Professional Documents

Culture Documents

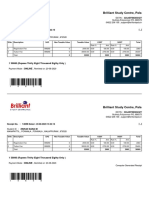

Sahaj Assessment Year Indian Income Tax Return Year: Receipt No/ Date Seal and Signature of Receiving Official

Uploaded by

Ajit KumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sahaj Assessment Year Indian Income Tax Return Year: Receipt No/ Date Seal and Signature of Receiving Official

Uploaded by

Ajit KumarCopyright:

Available Formats

SAHAJ

FORM

INDIAN INCOME TAX RETURN

[For Individuals having Income from Salary / Pension / Income from One House Property (excluding loss brought forward from previous years) / Income from Other Sources (Excluding Winning from Lottery and Income from Race Horses)] (Please see rule 12 of the Income-tax Rules,1962) (Also see attached instructions)

ITR-1

Assessment Year Year

2011-12

PAN AIJPP0191N

PERSONAL INFORMATION

First Name PAIDIGANTAM

Middle Name

Last Name AJIT KUMAR Status

Flat / Door / Building 1-5-591 BALAJI COLONY Road / Street BALAJI COLONY Town/City/District TIRUPATI Email Address PVAJITKUMAR1@YAHOO.COM Income Tax Ward / Circle Whether original or revised return? Area / Locallity BALAJI COLONY State 02-ANDHRA PRADESH Mobile no (Std code) 8712227927 0877 Pin Code 517502

I - Individual Date of birth (DD/MM/YYYY) 15/07/1969 Sex (Select) M-Male

FILING STATUS

Phone No Employer Category (if in 2261727 employment) OTH Return filed under section [Pl see Form Instruction] 11 - u/s 139(1) Date 1 2 3 4 247,245

O-Original

If revised, enter Receipt no / Date RES - Resident Residential Status 1 Income from Salary / Pension (Ensure to fill Sch TDS1) Income from one House Property 2 3 Income from Other Sources (Ensure to fill Sch TDS2)

4 Gross Total Income (1+2c) 5 Deductions under Chapter VI A (Section) 5a a 80 C 5b b 80 CCC 5c c 80 CCD 5d d 80 CCF 5e e 80 D 5f f 80 DD 5g g 80 DDB 5h h 80 E 5i i 80 G 5j j 80 GG 5k k 80 GGA 5l l 80 GGC 5m m 80 U 6 6 Deductions (Total of 5a to 5m) 7 Total Income (4 - 6) 8 Tax payable on Total Income 9 Education Cess, including secondary and higher secondary cess on 8 10 Total Tax, Surcharge and Education Cess (Payable) (8 + 9) 11 11 Relief under Section 89 12 12 Relief under Section 90/91 13 Balance Tax Payable (10 - 11 - 12) 14 Total Interest Payable 15 Total Tax and Interest Payable (13 + 14) For Office Use Only Receipt No/ Date

0 0 0 0 0 0 0 0 0 0 0 0 0 0

TAX COMPUTATION

247,245 System Calculated 0 0 0 0 0 0 0 0 0 0 0 0 0 0 6 247,245 7 0 8 0 9 0 10

INCOME & DEDUCTIONS

0 0 13 14 15 Seal and Signature of Receiving Official 0 0 0

23 Details of Tax Deducted at Source from Salary [As per Form 16 issued by Employer(s)] Tax Deduction Income charg Name of the Total tax Account Number SI.No eable under the Employer Deducted (TAN) of the head Salaries Employer (3) (4) (5) (1) (2) 1 MUMT05749C 2 3 (Click + to add more rows to 23) TDS on Salary above. Do not delete blank rows. ) 24 Details of Tax Deducted at Source Other than Salary Tax Deduction Account Number (TAN) of the Deductor Name of the Deductor Total tax Deducted (4) 11,139 Amount out of (4) claimed for this year (5)

SI.No

(1)

1 2 3 4

(2) (3) MUMT05749C TATA CONSULTA NCY SERVICES EMPLOYEE S' PROVIDEN T FUND

(Click + to add more rows ) TDS other than Salary above. Do not delete blank rows. )

25 Sl No 1 2 3 4 5 6

Details of Advance Tax and Self Assessment Tax Payments Date of Deposit (DD/MM/YYYY) Serial Number of Challan

BSR Code

Amount (Rs)

(Click '+' to add more rows ) Tax Payments. Do not delete blank rows. )

TAXES PAID

16 Taxes Paid PLEASE NOTE THAT CALCULATED FIELDS (IN WHITE) ARE PICKED UP FROM OTHER SCHEDULES AND ARE NOT TO BE ENTERED. For ex : The taxes paid figures below will get filled up when the Schedules linked to them are filled. a Advance Tax (from item 25) b TDS (Total from item 23 + item 24) 16a 16b 0 0

0 c Self Assessment Tax (item 25) 16c 0 Total Taxes Paid (16a+16b+16c) 17 0 Tax Payable (15-17) (if 15 is greater than 17) 18 0 Refund (17-15) if 17 is greater than 15 19 Enter your Bank Account number (Mandatory ) No Select Yes if you want your refund by direct deposit into your bank account, Select No if you want refund by Cheque 22 In case of direct deposit to your bank account give additional details MICR Code Type of Account(As applicable) 26 Exempt income for reporting purposes only (from Dividends, Agri. income < 5000) VERIFICATION I, (full name in block letters), son/daughter of solemnly declare that to the best of my knowledge and belief, the information given in the return thereto is correct and complete and that the amount of total income and other particulars shown therein are truly stated and are in accordance with the provisions of the Income-tax Act, 1961, in respect of income chargeable to Income-tax for the previous year relevant to the Assessment Year 2011-12 Place Date Sign here -> PAN 27 If the return has been prepared by a Tax Return Preparer (TRP) give further details as below: Identification No of TRP Name of TRP Counter Signature of TRP REFUND 17 18 19 20 21

28

If TRP is entitled for any reimbursement from the Government, amount thereof (to be filled by TRP)

Instructions to fill up Excel Utility A) Preparing for filing IncomeTax Return : The appropriate excel utility as per the assessment year and applicable form, for which the return is to be prepared should be downloaded from the website : The tax payer need not use any other software for preparing their returns. The excel utility, once filled up as per the instructions, has the facility to generate an XML for uploading to the eFiling website. B) 5 Steps to upload the ITR. 1. Download and unzip the relevant ITR excel return preparation utility for the selected Assessment Year. 2. Fill up the ITR Excel form as per the tax payers details. 3. Validate the XML from the form by clicking on the "Validate" button. 4. Correct the reported errors and click on "XML Generate" to generate the XML file. 5. Upload the XML file generated to the eFiling site using appropriate login/password. C) No separate file validation utility is required as there are two checks for validating each XML. One check is within the excel utility itself and there is an additional validation check done while the XML is being uploaded to the efiling website. D) How to use this Excel Utility Overview Before you begin Structure of the utility for ITR1 Filling up the sections of the form using the utility Validating the sheets Generating the XML Printing Overview Fill up applicable schedules Validate each sheet Generate XML Validate Summary Upload the XML i

i ii iii iv v vi vii

ii

Before you begin Read the general instructions for filling up the form. The ITR1 Excel Utility is an Excel Workbook that consists of 2 integrated worksheets. Each of the sheets contains a data entry

iii

Structure of the utility for ITR1 The various sheets and the schedules covered per sheet is as below. The name of each sheet displays in the tab at the bottom of the workbook. Each sheet includes a number of distinct, titled sections / schedules. These titles are displayed in black color background with Each sheet is identified by the sheet tabs located at the bottom of the Excel window. These tabs are labelled with abbreviation

iv

v vi

Filling up the sections of the form using the utility. Every section / schedule is color coded to facilitate the user to enter data. There are following different types of cells in the sheet. a) Data entry cells for mandatory fields which are required to be compulsorily entered by the user. These have a red background color. Certain fields are mandatory under specific conditions. Ex : MICR Details are only required for dir b) Data entry cells for optional fields have a black font and a green background color. c) Fields whose values are automatically calculated / filled by the utility have a blue font for the labels and a white bac Navigation : Refer to the navigation buttons shown on the left for Next, Previous. The user can navigate between the shee or previous buttons as required. Moving through the cells : Use Tab Keys to move from one dataentry cell to another on the selected sheet. Adding more rows : Schedules such as TDS, Bank Payments allow users to enter data in tabular format. Using provided buttons below these tables, the taxpayer can add as many rows as required in these tables. Warning : Rows once added, are not required and should not be deleted, even if they are blank. The utility does not generate XML for rows left blank. Important Do's and Dont's while filling TDS and Bank Payment data : Do not skip any row in between as blank while filling up this data in the provided tables. Do not use 2 rows for entering value for a particular entry. Example : If address is longer than the available space, please continue typing in the provided space, and do not move to the next cell to complete the rest of the address. The cell will automatically expand and accept the full address in the same cell. Do not delete blank rows as utility will automatically ensure they are not added to the XML generated. Validating the sheets : Validate the filled up sheet using the "Validate" button. Correct errors identified by the validate feature. Generating the XML and Verifying before uploading to efiling Web Site : Click on the "XML Generate" button. This will re validate all the sheets, and direct the user to the confirmation page which shows the various schedules and the no of rows per schedule being generated. Once verified ok, the tax payer can then click on Save XML option to generate XML. The utility will inform the user with the name and location of the saved XML. This XML \can then be uploaded towards efiling your return and an acknowledgement can be hence generated. Printing. The print button provides the option to the user to print both the sheets of ITR1 after previewing the same. On clicking "Print", the tax payer can click on OK for print preview option, preview the pages which will be printed, and Click on the "Print.." button on the menu of the preview pages to print the ITR Return.

vii

GENERAL This section captures data on Tax Payers Personal Information, Filing status, Income and Deductions and Tax Computations

GENERAL2 This section captures data on Taxes Paid, Refunds, AIR Transactions, Verification and TRP information, TDS and Bankpaym

Assessment Year.

Each of the sheets contains a data entry area.

played in black color background with white text.

ese tabs are labelled with abbreviation forms of the schedules of the sheet.

ntered by the user. These have a red font and a green ICR Details are only required for direct deposit of refunds to

ue font for the labels and a white background color. The user can navigate between the sheets by either clicking on next

er on the selected sheet. in tabular format. ed in these tables. re blank.

s.

ovided space, atically expand

XML generated.

validate feature.

user to the confirmation page which

can be hence generated.

eviewing the same. pages which will be printed, and

d Deductions and Tax Computations

TRP information, TDS and Bankpayment details.

You might also like

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Top Secrets Of Excel Dashboards: Save Your Time With MS ExcelFrom EverandTop Secrets Of Excel Dashboards: Save Your Time With MS ExcelRating: 5 out of 5 stars5/5 (1)

- Objective Questions and Answers of Financial ManagementDocument52 pagesObjective Questions and Answers of Financial ManagementManohar Reddy81% (95)

- How To File Your Income Tax Return OnlineDocument7 pagesHow To File Your Income Tax Return OnlineRaghu NayakNo ratings yet

- General Instructions While Filling The Spread Sheet For Uploading of Invoice Data Along With EreturnsDocument10 pagesGeneral Instructions While Filling The Spread Sheet For Uploading of Invoice Data Along With EreturnsVinod Bhaskar0% (1)

- General Ledger End User Training ManualDocument47 pagesGeneral Ledger End User Training Manualsudheer1112No ratings yet

- Cashbook SampleDocument15 pagesCashbook Samplemaneesh_nayak3No ratings yet

- How To File Income Tax Return F.Y. 2015-16Document12 pagesHow To File Income Tax Return F.Y. 2015-16Dev puniaNo ratings yet

- Field Readiness Program: E-Business Tax Unsupervised Hands-OnDocument18 pagesField Readiness Program: E-Business Tax Unsupervised Hands-OnI'm RangaNo ratings yet

- Taxation Midterms Notes PDFDocument78 pagesTaxation Midterms Notes PDFHanna Mae MataNo ratings yet

- Cash Flow Statement TemplateDocument8 pagesCash Flow Statement TemplateFam Sin YunNo ratings yet

- TCS India Policy - Sick Leave Ver 1Document0 pagesTCS India Policy - Sick Leave Ver 1Ajit Kumar100% (1)

- Saalagraama Saastramu OkDocument190 pagesSaalagraama Saastramu OkAjit KumarNo ratings yet

- Evolution of Philippine Taxation: Saile - Bayeta - Friolo - Yabo - Matamo - Onguda - Jonem - PulgarinasDocument62 pagesEvolution of Philippine Taxation: Saile - Bayeta - Friolo - Yabo - Matamo - Onguda - Jonem - PulgarinasSapphire Yabo100% (4)

- Kaushik Sarkar Form 16 DynProDocument5 pagesKaushik Sarkar Form 16 DynProKaushik SarkarNo ratings yet

- SQL Server Functions and tutorials 50 examplesFrom EverandSQL Server Functions and tutorials 50 examplesRating: 1 out of 5 stars1/5 (1)

- Rental Billing StatementDocument6 pagesRental Billing StatementIsabel SilvaNo ratings yet

- Tan vs. Del Rosario Case DigestDocument7 pagesTan vs. Del Rosario Case DigestReycy Ruth TrivinoNo ratings yet

- 11 Soriano Et Al V Secretary of Finance and The CIRDocument1 page11 Soriano Et Al V Secretary of Finance and The CIRAnn QuebecNo ratings yet

- 01.20 Government BusinessDocument48 pages01.20 Government Businessmevrick_guyNo ratings yet

- DME Process in APDocument23 pagesDME Process in APNaveen KumarNo ratings yet

- 2011 ITR1 r4Document9 pages2011 ITR1 r4Prashant HosamaniNo ratings yet

- Assessment Year Indian Income Tax Return: I - IndividualDocument6 pagesAssessment Year Indian Income Tax Return: I - IndividualManjunath YvNo ratings yet

- ITR-4S: Assessment Year (Presumptive Business Income Tax Return) Indian Income Tax Return SugamDocument11 pagesITR-4S: Assessment Year (Presumptive Business Income Tax Return) Indian Income Tax Return SugamcachandhiranNo ratings yet

- IT Return 2011 2012Document3 pagesIT Return 2011 2012swapnil6121986No ratings yet

- Guide For Preparation of Income Tax Return-ITR1 (SARAL-II) For AY 2010-11Document6 pagesGuide For Preparation of Income Tax Return-ITR1 (SARAL-II) For AY 2010-11amitbabuNo ratings yet

- E-Filing of Vat ReturnDocument43 pagesE-Filing of Vat Returnanoop kumarNo ratings yet

- Sachin4kumar@yahoo - Co.in: Gross Total Income (1+2c) 4Document3 pagesSachin4kumar@yahoo - Co.in: Gross Total Income (1+2c) 4Sachin KumarNo ratings yet

- Return ChallanDocument20 pagesReturn Challansyedfaisal_sNo ratings yet

- Queries Related To ITR FilingDocument3 pagesQueries Related To ITR FilingRajesh KashyapNo ratings yet

- Smartform User Guide500024Document14 pagesSmartform User Guide500024suganya haniNo ratings yet

- Gross Total Income (1+2c) 4: System CalculatedDocument3 pagesGross Total Income (1+2c) 4: System CalculatedDHARAMSONINo ratings yet

- Assessment Year Indian Income Tax Return SahajDocument7 pagesAssessment Year Indian Income Tax Return SahajallipraNo ratings yet

- 5 Steps For Filing E-TDS ReturnDocument6 pages5 Steps For Filing E-TDS Returnk gowtham kumar100% (1)

- Introduction To TdsDocument28 pagesIntroduction To TdsGavendra BhartiNo ratings yet

- Steps For Filing Returns OnlineDocument4 pagesSteps For Filing Returns OnlineSumit BhatNo ratings yet

- Assessment Year Sahaj Indian Income Tax ReturnDocument7 pagesAssessment Year Sahaj Indian Income Tax Returnrajshri58No ratings yet

- Etds Software EasyofficeDocument63 pagesEtds Software EasyofficeetilahdNo ratings yet

- J2IUNDocument2 pagesJ2IUNkisbagmare2734No ratings yet

- IT-2 2011 With Formula and Surcharge and Annex DDocument15 pagesIT-2 2011 With Formula and Surcharge and Annex DPatti DaudNo ratings yet

- Guide: How To File Your Income Tax Returns Online (2013 Edition)Document13 pagesGuide: How To File Your Income Tax Returns Online (2013 Edition)Jasmine ScnNo ratings yet

- Step 1: Bir Form 2551QDocument7 pagesStep 1: Bir Form 2551QAce MarjorieNo ratings yet

- Form ITR-1Document3 pagesForm ITR-1Rajeev PuthuparambilNo ratings yet

- Assessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ DateDocument3 pagesAssessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ DatethakurrobinNo ratings yet

- Service Tax Invoice or Voucher Entry: Gateway of Tally Accounting Voucher F8 SalesDocument7 pagesService Tax Invoice or Voucher Entry: Gateway of Tally Accounting Voucher F8 SalesCehNo ratings yet

- EUT Day 3 - FB70 - Customer InvoiceDocument10 pagesEUT Day 3 - FB70 - Customer Invoicevaishaliak2008No ratings yet

- Income TaxCalculator SRS Ver3.0Document8 pagesIncome TaxCalculator SRS Ver3.0rahul_xxxruNo ratings yet

- RajVAT-QuickGuide To E-Filing of Returns-UpdatedDocument2 pagesRajVAT-QuickGuide To E-Filing of Returns-Updatedddemo17demoNo ratings yet

- Tax Deducted and Collected at SourceDocument34 pagesTax Deducted and Collected at SourceSIVA KUMAR C C 2002No ratings yet

- 2012 Itr1 Pr21Document5 pages2012 Itr1 Pr21MRLogan123No ratings yet

- Indian Income Tax Return Assessment Year SahajDocument7 pagesIndian Income Tax Return Assessment Year SahajSubrata BiswasNo ratings yet

- TDS Return FilingDocument34 pagesTDS Return FilingCABRAJJHANo ratings yet

- VAT Return Help FileDocument11 pagesVAT Return Help FileMadhu ShresthaNo ratings yet

- Underpayment of Estimated Tax by Corporations: Required Annual PaymentDocument4 pagesUnderpayment of Estimated Tax by Corporations: Required Annual Paymentkushaal subramonyNo ratings yet

- 39 Tds in TallyDocument50 pages39 Tds in TallytalupurumNo ratings yet

- Sap-Fi/Co - 2 Cont : Sales TaxDocument30 pagesSap-Fi/Co - 2 Cont : Sales Taxkrishna_1238No ratings yet

- End User Manual Vendor Master CreationDocument17 pagesEnd User Manual Vendor Master Creationsiva610No ratings yet

- PF Memeber Creat PaymentsDocument2 pagesPF Memeber Creat PaymentsGanga RajamNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Oklahoma Corporation Commission: How to Download Monthly Gas Production Reports for Your Well: Landowner Internet Tutorials Series I, #2From EverandOklahoma Corporation Commission: How to Download Monthly Gas Production Reports for Your Well: Landowner Internet Tutorials Series I, #2No ratings yet

- 4 - Hygiene Module - Grade 6-9Document19 pages4 - Hygiene Module - Grade 6-9Ajit KumarNo ratings yet

- Sai Sansthan Friday AartiDocument1 pageSai Sansthan Friday AartiAjit KumarNo ratings yet

- Sai Sansthan Thursday AartiDocument1 pageSai Sansthan Thursday AartiAjit KumarNo ratings yet

- Ajit Voter Id Inclusion Application Form 6 StatusDocument1 pageAjit Voter Id Inclusion Application Form 6 StatusAjit KumarNo ratings yet

- Irctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Document1 pageIrctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Ajit KumarNo ratings yet

- E3276s-150 V200R002 Software Upgrade GuideDocument15 pagesE3276s-150 V200R002 Software Upgrade GuideAjit KumarNo ratings yet

- Dell Vostro 1310 - enDocument12 pagesDell Vostro 1310 - enDasRazaNo ratings yet

- Hm75 Mobile Chipset BriefDocument4 pagesHm75 Mobile Chipset BriefAjit KumarNo ratings yet

- Unit 1 Human Resource Management: An Overview: StructureDocument11 pagesUnit 1 Human Resource Management: An Overview: StructureAjit KumarNo ratings yet

- Acer IconiaDocument52 pagesAcer IconiaAjit KumarNo ratings yet

- An Overview On MortgageDocument7 pagesAn Overview On MortgageAjit KumarNo ratings yet

- Blackberry Internet Service User Guide 1358200033629 4.4 enDocument66 pagesBlackberry Internet Service User Guide 1358200033629 4.4 enAjit KumarNo ratings yet

- Approach Note For Bandwidth-Sensitive Web Apps v2Document2 pagesApproach Note For Bandwidth-Sensitive Web Apps v2Ajit KumarNo ratings yet

- 2014 Sales DiscountDocument1 page2014 Sales DiscountAjit KumarNo ratings yet

- Hm75 Mobile Chipset BriefDocument4 pagesHm75 Mobile Chipset BriefAjit KumarNo ratings yet

- HM 77Document4 pagesHM 77wolfwbearwNo ratings yet

- ItcadbDocument15 pagesItcadbAjit KumarNo ratings yet

- TCS India Announcement - Health Insurance Coverage (HIS) and Premiums For 2008-09Document2 pagesTCS India Announcement - Health Insurance Coverage (HIS) and Premiums For 2008-09Ajit KumarNo ratings yet

- 42 Indian RushisDocument1 page42 Indian RushisAjit KumarNo ratings yet

- Hm75 Mobile Chipset BriefDocument4 pagesHm75 Mobile Chipset BriefAjit KumarNo ratings yet

- 3Q 2008 TPI Index - GlobalDocument17 pages3Q 2008 TPI Index - GlobalAjit KumarNo ratings yet

- South African 2007 Insurance Industry Survey 08-33-47Document92 pagesSouth African 2007 Insurance Industry Survey 08-33-47Ajit KumarNo ratings yet

- Sunlife - Web 2.0 For InsuranceDocument25 pagesSunlife - Web 2.0 For InsuranceAjit KumarNo ratings yet

- Agile MethodologiesDocument12 pagesAgile MethodologiesAjit KumarNo ratings yet

- SouthafricaDocument14 pagesSouthafricaAjit KumarNo ratings yet

- Branch Teller: Use SCR 008765 Deposit Fee Collection State Bank CollectDocument1 pageBranch Teller: Use SCR 008765 Deposit Fee Collection State Bank CollectShivani MishraNo ratings yet

- US Internal Revenue Service: Irb07-20Document44 pagesUS Internal Revenue Service: Irb07-20IRSNo ratings yet

- Tax Invoice Seller Buyer: (AED) (AED) (AED)Document2 pagesTax Invoice Seller Buyer: (AED) (AED) (AED)ZiZo AgnoNo ratings yet

- New Smart Samriddhi Brochure 09.03.2021Document12 pagesNew Smart Samriddhi Brochure 09.03.2021GAJALAKSHMI LNo ratings yet

- Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Document3 pagesMonthly Remittance Return of Creditable Income Taxes Withheld (Expanded)appipinnim100% (2)

- Actg Coach Actg Princ1Document3 pagesActg Coach Actg Princ1Amir IrfanNo ratings yet

- No Loan May Be Sanctioned On The Basis of This Salary Slip Without Obtaining NOC From Competent Authority in NDMCDocument1 pageNo Loan May Be Sanctioned On The Basis of This Salary Slip Without Obtaining NOC From Competent Authority in NDMCParasNo ratings yet

- 5 Estate Tax Myths: Myth No. 1. The "Survivorship" Clause Can Survive DeathDocument3 pages5 Estate Tax Myths: Myth No. 1. The "Survivorship" Clause Can Survive DeathJP PalamNo ratings yet

- Brilliant Study Centre, Pala: 14658 292543 SANA MDocument1 pageBrilliant Study Centre, Pala: 14658 292543 SANA MMINNAH FATHIMANo ratings yet

- TAX Mock September 2023Document64 pagesTAX Mock September 2023Saqib IqbalNo ratings yet

- AsynchDocument4 pagesAsyncherickamaeebaloNo ratings yet

- PayrollDocument6 pagesPayrollAlireza T.No ratings yet

- LIC STMTDocument1 pageLIC STMTEl Solo LoboNo ratings yet

- Tax 1 Unit 1. Chapter 3Document5 pagesTax 1 Unit 1. Chapter 3angelika dijamcoNo ratings yet

- UK Payroll ProcessDocument3 pagesUK Payroll ProcessNisha JoshiNo ratings yet

- Principles of Accounting Midterm Exam - Sum 2022Document7 pagesPrinciples of Accounting Midterm Exam - Sum 2022Yến Hoàng HảiNo ratings yet

- Crc-Ace Review School: TAXATION (1-70)Document10 pagesCrc-Ace Review School: TAXATION (1-70)LuisitoNo ratings yet

- Word Income From House PropertyDocument19 pagesWord Income From House PropertyRathin Banerjee100% (1)

- Direct and Indirect TaxDocument12 pagesDirect and Indirect TaxSresth VermaNo ratings yet

- Notice: Agency Information Collection Activities Proposals, Submissions, and ApprovalsDocument6 pagesNotice: Agency Information Collection Activities Proposals, Submissions, and ApprovalsJustia.comNo ratings yet

- FNF 02 I33514 Ankit ShuklaDocument3 pagesFNF 02 I33514 Ankit ShuklaAnkit ShuklaNo ratings yet

- Income Tax Return For Individuals: Taxpayer InformationDocument6 pagesIncome Tax Return For Individuals: Taxpayer InformationSYDNEYNo ratings yet

- Shyama Health Care &fitness Solution: Ret No.018 13636203Document1 pageShyama Health Care &fitness Solution: Ret No.018 13636203Wjajshs UshdNo ratings yet

- Module 9Document7 pagesModule 9trixie maeNo ratings yet

- Info On Vat in RomaniaDocument16 pagesInfo On Vat in RomaniaAd FelixNo ratings yet

- Annex E - TCC-GOCC - Sworn ApplicationDocument1 pageAnnex E - TCC-GOCC - Sworn ApplicationanabuaNo ratings yet