Professional Documents

Culture Documents

88 Forms of Turbulance

Uploaded by

David and Polly Parker, Realtors0 ratings0% found this document useful (0 votes)

151 views1 page88 types of turbulence things that might go wrong during your transaction. Buyer / borrower does not tell the truth on loan application. Loan program changes with higher rates, points and fees.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document88 types of turbulence things that might go wrong during your transaction. Buyer / borrower does not tell the truth on loan application. Loan program changes with higher rates, points and fees.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

151 views1 page88 Forms of Turbulance

Uploaded by

David and Polly Parker, Realtors88 types of turbulence things that might go wrong during your transaction. Buyer / borrower does not tell the truth on loan application. Loan program changes with higher rates, points and fees.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

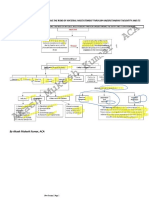

88 Types of Turbulence

Things That Might Go Wrong During Your Transaction

The Buyer/Borrower: 34. Cannot find a suitable The Property:

1. Does not tell the truth on loan replacement property. 62. County will not approve septic

application. 35. Will not allow appraiser inside system or well.

2. Has recent late payments on credit home. 63. Termite report reveals substantial

report. 36. Will not allow inspectors inside damage and seller is not willing to fix.

3. Finds out about additional debt after home in a timely manner. 64. Home was misrepresented as to

loan application. 37. Removes property from the size and condition.

4. Borrower loses job. premises the buyer believed was 65. Home is destroyed prior to closing.

5. Coborrower loses job. included. 66. Home is not structurally sound.

6. Income verification lower than what 38. Cannot clear up liens – is short on 67. Home is uninsurable for

was stated on loan application. cash to close. homeowner’s insurance.

7. Overtime income not allowed by 39. Did not own 100% of property as 68. Property incorrectly zoned.

underwriter for qualifying. previously disclosed. 69. Portion of home sits on neighbor's

8. Applicant makes large purchase on 40. Encounters problems getting property.

credit before closing. partners’ signatures. 70. Unique home and comparable

9. Illness, injury, divorce or other 41. Leaves town without giving properties for appraisal difficult to find.

financial setback during escrow. anyone Power of Attorney.

10. Lacks motivation. 42. Delays the projected move-out The Escrow/Title Company:

11. Gift donor changes mind. date. 71. Fails to notify lender/agents of

12. Cannot locate divorce decree. 43. Did not complete the repairs unsigned or unreturned documents.

13. Cannot locate petition or agreed to in contract. 72. Fails to obtain information from

discharge of bankruptcy. 44. Seller’s home goes into beneficiaries, lien holders, insurance

14. Cannot locate tax returns. foreclosure during escrow. companies or Lenders in a timely

15. Cannot locate bank statements. 45. Misrepresents information about manner.

16. Difficulty in obtaining verification of home and neighborhood. 73. Lets principals leave town without

rent. 46. Does not disclose all hidden or getting all necessary signatures.

17. Interest rate increases and unknown defects and they are 74. Loses or incorrectly prepares

borrower no longer qualifies. subsequently discovered. paperwork.

18. Loan program changes with higher 75. Does not pass on valuable

rates, points and fees. The Realtor(s): information quickly enough.

19. Child support not disclosed on 47. Has no client control over buyers 76. Does not coordinate well, so that

application. or sellers. many items can be done

20. Bankruptcy within the last two 48. Delays access to property for simultaneously.

years. inspection and appraisals. 77. Does not bend the rules on small

21. Mortgage payment is double the 49. Does not get completed problems.

previous housing payment. paperwork to the Lender in time. 78. Finds liens or other title problems

22. Borrower/coborrower does not 50. Inexperienced in this type of at the last minute.

have steady two-year employment property transaction.

history. 51. Takes unexpected time off during The Appraiser:

23. Borrower brings in handwritten transaction and can’t be reached. 79. Is not local and misunderstands

pay stubs. 52. Misleads other parties to the the market.

24. Borrower switches to job with a transaction – has huge ego. 80. Is too busy to complete the

probation period. 53. Does not do sufficient homework appraisal on schedule.

25. Borrower switches from job with on their clients or the property and 81. No comparable sales are

salary to 100% commission income. wastes everyone’s time. available.

26. Borrower/coborrower/seller dies. 82. Is not on the Lender’s “approved

27. Buyer is too picky about property

The Lender(s): list.”

54. Does not properly pre-qualify the 83. Makes important mistakes on

in price range they can afford.

borrower. appraisal and brings in value too low.

28. Buyer feels the house is

55. Wants property repaired prior to 84. Lender requires a second or

misrepresented.

closing. “review” appraisal.

29. Veterans DD214 form not

56. The market raises rates, points or

available.

30. Buyer comes up short of money at

costs. Inspectors:

57. Borrower does not qualify because 85. Pest inspector not available when

closing.

of a late addition of information. needed.

31. Buyer does not properly “paper

58. Lender requires a last-minute 86. Pest inspector too picky about

trail” additional money that comes

second appraisal or other documents. condition of property.

from gifts, loans, etc.

59. Lender loses a form or misplaces 87. Home inspector not available

32. Buyer does not bring cashier’s

entire file. when needed.

check to title company for closing

60. Lender doesn’t simultaneously ask 88. Inspection reports alarm buyer

costs and down payment.

for all needed information. and sale is cancelled.

The Seller: 61. Lender doesn’t fund loan in time

33. Loses motivation to sell (job for close.

transfer does not go through,

reconciles marriage, etc.).

© BY REFERRAL ONLY, Inc. All rights reserved. This material may not be reproduced without the express, written consent of BY REFERRAL ONLY.

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- First PageDocument12 pagesFirst PageBedynz Mark PimentelNo ratings yet

- Budget (May 30 Final)Document252 pagesBudget (May 30 Final)EffNowNo ratings yet

- Ca MemberDocument59 pagesCa Membercap3classesNo ratings yet

- CICPA OverviewDocument20 pagesCICPA OverviewalexanadraNo ratings yet

- Answers To Quiz 10Document3 pagesAnswers To Quiz 10George RahwanNo ratings yet

- Financial ManagementDocument98 pagesFinancial Managementkcmiyyappan2701No ratings yet

- Education Rules, 2059 (2002)Document208 pagesEducation Rules, 2059 (2002)Atish SinghNo ratings yet

- PMP® Short Notes: Based On PMBOK® Guide Fifth Edition To Know About Our Training Schedule, Please Visit Email IdDocument6 pagesPMP® Short Notes: Based On PMBOK® Guide Fifth Edition To Know About Our Training Schedule, Please Visit Email IdMahbub KhanNo ratings yet

- Handout - Concept and Situs of IncomeDocument27 pagesHandout - Concept and Situs of Incomesosexyme123No ratings yet

- GDEX Annual Report 2009 - 2nd PartDocument88 pagesGDEX Annual Report 2009 - 2nd PartElaine YeapNo ratings yet

- EO EncounterDocument12 pagesEO EncounterMJ YaconNo ratings yet

- 7 Depreciation, Deplbtion, Amortization, and Cash FlowDocument52 pages7 Depreciation, Deplbtion, Amortization, and Cash FlowRiswan Riswan100% (1)

- Hinigaran2017 Audit ReportDocument146 pagesHinigaran2017 Audit ReportChito BarsabalNo ratings yet

- S 37 L 0Document23 pagesS 37 L 0anon-475496No ratings yet

- Metro Board of Directors Meeting Agenda, January 2021Document21 pagesMetro Board of Directors Meeting Agenda, January 2021Metro Los AngelesNo ratings yet

- ACC LESSON 1 Balance SheetDocument38 pagesACC LESSON 1 Balance SheetRojane L. AlcantaraNo ratings yet

- 1 As Disclouser of Accounting PoliciesDocument6 pages1 As Disclouser of Accounting Policiesanisahemad1178No ratings yet

- CAS 706 Emphasis of MatterDocument10 pagesCAS 706 Emphasis of MatterzelcomeiaukNo ratings yet

- ISA-315 SummaryDocument19 pagesISA-315 SummaryTaha JasdenNo ratings yet

- Credit Audit FormatDocument14 pagesCredit Audit FormatRAGAVINo ratings yet

- TN Comptroller's FY2017 Audit of Grundy CountyDocument208 pagesTN Comptroller's FY2017 Audit of Grundy CountyDan LehrNo ratings yet

- CG & Corp Failure-ScidirectDocument8 pagesCG & Corp Failure-ScidirectindahmuliasariNo ratings yet

- Handbook TNSTC MduDocument54 pagesHandbook TNSTC MduarthiaugustyNo ratings yet

- Internal Control PoliciesDocument30 pagesInternal Control Policiesintel4mpkNo ratings yet

- Financial Controls FlowchartDocument5 pagesFinancial Controls Flowchartvanausab100% (1)

- Gharkul Ravi PDFDocument2 pagesGharkul Ravi PDFSalman ShaikhNo ratings yet

- Revised Cash Exam ManualDocument34 pagesRevised Cash Exam ManualMaria CharessaNo ratings yet

- 2 Notes Lecture Audit of Cash 2021Document1 page2 Notes Lecture Audit of Cash 2021JoyluxxiNo ratings yet

- PDF Resa Ap Quiz 5b43 - Compress PDFDocument42 pagesPDF Resa Ap Quiz 5b43 - Compress PDFVianney Claire RabeNo ratings yet

- Cbe 1Document18 pagesCbe 1Hasnain ShahNo ratings yet