months for any withdrawal that incurs a surrender charge.

American National

8/1/2013

60 days from app signed date

SPDA

Palladium MYG 9 SPDA

9 year term 3.00% to 79 1.00% 80-85

$100,000+ 4.50% first year 2.50% years 2-9 <$100,000 4.40% first year 2.40% years 2-9

None

$100,000+ 2.72% <$100,000 2.62%

1.00%

Yes

0-85

$5,000 NQ or Q $1MM maximum

10 years 8,8,8,7,6,5,4,3,2,1 30-day window after initial guarantee period to Interest after 30 days, and surrender without penalty. 10% after first year (If surrender is not initiated, the contract will renew at an annual interest rate for the remainder of the initial 10-year term with surrender charges and MVA through the 10th year.)

Full account value at death of owner

Confinement (Available to age 80 at time of issue. 90day wait. 60-day confinement) Annuitization is allowed after the 3rd contract year without surrender Disability Waiver charges as long as the payout is at (If client is not receiving disability least 60+ months. MVA would still payments at time of issue, and is age apply. No surrender charges or MVA 65+ at time of disability) apply if annuitized during the 30-day window at the end of the initial Terminal Illness guarantee period. (If client is diagnosed as terminally ill after the date of issue.)

100% chargeback in the first 12 policy months for any withdrawal that incurs a surrender charge.

American National

8/1/2013

60 days from app signed date

SPDA

Palladium MYG 10 SPDA

10 year term 4.00% to 79 2.00% 80-85

$100,000+ 3.60% first year 2.60% years 2-10 <$100,000 3.50% first year 2.50% years 2-10

None

$100,000+ 2.70% <$100,000 2.60%

1.00%

Yes

0-85

$5,000 NQ or Q $1MM maximum

10 years 8,8,8,7,6,5,4,3,2,1 30-day window after initial guarantee period to Interest after 30 days, and surrender without penalty. 10% after first year (If surrender is not initiated, the contract will renew at an annual interest rate for the remainder of the initial 10-year term with surrender charges and MVA through the 10th year.)

Full account value at death of owner

Confinement (Available to age 80 at time of issue. 90day wait. 60-day confinement) Annuitization is allowed after the 3rd contract year without surrender Disability Waiver charges as long as the payout is at (If client is not receiving disability least 60+ months. MVA would still payments at time of issue, and is age apply. No surrender charges or MVA 65+ at time of disability) apply if annuitized during the 30-day window at the end of the initial Terminal Illness guarantee period. (If client is diagnosed as terminally ill after the date of issue.)

100% chargeback in the first 12 policy months for any withdrawal that incurs a surrender charge.

American National

8/1/2013

60 days from app signed date

SPDA Additional WealthQuest Citadel 5 premiums Diamond accepted in first year only

3.00% to 80 2.00% 81-85

$100,000+ 1.40% first year 1.40% 2nd year N/A <$100,000 1.30% first year 1.30% 2nd year N/A 1.00% No 0-85

Confinement (Available to age 80 at time of issue. 90day wait. 60-day confinement) $5,000 NQ or Q $1MM maximum 5 years 7,7,7,6,5 Contract Surrender Charges - No rolling surrender charges. Disability Waiver (If client is not receiving disability payments at time of issue, and is age 65+ at time of disability) Terminal Illness (If client is diagnosed as terminally ill after the date of issue.) Can annuitize the full contract value at 100% chargeback in the first 12 the end of the first contract year policy months for any withdrawal that without surrender penalties if incurs a surrender charge. annuitized for at least 10 years.

10% beginning in the first year

Full account value at death of owner

American National

8/1/2013

60 days from app signed date

FPDA

WealthQuest Citadel 7 Diamond

3.50% to 80 2.50% 81-85

$100,000+ 2.40% first year 1.40% 2nd year <$100,000 2.30% first year 1.30% 2nd year

$5,000 NQ $2,000 Q 1% on all premiums for 3 years N/A 1.00% No 0-85 $1,000 minimum additional premiums, or $100 ACH 10% beginning in the first year

Confinement (Available to age 80 at time of issue. 90day wait. 60-day confinement) 7 years 7,7,7,6,5,4,2 Contract Surrender Charges - No rolling surrender charges. Disability Waiver (If client is not receiving disability payments at time of issue, and is age 65+ at time of disability) Terminal Illness (If client is diagnosed as terminally ill after the date of issue.) Can annuitize the full contract value at 100% chargeback in the first 12 the end of the first contract year policy months for any withdrawal that without surrender penalties if incurs a surrender charge. annuitized for at least 10 years.

Full account value at death of owner

ENHANCED LIQUIDITY PACKAGE $5,000 2.25% to 75 1.50% 76-80 Athene Annuity 7/30/2013 60 days from app signed date SPDA MaxRate 5 SPDA Renewal Commission: 1.13% to 75 0.75% 76-80 2.85% (2.75% in FL) 2.65% with enhanced liquidity package (2.55% in FL) None N/A 1.00% Yes* 0-80 5 additional 10% each year after first deposits of at least only when purchasing the $500 allowed in the enhanced liquidity first 6 months package $1,000,000 maximum 10% each year after first SEPP 5 years 9,8,7,6,5 Full Account Value at death of owner Confinement 1-year wait, 90 day confinement RMD Terminal Illness 1-year wait 100% chargeback for full surrender, partial withdrawal, or death during Cash surrender value except for the 30 the first six months day window after initial rate guarantee and 50% in months 7-12. period 100% Charge back for Annuitization for 24 months.

Last updated 8/30/2013

www.Adams-Moore.com

For agent use only. Not all annuities approved in all states. Not responsible for errors.

Call us toll free at (877) 888-0858 Local (704) 227-0786

Full Details for Fixed and Multi-Year Guaranteed Annuities

1st year Company Effective Date Rate Lock SPDA/ FPDA Product Commission Current Rate premium/ interest rate bonus

Average Annual Yield

Min Guar Rate MVA

Issue Ages

Min/Max Premium

Liquidity

Surrender Charges

Death Benefit

Waivers

Annuitization Options

Commission Chargeback Rules

ENHANCED LIQUIDITY PACKAGE $5,000 NQ or Q 2.50% to 75 1.70% 76-80 Athene Annuity 6/28/2013 60 days from app signed date SPDA MaxRate 7 SPDA Renewal Commission: 1.25% to 75 0.85% 76-80 3.25% (3.15% in FL) 3.00% with enhanced liquidity package (2.90% in FL) None N/A 1.00% Yes* 0-80 5 additional 10% each year after first deposits of at least only when purchasing the $500 allowed in the enhanced liquidity first 6 months package $1,000,000 maximum 10% each year after first SEPP 7 years 9,8,7,6,5,4,3 Full Account Value at death of owner Confinement 1-year wait, 90 day confinement RMD Terminal Illness 1-year wait 5-year term* 9,8,7,6,5 5-year term: 2.50% to 79 1.25% 80-90 F&G Life 8/1/2013 60 days from date app received SPDA FG Guarantee Plus 7-year term: 3.25% to 79 1.625% 80-90 5-year term: 3.00% first year 2.00% years 2-5 7-year term: 3.50% first year 2.50% years 2-7 1.00% 7 years: 2.64% 7-year term 9,8,7,6,5,4,3** 5 years: 2.20% 1.00% Yes 0-90 $5,000 NQ $2,000 Q Cumulative interest, beginning in 30 days *In NC, surrender charges do not renew after 5th Surrender value at death year. In other states, there's a 30-day window to None of owner withdraw funds without penalty. Otherwise, annuity renews for another 5 years with identical surrender charges. ** 30-day window after 7th year. Or, auto-renewal into new 7 year surrender period with same surrender charges as shown above. Annuitization available at any time (Please check commission chargeback provisions.) 100% chargeback for full surrender, partial withdrawal, or death during Cash surrender value except for the 30 the first six months day window after initial rate guarantee and 50% in months 7-12. period 100% Charge back for Annuitization for 24 months.

No chargeback of commission at death. 100% chargeback for surrenders in first 12 months, 50% in months 13-24. Commission adjustment to SPIA commission for Annuitization of a deferred contract in the first 12 months.

5-year term* 9,8,7,6,5 7-year term 9,8,7,6,5,4,3** $5,000 NQ $2,000 Q Cumulative interest, beginning in 30 days *In NC, surrender charges do not renew after 5th year. In other states, there's a 30-day window to withdraw funds without penalty. Otherwise, annuity renews for another 5 years with identical surrender charges. ** 30-day window after 7th year. Or, auto-renewal into new 7 year surrender period with same surrender charges as shown above. Full account value at death of owner

F&G Life

8/1/2013

60 days from date app received

SPDA

FG Guarantee Platinum

5-year term: 2.50% to 79 1.25% 80-90 7-year term: 3.25% to 79 1.625% 80-90

5-year term: 2.10% for 5 years (1.95% in NC) 7-year term: 2.60% for 7 years

None

5 years: 2.10% (1.95% in NC) 7 years: 2.60%

Nursing Home Annuitization available at any time Terminal Illness Unemployment

1.00%

Yes

0-90

(Please check commission chargeback (.50% reduction in commission when provisions.) the total premium for any client in the same year exceeds $600,000, retroactive to the first dollar of commission.)

3 years 9,8,7 F&G Life 8/1/2013 60 days from date app received SPDA FG Guarantee Platinum 3 1.50% to 79 0.75% 80-90 1.20% for 3 years None 1.20% 1.00% Yes 0-90 $5,000 NQ $2,000 Q Cumulative interest, beginning in 30 days 30-day window following initial guarantee period to withdraw funds without penalty. Otherwise, surrender charges renew and start over at 9%. Full account value at death of owner

Nursing Home Annuitization available at any time Terminal Illness Unemployment (Please check commission chargeback provisions.)

7.00% to 75 5.00% 76-85 Forethought Life 7/22/2013 45 days from app signed date SPDA Secure Income 125 Commissions are reduced by 1.00% in the states of AK, CT, DE, MN, OR, SC, TX and UT.

$250K+ 1.25% first year $100K - $249K 1.25% first year $25K - $99K 1.25% first year (1.00% min.)

None

N/A *No market value adjustment to the surrender charge in a rising rate environment

$25,000 1.00% No 0-85 Maximum: $1,000,000 0-75; $500K 76+

10% each year after the first. Free RMD for all Q plans

10 years: 12,12,11,10,9,8,7,6,4,2

Nursing Home(at any time on or after the 1st contract anniversary, if client should become confined to an approved nursing facility for at least 60 Full account value at consecutive days, withdrawal charges death of the owner on any portion of the CV withdrawn will After 5th contract year without penalty be waived. Optional: Increased if choose a payout option of at least 5 Death Benefit Guarantee years certain. Terminal Illness Rider (1.25% Cost) LIFETIME INCOME RIDER 25% PREMIUM BONUS PLUS 5% GUARANTEED INTEREST FOR 10 YEARS IN THE INCOME ACCOUNT

100% Chargeback for death or any withdrawals in the first year. Issue Age 0-80 100% 0-6 months 50% months 7-12 Issue Age 81+ 100% 0-12 months

1 Year Guarantee: $250,000+ 4.15% first year $100,000 - $249,999 3.40% first year $15,000 - $99,999 2.40% first year (1.65% bailout rate in years 2-6)

$250K+ 2.06% $100k - $249K 1.94% <$99K 1.77%

3 Year Guarantee: $250K+ 3.05% years 1-3 60 days from date application received 3.00% to 75 1.95% 76-80 1.05% 81-85 $100K - $249K 2.85% years 1-3 <$99K 2.25% years 1-3 (1.65% bailout rate in years 4-6)

$250K+ 2.35% $15,000 None $100k - $249K 2.25% <$99K 1.95% 1.00% No 0-85 $500,000 maximum

10% each year including the first Available after 30 days

Genworth

7/31/2013

SPDA

SecureLiving Liberty

6 years: 9,9,8,7,6,5

Medical Care/Nursing Home Waiver Full account value at death of the owner Bail Out Guaranteed Return of Premium

Can annuitize after 13 months without 100% Chargeback for death in the any surrender charges. first 6 months for any owner with an issue age of 76 or older. Options are Lifetime Income with 100% Chargeback the first twelve Period Certain (10, 15, or 20 years) or months for Full or Partial Joint Life and Survivor Income with 10 Withdrawals above the penalty free Year Period Certain. amount.

Last updated 8/30/2013

www.Adams-Moore.com

For agent use only. Not all annuities approved in all states. Not responsible for errors.

Call us toll free at (877) 888-0858 Local (704) 227-0786

Full Details for Fixed and Multi-Year Guaranteed Annuities

Genworth

7/31/2013

60 days from date application received Rate Lock

SPDA

SecureLiving Liberty

3.00% to 75 1.95% 76-80 1.05% 81-85 Commission Current Rate

$15,000 None 1st year premium/ interest rate bonus Average Annual Yield 1.00% Min Guar Rate MVA No 0-85 $500,000 maximum Min/Max Premium

10% each year including the first Available after 30 days

6 years: 9,9,8,7,6,5

Medical Care/Nursing Home Waiver Full account value at death of the owner Death Benefit Bail Out Guaranteed Return of Premium

Company

Effective Date

SPDA/ FPDA

Product

Issue Ages

Liquidity

Surrender Charges

Waivers

Can annuitize after 13 months without 100% Chargeback for death in the any surrender charges. first 6 months for any owner with an issue age of 76 or older. Options are Lifetime Income with 100% Chargeback the first twelve Period Certain (10, 15, or 20 years) or months for Full or Partial Joint Life and Survivor Income with 10 Withdrawals above the penalty free Year PeriodAnnuitization Certain. amount. Commission Options Chargeback Rules

5 Year Guarantee: $250K+ 2.55% years 1-5 $100K - $249K 2.40% years 1-5 <$99K 2.00% years 1-5 (1.65% bailout rate in year 6) $100K+ 4.80% first year $50,000 - $99,999 4.30% first year Genworth 7/31/2013 60 days from date application received SPDA SecureLiving Independence 2.25% to 75 1.31% 76-80 0.94% 81-85 $15,00 - $49,999 3.80% first year (2.55% bailout rate in years 1 &2 yr $15,000$100,000+ ) .50%and 1.00% depending on premium amounts

$250K+ 2.40% $100k - $249K 2.27% <$99K 1.94%

$15,000 N/A 1.00% years 1-6 No 0-85 $500,000 maximum

10% each year including the first Available after 30 days 6 years: 9,9,8,7,6,5 Full account value at death of the owner

Medical Care/Nursing Home Waiver (90 day wait, 30 day confinement) Guaranteed Return of Premium

Can annuitize after 13 months without 100% Chargeback for death in the any surrender charges. first 6 months for any owner with an issue age of 76 or older. Options are Lifetime Income with 100% Chargeback the first twelve Period Certain (10, 15, or 20 years) or months for Full or Partial Joint Life and Survivor Income with 10 Withdrawals above the penalty free Year Period Certain. amount.

1-Year Guarantee: 2.60% < $49,999 3.35% $50k - $99,999 4.10% - $100k+ None N/A

3-Year Guarantee: 2.05% - < $49,999 Genworth 7/31/2013 60 days from date application received SPDA SecureLiving Smart Rate 3.00% to 75 2.70% 76-80 1.05% 81-85 2.45% $50k - $99,999 3.85% $100k+ None N/A 1.00% No 0-85

$5,000 NQ $2,000 Q $500,000 maximum

10% each year including the first. Available after 30 days

7 years: 7,7,7,6,5,4,3

Medical Care/Nursing Home Waiver Full account value at death of the owner (90 day wait, 30 day confinement) Guaranteed Return of Premium

Can annuitize after 13 months without 100% Chargeback for death in the any surrender charges. first 6 months for any owner with an issue age of 76 or older. Options are Lifetime Income with 100% Chargeback the first twelve Period Certain (10, 15, or 20 years) or months for Full or Partial Joint Life and Survivor Income with 10 Withdrawals above the penalty free Year Period Certain. amount.

5-Year Guarantee: 1.65% - < $49,999 None 2.00% $50k - $99,999 2.20% $100k+ N/A

First Year 5.75% to 70 4.65% 71-80 4.40% 81-89 30 days from date application received Second Year 5.00% 0-70 3.85% 71-80 3.60% 81-89 Third Year 4.05% 0-70 2.95% 71-80 2.00% 81-89 4.03% effective yield 1% Annuitization (assuming you are bonus vests per annuitizing for min. of year, up to 10% 7 years.)

$10,000 Maximum: 10% of the initial purchase $750,000 for ages payment in the first 0-79. $500,000 for contract year. After first ages 80+ contract year, 10% per year of cash value, as of Additional most recent contract premiums accepted anniversary in first three contract years; min $5,000

Great American

8/7/2013

SPDA

Secure American

3.00% AV* 1.00% SV*

1.00%

No

0-89(NQ) 18-89(Q)

7 years 9,8,7,6,5,4,3 Applies to each purchase payment

Upon the death of the owner, the death benefit will equal the account value, which includes any earned Annuitization bonus if the contract is annuitized, less any applicable premium tax or other taxes not previously deducted.

Extended Care Terminal Illness Up to 10% Annuitization bonus

If the contract is annuitized after the first contract year for a period of at least seven years, a bonus will be added to the account value. The bonus will be equal to 1% of the amount annuitized for each completed contract year, up to a maximum of 10%. Withdrawals, surrenders, loans and ESP payments will adversely affect the amount available for Annuitization.

ANNUITIZATION 100% in the first year for periods of 10+ years or life; 50% for 9 years or less DEATH 50% in the first 6 months only PARTIAL WITHDRAWALS 100% in months 1-6; 50% in months 7-12 SURRENDERS 100% in months 0-6; 50% in months 7-12

Great American

8/7/2013

30 days from date application received

SPDA

Secure Gain 5

2.50% to age 80 1.50% ages 81-89

<$100,000 2.15% year 1 2.00% year 2 2.10% year 3 2.20% year 5 2.30% year 5 $100,000+ .10% bps higher

.25% interest rate bonus for one year

<$100,000 2.15% 1.00% $100,000+ 2.25%

Yes (No MVA in IN, MN, MO, OH, VA) 18-89 Q 0-89 NQ

$10,000 $750,000 max for ages 0-79 $500,000 max for ages 80+

10% during the first year, and 10% each year thereafter (noncumulative) as of the end of the prior contract anniversary.

9,8,7,6,5

DEATH Full account value at 50% in the first 6 months only Annuitization allowed at any time the death of the Terminal Illness Waiver using full account value PARTIAL WITHDRAWALS owner (diagnosed after first contract year; 12 100% in months 1-6; months or less to live as diagnosed by a 50% in months 7-12 physician) SURRENDERS 100% in months 0-6; 50% in months 7-12

Extended Care Waiver (confinement after first contract year, 90 consecutive days)

ANNUITIZATION 100% in the first year for periods of 10+ years or life; 50% for 9 years or less

Last updated 8/30/2013

www.Adams-Moore.com

For agent use only. Not all annuities approved in all states. Not responsible for errors.

Call us toll free at (877) 888-0858 Local (704) 227-0786

Full Details for Fixed and Multi-Year Guaranteed Annuities

1st year Company Effective Date Rate Lock SPDA/ FPDA Product Commission Current Rate premium/ interest rate bonus

Average Annual Yield

Min Guar Rate MVA

Issue Ages

Min/Max Premium

Liquidity

Surrender Charges

Death Benefit

Waivers

Annuitization Options

Commission Chargeback Rules

Great American

8/7/2013

30 days from date application received

SPDA

Secure Gain 7

2.50% to age 80 1.50% ages 81-89

<$100,000 2.60% year 1 1.85% year 2 2.10% year 3 2.35% year 5 2.60% year 5 2.85% year 6 3.10% year 7 $100k + .10 bps higher

1.00% interest rate bonus for one year .25% added to base rate in years 2-7

<$100,000 2.49% 1.00% $100,000+ 2.59%

Yes (No MVA in IN, MN, MO, OH, VA) 18-85 Q 0-85 NQ

$10,000 $750,000 max for ages 0-79 $500,000 max for ages 80+

10% during the first year, and 10% each year thereafter (noncumulative) as of the end of the prior contract anniversary.

9,8,7,6,5,4,3

Extended Care Waiver (confinement after first contract year, 90 DEATH consecutive days) Full account value at 50% in the first 6 months only Annuitization allowed at any time the death of the Terminal Illness Waiver using full account value PARTIAL WITHDRAWALS owner (diagnosed after first contract year; 12 100% in months 1-6; months or less to live as diagnosed by a 50% in months 7-12 physician) SURRENDERS 100% in months 0-6; 50% in months 7-12

ANNUITIZATION 100% in the first year for periods of 10+ years or life; 50% for 9 years or less

Guggenheim

8/1/2013

45 days from date application received

SPDA

ProOption 5 With Return of Premium

2.50% to age 80 1.88% ages 81-85 1.25% ages 86-90

2.15% year 1 2.25% year 2 2.35% year 3 2.45% year 5 2.55% year 5

None

Same as guaranteed rate

1.00%

Yes

0-90 Q & NQ

Qualified: $5,000 Min $1,000,000 Max Non-Qualified $10,000 Min $1,000,000 Max

10% of previous anniversary account value in Year 2 and later. 7,6,5,4,3 RMD's allowed in all years (with chargeback in Year 2)

Full account value at the death of the Nursing Home owner. (Contract purchased prior to age 76, 90 consecutive days) Surrender charges Terminal Illness waived (Contract Purchased prior to age 70) No MVA applied.

Can annuitize at any time . Surrender charges are waived 100% on any withdrawal or death upon Annuitixation for a within 1st contract year. minimum of 10 years, or 5 years after the initial guarantee period.

Guggenheim

8/1/2013

45 days from date application received

SPDA

ProOption 7 With Return of Premium

2.50% to age 80 1.88% ages 81-85 1.25% ages 86-90

2.55% year 1 2.65% year 2 2.75% year 3 2.85% year 5 2.95% year 5 3.05% year 6 3.15% year 7

None

Same as guaranteed rate

1.00%

Yes

0-90 Q & NQ

Qualified: $5,000 Min $1,000,000 Max Non-Qualified $10,000 Min $1,000,000 Max

10% of previous anniversary account value in Year 2 and later. 7,6,5,4,3,2,1 RMD's allowed in all years (with chargeback in Year 2)

Full account value at the death of the Nursing Home owner. (Contract purchased prior to age 76, 90 consecutive days) Surrender charges Terminal Illness waived (Contract Purchased prior to age 70) No MVA applied.

Can annuitize at any time . Surrender charges are waived 100% on any withdrawal or death upon Annuitixation for a within 1st contract year. minimum of 10 years, or 5 years after the initial guarantee period.

Guggenheim

8/1/2013

45 days from date application received

SPDA

ProOption 10 With Return of Premium

3.00% to age 80 2.25% ages 81-85 1.50% ages 86-90

2.70% year 1 2.80% year 2 2.90% year 3 3.00% year 4 3.10% year 5 3.20% year 6 3.30% year 7 3.40% year 8 3.50%year 9 3.60% year 10

None

Same as guaranteed rate

1.00%

Yes

0-90 Q & NQ

Qualified: $5,000 Min $1,000,000 Max Non-Qualified $10,000 Min $1,000,000 Max

10% of previous anniversary account value in Year 2 and later. 7,6,5,4,3,2,1,1,1,0.75 RMD's allowed in all years (with chargeback in Year 2)

Full account value at the death of the Nursing Home owner. (Contract purchased prior to age 76, 90 consecutive days) Surrender charges Terminal Illness waived (Contract Purchased prior to age 70) No MVA applied.

Can annuitize at any time . Surrender charges are waived 100% on any withdrawal or death upon Annuitixation for a within 1st contract year. minimum of 10 years, or 5 years after the initial guarantee period.

3-year term: 2.10% $250K+ 2.00% under $250K 4-year term: 2.35% $200K+ 2.25% under $250K 5-year term: 2.80% $250K+ 2.70% under $200K 6-year term: 3.00% $250K+ 2.90% under $250K 7-year term: 3.30% $250K+ 3.20% under $250K 8-year term: 3.40% $250K+ 3.30 under $250K 9-year term: 3.50% $250K+ 3.40% under $250K 10-year term: 3.60% $250K+ 3.50% under $250K 7 year term: Option A 2.50% 0-76 w/ no trail Option B, C, D 1.50% 0-76 w/.25% trail .25% reduction over 76 7-year guaranteed rate $15,000 - $74,999 1.50%

None

Same as guaranteed rate Same as guaranteed rate

3-year term: 7,6,5 4-year term: 7,6,5,4

3-Year term 1.00% to 80 0.75% 81-85 0.50% 86-90 4-Year term 1.75% to 80 1.31% 81-85 0.88% 86-90 Guggenheim 8/1/2013 45 days from date application received SPDA Preserve Multi-Year Guaranteed Annuity 5-9 year terms 2.50% to 80 1.88% 81-85 1.25% 86-90 10- year term 3.00% to 80 2.25% 81-85 1.50% 86-90 *Call for renewals

None

None

Same as guaranteed rate

5-year term: 7,6,5,4,3

None

Same as guaranteed rate 1.00% Yes 0-90 Q & NQ

Qualified: $5,000 Min $1,000,000 Max Non-Qualified $10,000 Min $1,000,000 Max

10% of previous anniversary account value in Year 2 and later. RMD's allowed in all years (with chargeback in Year 2)

6-year term: 7,6,5,4,3,2

Full account value at death Surrender charges waived No MVA applied.

None

Same as guaranteed rate

7-year term: 7,6,5,4,3,2,1

Nursing Home (Contract purchased prior to age 76, 90 Can annuitize at any time . Surrender consecutive days) charges are waived upon Annuitixation 100% on any withdrawal or death for a minimum of 10 years, or 5 years within 1st contract year. Terminal Illness after the initial guarantee period. (Contract Purchased prior to age 70)

None

Same as guaranteed rate

8-year term: 7,6,5,4,3,2,1,1

None

Same as guaranteed rate

9-year term: 7,6,5,4,3,2,1,1,1

None

Same as guaranteed rate

10-year term: 7,6,5,4,3,2,1,1,1,0.75

$15,000+ 1.50% 1% on $75,000+ 75,000+ 1.64% See Left Yes 0-80 $15,000 Interest in 30 days, 10% after one year Annuitize your contract prior to 9th Nursing Home & Terminal Illness contract anniv. cash surrender value will be applied to the payout option, if Surrender charges waived if owner is Accumulation value is pd. you annuitize your contract on after the confined for at least 45 days during any to the beneficiary 9th contract anniv, the accumulation 30 day window at end of initial guarantee period to continuous 60-day period. value will be applied to payout option. withdraw funds without penalty. After window, Annuitization available after 1st surrender charges continue but do not reset. Guaranteed Return of Premium contract yr for a min. of 10 yrs. 7 or 10 years 9,8,7,6,5, 4,3,2,1 Chargeback for surrenders or Annuitization in the first year: 100% first 6 months 50% months 7-12 No chargeback at death in first year. .

ING USA

7/17/2013

45 days from date transfer request is sent by ING

$75,000+ 2.50% 1st year 1.50% years 2-7

SPDA

Guarantee Choice Annuity

Last updated 8/30/2013

www.Adams-Moore.com

For agent use only. Not all annuities approved in all states. Not responsible for errors.

Call us toll free at (877) 888-0858 Local (704) 227-0786

Full Details for Fixed and Multi-Year Guaranteed Annuities

1st year Company Effective Date 7/17/2013 Rate Lock 45 days from date transfer request is sent by ING SPDA/ FPDA SPDA Product Guarantee Choice Annuity Commission Current Rate premium/ interest rate bonus 10 year term: Option A 3.25% 0-76 w/ no trail Option B, C, D 2.00% 0-80 w/.25% trail .25% reduction over 76 2.00% to 75 1.50% 76-85 1.20% 86-89 2.50% 0-75 2.00% 76-85 1.70% 86-89 3.00% 0-75 2.20% 76-85 1.80% 86-89 3.50% 0-75 2.70% 76-85 2.00% 86-89

Average Annual Yield

Min Guar Rate See Left Yes MVA

Issue Ages 0-80

Min/Max Premium $15,000

Liquidity Interest in 30 days, 10% after one year

ING USA

10-year guaranteed rate $15,000 - $74,999 1.50% 1% on $75,000+ $75,000+ 2.50% 1st year 1.50% years 2-10 4 years: 2.00% first year 1.00% years 2-4 5 years: 2.40% first year 1.40% years 2-5 7 years: 3.25% first year 2.25% years 2-7 10 years: 3.60% first year 2.60% years 2-10 QIO 1st.yr rate 2.75%

$15,000+ 1.50% 75,000+ 1.60%

Death Annuitization Annuitize your contract prior to 9th Waivers Nursing Home & Terminal Illness contract anniv. Options cash surrender value Benefit will be applied to the payout option, if Surrender charges waived if owner is Accumulation value is pd. you annuitize your contract on after the confined for at least 45 days during any to the beneficiary 9th contract anniv, the accumulation 30 day window at end of initial guarantee period to continuous 60-day period. value will be applied to payout option. withdraw funds without penalty. After window, Annuitization available after 1st surrender charges continue but do not reset. Guaranteed Return of Premium contract yr for a min. of 10 yrs.

Surrender 7 or 10 years Charges 9,8,7,6,5, 4,3,2,1

Chargeback for surrenders or Commission Annuitization in the first year: Chargeback Rules 100% first 6 months 50% months 7-12 No chargeback at death in first year. .

1.00%

1.25%

0-89 4, 5, 7, or 10 years 8,8,7,7,6,5,4,3,2,1 10% beginning in the first year 30-day window BEFORE end of initial GRO period to withdraw funds without penalty or MVA No MVA at death. Full account value at the death of the annuitant

Nursing Home $20,000 Max premium $1M 0-75 $750K 76-89 Terminal Illness RMD Full Annuitization after 1st. Year partial @ maturity Full account value upon Annuitization 100% chargeback in the first 12 months for surrenders in each GRO period. No chargeback at death.

Integrity Life

7/31/2013

60 days from date application received

1.00%

1.60% 1.00% Yes

0-89

SPDA

MultiVantage

1.00%

2.39%

0-89

1.00%

2.70%

0-89

2 year & 3-year GRO will be closed to renewals, fund transfers, and new contributions eff. 9/30/12.

n/a

n/a $5,000 NQ $2,000 Q

Guaranteed Rate Option: 5.00% to 79 3.00% 80-85

5-year GRO rate: 2.00% first year 1.25% years 2-5 2.20% first year 1.45% years 2-6 7-year GRO rate: 2.65% first year 1.90% years 2-7 10-year GRO rate: 2.95% first year 2.20 years 2-10 1-year rate: 2.75% 3-year rate: 2.65% first year 1.65% years 2-3 5 year rate: 2.50% first year 1.50% years 2-5 7 year rate: 2.30% first year 1.30% years 2-7 3-year term: 1.40% $200K+ 1.15%>$200K 4-year term: 1.65% $200K+ 1.40% under $200K 5-year term: 2.50% $200K+ 2.25% under $200K 6-year term: 2.25% $200K+ 2.00% under $200K 7-year term: 2.50% $200K+ 2.30% under $200K 8-year term: 2.75% $200K+ 2.55 under $200K 9-year term: 3.00% $200K+ 2.75% under $200K 10-year term: 3.50% $200K+ 3.30% under $200K

0.75%

1.40%

7 years 8,7,6,5,4,3,2 10% beginning in the first year (7 year surrender. MVA extends to the end of the 7th year, or 10th year on the 10-year term) Deposit Surrender Schedule - each deposit incurs a new surrender charge period. Of 7 years

Nursing Home Terminal Full account value at the Illness death of the annuitant Unemployment (owner) 100% chargeback in the first 6 Annuitization outside of the 30-day months for surrenders or withdrawals window will incur MVA calculations but over 10%. no surrender charges. No chargeback at death.

Integrity Life

7/31/2013

60 days from date application received

FPDA

New Momentum

Quarterly Enhanced Interest Rate Option: 2.00% to 79 0.00% 80-85

0.75%

1.57%

1.00%

Yes

0-85

0.75%

2.00%

$1,000 additional lump sum premiums or $100 min if set up on EFT

0.75%

2.27%

n/a

n/a

Integrity Life

7/31/2013

60 days from date application received

1.00%

1.98% minimum 1.00% No 0-85 $3,000 10% beginning in the first year 7 years 7,7,7,6,5,4,3

SPDA

SPDA Series II

4.00% to 79 2.25% 80-85

1.00%

1.70% minimum

Annuitization can begin at any time. Full account value at the However, there is a chargeback of (The unemployment, terminal illness death of the annuitant commissions in the first year due to and healthcare waivers are NOT allowed annuitized contracts. in NC or SC.) GUARANTEED RETURN OF PREMIUM

Unemployment, Terminal Illness, Healthcare, and RMD

100% first six months, 50% months 7-12 for partial withdrawals (except penalty-free amounts) or full surrenders. No chargeback at death. New money Annuitization rates and full commission after 5 years.

1.00%

1.44%

None

Same as guaranteed rate Same as guaranteed rate

3-year term: 10,10,10 4-year term: 10,10,10,10

None

3-Year term 1.50% to 80 1.125% 81-85 .75% 86-90 North American Guarantee Choice Plus 4-Year term 2.00% to 80 1.50% 81-85 1% 86-90 5-10 year terms 2.50% to 80 1.88% 81-85 1.25% 86-90 .75% at re-entry

None

Same as guaranteed rate

5-year term: 10,10,10,10,10

100% first 6 months 50% months 7-12 Nursing Home for any and all withdrawals (Age 75 or younger at time of issue; 1- Available after first year if annuitized for year wait, 90 day confinement - penalty- life. After 5th year if annuitized for at In CT, IN, KY, LA, MD, OK, OR, SC, free withdrawals increased to 20% per least 60 months. TX, UT, VT, VA, & WA, the year) Guarantee Annuity commissions are .25% less and re-entry commissions are .125% less. Commissions are not paid on new premium added to a spousal continuance case.

None

Same as guaranteed rate 1.00% Yes 0-90 $2,000 Q $10,000 NQ Current year interest withdrawals after 30 days

6-year term: 10,10,10,10,10,9 Full account value at death of owner or annuitant

North American

8/1/2013

45 days from date application received

SPDA

None

Same as guaranteed rate

7-year term: 10,10,10,10,10,9,8

None

Same as guaranteed rate

8-year term: 10,10,10,10,10,9,8,6

None

Same as guaranteed rate

9-year term: 10,10,10,10,10,9,8,6,4

None

Same as guaranteed rate

10-year term: 10,10,10,10,10,9,8,6,4,2

North American

8/1/2013

45 days from date application received

FPDA

Boomer Annuity

To age 75: 7.00% first year 3.00% years 2-5 2.00% years 6-7 1.00% years 8-10 1.50% years 11+ 25% reduction in above rates for ages 76-80

1.35% first year PLUS 5% cash bonus on all premiums received in the first 5 contract years!

$2,000 Q $10,000 NQ 5.00% N/A 1.00% Yes 0-80 $50/month minimum premium after initial premium 5% of account value each year after first year

10 years 15,14,13,12,11, 10,8,6,4,2 Contract Surrender Charges - no rolling surrenders

Full account value at death of first owner or second annuitant

Nursing Home (Age 75 or younger at time of issue; 1year wait, 90 day confinement - penaltyAccount value after first contract year. free withdrawals increased to 20% per year) 2% Annuitization bonus if annuitized in years 8-10, 5% years 11+ Annuitization Bonus 2% years 8-10 5% years 11+

100% first 6 months 50% months 7-12 for any and all withdrawals including RMDs

Last updated 8/30/2013

www.Adams-Moore.com

For agent use only. Not all annuities approved in all states. Not responsible for errors.

Call us toll free at (877) 888-0858 Local (704) 227-0786

Full Details for Fixed and Multi-Year Guaranteed Annuities

1st year Company Effective Date Rate Lock SPDA/ FPDA Product Commission Current Rate premium/ interest rate bonus

Average Annual Yield

Min Guar Rate MVA

Issue Ages

Min/Max Premium

Liquidity

Surrender Charges

Death Benefit

Waivers

Annuitization Options

Commission Chargeback Rules

5.50% to 80 4.13% 81-85 45 days from date application received .50% on premiums applied in years 2-5 (1% comm reduction in VA.) 4.50% first year 1.50% years 2-5 1% minimum yrs 6-9 $2,000 Q $10,000 NQ N/A N/A 1.00% Yes 0-85 $50/month minimum premium after initial premium 10% each year after first year; one withdrawal allowed per year 9 years 12,11,10,9,8, 7,6,4,2 Contract Surrender Charges - no rolling surrender charges Full account value at death of first owner or second annuitant

Nursing Home (Age 75 or younger at time of issue; 1year wait, 90 day confinement - penaltyfree withdrawals increased to 20% per year) 100% first Terminal Illness 6 months Annuitization using full account value (Age 75 or younger at time of issue; oneis available after first year if annuitized time penalty-free withdrawal up to 50% 50% months with life contingency, or after 5th year if of AV) 7-12 annuitized for at least 60 months. for any and all withdrawals including Unemployment RMDs (age 65 or younger at time of issue; oneyear wait; increases penalty-free withdrawals to 20% per year) INCOME PAY RIDER

North American

8/1/2013

FPDA

North American Director

FLEX I & II: 4.50% first year 2.50% years 2-3 0.50% years 4-9 Flex I: 25% reduction ages 76-80 50% reduction 81-85 FPDA North American Flex II & III Flex II: 25% reduction ages 76-79 Flex III To age 75: 4.50% first year 2.50% years 2-5 0.50% years 6-10 0.50% years 11-15 First Year Guaranteed Rate: Flex II: 1.40% (1st year) 10-year term Flex III: 1.55% (1st year) 14-year term Flex II: 5% Flex III: 10% N/A Premium bonus applies to all premiums received in first 5 contract years. 1.00% Yes Flex II: 0-79 Flex III: 0-75

North American

8/1/2013

45 days from date application received

$2,000 Q $10,000 NQ $50/month minimum premium after initial premium 10% per year after first contract year

Flex II: 10 Years 15,14,13,12,11, 10,8,6,4,2 Flex III: 14 years 18,18,17,15,15,15,15, 14,12,10,8,6,4,2 Contract Surrender Charges - no rolling surrender charges

Nursing Home (Age 75 or younger at time of issue; 1year wait, 90 day confinement - penaltyfree withdrawals increased to 20% per Full account value paid at year) Available after first year if annuitized for death of first life. After 5th year if annuitized for at owner/annuitant or least 60 months. second annuitant (if joint) INCOME PAY RIDER GUARANTEED RETURN OF PREMIUM

100% first contract year, 50% second contract year for any and all withdrawals including RMDs

$2,000 NQ or Q Unlimited rate lock with a $100 fee No ratelock otherwise NSS Life is only approved to do business in CA, CO, CT, FL, IL, IN, MI, NJ, NY, NC, OH, PA, WV, WI Up to 10% may be withdrawn in each contract year. Full liquidity is available during Additional deposits a 30-day window at the of at least $25 end of the one-year allowed after first period. year $25,000 max deposit per client 5 years 6,5,4,3,2 No new surrender charges on additional deposits

NSS Life

1/2/2013

FPDA

Preferred Choice One Year Annuity

.50% on all deposits .50% trails for 3 years

1.00% for one year

n/a

1.00%

1.00%

No

Unlimited

Full Account Value at death

None

Any time without penalty

Prorata chargeback of commissions for surrenders or withdrawals in first year for any reason, except for penalty-free amounts. First year withdrawals of $5,000 or more from subsequent deposits will also incur a commission prorated chargeback.

$2,000 Unlimited rate lock with a $100 fee No ratelock otherwise FPDA Additional premiums accepted in first 90 days $25,000 maximum premium per client Additional premiums accepted in first 90 days 5 years 6,5,4,3,2 30 day window after 3 years to withdraw with no penalty

NSS Life

1/2/2013

Optimum 3

1% at all ages on initial deposit

2.00% for three years

n/a

2.00%

1.00%

No

Unlimited

10% free each year after first contract year

Full Account Value at death

None

Any time without penalty

Prorata chargeback of commissions for surrenders or withdrawals in first year for any reason, except for penalty-free amounts. First year withdrawals of $5,000 or more from subsequent deposits will also incur a commission prorated chargeback.

NSS Life

1/2/2013

Unlimited rate lock with a $100 fee No ratelock otherwise

2.75% ages 0-79 first year 1.75% on additional deposits FPDA Preferred 5 1.00% ages 80+ first year .50% additional deposits years 2-5 3.00% first year n/a n/a 2.00% No Unlimited

$1,000 lump sum $25 minimum thereafter $100,000 maximum premium per client 5 years 6,5,4,3,2 No new surrender charges on additional deposits

10% free each year after first contract year

Full Account Value at death

None

Any time without penalty

Prorata chargeback of commissions for surrenders or withdrawals in first year for any reason, except for penalty-free amounts. First year withdrawals of $5,000 or more from subsequent deposits will also incur a commission prorated chargeback.

NSS Life

1/2/2013

Unlimited rate lock with a $100 fee No ratelock otherwise

2.75% ages 0-79 first year 1.75% on additional deposits 1.00% ages 80+ first year .50% additional deposits years 2-5 EXTRA .25% COMMISSION THROUGH 3/31/13

$1,000 lump sum $25 minimum thereafter $100,000 maximum premium per client 8 years 9,8,7,6,5,4,3,2 No new surrender charges on additional deposits

FPDA

Preferred 8

3.50% first year

n/a

n/a

2.00%

No

Unlimited

10% free each year after first contract year

Full Account Value at death

None

Any time without penalty

Prorata chargeback of commissions for surrenders or withdrawals in first year for any reason, except for penalty-free amounts. First year withdrawals of $5,000 or more from subsequent deposits will also incur a commission prorated chargeback.

Last updated 8/30/2013

www.Adams-Moore.com

For agent use only. Not all annuities approved in all states. Not responsible for errors.

Call us toll free at (877) 888-0858 Local (704) 227-0786

Full Details for Fixed and Multi-Year Guaranteed Annuities

1st year Company Effective Date Rate Lock SPDA/ FPDA Product Commission Current Rate premium/ interest rate bonus

Average Annual Yield

Min Guar Rate MVA

Issue Ages

Min/Max Premium

Liquidity

Surrender Charges

Death Benefit

Waivers

Annuitization Options

Commission Chargeback Rules

Years 1-5: 2.75% $25,000-$350,000 2.25% $10,000 - $25,000 (1.00 % min) Oxford Life 60 days from date application signed Income Protector SPDA 3.00% to 18-75 2.00% 76-80 *Income account rate years 1-5 $25,000+ - 7.50% (*$6% min yrs 6-10) <$25,000 - 7.00% (*6% min yrs 6-10) [*5% greater than policy base rate for first 10 years) None N/A 1.00% Yes 18-80 $350,000 maximum $10,000 Systematic withdrawal of interest in the first year* OR 2 penalty-free withdrawals per year cumulatively, 10% of accumulated annuity value starting in the second year

Terminal Illness Home Health Care Nursing Home Optional Guaranteed Lifetime Withdrawal Benefit- Guaranteed Income Account Roll-Up Rate = 5% over fixed rates shown above Prior to any withdrawals under the GLWB or base policy, the Income Account Value equals 100% of your initial premium, plus the premium Account value after first contract year bonus, guaranteed to grow at a rate of as long as it is done for the remaining 5.00% over the base guaranteed rate 5. annually for the first 10 years. Can receive monthly, quarterly, semi-annual or annual GLWB payments. When you first elect GLWB payments, your annual payments will be based on your current Income Account Value multiplied by a percentage based on your age. Payments can be started and stopped at any time. If a RMD is required, you will be allowed to take the greater of the GLWB payment or the RMD.

8/1/2013

SPDA

5 years 10, 9, 8, 7, 6

Full account value at death

Charge-back will be in effect for death in the first year adjusted semiannually 100% months 1-6 & 50% 7-12.

Principal Financial

8/15/2013

60 days from date application signed

SPDA

Principal Guaranteed Fixed Annuity

4.10% to 80 2.75% 81-85 1.45% 86-90

1-year rate: 1.30% (1.00% min.) 3-year rate: 1.30% for 3 years (1.00% min years 4-5) 5-year rate: 1.30% for 5 years 4 years: 1.15% for 4 years plus .25% premium credit for $100,000+ 6 years: 1.45% for 6 years plus 2.00% premium credit for $100,000+ 4-year term: $100,000+ only: 0.25% 6-year term: $50,000-$99,000: 1.00% $100,000 + 2.00% None

1-Year: 1.30% 3-years: 1.30% 5-years: 1.30% 4-year term: $100,000+: 1.15% >$100,000: 1.21% 6-year term: >$50,000: 1.45% $50,000-$99,000: 1.62% $100,000 + 1.78% 3 years: 0.90% for $100K; .75% for $50k - $99,999; 4 years: 1.78% premium credit for $100K; 1.65% premium credit for $50k $99,999 1.52% <$50,000 0-90 6 years: 2.29%$100K; 2.07% for $50k $99,999; 1.80% <$50,000 0-90 1.00% No 0-85 in OK

$5,000 $2,000 minimum additional premiums in first year only $1,000,000 maximum Terminal Illness Disability Nursing Home Full accumulation value to age 85 at issue at death. GUARANTEED RETURN OF PREMIUM 100% chargeback in first year for Annuitize at any time without surrender surrenders or Annuitization in first charges year. Prorated chargeback if annuitized in first year and premium Premium credit is lost if annuitized in credit option is chosen at issue. first 3 year. No chargeback at death.

10% each year beginning in the first year

5 years 7,7,7,6,5

Principal Financial

8/15/2013

60 days from date application signed

Principal Secure Fixed Annuity FPDA Guaranteed return of principal

0-90

$5,000 $2,000 minimum additional contributions in first year only $1M maximum

15% of the contract year's beginning account value, plus 15% of any additional premium payments made during the contract year, or the RMD

4 years: 7,6,6,5 6-year: 7,6,6,5,5,4 No forced renewal. One time renewal after initial guarantee period. Full account value at death Terminal Illness Disability (under age 65) Confinement (6-consecutive days)

3 years: 1.05% for $100K; .90% for $50k - $99,999 4 years: 1.40% 60 days from date application signed Principal Select Fixed Annuity FPDA Guaranteed return of principal 6 years: 1.95% $100K; 1.90% $50k - $99,999; 1.80% <$50,000 9 years: 1.70% $100K+; 1.55% for <$100,000K

3 years: None 4-year term: 1.50% $100K; 1.00% $50k - $99,999; 0.50% <$50,000 6-year term: 2.00% $100K 1.00% $50k - $99,999 9 years: None

Principal Financial

8/15/2013

$5,000 $2,000 minimum additional contributions in first year only $1M maximum

15% of the contract year's beginning account value, plus 15% of any additional premium payments made during the contract year, or the RMD

4 years: 7,6,6,5 6-year: 7,6,6,5,5,4 No forced renewal. One time renewal after initial guarantee period. Full account value at death Terminal Illness Disability (under age 65) Confinement (6-consecutive days)

9 years: 1.70% $100K+; 1.55% <$100,000K

3.25% to 75 2.60% 76-80 1.95% 81-85 Upon issue, commissions will be paid on first $300,000 of premium until after the free look period is up, **Product not available in AL, MD, then rest of commissions will be paid. Renewal MT, ND, NY, OK, OR, Commission will be SC, TX, UT, or WA payable upon the election of a new guarantee period if the agents appointment is still active. Eleos MVA Penalties are waived at death of owner if the Nursing Home owner and annuitant are Hospitalization the same person. Allows withdrawals up to 25% of the Waived for 90 consecutive days of Hospital/Nursing If the owner is not the value penalty free each year. home confinement after 1st year, up to 25% each annuitant, the surrender Available ONLY to annuitants age 74 or year. value is paid on death of younger at issue. the owner. 5 years 8,7,6,5,4

Reliance Standard

6/25/2013

45 days from date application received

SPDA

3.30% first year 2.30% base rate

None

Depends on renewal rate

$10,000 1.00% Yes 0-85 $500k Max.

10% per year including first year, available 30 days after policy issue

Annuitize at the end of the fifth contract year or any time after the Surrender Charge Period and choose an income option with a payout period of 10+ years.

100% first 6 months 50% months 7-12

Last updated 8/30/2013

www.Adams-Moore.com

For agent use only. Not all annuities approved in all states. Not responsible for errors.

Call us toll free at (877) 888-0858 Local (704) 227-0786

Full Details for Fixed and Multi-Year Guaranteed Annuities

1st year Company Effective Date Rate Lock SPDA/ FPDA Product Commission Current Rate premium/ interest rate bonus

Average Annual Yield

Min Guar Rate MVA

Issue Ages

Min/Max Premium

Liquidity

Surrender Charges

Death Benefit

Waivers

Annuitization Options

Commission Chargeback Rules

3.25% to 75 2.60% 76-80 1.95% 81-85 Upon issue, commissions will be paid on first $300,000 of premium until after the free look period is up, then rest of commissions will be paid. Renewal Commission will be payable upon the election of a new guarantee period if the agents appointment is still active. Penalties are waived at death of owner if the Nursing Home owner and annuitant are Hospitalization the same person. Allows withdrawals up to 25% of the Waived for 90 consecutive days of Hospital/Nursing If the owner is not the value penalty free each year. home confinement after 1st year, up to 25% each annuitant, the surrender Available ONLY to annuitants age 74 or year. value is paid on death of younger at issue. the owner. 5 years 8,7,6,5,4

Reliance Standard

6/25/2013

45 days from date application received

Eleos-SP SPDA SPDA **Product not available in AL, MT, MO, NY, UT,

3.15% first year 2.15% base rate

None

Depends on renewal rate

$10,000 1.00% No 0-85 $500k Max.

10% per year including first year, available 30 days after policy issue

Annuitize at the end of the fifth contract year or any time after the Surrender Charge Period and choose an income option with a payout period of 10+ years.

100% first 6 months 50% months 7-12

5.25% to 75 4.20% 76-80 3.15% 81-85 Upon issue, commissions will be paid on first $200,000 of premium until after the free look period is up, then rest of commissions will be paid. Renewal Commission will be payable upon the election of a new guarantee period if the agents appointment is still active. 10% per year including first year, available 30 days after policy issue *Cumulative interest available beginning in year 3 up to 30% of single premium 7 years 9,8,7,6,5,4,2 Penalties are waived at death of owner as long as Nursing Home the owner and annuitant Hospitalization are the same person. Allows withdrawals up to 25% of the value penalty free each year. If the owner is not the Available ONLY to annuitants age 74 or annuitant, the surrender younger at issue. value is paid on death of the owner.

Reliance Standard

6/25/2013

45 days from date application received

SPDA

Apollo-MVA

3.10% first year 2.10% base rate

None

Depends on renewal rate

$5,000 1.00% Yes 0-85 $500k Max

Annuitize at the end of the fifth contract year or any time after the Surrender Charge Period and choose an income option with a payout period of 10+ years.

100% first 6 months 50% months 7-12

5.25% to 75 4.20% 76-80 3.15% 81-85 Upon issue, commissions will be paid on first $200,000 of premium until after the free look period is up, then rest of commissions will be paid. Renewal Commission will be payable upon the election of a new guarantee period if the agents appointment is still active. 10% per year including first year, available 30 days after policy issue *Cumulative interest available beginning in year 3 up to 30% of single premium Penalties are waived at Nursing Home death of owner as long as the owner and annuitant Hospitalization are the same person. Annuitize at the end of the fifth contract year or any time after the Surrender 100% first Charge Period and choose an income 6 months option with a payout period of six or Allows withdrawals up to 25% of the more years. If the owner is not the 50% months value penalty free each year. annuitant, the surrender 7-12 Available ONLY to annuitants age 74 or Life, Life with pmts certain, Designated value is paid on death of younger at issue. Period, or Joint and Last Survivor the owner.

Reliance Standard

6/25/2013

45 days from date application received

SPDA

Apollo-SP

2.95% first year 1.95% base rate

None

Depends on renewal rate

$5,000 1.00% No 0-85 $500k Max

7 years 9,8,7,6,5,4,2 Apollo surrender charge reduced for ages 60+(8,7,6.5,5.5,4.5,3.5,2.0)

Reliance Standard Notes: Contract Owner must also be the annuitant for all annuity applications except in situations where the Contract Owner is a Trust, Corporation or other Non-Natural entity. In addition, Joint Owners must also be designated as Joint Annuitants.

Confinement Waiver: 90 day confinement; All fund penalty-free (no age restriction) Beginning in year one 10% per year. 60 days from date application received Monthly Systematic Interest available when application taken (additional form required). If not selected initially, must wait till first anniversary. Terminal Illness: 6 months or less to live as defined by a physician 6 years 7,7,7,6,5,3 Full account value at death Can annuitize after the first contract year with no penalty if a period of at least 5 years is chosen. Chargeback on Non-accidental deaths 100% first 6 months 50% months 7-12 No Chargeback on accidental deaths

Sagicor Life

5/1/2013

SPDA

Gold Series Sage Choice

3.00% to 80 1.00% 81-90

2.50% first year

None

N/A

2% years 2-10 3% year 11+

Yes

0-90 NQ or Q

$2,000 NQ or Q

Bail Out Provision After the first policy year if the renewal rate is lower than a rate that is 1% below the initial fixed interest rate, the owner may request, within 30 days of notification, to receive the accumulation value without incurring a surrender charge.

5 Year: 2.85% 5-year & 7-year terms 2.25% to 80 1.50% 81-90 SPDA Personal Choice 10-year terms 2.75% to 80 2.00% 81-90 7 Year: 3.20% 10 Year: 3.45% See Waivers Column (right) for rate reductions related to liquidity options None 2.85% for 5 years 3.20% for 7 years 3.45% for 10 years 1.00% Yes 0-90 $2,500 minimum $1,000,000 maximum Liquidity riders are optional. See Waivers Column (right)

Sentinel Security Life

5/22/2013

45 days from date application received

These riders, which must be added at issue*, eliminate surrender charges and Full account value costs MVA. A rate reduction applies, as 10 years 0.35%. Full account stipulated below: 9,8,7,6,5,5,5,5,5,5 value without fee on ages (5% surrender charge at renewal until attained age 86-90. (Death of owner Preferred 10%: 0.08% 94.) or annuitant) Terminal Illness/Nursing Home: 0.15% 72(t): 0.05% No penalties or MVA 30 days prior to the end of If selected full account Death Benefit: 0.35% any guarantee period Can annuitize after the first contract value at death of Cumulative Interest: 0.08% year with no penalty if a period of at annuitant or owner, the RMD - 0.16% Renewal surrender charges: least 5 years is chosen. Death Benefit will be Attained age 90-93: 5% equal to the total contract (*May be added at issue or at the Age 94 - 4% value. beginning of a subsequent guarantee Age 95 - 3% period.) Age 96 - 2% Any Surrender Charges Age 97 - 1% and MVA will be waived. All clients ages 86-90 MUST Ages 98-99 - 0% purchase death benefit rider except in the state of FL.

100% first 6 months 50% months 7-12 No Chargeback at death.

Last updated 8/30/2013

www.Adams-Moore.com

For agent use only. Not all annuities approved in all states. Not responsible for errors.

Call us toll free at (877) 888-0858 Local (704) 227-0786

Full Details for Fixed and Multi-Year Guaranteed Annuities

1st year Company Effective Date Rate Lock SPDA/ FPDA Product Commission Current Rate premium/ interest rate bonus 1-year rate guarantee with premium bonus option: 1.50% NQ 1.75% Q 1-year rate guarantee with interest rate bonus option: Western National Life 8/19/2013 90 days from date application signed SPDA Western National 5 2.00% to 85 1.00% 86-90 2.50% NQ 2.75% Q 3-year rate guarantee 1.85% NQ or Q 0.35% interest rate bonus for 3 years

Average Annual Yield

Min Guar Rate MVA

Issue Ages

Min/Max Premium

Liquidity

Surrender Charges

Death Benefit

Waivers

Annuitization Options

Commission Chargeback Rules

1.00%

Depends on renewal rate in years 2-5

1% 1.00% Depends on renewal rate in years 2-5 Guaranteed Return of Principal is optional at pointof-sale 0-90 NQ 0-70 Q

No

Depends on renewal rate in years 4 & 5

After 30 days accumulated interest or $5,000 NQ Up to 15% of the previous $2,000 Q 5 years anniversary annuity value $2,000 additional 9,8,7,6,5 premium minimum If you do not use all of the Deposit Surrender Charges - Each deposit incurs a 15% free withdrawal in a $1,500,000 new surrender charge period. policy year, you may carry maximum over the unused portion to the next policy year up to a maximum of 20%.

Extended Care Full Account Value at death Terminal Illness Activities of Daily Living

Chargeback for surrenders for any reason. Annuitization available without penalty 100% after 3 years using full account value if months 1-12 annuitized for at least 5 years. 50% months 13-24

5-year rate guarantee 1.55% NQ or Q 1-year rate guarantee with premium bonus option: 1.95% NQ, Q 2.10% 1-year rate guarantee with interest rate bonus option: 2.95%NQ or 3.10% Q Western National Life 90 days from date application signed

None

1.00%

1.00%

Depends on renewal rate in years 2-7

1.00%

Depends on renewal rate in years 2-7 1% Guaranteed Return of Principal is optional at pointof-sale 0-90 NQ 0-70 Q

8/19/2013

SPDA

Western National 7

3.00% to 85 1.50% 86-90

3-year rate guarantee 2.50%

0.70% interest rate bonus for 3 years

No

N/A

After 30 days accumulated interest or $5,000 NQ Up to 15% of the previous $2,000 Q 7 years anniversary annuity value $2,000 additional 9,8,7,6,5,4,2 premium minimum If you do not use all of the Deposit Surrender Charges - Each deposit incurs a 15% free withdrawal in a $1,500,000 new surrender charge period. policy year, you may carry maximum over the unused portion to the next policy year up to a maximum of 20%.

Extended Care Terminal Illness Full Account Value at death Activities of Daily Living GUARANTEED RETURN OF PREMIUM

Chargeback for surrenders for any reason. Annuitization available without penalty 100% after 3 years using full account value if months 1-12 annuitized for at least 5 years. 50% months 13-24

5 year rate None 2.15% 7 year rate None 2.15%

Depends on renewal rate in years 6 & 7

N/A