Professional Documents

Culture Documents

Two Weeler

Uploaded by

mehraru0 ratings0% found this document useful (0 votes)

132 views2 pagesit is a good story

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentit is a good story

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

132 views2 pagesTwo Weeler

Uploaded by

mehraruit is a good story

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Two-wheelers drag total vehicle sales down in fiscal 2008

Mumbai: In a sign of cooling consumption, vehicle sales in India,

Asia’s third largest market for automobiles, slid in fiscal 2008 as

higher interest rates, dwindling vehicle financing and inflation at a

three-year high made it hard for consumers to spend on big-ticket

items such as cars and two-wheelers.

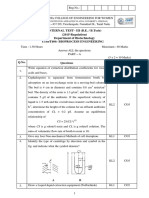

Turbulent Times (See Graphic)

Overall sales of passenger cars, trucks and two-wheelers dropped

4.7% in the year ended March, according to the Society of Indian

Automobile Manufacturers (Siam), an industry body.

Sales of passenger vehicles rose 12.2% to almost 1.5 million vehicles,

mostly led by new models such as Hyundai Motor India Ltd’s i10 small

car.

Two-wheeler sales bore the brunt of the decline, with sales dipping

8% to 7.25 million units, as higher interest rates and lack of financing

played spoilsport for the sector during the year.

In March, however, overall vehicle sales were up 1.8% from a year

ago. Passenger cars were up 11% during the month, while two-

wheelers remained little changed from the year-ago period.

Sales of two-wheelers, the entry-level vehicle for most people, are

mostly dependent on bank loans, which in the rural pockets seem to

have dried up as banks have grown wary of lending to a class that is

feeling the pinch of the high cost of living, or inflation, and on rising

repayment costs on loans because of interest rates that haven’t

budged from high levels in the past two years. Banks have also been

ticked off by the country’s highest court for arm-twisting clients for

repayments.

“The two-wheeler industry is passing through turbulent times due to

consumer sentiments being low and various other factors like finance

options being limited, availability as such being low in some pockets

and consumers’ affordability being under pressure,” said N.R.

Narayanan, group business head (vehicle loans) at ICICI Bank Ltd.

The bank has been an aggressive lender of loans for both homes and

vehicles.

In two-wheelers, Hero Honda Motors Ltd, India’s largest bike seller,

managed to sustain sales, while rivals Bajaj Auto Ltd and TVS Motor

Co. Ltd saw double-digit declines in fiscal 2008. Hero Honda sold

more than 3.24 million vehicles in the year. Its sales in March were up

15% to 308,052 units.

Meanwhile, Bajaj Auto’s sales in the year dropped 20% after it sold

about 1.68 million units. Its sales in March, too, were dismal at 114,436

units, down 20% over the same month last year.

Sales at TVS Motor during the year slid 19% to 1.15 million units,

while its March sales stood at 103,975 units, a decline of 13% over the

same month a year ago.

Struck by declining vehicle sales, a leading indicator of economic

growth, India’s finance minister P. Chidambaram had reduced the

excise duties on small cars and two-wheelers by 4 percentage points

in his Budget for the current fiscal year. But vehicle makers are facing

rising costs of commodities such as steel that they as raw material,

and the reluctance of banks to lend, which together are eroding their

sales and profits.

In passenger vehicles, Maruti Suzuki India Ltd, which makes half of

the cars sold in the country, increased sales 12% to 711,824 units in

fiscal 2008. Maruti’s sales in March remained flat at 64,421 cars.

South Korean Hyundai Motor Co.’s local unit posted an 11% uptick in

sales in the fiscal, while sales of passenger vehicles at Tata Motors

Ltd, India’s largest auto maker by revenue, was up just 0.44% at

227,919 units. March sales at Hyundai rose 52%, while Tata Motors

sales were up just 3% that month over March 2007.

“We expect (sales of) passenger cars to grow this year. However, the

growth might be hampered due to high interest rates. With inflation

rising, we don’t expect RBI (the Reserve Bank of India) to cut rates so

soon,” said Neeraj Bandhu, manager, South Asia vehicle forecasts at

CSM Worldwide, a consultancy.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Art of Blues SolosDocument51 pagesThe Art of Blues SolosEnrique Maldonado100% (8)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Information Security Chapter 1Document44 pagesInformation Security Chapter 1bscitsemvNo ratings yet

- Hotel Reservation SystemDocument36 pagesHotel Reservation SystemSowmi DaaluNo ratings yet

- P394 WindActions PDFDocument32 pagesP394 WindActions PDFzhiyiseowNo ratings yet

- G.R. No. 185449, November 12, 2014 Del Castillo Digest By: DOLARDocument2 pagesG.R. No. 185449, November 12, 2014 Del Castillo Digest By: DOLARTheodore DolarNo ratings yet

- Office Storage GuideDocument7 pagesOffice Storage Guidebob bobNo ratings yet

- Transparency Documentation EN 2019Document23 pagesTransparency Documentation EN 2019shani ChahalNo ratings yet

- Personal Best B1+ Unit 1 Reading TestDocument2 pagesPersonal Best B1+ Unit 1 Reading TestFy FyNo ratings yet

- Employees' Pension Scheme, 1995: Form No. 10 C (E.P.S)Document4 pagesEmployees' Pension Scheme, 1995: Form No. 10 C (E.P.S)nasir ahmedNo ratings yet

- Agfa CR 85-X: Specification Fuji FCR Xg5000 Kodak CR 975Document3 pagesAgfa CR 85-X: Specification Fuji FCR Xg5000 Kodak CR 975Youness Ben TibariNo ratings yet

- CH 1 India Economy On The Eve of Independence QueDocument4 pagesCH 1 India Economy On The Eve of Independence QueDhruv SinghalNo ratings yet

- Dissertation On Indian Constitutional LawDocument6 pagesDissertation On Indian Constitutional LawCustomPaperWritingAnnArbor100% (1)

- Phase 1: API Lifecycle (2 Days)Document3 pagesPhase 1: API Lifecycle (2 Days)DevendraNo ratings yet

- Anaphylaxis Wallchart 2022Document1 pageAnaphylaxis Wallchart 2022Aymane El KandoussiNo ratings yet

- Online Learning Interactions During The Level I Covid-19 Pandemic Community Activity Restriction: What Are The Important Determinants and Complaints?Document16 pagesOnline Learning Interactions During The Level I Covid-19 Pandemic Community Activity Restriction: What Are The Important Determinants and Complaints?Maulana Adhi Setyo NugrohoNo ratings yet

- Interruptions - 02.03.2023Document2 pagesInterruptions - 02.03.2023Jeff JeffNo ratings yet

- Section 8 Illustrations and Parts List: Sullair CorporationDocument1 pageSection 8 Illustrations and Parts List: Sullair CorporationBisma MasoodNo ratings yet

- Using Boss Tone Studio For Me-25Document4 pagesUsing Boss Tone Studio For Me-25Oskar WojciechowskiNo ratings yet

- MSDS - Tuff-Krete HD - Part DDocument6 pagesMSDS - Tuff-Krete HD - Part DAl GuinitaranNo ratings yet

- Enerparc - India - Company Profile - September 23Document15 pagesEnerparc - India - Company Profile - September 23AlokNo ratings yet

- Cabling and Connection System PDFDocument16 pagesCabling and Connection System PDFLyndryl ProvidoNo ratings yet

- Health Insurance in Switzerland ETHDocument57 pagesHealth Insurance in Switzerland ETHguzman87No ratings yet

- Polytropic Process1Document4 pagesPolytropic Process1Manash SinghaNo ratings yet

- What Caused The Slave Trade Ruth LingardDocument17 pagesWhat Caused The Slave Trade Ruth LingardmahaNo ratings yet

- Research Article: Finite Element Simulation of Medium-Range Blast Loading Using LS-DYNADocument10 pagesResearch Article: Finite Element Simulation of Medium-Range Blast Loading Using LS-DYNAAnonymous cgcKzFtXNo ratings yet

- Week 8: ACCG3001 Organisational Planning and Control Tutorial In-Class Exercise - Student HandoutDocument3 pagesWeek 8: ACCG3001 Organisational Planning and Control Tutorial In-Class Exercise - Student Handoutdwkwhdq dwdNo ratings yet

- Working Capital ManagementDocument39 pagesWorking Capital ManagementRebelliousRascalNo ratings yet

- Audit Certificate: (On Chartered Accountant Firm's Letter Head)Document3 pagesAudit Certificate: (On Chartered Accountant Firm's Letter Head)manjeet mishraNo ratings yet

- A PDFDocument2 pagesA PDFKanimozhi CheranNo ratings yet

- Kaitlyn LabrecqueDocument15 pagesKaitlyn LabrecqueAmanda SimpsonNo ratings yet