Professional Documents

Culture Documents

Maravedis Backhaul Report Brochure Sep2010

Uploaded by

omsfadhlOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Maravedis Backhaul Report Brochure Sep2010

Uploaded by

omsfadhlCopyright:

Available Formats

0'?.

'@A'%$

Wireless Backhaul Market from an All-IP

Perspective#

!"#$%&'()*#+,*&-.-%#

)*/#&0'#+).)1'/2%#3')4#

!"#$%&'$(')$*'+,--'.)/$0&1.'$2#"/$3,4.%'5-/$67$89:$";9$7<=<><$

56#

Wireless Backhaul from an All-IP Perspective

September 2010

Table of Contents

List of Figures _________________________________________________ 5

List of Tables__________________________________________________ 7

Questions Answered by This Report ______________________________ 8

1. Executive Summary _________________________________________ 9

2. Key Findings ______________________________________________ 11

3. 4G Backhaul Requirements __________________________________ 14

3.1

A Comprehensive Throughput Analysis for 4G Backhaul____________ 14

3.2

Where in the Aggregation does Microwave Fit? ____________________ 15

3.3

Will X2 Interface be a Headache?________________________________ 16

4. Microwave Regulatory Update________________________________ 17

4.1

Microwave Licensing in USA (FCC) ______________________________ 17

4.2

Microwave Licensing in Europe (ETSI) ___________________________ 19

5. Ethernet Microwave Backhaul Market Update Q2 2010 ___________ 21

5.1

Market Overview _____________________________________________ 21

5.2

Microwave Market Shares ______________________________________ 22

5.3

Microwave Shipments by Frequency Band________________________ 24

5.4

Migration from TDM to Pure Packet Microwave ____________________ 26

5.5

Future Microwave Market Evolution _____________________________ 26

6. Wireless Backhaul Equipment Analysis________________________ 27

6.1

Backhaul Solutions ___________________________________________ 27

6.2

Frequency Support ___________________________________________ 29

6.3

Maximum Throughput _________________________________________ 31

6.4

Pure Packet vs. Hybrid Architecture _____________________________ 33

6.5

Embedded Switching Capacity__________________________________ 34

6.6

Ethernet Demarcation _________________________________________ 35

6.7

Mean Time Between Failures (MTBF) ____________________________ 36

7. Wireless Backhaul Vendor Profiles____________________________ 37

7.1 Alcatel-Lucent _______________________________________________

7.1.1 Vendor Overview ____________________________________________

7.1.2 Financial __________________________________________________

7.1.3 Backhaul Solutions __________________________________________

7.1.4 Product Overview ___________________________________________

7.1.5 SWOT ____________________________________________________

7.1.6 Future ____________________________________________________

37

37

38

38

39

41

42

7.2 Aviat Networks _______________________________________________

7.2.1 Vendor Overview ____________________________________________

7.2.2 Financial __________________________________________________

7.2.3 Backhaul Solutions __________________________________________

42

42

43

44

Maravedis 2010-All Rights Reserved

Wireless Backhaul from an All-IP Perspective

September 2010

7.2.4 Product Overview ___________________________________________ 45

7.2.5 SWOT ____________________________________________________ 49

7.2.6 Future ____________________________________________________ 49

7.3 BridgeWave _________________________________________________

7.3.1 Vendor Overview ____________________________________________

7.3.2 Financial __________________________________________________

7.3.3 Backhaul Solutions __________________________________________

7.3.4 Product Overview ___________________________________________

7.3.5 SWOT ____________________________________________________

7.3.6 Future ____________________________________________________

50

50

50

50

51

53

53

7.4 Ceragon ____________________________________________________

7.4.1 Vendor Overview ____________________________________________

7.4.2 Financial __________________________________________________

7.4.3 Backhaul Solutions __________________________________________

7.4.4 Product Overview ___________________________________________

7.4.5 SWOT ____________________________________________________

7.4.6 Future ____________________________________________________

54

54

54

55

56

59

60

7.5 DragonWave _________________________________________________

7.5.1 Vendor Overview ____________________________________________

7.5.2 Financial __________________________________________________

7.5.3 Backhaul Solutions __________________________________________

7.5.4 Product Overview ___________________________________________

7.5.5 SWOT ____________________________________________________

7.5.6 Future ____________________________________________________

60

60

61

62

63

65

65

7.6 Ericsson ____________________________________________________

7.6.1 Vendor Overview ____________________________________________

7.6.2 Financial __________________________________________________

7.6.3 Backhaul Solutions __________________________________________

7.6.4 Product Overview ___________________________________________

7.6.5 SWOT ____________________________________________________

7.6.6 Future ____________________________________________________

66

66

66

67

68

71

71

7.7 Exalt _______________________________________________________

7.7.1 Vendor Overview ____________________________________________

7.7.2 Financial __________________________________________________

7.7.3 Backhaul Solutions __________________________________________

7.7.4 Product Overview ___________________________________________

7.7.5 SWOT ____________________________________________________

7.7.6 Future ____________________________________________________

72

72

72

72

73

76

76

7.8 Huawei _____________________________________________________

7.8.1 Vendor Overview ____________________________________________

7.8.2 Financial __________________________________________________

7.8.3 Backhaul Solutions __________________________________________

7.8.4 Product Overview ___________________________________________

7.8.5 SWOT ____________________________________________________

7.8.6 Future ____________________________________________________

77

77

77

77

78

80

80

7.9 NEC ________________________________________________________

7.9.1 Vendor Overview ____________________________________________

7.9.2 Financial __________________________________________________

7.9.3 Backhaul Solutions __________________________________________

7.9.4 Product Overview ___________________________________________

7.9.5 SWOT ____________________________________________________

7.9.6 Future ____________________________________________________

81

81

81

81

83

86

86

Maravedis 2010-All Rights Reserved

Wireless Backhaul from an All-IP Perspective

September 2010

7.10 Nokia Siemens Networks (NSN) _________________________________

7.10.1 Vendor Overview ___________________________________________

7.10.2 Financial__________________________________________________

7.10.3 Backhaul Solutions__________________________________________

7.10.4 Product Overview ___________________________________________

7.10.5 SWOT ___________________________________________________

7.10.6 Future ____________________________________________________

86

86

87

87

88

92

92

7.11 SkyFiber ____________________________________________________

7.11.1 Vendor Overview ___________________________________________

7.11.2 Financial __________________________________________________

7.11.3 Backhaul Solutions__________________________________________

7.11.4 Product Overview ___________________________________________

7.11.5 SWOT ___________________________________________________

7.11.6 Future ____________________________________________________

93

93

93

93

94

97

98

8. Annex: Table of TDM Capacities ______________________________ 98

9. Acronyms ________________________________________________ 98

10. Bibliography _____________________________________________ 101

Maravedis 2010-All Rights Reserved

Wireless Backhaul from an All-IP Perspective

September 2010

List of Figures

Figure 1 Point-to-point microwave backhaul revenue 2010 ....................................................... 21!

Figure 2 Point-to-point microwave backhaul by region .............................................................. 22!

Figure 3 Microwave backhaul vendor market share Q2 2010.................................................... 23!

Figure 4 Microwave backhaul vendor evolution 2010 ................................................................ 24!

Figure 5 Point-to-point microwave backhaul revenue by frequency band.................................. 25!

Figure 6 TDM vs. hybrid vs. pure-packet operation by revenue................................................. 26!

Figure 7 Point-to-point microwave forecast 2010-2015.............................................................. 27!

Figure 8 Parts of a mobile backhaul network ............................................................................. 28!

Figure 9 The need for a large number of cells ........................................................................... 29!

Figure 10 Frequency band support chart ................................................................................... 30!

Figure 11 Microwave transmission atmospheric absorption ...................................................... 30!

Figure 12 Memorylink Gigahertz performance in interference ................................................... 31!

Figure 13 Ethernet frame terminology........................................................................................ 32!

Figure 14 Comparative maximum throughput chart by model ................................................... 32!

Figure 15 Key Ethernet OAM standards .................................................................................... 35!

Figure 16 Mean time between failures comparison chart........................................................ 37!

Figure 17 9500 MPR IDU (various sizes) and multipurpose ODU (valid for both split mount and

outdoor configurations) ....................................................................................................... 40!

Figure 18 9500 MPR indoor RF unit........................................................................................... 40!

Figure 19 Eclipse packet node, E-LINK 1000EXR and Eclipse EDGE ODU ............................. 45!

Figure 20 Eclipse packet node throughput................................................................................. 46!

Figure 21 Eclipse packet node with IRU600 indoor RF unit on top............................................ 47!

Figure 22 BridgeWave FlexPort outside (with one and two foot antennas) and inside views,

respectively ......................................................................................................................... 51!

Figure 23 BridgeWaves innovative Adaptive Rate and Modulation mechanism ....................... 52!

Figure 24 Left: FibeAir IP-10 IDU and RFU-C; Right: FibeAir 3200T IDU.................................. 57!

Figure 25 Ceragons FibeAir outdoor enclosure......................................................................... 57!

Figure 26 Ceragons RFU-HS and RFU-HP radio units ............................................................. 58!

Figure 27 DragonWaves Horizon Compact (left), Quantum (middle) and two SDU versions

(right)................................................................................................................................... 63!

Figure 28 Mini-link 80 GHz demonstration at MWC 2010 .......................................................... 68!

Figure 29 Mini-link ODUs: short haul (left) and long-haul (right) ................................................ 70!

Figure 30 Ericsson Mini-link TN/LH IDUs: AMM 2p (top left), AMM 6p (bottom left) and AMM

20p (right)............................................................................................................................ 70!

Figure 31 Exalt ExtendAir and ExploreAir (front and back)........................................................ 74!

Maravedis 2010-All Rights Reserved

Wireless Backhaul from an All-IP Perspective

September 2010

Figure 32 Exalt IDUs of EX-s (left) and EX-i (right) .................................................................... 74!

Figure 33 Exalts semi-protected configuration .......................................................................... 75!

Figure 34 Huawei OptiX RTN 605 and RTN 620 IDUs .............................................................. 79!

Figure 35 Huawei SWOT analysis ............................................................................................. 80!

Figure 36 Frequency band-capacity matrix for NECs microwave products............................... 83!

Figure 37 NEC PASOLINK NEO TE .......................................................................................... 84!

Figure 38 NEC PASOLINK NEO IP IDU .................................................................................... 85!

Figure 39 NEC PASOLINK NEO ODUs Type 1 (left) and Type 2 (right) ................................... 85!

Figure 40 NSN FlexiPacket ODU for ETSI market (left) and ANSI market (right)...................... 90!

Figure 41 NSN FlexiPacket FirstMile (top), FlexiHub 1200 (mid) and FlexiHub 2200 (bottom) . 91!

Figure 42 NSN FlexiHybrid IDU ................................................................................................. 91!

Figure 43 SkyLINK OLU (left) and CST (right) ........................................................................... 94!

Figure 44 Electromagnetic spectrum diagram............................................................................ 95!

Figure 45 Example of sway for a 15 m tower ............................................................................. 96!

Figure 46 SkyFiber SWOT analysis ........................................................................................... 97!

Maravedis 2010-All Rights Reserved

Wireless Backhaul from an All-IP Perspective

September 2010

List of Tables

Table 1 IMT-Advanced cell spectral efficiency minimum requirements ..................................... 14!

Table 2 Number of 4G eNodeBs backhauled by a microwave link ............................................ 15!

Table 3 Microwave on-demand licensed frequency bands (ULS licensing)............................... 18!

Table 4 Common microwave frequency bands in ETSI countries.............................................. 20!

Table 5 Regulatory status of 60 GHz and 80 GHz bands in Europe.......................................... 20!

Table 6 point-to-point microwave shipments Q1-Q2 2010 ......................................................... 25!

Table 7 Traditional microwave backhaul classification by capacity............................................ 28!

Table 8 Traditional microwave backhaul classification by link distance ..................................... 29!

Table 9 Hybrid and pure packet support among wireless backhaul vendors ............................. 34!

Table 10 Ethernet OAM support within the microwave market .................................................. 36!

Table 11 Alcatel-Lucent microwave product offering ................................................................. 39!

Table 12 Alcatel-Lucent SWOT analysis.................................................................................... 42!

Table 13 Overview of Aviats microwave products..................................................................... 45!

Table 14 Eclipse packet node IDU options ................................................................................ 48!

Table 15 Aviats microwave products power consumption......................................................... 48!

Table 16 Aviat SWOT analysis................................................................................................... 49!

Table 17 BridgeWave SWOT analysis ....................................................................................... 53!

Table 18 Ceragon microwave product offering .......................................................................... 56!

Table 19 Radio unit options available from Ceragon ................................................................. 58!

Table 20 Ceragon SWOT analysis............................................................................................. 60!

Table 21 DragonWave microwave product offering ................................................................... 62!

Table 22 Ericsson microwave product offering .......................................................................... 67!

Table 23 Exalt licensed microwave product offering .................................................................. 73!

Table 24 Exalt SWOT analysis................................................................................................... 76!

Table 25 Huawei microwave product offering ............................................................................ 78!

Table 26 Huawei Ethernet switching capability comparison ...................................................... 79!

Table 27 NEC SWOT analysis ................................................................................................... 86!

Table 28 NSN microwave product offering................................................................................. 88!

Table 29 NSN SWOT analysis ................................................................................................... 92!

Table 30 Hierarchy of the most common SONET/SDH data rates ............................................ 98!

Maravedis 2010-All Rights Reserved

Wireless Backhaul from an All-IP Perspective

September 2010

Questions Answered by This Report

What frequency bands does each major backhaul vendor support?

What are the drawbacks of unlicensed frequency bands?

What is the maximum microwave throughput achieved for a single channel?

What compression techniques have microwave vendors developed in order to increase

throughput?

How does microwave equipment manage TDM and packet traffic at the same time?

What embedded switching features do microwave vendors implement in their

microwave equipment?

What is MEF and what are its certifications for?

Are mobile operators worried about the migration to IPv6?

What functionality do microwave vendors add to Ethernet in order to add reliability?

What are the most reliable vendors in the wireless backhaul space?

What throughput is required for 4G backhaul purposes?

In which parts of the backhaul network can microwave be deployed?

How much growth did the microwave market experience in 2010?

What are the market shares of the most important microwave vendors ?

Which frequency bands generated the most revenue in Q2 2010?

What will be the size of the microwave market be in 2015?

What are the wireless backhaul equipment offerings of the most important vendors in

the industry?

What are the strengths and weaknesses of each vendors products?

What are the opportunities and threats for the major vendors?

What are these vendors plans going forward?

And much more!

Maravedis 2010-All Rights Reserved

Wireless Backhaul from an All-IP Perspective

September 2010

1. Executive Summary

Global downturn still affecting microwave market

Despite the increasing demand for data services, the global downturn continues to impact

mobile carriers deployment decisions. In the second quarter of 2010, the total size of the pointto-point microwave market was US$1.07 billion. This figure represents a 4.3% decrease with

respect to the previous quarter, when the size of the market reached US$1.12 billion. Latin

America was the only region that saw an increase in microwave shipments in Q2 2010 (15.6%,

to reach US$120.45 million worth in shipments).

Huawei aggressively climbing microwave shipment ranking

During the second quarter of 2010, Huawei experienced a sharp 51.6% growth in microwave

shipments (US$186.85 million in shipments during Q2 2010), which has propelled it to second

place on the podium, just behind market leader Ericsson (US$197.25 million in the same

quarter). Huawei, which introduced its first microwave products in 2007, has overtaken other

vendors who have been in the market for longer, thanks to unique financial support and a

favorable environment in its mother country.

The two traditional market leaders, Ericsson and NEC, experienced considerable decreases in

their shipments (23.7% and 29.1%, respectively) between the first and second quarter of 2010.

The other vendors covered in this analysis did not show much change in shipment levels

between Q1 and Q2, although there was an interesting battle between Alcatel-Lucent

(US$118.80 million) and Nokia Siemens (US$115.91 million), which follow a very similar

strategy with their respective microwave portfolios.

Pure packet microwave is the future

Today the biggest trend is to deploy hybrid systems, since they offer the most secure method of

keeping 2G and 3G networks working by adding packet capacity for 4G services. However,

hybrid microwave system shipments decreased by 1.9% to US$744.75 million in Q2 2010. From

all the vendors covered in this report, only Ericsson and Ceragon have exclusively hybrid

equipment in place to support Ethernet services.

Pure packet, the most advanced microwave backhaul technology to-date, increased its

shipments by 5.6% to US$198.92 million in Q2 2010, although it still has a very small market

share compared to hybrid microwave. Besides 80 GHz solutions in the classical 6 to 38 GHz

range, which are mostly pure packet, only NSN and Alcatel-Lucent are fully committed to pure

packet microwave, offering this equipment for any kind of new deployment. DragonWave and

SkyFiber are the only vendors covered in this report who do not offer hybrid solutions

(exclusively pure packet).

TDM microwave shipments decreased 26.4% in just one quarter, totaling US$126.43 million in

Q2 2010. Given the increased flexibility and cost effectiveness of carrier Ethernet backhaul, this

decrease is reasonable. Vendors are not recommending TDM links for new short haul

deployments; most TDM links are long haul, since there are still microwave vendors offering this

kind of technology for trunk applications.

Encouraging future for microwave

The slowdown experienced by microwave from Q1 to Q2 2010 will not last long, since operators

really need to upgrade their backhaul links in advance to enable higher radio access speeds

that could cause their cellular networks to struggle. The auction of spectrum for 4G networks in

many countries especially in Europe, a microwave-heavy region will urge operators to take

another look at their microwave deployments to see whether they are prepared to handle the

foreseeable data traffic growth. The deployment of 4G networks, especially in urban areas,

should cause the demand for microwave links to increase, although given current uncertainty

we propose a conservative estimate of US$9 billion in revenue by 2015.

Maravedis 2010-All Rights Reserved

Wireless Backhaul from an All-IP Perspective

September 2010

New spectrum for cost-effective backhaul

Besides the traditional 6 to 38 GHz bands (with slight differences depending on whether ANSI

or ETSI spectrum allocation is used), operators are looking for new portions of spectrum to help

them deploy 4G networks. Microwave vendors are responding to these needs by trying to

support a wider range of frequency bands. For instance, Ericsson and NEC have developed

equipment for new adjacent bands to traditional spectrum 42 GHz and 52 GHz, respectively

although without much market demand as of yet.

Larger carriers such as Clearwire USA are adopting millimeter wave (80 GHz) solutions. As a

result, most microwave vendors offer or plan to offer 80 GHz products, be they in-house

developed or supplied under OEM agreements. Of all the microwave vendors covered in this

report, only Ceragon, DragonWave and Exalt are lacking 80 GHz products in their commercial

offerings.

Vendors such as SkyFiber are offering Free Space Optics technology to mobile carriers, who

are trialing it successfully. Sophisticated mechanisms are being devised to solve traditional

problems of FSO such as vibration and sway sensitivity. Of the advantages that FSO represents

compared to other unlicensed wireless solutions, most important is the absence of

radiomagnetic pollution.

The throughput battle

The evolution from TDM to packet microwave is enabling the development of compression

techniques that increase the effective throughput being experienced at the Ethernet port level.

There are three kinds of packet compression techniques employed by microwave vendors:

header compression, inter-frame gap suppression and payload compression.

Although this report recommends 180 Mbps and 135 Mbps as the most suitable backhaul

capacities for downlink and uplink, 1 Gbps is currently the reference point all microwave

vendors are trying to achieve. Millimeter wave equipment, FSO solutions and most traditional

microwave solutions through the combination of XPIC and 56 MHz channels are the alternatives

for reaching this capacity.

Advanced networking capability

Following the trend of technology convergence, microwave vendors are progressively

integrating more advanced networking features. All equipment analyzed in this report exceeds

MEF 22 recommendation of four prioritization levels, with some vendors such as Ericsson,

Huawei, Exalt and BridgeWave offering eight. Surprisingly, none of the vendors covered in this

report have detected any demand for IPv6 support, being reduced to a simple milestone on their

roadmaps.

In addition to MEF certification, microwave equipment needs to offer carriers the possibility to

monitor performance of each the network in order to detect any malfunction. This is why OAM

(operation and maintenance) standards have been developed to incorporate this functionality.

Concretely there are three standards commonly implemented in the industry for Ethernet OAM:

IEEE 802.1ag, Y.1731 and IEEE 802.3ah. SkyFiber, Exalt and Aviat are the only vendors

covered in this report that do not implement any of the OAM protocols available. It is interesting

to see that some rely on companion networking equipment to implement them, such as in the

cases of NSN, Ericsson and NEC.

Maravedis 2010-All Rights Reserved

10

You might also like

- Module 4Document21 pagesModule 4omsfadhlNo ratings yet

- Strategic Management Lesson 10Document3 pagesStrategic Management Lesson 10omsfadhlNo ratings yet

- History: Public PolicyDocument7 pagesHistory: Public PolicyomsfadhlNo ratings yet

- 118145717744Document20 pages118145717744omsfadhl100% (1)

- Strategic Management - Pre TestDocument1 pageStrategic Management - Pre Testomsfadhl100% (1)

- Module 10 ExercisesDocument5 pagesModule 10 Exercisesomsfadhl50% (2)

- Illustration 7.3 Answer Q2Document1 pageIllustration 7.3 Answer Q2omsfadhlNo ratings yet

- The Analytic Hierarchy Process (AHP) : (Caput Report)Document6 pagesThe Analytic Hierarchy Process (AHP) : (Caput Report)omsfadhlNo ratings yet

- MODULE 6 ExerciseDocument2 pagesMODULE 6 ExerciseomsfadhlNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Resume Kantesh MundaragiDocument3 pagesResume Kantesh MundaragiKanteshNo ratings yet

- Comics Trip MasterpiecesDocument16 pagesComics Trip MasterpiecesDaniel Constantine100% (2)

- Ermita Malate Hotel Motel Operators V City Mayor DigestDocument1 pageErmita Malate Hotel Motel Operators V City Mayor Digestpnp bantay100% (2)

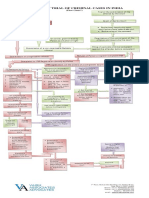

- Process of Trial of Criminal Cases in India (Flow Chart)Document1 pageProcess of Trial of Criminal Cases in India (Flow Chart)Arun Hiro100% (1)

- Solution ManualDocument40 pagesSolution Manualkhaled_behery9934100% (1)

- Rhetorical Analysis EssayDocument8 pagesRhetorical Analysis Essayapi-308821140No ratings yet

- Guide Item Dota 2Document11 pagesGuide Item Dota 2YogaWijayaNo ratings yet

- Tolkien Essay-TreesDocument10 pagesTolkien Essay-Treesapi-657753727No ratings yet

- BBC Focus - Answers To Lifes Big Questions 2017Document100 pagesBBC Focus - Answers To Lifes Big Questions 2017AD StrategoNo ratings yet

- Swift Case Study Mapping A Path To Iso 20022 With Swift Translator Jan2022Document3 pagesSwift Case Study Mapping A Path To Iso 20022 With Swift Translator Jan2022Bolaji EsanNo ratings yet

- ARCODE UCM Test Instructions V13.EnDocument4 pagesARCODE UCM Test Instructions V13.EnHenri KleineNo ratings yet

- Assignment 1684490923Document16 pagesAssignment 1684490923neha.engg45755No ratings yet

- John Lear UFO Coverup RevelationsDocument30 pagesJohn Lear UFO Coverup RevelationscorneliusgummerichNo ratings yet

- At The End of The Lesson, The Students Will Be Able To Apply The Indefinite Articles in The Given SentencesDocument11 pagesAt The End of The Lesson, The Students Will Be Able To Apply The Indefinite Articles in The Given SentencesRhielle Dimaculangan CabañezNo ratings yet

- SHARE SEA Outlook Book 2518 r120719 2Document218 pagesSHARE SEA Outlook Book 2518 r120719 2Raafi SeiffNo ratings yet

- A Comparative Study of Intelligence in Children of Consanguineous and Non-Consanguineous Marriages and Its Relationship With Holland's Personality Types in High School Students of TehranDocument8 pagesA Comparative Study of Intelligence in Children of Consanguineous and Non-Consanguineous Marriages and Its Relationship With Holland's Personality Types in High School Students of TehranInternational Medical PublisherNo ratings yet

- Docu69346 Unity Hybrid and Unity All Flash Configuring Converged Network Adaptor PortsDocument11 pagesDocu69346 Unity Hybrid and Unity All Flash Configuring Converged Network Adaptor PortsAmir Majzoub GhadiriNo ratings yet

- Case Study 1 - Whirlpool Reverser Logistics - With New Rubric - Winter 2022Document4 pagesCase Study 1 - Whirlpool Reverser Logistics - With New Rubric - Winter 2022ShravanNo ratings yet

- Way of St. LouiseDocument18 pagesWay of St. LouiseMaryann GuevaradcNo ratings yet

- Appraisal: Gilmore and Williams: Human Resource ManagementDocument18 pagesAppraisal: Gilmore and Williams: Human Resource ManagementShilpa GoreNo ratings yet

- Christian Borch & Gernot Bohme & Olafur Eliasson & Juhani Pallasmaa - Architectural Atmospheres-BirkhauserDocument112 pagesChristian Borch & Gernot Bohme & Olafur Eliasson & Juhani Pallasmaa - Architectural Atmospheres-BirkhauserAja100% (1)

- ShowBoats International (May 2016)Document186 pagesShowBoats International (May 2016)LelosPinelos123100% (1)

- Chen, Y.-K., Shen, C.-H., Kao, L., & Yeh, C. Y. (2018) .Document40 pagesChen, Y.-K., Shen, C.-H., Kao, L., & Yeh, C. Y. (2018) .Vita NataliaNo ratings yet

- Mushaf Qiraat Asim - (Syukbah)Document604 pagesMushaf Qiraat Asim - (Syukbah)amnrs88100% (1)

- Jurnal Inggris CyberDocument7 pagesJurnal Inggris Cybertamara amandaNo ratings yet

- Reflections: The Sol JournalDocument13 pagesReflections: The Sol Journalapi-268650070No ratings yet

- Nclex PogiDocument8 pagesNclex Pogijackyd5No ratings yet

- Articles of IncorporationDocument2 pagesArticles of IncorporationLegal Forms100% (1)

- Features of Contingency Approach To ManagementDocument9 pagesFeatures of Contingency Approach To ManagementSharon AmondiNo ratings yet

- Commercial Dispatch Eedition 6-13-19Document12 pagesCommercial Dispatch Eedition 6-13-19The Dispatch100% (1)