Professional Documents

Culture Documents

Financial Management

Uploaded by

Geviena Pinky Sy SarmientoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Management

Uploaded by

Geviena Pinky Sy SarmientoCopyright:

Available Formats

CHAPTER 1

THE PROBLEM AND ITS SCOPE

Introduction

Rationale One of the highly celebrated doctrines in Economics is the doctrines of intertemporal choice. In this context, the rationality of the person is not measured based on basic mental prowess but on his spending pattern. It is highly regarded as worthy emulating when one foregoes current spending in lieu of future choices provided the derived benefit is greater. However, no matter what mode of spending is adhered to, what dominates as a phenomenal event is the surging up of international prices of wide range commodities. A soar in price of the major needs of consumers is of special concern to the worlds economy particularly to developing countries like the Philippines. Even though Philippines is now one of the newly industrialized countries, thousands of Filipinos still becomes frustrated due to low standards of living in the country. An increasing number of the Filipino workforce leaves the country everyday to seize better income opportunities in order to cope with the recent crisis. In todays era, families financial management practices like saving, spending, budgeting, and borrowing are issues commonly discussed daily in every household. These issues arise due to the sharply rising of prices that threatens the stability of the family. Moreover, the increase in prices of commodities offers few means of substitution

and adjustment of personal finances through proper saving, spending, budgeting and borrowing. Many households do saving for their future needs and assurance of selfsufficiency. Through proper saving, everyone can get from where they are to where they want to be. Mainly in urban poor households, they usually borrow money for their daily consumption. The greater the amount they borrowed, the more chances of meeting financial problem. Many households reduce their borrowings through restriction of spending which is necessary to accumulate resources for future financial security. Minimizing the unwanted spending of every household can be done in the course of proper budgeting. Budgeting will not eliminate everyones financial worries but it helps develop and create decisions in managing money. As financial management students, this is basically the reason why the proponents conducted this study. This paper intends to explore the financial management practices of every household in terms of the following categories: saving, spending, borrowing, and budgeting. It further intends to study the differences of every households financial management practices in accordance with their economic classes. Through the conduct of this study, the researchers aim to gather the desired information that will point out the best financial management practices of the selected households in Tagbilaran City that may be used as a basis in attaining financial growth and stability.

THE PROBLEM

Statement of the Problem The primary focus of this study is to determine the financial management practices of the randomly selected households in Tagbilaran City in accordance with the soaring prices of commodities. Driven by curiosity, the researchers wanted to ascertain the views behind the following objectives: 1. The profile of household heads in terms of: a. Age b. Civil Status c. Gender d. Educational Attainment e. Number of members in every household 2. What are the financial management practices of every household in accordance with the following categories: a. Saving b. Spending c. Budgeting d. Borrowing

Significance of the Study In todays growing economy, financial management would be a great help to improve the economic status of the people and its nation. Acquiring new ideas about financial management and sharing it to the following sector may contribute a lot to go

beyond our limitations of thinking in terms of money management. It may provide practical practices in raising the level of our knowledge and behavior and leading us to become financially aware how prices affect the income of every household. Households. They will become more aware of the magnitude of their finances which correspond to the advent increased of prices of commodities over the years. They would also learn how to cope with this phenomenon while learning from their best practices. Business. Through this study, these firms and organizations will know the impact of the increasing prices of commodities on the behavior and practices of every household. Local Government. The government will be more aware on the situation of consumers today with regard to the increasing prices of commodities. This may open their consciousness to legislate and implement interventions in order for them to help ease the burden of every household regarding this. Researchers.During the conduct of this study, the researchers will learn about the proper management of money while enhancing their knowledge and skills in research. The researchers will likewise improve their interpersonal skills as they work in teams. Future Researchers. This study will be helpful for other researchers who may be focusing on understanding the concept of managing finances of every household in relation to other economic phenomena. The notable significance of this study is the possibility that other researchers may be able to use the findings of this study for future related studies that will create an impact to society.

Scope and Limitation This research will be conductedin the fifteen (15) barangays of Tagbilaran City to determine the financial management practices of every household wherein the prices of major commodities are rising. This is limited only to the four areas of financial management: saving, spending, budgeting, and credit management. The researchers will adapt a purposive sampling to find out specific correspondents. This study is using dwelling as the specific parameter. Furthermore, the result of the information being gathered from the selected respondents will be limited only to their willingness and honesty in answering the survey questionnaire.

RESEARCH METHODOLOGY This research will be conducted in order to determine how every household manages their finances when the prices of major commodities are driven up. In order to answer this research goal, the researchers opted to use the descriptive survey method with the assistance of a questionnaire which gathers information about the present existing condition.

Research Environment Tagbilaran city is the provincial capital of the province of Bohol: the hub of commerce and the lone city of the island. It is the principal gateway to the island province of Bohol and is known as the City of Friendship. Tagbilaran lies on the southwestern part of the province, and has a total land area of 32.7 km, with about 13 km of

coastline. It is composed of fifteen (15) barangays the Bool, Booy, Cabawan, Cogon, Dampas, Dao, Manga, Mansasa, Poblacion I, Poblacion II, Poblacion III, San Isidro, Taloto, Tiptip and Ubujan wherein the study coversto know the financial management practices of households in respect with their economic classes.

Research Participants Since the research is multi-stakeholder wise, specifically the researchers wanted to solicit reliable information from100 respondents which will be categorized based on the economic classes specifically on the general appearance of their house or dwelling units. The classes provided by the Research Center of Holy Name University are described as follows:

AB(Upper Class)

- Made of heavy high quality of materials, very well constructed, well painted, generally has a lawn or garden, located inexpensive neighborhood,

expensive furnishings C (Middle Class) - Made of mixed heavy and light materials, painted, well-constructed, may or may not have a garden, adequate furnishing but not necessarily expensive D (Lower Class) - Very light, cheap materials, poorly constructed, generally unpainted, generally has no garden, scanty furniture, located in shabby surroundings

E (Extremely Lower Class)

A barong-barong type of dwelling or one-room

affair in a poorly constructed house, dilapidated, bear with hardly any furniture, located in slim districts or interiors, no yard or garden

Research Instruments

The study will be using a group made survey questionnaire with two parts as a tool in gathering information. The researchers will distribute personally the questionnaires to the chosen respondents. The first part is for the respondents profile. The second part evaluates the type of financial management practices of the respondents. It will also adopt a structured interview to the affected consumers.

Respondents will be asked to answer the research instrument by writing the necessary data on the first part and by checking among the choices in the second part. Research Procedure Gathering of Data.The researchers will secure the number of households in Tagbilaran City from the City Hall. After identifying the number of households per barangay, the researchers will go to the selected respondents administering the questionnaire. Researchers will conduct a house-to-house visit to the identified class AB, C, D, E respondents basing from the economic classification. A letter of permission from the researchers will be sent to the Barangay Captains in Tagbilaran City that we will be conducting a research study in their community

concerning the consumers financial managem ent practices in relation to the rising prices of major commodities. Afterwards, the questionnaires will be retrieved for data analysis and interpretation. Treatment of Data.In determining the significance of date being gathered, Descriptive Measures specifically tabulated description (i.e., tables), graphical description (i.e., graphs and charts), and statistical commentary (i.e., interpretation of the results) will be employed. They were specifically use to identify the financial management practices of every household.

DEFINITION OF TERMS Financial Management Practices are habits on how financial matters will be managed and used. Household is a group of people who are related by blood, by law or either of the two and living under one roof which constitute a family. Behavioral Methods are analysis of individuals' actions to identify behavioral patterns as a result to a certain stimuli. Cognitive Methods are ways that focuses on how individual thinks and assesses in stressful situation.

THE FINANCIAL MANAGEMENT PRACTICES OF SELECTED HOUSEHOLDS IN TAGBILARAN CITY

MEMBERS: SARMIENTO, GEVIENA PINKY CAGOCO, CINDY MARIE EJERA, GRACE FLORES JUYAD, JECEL MAE POTANE, NHORIEN SARMIENTO, GEVIENA PINKY

DR. ERNESTO O. GOLOSINO CLASS ADVISER

MS. MARIE NOREEN MARCOJOS, MBA TECHNICAL ADVISER

You might also like

- 0.18liter Per Hour: Anti ScalantDocument1 page0.18liter Per Hour: Anti ScalantGeviena Pinky Sy SarmientoNo ratings yet

- Oath of OfficeDocument17 pagesOath of OfficeGeviena Pinky Sy SarmientoNo ratings yet

- Geviena Pinky S. SarmientoDocument3 pagesGeviena Pinky S. SarmientoGeviena Pinky Sy SarmientoNo ratings yet

- MaintenanceDocument2 pagesMaintenanceGeviena Pinky Sy SarmientoNo ratings yet

- MCP 037 SS 038 036: Automatic Fire Alarm System Layout Plan (As Built)Document1 pageMCP 037 SS 038 036: Automatic Fire Alarm System Layout Plan (As Built)Geviena Pinky Sy SarmientoNo ratings yet

- EP-Death in The Hotel 2013-5Document6 pagesEP-Death in The Hotel 2013-5Geviena Pinky Sy SarmientoNo ratings yet

- Checking Best Practices For Preventive MaintenanceDocument5 pagesChecking Best Practices For Preventive MaintenanceGeviena Pinky Sy SarmientoNo ratings yet

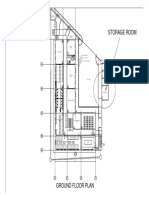

- Storage RoomDocument1 pageStorage RoomGeviena Pinky Sy SarmientoNo ratings yet

- Property Lines-8.5 X 11Document1 pageProperty Lines-8.5 X 11Geviena Pinky Sy SarmientoNo ratings yet

- Sound System Accessories BundleDocument2 pagesSound System Accessories BundleGeviena Pinky Sy SarmientoNo ratings yet

- Sample Format of Case FolderDocument1 pageSample Format of Case Foldermirage100% (1)

- Shell Omala 220 Gear OilDocument2 pagesShell Omala 220 Gear OilGeviena Pinky Sy SarmientoNo ratings yet

- Checking Best Practices For Preventive MaintenanceDocument5 pagesChecking Best Practices For Preventive MaintenanceGeviena Pinky Sy SarmientoNo ratings yet

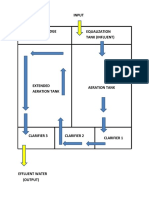

- STPDocument2 pagesSTPGeviena Pinky Sy SarmientoNo ratings yet

- Plate# LetterDocument1 pagePlate# LetterGeviena Pinky Sy SarmientoNo ratings yet

- Jonalyn Layout1Document1 pageJonalyn Layout1Geviena Pinky Sy SarmientoNo ratings yet

- JL - S Frozen CostumeDocument1 pageJL - S Frozen CostumeGeviena Pinky Sy SarmientoNo ratings yet

- Judicial Affidavit Details Mutilation Medical ExaminationDocument4 pagesJudicial Affidavit Details Mutilation Medical ExaminationGeviena Pinky Sy SarmientoNo ratings yet

- Spa EdithDocument1 pageSpa EdithGeviena Pinky Sy SarmientoNo ratings yet

- Kimjoy Ojt ReportDocument18 pagesKimjoy Ojt ReportGeviena Pinky Sy SarmientoNo ratings yet

- Affidavit Kate KatreDocument2 pagesAffidavit Kate KatreGeviena Pinky Sy SarmientoNo ratings yet

- Itinerary: Tagbilaran Land-Sea-Air Tours and Travel and Transport Services 11 Sikatuna Street, Tagbilaran CityDocument1 pageItinerary: Tagbilaran Land-Sea-Air Tours and Travel and Transport Services 11 Sikatuna Street, Tagbilaran CityGeviena Pinky Sy SarmientoNo ratings yet

- In-House Rates: Particular CAR VAN Coaster BUS Car-Van-Coaster-Bus (Tour Rental)Document3 pagesIn-House Rates: Particular CAR VAN Coaster BUS Car-Van-Coaster-Bus (Tour Rental)Geviena Pinky Sy SarmientoNo ratings yet

- Housekeeping BikesDocument8 pagesHousekeeping BikesGeviena Pinky Sy SarmientoNo ratings yet

- Bellevue Pricelist 2016 SCOTTY'sDocument8 pagesBellevue Pricelist 2016 SCOTTY'sGeviena Pinky Sy SarmientoNo ratings yet

- Bsta LetterDocument1 pageBsta LetterGeviena Pinky Sy SarmientoNo ratings yet

- Affidavit Kate KatreDocument2 pagesAffidavit Kate KatreGeviena Pinky Sy SarmientoNo ratings yet

- Affidavit of Witness: Divino Miag-AoDocument2 pagesAffidavit of Witness: Divino Miag-AoGeviena Pinky Sy SarmientoNo ratings yet

- Suiza ItineraryDocument2 pagesSuiza ItineraryGeviena Pinky Sy SarmientoNo ratings yet

- CounterAffidavit SanaFinalNaThis EDITEDDocument4 pagesCounterAffidavit SanaFinalNaThis EDITEDGeviena Pinky Sy SarmientoNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 2 Quarter: Research Design and MethodologyDocument43 pages2 Quarter: Research Design and MethodologyJhon Keneth NamiasNo ratings yet

- Module in Elementary Statistics and Probability With LaboratoryDocument15 pagesModule in Elementary Statistics and Probability With LaboratoryMonec JalandoniNo ratings yet

- Sampling Theory PPT 1 1Document41 pagesSampling Theory PPT 1 1Cristine Joy PalmesNo ratings yet

- Smartphone and Academic Performance of Grade 12 Students of Santo Tomas Catholic SchoolDocument37 pagesSmartphone and Academic Performance of Grade 12 Students of Santo Tomas Catholic SchoolSharmaine CarreraNo ratings yet

- Survey Questions Don KlanakinDocument11 pagesSurvey Questions Don Klanakin4608 VANSHIKA SHARMANo ratings yet

- Virtuoso Pianist Pt1 A4Document58 pagesVirtuoso Pianist Pt1 A4Anonymous 7WTnOtUcyyNo ratings yet

- Chapter 1-5Document77 pagesChapter 1-5Angel Achas100% (1)

- 2015-2016 IPPCR TestDocument15 pages2015-2016 IPPCR TestMohamed Issam45% (29)

- Question TypeDocument13 pagesQuestion TypeEllena ChuaNo ratings yet

- Background of The StudyDocument24 pagesBackground of The StudyCyrah Mae RavalNo ratings yet

- Preserving Butbut Tribe Identity and Maximizing Economic GrowthDocument11 pagesPreserving Butbut Tribe Identity and Maximizing Economic GrowthKrystalline Naldoza DugangNo ratings yet

- Charter School Parent Survey Results Presentation 7.12.16Document35 pagesCharter School Parent Survey Results Presentation 7.12.16The Republican/MassLive.com100% (1)

- UP Statistics LectureDocument102 pagesUP Statistics LectureJhoanie Marie Cauan100% (1)

- Research and Practice in Human Resource ManagementDocument10 pagesResearch and Practice in Human Resource ManagementAlexandru NaeNo ratings yet

- Consumer Demand For Counterfeit GoodsDocument17 pagesConsumer Demand For Counterfeit Goodsiulia gheorghiu100% (1)

- FULLpractical Research PDFDocument87 pagesFULLpractical Research PDFRubygen R CañeteNo ratings yet

- Amoto - Research PaperDocument36 pagesAmoto - Research PaperMa Antonetta Pilar SetiasNo ratings yet

- Aging Parents Helping Adult Children The Experience of The Sandwiched GenerationDocument11 pagesAging Parents Helping Adult Children The Experience of The Sandwiched GenerationSesame YuNo ratings yet

- Survey Questionnaire For Research PaperDocument5 pagesSurvey Questionnaire For Research Paperfvj8675e100% (1)

- Indian Economy on Eve of Independence & Post-Independence DevelopmentsDocument24 pagesIndian Economy on Eve of Independence & Post-Independence DevelopmentsAsitha AjayanNo ratings yet

- Career Decision and K To 12 Curriculum Exits of SeDocument8 pagesCareer Decision and K To 12 Curriculum Exits of SeValeree GuiaNo ratings yet

- A Comparative Studybetween Grab and Traditional Taxi Transportation Marketing StrategyDocument30 pagesA Comparative Studybetween Grab and Traditional Taxi Transportation Marketing StrategyGinny MontalbanNo ratings yet

- Debt and Distress - Evaluating The Psychological Cost of CreditDocument22 pagesDebt and Distress - Evaluating The Psychological Cost of CreditPusatStudyPerilakuEkonomiNo ratings yet

- New Modules 1 4 Methods of Research New 2013Document58 pagesNew Modules 1 4 Methods of Research New 2013Christine Rodriguez-GuerreroNo ratings yet

- PR2 WK 3 and 4Document4 pagesPR2 WK 3 and 4Euneel EscalaNo ratings yet

- Practical Research 1 ReviewerDocument2 pagesPractical Research 1 ReviewerJohn Louis GutierrezNo ratings yet

- Personnel Review: Emerald Article: Reviewing Sexual Harassment in The Workplace - An Intervention ModelDocument20 pagesPersonnel Review: Emerald Article: Reviewing Sexual Harassment in The Workplace - An Intervention Modelselina_inaNo ratings yet

- Sales Promotion in FMCDocument38 pagesSales Promotion in FMCVivek SinghNo ratings yet

- QB BCom BBA Business Research MethodsDocument22 pagesQB BCom BBA Business Research MethodsMaheswar KondreddyNo ratings yet

- 1 s2.0 S2405844023088254 MainDocument21 pages1 s2.0 S2405844023088254 MainWinarniNo ratings yet