Professional Documents

Culture Documents

Model Test Paper BCSM PDF

Uploaded by

yogeshdeopaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Model Test Paper BCSM PDF

Uploaded by

yogeshdeopaCopyright:

Available Formats

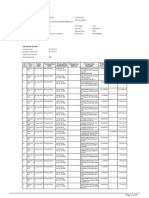

BSEs Certification for Stock Markets (BCSM) Examination

MODEL TEST PAPER FOR BCSM Q. Id

1

Question

Indian Securities market is one among top______ securities markets of the world. The Bombay Stock Exchange was established in ______

Option 1

Four

Option 2

Eight

Option 3

Three

Option 4

Six

1875

1873

1874

1872

The Bombay Stock Exchange was established as a ___________ As of December 31, 2009 the Bombay Stock Exchange was among the top_____ of global exchanges in terms of market capitalization of its listed companies As of December 31, 2009 the Bombay Stock Exchange was the worlds number _____ exchange in the world in terms of listed companies The first exchange in India to get ISO 9001:2000 certification was _____ Bombay Stock Exchange was the __________ in the world to obtain the ISO 9001:2000 certifications Exchange traded fund (ETF) on SENSEX are listed on BSE and Exchange in ________

Limited Liability Firm

A partnership firm

A company

Voluntary non-profit organization

Six

Eight

Ten

nine

One

Two

Five

Three

The Multi Commodity Exchange

The Bombay Stock Exchange

The OTCEI

The National Stock Exchange

First

Second

Fifth

Third

UK

USA

Hong Kong

Japan

The debt market in India covers all, except

Letters of Credit

External Commercial Borrowings

State Govt. debts

Central Govt. debts

10

Currently, Indian Securities market comprised of _________ stock exchanges spread throughout the country

15

22

19

17

11

Which of the following is not a market regulator

Ministry of Corporate Affairs

Securities and Exchange Board of India (SEBI)

Ministry of commerce

Department of Economic Affairs

BSE Institute Limited

Page 1 of 9

BSEs Certification for Stock Markets (BCSM) Examination

12

Contracts for sale and purchase of government securities, gold-related securities, money market securities and securities derived from these securities and ready forward contracts in debt securities shall be regulated by ______, once they are not traded on any stock exchange Majority of the powers granted under SCRA are exercisable by______ The powers under the Companies Act relating to issue and transfer of securities and non-payment of dividend are administered by _________ in case of listed public companies and public companies proposing to get their securities listed Which of the following is not a key regulations currently governing Indian securities market Securities Contracts (Regulation) Act (SCRA), 1956 gives SEBI regulatory jurisdiction over The Securities Contracts (Regulation) Act, 1956 was enacted to _______ undesirable transactions in securities by regulating the business of dealing therein and by providing for certain other matters connected therewith Under the Securities Contracts (Regulation) Act (SCRA), 1956, section 2(h) does not include which as Securities

DCA

SEBI

SBI

RBI

13

DEA

SEBI

MCA

RBI

14

FMC

SEBI

RBI

DEA

15

The Foreign Exchange Manageme nt Act, 1999 Stock Exchanges

The Securities Contracts Regulation Act, 1956 Real Estates Markets

The SEBI Act, 1992

The Companies Act, 1956

16

Commodities

Banks

17

exempt

prevent

receive

promote

18

Commoditi es

Mutual Fund Units A contract which derives its value from the prices, or index of prices, of underlying securities

Government securities

Derivatives

19

Derivative includes

Mutual Funds

Rights issue

ETF

BSE Institute Limited

Page 2 of 9

BSEs Certification for Stock Markets (BCSM) Examination

20

21

Every recognised stock exchange and every member thereof shall maintain and preserve for such periods not exceeding __________ such books of account, and other documents as the Central Government, after consultation with the stock exchange concerned, may prescribe in the interest of the trade or in the public interest A member of a ________ shall not in respect of any securities enter into any contract as a principal with any person other than a member of a recognised stock exchange, unless he has secured the consent or authority of such person and discloses in the note, memorandum or agreement of sale or purchase that he is acting as a principal The Companies Act, 1956 does not deal with

Five years

One year

Two years

Four years

commodity exchange

financial institution

recognised stock exchange

Mutual Fund

22

Commodity markets

Issues of Securities

Allotment and transfer of securities

Money markets

23

Under Section 31 of The Companies Act, 1956, any company could be of the form except Broad indices are expected to capture the __________ of equity market and need to represent the return obtained by typical portfolios in the country The primary function of a stock index is to serve as _________ of the equity market

Limited Liability Firm

Public Companies

Private Companies

Trust

24

selective behaviour

Overall behavior

Liquidity behavior

Price behavior

25

A benchmark

a barometer

A litmus test

A yardstick

26

"Spot delivery contract" has been defined in Section 2(i) to mean a contract which does not provide for

Sale of shares on a spot date

Actual delivery of securities and the payment thereof

Transfer of the securities by the depository from the account of a beneficial owner to the account of another beneficial owner

All given options are correct

BSE Institute Limited

Page 3 of 9

BSEs Certification for Stock Markets (BCSM) Examination

27

28

29

SEBI may direct a recognised stock exchange to suspend such of its business for such period not exceeding ________and subject to such conditions as may be specified in the notification The Companies Act, 1956 stipulates that a meeting of the Board of Directors shall be held atleast _______ in every quarter of the calendar year and committees of the Board like investment committee, audit committee, compensation committee etc. shall meet as and when required As per The Companies Act, 1956, excluding directorship in private companies, unlimited companies, Section 25 companies and alternate directors, an individual can be a Director maximum to how many companies The stock exchanges provide facilities for _________________ to the common masses

Seven days

One day

Two days

Five days

Three times

Once

Twice

Five times

15

20

25

10

30

Trading in commoditie s

Trading in securities

Accumulation of wealth

Gambling

31

All are various components of securities markets, except

Commercia l Banks

Derivatives

Issuers of securities

Securities

32

As per The Securities Contract (Regulation) Act, 1956 Securities includes all, except

Commercia l Banks Providing liquidity to holders of common shares The Companies Act, 1956 The Securities Contract (Regulation ) Act, 1946

Bonds

Derivatives

Post Office Fixed Deposit Providing a secondary market to investors of securities

33

Stock exchanges serve all purposes, except ______________ set out the code of conduct for the corporate sector in relation to issue, allotment and transfer of securities, disclosures to be made in public issues and non payment of dividend __________________ provides for regulation of transaction in securities through control over stock exchanges

Providing a place for lawful gambling

Try to seek the best price for the securities

34

The Companies Act, 1963

The Reserve Bank of India Act, 1934 The Securities Contract (Regulation) Act, 1956

The SEBI Act, 1992

35

The Companies Act, 1956

The SEBI Act, 1992

BSE Institute Limited

Page 4 of 9

BSEs Certification for Stock Markets (BCSM) Examination

36

_______________ provides for the electronic maintenance and transfer of ownership of dematerialized securities Section ________of the SEBI Act provides that it shall be the duty of the Board to protect the interests of investors in securities and to promote the development of, and to regulate the securities market, by such measures as it thinks fit

The Securities Contract (Regulation ) Act, 1956

The Depository Act, 1956

The Companies Act, 1956

None of the above

37

12(1)

11(1)

11 (5)

11 (2)

38

Which is not an activity of SEBI

Regulating Banking Treasuries

It regulates the business in stock exchanges and any other securities markets and the working of collective investment schemes, including mutual funds, registered by it

Regulating Commodity Exchanges

Regulating Financial Markets

39

Section ________of the SEBI Act provides that it shall be the duty of the Board to protect the interests of investors in securities and to promote the development of, and to regulate the securities market, by such measures as it thinks fit

12(1)

11(1)

11 (5)

11 (2)

40

Which is not an activity of SEBI

Regulating Banking Treasuries

It regulates the business in stock exchanges and any other securities markets and the working of collective investment schemes, including mutual funds, registered by it

Regulating Commodity Exchanges

Regulating Financial Markets

BSE Institute Limited

Page 5 of 9

BSEs Certification for Stock Markets (BCSM) Examination

41

The cash flows associated with ________ are difficult to evaluate due to the uncertainty and variability associated with them An increase in a firm's expected growth rate would normally cause the firm's required rate of return to

common stocks

preference shares

bonds

debentures

42

remain unchanged

Increase

Decrease

All given options are correct The stock is experiencing supernormal growth The constant growth model takes into consideration the proportional capital gains increased on a stock

43

If the expected rate of return on a stock exceeds the required rate,

The stock is a bad buy. The constant growth model takes into considerati on the capital gains earned on a stock If your uncle earns a return similar to the overall stock market, this means the stock market is inefficient Weak-form market efficiency implies that recent trends in stock prices would be of tremendou s use in selecting stocks

The stock is a good buy It is appropriate to use the constant growth model to estimate stock value even if the growth rate never becomes constant If a market is strongform efficient this implies that the returns on bonds and stocks should be identical Weak-form market efficiency implies that recent trends in stock prices would be of no use in selecting stocks

The stock should be sold

44

Which of the following statements is most correct?

Two firms with the same dividend and growth rate must also have the same stock price

45

Which of the following statements is most correct?

If a market is weak-form efficient this implies that all public information is rapidly incorporated into market prices

If your uncle earns a return higher than the overall stock market, this means the stock market is inefficient Semistrongform market efficiency implies that all private and public information is rapidly incorporated into stock prices

46

Which of the following statements is most correct?

Market efficiency implies that all stocks should have the same expected return

BSE Institute Limited

Page 6 of 9

BSEs Certification for Stock Markets (BCSM) Examination

47

Which of the following statements is most correct?

Semistrong -form market efficiency means that stock prices reflect all public information

An individual who has information about past stock prices should be able to profit from this information in a weakform efficient market

An individual who has inside information about a publicly traded company should be able to profit from this information in a strongform efficient market compounding frequency

Strong-form market efficiency means that stock prices reflect all public information

48

The effective rate of interest differs from the nominal rate of interest in that it reflects the impact of : For any interest rate and for a given period of time, the more frequently interest is compounded, the future value becomes______. The tighter the probability distribution of expected future returns, the smaller the risk of a given investment as measured by the _____________

compoundi ng frequency

future value

volatility

49

higher

lower

remains the same

difficult to compute

50

skewness

mean

standard deviation

mode

BSE Institute Limited

Page 7 of 9

BSEs Certification for Stock Markets (BCSM) Examination

Answers: Q. Id 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 Answer

Eight 1875 Voluntary non-profit organisation Ten One The Bombay Stock Exchange Second Hong Kong External Commercial Borrowings 22 Ministry of commerce RBI DEA SEBI The Foreign Exchange Management Act, 1999 Stock Exchanges prevent Commodities A contract which derives its value from the prices, or index of prices, of underlying securities Five years recognised stock exchange Money markets Trust Overall behavior a barometer All given options are correct Seven days Once 15 Trading in securities Commercial Banks Post Office Fixed Deposit Providing a place for lawful gambling The Companies Act, 1956 The Securities Contract (Regulation) Act, 1956 The Depository Act, 1996 11(1) Regulating Banking Treasuries 11(1) Regulating Banking Treasuries common stocks All given options are correct The stock is a good buy The constant growth model takes into consideration the capital gains earned on a stock If your uncle earns a return higher than the overall stock market, this

BSE Institute Limited

Page 8 of 9

BSEs Certification for Stock Markets (BCSM) Examination

46 47 48 49 50

means the stock market is inefficient Weak-form market efficiency implies that recent trends in stock prices would be of no use in selecting stocks Semistrong-form market efficiency means that stock prices reflect all public information compounding frequency higher standard deviation

BSE Institute Limited

Page 9 of 9

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Insurance Agency Business PlanDocument43 pagesInsurance Agency Business PlanJoin Riot100% (5)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Chap 5 - Books of Prime Entry and Subsidiary LedgersDocument21 pagesChap 5 - Books of Prime Entry and Subsidiary LedgersEli Syahirah50% (2)

- ICORPFIN Executive Optical Business Plan - CARBONELLDocument10 pagesICORPFIN Executive Optical Business Plan - CARBONELLZhanika Marie CarbonellNo ratings yet

- AirwayBill 0NGKT15231058Document1 pageAirwayBill 0NGKT15231058halipzramlyzNo ratings yet

- HDFC MF Factsheet March 2016 22-04-2016Document100 pagesHDFC MF Factsheet March 2016 22-04-2016yogeshdeopaNo ratings yet

- 2015 - NISM-Series-V-A - Mutual Fund Distributors Workbook-Sep 2015 PDFDocument249 pages2015 - NISM-Series-V-A - Mutual Fund Distributors Workbook-Sep 2015 PDFSwapna SA67% (3)

- NISM Series IV-Interest Rate Derivatives New Workbook Version Sep-2015 PDFDocument107 pagesNISM Series IV-Interest Rate Derivatives New Workbook Version Sep-2015 PDFyogeshdeopaNo ratings yet

- NISM Series IV-Interest Rate Derivatives New Workbook Version Sep-2015 PDFDocument107 pagesNISM Series IV-Interest Rate Derivatives New Workbook Version Sep-2015 PDFyogeshdeopaNo ratings yet

- NISMS07ADocument134 pagesNISMS07Ayogeshdeopa100% (1)

- Imt 40Document6 pagesImt 40yogeshdeopaNo ratings yet

- Bankingsystem Structureinpakistan:: Prepared by & Syed Ali Abbas Zaidi MoinDocument12 pagesBankingsystem Structureinpakistan:: Prepared by & Syed Ali Abbas Zaidi MoinmoeenNo ratings yet

- New Income Tax Return BIR Form 1700 - November 2011 RevisedDocument4 pagesNew Income Tax Return BIR Form 1700 - November 2011 RevisedBusinessTips.Ph100% (2)

- Chile 1970-1973, Economic Development and Its International Setting. Institute of Social StudiesDocument423 pagesChile 1970-1973, Economic Development and Its International Setting. Institute of Social StudiesdavidizanagiNo ratings yet

- Industrial SicknessDocument10 pagesIndustrial SicknessAditya0% (1)

- Unit 1 - Introduction To Principles of AccountingDocument100 pagesUnit 1 - Introduction To Principles of AccountingNgonga FumbeloNo ratings yet

- HSBCDocument21 pagesHSBCHarsha SanapNo ratings yet

- Financial Analysis Shell PakistanDocument17 pagesFinancial Analysis Shell PakistanYasir Bhatti100% (1)

- Chapter 1 Cash and Cash Equivalents AutoRecoveredDocument44 pagesChapter 1 Cash and Cash Equivalents AutoRecoveredJhonielyn Regalado RugaNo ratings yet

- Detailed Statement: Page 1 of 32Document32 pagesDetailed Statement: Page 1 of 32arun visweshwaranNo ratings yet

- Types of Housing LoanDocument20 pagesTypes of Housing LoanIzzuddin ZulkefliNo ratings yet

- Best of Mobile Pos 2014 PDFDocument127 pagesBest of Mobile Pos 2014 PDFAndalynaNo ratings yet

- Circular 1 Switching Fee AePS EKYC Card 0 0Document2 pagesCircular 1 Switching Fee AePS EKYC Card 0 0Sharanya KunduNo ratings yet

- Chapter 6 Loan and DebenturesDocument9 pagesChapter 6 Loan and DebenturesranunNo ratings yet

- Ramakar Jha CBSE FMM I Book Final VersionDocument279 pagesRamakar Jha CBSE FMM I Book Final Versionmilan senNo ratings yet

- Banking Awareness EbookDocument467 pagesBanking Awareness EbookSivaji Haldar50% (2)

- Corporate Failure: Bank of Credit and Commerce InternationalDocument15 pagesCorporate Failure: Bank of Credit and Commerce InternationalHussain Amin100% (1)

- PDF Oracle Finance Interview Questions and Answers PDFDocument4 pagesPDF Oracle Finance Interview Questions and Answers PDFJoy ReddickNo ratings yet

- Narrative ReportDocument30 pagesNarrative ReportClevin CabuyaoNo ratings yet

- 392 T 1 W 12 SolnDocument2 pages392 T 1 W 12 SolnHongyi Frank LiangNo ratings yet

- Exam 1 LXTDocument31 pagesExam 1 LXTphongtrandangphongNo ratings yet

- Problem SetDocument1 pageProblem SetNoel PadronNo ratings yet

- EX-99, Boise Inc-Carlson CapitalDocument17 pagesEX-99, Boise Inc-Carlson CapitalJake MannNo ratings yet

- UBFB3023 Tutorial 11 A Jan 10Document9 pagesUBFB3023 Tutorial 11 A Jan 10Phang Chen DeNo ratings yet

- Islamic Financial System Principles and Operations PDF 100 200Document101 pagesIslamic Financial System Principles and Operations PDF 100 200Asdelina R100% (1)

- Union Bank of India Probationary Officers EDocument48 pagesUnion Bank of India Probationary Officers ERahul KulkarniNo ratings yet

- Presentation 4 Sales and LeaseDocument106 pagesPresentation 4 Sales and Leaselouise_canlas_1No ratings yet