Professional Documents

Culture Documents

Chapter 25

Uploaded by

amysilverbergCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 25

Uploaded by

amysilverbergCopyright:

Available Formats

CHAPTER 25 . 1.

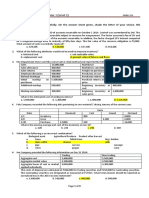

The standards which govern the CPAs association with unaudited financial statements of private companies are the:d.. Statements on Standards for Accounting &Review Services (SSARS). 2.The two types of services provided in connection with the Statements on Standards for Accounting &Review Services are: b. .COMPILATION & REVIEW services. 3.Statements on Standards for Attestation Engagements are established by the: c..Auditing Standards Board.2=ASB 4.Because the same CPA firm does both the annual audit &the public company interim financial statement review, they are referred to as _______. c..AUDITORS 5.Practitioners who perform reviews &compilations are referred to in the SSARS standards as: b..accountants. 6.A(n) _______ results in a conclusion that is in a positive form.c..EXAMINATION 7.Compilation reports may be of all but which of the following types? a..Compilation with limited independence. 8.An examination results in a conclusion that is in a(n) _______ form. c..POSITIVE 9.A CPA firm can issue a compilation report:d..even if it is not independent. 10.Which of the following meets the attestation standards definition of an examination? AN AUDIT OF FINANCIAL STATEMENTS 11.Which of the following would not be included in a CPAs report based upon a review of the financial statements of a nonpublic entity? A state was in accord with GAAS 12.The distribution of which of the following types of reports is unrestricted?a..EXAM& REVIEW13.The statement that Nothing came to our attention which would indicate that these statements are not fairly presented expresses which of the following? b.. NEGATIVE ASSURANCE assurance. 14.For reviews, an accountant does not do which of the following? d. .An accountant will not do any of the above in a review. 15.An auditor who conducts an examination in accordance with generally accepted auditing standards &concludes that the financial statements are fairly presented in accordance with a comprehensive basis of accounting other than GAAP, should issue a: b..SPECIAL report. 16.Specific attestation standards have been developed in all but which of the following areas?d..Standards have been developed for ALL of the above.17.Reports on agreed-upon procedures are intended to be distributed: a..to ONLY the involved parties, who would have the requisite knowledge about those procedures & the level of assurance resulting from them. 18.Which of the following is not an area of emphasis in a review conducted under the SSARS? a..Tof INTernalCONTROLS 19.Distribution of which of the following types of reports is limited? c..AGREED-UPON PROCedure. 20.In which type of report would you read the following statement: We believe that our examination provides a reasonable basis for our opinion.c..EXAMination 21.Which of the following forms of review are permissible under SSARS? a..REView, with FULL DISClosure w 22.Evidence for a review engagement consists primarily of: b..ANAL PRO. 23.Which of the following services is performed under the attestation standards?c.a..WebTrust .b. .SysTrust 23=.c..Both a &b 24. (Public)The Securities &Exchange Commission requires quarterly financial information as a part of the: b..10-Q report. 25. (Public)The quarterly reports submitted to the SEC by the client: d..do NOT have to be audited, but the CPA firm which does the year-end audit must review the quarterly statements before they are submitted to the SEC. 26.The WebTrust service requires that a CPA update its testing of the e-commerce aspects of a entitys Web site at least ever y: d..twelve months. 27.Reports on debt compliance &similar engagements may be issued as a separate report or as part of a report that expresses the auditors opinion on the financial statements. When they are issued as a part of the report on the financ ial statements, it is done by: b..ADDING a paragraph AFTER the opinion paragraph. 28.Auditors frequently audit statements that were prepared on a comprehensive basis of accounting other than GAAP. When this occurs: a..GAAS apply to these engagements &the reporting requirements differ. 29.Which of the following is not a standard contained in both the Statement on Standards for Attestation Engagements &the Statement on Auditing Standards? d..The practitioner must obtain a sufficient understanding of the clie nts internal control. 30.Which of the following is not one of the types of engagements &related forms of conclusions that are defined by the attestation standards? b..COMPILATION. 31.Which of the following types of engagement reports would provide positive assurance?a..An examination. 32.Which of the following is not one of the general types of prospective financial statements included in the attestation standards? c..EARNINGS ESTIMATES. 33.A report on an examination is _______ as to the distribution by the client after it is issued. c..UNRestricted 34._______ are prospective financial statements that present an entitys expected financial position, results of operations, &cash flows, to the best of the responsible partys knowledge &belief. a..FORECASTS 35._______ are prospective financial statements that present an entitys financial position, results of operations, &cash flows, to the best of the responsible partys knowledge &belief, given one or more hypothetical assumptions. b. .Projections 36.Professional standards prohibit one of the following types of engagements for prospective financial statements from being undertaken.b..A REVIEW. 37.General use statements are prepared for use by ________.b..any third parties 38.An agreed-upon procedures engagement is one in which: c..the auditor &MGMT or a third party agree that the audit will be limited to certain specific audit procedures. 39.Statements on Accounting &Review Services are issued by the:d..Accounting &Review Services Committee of the AICPA.40.Assurance provided by a review is substantially less than an audit. Which of the following statements is true regarding these services? c..A REView requires LESS evidence than an audit. 41.An accountant who reviews the financial statements of a nonpublic entity should issue a report stating that a review: c..is substantially less in scope than an audit. 42.Which of the following procedures is not included in a review engagement of a nonpublic entity? d..A study &evaluation of internal control. 43.When an accountant performs more than one level of service (for example, a compilation &a review, or a compilation &an audit) concerning the financial statements of a nonpublic entity, the accountant generally should issue the report that is appropriate for: d..the HIGHESTS level of service rendered. 44. (Public)The title of a review report issued for a public companys quarterly financial statements is titled with which of the following? c..REPORT of Independent Registered PA Firm. 45.You are a CPA retained by the manager of a cooperative retirement village to do write-up work. You are expected to prepare unaudited financial statements with each page marked unaudited &accompanied by a disclaimer of opinion stating no audit was performed. In performing the work, you discover that there are no invoices to support a claim for a $25,000 disbursement. The manager informs you that all the disbursements are proper. What s hould you do?d..NOTIFY the owners that some of the claimed disbursements are unsupported &withdraw if the situation is not satisfactorily resolved. 46.Debt compliance letters are ordinarily addressed to:c..CREDITOR financial institutions. 47.Why do standards prohibit the general use of projections? c..Underlying hypothetical assumptions are difficult to interpret without obtaining additional .information. 48.Evaluating the preparation of the prospective financial statements. b..Understanding internal controls. 49 .An accountant may accept an engagement to apply agreed-upon procedures to prospective financial statements provided that:a..distribution of the report is to be restricted to the specified users involved. 50.Non-accounting data included in a long-form report have been subjected to auditing procedures. The a uditors report should state this fact &should explain that the non-accounting data are presented for analysis purposes. In addition, the auditors report should state whether the non-accounting data are:b..fairly stated in all material respects in relation to the basic financial statements taken as a whole. 51.An auditor has been asked to report on the balance sheet of Kane Company but not on the other basic financial statements. The auditor will have access to all information underlying the basic financial statements. Under these circumstances, the auditor: a..may accept the engagement because such engagements merely involve limited reporting objectives. 52.A CPA who has been engaged to audit financial statements that were prepared on a cash basis: a..must ascertain that there is proper disclosure of the fact that the cash basis has been used, the general nature of material items omitted, &the net effect of such omissions. 53.One example of a special report, as defined by Statements on Auditing St andards, is a report issued in connection with: b..price-level basis financial statements. 54.In a review service where the client has failed to follow GAAP, the accountant is: a..not required to determine the effect of a departure if management has not done so, but that fact must be disclosed in the report. 55.WebTrust engagements should be performed following guidance provided by the:a..AICPA attestation standards. 56.The engagement &report on debt compliance letters should be limited to compliance matters that the auditor is qualified to evaluate. Which of the following engagements would be inappropriate for the CPA to attempt to evaluate? a..Determining whether the client has properly restricted its business activities to the requirements of an agreement. 57.Prospective financial statements are for general use or for limited use. General use refers to use by any third party, where as limited use refers to use by third parties with which the responsible party is negotiating directly. Which of the following statements is not correct? c..Projections can be provided for general use. 58.Before performing a review of a nonpublic entitys financial statements, an accountant should: b..obtain a sufficient level of knowledge of the accounting principles &practices of the industry in which the entity operates. 59.An auditor who was engaged to perform an examination of the financial statements of a nonpublic entity has been asked by the client to refrain from performing various audit procedures &change the nature of the engagement to a review of the financial statements in accordance with standards established by the A ICPA. The clients request was made because the cost to complete the examination was significant. Under these circumstances, the auditor would most likely: d..honor the clients request. 60.An accountants standard report on a compilation of a projection should not include a: d..statement that the accountant expresses ONLY limited assurance that the results may be achieved. 61.Attestation standards allow a CPA to perform all but which of the following services for a forecast or projection? b. REVIEW 62.Under what standards are WebTrust &SysTrust engagements performed? b. .SSAE 63.Negative assurance is not permissible in: c..reports based on an audit of interim financial statements of a closely held business entity. 64.The auditors best course of action with respect to other financial information included in an annual report containing the auditors report is to: a..read &consider the manner of presentation of the other financial information. 65.A CPA who is not independent &is associated with financial statements should disclaim an opinion with respect to those financial statements. The disclaimer should: c..not describe the reason for lack of independence but should state specifically that the CPA is not independent.

You might also like

- Guiffre V MaxwellDocument40 pagesGuiffre V MaxwellTechno Fog91% (32)

- Sales & Consumer Protection Act EssentialsDocument19 pagesSales & Consumer Protection Act EssentialsamysilverbergNo ratings yet

- John PFTDocument231 pagesJohn PFTAlexander Santiago ParelNo ratings yet

- Aveva Installation GuideDocument48 pagesAveva Installation GuideNico Van HoofNo ratings yet

- 001 Gace Early Childhood TestDocument3 pages001 Gace Early Childhood Testapi-265795386No ratings yet

- Sample Exam 2Document16 pagesSample Exam 2Zenni T XinNo ratings yet

- At5906 Audit ReportDocument8 pagesAt5906 Audit ReportImelda leeNo ratings yet

- Chapter 05 - Audit Evidence and DocumentationDocument59 pagesChapter 05 - Audit Evidence and Documentationkevin ChenNo ratings yet

- App ADocument92 pagesApp AMohammadYaqoob100% (1)

- Fabm2 q2 Module 4 TaxationDocument17 pagesFabm2 q2 Module 4 TaxationLady HaraNo ratings yet

- MAS Compilation of QuestionsDocument21 pagesMAS Compilation of QuestionsHazel Joy GaboNo ratings yet

- (Fingerprints Group) 2011 CIMA Global Business Challenge ReportDocument23 pages(Fingerprints Group) 2011 CIMA Global Business Challenge Reportcrazyfrog1991No ratings yet

- Prequalifying Exam Level 2 3 Set B FSUU AccountingDocument9 pagesPrequalifying Exam Level 2 3 Set B FSUU AccountingRobert CastilloNo ratings yet

- 05 Budgeting QuestionsDocument5 pages05 Budgeting QuestionsWynie AreolaNo ratings yet

- Dwarf Boas of The Caribbean PDFDocument5 pagesDwarf Boas of The Caribbean PDFJohn GamesbyNo ratings yet

- Midterm Exams ReviewDocument5 pagesMidterm Exams ReviewJeanette LampitocNo ratings yet

- PDF - Revenue From Contract With Customers (IFRS 15)Document27 pagesPDF - Revenue From Contract With Customers (IFRS 15)Tram NguyenNo ratings yet

- Conceptual Frame Work QBDocument15 pagesConceptual Frame Work QBnanthini nanthini100% (1)

- Prelims Ms1Document6 pagesPrelims Ms1ALMA MORENANo ratings yet

- Evaluation of Misstatements Identified During The Audit: Risk Management & Audit-ICMAP 1Document18 pagesEvaluation of Misstatements Identified During The Audit: Risk Management & Audit-ICMAP 1mrizwan84No ratings yet

- Midterm Exams at University of San Jose RecoletosDocument5 pagesMidterm Exams at University of San Jose RecoletosMa. Kristine Laurice Amancio100% (1)

- Acct 3Document25 pagesAcct 3Diego Salazar100% (1)

- Answer: B: Cf-Multiple Choice Questions (1) - Thuhien-UehDocument5 pagesAnswer: B: Cf-Multiple Choice Questions (1) - Thuhien-UehMinh Phạm100% (1)

- Go-Go Corp Internal Audit IssuesDocument4 pagesGo-Go Corp Internal Audit IssuesGain GainNo ratings yet

- Chapter FourDocument18 pagesChapter Fourmubarek oumerNo ratings yet

- FINALS - Theory of AccountsDocument8 pagesFINALS - Theory of AccountsAngela ViernesNo ratings yet

- 4 Responsibility and Transfer Pricing Part 1Document10 pages4 Responsibility and Transfer Pricing Part 1Riz CanoyNo ratings yet

- AIS10Document4 pagesAIS10XiaoMeiMei100% (1)

- (Set F) (MC) Chapter 19 - Cost Behavior and Cost-Volume-Profit Analysis Examination Question and AnswersDocument4 pages(Set F) (MC) Chapter 19 - Cost Behavior and Cost-Volume-Profit Analysis Examination Question and AnswersJohn Carlos DoringoNo ratings yet

- At - Prelim Rev (875 MCQS) Red Sirug Page 1 of 85Document85 pagesAt - Prelim Rev (875 MCQS) Red Sirug Page 1 of 85Waleed MustafaNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument48 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsHồ Đan ThụcNo ratings yet

- TỔNG HỢP CÁC CÂU HỎI KIỂM TOÁN TÀI CHÍNH DƯỚI 40 KÝ TỰDocument97 pagesTỔNG HỢP CÁC CÂU HỎI KIỂM TOÁN TÀI CHÍNH DƯỚI 40 KÝ TỰMy Nguyễn TràNo ratings yet

- Advanced Accounting Test Bank Chapter 07 Susan Hamlen PDFDocument60 pagesAdvanced Accounting Test Bank Chapter 07 Susan Hamlen PDFsamuel debebeNo ratings yet

- Quizzes Ias 37 Ke Toan Quoc Te1Document12 pagesQuizzes Ias 37 Ke Toan Quoc Te1Mỹ Ngọc Trần ThịNo ratings yet

- Audit Assessment True or False and MCQ - CompressDocument8 pagesAudit Assessment True or False and MCQ - CompressHazel BawasantaNo ratings yet

- Quizzer 4Document5 pagesQuizzer 4Raraj100% (1)

- Financial Analysis - HomeworkDocument7 pagesFinancial Analysis - HomeworkTuan Anh LeeNo ratings yet

- Lecture Week 4Document48 pagesLecture Week 4朱潇妤No ratings yet

- Ais The Expenditure Cycle Purchasing To Cash Disbursements Test BankDocument29 pagesAis The Expenditure Cycle Purchasing To Cash Disbursements Test Bankgutlaysophia06No ratings yet

- Chapter 3 & 4: Internal Control and Audit MethodologyDocument9 pagesChapter 3 & 4: Internal Control and Audit Methodologylazycat1703No ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument5 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureClarisse AlimotNo ratings yet

- KTQTDocument6 pagesKTQTKHANH PHAM QUOCNo ratings yet

- Window Dressing Tactics ExplainedDocument10 pagesWindow Dressing Tactics ExplainedMansi JainNo ratings yet

- Assignment On Segment Reporting, Jonas Albert AtasDocument2 pagesAssignment On Segment Reporting, Jonas Albert AtasJonasAlbertAtasNo ratings yet

- Solution Manual: Ateneo de Naga University College of Business and Accountancy Accountancy DepartmentDocument39 pagesSolution Manual: Ateneo de Naga University College of Business and Accountancy Accountancy DepartmentCaryll Joy BisnanNo ratings yet

- Bl2: The Law On Private Corporation Final Examination General InstructionsDocument4 pagesBl2: The Law On Private Corporation Final Examination General InstructionsShaika HaceenaNo ratings yet

- (Set D) (MC) Chapter 19 - Cost Behavior and Cost-Volume-Profit Analysis Examination Question and AnswersDocument2 pages(Set D) (MC) Chapter 19 - Cost Behavior and Cost-Volume-Profit Analysis Examination Question and AnswersJohn Carlos DoringoNo ratings yet

- 20180731103842D5760 GNBCY PP Chap14 Differential Analysis The Key To Decision Making With Cover PageDocument91 pages20180731103842D5760 GNBCY PP Chap14 Differential Analysis The Key To Decision Making With Cover PageBENNo ratings yet

- Chapter 14Document32 pagesChapter 14faye anneNo ratings yet

- AUDITINGDocument20 pagesAUDITINGAngelieNo ratings yet

- True or False Chapter 4 and 5 QuestionsDocument2 pagesTrue or False Chapter 4 and 5 Questionswaiting4y100% (1)

- Sua Bai C4 - UEH - Ths. Nguyen Dinh Hoang UyenDocument6 pagesSua Bai C4 - UEH - Ths. Nguyen Dinh Hoang UyenKiên TrầnNo ratings yet

- Module 1 Practice QuestionsDocument7 pagesModule 1 Practice QuestionsEllah MaeNo ratings yet

- luyện tập IFRSDocument6 pagesluyện tập IFRSÁnh Nguyễn Thị NgọcNo ratings yet

- CVP AssignmentDocument5 pagesCVP AssignmentAccounting MaterialsNo ratings yet

- Practice Problems For The Final - 2 - UpdatedDocument8 pagesPractice Problems For The Final - 2 - Updatedmaroo566100% (1)

- Session 6 - Process Costing: Multiple ChoiceDocument10 pagesSession 6 - Process Costing: Multiple Choiceatty lesNo ratings yet

- Chapter 13 Test Bank Romney AisDocument35 pagesChapter 13 Test Bank Romney AisEarl QuimsonNo ratings yet

- Financial Instruments: Class 6Document6 pagesFinancial Instruments: Class 6KristenNo ratings yet

- College of Accountancy & Economics Auditing Theory DocumentDocument15 pagesCollege of Accountancy & Economics Auditing Theory DocumentmaekaellaNo ratings yet

- Bài kiểm tra trắc nghiệm chủ đề - Công cụ tài chính - - Xem lại bài làmDocument11 pagesBài kiểm tra trắc nghiệm chủ đề - Công cụ tài chính - - Xem lại bài làmAh TuanNo ratings yet

- QuestionsDocument5 pagesQuestionsYonas100% (1)

- Chapter 10 Test BankDocument48 pagesChapter 10 Test BankDAN NGUYEN THE100% (1)

- ch11 Doc PDF - 2 PDFDocument39 pagesch11 Doc PDF - 2 PDFRenzo RamosNo ratings yet

- Other Assurance Services ReviewDocument24 pagesOther Assurance Services ReviewAid BolanioNo ratings yet

- AT Quizzer 17 - Other Assurance and Non Assurance ServicesDocument10 pagesAT Quizzer 17 - Other Assurance and Non Assurance ServicesRachel LeachonNo ratings yet

- Chapter 16 Test BankDocument25 pagesChapter 16 Test BankDiane CabiscuelasNo ratings yet

- Chapter 13 Post Test SolutionsDocument3 pagesChapter 13 Post Test SolutionsamysilverbergNo ratings yet

- CH 10 (Later Part of Chapter Notes, Starting at Colletive Agreements On Page 365)Document7 pagesCH 10 (Later Part of Chapter Notes, Starting at Colletive Agreements On Page 365)amysilverbergNo ratings yet

- CH 16 Post TestDocument2 pagesCH 16 Post TestamysilverbergNo ratings yet

- Employment QuestionsDocument5 pagesEmployment QuestionsamysilverbergNo ratings yet

- Chapter 10Document6 pagesChapter 10amysilverbergNo ratings yet

- Chapter 15 Pretest Sale & Consumer ProtectionDocument12 pagesChapter 15 Pretest Sale & Consumer ProtectionamysilverbergNo ratings yet

- Midterm #2Document2 pagesMidterm #2amysilverbergNo ratings yet

- Chapter 7 Pretest SolutionsDocument3 pagesChapter 7 Pretest SolutionsamysilverbergNo ratings yet

- CH 10 Post Test SolutionsDocument1 pageCH 10 Post Test SolutionsamysilverbergNo ratings yet

- Audit Sampling ConceptsDocument1 pageAudit Sampling ConceptsamysilverbergNo ratings yet

- Rough Employment QuestionDocument1 pageRough Employment QuestionamysilverbergNo ratings yet

- Assignment 2 OutlineDocument3 pagesAssignment 2 OutlineamysilverbergNo ratings yet

- CH 2Document4 pagesCH 2amysilverbergNo ratings yet

- CH 6Document7 pagesCH 6amysilverbergNo ratings yet

- CH 1 Review SolutionsDocument4 pagesCH 1 Review SolutionsamysilverbergNo ratings yet

- 13Document63 pages13amysilverbergNo ratings yet

- Demand for Auditing ProfessionDocument6 pagesDemand for Auditing ProfessionamysilverbergNo ratings yet

- Invididual Case OutlineDocument2 pagesInvididual Case OutlineamysilverbergNo ratings yet

- Midterm TIPSDocument3 pagesMidterm TIPSamysilverbergNo ratings yet

- Invididual Case OutlineDocument2 pagesInvididual Case OutlineamysilverbergNo ratings yet

- AUDIT GROUPDocument4 pagesAUDIT GROUPamysilverbergNo ratings yet

- The Expense Report Case: Possible Approach To Compliance AuditDocument1 pageThe Expense Report Case: Possible Approach To Compliance AuditamysilverbergNo ratings yet

- 7 Equity Futures and Delta OneDocument65 pages7 Equity Futures and Delta OneBarry HeNo ratings yet

- Module 5 Communication & Change MGT - HS Planning & Policy Making ToolkitDocument62 pagesModule 5 Communication & Change MGT - HS Planning & Policy Making ToolkitKristine De Luna TomananNo ratings yet

- Divide Fractions by Fractions Lesson PlanDocument12 pagesDivide Fractions by Fractions Lesson PlanEunice TrinidadNo ratings yet

- Offshore Wind Turbine 6mw Robust Simple EfficientDocument4 pagesOffshore Wind Turbine 6mw Robust Simple EfficientCristian Jhair PerezNo ratings yet

- Assessment (L4) : Case Analysis: Managerial EconomicsDocument4 pagesAssessment (L4) : Case Analysis: Managerial EconomicsRocel DomingoNo ratings yet

- Teacher Commitment and Dedication to Student LearningDocument8 pagesTeacher Commitment and Dedication to Student LearningElma Grace Sales-DalidaNo ratings yet

- Type of PoemDocument10 pagesType of PoemYovita SpookieNo ratings yet

- Putri KartikaDocument17 pagesPutri KartikaRamotSilabanNo ratings yet

- Assessment of Benefits and Risk of Genetically ModDocument29 pagesAssessment of Benefits and Risk of Genetically ModSkittlessmannNo ratings yet

- List of DEA SoftwareDocument12 pagesList of DEA SoftwareRohit MishraNo ratings yet

- Self-Learning Module in General Chemistry 1 LessonDocument9 pagesSelf-Learning Module in General Chemistry 1 LessonGhaniella B. JulianNo ratings yet

- Research PaperDocument15 pagesResearch PapershrirangNo ratings yet

- An Improved Ant Colony Algorithm and Its ApplicatiDocument10 pagesAn Improved Ant Colony Algorithm and Its ApplicatiI n T e R e Y eNo ratings yet

- Cats - CopioniDocument64 pagesCats - CopioniINES ALIPRANDINo ratings yet

- Monitoring Tool in ScienceDocument10 pagesMonitoring Tool in ScienceCatherine RenanteNo ratings yet

- IS 2848 - Specition For PRT SensorDocument25 pagesIS 2848 - Specition For PRT SensorDiptee PatingeNo ratings yet

- JTIL Purchase Requisition for Plasma Machine SparesDocument3 pagesJTIL Purchase Requisition for Plasma Machine Sparesshivam soniNo ratings yet

- Indra: Detail Pre-Commissioning Procedure For Service Test of Service Water For Unit 040/041/042/043Document28 pagesIndra: Detail Pre-Commissioning Procedure For Service Test of Service Water For Unit 040/041/042/043AnhTuấnPhanNo ratings yet

- Corporate GovernanceDocument35 pagesCorporate GovernanceshrikirajNo ratings yet

- Appendix B, Profitability AnalysisDocument97 pagesAppendix B, Profitability AnalysisIlya Yasnorina IlyasNo ratings yet

- Experimental Investigation On The Properties of Compressed Earth Blocks Stabilised With A Liquid ChemicalDocument7 pagesExperimental Investigation On The Properties of Compressed Earth Blocks Stabilised With A Liquid ChemicalDeb Dulal TripuraNo ratings yet

- DMDPrework QuizDocument5 pagesDMDPrework Quizjunpe- yuutoNo ratings yet

- Robin Engine EH722 DS 7010Document29 pagesRobin Engine EH722 DS 7010yewlimNo ratings yet

- Country Profile - NigerDocument1 pageCountry Profile - Nigernana kayNo ratings yet