Professional Documents

Culture Documents

MarketCulture Telstra Transformation Case Study - May2010

Uploaded by

kary290790Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MarketCulture Telstra Transformation Case Study - May2010

Uploaded by

kary290790Copyright:

Available Formats

A Strong Market Culture is the DNA of Profitable Businesses

TELSTRA CASE STUDY

The CFO leads cultural transformation and acts as a guiding light for the whole organization. I set out to transform the Finance Group into a support group that would create new value, provide top service and be seen to be valuable by its customers..and deliver millions of dollars to the bottom line. John V. Stanhope Chief Financial Officer and Group Managing Director, Finance and Administration, Telstra Corporation

THE CONTEXT

Telstra is a $25 billion Australian telecommunications and media services company. It ranks as 11th largest Telco worldwide in terms of market capitalization. It provides fixed line, mobile and broadband Internet services. Its cable TV, online directory and Yellow Pages books form the basis of its media services. Telstras cultural legacy is one of a government owned monopoly that has progressively adapted to an increasingly deregulated, commercial and competitive environment. The Finance and Administration (F&A) Group, a corporate support function of more than 2400 people has operated in a company that has always held strong market positions in all of its Australian markets. The company has undergone many changes over the years to become more customer-focused, but it is still known in several market segments for its poor customer service. The Chief Financial Officer (CFO) wanted to change this, starting within his own group. A customer service focused cultural change, known as value service culture (VSC) was initiated in June 2008. This case traces the value service cultural change over its first 24 months to June 2010.1

The

CFO

and

members

of

the

senior

leadership

team

were

interviewed

by

MarketCulture

several

times

over

the

course

of

the

2

year

journey.

Ongoing

discussions

took

place

with

the

CFO

throughout

the

period.

Internal

documents

were

used

to

identify

the

sequence

of

initiatives

undertaken.

Members

of

the

MarketCulture

team

were

engaged

at

the

start

and

participated

in

many

of

the

major

events

along

the

way.

(800) 817-8582 Monterey Boston Sydney www.MarketCulture.com MarketCulture Strategies. All Rights Reserved. 2010

A Strong Market Culture is the DNA of Profitable Businesses

WHAT WAS THE PROCESS?

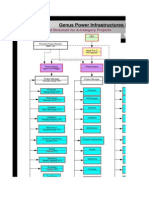

A summary of the culture enhancement and change process is summarized in Figure 1. Figure 1: The Culture Change Process The Telstra culture change process moved through the four phases, each having specific steps. 1. Planning for Success: Included a culture assessment and a Culture Change Roadmap 2. Culture Transformation: Involved upskilling, process reviews, short term wins and forums for sharing of best practices 3. Embedded Culture: Making it Stick with best practice workshops and new performance review systems and processes 4. Continuous Monitoring and Revitalization: Culture measurement and profit gains

PHASE 1: PLANNING FOR SUCCESS

A culture audit is an essential first step to planning the cultural change effort. The advantage of this is to gain more in-depth insight into the culture, build relationships and additional buy-in, reduce the risk of resistance to skill development and culture change, identify leaders that can be change champions and provide key input into an Assessment and Implementation Plan. This is also a time for the executive leader to craft and refine the vision, goals, strategy and priorities. This needs to have within it a sense of urgency which can be easily communicated and

(800) 817-8582 Monterey Boston Sydney www.MarketCulture.com MarketCulture Strategies. All Rights Reserved. 2010

A Strong Market Culture is the DNA of Profitable Businesses

understood by everyone in the organization. These elements are inputs to a culture change plan. The first step was for the CFO to articulate his vision and the sense of urgency. A culture audit was undertaken involving interviews across all levels of the F&A Group and in the main lines of business. This reported an internally focused, siloed and hierarchical culture with little understanding of the real needs of stakeholder groups serviced by F&A. It reflected a lack of urgency in its attitude to making changes. A plan for change was developed starting with the launch of the vision and goals.

PHASE 2: CULTURE TRANSFORMATION

Launch of a culture change requires a memorable event and ongoing communication and activities that demonstrate what the new culture is to look like. A powerful guiding coalition is needed to coordinate and lead the changed behaviors. New skills may be required and methods for sharing learnings and experiences need to be put in place. The Launch of Value Service Culture At an offsite conference with his top 80 people, John Stanhope reviewed his tenure as CFO starting in 2004 and asked the question: Are we there yet? He was referring to F&A as an effective, valuable service organization to the rest of the business. Answering this question with a resounding no the CFO posed the challenge of developing a strong service culture in order to actively understand the needs of its customers and deliver what is of most value to them. He called this a value service culture which soon took the mantle of VSC. The key goal was defined: To understand our customers needs and behaviors better than ever, and deliver what is of most value to them.

Tackling culture change needs a memorable watershed event where the vision is clear, the stakes are raised, the leader leads, and the experience is emblazoned in peoples minds. The Are we There Yet offsite conference was that event.

Creating the Relevance and Tangibility of VSC A guiding coalition, of several, but not all the senior leadership team, was formed to steer the culture change and report to the full senior leadership team. This included the CFO, executive HR representation and a marketing communications specialist who reported direct to the CFO. This group was able to focus on VSC initiatives with emphasis on communications and planning for training. Heads of lines of business held their own offsite meetings to communicate the VSC initiative and set tasks to identify their internal customers.

The desired new culture needs to be made real. People need to see it, feel it and emotionally connect to it. They have to see it will benefit them and they need to have the skills and confidence to enact the new behaviors.

(800) 817-8582

Monterey Boston Sydney www.MarketCulture.com MarketCulture Strategies. All Rights Reserved. 2010

A Strong Market Culture is the DNA of Profitable Businesses

As this occurred a two-day workshop was designed. This covered the VSC mindset and practical how to tools to help people understand customer needs, monitor satisfaction, recognize value and non-value adding activities, along with tools to assist collaboration. It was conducted with mixed groups across functions and levels. The first set of workshops covered 200 people. The CFOs attendance and participation reinforced his commitment to the culture change.

Making it Real: Passing on the VSC Experience Four months after the first wave of training, a VSC Summit was conducted. Here, groups of past VSC workshop participants and their teams presented to a wider audience the results of their experience applying the VSC tools. These experiences occurred at all levels in the F&A structure. They reported on gains made from stopping non-value activities such as the provision of 250 large reports which were subsequently found to be of little value to their intended users. Another reported increasing accuracy and speed of delivery of internal mail. This occurred through a better understanding of customer needs by simplifying the receipt and collection process and educating customers on the process. These presentations created a sense of fun and heightened the collaboration of the teams doing them.

What people see and hear needs to create a sense of fun and excitement for them to connect with the new cultural expectations. Stories are the conversations that create shared experiences and produce a common cultural bond between people.

Stories circulated about how VSC thinking had brought about positive results. One story was of the manager who noticed a worn carpet leading to a storeroom and asked the question as to why it was so worn. The answer eventually led to discovering the storage of physical information records that were being delivered on a regular basis with no record of their retrieval for intended users. This led to digitization and complete elimination of the physical records and their physical storage.

WHATS THE IMPACT SO FAR?

After the launch and implementation of communication and change activities a major review of progress should be undertaken. Whats working and whats stopping change should be assessed. This may be at the 9 to 12 months mark. First Year Anniversary of VSC At the Telstra offsite conference, heads of F&A lines of business presented their plans for the 2009-2010 year and how the VSC was embedded in them. These all contained initiatives designed to weave VSC into the fabric of daily activities. Cross-functional workshop groups were formed at the conference to address a hypothetical question: It is 2014 and

(800) 817-8582

It had reached the time when managers at all levels needed to take responsibility for the embedding of the value service culture. Blocking behavior needed to be addressed and a renewed commitment and urgency was required to achieve the customer satisfaction targets that had been set.

Monterey Boston Sydney www.MarketCulture.com MarketCulture Strategies. All Rights Reserved. 2010

A Strong Market Culture is the DNA of Profitable Businesses

the VSC has failed why? The answers revealed two key risks. The first and strongest was; It is Johns VSC and he left the business. The second referred to lack of momentum and urgency in embedding VSC behaviors deep into all parts of F&A and inability to overcome blocking behaviour. The CFO asked all 100 attendees to provide him with a written one page commitment to VSC with actions they would personally take to embed it in their areas. Also he threw out the challenge to all lines of business to achieve the customer satisfaction benchmark identified by customers in the research study just completed.

PHASE 3: EMBEDDING THE NEW CULTURE.

During the culture transformation process (Phase 2) new attitudes, skills and shared learnings are experienced. Usually the systems and processes lag. This is for good reason because learning best practices is still occurring. But the time comes in the embedding phase when orientation and performance evaluation systems and processes require redesign. These should include desired culture behaviors and targets to support the embedding process. Building Momentum of VSC At this time in Telstra, emphasis shifted from focus on short term wins to systematized performance evaluation and reward systems. The HR Group worked with line of business managers to incorporate VSC behavior descriptions and quantitative customer satisfaction targets in the performance review system. These became hard-wired into everyones performance goals. Workshops continued and another summit was conducted. While the previous summits had been driven by HR, this one was planned by a small multi-function, multi-level group from across F&A. This summit took the form of a workshop in which examples of best practice were shared and reward and recognition approaches discussed. Also an external company speaker provided experience of another companys cultural change. This was designed to provide another perspective on the challenges of embedding a new culture. The issue of blocking behavior was addressed and how to overcome it through coaching, communicating, motivating and rewarding. The summit was regarded as successful by the 200 who attended in signaling that it is our VSC and it is becoming embedded. In 2010 various groups moved to actively create a more open and innovative environment. This included cross-function communication forums, more frequently held discussion groups with customers, and coaching. PHASE 4: PERFORMANCE MONITORING AND REVITALIZATION Performance should be measured in terms of customer satisfaction and cultural behaviors. Both should be benchmarked so that targets for improvement can be set. Getting the F&A Customer View During this period the CFO commissioned the development of a rigorous new method of customer satisfaction research focused on measuring the value perception of internal customers. A world first customized version of the Customer Value Analysis (CVA)

(800) 817-8582 Monterey Boston Sydney www.MarketCulture.com MarketCulture Strategies. All Rights Reserved. 2010

A Strong Market Culture is the DNA of Profitable Businesses

methodology was developed and implemented having relevance to a Support function servicing internal customers. The results showed that F&As internal customers perceived improvements had been made in the understanding of their needs and delivery of service. However, 7 of the 10 F&A lines of business did not yet reach the satisfied level and all were short of the perfect world expectation on the numeric scale. The results of the customer satisfaction survey was a defining moment in the journey and helped demonstrate that VSC was not a fad. It demonstrated the seriousness of measuring satisfaction and enabled targets to be set for the next year. Benchmarking F&As Culture against High Performance Business Cultures

Measuring how well we are doing ultimately depends on the perceptions of our customers. Objective measurement provides benchmarks of where we stand and how much we need to do to achieve future customer satisfaction targets.

In December 2009 a sample of F&A employees2 completed a culture survey, called the Customer Responsiveness Index Research indicates that (CRI). It was used to measure seven behavioral factors culture has a substantial exhibited by F&A with reference to their internal customers. impact on business These factors are highly correlated with business performance. The CRI performance. The results, reported in March 2010, showed survey measures those average to above average scores relative to a database of 3 cultural factors that have other organizations on all factors except empowerment This been shown to have the was consistently low across almost all sub-groups sampled. Lack of empowerment inhibits the ability of employees to strongest predictive propose new ideas and act on new ways of solving customers correlation with business problems. performance. When investigated further it was found that many employees did not feel empowered because of their own lack of confidence in approaching customers. This lack of empowerment from within was overcome by teaming them with an experienced buddy to gain confidence in customer interaction. Profit Impact and Business Value Culture has a profit impact. The benefits of culture enhancement should be measured in dollars. There have been significant monetary benefits from the VSC change. An investigation by F&A of estimated gains and savings revealed: Annualized gains and cost savings of $15 million were estimated for 2009. These were expected to continue in future years with an erosion of these gains over time assumed if no further investment occurs.

Details

of

the

CRI

methodology

can

be

found

at

www.marketculture.com.

The

seven

behavioral

factors

measured

by

this

tool

are

customer

insight,

customer

anticipation,

customer

alternatives,

peripheral

vision,

strategic

alignment,

cross-functional

collaboration

and

empowerment.

3

Empowerment

is

defined

as

the

extent

to

which

employees

are

empowered

to

make

decisions,

propose

ideas

and

control

how

work

is

performed.

(800) 817-8582 Monterey Boston Sydney www.MarketCulture.com MarketCulture Strategies. All Rights Reserved. 2010

A Strong Market Culture is the DNA of Profitable Businesses

Added value to the business of $55 million4

These gains were derived from analysis of specific initiatives by: a) Credit Management acting to collaborate with Telstras customers to reduce bad debts and achieve cost savings from less follow-up calls and longer customer retention periods. b) Risk Management & Assurance collaborating with internal customers through an education initiative clarifying compliance requirements and streamlined processes for reducing work for both parties. Cost savings resulted from labour savings. c) Corporate Security and Investigations working with Telstra retail shops to provide better processes, follow-up and liaison with those shops most targeted by fraud. Reduction of fraud yielded measurable cost savings. Care was taken to attribute only those gains and savings that could be aligned with VSC initiatives to do with understanding customer needs, providing greater value for customers, monitoring customer feedback and collaborating with customers to deliver the Groups fiduciary responsibilities more efficiently.

WHAT CAN WE CONCLUDE?

To lead a successful transformation, you have to capture the hearts and minds of the entire group. Then you must provide tools that are relevant to every function and level and provide a common framework and way of thinking and doing. Measurement is key. If it is not measured, it doesnt exist. This is particularly true of culture something that is abstract in the minds of most people. Periodic in-process benchmarking measurement of culture tracks the progress of the change initiatives undertaken and provides opportunities for corrective actions to be implemented. It makes culture real. Similarly, systematic measurement of customer satisfaction and perceived value makes customers real and represents the outcome of culture improvements. These outcomes can also be measured in terms of dollar gains. Culture improvement can and should be measured as an asset that adds value to the business. Finally, the passion, leadership and support of the C-level executive sponsor and the executive team are crucial to success. The last word, as with the first word, is left to John Stanhope:

Culture change is simply a behavioural change. Simply said, not easy to do. The change in behaviour must come from within each and every one of my staff. The behaviour that always tests Am I meeting the customers need and being valuable. This testing must just become a natural behaviour. When this is the case we are truly there.

MarketCulture Strategies, Inc www.marketculture.com June 2010

4

This

was

calculated

by

projecting

the

annualized

gains

forward

for

10

years,

allowing

for

erosion

of

these

gains

over

time,

and

discounting

them

back

at

Telstras

pre-tax

weighted

average

cost

of

capital.

(800) 817-8582 Monterey Boston Sydney www.MarketCulture.com MarketCulture Strategies. All Rights Reserved. 2010

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Article On Benchmarking by Kenneth CrowDocument17 pagesArticle On Benchmarking by Kenneth Crowkary290790No ratings yet

- Program ContentDocument2 pagesProgram Contentkary290790No ratings yet

- Case Study 1 - Benchmarking at XeroxDocument3 pagesCase Study 1 - Benchmarking at Xeroxkary290790100% (1)

- Case Study 3 On Product BenchmarkingDocument3 pagesCase Study 3 On Product Benchmarkingkary290790No ratings yet

- Article On BenchmarkingDocument10 pagesArticle On Benchmarkingkary290790No ratings yet

- Case Study On Product DissectionDocument6 pagesCase Study On Product Dissectionkary290790No ratings yet

- World Class R&D Structure, Projectised Structure & InfrastuctureDocument65 pagesWorld Class R&D Structure, Projectised Structure & Infrastucturekary290790No ratings yet

- Transforming Organizational ChangeDocument42 pagesTransforming Organizational Changekary290790No ratings yet

- Article - Benchmarking IntroDocument5 pagesArticle - Benchmarking Introkary290790No ratings yet

- Organizational Design & StructureDocument27 pagesOrganizational Design & Structurekary2907900% (1)

- Organization Structure For Operations / Supply Chain ManagementDocument1 pageOrganization Structure For Operations / Supply Chain Managementkary290790No ratings yet

- Employee CoDocument5 pagesEmployee Cokary290790No ratings yet

- Article - Benchmarking Understanding The BasicsDocument4 pagesArticle - Benchmarking Understanding The Basicskary290790No ratings yet

- Man ChangeDocument72 pagesMan Changekary290790No ratings yet

- CoDocument5 pagesCokary290790No ratings yet

- Transforming Your OrganizationDocument17 pagesTransforming Your Organizationjimmy0000007No ratings yet

- Bosch IndiaDocument8 pagesBosch Indiakary290790No ratings yet

- Culture Transformation Viewpoint 2012Document8 pagesCulture Transformation Viewpoint 2012kary290790100% (1)

- How IBMDocument3 pagesHow IBMkary290790No ratings yet

- PWC Looking Ahead Driving Co Creation in The Auto Industry PDFDocument12 pagesPWC Looking Ahead Driving Co Creation in The Auto Industry PDFkary290790No ratings yet

- Mailchimp Grants EmployeesDocument6 pagesMailchimp Grants Employeeskary290790No ratings yet

- How One Company Taught Its Employees How To Be HappierDocument5 pagesHow One Company Taught Its Employees How To Be Happierkary290790No ratings yet

- Employee Engagement Maximizing Organizational PerformanceDocument25 pagesEmployee Engagement Maximizing Organizational Performancekanwarsingh100% (1)

- The Engagement ExchangeDocument2 pagesThe Engagement Exchangekary290790No ratings yet

- Co-Creation For Sustained ValueDocument15 pagesCo-Creation For Sustained Valuekary290790No ratings yet

- Total Quality Management As The Basis For Organizational TransforDocument412 pagesTotal Quality Management As The Basis For Organizational Transforkary290790No ratings yet

- 118 226 1 PBDocument19 pages118 226 1 PBkary290790No ratings yet

- Presentation 2Document8 pagesPresentation 2kary290790No ratings yet

- Strategy Case Studies (Catalogue II)Document77 pagesStrategy Case Studies (Catalogue II)kary290790No ratings yet

- ShellyDocument11 pagesShellykary290790No ratings yet

- A.jjeb.g.p 2019Document4 pagesA.jjeb.g.p 2019angellajordan123No ratings yet

- Ada AtlantisDocument10 pagesAda AtlantisAda MacallopNo ratings yet

- Evergreen Park Arrests 07-22 To 07-31-2016Document5 pagesEvergreen Park Arrests 07-22 To 07-31-2016Lorraine SwansonNo ratings yet

- 2018-Gray-Life, Death, or Zombie - The Vitality of International OrganizationsDocument13 pages2018-Gray-Life, Death, or Zombie - The Vitality of International OrganizationsNightWalkerNo ratings yet

- Colville GenealogyDocument7 pagesColville GenealogyJeff MartinNo ratings yet

- Philippine Phoenix Surety vs. WoodworksDocument1 pagePhilippine Phoenix Surety vs. WoodworksSimon James SemillaNo ratings yet

- To The Lighthouse To The SelfDocument36 pagesTo The Lighthouse To The SelfSubham GuptaNo ratings yet

- SWOT Analysis and Competion of Mangola Soft DrinkDocument2 pagesSWOT Analysis and Competion of Mangola Soft DrinkMd. Saiful HoqueNo ratings yet

- Document 2 - Wet LeasesDocument14 pagesDocument 2 - Wet LeasesDimakatsoNo ratings yet

- First Online Counselling CutoffDocument2 pagesFirst Online Counselling CutoffJaskaranNo ratings yet

- 3-16-16 IndyCar Boston / Boston Grand Prix Meeting SlidesDocument30 pages3-16-16 IndyCar Boston / Boston Grand Prix Meeting SlidesThe Fort PointerNo ratings yet

- Class Program: HUMSS 11-MarxDocument2 pagesClass Program: HUMSS 11-MarxElmer PiadNo ratings yet

- Bond by A Person Obtaining Letters of Administration With Two SuretiesDocument2 pagesBond by A Person Obtaining Letters of Administration With Two Suretiessamanta pandeyNo ratings yet

- The Absent Presence of Progressive Rock in The British Music Press 1968 1974 PDFDocument33 pagesThe Absent Presence of Progressive Rock in The British Music Press 1968 1974 PDFwago_itNo ratings yet

- Soal Paket B-To Mkks Diy 2019-2020Document17 pagesSoal Paket B-To Mkks Diy 2019-2020Boku Hero-heroNo ratings yet

- Matalam V Sandiganbayan - JasperDocument3 pagesMatalam V Sandiganbayan - JasperJames LouNo ratings yet

- TA Holdings Annual Report 2013Document100 pagesTA Holdings Annual Report 2013Kristi DuranNo ratings yet

- Project On Hospitality Industry: Customer Relationship ManagementDocument36 pagesProject On Hospitality Industry: Customer Relationship ManagementShraddha TiwariNo ratings yet

- Commandos - Beyond The Call of Duty - Manual - PCDocument43 pagesCommandos - Beyond The Call of Duty - Manual - PCAlessandro AbrahaoNo ratings yet

- Special Power of Attorney: Know All Men by These PresentsDocument1 pageSpecial Power of Attorney: Know All Men by These PresentsTonie NietoNo ratings yet

- CH03 - Case1 - GE Becomes A Digital Firm The Emerging Industrial InternetDocument4 pagesCH03 - Case1 - GE Becomes A Digital Firm The Emerging Industrial Internetjas02h10% (1)

- The Mental Health Act 2018 Tested by High Court of UgandaDocument7 pagesThe Mental Health Act 2018 Tested by High Court of UgandaLDC Online ResourcesNo ratings yet

- Modern Dispatch - Cyberpunk Adventure GeneratorDocument6 pagesModern Dispatch - Cyberpunk Adventure Generatorkarnoparno2No ratings yet

- Acknowledgment, Dedication, Curriculum Vitae - Lanie B. BatoyDocument3 pagesAcknowledgment, Dedication, Curriculum Vitae - Lanie B. BatoyLanie BatoyNo ratings yet

- Đề Cương CK - QuestionsDocument2 pagesĐề Cương CK - QuestionsDiệu Phương LêNo ratings yet

- Module 4 - Starting Your BusinessDocument8 pagesModule 4 - Starting Your BusinessJHERICA SURELLNo ratings yet

- Frias Vs Atty. LozadaDocument47 pagesFrias Vs Atty. Lozadamedalin1575No ratings yet

- A Review Essay On The European GuildsDocument11 pagesA Review Essay On The European GuildsAnonymous xDPiyENo ratings yet

- Customer Service Observation Report ExampleDocument20 pagesCustomer Service Observation Report ExamplesamNo ratings yet

- Bos 2478Document15 pagesBos 2478klllllllaNo ratings yet