Professional Documents

Culture Documents

Family & Friends Mortgage

Uploaded by

bkbk5Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Family & Friends Mortgage

Uploaded by

bkbk5Copyright:

Available Formats

IT’S SIMPLE, ACTUALLY.

FAMILY MORTGAGES

A GUIDE TO

VIRGIN MONEY LETS YOU SET UP YOUR

OWN LOAN WITH FAMILY OR FRIENDS.

THEN WE MANAGE IT FOR YOU. ALONG

THE WAY, WE’LL PROTECT YOUR

RELATIONSHIPS AND SAVE YOU

THOUSANDS IN BANK FEES. SOUND

GOOD?

TO GET STARTED SETTING UP YOUR FAMILY MORTGAGE TODAY,

VISIT: WWW.VIRGINMONEY.COM OR CALL 1.800.805.2472

WHAT IS A FAMILY MORTGAGE? 1

HOW DO I SET UP A FAMILY 3

MORTGAGE?

TIPS FOR THE BORROWER 7

TIPS FOR THE LENDER 8

Q&A 10

THE SKINNY ON VIRGIN 13

MONEY

THE LEGAL FINE PRINT

BEFORE WE GET STARTED, WE’D LIKE TO GIVE OUR LEGAL TEAM

THEIR MOMENT IN THE SPOTLIGHT. READY... SET... GO!

The materials in this guide should be used for general guidance and

informational purposes only and are not geared toward any specific

transaction or goal. The scenarios presented are fictitious and purely

for representational purposes. Every transaction is unique and ques-

The Virgin Money Bill of Rights expresses what we tions about your specific loan transaction, its circumstances, or any

think money should be about. Keep an eye on this recent changes to the laws of your state that might affect your loan

space for your rights. should be directed to a licensed legal or real estate professional in

your state. We recommend that you consult an attorney or tax advi-

sor before entering into a financial transaction of this nature. Virgin

Money is not a law firm and does not provide legal advice or tax

advice. Virgin Money is not a lender or a loan broker and does not

originate loans on behalf of other parties. The information contained

herein is the sole property of Virgin Money USA, Inc., and may not be

reproduced or redistributed for any purpose without the express

written consent of Virgin Money USA, Inc.

TO GET STARTED SETTING UP YOUR FAMILY MORTGAGE TODAY,

VISIT: WWW.VIRGINMONEY.COM OR CALL 1.800.805.2472

REAL PEOPLE. VIRGIN MONEY WHAT IS A FAMILY MORTGAGE?

PROFILES

LINE UP A HOME LOAN FROM FAMILY A private mortgage is a loan between private parties,

OR FRIENDS. usually two individuals, which is secured by real estate.

Just like a traditional bank mortgage, a private mortgage

When Amy Semerjian decided to buy a 1904 might be used to buy, renovate, or refinance a home, or

farmhouse in Northampton, Massachusetts even as a way to secure a personal loan used for other

she assumed she would get her mortgage non-real estate purposes. A private mortgage can pro-

from a bank. Then, her mother made her an vide the structure of a bank mortgage while retaining the

offer she couldn’t refuse: use Mom and Dad flexibility associated with loans between relatives and

as her lender. Her mother notes, “I figured, friends, resulting in a win-win transaction for both the

‘why is my daughter paying the bank when borrower and the lender.

she could be paying me?’”

With the help of Virgin Money, Amy

When the loan is between family members, we call it –

borrowed $180,000 from her parents. But you guessed it - a family mortgage.

this wasn’t a loan sealed with a handshake

and a promise. She signed paperwork every You can use our Family Mortgage in many of the same

bit as official as she would at a bank. As a situations you might use a traditional bank mortgage,

result, she secured a tax-deductible mort- such as, to:

gage at a competitive 5.75% interest rate,

avoiding lenders’ fees and keeping the Help purchase a home. The money can be used for the

money she pays in the family. entire purchase of the home, for the down payment, or

to supplement bank financing and avoid paying Private

Meanwhile, in addition to helping their Mortgage Insurance (PMI).

daughter, Amy’s parents earn a decent

return on their investment, which is not

easy in these days of low interest rates.

Refinance a bank mortgage. The money can be used to

“It’s a little bit scary borrowing from your lower the interest rate, to eliminate PMI, to keep interest

parents, but this is an official thing,” said payments within the family rather than paid to a bank,

Amy. “And in our situation, it’s to our or to achieve more favorable terms.

mutual benefit.” Amy’s parents are now

earning $1,200 a month from their Formalize an existing home loan from relatives. Home

daughter’s loan. “The mortgage was actu- loans from relatives made in the past can be formalized

ally $173,000, but she wanted a little extra to realize tax benefits, such as interest deductibility,

for shoes,” joked her mother. “It’s so nice to capital gains write-offs, and legal benefits (e.g. probate,

keep it in the family.” legal protection).

Renovate a home. The money can be used in place of a

home equity loan.

When you or someone you know needs mortgage financ-

ing, consider a Virgin Money Family Mortgage. Here’s

why:

Family Mortgages keep the money in the family. Interest

is going to have to be paid on the mortgage, whether it

is to a bank or to a family member. Why not pay it to

someone you know?

Family Mortgages create a win-win situation for the

parties involved. It is possible to design a private mort-

gage so that lenders generate a higher return than they

would in a money market or a savings account, and so

that borrowers get lower interest rates than they would

with a traditional lender.

TO GET STARTED SETTING UP YOUR FAMILY MORTGAGE TODAY, VISIT:

WWW.VIRGINMONEY.COM OR CALL 1.800.805.2472 1

LEARN MORE... Our Family Mortgages create a win-win situation for the

...CAN I USE VIRGIN MONEY FAMILY parties involved. It is possible to design a private mort-

gage so that lenders generate a higher return than they

MORTGAGE FOR MY DOWN PAYMENT? would in a money market or a savings account, and so

Yes, a family loan is one way to come up that borrowers get lower interest rates than they would

with the money for a down payment on a with an institutional lending source.

home. Many banks insist that borrowers

retain at least an 80/20 debt/equity ratio in What’s in it for the borrower? Plenty. Here are just a few

their new home. Typically borrowers who benefits to consider.

can’t come up with 20% of the purchase

price for their new home must pay Private A low interest rate: Often, interest rates charged

Mortgage Insurance (PMI) at a high rate. through intra-family arrangements are lower than rates

We can help you bridge this gap. Call us if charged through banks and traditional lenders. On

you need help working with your bank to average, private mortgage interest rates are between

use a Virgin Money Family Mortgage for

one half and one full point lower, and that can add up to

your down payment.

thousands of dollars in interest savings over the life of

the loan.

Flexible payments: A private mortgage can be designed

to allow a level of flexibility in the repayment schedule

not available in a loan from banks and traditional lend-

ers. For example, payments can be temporarily paused,

shifted to the end of the loan, or reduced for a pre-

defined period of time - as long as the lender agrees to

the change. That is something a borrower could never

achieve with a bank mortgage.

Tax deductible interest: If a private mortgage is properly

formalized, the borrower can usually deduct the mort-

gage interest charged, just like a traditional bank mort-

gage.

If a private mortgage is properly set up and is legally

binding, lenders find the transaction also benefits them

for the following reasons.

A strong investment vehicle. Family lenders are able to

generate a good interest rate relative to comparably

safe investments such as money market accounts,

certificates of deposit, treasury notes, etc.

Protection. As long as the loan is secured by real estate,

the lender can rest assured that their investment is

protected. This can be particularly important when an

unforeseen event occurs, such as the death of the bor-

DREAMS rower.

You have the right to big, fat, humongous dreams.

That’s right. We said it. Humongous. You should Monthly income stream. Private mortgages generate a

share your humongous dreams with people who recurring income stream from payments - in cash - paid

care for you. Together, you can figure out a way to by the borrower. This is an attractive feature relative to

finance them—to make them happen. Then one other investments, especially for retirees and others on

day you’ll wake up, rub the sleep from your eyes, a fixed income.

and hardly believe it all happened to you. And

you’ll live happily ever after. The end.

TO GET STARTED SETTING UP YOUR FAMILY MORTGAGE TODAY, VISIT:

WWW.VIRGINMONEY.COM OR CALL 1.800.805.2472 2

HOW CAN WE HELP? HOW DO I SET UP A FAMILY

VIRGIN MONEY CAN SET UP YOUR MORTGAGE?

FAMILY MORTGAGE.

Even when it’s between relatives, legally binding docu-

Our team is well versed in facilitating all

ments and proper management are necessary for a

types of private mortgage transactions. We

understand the questions and concerns you

mortgage. Here’s why:

may have when arranging a private mort-

gage, and are skilled in handling unique For the borrower, proper documentation will ensure that

repayment situations that may arise. Virgin tax benefits are realized (we provide more details on this

Money offers a variety of services geared to below.)

make your private mortgage transaction as

secure and successful as possible. Some of For the lender, proper documentation will ensure that he

our services include: or she is protected in the case of default and foreclosure.

Mortgage documentation and set up. By spelling out the loan details you can protect your

Promissory notes, mortgage recording, title personal relationships because you are clarifying expec-

searches, compliance with the Applicable

tations upfront.

Federal Rate.

Mortgage payment processing. Repay- Take full advantage of the flexibility of a private mort-

ment schedules tailored to your individual gage by picking an interest rate and a repayment sched-

situation, loan restructuring to ensure that ule that meet your unique needs. In the case of an

missed payments do not lead to default, intra-family mortgage, the interest rate and the repay-

direct debit and direct deposit of payments, ment plan are usually selected to give the borrower a

late payment follow up. better deal than they might find at a bank.

Payment tracking and accounting. In this section we outline the steps to set up a Virgin

Online account access, year-end reporting Money Family Mortgage. These are:

for taxes, and record-keeping.

1. Agree to the terms and payment schedule

2. Create a legally binding document

3. Set up a plan for servicing (managing repayment and

reporting) the loan

TERMS AND PAYMENT SCHEDULES

Following is a list of the basic terms the borrower and

lender establish in order to prepare a family mortgage.

Amount borrowed

The total amount that is to be borrowed.

Repayment start date

FIT The date that the mortgage will begin to be repaid.

Typically banks set this date no sooner than 30 days

You have the right to a loan that’ll fit you like a

from the loan closing to allow time for the paperwork to

glove—and not a straightjacket. Look, we aren’t

slick salespeople. We’re not trying to trick you into

process. You may want to do the same.

buying something that isn’t right for you. If we

can help, we’ll let you know. If not, we’ll let you Interest rate

know that too. We’re good like that. We just want The loan agreement should clearly state the interest rate

everyone to be happy with their loan. Really, is to be charged, and whether it is compound or simple

that too much to ask? interest. The lender and borrower should pick a rate

using the following guidelines:

TO GET STARTED SETTING UP YOUR FAMILY MORTGAGE TODAY, VISIT:

WWW.VIRGINMONEY.COM OR CALL 1.800.805.2472 3

REAL PEOPLE. VIRGIN MONEY Avoid IRS scrutiny. In order for a transfer of private

PROFILES. money to be considered a mortgage loan and not a gift,

the lender must charge an interest rate at no lower than

SEE HOW KEEPING A HOME LOAN IN the minimum rate required by the federal government,

THE FAMILY CAN PAY OFF. called the Applicable Federal Rate (AFR). If you charge

less than the AFR, the IRS may view the forgone inter-

Like many retirees who rely on interest

from their retirement savings, Jane Driscoll

est income as a gift from you.

of Dedham, MA had watched her monthly

income drop in recent years with the Consider the opportunity cost to the lender. The money

decline in interest rates. Unbeknownst to loaned would most likely be earning a return if invested

Jane, the solution to her declining interest elsewhere (i.e. a savings account or CD). Consider that

rates would come from her daughter’s alternative and pick a rate that both the borrower and

purchase of a home. the lender feel is fair given alternative uses of the

money.

Her daughter, Margaret Driscoll, had

recently pre-qualified for a mortgage on a Payments

new home. However, when Margaret and Each payment you make will go towards the principal

Jane discussed the mortgage rate and

(the loan amount) and the interest, but you can choose

contrasted it to the rate on Jane’s CDs, they

had an idea. A few days prior, Margaret had

how quickly you pay down the two different amounts.

heard about how Virgin Money can set up Standard mortgage payments include principal plus

and manage intra-family mortgages. interest, but you can also choose to make interest-only

or principal only payments. Here are some of the differ-

After talking with Virgin Money, Margaret ent combinations to consider:

and Jane decided it made more sense for

Margaret to get her home loan from her Principal Plus Interest. Each installment paid toward

mother rather than the bank. repayment of the mortgage consists of two parts, the

interest owed and the principal. This is typically how a

“It was crazy to pay all of that interest to a conventional mortgage from a bank

bank when I could just as easily pay it to is repaid.

my mother. It turns out we both benefited,”

she said. “My mom nearly doubled her

monthly income [compared to her CDs] and

Interest Only. Each installment paid toward of the mort-

I’m paying a lower rate on my mortgage gage repays the interest obligation only; the principal

than any bank could offer me.” balance usually comes due as a lump sum at the end of

the mortgage term.

Repayment Schedules

Mortgage payments are organized into a schedule which

determines how much you pay and when you pay it.

Traditional bank mortgages are amortized; the borrower

pays the same amount every month for the life of the

loan. However, consider using a graduated schedule if

the borrower has low income now but expects it to

increase with time.

You might also choose a seasonal loan if the borrower’s

income is dependent on a job or business that is sea-

sonal and fluctuates on a predictable pattern throughout

the year.

Amortized. The repayment schedule consists of pay-

ments that are always the same dollar amount and are

due at regular payment dates (monthly, quarterly, or

annually) for the life of the loan.

TO GET STARTED SETTING UP YOUR FAMILY MORTGAGE TODAY, VISIT:

WWW.VIRGINMONEY.COM OR CALL 1.800.805.2472 4

REAL PEOPLE. VIRGIN MONEY Graduated. The repayment schedule starts with lower

PROFILES. payments initially (monthly, quarterly, or annually) but

they gradually increase later in the life of the loan.

BORROWING FOR YOUR NEW HOME

FROM THE BANK OF MOM AND DAD. Seasonal. The repayment schedule where both principal

and interest payments are lower during some months of

Samira Sadeghi and her husband jointly

purchased their home, a duplex in the Bay

the year and higher in other months of the year

Area, with her parents. It made sense: her (typically used for situations where a borrower’s income

parents got on site rental management for is different at different times of the year).

an investment property, and Samira and her

husband could afford their first home. Late payments and default

In the event of any problems with repayment of the

Last year, her parents paid off the bank loan loan, it is important to have the consequences spelled

on the property and then used Virgin Money out so both parties are clear about how to handle the

to hold Samira’s mortgage themselves. Now situation. Particularly with a family mortgage, the best

Samira and her husband make their way to protect the personal relationship is to put into

monthly payments to her parents, who get writing the expectations for both parties, and the conse-

a 6% return on their money. “I still get my

quences of failing to meet those expectations.

tax deductions and everything you’d get

with a bank, but I’m not paying a bank, I’m

paying my Dad,” she said “I love the whole Late payments. Establish the number of days after

idea.” which each payment is deemed late. This number can

range from 0–15. Most Virgin Money clients choose a

10–15 day “grace period” after which a payment is

deemed “late” and a late fee becomes due. Our clients’

late payment fee range from 0–$100 and currently

average about $25, but you can choose any amount. For

family transactions, some clients elect to have no late

fee and we have found that this does not impact the

borrower’s willingness to make payments on time. This

is partially because Virgin Money collects payments in

an automated way using direct debit.

Default. Once the borrower exceeds the grace period

without making a payment, he or she is technically in

violation of the contract. Determine what defines a

default and what rights you will exercise in the event

that a default occurs. If a borrower defaults on a private

loan and the lender can show through documentation

that the loan was a legitimate one and tried to collect on

it, the lender may be able to write off the bad debt

portion of the loan as a capital gains loss (subject to

annual maximums).

CREATE A LEGALLY BINDING DOCUMENT

LOVE Once all the terms are set, it’s time to make the agree-

You have the right to mix money and relationships, ment legally binding. All family mortgage transactions

and live to tell the tale. Yes, it can be done. Trust have two components:

us. And it’s where we come in. We’ll look after your

loan and handle all the details. You never even Promissory Note. The promissory note establishes the

need to talk business with your loan partner unless debt between the parties and records how that debt is

you want to. So you can mix money with relation- going to be repaid.

ships, and still come out happy as a clam. How

sweet is that?

TO GET STARTED SETTING UP YOUR FAMILY MORTGAGE TODAY, VISIT:

WWW.VIRGINMONEY.COM OR CALL 1.800.805.2472 5

LEARN MORE... Mortgage/Deed of Trust. This creates an interest in the

...WHAT DIFFERENT TYPES OF FAMILY real estate to secure repayment of the debt. Attached to

the Mortgage/Deed of Trust is a legal description of the

MORTGAGES ARE THERE? property, usually taken from the deed to the property.

A first mortgage - when the entire purchase

price is financed solely by the private If the family mortgage transaction is being done to

lender, and there is no bank or other lend- purchase a property, there will need to be a transfer of

ing institution involved. the title to the property to the borrower in conjunction

with the loan. The following materials will need to be

A second mortgage - used to supplement a prepared as part of the transfer of the title to the prop-

bank mortgage, typically for financing a erty:

down payment or a renovation. In general,

these loans range in size from $25,000 to A deed (transferring the property from seller to buyer).

$75,000.

State and federal compliance documents - these vary

A refinancing - used to pay off a conven-

tional mortgage with a bank, typically

dependent upon which state you are in and on the

trading in a market rate with the bank for a circumstances of the transaction. Examples include:

lower rate from family or friends. Virgin

Money typically finds that the interest rates • Transfer tax form

charged by family members for refinancing • Lead paint

transactions are 1% lower than market • Smoke detectors

rates. Sometimes homeowners will also • IRS seller documents (capital gains)

refinance to take some of the equity out of

their home, called a cashout refinance. Legal description of property being transferred (for the

deed and to be used in the mortgage)

A private equity loan - when real estate

serves as collateral for a private loan; the

In addition, the following items are optional but are

loan is often used for a renovation or other

personal expense.

often used in loan transactions, whether for a purchase

or for a refinance, especially in traditional bank mort-

gages:

• Appraisal

• Home Inspection

• Full title search and title insurance

• Purchase and sale agreement

• Real estate taxes (check to see that all are paid)

• Homeowner’s insurance (paid in advance for one year)

SET UP A PLAN FOR REPAYMENT OF THE LOAN

Finally, there will need to be a plan for managing the

repayment of the loan. Most parties to a private loan

use one of the following two options:

You can do it yourself. You can send a check every

period by the due date specified in your promissory

note. Keep in mind that over 33% of self-administered

payments by check are late or missed entirely, and this

tends to be a significant cause of strained relationships

and misunderstandings. Missed payments also make it

difficult to calculate year-end numbers for tax filings.

TO GET STARTED SETTING UP YOUR FAMILY MORTGAGE TODAY, VISIT:

WWW.VIRGINMONEY.COM OR CALL 1.800.805.2472 6

LEARN MORE... You can hire a neutral 3rd party such as Virgin Money to

...HOW CAN THE INTEREST RATE ON A manage the repayment. Virgin Money administers pay-

ments using direct deposit and direct debit, which

FAMILY MORTGAGE BENEFIT BOTH THE makes loan repayment more convenient for both parties

BORROWER AND THE LENDER? and dramatically reduces the likelihood of late payments

and default. It also makes it easy at tax-time with all

Though bank mortgage rates fluctuate over

time, they are usually 2–3% higher than

the paperwork ready to be filed. Clients tell us that they

the Applicable Federal Rate (AFR), the rate also value our optional free credit reporting service

that the IRS requires as a minimum for which helps borrowers build credit - which they would

private loans (see more on this in the next be unable to do if the loan was managed privately.

section.) At the same time, the AFR tends

to be higher than the rate individuals can

earn on short-term cash investments, such TIPS FOR THE BORROWER

as money market accounts and CDs. This

means that the parties to a family mortgage Being on the borrowing side of a private transaction can

can agree to a rate that is lower than a be as stressful as being on the lending side. To help you

traditionally available mortgage (to the prepare for the conversations with your lender, and for

borrower’s benefit) and higher than alterna-

the deal you hope to close, here are three things

tive cash investments (to the lender’s

benefit), and that meets the IRS guidelines

you—as the borrower—should know.

for a private loan.

Know how a family mortgage can work. Your request for

For example, a son closes on a family money might begin as an informal conversation, maybe

mortgage at 4.9% and feels he has won even over the kitchen table. It might also be a phone

because he is getting the money he needs call where you bring up the idea and get an encouraging

at less than it is available from banks. His response. While the first contact for a private loan

win is felt as a reduction of thousands of should be informal, soon after you need to demonstrate

dollars in interest payments over the life of to the potential lender that you have what it takes to be

the loan. If we assume that his parents a good investment. The best way to do this is to make a

were earning 4% keeping their money in plan with your lender to formalize the loan. Refer to this

CDs, by issuing the mortgage they have

guide to show how a family mortgage could work. Be

increased their investment return from 4%

to 4.9%, a win for the parents that is felt in

ready to show your potential lender how Virgin Money

increased monthly cash payments. The can manage the process to make it as easy as possible.

4.9% rate is thus a win for both parties and Your potential lender is more likely to seriously consider

is acceptable to the IRS because the AFR for your request if you can alleviate their two greatest

that month is 4.59%. concerns, that the loan will jeopardize the relationship,

and that the money might be lost. Sharing this guide

In addition, even though the loan is with your potential lender will help you do that.

between family members, as long as it is

structured as a formal mortgage, the son Know how a family mortgage can benefit your lender. In

will also be able to deduct his interest previous pages we have described several ways that a

payments on his taxes, just as if the intra- private loan can benefit lenders. Make sure you explain

family mortgage were a bank mortgage.

these benefits to your lender. In summary, these are:

The parents will have the protection of

knowing that the loan is secured by real

estate, and that they have the option to • Get a higher yield than on other investments.

gain ownership of the home in the case of • Get a steady stream of income from an investment

default, to recapture any loss on the loan. that is secured by real estate.

• Keep the money in the family.

Depending on how much you know about your lender’s

finances, you can discuss these benefits as they relate

directly to your lender’s circumstances. You should also

think through how to respond logically to objections and

questions that your lender may have. For example, one

typical objection to a request for a family mortgage is

that the loan is a 30-year investment and many lenders

TO GET STARTED SETTING UP YOUR FAMILY MORTGAGE TODAY, VISIT:

WWW.VIRGINMONEY.COM OR CALL 1.800.805.2472 7

LEARN MORE... do not want to tie up their money for 30 years. Most

...WHAT IS THE DIFFERENCE BETWEEN home buyers refinance or move after 5-7 years, but

there is understandably a certain amount of nervous-

COMPOUND INTEREST AND SIMPLE ness about committing to a 30-year loan. Explain to

INTEREST? your lender that you can refinance the mortgage at any

time with a bank or another private lender. They can

Compound interest calculates interest based

on the principal and interest; simple interest

also add a clause to the mortgage ensuring that they

only calculates interest on the principal have a legal right to demand full payment and effec-

amount of money. tively cause refinancing. This is quite common.

Know how a family mortgage can benefit you. In previ-

ous pages we also described the ways a private loan can

benefit borrowers. Since your lender is probably inter-

ested at least in part helping you out, it’s a good idea to

be able to express and discuss the benefits you receive

by getting your loan from a family member instead of

from a bank.

In summary, these are:

• You can set your own interest rate which may be

lower than a bank would offer you.

• You can set your own repayment schedule to meet

the cash flow needs of your new business.

• You can make adjustments to your repayment

schedule to give you the best chance of repaying the

loan.

• You can still get the benefit of a federal tax deduc-

tion for interest paid just like a traditional bank

mortgage.

On this last benefit, note that the loan must be struc-

tured, documented, and recorded as a private mortgage

- rather than an unsecured loan that is not recorded

with appropriate local authorities.

We do recommend that you consult your tax advisor

regarding any changes to the tax laws which may affect

the ability to deduct mortgage interest payments.

TIPS FOR THE LENDER

Before delving into a mortgage with a relative, make

sure you take the following steps. You may also want to

FREEDOM discuss the transaction with your attorney or financial

You have the right to break free from the hope- planner to make sure it is appropriate in your individual

crushing, handcuffing, penny-pinching nature of situation.

most bank loans. And not look back. Find your own

borrower. Or find your own lender. Choose your Document the loan. Creating a legally binding document

own interest rate. Create your own repayment is one of the most important things you can do when

schedule. Go on with your bad self. Let the banks handling a family mortgage transaction.

keep their lollipops. Keep more of your money.

And keep it between your family and friends.

TO GET STARTED SETTING UP YOUR FAMILY MORTGAGE TODAY, VISIT:

WWW.VIRGINMONEY.COM OR CALL 1.800.805.2472 8

HOW CAN WE HELP? Many people mistakenly assume that it is offensive or

VIRGIN MONEY CAN MANAGE REPAY- inappropriate to ask for formal documentation when

arranging to transfer funds between relatives. In fact,

MENT OF THE LOAN. structuring formal documentation is perhaps one of the

In addition to providing the documentation most appropriate things that can be done. Not only does

for your private mortgage, Virgin Money will: it protect both parties financially, but it also preserves

the personal relationship. It can prevent confusion over

• Create a repayment schedule. repayment start dates, interest rates, repayment sched-

• Setup the bank accounts to take and ules, grace periods, and other terms of the loan.

receive electronic payments (payment can

also be received via check or money order). If your borrower is reluctant to formalize the loan with a

• Record the mortgage with the appropriate legally binding document, you can try one or more of

government authority to ensure that the the following explanations:

borrower can enjoy mortgage interest tax

deductions.

Your Accountant: Explain to your relative that your

• Provide knowledgeable customer support.

accountant mandates a fully legally binding agreement

When it comes to the ongoing business of before you create a family mortgage transaction.

keeping the borrower and lender on track

per the terms of the loan, Virgin Money will: The IRS. Explain to your relative the possibility that you

will be audited and that you need to have documenta-

• Send a reminder email to the borrower tion in order to show that you are setting up a family

before each payment comes due mortgage, and not making a gift.

• Debit the borrower’s bank account as set

out in the promissory note (or receive The Media. Explain that you have heard several stories

payment via check). recently about undocumented transactions jeopardizing

• Credit an account designated by the family relationships and don’t want to take the chance

lender.

with your own.

• Send a confirmation email to the lender

once the electronic deposit has been

completed. Past Experiences. If appropriate, reference past experi-

• Furnish both parties with year-end tax ences that deal with an informal loan ending poorly for

summary statements that detail the you and the other party.

interest and principal paid during that

year. Understand the tax implications. Any interest you earn

on a private loan is considered income by the IRS and

therefore is considered taxable. You may make a gift of

that income, but only up to $12,000 each year, which is

the Annual Gift Tax exclusion ($24,000 if made by a

couple; $48,000 if made by a couple to a couple).

The interest rate should be set at least at the relevant

Applicable Federal Rate (see our earlier discussion of the

AFR); however, if you do not plan to make any addi-

tional gifts to the mortgage recipient, it is possible to set

a below-market rate because the foregone interest is

not likely to add up to $12,000 unless your mortgage is

a multi-million dollar transaction. Interest paid by the

borrower can be deductible when the loan is structured

properly.

Reflect on your own interests. Before you agree to a

private mortgage with a relative, be clear about your own

interests. Ask yourself why the possibility of a family

mortgage appeals to you. Is it because you want to help

a friend or relative? Is it because you’ll generate a higher

return on your investment than you would in the stock

TO GET STARTED SETTING UP YOUR FAMILY MORTGAGE TODAY, VISIT:

WWW.VIRGINMONEY.COM OR CALL 1.800.805.2472 9

LEARN MORE... market or in a savings account? Chances are, it’s a

...HOW DO I DEAL WITH DEFAULT OF A combination of both. Articulate your goals as a lender

and share these with your borrower.

FAMILY MORTGAGE?

Basically, in the case of default, individual If you are planning to loan to a family member, be

private lenders have the same tools as a sensitive that such a loan might raise some emotional

bank. Family lenders have the option to issues for other family members, such as jealousy. The

foreclose and to impact the credit rating of best approach is to be open with your family about the

the borrower, if necessary. In practice, we loan, and make the same opportunity - possibly even at

have found that for family mortgages, the same terms - available to other family members.

lenders and borrowers prefer to restructure Clarity in the legal document about who does what in

loans rather than foreclose on their relatives. the case of late payments or default also prevents a

difficult situation down the road if the loan should turn

There are various ways that Virgin Money bad. Certainly, if you have a spouse, it’s best to discuss

has made it easy to implement loan

the transaction before signing the papers. Make sure

restructuring. For example, the private

lender could:

that you are in agreement about the terms and expecta-

tions of the arrangement.

• Forgive the missed payment completely,

in other words, make a gift of the amount

of the payment. Just be aware that if you Q&A

exceed $12,000 in forgiven payments in a

year you will be exceeding your gift tax Q: I’m making a loan to my sister so that she can pur-

exclusion for the year, per IRS regula- chase a home. Why can’t I just download a free prom-

tions. issory note from the Internet to document the family

• Agree that the borrower will skip a pay mortgage instead of paying for a family mortgage

ment one month and then double up in a through Virgin Money?

later month.

A: Sure you could. But this is a risky choice. If you use

• Postpone the entire payment schedule for

an agreed upon period, until the borrower

a simple promissory note, you and your sister will need

is able to stabilize his or her financial to do several things on your own to ensure that you

situation and resume the payment minimize financial risk, enjoy tax benefits (mortgage

schedule. interest tax deduction), and avoid emotional pitfalls of

• Require that the borrower add the pay- interpersonal transactions. You’ll need to:

ment to the end of the loan term.

• Create a mortgage agreement, not just a promissory

The payment schedule changes listed above note.

do not require a new promissory note. • Record the mortgage with public authorities.

Payment schedule changes that do require • Manage the repayment plan.

a new note include a change on loan type • Recalculate the schedule to accommo date missed

(secured/unsecured), a change in the

payments, late payments, and partial payments.

interest rate, or a complete restructuring of

the payment schedule from one form to

• Keep track of interest payments and prepare a 1098

another (such as from amortized to gradu- form for the IRS.

ated.)

Usually, a loan such as a mortgage that takes place over

a period of years will bring different circumstances for

each party as the years pass. Payments could be

neglected; agreements and promissory notes can be

stashed in a drawer or closet so that the terms are

forgotten or ignored. By managing the entire repayment

process of your loan, including payment processing,

online accounts, and proven methods of payment collec-

tion, Virgin Money relieves you of having to manage

your loan and reduces any stress to the personal rela-

tionship that the loan might cause. In other words,

Virgin Money can provide a buffer, allowing you to keep

your loan separate from your personal relationship.

TO GET STARTED SETTING UP YOUR FAMILY MORTGAGE TODAY, VISIT:

WWW.VIRGINMONEY.COM OR CALL 1.800.805.2472 10

HOW CAN WE HELP? Q: Do we have to keep track of the interest income?

VIRGIN MONEY CAN TAKE CARE OF A: Yes, you must report to the IRS all interest payments

as income for the lender and deductions for the borrower.

YOUR DOCUMENTATION NEEDS. A benefit of using Virgin Money is that we can keep track

Virgin Money provides the financing docu- of interest income for you, and provide a year-end report

ments for a real estate transaction: the for tax purposes.

promissory note, the mortgage itself, and

the legal description. Virgin Money will also Q: Why does it matter that I record the mortgage with

record your mortgage with your local Regis- public authorities?

try of Deeds. In addition to the financing A: If your borrower wants to deduct mortgage interest,

documents for a real estate transaction, the mortgage must be recorded with the relevant registry

Virgin Money also offers related services, of deeds. In the event of a default or an audit, you must

including advanced title searches, title show that your transaction was in fact legitimate.

insurance and notary public/closing agents

who will come to your door. And of course,

If you want to write-off a defaulted loan or mortgage as

Virgin Money provides loan management

services for administering the repayment of

bad debt, you must show that you did in fact have docu-

your loan once it is signed and recorded. mentation, that your transaction was legitimate, and that

you did try to collect on it. This means that you must

Call to speak with a private loan specialist keep detailed and accurate records of the logistics of the

to determine which of the following services loan, including each payment, interest rates, and other

you will need in addition to documentation. structures. Virgin Money can handle all the aspects of

managing and recording your mortgage so that you have

• Basic Owner Search: This provides the detailed documentation for public authorities.

name of the current owner, a legal

description of the property, and basic Q: What will other relatives say about this loan?

property tax information. A: If you are a parent setting up a mortgage with one

• Property Search: This provides the name

child, you may be worried about other children becoming

of the current owner, a legal description

for the property, tax information including

resentful. We recommend that you explain your reasoning

the current status of tax payments, and a to your children and let them know that you are structur-

listing of all mortgages and deeds of trust ing the loan as a business investment for both you and

currently pending against the property. the borrower, not gifting money arbitrarily.

• Full Title Search: This search includes

items listed under Property Search as well You should also consider making similar resources avail-

as a detailed report on the property going able on similar terms to other children. This will reduce

back 60 years (depending on the state), the likelihood that you will be accused of playing favorites.

all outstanding liens/encumbrances

(mortgages, deeds of trust, judgments, Q: If interest rates go up or if I can make a higher

liens, UCC filings, tax liens, etc.) pending return on alternative investments in the future, can I

against the property for any party,

increase the interest rate on the mortgage?

enhanced property tax information includ-

ing special assessments against the

A: Yes. There are two options for you in this case. If you

property and any exemptions for the have structured a promissory note with a demand fea-

property. ture, you should not have a problem with getting back

• Tax Escrow Account: This is the monthly your funds so you can make an alternative investment.

payment of a portion of the real estate

taxes into an account which is then used One thing to keep in mind is that if you are going to

to pay the taxes when they are due. incorporate the demand feature into your promissory

• Insurance Escrow Account: This is the note, it’s a good idea to determine the process with

monthly payment of a portion of the which you intend to demand payment (i.e. in writing,

homeowner’s insurance into an account orally), and how long you will give the borrower to pay

which is then used to pay the insurance back the money after you demand it.

when it comes due.

Alternatively, when you are setting up the loan, you

might want to consider structuring the mortgage with an

adjustable rate linked to a market rate such as the

prime rate.

TO GET STARTED SETTING UP YOUR FAMILY MORTGAGE TODAY, VISIT:

WWW.VIRGINMONEY.COM OR CALL 1.800.805.2472 11

HOW CAN WE HELP? Q:What happens if my borrower loses his or her job?

WE CAN WORK WITH YOUR ATTORNEY. A: There are a number of unexpected events during the

life of a loan that may take place, and unemployment

Private real estate transactions in the for the borrower is one of them. If the borrower is

following states typically require the unable to continue making payments during a period of

involvement of a local real estate attorney: financial distress, Virgin Money makes it easy to restruc-

ture the loan and keep it on track to be repaid.

CONNECTICUT

DELAWARE For example, depending on your situation, you can

GEORGIA choose to make the loan payments interest-only to

MASSACHUSETTS lower the burden on the borrower, or you can choose to

NEW JERSEY

forgive the missed payments, spread them out over the

WEST VIRGINIA

course of the mortgage, or add them to the end of the

However, in each of these states, you can term with a balloon payment. Virgin Money specializes

still use our loan servicing including: in different types of loan restructuring options while

keeping the initial terms of the agreement intact. In our

• Automatic payment processing. experience, this reduces the risk of foreclosure and

• Online record-keeping and account helps keep the relationship intact.

management.

• Year-end annual summary reports for

taxes.

Call us to determine the best role for Virgin

Money in your family mortgage.

TALK

You have the right to talk about money. And not

just when it’s time to split the check. Whether

you’re offering a loan or asking for one, it’ll prob-

ably be a little awkward at first. But don’t let that

stop you. Speak from the heart. Be honest. Just

don’t be shy. Good things can come from this

single conversation. Besides, compared to the

birds and the bees, this one’s easy.

TO GET STARTED SETTING UP YOUR FAMILY MORTGAGE TODAY, VISIT:

WWW.VIRGINMONEY.COM OR CALL 1.800.805.2472 12

ABOUT VIRGIN MONEY

We are not a bank. We are not your attorney. We are a

financial services company, and we manage loans and

mortgages that fit you. That last part’s really important.

They fit your needs. They fit your dreams. They fit your

wallet because they’re for you. Some call that revolu-

tionary. We call it changing the face of money.

We’ve been doing it for years. We’ve seen over $200 mil-

lion in loans and mortgages as CircleLending. Now, with

the backing of the Virgin brand, we’re stretching higher

and farther than ever to offer products that bring money

and people closer together.

HOW WE DO IT

We take the simple steps that make sense when you’re

doing a loan or mortgage. The secret to our sauce (shh!)

is a huge helping of friendly, knowledgeable and reliable

support from our team. Every step of the way.

Here is our process:

Document the loan

Set up a repayment schedule

Transfer payments from borrower to lender

according to the schedule

Email regular statements and reminders

Send year-end reports for claiming tax deductions

Take your pick of our real estate products: we offer a

Family Mortgage, a Seller Mortgage or a Retirement Mort-

gage. Entrepreneurs can use a Business Builder loan to

raise capital but stay focused on their business. Anyone

can come up with a good use for a Handshake Plus per-

sonal loan. New car? Tuition? Wedding? Draft a loan

online and you’re on your way.

VALUE At the end of the day, we want to make your loan a suc-

cess and you happy. Why? One, so you’ll refer your family

You have the right to get way more than you pay and friends to us. And two, because it makes us feel good.

for. To the point where you almost feel bad about

it. But don’t feel bad. That would be silly. Of course

we’ll give you great products at fair prices. No

brainer, there. But we’ll also give you other

things-like straight answers to your questions and

brilliant customer service. And we mean like,

pass-the-sunblock brilliant.

TO GET STARTED SETTING UP YOUR FAMILY MORTGAGE TODAY,

VISIT: WWW.VIRGINMONEY.COM OR CALL 1.800.805.2472 13

CALL TO DISCUSS YOUR

VISIT: WWW.VIRGINMONEY.COM

CALL US AT 1.800.805.2472

HOURS OF OPERATION ARE M - F: 9AM - 7PM ET

OPTIONS WITH ONE OF OUR

PRIVATE LOAN SPECIALISTS.

IT’S FREE. WE’RE PRETTY NICE. AND WE

WON’T KEEP CALLING UNLESS YOU

WANT US TO.

TO GET STARTED SETTING UP YOUR FAMILY MORTGAGE TODAY,

VISIT: WWW.VIRGINMONEY.COM OR CALL 1.800.805.2472

You might also like

- Mortgage Payments Weighing You Down ReportDocument3 pagesMortgage Payments Weighing You Down ReportSteve Mun GroupNo ratings yet

- How To Decide In The Elections: A Global Vote-Formula on Issues and Leadership and the Obama-Romney Case in 2012From EverandHow To Decide In The Elections: A Global Vote-Formula on Issues and Leadership and the Obama-Romney Case in 2012No ratings yet

- Cracking Open the Nest Egg: How to make your retirement saving last the distanceFrom EverandCracking Open the Nest Egg: How to make your retirement saving last the distanceNo ratings yet

- Interest OnlyDocument2 pagesInterest OnlySahaNo ratings yet

- Mortgage Interest CreditDocument9 pagesMortgage Interest CreditMortgage ServiceNo ratings yet

- Skinlife Force 2.0: Anti-Microbial Solution For TextileDocument11 pagesSkinlife Force 2.0: Anti-Microbial Solution For TextilejazzyzNo ratings yet

- 8 Things That May Be Missing From Your City Strategic PlanDocument11 pages8 Things That May Be Missing From Your City Strategic Planjose.garcilaso5477No ratings yet

- SLI Assignment of ContractDocument1 pageSLI Assignment of ContractJames BryantNo ratings yet

- Offer Purchase AgreementDocument2 pagesOffer Purchase AgreementAnnika MonariNo ratings yet

- Financial Starter Kit: Gain Financial Literacy and Avoid the Pitfalls of the American DreamFrom EverandFinancial Starter Kit: Gain Financial Literacy and Avoid the Pitfalls of the American DreamRating: 4 out of 5 stars4/5 (1)

- The Reverse Mortgage Advantage: The Tax-Free, House Rich Way to Retire Wealthy!From EverandThe Reverse Mortgage Advantage: The Tax-Free, House Rich Way to Retire Wealthy!No ratings yet

- The Home Saving Bible - Retaining Wealth Through the PandemicFrom EverandThe Home Saving Bible - Retaining Wealth Through the PandemicNo ratings yet

- What Is Home Equity?Document8 pagesWhat Is Home Equity?Jason CarterNo ratings yet

- BIFFPP-Step 7 CPA BermudaDocument8 pagesBIFFPP-Step 7 CPA BermudaRG-eviewerNo ratings yet

- The Little Black Book of Wealth Building Mortgage Secrets: Insider Strategies for Securing a Stable Mortgage and Avoiding Common Pitfalls in Any MarketFrom EverandThe Little Black Book of Wealth Building Mortgage Secrets: Insider Strategies for Securing a Stable Mortgage and Avoiding Common Pitfalls in Any MarketNo ratings yet

- The Claims Game: The Tricks and Deceptive Tactics Insurance Companies Use to Underpay or Deny Your ClaimFrom EverandThe Claims Game: The Tricks and Deceptive Tactics Insurance Companies Use to Underpay or Deny Your ClaimNo ratings yet

- On Home Buying And Credit Repair What You Need To KnowFrom EverandOn Home Buying And Credit Repair What You Need To KnowRating: 2 out of 5 stars2/5 (1)

- Truth in Private Lending: Real Estate Investors Guide to Keeping Scammers Away From Your MoneyFrom EverandTruth in Private Lending: Real Estate Investors Guide to Keeping Scammers Away From Your MoneyNo ratings yet

- 100% Financing For Your New Home Guaranteed. No FICO Score Requirement!From Everand100% Financing For Your New Home Guaranteed. No FICO Score Requirement!No ratings yet

- Release Your Bad Credit Now: The Professional Do It Yourself Guide For Improving Your CreditFrom EverandRelease Your Bad Credit Now: The Professional Do It Yourself Guide For Improving Your CreditNo ratings yet

- The Pros & Cons of Homeownership #1: Wealth Creation: Financial Freedom, #202From EverandThe Pros & Cons of Homeownership #1: Wealth Creation: Financial Freedom, #202No ratings yet

- How to Buy a House: Vital Real Estate Strategy for the First Time Home BuyerFrom EverandHow to Buy a House: Vital Real Estate Strategy for the First Time Home BuyerNo ratings yet

- Turn a Reverse Mortgage Into an Income-Investing Portfolio: Financial Freedom, #138From EverandTurn a Reverse Mortgage Into an Income-Investing Portfolio: Financial Freedom, #138No ratings yet

- House Hacking to Defeat Credit Card Debt: Financial Freedom, #146From EverandHouse Hacking to Defeat Credit Card Debt: Financial Freedom, #146No ratings yet

- Secrets Of The 800+ Club: How To Raise Your Credit Score, Maintain Good Credit, And Live The Life Of UnicornsFrom EverandSecrets Of The 800+ Club: How To Raise Your Credit Score, Maintain Good Credit, And Live The Life Of UnicornsRating: 4 out of 5 stars4/5 (4)

- Home Buying 101: A Handbook and Guide While Buying Your Dream Home!From EverandHome Buying 101: A Handbook and Guide While Buying Your Dream Home!No ratings yet

- The Hidden Value in Your Life Insurance: Funds for Your RetirementFrom EverandThe Hidden Value in Your Life Insurance: Funds for Your RetirementNo ratings yet

- 5 Laws of Credit: For Your Personal Credit and Financial FreedomFrom Everand5 Laws of Credit: For Your Personal Credit and Financial FreedomNo ratings yet

- Acquiring Rental Property: Learning Your Options for Starting Your Investment Portfolio: Real Estate Knowledge Series, #2From EverandAcquiring Rental Property: Learning Your Options for Starting Your Investment Portfolio: Real Estate Knowledge Series, #2No ratings yet

- What Your Realtor, Loan Officer and Appraiser Forgot to Tell You!: A Guide for First Time Home BuyersFrom EverandWhat Your Realtor, Loan Officer and Appraiser Forgot to Tell You!: A Guide for First Time Home BuyersRating: 5 out of 5 stars5/5 (1)

- Spotlight On Finance-June 20171Document5 pagesSpotlight On Finance-June 20171pguevarezNo ratings yet

- Christians Need Credit Repair 2: Call the Credit DoctorFrom EverandChristians Need Credit Repair 2: Call the Credit DoctorNo ratings yet

- Cashflow Without RentalsDocument17 pagesCashflow Without RentalsSadegh SimorghNo ratings yet

- The Everything Improve Your Credit Book: Boost Your Score, Lower Your Interest Rates, and Save MoneyFrom EverandThe Everything Improve Your Credit Book: Boost Your Score, Lower Your Interest Rates, and Save MoneyNo ratings yet

- Fraud Fighters: Uncovering Deceitful Schemes and Protecting YourselfFrom EverandFraud Fighters: Uncovering Deceitful Schemes and Protecting YourselfNo ratings yet

- The Debt Pit Escape Plan: Get Creditors Off Your Back, Climb Out of Debt and Rebuild Your CreditFrom EverandThe Debt Pit Escape Plan: Get Creditors Off Your Back, Climb Out of Debt and Rebuild Your CreditNo ratings yet

- The Credit Score Blueprint: Strategies and Secrets to Raising Your Credit Score: Strategies and Secrets to Raising Your Credit ScoreFrom EverandThe Credit Score Blueprint: Strategies and Secrets to Raising Your Credit Score: Strategies and Secrets to Raising Your Credit ScoreNo ratings yet

- The Seven Winning Numbers: Your path to creating wealth with certainty (leave nothing to chance)From EverandThe Seven Winning Numbers: Your path to creating wealth with certainty (leave nothing to chance)No ratings yet

- A Good Financial Advisor Will Tell You...: Everything You Need To Know About Retirement, Generating Lifetime Income And Planning Your LegacyFrom EverandA Good Financial Advisor Will Tell You...: Everything You Need To Know About Retirement, Generating Lifetime Income And Planning Your LegacyRating: 4 out of 5 stars4/5 (1)

- The Benefits of A Revocable Living Trust - Financial SamuraiDocument41 pagesThe Benefits of A Revocable Living Trust - Financial SamuraiPatrick Duncan100% (1)

- The Elephant in the Room: Sharing the Secrets for Pursuing Real Financial SuccessFrom EverandThe Elephant in the Room: Sharing the Secrets for Pursuing Real Financial SuccessNo ratings yet

- Scam Busters - How to Avoid the Most Popular Scams of Today!From EverandScam Busters - How to Avoid the Most Popular Scams of Today!No ratings yet

- Vba 26 1880 AreDocument2 pagesVba 26 1880 Areapi-269916574No ratings yet

- SBA Loan ChartDocument2 pagesSBA Loan ChartsbdcwtNo ratings yet

- Shawano County Fair TabDocument20 pagesShawano County Fair TabWolfRiverMediaNo ratings yet

- Theory of AccountsDocument11 pagesTheory of AccountsMarc Eric Redondo50% (2)

- Housing Loan ProcedureDocument98 pagesHousing Loan ProcedureGuy BrownNo ratings yet

- VariancesDocument3 pagesVariancesabhikmehta2No ratings yet

- How To Win The BSGDocument30 pagesHow To Win The BSGErdi Akın100% (4)

- Project Hire Purchase and LeasingDocument29 pagesProject Hire Purchase and Leasingsawantrohan214No ratings yet

- Wells Fargo Sued For Alleged Racist Business Practices at San Antonio Customer Service CenterDocument23 pagesWells Fargo Sued For Alleged Racist Business Practices at San Antonio Customer Service CenterDavid Lynch100% (1)

- Email Template LibraryDocument333 pagesEmail Template LibraryHarrison KeithNo ratings yet

- Renovo FinancialDocument11 pagesRenovo FinancialRenovo Financial, LLCNo ratings yet

- Exporting, Importing, and CountertradeDocument29 pagesExporting, Importing, and CountertradeReeja BaigNo ratings yet

- William T. Whiting V Citimortgage IncDocument35 pagesWilliam T. Whiting V Citimortgage IncForeclosure FraudNo ratings yet

- Chapter 15Document18 pagesChapter 15baburamNo ratings yet

- Miquela Anderson - ResumeDocument4 pagesMiquela Anderson - Resumeapi-631992517No ratings yet

- Final ExamDocument102 pagesFinal Examapi-260317931No ratings yet

- Chapter 4 Risks of Financial InstitutionsDocument39 pagesChapter 4 Risks of Financial InstitutionsTu NgNo ratings yet

- IA3 Chapter 2Document7 pagesIA3 Chapter 2Juliana ChengNo ratings yet

- BT Chap 5Document4 pagesBT Chap 5Hang NguyenNo ratings yet

- Conservative Approach To Working Capital Financing: Financing Strategy in EquationDocument4 pagesConservative Approach To Working Capital Financing: Financing Strategy in Equationshamel marohomNo ratings yet

- Financial Institutin ManagementDocument7 pagesFinancial Institutin ManagementAbu SufianNo ratings yet

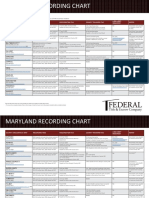

- Maryland Transfer and Recordation Tax Table (2020)Document2 pagesMaryland Transfer and Recordation Tax Table (2020)Federal Title & Escrow CompanyNo ratings yet

- Don'T Miss Out With $24 000 Worth of Prizes To Giveaway!: EventsDocument15 pagesDon'T Miss Out With $24 000 Worth of Prizes To Giveaway!: EventsBriannaTeeseNo ratings yet

- Financially Yours: Assignment IDocument3 pagesFinancially Yours: Assignment IDevesh Prasad MishraNo ratings yet

- PIM Chalinze Road - 21112017 - 0Document24 pagesPIM Chalinze Road - 21112017 - 0VishalBeheraNo ratings yet

- LIBERI V TAITZ (APPEAL) - Appellants' Request For Judicial Notice - 23892610-Liberi-Et-Al-v-Taitz-Et-Al-Req-for-Judicial-Notice-3rd-CircutDocument88 pagesLIBERI V TAITZ (APPEAL) - Appellants' Request For Judicial Notice - 23892610-Liberi-Et-Al-v-Taitz-Et-Al-Req-for-Judicial-Notice-3rd-CircutJack RyanNo ratings yet

- Nursery Technology For Important TreeDocument4 pagesNursery Technology For Important TreeMoshiur Rahman ChowdhuryNo ratings yet

- Illustrative LBO AnalysisDocument21 pagesIllustrative LBO AnalysisBrian DongNo ratings yet

- Mortgage Case StudyDocument7 pagesMortgage Case StudyRajeshKumar0% (1)

- Kanesha SmithDocument23 pagesKanesha Smithalicewilliams83nNo ratings yet