Professional Documents

Culture Documents

Import Export Code Reg Procedure PP 01

Uploaded by

sahuanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Import Export Code Reg Procedure PP 01

Uploaded by

sahuanCopyright:

Available Formats

Importer-Exporter Code Number (lEC No.

) Registration Procedures:

IEC Code is unique 10 digit code issued by DGFT Directorate General of Foreign Trade, Ministry of Commerce and Government of India to Indian Companies. IEC Code is Importer Exporter Code. To import or export in India, IEC Code is mandatory. No person or entity shall make any Import or Export without IEC Code Number. Mandatory Requirements to apply for IEC Code Number : 1. PAN Number 2. Current Bank Account in a Bank who deals in Foreign Exchange 3. Bankers Certificate 4. IEC Code Number Application Fee Rs 250.00 (Expert TIP : Pay via EFT (Electronic Fund Transfer ), and submit IEC Online Application form, If you wish to receive IEC Number instantly) 5. The physical application containing required documents should reach DGFT RLA concerned within 15 days of its online submission. 6. E-mail is not mandatory. If it is provided it will facilitate faster communication. Check List of Documents to apply for IEC Code : 1. Covering Letter on your company's letter head for issue of new IEC Code Number. 2. Two copies of the application in prescribed format ( Aayaat Niryaat Form ANF 2A ) must be submitted to your regional Jt.DGFT Office. 3. Each individual page of the application has to be signed by the applicant. 4. Part 1 & Part 4 has to be filled in by all applicants. In case of applications submitted electronically. 5. No hard copies of Part 1 may be submitted. However in cases where applications are submitted otherwise, hard copy of Part 1has to be submitted. 6. Only relevant portions of Part 2 need to be filled in. 7. Rs 250.00 Bank Receipt (in duplicate)/Demand Draft/EFT details evidencing payment of application fee in terms of Appendix 21B. 8. Certificate from the Banker of the applicant firm in the format given in Appendix 18A. 10. Two copies of passport size photographs of the applicant duly attested by the Banker of the applicant. 11. Self addresses envelope with Rs.25/- postal stamp for delivery of IEC certificate by registered post or challan/DD of Rs.100/- for speed post. Registration Procedure with APEDA : 1. Application form duly filled and signed by authorized signatory. 2. Self certified copy of Import-Export code issued by D.G.F.T. 3. List of Directors/Partners/Proprietor on companys letterhead in triplicate. 4. Pvt. Ltd./Public Ltd. Co.s/societies should forward a copy of their Memorandum and Article of Association and Partnership firms should forward a copy of partnership deed attested by notary. 5. Self certified copy of PAN issued by Income Tax Department. 6. The company should compulsorily mention their e-mail ID, phone and fax number etc. in their application. 7. In case the exporter desires to register as Manufacturer Exporter, he should furnish the copy of companys registration with FFO, Directorate of Industries, State Dept. of Horticulture/Agmark/EIA etc. 8. Bank certificate duly signed by the Authorities.

1|Page

You might also like

- EXPORT Licence ProceduresDocument9 pagesEXPORT Licence ProceduresdheerajdorlikarNo ratings yet

- Check List of Documents To Apply For IEC CodeDocument1 pageCheck List of Documents To Apply For IEC Codenaveen_patel0% (1)

- Importer Exporter Code Number or IEC Code No in India. - DGFTDocument6 pagesImporter Exporter Code Number or IEC Code No in India. - DGFTparas_devendraNo ratings yet

- Iec License Guide LineDocument33 pagesIec License Guide LineJohn AlexanderNo ratings yet

- IEC RegistrationDocument6 pagesIEC RegistrationParas MittalNo ratings yet

- IEC GuidelinesDocument5 pagesIEC Guidelinesiyer_prakashsNo ratings yet

- 4310 - Export Import Procedure For Gems & JewelleryDocument11 pages4310 - Export Import Procedure For Gems & JewelleryPriyalNo ratings yet

- Import Export Code (IEC) India: What You Should KnowDocument7 pagesImport Export Code (IEC) India: What You Should Knowsaravanan_c1No ratings yet

- IEC Documentation ProcedureDocument7 pagesIEC Documentation ProcedureRamalingam ChandrasekharanNo ratings yet

- Import Export Code NumberDocument8 pagesImport Export Code NumberShailesh DsouzaNo ratings yet

- Import Export Code (IEC) India: What You Should KnowDocument7 pagesImport Export Code (IEC) India: What You Should KnowDuma DumaiNo ratings yet

- Circular On Registration and Guidelines For CRES 2021-24 DT 27 Feb 2021-24 1 Mar 2021 Updated On 22 MarDocument9 pagesCircular On Registration and Guidelines For CRES 2021-24 DT 27 Feb 2021-24 1 Mar 2021 Updated On 22 MarMarlinNo ratings yet

- Appendix 21 C Procedure of Electronic Fund Transfer (Procedure For Deposit/refund of Import Application Fees Through Electronic Fund Transfer For Notified Schemes Through Designated Banks)Document3 pagesAppendix 21 C Procedure of Electronic Fund Transfer (Procedure For Deposit/refund of Import Application Fees Through Electronic Fund Transfer For Notified Schemes Through Designated Banks)Samarjit KararNo ratings yet

- Iec Apply NotesDocument5 pagesIec Apply Notesmaneeshmathew51No ratings yet

- DGFTDocument35 pagesDGFTgagan15095895No ratings yet

- APEDADocument2 pagesAPEDAkkkkNo ratings yet

- Detailed Steps and Explanation of Procedure To Start Business in IndiaDocument10 pagesDetailed Steps and Explanation of Procedure To Start Business in IndiaWhats BuzzNo ratings yet

- Salient Features of New Meerut Transportation EOI Amongst DealersDocument3 pagesSalient Features of New Meerut Transportation EOI Amongst DealersSrijan TiwariNo ratings yet

- EntrepDocument24 pagesEntrepPrincess Rena RamosNo ratings yet

- Submission of Online RCMC ApplicationDocument3 pagesSubmission of Online RCMC ApplicationChetan TejaniNo ratings yet

- Anf 2 A Application Form For Issue / Modification in Importer Exporter Code Number (IEC)Document7 pagesAnf 2 A Application Form For Issue / Modification in Importer Exporter Code Number (IEC)Tejas SompuraNo ratings yet

- Registering A Company in IndiaDocument8 pagesRegistering A Company in IndiaSomesh Rocku SomeshNo ratings yet

- Checklist IECDocument1 pageChecklist IECNikunj KothariNo ratings yet

- Q.1Application For Grant of IEC Number and Process of Online and Application Getting IEC NoDocument12 pagesQ.1Application For Grant of IEC Number and Process of Online and Application Getting IEC NoSabhaya ChiragNo ratings yet

- Steps Involved in Starting Business in India: No: Procedure Time To Complete: Cost To CompleteDocument10 pagesSteps Involved in Starting Business in India: No: Procedure Time To Complete: Cost To Completesarfraj_2No ratings yet

- Obtain Director Identification Number (DIN) : WebsiteDocument2 pagesObtain Director Identification Number (DIN) : WebsitemitulNo ratings yet

- A Project Report On Setting Up A Pen FactoryDocument18 pagesA Project Report On Setting Up A Pen FactoryAnupriya BediNo ratings yet

- Legal Procedure To Start BusinessDocument9 pagesLegal Procedure To Start BusinessRomit BhatiaNo ratings yet

- SBI Ka Checklistfor Non-Personel CA Open Karne Ke LiyeDocument13 pagesSBI Ka Checklistfor Non-Personel CA Open Karne Ke LiyeDeepakNo ratings yet

- EPCG License RequirementsDocument14 pagesEPCG License RequirementsAmit AshishNo ratings yet

- Sri Lanka - Export Development Board and Sri Lanka CustomsDocument17 pagesSri Lanka - Export Development Board and Sri Lanka CustomstitaskhanNo ratings yet

- Mandatory Disclosure Form (MDF)Document2 pagesMandatory Disclosure Form (MDF)jonilyn florentino100% (1)

- Procedure For Lodgment of Claims Under para 1-4 (A) and 1-4 (D) of Textile Division's Notification Duty Drawback Taxes Order 2017-18Document8 pagesProcedure For Lodgment of Claims Under para 1-4 (A) and 1-4 (D) of Textile Division's Notification Duty Drawback Taxes Order 2017-18Saad UllahNo ratings yet

- Importer Exporter Code Number FINALDocument10 pagesImporter Exporter Code Number FINALVishal PhullNo ratings yet

- Reliance Call NoticeDocument6 pagesReliance Call NoticeBharatNo ratings yet

- Online Account Opening Instructions For SBIDocument9 pagesOnline Account Opening Instructions For SBIIlan ChezhianNo ratings yet

- Steps How To Apply Tax ClearanceDocument2 pagesSteps How To Apply Tax ClearanceFenny TampusNo ratings yet

- Part A: Application Form For Issue / Modification in Importer Exporter Code Number (IEC)Document11 pagesPart A: Application Form For Issue / Modification in Importer Exporter Code Number (IEC)deepisainiNo ratings yet

- Public NoticeDocument3 pagesPublic NoticegokulsaravananNo ratings yet

- Pakistan Import DocumentationDocument2 pagesPakistan Import DocumentationUmer Qureshi100% (1)

- Instructions 2k23 FinalDocument29 pagesInstructions 2k23 FinalRAYZON ENERGIESNo ratings yet

- DocumentsRequired EngDocument4 pagesDocumentsRequired EngVijay KumarNo ratings yet

- Registration Formalities For Exports: Unit 1Document29 pagesRegistration Formalities For Exports: Unit 1iampavi91100% (1)

- FAQ On DGFT EDI System Q 1. What Are The DGFT Schemes For Which Online Applications Can Be Filed?Document4 pagesFAQ On DGFT EDI System Q 1. What Are The DGFT Schemes For Which Online Applications Can Be Filed?Anonymous jwHK79lNo ratings yet

- How To Claim Shares and Dividend Transferred To Iepf AuthorityDocument8 pagesHow To Claim Shares and Dividend Transferred To Iepf AuthorityChetan Patel100% (3)

- Procedure For Online Registration in EPS For Open Tender SuppliersDocument1 pageProcedure For Online Registration in EPS For Open Tender SuppliersSoumya Ranjan NayakNo ratings yet

- Quarterly Income Tax For Corporations and PartnershipsDocument2 pagesQuarterly Income Tax For Corporations and PartnershipsSky LeeNo ratings yet

- Jhulaghat FinalDocument108 pagesJhulaghat FinalAltafNo ratings yet

- The Institution of Engineers (India) : Important Information and Instructions For AIE ApplicantsDocument9 pagesThe Institution of Engineers (India) : Important Information and Instructions For AIE ApplicantsAlbert SekarNo ratings yet

- InstructionscagDocument4 pagesInstructionscagsheetalNo ratings yet

- Starting A Business in IndiaDocument21 pagesStarting A Business in Indiaa r karnalkarNo ratings yet

- Remittances Out of IndiaDocument2 pagesRemittances Out of IndiaArun ChavanNo ratings yet

- How To Start A Firm in IndiaDocument15 pagesHow To Start A Firm in IndiaAnonymous bAoFyANo ratings yet

- Application Form For End User Certificate UnderDocument4 pagesApplication Form For End User Certificate Underakashaggarwal88No ratings yet

- IMPEX Procedure PDFDocument174 pagesIMPEX Procedure PDFKrishna SinghNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Commercial Banking Revenues World Summary: Market Values & Financials by CountryFrom EverandCommercial Banking Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Starbuck Case StudyDocument2 pagesStarbuck Case StudysahuanNo ratings yet

- Procedure For Clearance of Export GoodsDocument11 pagesProcedure For Clearance of Export GoodssahuanNo ratings yet

- Starbuck Case StudyDocument2 pagesStarbuck Case StudysahuanNo ratings yet

- S.No Plot Type/No. Plot Areas in SQ.M Plot Areas in SQ - FT DescriptionDocument6 pagesS.No Plot Type/No. Plot Areas in SQ.M Plot Areas in SQ - FT DescriptionsahuanNo ratings yet

- Registration With APEDA PP 01Document1 pageRegistration With APEDA PP 01sahuanNo ratings yet

- Memorandum of Agreement Page 2Document1 pageMemorandum of Agreement Page 2sahuanNo ratings yet

- Import Export Code Reg Procedure PP 04Document1 pageImport Export Code Reg Procedure PP 04sahuanNo ratings yet

- An Introduction To BasisDocument8 pagesAn Introduction To BasissahuanNo ratings yet

- Memorandum of Agreement Page 1Document1 pageMemorandum of Agreement Page 1sahuanNo ratings yet

- IndemnityDocument1 pageIndemnitysahuanNo ratings yet

- Sample Melting Steel Scrap ContractDocument4 pagesSample Melting Steel Scrap ContractsahuanNo ratings yet

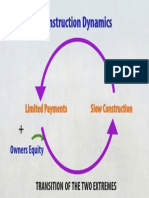

- Construction Dynamics 2Document1 pageConstruction Dynamics 2sahuanNo ratings yet

- Garden City 2Document1 pageGarden City 2sahuanNo ratings yet

- Garden City 1Document1 pageGarden City 1sahuanNo ratings yet

- Construction Dynamics 2BDocument1 pageConstruction Dynamics 2BsahuanNo ratings yet

- Authority MatrixDocument1 pageAuthority Matrixsahuan100% (1)

- European OperationDocument20 pagesEuropean OperationsahuanNo ratings yet

- PR - Sweet Homes - English) Final 18 AprilDocument2 pagesPR - Sweet Homes - English) Final 18 AprilsahuanNo ratings yet

- Affection PlanDocument1 pageAffection PlansahuanNo ratings yet

- 2 TolentinoDocument12 pages2 TolentinoMA. ANGELINE GRANADANo ratings yet

- Unit 4 ADocument10 pagesUnit 4 AChetan p ShirahattiNo ratings yet

- TPT 510 Topic 3 - Warehouse in Relief OperationDocument41 pagesTPT 510 Topic 3 - Warehouse in Relief OperationDR ABDUL KHABIR RAHMATNo ratings yet

- 5024Document2 pages5024Luis JesusNo ratings yet

- How To Connect To iSCSI Targets On QNAP NAS Using MPIO On Windows 2008Document30 pagesHow To Connect To iSCSI Targets On QNAP NAS Using MPIO On Windows 2008Jazz OberoiNo ratings yet

- Course Information2009 2010Document4 pagesCourse Information2009 2010shihabnittNo ratings yet

- Paper 1 Set 2 PDFDocument531 pagesPaper 1 Set 2 PDFabdul rehman aNo ratings yet

- Cruiziat Et Al. 2002Document30 pagesCruiziat Et Al. 2002Juan David TurriagoNo ratings yet

- Differentiating Language Difference and Language Disorder - Information For Teachers Working With English Language Learners in The Schools PDFDocument23 pagesDifferentiating Language Difference and Language Disorder - Information For Teachers Working With English Language Learners in The Schools PDFIqra HassanNo ratings yet

- Directorate of Technical Education, Maharashtra StateDocument47 pagesDirectorate of Technical Education, Maharashtra StatePandurang GunjalNo ratings yet

- Alfa Laval Aalborg Os Tci Marine BoilerDocument2 pagesAlfa Laval Aalborg Os Tci Marine Boilera.lobanov2020No ratings yet

- STRESS HealthDocument40 pagesSTRESS HealthHajra KhanNo ratings yet

- Turning The Mind Into An AllyDocument244 pagesTurning The Mind Into An AllyNic Sosa67% (3)

- Pipetite: Pipetite Forms A Flexible, Sanitary Seal That Allows For Pipeline MovementDocument4 pagesPipetite: Pipetite Forms A Flexible, Sanitary Seal That Allows For Pipeline MovementAngela SeyerNo ratings yet

- IO5 Future Skills Foresight 2030 ReportDocument96 pagesIO5 Future Skills Foresight 2030 ReportjuliavalleNo ratings yet

- Assignment On Unstable or Astatic Gravimeters and Marine Gravity SurveyDocument9 pagesAssignment On Unstable or Astatic Gravimeters and Marine Gravity Surveyraian islam100% (1)

- Jungbluth Main Catalogue-LanacDocument60 pagesJungbluth Main Catalogue-LanacMilenkoBogdanovicNo ratings yet

- Revised LabDocument18 pagesRevised LabAbu AyemanNo ratings yet

- BROMINE Safety Handbook - Web FinalDocument110 pagesBROMINE Safety Handbook - Web Finalmonil panchalNo ratings yet

- Serie10 User Man ProgDocument1,042 pagesSerie10 User Man Progfahmi derbel100% (1)

- Cause List 2.1.2023Document4 pagesCause List 2.1.2023あいうえおかきくけこNo ratings yet

- (Official) AVTC5 - Unit 1 - Before ClassDocument11 pages(Official) AVTC5 - Unit 1 - Before ClassNhân NguyễnNo ratings yet

- Auditing BasicsDocument197 pagesAuditing BasicsMajanja AsheryNo ratings yet

- Management Accounting/Series-4-2011 (Code3024)Document18 pagesManagement Accounting/Series-4-2011 (Code3024)Hein Linn Kyaw100% (2)

- The FlyDocument8 pagesThe FlyDrei Tiam Lacadin100% (1)

- Best S and Nocella, III (Eds.) - Igniting A Revolution - Voices in Defense of The Earth PDFDocument455 pagesBest S and Nocella, III (Eds.) - Igniting A Revolution - Voices in Defense of The Earth PDFRune Skjold LarsenNo ratings yet

- ArticleDocument9 pagesArticleElly SufriadiNo ratings yet

- SAMPLE Forklift Safety ProgramDocument5 pagesSAMPLE Forklift Safety ProgramSudiatmoko SupangkatNo ratings yet

- Dr. Alberto A. Jumao-As JRDocument46 pagesDr. Alberto A. Jumao-As JRClinton Mazo100% (1)

- 02-Fundamentals of Engineering EconomyDocument14 pages02-Fundamentals of Engineering EconomyLin Xian XingNo ratings yet