Professional Documents

Culture Documents

36ONE Fact Sheets September

Uploaded by

rdixit2Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

36ONE Fact Sheets September

Uploaded by

rdixit2Copyright:

Available Formats

36ONE Fund Fact Sheet September 2012

The 36ONE Fund is a single strategy, equity long-short hedge fund with a low net equity bias that invests in equities and other financial instruments which are used to enhance returns and manage risk. Fund name: Strategy: Investment Manager: E-mail: Investment Objectives: Generate absolute returns over the long-term regardless of market direction; Enhance investors' capital in real terms; Generate above average returns; Reduce market timing risk by managing market volatility.

Cumulative Performance Since Inception

200 195 190 185 180 175 170 165 160 155 150 145 140 135 130 125 120 115 110 105 100 95 90 85 80

INVESTMENT PERFORMANCE Returns to 30 Sep 2012 1 Month 3 Months 6 Months 12 Months Since Inception p.a. Risk Measures Standard Deviation (annualised)* Loss Deviation* Gain Deviation* Sharpe Ratio* Sortino Ratio* Largest Draw Down Largest Uninterupted Loss Best Month Worst Month Gain Periods Loss Periods % Gain Periods Correlation Value at Risk - 95%

*Statistics based on 36 month rolling period

36ONE

0.43% 5.02% 6.87% 20.26% 19.58%

Cash

0.37% 1.10% 2.35% 4.88% 6.16%

ALSI

1.64% 7.26% 8.31% 24.43% 17.89%

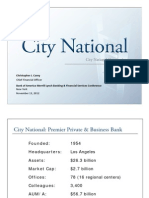

36ONE Fund Equity long-short 36ONE Asset Management

sliptz@36one.co.za

36ONE

3.89% 0.52% 3.55% 2.76 20.10 -1.09% -1.09% 3.53% -0.83% 41 5 89.13% 1.00 2.73%

Cash

0.18% 0.48% n/a 0.92% 0.37% 46 100.00% 0.26 0.68%

ALSI

13.96% 5.4% 11.75% 0.73 1.84 -13.70% -13.70% 11.02% -9.87% 28 18 60.87% 0.62 5.42%

Growth

Contact Name: Tel: Fax:

Benchmark ALSI Fund

Steven Liptz (2711) 722 7393 (2711) 722 7391 sliptz@36one.co.za 6A Sandown Valley Crescent, Sandown, Sandton, 2196

E-mail: Physical:

Relative Frequency Distribution of Returns

70%

60%

Inception: Fund Size: Benchmark: Subscriptions: Redemptions: Management fee: Performance fee:

<-10% -10--8% -8--6% -6--4% -4--2% -2--0% 0-2% 2-4% 4-6% 6-8% 8-10% >10%

1 December 2008 R302.7 million Standard Bank Wholesale Call Rate Monthly 1 calendar month 1% p.a. 20% of gains using the high watermark Investment Data Services PWC

50%

Monthly Periods (%)

40%

30%

20%

10%

0%

Administrators: Auditors:

Return Range (% )

Net Monthly Performance Since Inception: Jan

2008 2009 2010 2011 2012 2.04 1.08 1.12 2.57

Feb

1.88 2.00 1.30 2.61

Mar

2.49 1.96 -0.01 1.58

Apr

2.10 1.41 2.02 2.21

May

2.80 -0.83 0.75 -0.28

Jun

1.72 -0.26 0.24 -0.16

Jul

3.53 2.22 0.37 1.90

Aug

2.00 0.46 0.35 2.62

Sep

1.35 2.01 1.32 0.43

Oct

3.43 2.09 3.34 -

Nov

0.11 0.75 1.15 -

Dec

1.50 3.47 1.89 0.71 -

YTD

1.50 30.44 15.76 13.36 14.25

This Data Sheet is a private publication intended for private circulation, and may not be distributed to any person other than the recipient. It is for information purposes only, regarding decisions taken within the fund and the profile assumed by the fund, and should not be seen as an offer to sell or an invitation to invest. It is the responsibility of any person in possession of this document to inform themselves of, and observe, any applicable laws and regulations of the relevant jurisdiction. Performance numbers are historical, and the performance data is provided by Investment Data Services. The value of all investments and the income there from can go down as well as up, and as such the past is not necessarily a guide to future performance. 36ONE Asset Management is an authorised financial services provider. The 36ONE Fund, along with all other hedge funds in South Africa, is unregulated by the FSB.

36ONE Hedge Fund Fact Sheet September 2012

The 36ONE Hedge Fund is a single strategy, equity long-short hedge fund that invests in equities and other financial instruments which are used to enhance returns and manage risk. Fund name: Strategy: Investment Manager: E-mail: Investment Objectives: Generate absolute returns over the long-term regardless of market direction; Enhance investors' capital in real terms; Generate above average returns; Reduce market timing risk by managing market volatility.

Cumulative Performance Since Inception

340 330 320 310 300 290 280 270 260 250 240 230 220 210 200 190 180 170 160 150 140 130 120 110 100 90

INVESTMENT PERFORMANCE Returns to 30 Sep 2012 1 Month 3 Months 6 Months 12 Months Since Inception p.a. Risk Measures Standard Deviation (annualised)* Loss Deviation* Gain Deviation* Sharpe Ratio* Sortino Ratio* Largest Draw Down Largest Uninterupted Loss Best Month Worst Month Gain Periods Loss Periods % Gain Periods Correlation Value at Risk - 95%

*Statistics based on 36 month rolling period

36ONE

0.42% 6.32% 8.59% 26.38% 20.32%

Cash

0.37% 1.10% 2.35% 4.88% 7.54%

ALSI

1.64% 7.26% 8.31% 24.43% 12.19%

36ONE Hedge Fund Equity long-short 36ONE Asset Management

sliptz@36one.co.za

36ONE

5.61% 1.24% 5.02% 2.54 11.29 -11.57% -11.57% 6.25% -11.57% 64 14 82.05% 1.00 3.48%

Cash

0.18% 0.18% n/a 0.95% 0.37% 78 100.00% -0.23 0.68%

ALSI

13.96% 5.4% 10.01% 0.73 1.84 -23.34% -23.34% 12.45% -13.24% 49 29 62.82% 0.61 5.42%

Growth

Contact Name: Tel: Fax:

Benchmark ALSI Fund

Steven Liptz (2711) 722 7393 (2711) 722 7391 sliptz@36one.co.za 6A Sandown Valley Crescent, Sandown, Sandton, 2196

E-mail: Physical:

Relative Frequency Distribution of Returns

50% 45% 40% 35%

Inception: Fund Size: Benchmark: Subscriptions: Redemptions: Management fee: Performance fee:

<-10% -10--8% -8--6% -6--4% -4--2% -2--0% 0-2% 2-4% 4-6% 6-8% 8-10% >10%

1 April 2006 R2.2 billion Standard Bank Wholesale Call Rate Monthly 1 calendar month 1% p.a. 20% of gains using the high watermark Investment Data Services PWC

Monthly Periods (%)

30% 25% 20% 15% 10% 5% 0%

Administrators: Auditors:

Return Range (% )

Net Monthly Performance Since Inception: Jan

2006 2007 2008 2009 2010 2011 2012 5.86 -11.57 -0.11 1.27 1.92 3.24

Feb

1.79 4.74 -1.04 1.61 1.98 3.15

Mar

3.79 1.12 1.47 0.54 0.04 2.04

Apr

1.27 6.24 4.32 2.65 1.68 2.69 2.57

May

0.02 5.28 2.24 4.65 -1.90 1.34 -0.52

Jun

1.44 -0.07 -2.28 2.20 -0.43 0.70 0.10

Jul

2.40 0.44 -5.73 5.18 3.03 0.47 2.39

Aug

3.35 1.76 -0.38 1.29 0.16 0.36 3.40

Sep

2.39 1.40 -3.25 2.89 2.55 1.26 0.42

Oct

4.58 5.43 1.26 5.39 2.45 4.36 -

Nov

6.25 -2.76 -1.97 -0.80 1.64 1.58 -

Dec

3.81 2.08 1.30 5.16 1.40 1.03 -

YTD

28.44 35.57 -10.80 32.72 14.83 19.17 18.00

This Data Sheet is a private publication intended for private circulation, and may not be distributed to any person other than the recipient. It is for information purposes only, regarding decisions taken within the fund and the profile assumed by the fund, and should not be seen as an offer to sell or an invitation to invest. It is the responsibility of any person in possession of this document to inform themselves of, and observe, any applicable laws and regulations of the relevant jurisdiction. Performance numbers are historical, and the performance data is provided by Investment Data Services. The value of all investments and the income there from can go down as well as up, and as such the past is not necessarily a guide to future performance. 36ONE Asset Management is an authorised financial services provider. The 36ONE Hedge Fund, along with all other hedge funds in South Africa, is unregulated by the FSB.

36ONE OFFSHORE PORTFOLIO

FUND ADVISOR

The 36ONE O shore Portfolio is a single strategy, equity long short hedge fund that invests in equities and other nancial instruments which are used to enhance returns and manage risk.

September 2012

Commentary

STRATEGY

- generate absolute returns regardless of market direction; - enhance investors capital in real terms; - generate above average returns; - reduce market timing risk by managing market volatility.

The fund did not participate in the local markets rise of 1.6% for the month principally due to our underweight position in resources, which bounced from multi-year lows. The violent labour unrest currently underway in the local mining sector will negatively impact the profitability of affected mining companies, but will also disrupt supply of certain key minerals, pushing up spot prices. We have positioned the fund to benefit from the anticipated increase in spot commodity prices of those metals for which South Africa constitutes the majority of world supply a much better risk/reward trade than exposure to the miners themselves, in our opinion. We are also growing increasingly concerned about the strong growth in unsecured lending, which could ultimately lead to a credit bubble and increased strain on consumer spending. We have therefore positioned the fund more defensively to mitigate against these risks.

Monthly Returns (USD)

STRATEGY

Long - Short Equity with a low net bias

Jan 2008 2009 2010 2011 2012 -0.31% 0.62% 0.04% 2.58%

Feb 0.43% 1.31% 1.11% 2.49%

Mar 1.66% 2.77% 0.03% 1.12%

April 2.50% 0.97% 1.67% 1.62%

FUND DATA

Domicile Fund Structure Subscriptions Redemptions Administrator Auditors Base Currency Cayman Islands Segregated Portfolio Monthly 1 Calendar Month Altree Fund Services Ltd. Deloitte USD $150 000 $100 000 2% 20%* 1 May 2008

These gures represent net returns. Management and Performance fees have been deducted from the fund

Fund Analysis

May June 2.99% 1.29% 3.11% 3.10% -0.94% -0.34% 0.81% 0.06% -0.96% -0.07%

July 2.20% 4.01% 2.94% 0.16% 1.58%

Aug Sep 2.24% -0.60% 1.52% 1.79% 0.37% 2.15% 0.25% 1.18% 1.98% 0.08%

Oct 4.29% 2.33% 1.57% 3.16%

Nov 1.48% 0.10% 0.69% 1.12%

Dec 2.64% 3.62% 2.58% 0.58%

YTD 17.68% 26.67% 15.63% 10.61% 10.85%

Fund Analysis

Current Month Return Deepest Drawdown % Protable Months Average Monthly Return Average Loss Best Month Worst Month Last 12 Months 0.08% -1.28% 88.68% 1.43% -0.54% 4.28% -0.96% 16.30% LIBOR Annualised Return Annualised Volatility Sharpe Net Equity Exposure Leverage Largest Long Exposure Largest Short Exposure 0.22% 18.43% 4.44% 3.99 51.43% 120.37% 6.85% 3.32%

Minimum investment Top Up Investment Annual Management Fee Annual Performance Fee Formation Date

* 20% of increase in NAV will be levied on a high watermark basis.

CONTACT DETAILS

Maree Wilms maree.wilms@sa-alpha.com T +27 11 722 7309

Net Sector Exposure

Basic Materials Bonds Consumer Goods Consumer Services Financials Health Care 4.7% 6.8% 13.0% 7.6% 6.9% 5.1% Index Futures Industrials Oil and Gas Other Technology Telecommunications Unlisted -7.1% 7.0% 1.7% 2.3% 4.0% 4.5% 1.6%

CUMULATIVE PERFORMANCE GRAPH

120% 100% 80% 60% 40% 20% 0% -20% -40% -60%

36ONE MSCI World DJ/CS Hedge Fund Index HFRX Equity Hedge Index

Dec-08

Dec-09

Dec-10

Apr-08

Aug-08

Aug-09

Aug-10

Aug-11

Dec-11

Apr-09

Jun-08

Apr-10

Jun-09

Apr-11

Jun-10

Apr-12

Oct-08

Jun-11

Disclaimer

Investment in a fund carries a high degree of risk including, but not limited to, the risks referred to below. No assurance can be given that investors will realise a pro t on their investment. Moreover, investors may lose some or all of their investment. The risks referred to below are not exhaustive. They relate to investment in a portfolio, the investment activities of the portfolio and the underlying funds in which they may invest or to which they may be exposed. References to a Portfolio below should be referred to in this context. The information herein does consequently not constitute an o er, or an invitation to o er, or a recommendation to enter into any transaction. You are privy to this information our capacity as a potential counterparty acting at arms length. We are not acting as your nancial adviser or in a duciary capacity in respect of this proposed transaction or any other transaction with you unless otherwise expressly agreed by us in writing. Potential investors should review the Private Placement Memorandum carefully and in its entirety and consult with their professional advisors before making an application for shares. The success of the fund and furthermore each Portfolio is signi cantly dependent on the investment advisors to each Portfolio as detailed in the Appendix. Their past investment performance may not be construed as an indication of the future results of an investment in the Fund or a Portfolio. Investments in a fund are generally medium to long term investments. The value of shares in the fund may go down as well as up and past performance is not necessarily a guide to future performance. Investments are traded as ruling prices and can engage in scrip lending. Forward pricing is used. Commission and incentives maybe be paid and if so, are included in the overall cost. Fluctuations or movements in exchange rates may cause the value of the underlying investments to go up or down. Share prices are calculated on a net asset value basis and brokerage, marketable securities, tax, auditors fees, amongst others, maybe be levied against the portfolio.

Aug-12

Oct-09

Feb-09

Feb-10

Oct-10

Feb-11

Oct-11

Feb-12

Jun-12

You might also like

- 02 Oct 2013 Fact SheetDocument1 page02 Oct 2013 Fact SheetfaisaladeemNo ratings yet

- Portfolio Diversification Enigma CaseDocument3 pagesPortfolio Diversification Enigma CaserahulNo ratings yet

- SSRN Id2381435Document97 pagesSSRN Id2381435TBP_Think_TankNo ratings yet

- Calculation of Sharpe RatioDocument23 pagesCalculation of Sharpe RatioVignesh HollaNo ratings yet

- 2013 6 June Monthly Report TPOUDocument1 page2013 6 June Monthly Report TPOUSharonWaxmanNo ratings yet

- Harness Performance and AttributionsDocument12 pagesHarness Performance and AttributionsyochamNo ratings yet

- Sip 06 May 201010Document5 pagesSip 06 May 201010Sneha SharmaNo ratings yet

- 2014 09 September Monthly Report TPOIDocument1 page2014 09 September Monthly Report TPOIValueWalkNo ratings yet

- 1Q12 Investor InformationDocument58 pages1Q12 Investor Informationvishan_sharmaNo ratings yet

- 2011-07-31 Brait Multi StrategyDocument2 pages2011-07-31 Brait Multi StrategykcousinsNo ratings yet

- Birla Sun Life Cash ManagerDocument6 pagesBirla Sun Life Cash ManagerrajloniNo ratings yet

- ALFM Money Market Fund Key Facts and PerformanceDocument3 pagesALFM Money Market Fund Key Facts and Performanceippon_osotoNo ratings yet

- Gds Two Pager 2011 DecDocument2 pagesGds Two Pager 2011 DecridnaniNo ratings yet

- 3rd Eye Capital - Exec SummaryDocument1 page3rd Eye Capital - Exec SummarygahtanNo ratings yet

- Thomson Reuters Company in Context Report: Baker Hughes Incorporated (Bhi-N)Document6 pagesThomson Reuters Company in Context Report: Baker Hughes Incorporated (Bhi-N)sinnlosNo ratings yet

- Singapore Company Focus: HOLD S$3.70Document9 pagesSingapore Company Focus: HOLD S$3.70LuiYuKwangNo ratings yet

- STENHAM Targeted ALL FactsheetDocument2 pagesSTENHAM Targeted ALL FactsheetgneymanNo ratings yet

- Petgas 060420111Document13 pagesPetgas 060420111Sky KhooNo ratings yet

- GTBank H1 2011 Results PresentationDocument17 pagesGTBank H1 2011 Results PresentationOladipupo Mayowa PaulNo ratings yet

- Shariah Growth Fund: Fund Fact Sheet October 2011Document1 pageShariah Growth Fund: Fund Fact Sheet October 2011Wan Mohd FadhlanNo ratings yet

- BAM Balyasny 200809Document6 pagesBAM Balyasny 200809jackefellerNo ratings yet

- Thomson Reuters Company in Context Report: Bank of America Corporation (Bac-N)Document6 pagesThomson Reuters Company in Context Report: Bank of America Corporation (Bac-N)sinnlosNo ratings yet

- RHB Dana Hazeem Fund FactsheetDocument2 pagesRHB Dana Hazeem Fund FactsheetHarun AliasNo ratings yet

- 2011-05 ISAM Systematic Newsletter USDDocument4 pages2011-05 ISAM Systematic Newsletter USDturtletrader123456No ratings yet

- JF Asia New Frontiers: Fund ObjectiveDocument1 pageJF Asia New Frontiers: Fund ObjectiveMd Saiful Islam KhanNo ratings yet

- Asteri Capital (Glencore)Document4 pagesAsteri Capital (Glencore)Brett Reginald ScottNo ratings yet

- JANUARY 2016: Bond FundDocument2 pagesJANUARY 2016: Bond FundFaiq FuatNo ratings yet

- Value Research: FundcardDocument6 pagesValue Research: FundcardAnonymous K3syqFNo ratings yet

- Thomson Reuters Company in Context Report: Aflac Incorporated (Afl-N)Document6 pagesThomson Reuters Company in Context Report: Aflac Incorporated (Afl-N)sinnlosNo ratings yet

- Investor Presentation: Q2FY13 & H1FY13 UpdateDocument18 pagesInvestor Presentation: Q2FY13 & H1FY13 UpdategirishdrjNo ratings yet

- Dalma Unifed Return Fund Annual ReportDocument3 pagesDalma Unifed Return Fund Annual ReportDalma Capital ManagementNo ratings yet

- Microequities Deep Value Microcap Fund December 2011 UpdateDocument1 pageMicroequities Deep Value Microcap Fund December 2011 UpdateMicroequities Pty LtdNo ratings yet

- HDFC Top 200 Fund Rating and AnalysisDocument6 pagesHDFC Top 200 Fund Rating and AnalysisSUNJOSH09No ratings yet

- Fundcard L&TCashDocument4 pagesFundcard L&TCashYogi173No ratings yet

- ValueResearchFundcard HDFCTop200 2011aug03Document6 pagesValueResearchFundcard HDFCTop200 2011aug03ShaishavKumarNo ratings yet

- Element Global Value - 3Q13Document4 pagesElement Global Value - 3Q13FilipeNo ratings yet

- 2020 12 December PublicDocument2 pages2020 12 December Publicsumit.bitsNo ratings yet

- BisB Money Market Fund Weekly Fact SheetDocument1 pageBisB Money Market Fund Weekly Fact SheetfaisaladeemNo ratings yet

- Pavise Equity Partners LP Performance Summary and Commentary for July 2022Document4 pagesPavise Equity Partners LP Performance Summary and Commentary for July 2022Kan ZhouNo ratings yet

- BIMBSec - TM 1QFY12 Results Review - 20120531Document3 pagesBIMBSec - TM 1QFY12 Results Review - 20120531Bimb SecNo ratings yet

- Goldman Sachs Presentation To Credit Suisse Financial Services ConferenceDocument10 pagesGoldman Sachs Presentation To Credit Suisse Financial Services ConferenceGravity The NewtonsNo ratings yet

- ES June 2010Document3 pagesES June 2010billhansenNo ratings yet

- Wah Seong 4QFY11 20120223Document3 pagesWah Seong 4QFY11 20120223Bimb SecNo ratings yet

- Thabat Fund Fact Sheet - January 2021Document4 pagesThabat Fund Fact Sheet - January 2021ResourcesNo ratings yet

- Performance %: Unit Price (30/06/2015) : Rs. 10.1642Document1 pagePerformance %: Unit Price (30/06/2015) : Rs. 10.1642Ahmer KhanNo ratings yet

- Bismillah-ar-Rehman-ar-Raheem: Muhammad Faraz Ishaque Hafiz Muhammad Qasim Waqar Ali JavedDocument31 pagesBismillah-ar-Rehman-ar-Raheem: Muhammad Faraz Ishaque Hafiz Muhammad Qasim Waqar Ali JavedMuhammad MehdiNo ratings yet

- Value Research: FundcardDocument4 pagesValue Research: FundcardYogi173No ratings yet

- 29 Jan 2014 Fact Sheet1Document1 page29 Jan 2014 Fact Sheet1faisaladeemNo ratings yet

- ADIB Investor Presentation FY 2011Document38 pagesADIB Investor Presentation FY 2011sunilkpareekNo ratings yet

- HDFCDocument78 pagesHDFCsam04050No ratings yet

- AMANX FactSheetDocument2 pagesAMANX FactSheetMayukh RoyNo ratings yet

- BisB Money Market Fund Weekly Fact SheetDocument1 pageBisB Money Market Fund Weekly Fact SheetfaisaladeemNo ratings yet

- Summer InsectsDocument72 pagesSummer InsectsCanadianValue0% (1)

- Flagship One Pager - All ReturnsDocument6 pagesFlagship One Pager - All ReturnsridnaniNo ratings yet

- 2011 Annual ReportDocument96 pages2011 Annual ReportOsman SalihNo ratings yet

- 2012 11 13 Cyn Bofa-Ml Slides FinalDocument37 pages2012 11 13 Cyn Bofa-Ml Slides FinalrgosaliaNo ratings yet

- CCR Arbitrage Volatilité 150: Volatility StrategyDocument3 pagesCCR Arbitrage Volatilité 150: Volatility StrategysandeepvempatiNo ratings yet

- Fact Sheet MT PR UscDocument2 pagesFact Sheet MT PR Uscdonut258No ratings yet

- Asset Allocation Webcast: Live Webcast Hosted byDocument60 pagesAsset Allocation Webcast: Live Webcast Hosted bysuperinvestorbulletiNo ratings yet

- 11 15 16 Asset AllocationDocument60 pages11 15 16 Asset AllocationZerohedge100% (1)

- Hip 4Document8 pagesHip 4rdixit2No ratings yet

- Hip 3Document7 pagesHip 3rdixit2No ratings yet

- StrategyDocument1 pageStrategyrdixit2No ratings yet

- Cover LetterfgadgDocument1 pageCover Letterfgadgrdixit2No ratings yet

- Faqs App SilverDocument3 pagesFaqs App Silverrdixit2No ratings yet

- Customers and End-Users in Derivatives MarketsDocument1 pageCustomers and End-Users in Derivatives Marketsrdixit2No ratings yet

- Draft Revised1Document19 pagesDraft Revised1rdixit2No ratings yet

- Lab 5 PhysDocument1 pageLab 5 Physrdixit2No ratings yet

- Trustworthiness Table - Henderson and Ryan-NichollsDocument1 pageTrustworthiness Table - Henderson and Ryan-Nichollsrdixit2No ratings yet

- Chapter 1Document19 pagesChapter 1rdixit2No ratings yet

- StrategyDocument1 pageStrategyrdixit2No ratings yet

- SdssdsDocument1 pageSdssdsrdixit2No ratings yet

- Derivatives DealersDocument1 pageDerivatives Dealersrdixit2No ratings yet

- Der 1Document1 pageDer 1rdixit2No ratings yet

- Brazil's Growing Derivatives Markets and Short-Term Interest Rate HedgingDocument1 pageBrazil's Growing Derivatives Markets and Short-Term Interest Rate Hedgingrdixit2No ratings yet

- Over-The-Counter MarketsDocument1 pageOver-The-Counter Marketsrdixit2No ratings yet

- B 2Document2 pagesB 2rdixit2No ratings yet

- B 5Document1 pageB 5rdixit2No ratings yet

- Brazil's Derivatives Markets: Hedging, Central Bank Intervention and RegulationDocument2 pagesBrazil's Derivatives Markets: Hedging, Central Bank Intervention and Regulationrdixit2No ratings yet

- Implied SurfaceDocument17 pagesImplied Surfacerdixit2No ratings yet

- Implied SurfaceDocument17 pagesImplied Surfacerdixit2No ratings yet

- MA ConferencesDocument1 pageMA Conferencesrdixit2No ratings yet

- Oct 14 THDocument1 pageOct 14 THrdixit2No ratings yet

- TimelineDocument3 pagesTimelinerdixit2No ratings yet

- My Volatility ModelDocument49 pagesMy Volatility Modelrdixit2No ratings yet

- Vi X CurrentDocument154 pagesVi X Currentrdixit2No ratings yet

- ESD70session3 2part1Document40 pagesESD70session3 2part1rdixit2No ratings yet

- Implied SurfaceDocument17 pagesImplied Surfacerdixit2No ratings yet

- BSM Toolbox OriginalDocument651 pagesBSM Toolbox Originalrdixit2No ratings yet

- Vix Trades Aug 12 to 16 RecapDocument1 pageVix Trades Aug 12 to 16 Recaprdixit2No ratings yet

- A Study On The Performance of Large Cap Equity Mutual Funds in India PDFDocument16 pagesA Study On The Performance of Large Cap Equity Mutual Funds in India PDFAbhinav AgrawalNo ratings yet

- Comparative Analysis A Project ReportDocument58 pagesComparative Analysis A Project ReportSunny AroraNo ratings yet

- CMSR - Mutual Funds:Equity ShareDocument5 pagesCMSR - Mutual Funds:Equity Shareprarthana rameshNo ratings yet

- Portfolio Evaluation TechniquesDocument18 pagesPortfolio Evaluation TechniquesMonalisa BagdeNo ratings yet

- Mutual Funds Correction PDFDocument48 pagesMutual Funds Correction PDFPrethesh JainNo ratings yet

- Investment Analysis of Rates, Risk and UtilityDocument68 pagesInvestment Analysis of Rates, Risk and Utility杜晓晚No ratings yet

- Chapter 5 Mutual FundsDocument32 pagesChapter 5 Mutual FundsceojiNo ratings yet

- DR Ernest ChanDocument23 pagesDR Ernest ChanrajputjpsNo ratings yet

- Gmo Climate Change Investment Fund - Fact SheetDocument2 pagesGmo Climate Change Investment Fund - Fact Sheetb1OSphereNo ratings yet

- Dynamis Fund Case StudyDocument16 pagesDynamis Fund Case StudyEric Yong100% (1)

- Understanding Asset Allocation - Victor CantoDocument337 pagesUnderstanding Asset Allocation - Victor CantoSunghoo Yang100% (1)

- Climate Sensitivity Predicts Stock ReturnsDocument39 pagesClimate Sensitivity Predicts Stock ReturnsRafa Pérez PellicerNo ratings yet

- Top 5 Tax Saving Mutual FundsDocument41 pagesTop 5 Tax Saving Mutual FundsGautamNo ratings yet

- 1 AstudyonportfolioevaluationandinvestmentDocument10 pages1 AstudyonportfolioevaluationandinvestmentVedant JainabadkarNo ratings yet

- Security Analysis and Investment Management Unit 1 Investment: Meaning, Nature, ScopeDocument10 pagesSecurity Analysis and Investment Management Unit 1 Investment: Meaning, Nature, ScopeMD SHUJAATULLAH SADIQNo ratings yet

- The Surprising Alpha From Malkiel's Monkey and Upside-Down StrategiesDocument15 pagesThe Surprising Alpha From Malkiel's Monkey and Upside-Down StrategiesAndresNo ratings yet

- Artemis+Research - Dennis+Rodman+and+Portfolio+Optimization - April2016Document7 pagesArtemis+Research - Dennis+Rodman+and+Portfolio+Optimization - April2016jacekNo ratings yet

- Study of Factors Affecting Sales of ICICI Prudential Mutual Fund and Promotion and Competition Analysis of Its Popular SchemesDocument64 pagesStudy of Factors Affecting Sales of ICICI Prudential Mutual Fund and Promotion and Competition Analysis of Its Popular SchemesChandan SrivastavaNo ratings yet

- Chapter 6 Efficient DiversificationDocument70 pagesChapter 6 Efficient DiversificationA_Students50% (2)

- Franklin Fact SheetDocument54 pagesFranklin Fact SheetDeepakGarudNo ratings yet

- Blackrock Smart Beta Guide en Au PDFDocument68 pagesBlackrock Smart Beta Guide en Au PDFdehnailNo ratings yet

- ATRAM Philippine Balanced Fund Review: Market Rebounds in April Despite COVID-19 FearsDocument2 pagesATRAM Philippine Balanced Fund Review: Market Rebounds in April Despite COVID-19 FearsJust VillNo ratings yet

- Chapter 8: Index Models: Problem SetsDocument14 pagesChapter 8: Index Models: Problem SetsAlyse97No ratings yet

- Volatility Investing With The VSTOXXDocument20 pagesVolatility Investing With The VSTOXXSuman Saurabh100% (1)

- CFA Level I Portfolio Risk and ReturnDocument16 pagesCFA Level I Portfolio Risk and ReturnIves LeeNo ratings yet

- CDocument16 pagesC7610216922No ratings yet

- Aima0106 Strategy PaperDocument11 pagesAima0106 Strategy PaperMichael VersageNo ratings yet