Professional Documents

Culture Documents

Case Study

Uploaded by

chandu1113Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case Study

Uploaded by

chandu1113Copyright:

Available Formats

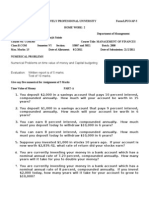

Case Study-1 The cost of capital and rate of return on investment of netree ltd is 10% and 15% respectively

the company has 10lakh equity shares of rs 10 each outstanding and its EPS is Rs.5 Calculate the value of the firm in the following situation using the walters dividend model. a) 100% retention ratio b) 50% retention ratio c) No retention. Comment on your results. P= D+(E-D)r/k K Where P is the price per equity share D is the above dividendn per share E is the earnings per share (E-D) is the retained earnings per share r is the rate of return on investements k is the cost equity

Case study-2 Urmila ltd and Lara ltd are identical in every respect except that the former does not have debt in this capital structure while later employs rs 600000 of 15% debt .the ebit for both the firms are 200000 equity capitalization rate for unleveled company is 20%compute the value of the firms using NOI and NI approach .if your holding 10% shares of levered company show that how will you gain by arbitrage process According to NI approach: Urmila Ltd (Unlevered) EBIT Less Interest Earnings for Equity Holders Equity Capitalization Market Value of Equity (E) Market Value of Debt (D) 200000 200000 .20 1000000 0 Lara Ltd (Levered) 200000 90000 110000 ---110000 600000

Total Value of Firm (E+D) Valuation using NOI approach: Value of Urmila ltd =

Rs 1000000

Rs 710000

200000 / .20 = Rs 1000000

Value of Lara Ltd = Rs 200000 + Rs 600000 = Rs 800000

Case study-3 Tia Ltd is considering to produce high quality fountain pen .the necessary equipment to manufacture the fountain pen would cost rs 200000 and would last 5 year .the expected salvage value will be 20000.depriciation will be as per the straight line method.the fountain pen can be sold at rs 10 each regardless of the level of production ,the manufacturer will incur cash cost of rs 25000 each year .the variable costs are estimated at rs 5 per pen The M.D of tia ltd ray,estimates to sell about 70000 fountain pens per year .the tax rate is 30% assume 20% cost of capital and rs 50000 additional working capital requirement .should the proposal be accepted ? give your advice to Miss tia ray Fixed cost: (5 years) Equipment: Rs 200000 Maintenance: Rs 125000 Working capital = Rs 50000 Variable cost: Rs 5 * 70000 * 5 years = Rs 1750000 Cost of capital = Rs 250000 * .20 * 5 years = Rs 250000 Total Cost = Rs 2325000 Revenue = Rs 10 * 70000 * 5 years = Rs 3500000 Profit before tax = Rs 3500000 Rs 2325000 = Rs 1175000

Tax rate = 30% Profit after tax = Rs 1175000 * (1-.30) = Rs 822500 Advice to Miss Tia Ray is to go ahead with the proposal. Case study 4 As an investment advisor you have been approached by a client called vikas for your advice on investment plan .he is currently 40 years old and has rs 600000 in the bank .he plans to work for 20years more and retire at age of 60.his present salary is rs.500000 per year. he expects his salary to increase at the rate of 12 percent per year until his retirement. vikas has decided to invest his bank balance and future savings in a balance mutual fund scheme that he believes will provide a return of 9 percent per year. you agree with his assessment .vikas seeks your help in answering several question below .in answering these question ignore the tax factor. 1) once he retires at the age of 60,he would like to withdraw rs 800000 per year for his consumption needs from his investments for the following 15 years .(he expects to live up to the age of 75 years) each annual with drawl will be made at the beginning of the year. how much should be the value of his investments when vikas turns 6o to meets this requirement need? 2) How much should vikas save each year for the next 20 years to be able to withdraws rs 800000 per year from the beginning of the 21 st year ? assume that the savings will occur at the end of each year. 3) Suppose vikas wants to donate rs 500000 per year in the last 5 years of his life to a charitable cause .each donation would be made at the beginning of the year. further he wants to bequeath rs 1000000 to his son at the end of life. how much should he have in his investment account when he reaches the age of 60 to meet this need for donation and bequeathing

You might also like

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- How to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysFrom EverandHow to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysNo ratings yet

- Time Value and Capital BudgetingDocument9 pagesTime Value and Capital BudgetingaskdgasNo ratings yet

- Time Value of Money Problems SolvedDocument13 pagesTime Value of Money Problems SolvedGajendra Singh Raghav50% (2)

- Economic NumericalDocument26 pagesEconomic NumericalSantosh ThapaNo ratings yet

- Question Sheet: (Net Profit Before Depreciation and After Tax)Document11 pagesQuestion Sheet: (Net Profit Before Depreciation and After Tax)Vinay SemwalNo ratings yet

- Group Assignment Fm2 A112Document15 pagesGroup Assignment Fm2 A112Ho-Ly Victor67% (3)

- FM Questions MSDocument7 pagesFM Questions MSUdayan KarnatakNo ratings yet

- CFP TAXDocument15 pagesCFP TAXAmeyaNo ratings yet

- Time Value of Money SumsDocument13 pagesTime Value of Money SumsrahulNo ratings yet

- Homework QuestionsDocument6 pagesHomework Questionsgaurav shetty100% (1)

- Answers of The ProblemDocument11 pagesAnswers of The ProblemRavi KantNo ratings yet

- NIT Tiruchirappalli Financial Management ExamDocument2 pagesNIT Tiruchirappalli Financial Management ExamDavidNo ratings yet

- FM I AssignmentDocument3 pagesFM I AssignmentApeksha S KanthNo ratings yet

- Unit - I: Section - ADocument22 pagesUnit - I: Section - AskirubaarunNo ratings yet

- Tutorial - I For FM-I: Effective Interest Rate (EIR)Document3 pagesTutorial - I For FM-I: Effective Interest Rate (EIR)Sriram VenkatakrishnanNo ratings yet

- Mid TermAnswersDocument9 pagesMid TermAnswersMoulee DattaNo ratings yet

- Corporate Valuation NumericalsDocument47 pagesCorporate Valuation Numericalspasler9929No ratings yet

- Chapter 1 - Updated-1 PDFDocument29 pagesChapter 1 - Updated-1 PDFj000diNo ratings yet

- Time Value Money Calculations University NairobiDocument2 pagesTime Value Money Calculations University NairobiDavidNo ratings yet

- Documents - MX - FM Questions MsDocument7 pagesDocuments - MX - FM Questions MsgopalNo ratings yet

- How to Calculate Present Values of Fixed Income SecuritiesDocument52 pagesHow to Calculate Present Values of Fixed Income Securitiesmohitaggarwal123No ratings yet

- CALCULATE STOCK INDEXES, INTEREST RATES AND PRESENT VALUESDocument4 pagesCALCULATE STOCK INDEXES, INTEREST RATES AND PRESENT VALUESMithun SagarNo ratings yet

- Au Mod - 1Document8 pagesAu Mod - 1Keyur PopatNo ratings yet

- Bai Tap Ham Tai ChinhDocument4 pagesBai Tap Ham Tai ChinhLoi NguyenNo ratings yet

- Review For ISE2040 Final ExamDocument4 pagesReview For ISE2040 Final ExamRyan SNo ratings yet

- Cost of CapitalsDocument11 pagesCost of Capitals29_ramesh170No ratings yet

- TVM QuestionsDocument4 pagesTVM QuestionsSultan AwateNo ratings yet

- Unit 3: Cost of Capital Cost of DebtDocument11 pagesUnit 3: Cost of Capital Cost of DebtTaransh A100% (1)

- Practice QuestionsDocument4 pagesPractice QuestionsDimple PandeyNo ratings yet

- Module I: Introduction To Financial ManagementDocument10 pagesModule I: Introduction To Financial ManagementPruthvi BalekundriNo ratings yet

- Simple Interest (Average Return) Total Marks 15Document6 pagesSimple Interest (Average Return) Total Marks 15hassaan azharNo ratings yet

- FM QB New NewDocument22 pagesFM QB New NewskirubaarunNo ratings yet

- PES Institute of Technology MBA Financial Management 5 Marks QuestionsDocument2 pagesPES Institute of Technology MBA Financial Management 5 Marks QuestionsrohitcshettyNo ratings yet

- Cost of CapitalDocument166 pagesCost of Capitalmruga_12350% (2)

- Engineering Economic ExercisesDocument5 pagesEngineering Economic ExercisesAuliaMukadisNo ratings yet

- TVMDocument3 pagesTVMswapnil6121986No ratings yet

- CV Session 6 & 7 - NumericalsDocument3 pagesCV Session 6 & 7 - NumericalsSomnath KhandagaleNo ratings yet

- FM Practical QuestionsDocument6 pagesFM Practical QuestionsLakshayNo ratings yet

- Summer Holiday Homework Grade Xii CommerceDocument10 pagesSummer Holiday Homework Grade Xii CommerceJéévâNo ratings yet

- Tutorial 40 Sem 2 20212022Document6 pagesTutorial 40 Sem 2 20212022Nishanthini 2998No ratings yet

- Capital Budgeting Exercise1Document14 pagesCapital Budgeting Exercise1Bigbi Kumar100% (1)

- FINC1302 - Exer&Asgnt - Revised 5 Feb 2020Document24 pagesFINC1302 - Exer&Asgnt - Revised 5 Feb 2020faqehaNo ratings yet

- Class Asignment 1Document1 pageClass Asignment 1Anchal ChhabraNo ratings yet

- Capital Budgeting Exercise1Document14 pagesCapital Budgeting Exercise1rohini jha0% (1)

- Cash Flow and Equivalence PDFDocument6 pagesCash Flow and Equivalence PDFIscandar Pacasum DisamburunNo ratings yet

- HW 2Document3 pagesHW 2Love MittalNo ratings yet

- IBS Session 1 With SolutionDocument16 pagesIBS Session 1 With SolutionMOHD SHARIQUE ZAMANo ratings yet

- Sums Time ValueDocument2 pagesSums Time ValueMavani snehaNo ratings yet

- Time Value of Money Class ExerciseseDocument2 pagesTime Value of Money Class ExerciseseRohan JangidNo ratings yet

- Financial Management Dividend ModelsDocument10 pagesFinancial Management Dividend ModelsSavya Sachi50% (2)

- Engineering Economics ProblemsDocument9 pagesEngineering Economics Problemsjac bnvstaNo ratings yet

- Tutorial 3 For FM-IDocument5 pagesTutorial 3 For FM-IarishthegreatNo ratings yet

- ImranOmer - 37 - 15663 - 4 - Time Value Money Practice Questions (Revised)Document3 pagesImranOmer - 37 - 15663 - 4 - Time Value Money Practice Questions (Revised)EmaanNo ratings yet

- Time Value of Money ProblemsDocument2 pagesTime Value of Money ProblemsdaveferalNo ratings yet

- Capital Budgeting: From The Desk of Baber SaleemDocument41 pagesCapital Budgeting: From The Desk of Baber SaleemFarhan QureshiNo ratings yet

- Should Municipal Bonds be a Tool in Your Retirement Planning Toolbox?From EverandShould Municipal Bonds be a Tool in Your Retirement Planning Toolbox?No ratings yet

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- A Haven on Earth: Singapore Economy Without Duties and TaxesFrom EverandA Haven on Earth: Singapore Economy Without Duties and TaxesNo ratings yet

- Assignment 2Document8 pagesAssignment 2chandu1113100% (2)

- AllShare Guide EngDocument46 pagesAllShare Guide EngmanueljgilNo ratings yet

- India Pulses Report January 2012Document64 pagesIndia Pulses Report January 2012chandu1113No ratings yet

- Assignment Cost AccountingDocument3 pagesAssignment Cost Accountingchandu1113No ratings yet

- PESTEL Analysis of Croatia and Qatar's TourismDocument15 pagesPESTEL Analysis of Croatia and Qatar's TourismHassan AnwaarNo ratings yet

- Solution Manual For Investment Analysis and Portfolio Management 10th Edition by ReillyDocument6 pagesSolution Manual For Investment Analysis and Portfolio Management 10th Edition by Reillyburholibanumt4ahh9No ratings yet

- Foundation Economics.Document13 pagesFoundation Economics.Yaswanth Kumar Kollipara100% (1)

- Vocabulary Unit11-Unit16Document4 pagesVocabulary Unit11-Unit16Anna EgriNo ratings yet

- FinanceDocument14 pagesFinancePhaniraj LenkalapallyNo ratings yet

- Chap 11Document10 pagesChap 11muneeb100% (1)

- Marketing Plan MR Bean SingaporeDocument19 pagesMarketing Plan MR Bean SingaporejennifersmithsahNo ratings yet

- Rules of TradingDocument6 pagesRules of TradingEx TradersNo ratings yet

- Perfromance Task 2nd Quarter UcspDocument18 pagesPerfromance Task 2nd Quarter Ucsppalmajulius365No ratings yet

- Background & Theory of Relationship Marketing: Compiled by DR Rosaline FernandezDocument26 pagesBackground & Theory of Relationship Marketing: Compiled by DR Rosaline FernandezOmar SanadNo ratings yet

- Branding Proposal SummaryDocument3 pagesBranding Proposal SummaryAna Ckala33% (3)

- Quantopian Risk Model: Is The Return On TimeDocument16 pagesQuantopian Risk Model: Is The Return On Timezhouh1998No ratings yet

- Michael Mauboussin - Great Migration:: Public To Private EquityDocument24 pagesMichael Mauboussin - Great Migration:: Public To Private EquityAbcd123411No ratings yet

- Production & Operation Management: Assignment# 02Document6 pagesProduction & Operation Management: Assignment# 02herrajohnNo ratings yet

- Transaction Confirmation: 9th Floor 107 Cheapside London UK EC2V 6DNDocument2 pagesTransaction Confirmation: 9th Floor 107 Cheapside London UK EC2V 6DNSartaj SinghNo ratings yet

- Influencing currencies and the reciprocity principleDocument2 pagesInfluencing currencies and the reciprocity principleMostafaAhmedNo ratings yet

- Pestel and PorterDocument4 pagesPestel and PorterJonarissa BeltranNo ratings yet

- Amazon Business Model and Supply Chain AnalysisDocument12 pagesAmazon Business Model and Supply Chain AnalysisRahul Rajendra Kumar BanyalNo ratings yet

- Chips & Chicken GuideDocument28 pagesChips & Chicken GuideMatata MuthokaNo ratings yet

- PT Mulia Maju Sejahtera Bali: Shipping Address Invoice AddressDocument2 pagesPT Mulia Maju Sejahtera Bali: Shipping Address Invoice Addressidabagus julioswastikaNo ratings yet

- AsdfasdfasdfDocument2 pagesAsdfasdfasdfWaseem AfzalNo ratings yet

- Project-Baumol Sales Revenue Maximization ModelDocument10 pagesProject-Baumol Sales Revenue Maximization ModelSanjana BhabalNo ratings yet

- Hisar Commercial 10.09.2022Document15 pagesHisar Commercial 10.09.2022ajay mahalNo ratings yet

- Tape Reading and Active Trading PDFDocument97 pagesTape Reading and Active Trading PDFLeoPulido100% (1)

- Rics Guidance Note The Role of The Commercial Manager in Infrastructure 1st Edition 2017Document25 pagesRics Guidance Note The Role of The Commercial Manager in Infrastructure 1st Edition 2017Tharaka Kodippily100% (1)

- CS-Professional Paper-3 Financial, Treasury and Forex Management (Dec - 2010)Document11 pagesCS-Professional Paper-3 Financial, Treasury and Forex Management (Dec - 2010)manjinderjodhka8903No ratings yet

- Revision Circular FlowDocument18 pagesRevision Circular FlowenochscribdNo ratings yet

- ING Direct Case Study AnaysisDocument7 pagesING Direct Case Study AnaysisAbby Leigh GrabitzNo ratings yet

- Ready Willing and Able (Rwa) : Date: TODocument3 pagesReady Willing and Able (Rwa) : Date: TONyangaya BaguéwamaNo ratings yet

- DigitalBusinessInnovation RishiKulkarniDocument6 pagesDigitalBusinessInnovation RishiKulkarniprincy lawrenceNo ratings yet