Professional Documents

Culture Documents

Magma Fincorp Introduction

Uploaded by

Ankur AgarwalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Magma Fincorp Introduction

Uploaded by

Ankur AgarwalCopyright:

Available Formats

As he looked outside the window of his car, Sanjay Chamria, reminisced his 24 year journey with Magma Fincorp.

The company was started in 1988 with 3 people and its initial line of business as lending and leasing. Sanjay, a chartered accountant at 21 and a son of tax consultant was always ready to try his hand at business though he had the far easier option of inheriting a lucrative business; also, the job offers that came from cigarette maker ITC, or even RBI. It was the craze of the 1980s that drew him to this business. It was Magma Leasing in 1989 when leasing and hire purchase was a fad, with scores of entities popping up across the country. But only a few survived, only those who adapted to the changing business climate. From lending to purchase photocopiers and air-conditioners, he switched to lending for purchase of heavy equipment used in infrastructure. That led him to a tie-up with one of the biggest equipment makers, Caterpillar. What started as a three people firm more than two decades ago now employs 5,700 people in more than 200 locations with assets worth 14,000 crore. However, Sanjay now had a lot on his mind. Economy had slowed down and so did the collection efficiency from its major customers which included rural and semi urban households. The company had expanded in this time of de-growth into 3 new businesses namely gold loans, housing finance and insurance. However, with RBI revising its norms for financing to NBFCs, acquiring capital to fund its expansion had suddenly become a difficult task. He was going to attend a conference press call hosted by IDFC Securities which included audience ranging from private investors to mutual funds. He was to join Mr. V Lakshmi Narasimhan CFO, and Mr. Kailash Baheti, CSO of Magma Fincorp to talk about companys performance and important events. He had huge aspirations for Magma and he wanted to continue its expansion strategy to acquire new lines of businesses. Introduction Magma Fincorp (formerly Magma Leasing) is a Kolkata-headquartered asset financing company registered with the Reserve Bank of India. The company was incorporated in 1988 and commenced operations in 1989 and over time has grown into a mid-scale financial services company. In 1992, the company merged with Arm Group Enterprises to strengthen its presence and later in 1996 entered retail financing business for vehicles and construction equipment. In the year 2000, with the Acquisition of Consortium Finance Ltd, Magma expanded its network across Northern India. In early 2007, Magma acquired Shrachi Infrastructure Finance (SIFL), which helped it increase its footprint in southern and western India and enabled it to expand its distribution network to a Pan-India India level. Same year, the company formed a joint venture with International Tractors Limited (ITL) to enter tractor finance business. In 2008, Magma completed a major re-branding exercise and renamed itself as Magma Fincorp Limited. In 2009, Magma inked a joint venture with German insurer HDI Gerling to enter general insurance business. The company has received its R1 license in April 2011. In the same year, Magma picked up 7% stake in the newly formed Experian Credit Information Company of India Private Ltd, the Indian arm of the global credit information services company. In 2011, Kohlberg Kravis Roberts (KKR) a large global PE

firm and International Finance Corporation, an arm of the World Bank Group invested about $100 million in Magma. The company operates 275+ branches across 21 states and a union territory and has a strong presence in rural and semi-rural India. . It offers financing solutions for commercial vehicles, cars, construction equipment, tractors and utility vehicles. Over 75% of the branches are located in rural and semi-urban markets, playing a crucial role in financial inclusion in these markets. Further, over 50% of Magmas customers have availed their first time loans from the organized financial lender. The company is eyeing a national footprint to leverage its diversified businesses by increasing its presence in western and southern India. Magmas unique business model of focusing on the underpenetrated rural and semi-urban markets has enabled it to deliver consistent and sustained performance over the years. It dealt with the economic slowdown during 2008-09 by adopting a series of initiatives, including introduction of additional business and collection verticals, increased focus on maintaining asset quality, effective management of treasury and operating costs and strengthening its robust collection mechanism.

Industry Overview Non-banking financial companies (NBFCs) are fast emerging as an important segment of Indian financial system. It is an heterogeneous group of institutions (other than commercial and co-operative banks) performing financial intermediation in a variety of ways, like accepting deposits, making loans and advances, leasing, hire purchase, etc. They raise funds from the public, directly or indirectly, and lend them to ultimate spenders. They advance loans to the various wholesale and retail traders, small-scale industries and self-employed persons. Thus, they have broadened and diversified the range of products and services offered by a financial sector. Gradually, they are being recognised as complementary to the banking sector due to their customer-oriented services; simplified procedures; attractive rates of return on deposits; flexibility and timeliness in meeting the credit needs of specified sectors; etc. Infrastructure holds the key to the economic resurgence of India, and infrastructure financing holds the key to vitality of the infrastructure sector. On a policy plane, several

initiatives have been taken to promote infrastructure financing, but it seems as if they are not enough and effective. Infrastructure Finance Companies and Non-banking finance companies in the asset-based financing space are growing at impressive growth rate. The world of nonbanking finance in India, asset finance in particular, has widely been perceived as parallel to the banking system. Other than remittance and ondemand deposits, NBFCs practically do everything that banks do. As per Economic Survey 2012, NBFCs take more than 12% share in the assets of the entire financial system this is quite a sizeable contribution. Asset finance companies provide funding against tangible assets. Asset finance companies have been riding the capital expenditure boom of corporate India. Infrastructure companies, in particular, have seen a strong correlation between infrastructure spending and the growth of the industry. Growth and Market share of Magma Fincorp in the NBFC sector Magma Fincorp has been steadily growing in the NBFC sector. The relative reach of the NBFCs with respect to the bank gives them an edge over them. Moreover, faster processing and in-house collection/recovery infrastructure, gives these NBFCs the push to outperform banks in this segment. The company has grown to more than 7000 employees across geographies. It has a 21% growth (5 years compounded) in assets under management (AUM) to 18378 cr as on March 31 2013. The reported PAT of the company has grown from 39.04 cr in 2008 to 122.8 cr in 2012. The total income has also increased from 625 cr in 2008 to 1606 cr in 2012 (Refer Exhibit for the YOY comparison of the company). The company has a diverse portfolio ranging from passenger cars, commercial vehicles, construction equipment, tractors, refinancing, SME loans, gold loans, insurance and housing. The pie chart in Exhibit shows the distribution of the disbursements in its various businesses. Except for the commercial vehicle segment Magma showed stable positive growth in all the various lines of businesses, even though the industry de-grew in some of the segments. Strategy of Magma Fincorp Magma was started as a vehicle leasing company in 1989 since then has expanded its operations into 10 lines of businesses. The main strategy of Magma has been to acquire well-established profit making entities to venture into new lines of businesses. However, in each line of business Magma has a different strategy employed to keep the business profitable and to achieve growth despite an economic downturn. Commercial Vehicle Segment Even though automobiles have been used in India for decades, the extent of underpenetration makes the Indian automotive industry a sunrise sector. This explains why even as India is the worlds fifth largest commercial vehicle manufacturer; it is also the fastest

growing. While the small commercial vehicle (SCV) segment continued to sustain the sectorial momentum (19.8 percent volume growth y-o-y), the LCV and HCV segments degrew 12.9 percent and 27.6 percent respectively in 2012-13 following sluggish industrial movement. Magma constitutes a consolidated market share of 2.4 percent with presence in all segments. SCV and MCV being the highest margin segments among the commercial vehicle segment, Magma decided to further penetrate this segment while leaving out the LCV which is quite low margin. It also plans to penetrate deeper into the HCV segment which is again high margin but only when the industry shows signs of revival. This was the only segment which showed negative growth, however, it was more of a conscious withdrawal rather than an ominous sign. Passenger Car and utility vehicle segment Though the passenger car segment de-grew by 6.7 percent, Magma, with a strong presence in rural and semi-urban India capitalized on the growth provided by MUVs or Multi-Utility Vehicles. This segment grew by 32.1 percent and Magma to capitalize on its growth offered no-income proof loans based on bank documents with loan processing under 4 hours. This lean and hassle free approach loan availing approach led to a growth of 33.71 percent of Magma in this segment. Magma plans to continue its growth based on multi-utility vehicles and rope in contracts with various dealers to enable faster delivery of loans. Construction Equipment Infrastructure sector has experienced a dramatic slowdown which eventually hit the construction equipment segment. The segment saw de-growth of 8.22 % over the last year. However, the strategy of Magma in this case has to tie-up with different OEMs like JCB, L&T, and Telecon to finance their products. Magma also boasts of the shortest TAT (Turn Around Time) for financing assets to customers. These tie-ups and speedy delivery of loans helped Magma to achieve a positive growth of 4.11 percent even though the industry saw a negative growth of 8.22%. Tractor Financing This is one of the recent endeavors of Magma which was initiated in 2007-08 through a JV with ITL (International Tractors Limited). In this segment too, Magma has collaborations with OEMs like John Deere, Mahindra & Mahindra and ITL to offer low interest loans to farmers. Magma focuses on farmers having less than 6 acres of land and has tried to extend its reach to deep rural farmers. However, it had to sacrifice its collection efficiency to achieve the growth in this segment which was reduced to 96% as compared to 97.2% in the previous year. Even though overall this segment saw a negative growth of 1.5%, Magma saw a positive growth of around 54% in this segment. Suvidha (Refinancing)

This has been a natural extension of the commercial vehicle segment. Magma financed used-commercial vehicles (2-15 years old) targeting the lower end first-time rural buyers. Though in the niche stage, Magma has a strategy in place to target more customers by diversifying its product offerings to include tire loans. Magma also employs resident equipment evaluators to evaluate equipment valuation norms and to improve its collection efficiency. In this segment, Magma saw a growth of 61.7% as compared to the previous year. SME Loans This segment was included in the portfolio in the year 2007-08. Magma boasts of the highest unsecured EMI based loans to SMEs, of upto 2 crores. Magma employs comprehensive balance sheet appraisals for working capital financing in this segment. It has diversified its portfolio into 3 segments unsecured SME with an eligibility of upto crores, Micro-SME with an eligibility of upto 7.5 lacs and self-employed doctors where practicing doctors are given a loan of upto 15 lacs. The strategy in this segment has been to introduce new products to cater new un-banked segments of rural India. This product diversification has led to a Y-O-Y growth of around 45 % in this sector for Magma. Insurance A relatively newer addition to the portfolio, Magma started with this segment in the year 2012 with a joint venture with Germany-based general insurer, HDI Gerling. Product profile includes Motor insurance which includes passenger cars and commercial vehicles, Fire insurance and Industrial insurance. Coupled with financing of new and used vehicles, Magma also ventured in this post-buying solution to completely cater the demands of the segment. The strategy employed in this segment is to leverage on the already existing IT platform, branch network and support services to develop a low-investment insurance network across all states. It already has presence in 21 states with 42 shared branches and 3 independent branches. Within 6 months of it being operational, the company garnered a premium of 95.82 crores. Gold Loans With unavailability of cash with rural and semi-urban customers, Magma started with gold loans as it had complementary customer segments. This segment was started in 2012-13 and reported a collection of 58.4 cr in AUMs within the first nine months. The main strategy of Magma in this segment is to double its gold loan branches and focusing on states with high rural penetration like Gujarat, Madhya Pradesh and Rajasthan. Housing Finance The most recent venture of Magma, it became operational in May 2013 with its acquisition of GE Money Housing Finance. The strategy employed in this segment is to finance

affordable housing needs with loans upto 25 lacs in Tier 2 and Tier 3 markets targeting the rural and semi-urban households.

You might also like

- RJR Nabisco Special Committee Members and AdvisorsDocument13 pagesRJR Nabisco Special Committee Members and AdvisorsRattan Preet Singh25% (4)

- Time Management AnalysisDocument1 pageTime Management AnalysisAnkur AgarwalNo ratings yet

- Students Management FrameworkDocument7 pagesStudents Management FrameworkAnkur AgarwalNo ratings yet

- Cognizant ReportDocument2 pagesCognizant ReportAnkur AgarwalNo ratings yet

- MFI RegulationsDocument2 pagesMFI RegulationsAnkur AgarwalNo ratings yet

- Class Groups (E)Document2 pagesClass Groups (E)Ankur AgarwalNo ratings yet

- Globalization AssignmentDocument2 pagesGlobalization AssignmentAnkur AgarwalNo ratings yet

- CFCL - SR 2010-11 (Live Responsibly - Final)Document84 pagesCFCL - SR 2010-11 (Live Responsibly - Final)Ankur AgarwalNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Poultry FarmDocument22 pagesPoultry Farmrisingprince89No ratings yet

- CheckwritingDocument2 pagesCheckwritingLiz Pasillas100% (6)

- Chapter 2 Macro SolutionDocument16 pagesChapter 2 Macro Solutionsaurabhsaurs80% (10)

- Datapoint Business Plan Diamond BankDocument25 pagesDatapoint Business Plan Diamond BankCyril Justus EkpoNo ratings yet

- Practice Exam Chapter 6-9Document4 pagesPractice Exam Chapter 6-9John Arvi ArmildezNo ratings yet

- International Management: An IntroductionDocument22 pagesInternational Management: An IntroductionTeodoro Criscione100% (1)

- Manufacturing Shampoo Project ProfileDocument2 pagesManufacturing Shampoo Project Profilevineetaggarwal50% (2)

- An Introduction To SwapsDocument5 pagesAn Introduction To SwapsCh RajkamalNo ratings yet

- Lbo Model Short FormDocument6 pagesLbo Model Short FormHeu Sai HoeNo ratings yet

- East Hill Home Healthcare Services Was Organized On January 1Document1 pageEast Hill Home Healthcare Services Was Organized On January 1trilocksp SinghNo ratings yet

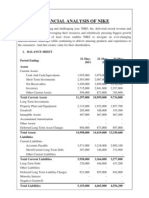

- Financial Analysis of NikeDocument5 pagesFinancial Analysis of NikenimmymathewpkkthlNo ratings yet

- HTTP WWW - Fciweb.nic - in RTI DOP-Adm Powers - HTMDocument4 pagesHTTP WWW - Fciweb.nic - in RTI DOP-Adm Powers - HTMNeha SharmaNo ratings yet

- Top - 100 Outsourcing Location Ranking - 2013 Tholons PDFDocument11 pagesTop - 100 Outsourcing Location Ranking - 2013 Tholons PDFvendetta82pgNo ratings yet

- Joint Venture PPT FinalDocument13 pagesJoint Venture PPT FinalKazi Taher SiddiqueeyNo ratings yet

- Fundraising Best Practices: 2020 EditionDocument23 pagesFundraising Best Practices: 2020 EditionFounder InstituteNo ratings yet

- A Study On The Investment Avenues For Indian InvestorDocument86 pagesA Study On The Investment Avenues For Indian Investormohd aleem50% (4)

- Analyzing Financial Data: Ratio AnalysisDocument12 pagesAnalyzing Financial Data: Ratio AnalysiscpdNo ratings yet

- FI Document: List of Update Terminations: SA38 SE38Document11 pagesFI Document: List of Update Terminations: SA38 SE38Manohar G ShankarNo ratings yet

- Brett Ishler ResumeDocument3 pagesBrett Ishler ResumebishlerNo ratings yet

- JLL Zuidas Office Market Monitor 2014 Q4 DEFDocument16 pagesJLL Zuidas Office Market Monitor 2014 Q4 DEFvdmaraNo ratings yet

- What Is An Extended TrialDocument19 pagesWhat Is An Extended TrialocalmaviliNo ratings yet

- Commodity Channel IndexDocument45 pagesCommodity Channel IndexVarlei Rezer100% (2)

- Chapter 6 - Slides HittDocument24 pagesChapter 6 - Slides HittNur ShafieQahNo ratings yet

- TCS-Registration Process - User Flow DocumentDocument8 pagesTCS-Registration Process - User Flow DocumentMadhan kumarNo ratings yet

- Assignment 2Document3 pagesAssignment 2KARLANo ratings yet

- Uncertainty and Risk Analysis in Petroleum Exploration and ProductionDocument12 pagesUncertainty and Risk Analysis in Petroleum Exploration and ProductionOladimeji TaiwoNo ratings yet

- Presented By: Presented By: - Rohit Goel Rohit Goel (M.B.A. HONS. 2.2) (M.B.A. HONS. 2.2) Roll No ROLL NO - 2207 2207Document12 pagesPresented By: Presented By: - Rohit Goel Rohit Goel (M.B.A. HONS. 2.2) (M.B.A. HONS. 2.2) Roll No ROLL NO - 2207 2207meetrohitgoel0% (1)

- Goat Farm BudgetingDocument9 pagesGoat Farm Budgetingqfarms100% (1)

- Mrs. StoneDocument11 pagesMrs. StonespanischkindNo ratings yet

- Unisa PDFDocument325 pagesUnisa PDFzukiswa0% (1)