Professional Documents

Culture Documents

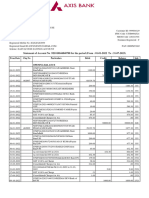

Fixed Deposit Rate Chart

Uploaded by

moregauravCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fixed Deposit Rate Chart

Uploaded by

moregauravCopyright:

Available Formats

Fixed deposit rate chart When a customer is inquiring about, or has decided to open an FD, one of his first

concerns is to know how much interest his money will earn. To answer such a query, the CSO needs to refer to the Interest Rate Chart and show it to the customer. The CSO should give complete and precise information to the customer clearly showing him the rate of interest he will earn for the period he wants to lock his money for.

Fixed Deposit Application-cum-Deposit Slip (Front and Back)

Process Once the customer has decided to open an FD, the CSO would need to hand over the Relationship Form and help him to fill it out. It is a good idea to check out at this point whether the customer already has an account with us. If yes, he may not be required to fill out the relationship form again. Just a Fixed Deposit Receipt (FDR) slip would need to be filled out and duly signed by the customer.

In case of a new relationship, you need to fill up a complete account opening form. Also, all the KYC documents as required for a new account is to be taken.

FD Funding

The next step for the CSO is to check the way in which the customer is funding the deposit. There are three options for the customer: By cash By cheque drawn on another bank By debit to his ICICI bank account Mandatory Requirement of PAN / Form 60/61 in case of Term Deposits exceeding Rs. 50000 :

It is mandatory to quote PAN while FD/RD opening and renewal of amount Rs 50000 and above. In case PAN is not issued to the customer, form 60/61 declara signed by sole / first customer needs to be attached. Where customer PAN is updated in our records, customer should not be returned for want of PAN. The sa be quoted from our records.

The requirement is applicable irrespective of mode of funding of Term Deposit. Thus it is applicable for FDs/RDs being opened through cash, transfer or clearin through renewal of existing FD. The Term Deposit requests to be rejected in case of non-availability of PAN / Form-60/61. The same is applicable for Term Deposits being opened under new customer id as well as existing customer id.

FDR slip Once the customer has submitted the FDR slip duly filled in with all relevant details, the CSO needs to write the Customer Identification Number (CUSTID) on the FDR slip. If it is a new deposit then the CSO needs to mention NEW CUST ID on the FDR slip. When the form goes to RPC for account opening, the new CUST ID would be generated. For example, Nidhi comes to open an FD with us. She does not have any other accounts with us. In such a case, the CSO would need to mention "New CUST ID" on the FDR. In case the CUSTID already exists then the CSO needs to mention it in the space provided. For example, Ajay comes to open an FD with us. He already has a savings account and would like the FD to be opened under the same relationship. In such a case, the CSO would need to mention the existing CUST ID on the FDR. FDR slip CSO receives the FDR slip from the existing customer and scrutinize the same for completeness and correctness Process the request using KWIKTD option in I-Core Handover the same to CSM for verification After verification, print the FDR and handover to the customer against acknowledgment Printing of FDR : On Secured stationery : Branch use DRP option to print FDR on secured stationery On non-secured stationery : Branch use MODRPT option to print FDR on non-secured stationery Please note that branch use KWIKTD option only for the below cases : 1. Existing Customers Funding through Transfer Cheque

2. 3.

Existing Customers Funding through Cash Deposit Existing Customers Funding through Debit Instructions

Except for above, all cases to be send to RPC for FD creation along with the Form and the FDR slip Process for FD (fixed deposit) Renewal: CSO to check the following :

FDR 1. Scrutinise the FD renewal application for signatures of the customer as per mode of operation. 2. Check for value dating of the over-due deposits. 3. FD having linked Overdraft and Demand Loan are not to be processed at branch . 4. Check whether the Renewal instructions has been entered by customer completely & correctly. 5. Check if the Maturity amount to be renewed or only principal amount. 6. If Principal amount to be renewed check the mode of payment of balance amount to customer : Credit to Saving Account/Demand Draft /Pay Order. 7. PAN number / form 60 required if FD renewal amount is Rs.50000 & more. 8. Check whether to be opened under cumulative or traditional mode. If not mentioned on the request, renewal will be continued in existing mode. 9. Process the renewal request by TDREN option in I-core & handover the FDR to CSM for verification. 10. After verification, print the FDR and handover the same to the customer against acknowledgment.

You might also like

- EW Abridged Circular To Shareholders 25 JAN 2017 FINAL PDFDocument2 pagesEW Abridged Circular To Shareholders 25 JAN 2017 FINAL PDFGodknows MudzingwaNo ratings yet

- KVIC PMEGP ManualDocument13 pagesKVIC PMEGP ManualD SRI KRISHNANo ratings yet

- One-Time Settlement (Ots) Scheme of Npas For Micro, Small & Medium Enterprises (Msme) SectorDocument7 pagesOne-Time Settlement (Ots) Scheme of Npas For Micro, Small & Medium Enterprises (Msme) SectorMadhav KotechaNo ratings yet

- FranchiseDocument5 pagesFranchiseNilesh JadhavNo ratings yet

- Internship Report On BankingDocument56 pagesInternship Report On BankingYasir Arafat100% (1)

- SOP WithdrawalsDocument111 pagesSOP Withdrawalsashoku24007No ratings yet

- Kosamattam Finance Limited Prospectus AprilDocument287 pagesKosamattam Finance Limited Prospectus Aprilmehtarahul999No ratings yet

- Kra Transfer FormDocument1 pageKra Transfer FormPaul Gichure0% (1)

- Print To Be Taken On Annexure 1 - Declaration From Borrowers With Foreign Currency ExposureDocument1 pagePrint To Be Taken On Annexure 1 - Declaration From Borrowers With Foreign Currency Exposureshyam kayal50% (2)

- Credit Rating ProcessDocument36 pagesCredit Rating ProcessBhuvi SharmaNo ratings yet

- Lending OperationsDocument54 pagesLending OperationsFaraz Ahmed FarooqiNo ratings yet

- Nyama Yethu Business Plan 2019Document30 pagesNyama Yethu Business Plan 2019Lindinkosi MdletsheNo ratings yet

- Business Plan (2022-2026)Document58 pagesBusiness Plan (2022-2026)mujuni brianmju100% (1)

- Project Report-Study On Credit AppraisalDocument57 pagesProject Report-Study On Credit AppraisalPramod Serma100% (1)

- Presented by DR Jey at BIRD LucknowDocument16 pagesPresented by DR Jey at BIRD LucknowvijayjeyaseelanNo ratings yet

- Bajaj Finserv Limited - ProspectusDocument533 pagesBajaj Finserv Limited - ProspectusYuresh NadishanNo ratings yet

- Kanisa Sacco Information BookletDocument24 pagesKanisa Sacco Information BookletGideon M Kimari0% (1)

- Report On Comparison of Performance Analysis and Risk Management Between DBBL & IBBLDocument22 pagesReport On Comparison of Performance Analysis and Risk Management Between DBBL & IBBLsagor007No ratings yet

- Lending Policies and GuidelinesDocument3 pagesLending Policies and Guidelinessentumbwe damiel0% (1)

- Banking: Islamic Banking: Institute of Business Administration (Iba), JuDocument8 pagesBanking: Islamic Banking: Institute of Business Administration (Iba), JuYeasminAkterNo ratings yet

- Web Info NetDocument25 pagesWeb Info NetHSFXHFHXNo ratings yet

- Management Consulting: Executive SummaryDocument10 pagesManagement Consulting: Executive SummarymarioNo ratings yet

- Business FinanceDocument13 pagesBusiness FinanceThone Gregor VisayaNo ratings yet

- Akhuwat in Pakistan (Microfinance) PDFDocument68 pagesAkhuwat in Pakistan (Microfinance) PDFikutmilisNo ratings yet

- Credits and FinancialDocument25 pagesCredits and FinancialShenna obalesNo ratings yet

- Final PPT FpoDocument27 pagesFinal PPT Fpoarvind_pathak_4No ratings yet

- Pay1 - Proposal For Merchant LendingDocument6 pagesPay1 - Proposal For Merchant LendingAdhe IdhiNo ratings yet

- Invitation LetterDocument1 pageInvitation Lettermi_dooNo ratings yet

- Sheep BusinessDocument10 pagesSheep BusinessFTNo ratings yet

- Proposal For Establishment of Boar Goats Breeding and Training Centre in Kibaale District Global Hand Org PDFDocument17 pagesProposal For Establishment of Boar Goats Breeding and Training Centre in Kibaale District Global Hand Org PDFmuyeghu011866100% (3)

- 2 Principles+of+LendingDocument25 pages2 Principles+of+LendingBratati SahooNo ratings yet

- NABARD Calf RearingDocument7 pagesNABARD Calf Rearingkumar4u_in0% (1)

- Industrial Training Attachment ReportDocument6 pagesIndustrial Training Attachment ReportTipiso SataoNo ratings yet

- Standard Operating Procedure (SOP) For NPS Account Maintenance - Karvy NPSDocument10 pagesStandard Operating Procedure (SOP) For NPS Account Maintenance - Karvy NPSahan verma100% (1)

- Project Report For Broiler Farm: 4,000 NOS BIRDSDocument6 pagesProject Report For Broiler Farm: 4,000 NOS BIRDSManish GovilNo ratings yet

- Integrated Marketing Communication: Done byDocument22 pagesIntegrated Marketing Communication: Done bymicrosabsNo ratings yet

- Registration With SEBI As Merchant Banker and Other MaterialDocument5 pagesRegistration With SEBI As Merchant Banker and Other Materialapi-3727090100% (3)

- Credit Appraisal: by N.R.Trivedi Dy. Manager Credit Head Office, Saurashtra Gramin BankDocument13 pagesCredit Appraisal: by N.R.Trivedi Dy. Manager Credit Head Office, Saurashtra Gramin Bankniravtrivedi72No ratings yet

- Schedule of Charges and Interest Rates PDFDocument5 pagesSchedule of Charges and Interest Rates PDFAjju PodilaNo ratings yet

- Cooperative SocietyDocument5 pagesCooperative SocietyKavita SinghNo ratings yet

- Sources of FundsDocument64 pagesSources of FundsravikumarreddytNo ratings yet

- Thanks For Downloading A Sample Plan: Click Here To Save 50% Off The First Month of Liveplan!Document32 pagesThanks For Downloading A Sample Plan: Click Here To Save 50% Off The First Month of Liveplan!John Alex OdhiamboNo ratings yet

- Dairy Farm Project Report 8 CowsDocument9 pagesDairy Farm Project Report 8 CowshariomsairamNo ratings yet

- Micro PPT PSLDocument23 pagesMicro PPT PSLSONALI HIREKHANNo ratings yet

- JMR AgriNET Evoucher Flyer - v0.1 - 010619Document4 pagesJMR AgriNET Evoucher Flyer - v0.1 - 010619Istiaque AhmedNo ratings yet

- How To Calculate UAE Gratuity Pay - GulfNewsDocument3 pagesHow To Calculate UAE Gratuity Pay - GulfNewsALPHYL BALASABASNo ratings yet

- Kumar Proposal For Enhancement 27-32Document34 pagesKumar Proposal For Enhancement 27-32Chanderparkash Arora0% (1)

- Format AMP1F03 Confidential Report From BankDocument2 pagesFormat AMP1F03 Confidential Report From BankArun Kumar SharmaNo ratings yet

- 1710-Dda 31.05.17Document53 pages1710-Dda 31.05.17sunilNo ratings yet

- IDBI Bank Home LoanDocument11 pagesIDBI Bank Home Loansahil7827No ratings yet

- Dan Alheri Farms Animal Husbandry Business PlanDocument28 pagesDan Alheri Farms Animal Husbandry Business PlanEmmanuelNo ratings yet

- National Savings CertificateDocument12 pagesNational Savings CertificateSiddesh PaiNo ratings yet

- Admission HELLEN PDFDocument1 pageAdmission HELLEN PDFSalihu AhmaduNo ratings yet

- AGRICULTURE Loan Application FormDocument9 pagesAGRICULTURE Loan Application FormKasipag LegalNo ratings yet

- ST Hannah's High-School-Fees-Structure-2020 PDFDocument1 pageST Hannah's High-School-Fees-Structure-2020 PDFRUTIYOMBA Eustache100% (1)

- Jet Diners Upgrade FormDocument2 pagesJet Diners Upgrade FormK S RaoNo ratings yet

- Internship Report On: Presented To: The Manager Soneri Bank Chungi Amer Sidhu BranchDocument4 pagesInternship Report On: Presented To: The Manager Soneri Bank Chungi Amer Sidhu BranchUsman DudezNo ratings yet

- EFTN Form V2 IPDCDocument2 pagesEFTN Form V2 IPDCРой ЧиNo ratings yet

- One-Stop Account Opening Process Retail Ver 3Document7 pagesOne-Stop Account Opening Process Retail Ver 3ዝምታ ተሻለNo ratings yet

- DD and PO FinalDocument3 pagesDD and PO Finalguria_0002No ratings yet

- Digital LibDocument15 pagesDigital LibmoregauravNo ratings yet

- Role of Media During Loksabha Election 2014Document9 pagesRole of Media During Loksabha Election 2014moregauravNo ratings yet

- Open Archive Library: MeaningDocument4 pagesOpen Archive Library: MeaningmoregauravNo ratings yet

- Role and Value of Public LibrariesDocument1 pageRole and Value of Public LibrariesmoregauravNo ratings yet

- Mane Hi Fulapakharachya Pankhasarakhi AasatatDocument1 pageMane Hi Fulapakharachya Pankhasarakhi AasatatmoregauravNo ratings yet

- The Reading ProcessDocument2 pagesThe Reading ProcessmoregauravNo ratings yet

- Languages For Special PurposesDocument1 pageLanguages For Special PurposesmoregauravNo ratings yet

- Hello SirDocument1 pageHello SirmoregauravNo ratings yet

- Format Tips Date One Line Space Name and Address of Recipient Two Spaces or The Reference LineDocument1 pageFormat Tips Date One Line Space Name and Address of Recipient Two Spaces or The Reference LinemoregauravNo ratings yet

- 2012-13 Annual Publication Withoutlinks v1Document22 pages2012-13 Annual Publication Withoutlinks v1moregauravNo ratings yet

- File Formats AssignmentDocument16 pagesFile Formats AssignmentmoregauravNo ratings yet

- The Purpose of File Naming ConventionsDocument6 pagesThe Purpose of File Naming ConventionsmoregauravNo ratings yet

- PathfinderDocument14 pagesPathfindermoregauravNo ratings yet

- Saving Account OpeningDocument18 pagesSaving Account OpeningmoregauravNo ratings yet

- Hmne Bhi Kisi Se Pyar Kiya ThaDocument1 pageHmne Bhi Kisi Se Pyar Kiya ThamoregauravNo ratings yet

- Hello SirDocument1 pageHello SirmoregauravNo ratings yet

- Presentation 1Document11 pagesPresentation 1moregauravNo ratings yet

- BIG CinemasDocument2 pagesBIG CinemasmoregauravNo ratings yet

- Which of The Following Is Not A Feature of Growth Based SchemesDocument1 pageWhich of The Following Is Not A Feature of Growth Based SchemesmoregauravNo ratings yet

- A Boy Does Not Fall in LoveDocument1 pageA Boy Does Not Fall in LovemoregauravNo ratings yet

- Role of Information and Knowledge in Social Change and DevelopmentDocument4 pagesRole of Information and Knowledge in Social Change and DevelopmentmoregauravNo ratings yet

- Core Banking SolutionsDocument1 pageCore Banking SolutionsmoregauravNo ratings yet

- Excel Shotcut KeysDocument4 pagesExcel Shotcut Keyskittyyy1No ratings yet

- Programme Schedule: Seminar On Use of E-Resources in LibraryDocument3 pagesProgramme Schedule: Seminar On Use of E-Resources in LibrarymoregauravNo ratings yet

- Which of The Following Is Not A Feature of Growth Based SchemesDocument1 pageWhich of The Following Is Not A Feature of Growth Based SchemesmoregauravNo ratings yet

- Contents PageDocument2 pagesContents PagemoregauravNo ratings yet

- Mane Hi Fulapakharachya Pankhasarakhi AasatatDocument1 pageMane Hi Fulapakharachya Pankhasarakhi AasatatmoregauravNo ratings yet

- Kuchh Pathar Mein Phool Khil Jaate HainDocument1 pageKuchh Pathar Mein Phool Khil Jaate HainmoregauravNo ratings yet

- Your Product Key Is:: Bnbvk-M3Yxx-Hwvxk-Fk6W9-H6Bg4Document1 pageYour Product Key Is:: Bnbvk-M3Yxx-Hwvxk-Fk6W9-H6Bg4moregauravNo ratings yet

- 12Document3 pages12moregauravNo ratings yet

- Report On Merger of Bank of Baroda, Vijaya and Dena BankDocument6 pagesReport On Merger of Bank of Baroda, Vijaya and Dena BankAnkit KumarNo ratings yet

- BPI V CA 1994Document9 pagesBPI V CA 1994Joyce KevienNo ratings yet

- Bid DocumentDocument40 pagesBid DocumentcatcpkhordhaNo ratings yet

- Loan Policy 1Document13 pagesLoan Policy 1Vijay GangwaniNo ratings yet

- Dispute FormsdjahsdasjpasDocument1 pageDispute FormsdjahsdasjpasMimi Gonzales DagdagNo ratings yet

- BDO Unibank: H1 Statement of ConditionDocument1 pageBDO Unibank: H1 Statement of ConditionBusinessWorldNo ratings yet

- KYC & Anti Money Laundering: CA. Ramesh ShettyDocument56 pagesKYC & Anti Money Laundering: CA. Ramesh ShettyMahapatra MilonNo ratings yet

- Contra Voucher: Vouchers in TallyDocument3 pagesContra Voucher: Vouchers in TallyAfrozNo ratings yet

- Types of BanksDocument10 pagesTypes of Bankssaeed BarzaghlyNo ratings yet

- XXXXXXXXXXX0788-01-01-2022to31-07-2023 ASHUDocument3 pagesXXXXXXXXXXX0788-01-01-2022to31-07-2023 ASHUashokchaturvedi1990No ratings yet

- F 2016114034 P 1Document147 pagesF 2016114034 P 1scribd167No ratings yet

- ForfeitureDocument34 pagesForfeiturerkarlinNo ratings yet

- A Study On Impact of Demonetization On Online Transactions: AbstractDocument5 pagesA Study On Impact of Demonetization On Online Transactions: AbstractJaivik PanchalNo ratings yet

- Questionnaire For The Customers of Housing Loans - Google FormsDocument17 pagesQuestionnaire For The Customers of Housing Loans - Google Formsasefsdff100% (3)

- Chapter 6 & 7 - Kapoor: Consumer CreditDocument24 pagesChapter 6 & 7 - Kapoor: Consumer CreditPaulo Lucas Guillot100% (1)

- CHAP - 3 - Consumer Loans, Credit Cards and Real Estate LendingDocument11 pagesCHAP - 3 - Consumer Loans, Credit Cards and Real Estate LendingNgoc AnhNo ratings yet

- Nike CorruptionDocument41 pagesNike CorruptionLas Vegas Review-JournalNo ratings yet

- How Can Virgin Money Shake Up The UKDocument5 pagesHow Can Virgin Money Shake Up The UKVanceChanNo ratings yet

- General Mathematics: Second Quarter Module 1: Simple and Compound InterestDocument15 pagesGeneral Mathematics: Second Quarter Module 1: Simple and Compound InterestJelrose Sumalpong100% (2)

- Comprehensive Prob Bank Recon - Sample ProblemDocument2 pagesComprehensive Prob Bank Recon - Sample ProblemKez MaxNo ratings yet

- Synchrony Bank Billing Statement - Mar-Apr 2023Document1 pageSynchrony Bank Billing Statement - Mar-Apr 2023Bush JeffNo ratings yet

- Chapter - 2: Foreign Exchange Exposure and Risk ManagementDocument34 pagesChapter - 2: Foreign Exchange Exposure and Risk Managementanand vishwakarmaNo ratings yet

- VP Commercial Real Estate Finance in NYC Resume Todd BakerDocument2 pagesVP Commercial Real Estate Finance in NYC Resume Todd BakerToddBaker1No ratings yet

- Service Request FormDocument1 pageService Request FormMamun RashedNo ratings yet

- Bill 4073 PuraDocument137 pagesBill 4073 Puraraniayuva59No ratings yet

- Mortgage PaymentDocument1 pageMortgage PaymentNat TikusNo ratings yet

- Chapter 08Document46 pagesChapter 08Ivo_NichtNo ratings yet

- Accounting 2 DR Selim Chapter 2Document25 pagesAccounting 2 DR Selim Chapter 2Souliman MuhammadNo ratings yet

- Shring Construction Quo-20-21-196Document1 pageShring Construction Quo-20-21-196chitranjan4kumar-8No ratings yet

- Final Project-Money MarketDocument60 pagesFinal Project-Money MarketSneha Dubey50% (4)

- Preclinical Pathology Review 2023: For USMLE Step 1 and COMLEX-USA Level 1From EverandPreclinical Pathology Review 2023: For USMLE Step 1 and COMLEX-USA Level 1Rating: 5 out of 5 stars5/5 (1)

- Improve Your Global Business English: The Essential Toolkit for Writing and Communicating Across BordersFrom EverandImprove Your Global Business English: The Essential Toolkit for Writing and Communicating Across BordersRating: 4 out of 5 stars4/5 (14)

- The NCLEX-RN Exam Study Guide: Premium Edition: Proven Methods to Pass the NCLEX-RN Examination with Confidence – Extensive Next Generation NCLEX (NGN) Practice Test Questions with AnswersFrom EverandThe NCLEX-RN Exam Study Guide: Premium Edition: Proven Methods to Pass the NCLEX-RN Examination with Confidence – Extensive Next Generation NCLEX (NGN) Practice Test Questions with AnswersNo ratings yet

- CUNY Proficiency Examination (CPE): Passbooks Study GuideFrom EverandCUNY Proficiency Examination (CPE): Passbooks Study GuideNo ratings yet

- Certified Professional Coder (CPC): Passbooks Study GuideFrom EverandCertified Professional Coder (CPC): Passbooks Study GuideRating: 5 out of 5 stars5/5 (1)

- Outliers by Malcolm Gladwell - Book Summary: The Story of SuccessFrom EverandOutliers by Malcolm Gladwell - Book Summary: The Story of SuccessRating: 4.5 out of 5 stars4.5/5 (17)

- The CompTIA Network+ & Security+ Certification: 2 in 1 Book- Simplified Study Guide Eighth Edition (Exam N10-008) | The Complete Exam Prep with Practice Tests and Insider Tips & Tricks | Achieve a 98% Pass Rate on Your First Attempt!From EverandThe CompTIA Network+ & Security+ Certification: 2 in 1 Book- Simplified Study Guide Eighth Edition (Exam N10-008) | The Complete Exam Prep with Practice Tests and Insider Tips & Tricks | Achieve a 98% Pass Rate on Your First Attempt!No ratings yet

- The Science of Self-Discipline: The Willpower, Mental Toughness, and Self-Control to Resist Temptation and Achieve Your GoalsFrom EverandThe Science of Self-Discipline: The Willpower, Mental Toughness, and Self-Control to Resist Temptation and Achieve Your GoalsRating: 4.5 out of 5 stars4.5/5 (77)

- Clinical Internal Medicine Review 2023: For USMLE Step 2 CK and COMLEX-USA Level 2From EverandClinical Internal Medicine Review 2023: For USMLE Step 2 CK and COMLEX-USA Level 2Rating: 3 out of 5 stars3/5 (1)

- 1,001 Questions & Answers for the CWI Exam: Welding Metallurgy and Visual Inspection Study GuideFrom Everand1,001 Questions & Answers for the CWI Exam: Welding Metallurgy and Visual Inspection Study GuideRating: 3.5 out of 5 stars3.5/5 (7)

- Note Taking Mastery: How to Supercharge Your Note Taking Skills & Study Like a GeniusFrom EverandNote Taking Mastery: How to Supercharge Your Note Taking Skills & Study Like a GeniusRating: 3.5 out of 5 stars3.5/5 (10)

- Check Your English Vocabulary for TOEFL: Essential words and phrases to help you maximise your TOEFL scoreFrom EverandCheck Your English Vocabulary for TOEFL: Essential words and phrases to help you maximise your TOEFL scoreRating: 5 out of 5 stars5/5 (1)

- The Official U.S. Army Survival Guide: Updated Edition: FM 30-05.70 (FM 21-76)From EverandThe Official U.S. Army Survival Guide: Updated Edition: FM 30-05.70 (FM 21-76)Rating: 4 out of 5 stars4/5 (1)

- EMT (Emergency Medical Technician) Crash Course with Online Practice Test, 2nd Edition: Get a Passing Score in Less TimeFrom EverandEMT (Emergency Medical Technician) Crash Course with Online Practice Test, 2nd Edition: Get a Passing Score in Less TimeRating: 3.5 out of 5 stars3.5/5 (3)

- College Level Anatomy and Physiology: Essential Knowledge for Healthcare Students, Professionals, and Caregivers Preparing for Nursing Exams, Board Certifications, and BeyondFrom EverandCollege Level Anatomy and Physiology: Essential Knowledge for Healthcare Students, Professionals, and Caregivers Preparing for Nursing Exams, Board Certifications, and BeyondNo ratings yet

- NASM CPT Study Guide 2024-2025: Review Book with 360 Practice Questions and Answer Explanations for the Certified Personal Trainer ExamFrom EverandNASM CPT Study Guide 2024-2025: Review Book with 360 Practice Questions and Answer Explanations for the Certified Personal Trainer ExamNo ratings yet

- Nursing School Entrance Exams: HESI A2 / NLN PAX-RN / PSB-RN / RNEE / TEASFrom EverandNursing School Entrance Exams: HESI A2 / NLN PAX-RN / PSB-RN / RNEE / TEASNo ratings yet

- USMLE Step 1: Integrated Vignettes: Must-know, high-yield reviewFrom EverandUSMLE Step 1: Integrated Vignettes: Must-know, high-yield reviewRating: 4.5 out of 5 stars4.5/5 (7)

- Summary of Sapiens: A Brief History of Humankind By Yuval Noah HarariFrom EverandSummary of Sapiens: A Brief History of Humankind By Yuval Noah HarariRating: 1 out of 5 stars1/5 (3)