Professional Documents

Culture Documents

Escrow Account

Uploaded by

Geeti Grover AroraCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Escrow Account

Uploaded by

Geeti Grover AroraCopyright:

Available Formats

Foreign Exchange Management (Export of goods and services) Regulations, 2000 Notification No.

FEMA 23 /2000-RB dated 3rd May 2000

C. Counter Trade

Any arrangement involving adjustment of value of goods imported into India against value of goods exported from India, shall require prior approval of the Reserve Bank. RBI/2011-12/264 A.P. (DIR Series) Circular No. 47 November 17, 2011 To All Category I Authorized Dealer Banks Madam/Sir, Set-off of export receivables against import payablesLiberalization of Procedure Attention of Authorized Dealer Category I (AD Category I) banks is invited to the fact that the requests received from the exporters through their AD branches for set-off of export receivables against import payables are considered by the Reserve Bank of India. As a measure of further liberalization, it has been decided to delegate power to AD Category I banks to deal with the cases of set-off of export receivables against import payables, subject to following terms and conditions: a) The import is as per the Foreign Trade Policy in force. b) Invoices/Bills of Lading/Airway Bills and Exchange Control copies of Bills of Entry for home consumption have been submitted by the importer to the Authorized Dealer bank. c) Payment for the import is still outstanding in the books of the importer. d) Both the transactions of sale and purchase may be reported separately in R Returns. e) The relative GR forms will be released by the AD bank only after the entire export proceeds are adjusted / received. f) The set-off of export receivables against import payments should be in respect of the same overseas buyer and supplier and that consent for set-off has been obtained from him. g) The export / import transactions with ACU countries should be kept outside the arrangement. h) All the relevant documents are submitted to the concerned AD bank who should comply with all the regulatory requirements relating to the transactions. 2. AD Category I banks may bring the contents of this circular to the notice of their constituents and customers concerned. 3. The directions contained in this circular have been issued under Sections 10(4) and 11(1) of the Foreign Exchange Management Act, 1999 (42 of 1999) and are without prejudice to permissions / approvals, if any, required under any other law.

Master Circular on Exports of Goods and Services Master Circular No.14 /2013-14 July 1, 2013 B.17 Counter-Trade Arrangement Counter trade proposals involving adjustment of value of goods imported into India against value of goods exported from India in terms of an arrangement voluntarily entered into between the Indian party and the overseas party through an Escrow Account opened in India in US Dollar will be considered by the Reserve Bank subject to following conditions : (i) All imports and exports under the arrangement should be at international prices in conformity with the Foreign Trade Policy and Foreign Exchange Management Act, 1999 and the Rules and Regulations made there under. (ii) No interest will be payable on balances standing to the credit of the Escrow Account but the funds temporarily rendered surplus may be held in a short-term deposit up to a total period of three months in a year (i.e., in a block of 12 months) and the banks may pay interest at the applicable rate. (iii) No fund based/or non-fund based facilities would be permitted against the balances in the Escrow Account. (iv) Application for permission for opening an Escrow Account may be made by the overseas exporter / organisation through his / their AD Category I bank to the Regional Office concerned of the Reserve Bank. C.28 Agency Commission on Exports (i) AD Category I banks may allow payment of commission, either by remittance or by deduction from invoice value, on application submitted by the exporter. The remittance on agency commission may be allowed subject to the following conditions: a. Amount of commission has been declared on GR/SDF/PP/SOFTEX form and accepted by the Customs authorities or Ministry of Information Technology, Government of India / EPZ authorities as the case may be. In cases where the commission has not been declared on GR/SDF/PP/SOFTEX form, remittance may be allowed after satisfying the reasons adduced by the exporter for not declaring commission on Export Declaration Form, provided a valid agreement/written understanding between the exporters and/or beneficiary for payment of commission exists. b. The relative shipment has already been made. (ii) AD Category I banks may allow payment of commission by Indian exporters, in respect of their exports covered under counter trade arrangement through Escrow Accounts designated in US Dollar, subject to the following conditions: (a) The payment of commission satisfies the conditions as at (a) and (b) stipulated in paragraph (i) above. (b) The commission is not payable to Escrow Account holders themselves. (c) The commission should not be allowed by deduction from the invoice value. (iii) Payment of commission is prohibited on exports made by Indian Partners towards equity participation in an overseas joint venture / wholly owned subsidiary as also exports under Rupee Credit Route except commission up to 10 per cent of invoice value of exports of tea & tobacco.

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- CPA Examination Regulations: What You Need To KnowDocument24 pagesCPA Examination Regulations: What You Need To KnowGeeti Grover AroraNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Procedure of Registration Under Professional TaxDocument1 pageProcedure of Registration Under Professional TaxGeeti Grover AroraNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- 11 Eco Sample Paper 1Document14 pages11 Eco Sample Paper 1Geeti Grover AroraNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- E-Icc & E-TripDocument2 pagesE-Icc & E-TripGeeti Grover AroraNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Van Conversion Bible - The Ultimate Guide To Converting A CampervanDocument170 pagesThe Van Conversion Bible - The Ultimate Guide To Converting A CampervanPil100% (3)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- VAT (Chapter 8 Compilation of Summary)Document36 pagesVAT (Chapter 8 Compilation of Summary)Dianne LontacNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Financial Analysis of OGDCLDocument16 pagesFinancial Analysis of OGDCLsehrish_sadaqat7873100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Splunk Certification: Certification Exam Study GuideDocument18 pagesSplunk Certification: Certification Exam Study GuidesalemselvaNo ratings yet

- Statement of Facts:: State of Adawa Vs Republic of RasasaDocument10 pagesStatement of Facts:: State of Adawa Vs Republic of RasasaChristine Gel MadrilejoNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- What Is Bitcoin MiningDocument4 pagesWhat Is Bitcoin MiningCarmen M Leal CurielNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shell Omala s2 GX 320 TdsDocument2 pagesShell Omala s2 GX 320 TdsOnie Hammamz OylNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- SecuritizationDocument46 pagesSecuritizationHitesh MoreNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Partes Oki - MPS5501B - RSPL - Rev - HDocument12 pagesPartes Oki - MPS5501B - RSPL - Rev - HJaiber Eduardo Gutierrez OrtizNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Samarth Arora: Curriculum VitaeDocument2 pagesSamarth Arora: Curriculum VitaeAditya SinghalNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- British Forces in 2nd Battle of AlameinDocument10 pagesBritish Forces in 2nd Battle of AlameinDinko Odak100% (1)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Universal Marine: Welcome To Our One Stop Marine ServicesDocument8 pagesUniversal Marine: Welcome To Our One Stop Marine Serviceshoangtruongson1111No ratings yet

- Invidis Yearbook 2019Document51 pagesInvidis Yearbook 2019Luis SanchezNo ratings yet

- Deploying MVC5 Based Provider Hosted Apps For On-Premise SharePoint 2013Document22 pagesDeploying MVC5 Based Provider Hosted Apps For On-Premise SharePoint 2013cilango1No ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- PLLV Client Consent FormDocument4 pagesPLLV Client Consent Formapi-237715517No ratings yet

- K8+ Single Chip Keyer Manual: 3 To 5 VDCDocument8 pagesK8+ Single Chip Keyer Manual: 3 To 5 VDCtito351No ratings yet

- County Project Name Cycle Project Address Proj City Proj Zip Applicant/Owner Name HDGP $ Home $ FHTF $ Lihtc9 $ Help $ Oahtc $ Ghap $ HPF $ Lihtc4 $Document60 pagesCounty Project Name Cycle Project Address Proj City Proj Zip Applicant/Owner Name HDGP $ Home $ FHTF $ Lihtc9 $ Help $ Oahtc $ Ghap $ HPF $ Lihtc4 $Mamello PortiaNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- HRM Ass1Document3 pagesHRM Ass1asdas asfasfasdNo ratings yet

- FinTech RegTech and SupTech - What They Mean For Financial Supervision FINALDocument19 pagesFinTech RegTech and SupTech - What They Mean For Financial Supervision FINALirvandi syahputraNo ratings yet

- Pepsico IncDocument26 pagesPepsico IncYKJ VLOGSNo ratings yet

- IM0973567 Orlaco EMOS Photonview Configuration EN A01 MailDocument14 pagesIM0973567 Orlaco EMOS Photonview Configuration EN A01 Maildumass27No ratings yet

- Bsa 32 Chap 3 (Assignment) Orquia, Anndhrea S.Document3 pagesBsa 32 Chap 3 (Assignment) Orquia, Anndhrea S.Clint Agustin M. RoblesNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- 2B. Glicerina - USP-NF-FCC Glycerin Nutritional Statement USP GlycerinDocument1 page2B. Glicerina - USP-NF-FCC Glycerin Nutritional Statement USP Glycerinchristian muñozNo ratings yet

- U-Blox Parameters Setting ProtocolsDocument2 pagesU-Blox Parameters Setting Protocolspedrito perezNo ratings yet

- Media and Information Literacy Quarter 3 Module 1Document67 pagesMedia and Information Literacy Quarter 3 Module 1Joshua Catequesta100% (1)

- Soal TKM B. Inggris Kls XII Des. 2013Document8 pagesSoal TKM B. Inggris Kls XII Des. 2013Sinta SilviaNo ratings yet

- Ara FormDocument2 pagesAra Formjerish estemNo ratings yet

- Impact of Wrongful Termination On EmployeesDocument4 pagesImpact of Wrongful Termination On EmployeesAvil HarshNo ratings yet

- Operational Business Suite Contract by SSNIT Signed in 2012Document16 pagesOperational Business Suite Contract by SSNIT Signed in 2012GhanaWeb EditorialNo ratings yet

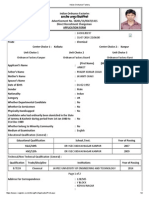

- Indian Ordnance FactoryDocument2 pagesIndian Ordnance FactoryAniket ChakiNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)