Professional Documents

Culture Documents

Finergo Episode 28 15june09

Uploaded by

FinergoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Finergo Episode 28 15june09

Uploaded by

FinergoCopyright:

Available Formats

04 KALEIDOSCOPE ERGO Monday, June 15, 2009

At a glance

Reliance Infrastructure Fund

Fund philosophy: To give investors long-term

capital appreciation by investing mainly in equities

and related instruments. The investments will be

only in equities related to the infrastructure and

related companies.

Opening date: May 25, 2009

Closing date: June 23, 2009

Offer price: Rs. 10 per unit

Finergo’s take: Infrastructure will be an industry

that will show consistent growth at least for the

next 10 years.

Quiz

1. What does ELSS stand for:

A) Employee Linked Savings Scheme

B) Equity Linked Small Stocks

C) Equity Linked Savings Scheme

D) Enterprise Level Securities and stocks

2. CAP in Large Cap or Mid-Cap stands for?

A) Capital

B) Capitalisation

C) Capacity

D) Capability

Send your answers to finergo@goergo.in or SMS

your answers to 92813 98889. For example, if you

choose A as the answer to question 1 and B as the

answer to question 2 type it as 1A2B and send it.

Winner will be chosen by lucky draw from all correct

answers.

Answers for last week’s quiz: Consolidation of banks will assure more government support as well as higher safety

20%

Palanimanickam

News you can use

No to consolidation

Banking on the

Employees of all State Bank associates have

shown negative sentiments towards the proposed

consolidation (Read lead article) of the public sec-

tor banks. They are of the opinion that doing so

power on oneness

would lead to a distraction in the core focus of the

banks from the common man to global competi-

tion. The employees association has called for a

What is it for you and me if PSBs were to consolidate?

strike on July 3. growth of these banks as well as to avail of loans.

DIVYA DARSHINI

divya@finerva.com boost the economy as a whole. 2. Government support will be

New mortality table for life insurance Although the PLR (Prime Lending more than before for there is less di-

The IRDA will soon be releasing the new table for

F

inance Minister Pranab Muk- Rate) of banks have come down by versification in policies and

calculating mortality rates. The table is based on herjee has emphasised the 1.75 to 2.25 per cent during the past procedures.

latest data relating to mortality and is also based on need to consolidate Public Sec- six months there is still scope for fur- 3. This would benefit the capital

the data provided by different insurance compa- tor Banks (PSBs). He stated that ther reduction. This will give impe- markets tremendously and thus the

nies relating to their claims. With this customers this merger of PSBs is very essential tus to economic growth too. The FM values of our stock investments and

could look forward to lower premium rates. for the country as well for the surviv- also pointed out that the Govern- mutual fund NAVs could see a posi-

al and growth of banks themselves. ment, as a majority shareholder, will tive growth.

HDFC coming up with NCD For, it not only aids in the reduction play a very supportive role in the 4. Indian public sector banks

The board of Housing Development Finance of risks due to financial stability but merger. could become more competitive in

Corporation (HDFC) has approved plans to raise also helps in improving the state of So, what does this mean for you comparison to global banks, thus

capital of Rs. 4,000 crore through non convertible competitiveness of Indian banks and me? Although on a macro level enabling them to offer cost-effective

debentures and warrants that could be converted globally. consolidation can help the country, yet world-class financial products.

to shares at a later date. Although the NCDs will be Recently, the Finance Minister there are a few positive take-homes 5. Common investors can be more

available only to Qualified Institutional Investors, met with the Chief Executives of the for us as individual investors as well: assured when investing in these en-

from a personal finance point of view it is a signif- PSBs and suggested that they look 1. Consolidation of banks may en- tities as there is more government

icant move considering it is one of the largest NCD through all the possible ways to fur- able better returns on investments support as well as higher safety. This

offering and also an indicator of market ther reduce their lending rates. Ac- and the lending rates could go down, is very critical, especially after what

sentiments. cording to him, this will assist in the making it cheaper and easier for us happened to the large US banks. ■

You might also like

- Finergo Episode 27 08june09Document1 pageFinergo Episode 27 08june09FinergoNo ratings yet

- Finergo Episode 22 DT 04may09Document1 pageFinergo Episode 22 DT 04may09FinergoNo ratings yet

- Finergo Episode 23 DT 11may09Document1 pageFinergo Episode 23 DT 11may09FinergoNo ratings yet

- Finergo Episode 26 DT 01june09Document1 pageFinergo Episode 26 DT 01june09FinergoNo ratings yet

- Finergo Episode 24 DT 18may09Document1 pageFinergo Episode 24 DT 18may09FinergoNo ratings yet

- Finergo Episode 21 DT 27apr09Document1 pageFinergo Episode 21 DT 27apr09finervaNo ratings yet

- Finergo Episode 20 DT 20apr09Document1 pageFinergo Episode 20 DT 20apr09FinergoNo ratings yet

- Finergo Episode 15Document1 pageFinergo Episode 15finervaNo ratings yet

- Episode 19 03apr09Document1 pageEpisode 19 03apr09finervaNo ratings yet

- Finergo Episode 18Document1 pageFinergo Episode 18finervaNo ratings yet

- Finergo Episode 16Document1 pageFinergo Episode 16finervaNo ratings yet

- Finergo Episode 14Document1 pageFinergo Episode 14finervaNo ratings yet

- Finergo Episode 17Document1 pageFinergo Episode 17finervaNo ratings yet

- Finergo Episode 13Document1 pageFinergo Episode 13finervaNo ratings yet

- Finergo Episode 12Document1 pageFinergo Episode 12finervaNo ratings yet

- Episode 05 08dec09Document1 pageEpisode 05 08dec09finervaNo ratings yet

- Finergo Episode 10Document1 pageFinergo Episode 10finervaNo ratings yet

- Episode 07 29dec09Document1 pageEpisode 07 29dec09finervaNo ratings yet

- Finergo Episode 11Document2 pagesFinergo Episode 11finervaNo ratings yet

- Episode 08 05jan08Document1 pageEpisode 08 05jan08finervaNo ratings yet

- Episode 09 12jan09Document1 pageEpisode 09 12jan09finervaNo ratings yet

- Episode 06 15dec09Document1 pageEpisode 06 15dec09finervaNo ratings yet

- Episode 01 10nov09Document1 pageEpisode 01 10nov09finervaNo ratings yet

- Episode 04 01dec09Document1 pageEpisode 04 01dec09finervaNo ratings yet

- Episode 03 24nov09Document1 pageEpisode 03 24nov09finervaNo ratings yet

- Episode 02 17nov09Document1 pageEpisode 02 17nov09finervaNo ratings yet

- Episode 01 10nov09Document1 pageEpisode 01 10nov09finervaNo ratings yet

- Finergo Episode 29 DT 22june09Document1 pageFinergo Episode 29 DT 22june09FinergoNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Data Sheet BC 547Document6 pagesData Sheet BC 547rodmansupiitaNo ratings yet

- DGDDocument2 pagesDGDmarksahaNo ratings yet

- Weygandt Managerial 6e SM Release To Printer Ch10Document40 pagesWeygandt Managerial 6e SM Release To Printer Ch10Dave Aguila100% (3)

- Marginal CostingDocument10 pagesMarginal Costinganon_672065362No ratings yet

- MASB7 Construction Contract1Document2 pagesMASB7 Construction Contract1hyraldNo ratings yet

- Decision Making: Relevant Costs and Benefits: Mcgraw-Hill/IrwinDocument54 pagesDecision Making: Relevant Costs and Benefits: Mcgraw-Hill/IrwinDaMin ZhouNo ratings yet

- Activity Sheet - Module 4Document4 pagesActivity Sheet - Module 4Chris JacksonNo ratings yet

- DemonetisationDocument3 pagesDemonetisationKashreya JayakumarNo ratings yet

- Advanced Accounting and Financial Reporting Exam 2Document6 pagesAdvanced Accounting and Financial Reporting Exam 2Gamuchirai KarisinjeNo ratings yet

- Light DimmerDocument4 pagesLight DimmerReen LeeNo ratings yet

- PZZ - © Aa VQ Gi Ms Kvab Gi Gi Ms KvabDocument13 pagesPZZ - © Aa VQ Gi Ms Kvab Gi Gi Ms KvabFarah DibaNo ratings yet

- 3 How To Create The PartsDocument47 pages3 How To Create The PartsArief Noor RahmanNo ratings yet

- SheltaDocument7 pagesSheltaconfused597No ratings yet

- Sworn Statement of Assets, Liabilities and Net WorthDocument4 pagesSworn Statement of Assets, Liabilities and Net WorthSugar Fructose GalactoseNo ratings yet

- Process Costing LafargeDocument23 pagesProcess Costing LafargeGbrnr Ia AndrntNo ratings yet

- Nota TransistorDocument13 pagesNota TransistorLokman HakimNo ratings yet

- True or False in Financial ManagementDocument7 pagesTrue or False in Financial ManagementDaniel HunksNo ratings yet

- Future Worth Analysis + Capitalized CostDocument19 pagesFuture Worth Analysis + Capitalized CostjefftboiNo ratings yet

- B-Com GP 1 2018 FinalDocument10 pagesB-Com GP 1 2018 FinalKhalid AzizNo ratings yet

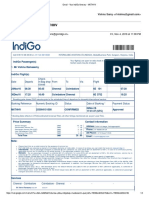

- Gmail - Your IndiGo Itinerary - M6THHV - Chennai CoimbatoreDocument3 pagesGmail - Your IndiGo Itinerary - M6THHV - Chennai CoimbatoreVishnu SamyNo ratings yet

- Cost Accounting SystemDocument64 pagesCost Accounting Systemaparna bingi0% (1)

- VL Mock ExamDocument11 pagesVL Mock ExamJohnelle Ashley Baldoza TorresNo ratings yet

- Define A Class AssignmentDocument5 pagesDefine A Class AssignmentRam AdityaNo ratings yet

- The Qmentary (더큐멘터리) - Seventeen (세븐틴) - Mansae (만세) (Eng-jpn-chn Sub) .SrtDocument16 pagesThe Qmentary (더큐멘터리) - Seventeen (세븐틴) - Mansae (만세) (Eng-jpn-chn Sub) .SrtArancha LucianaNo ratings yet

- 12 Ways To Beat Your BookieDocument82 pages12 Ways To Beat Your Bookieartus1460% (5)

- Globalization in The Asia Pacific and South AsiaDocument3 pagesGlobalization in The Asia Pacific and South AsiaKaren Aniñon BarcelonNo ratings yet

- Bus Ticket Invoice 1673864116Document2 pagesBus Ticket Invoice 1673864116SP JamkarNo ratings yet

- Saphelp Nw73ehp1 en 0c Ea5e52e35b627fe10000000a44538d FramesetDocument24 pagesSaphelp Nw73ehp1 en 0c Ea5e52e35b627fe10000000a44538d Framesety2kmvrNo ratings yet

- Sample UploadDocument14 pagesSample Uploadparsley_ly100% (6)

- Contract Change Order No. 1 RedactedDocument8 pagesContract Change Order No. 1 RedactedL. A. PatersonNo ratings yet