Professional Documents

Culture Documents

Enterpreneurial Finance Class of MBA

Uploaded by

Fahad RabbaniCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Enterpreneurial Finance Class of MBA

Uploaded by

Fahad RabbaniCopyright:

Available Formats

ENT FIN 2012 N AMIN

9/19/2012

Why Study Entrepreneurial Finance?

Entrepreneurs Unlikely to be funded unless you can answer questions like:

Entrepreneurial Finance

Instructor: Nauman J. Amin

BE (Mechanical) NED MBA IBA, Karachi Msc Investments (Finance) University of Birmingham, UK namin@iba.edu.pk

How much cash do you need? How much do you think your venture is worth? How can you defend your revenue projections? What do you think you can achieve in the next year?

Investors Unlikely to be successful unless you can assess:

The likelihood that the venture can be successful The cash needs of the venture Reasonable terms for investing

2

Learning Outcomes

Differentiate between corporate and entrepreneurial finance. Spot various sources of Capital for new venture and their suitability at various stages of a venture startup. Valuation & Capital Raising techniques Estimation Cash Flow & Financing Requirements by application of Financial Modeling & forecasting techniques Importance of exit and potential hurdles in Pakistan.

Prerequisites

Comprehend the fundamentals of accounting and finance You have a genuine interest in the topic Willingness to work (reasonably) hard Class Preparedness & Participation

Class Requirements

Must bring Textbook(Handout) and Calculator Encouraged to use Financial Calculator Quizzes would be unannounced; can be from last or coming lecture Active class participation will be rewarded by adjusting the grade upwards when it is on the margin

Less than one mark after adjusting for ve participation Active Class participation Does NOT mean asking random questions or wasting class time.

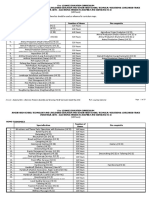

Grading Plan (Tentative)

Term Exams (mid-term) Final Exam Quizzes (n-1) Assignments Class Participation 40% 35% 10% 10% 5%

Absolute Grading plan In class viewing for Term exams only

ENT FIN 2012 N AMIN

9/19/2012

Textbook

Entrepreneurial Finance: Strategy, Valuation, and Deal Structure by Janet Kiholm Smith, Richard L. Smith, and Richard T. Bliss. http://www.sup.org/ent repreneurialfinance/

Recommended Reading

Entrepreneurial Finance 4th Edition, J. Chris Leach & Ronald W. Melicher

Students looking for more quantitative examples relating to Money management during life cycle of a venture

Recommended Reading

Launching New Ventures 6th Edition, Katleen R. Allen

Readable Focuses more on opportunity spotting business plan development Funding requirements

Course Outline

Divided in 03 distinct phases

Introduction & mechanics of Angel Investors & VCs Forecasting & Financing requirements Venture valuation & Exit

Methodology

Introduction to Concepts

Delivery: Through lectures & power point slides

Where Corporate Finance Ends Entrepreneurial Finance Begins

1. Investment and financing decisions are interdependent 2. Entrepreneurs Inability to diversify risk affect investment value 3. Outside investors may be actively involved in a venture 4. Information (and beliefs) of parties are very different 5. Incentives of parties are much different 6. New ventures are portfolios of real options 7. The importance of harvesting to realize a return 8. Maximizing value for the entrepreneur is different from maximizing shareholder value

Application of Concepts

Case studies In class discussion & role playing Assignments

Learning reinforcement

Problems

ENT FIN 2012 N AMIN

9/19/2012

Figure 1.1

Figure 1.2

Types of Entrepreneurship

Replicative versus innovative Opportunity-based versus necessity-based Corporate Venturing Social Venturing

Figure 1.4

Stages of New Venture Development

Stages of New Venture Development

Stages Opportunity Research and Development Start-up Early Growth Rapid Growth Exit

Assignment

Find an interesting product (use internet) Briefly describe the product. As a potential investor, identify 4-5 milestones that you might want to use as bases for staging your investment and evaluating the progress of the venture. Referring to Figure 1.4, identify the stage of development at which each milestone would be appropriate. Submit a hard copy before class starts.

Obtain Seed Financing Assess Opportunity Assess Strategic Alternatives Determine Organizational Structure Determine Organizational Form Prepare Business Plan

Obtain R&D Financing Build Research Team Conduct R&D Activities, e.g.: Secure Patent Develop Prototype Build Website Test Market/Market Research Assess/Update Business Plan Continue to Next Stage Extend Stage/Financing Modify R&D Strategy Abandon All research and development activity that must be completed before revenue generation can commence.

Obtain Start-up Financing Acquire Facilities and Equipment Initiate Production Build Starting Inventory Build Sales and Marketing Team Initiate Revenue Generation Assess/Update Business Plan

Actions

Obtain Early-Growth Financing Work Toward Breakeven Expand Team as Needed Expand Facilities as Needed Assess/Update Business Plan

Obtain Rapid-Growth Financing Work Toward Proven Viability Expand Team as Needed Expand Facilities as Needed Build Track Record for Harvest Assess/Update Business Plan

Obtain Continuing Financing: IPO Acquisition Buy-Out Early Investors Harvest Assess/Update Business Plan

Real Options

Continue to Next Stage Modify Concept Abandon

Continue to Next Stage Modify Production/Financing Modify Marketing/Financing Abandon All activities related to start of production and marketing and initiation of revenue-generating activities.

Continue to Next Stage Extend Stage/Financing Abandon

Continue to Next Stage Extend Stage/Financing

Choose Form of Exit

Description

All activities through preparation of business plan and before incurring significant expense.

All activities during the period before the venture reaches a level of sales sufficient for cash-flow breakeven.

All activities during the period after break-even and before sustainable viability is established.

All activities related to establishing continuing financing and enabling early investors to harvest.

You might also like

- It’S Business, It’S Personal: From Setting a Vision to Delivering It Through Organizational ExcellenceFrom EverandIt’S Business, It’S Personal: From Setting a Vision to Delivering It Through Organizational ExcellenceNo ratings yet

- Entrepreneur FinanceDocument30 pagesEntrepreneur FinanceNekoChanNo ratings yet

- Foundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part II - Financial InstrumentsFrom EverandFoundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part II - Financial InstrumentsNo ratings yet

- Estimating working capital requirementsDocument21 pagesEstimating working capital requirementsLakhan Sharma100% (1)

- Direct Taxes Course OutlineDocument9 pagesDirect Taxes Course OutlineAnushka TiwariNo ratings yet

- By Mahendra Singh SikarwarDocument21 pagesBy Mahendra Singh Sikarwarmss_singh_sikarwarNo ratings yet

- International Financial ManagementDocument17 pagesInternational Financial Managementatif hussainNo ratings yet

- CTFP Unit 2 PGBPDocument43 pagesCTFP Unit 2 PGBPKshitishNo ratings yet

- JEC SYLLABUS BA9257 Security Analysis and Portfolio ManagementDocument74 pagesJEC SYLLABUS BA9257 Security Analysis and Portfolio ManagementVivek Arnold100% (1)

- SFM PDFDocument328 pagesSFM PDFZainNo ratings yet

- Course Outline Advanced Corporate Finance 2019Document8 pagesCourse Outline Advanced Corporate Finance 2019Ali Shaharyar ShigriNo ratings yet

- 2 Project Financing in IndiaDocument20 pages2 Project Financing in IndiaashimathakurNo ratings yet

- CH 14 Hull Fundamentals 8 The DDocument13 pagesCH 14 Hull Fundamentals 8 The DjlosamNo ratings yet

- Some Information On Export Some Information On Export Financing FinancingDocument23 pagesSome Information On Export Some Information On Export Financing FinancingRoshani JoshiNo ratings yet

- MBA - ICFAI UniversityDocument21 pagesMBA - ICFAI UniversitysuryayuaNo ratings yet

- SAPM Course OutlinelDocument7 pagesSAPM Course OutlinelNimish KumarNo ratings yet

- SAPMDocument93 pagesSAPMSOUMIKNo ratings yet

- Hewlett Packard (HPQ) Equity ValuationDocument10 pagesHewlett Packard (HPQ) Equity ValuationMada ArslanNo ratings yet

- Clearing and Settlement: Financial DerivativesDocument28 pagesClearing and Settlement: Financial DerivativesnarunsankarNo ratings yet

- Security Analysis & Portfolio Management Syllabus MBA III SemDocument1 pageSecurity Analysis & Portfolio Management Syllabus MBA III SemViraja GuruNo ratings yet

- 02D. Cma Inter Direct Tax Practice Test Series - Ay 2020-21Document210 pages02D. Cma Inter Direct Tax Practice Test Series - Ay 2020-21Himanshu RajNo ratings yet

- Receivabbles Management An OverviewDocument10 pagesReceivabbles Management An OverviewHonika PareekNo ratings yet

- Corporate finance group work analysis and WACC calculationsDocument15 pagesCorporate finance group work analysis and WACC calculationscaglar ozyesilNo ratings yet

- Eco-10 em PDFDocument11 pagesEco-10 em PDFAnilLalvaniNo ratings yet

- Swaps: Prof Mahesh Kumar Amity Business SchoolDocument51 pagesSwaps: Prof Mahesh Kumar Amity Business SchoolasifanisNo ratings yet

- Diploma in Corporate Finance SyllabusDocument18 pagesDiploma in Corporate Finance Syllabuscima2k15No ratings yet

- Resume Format of PimrDocument1 pageResume Format of PimrApurva ShiralkarNo ratings yet

- Kota Tutoring: Financing The ExpansionDocument7 pagesKota Tutoring: Financing The ExpansionAmanNo ratings yet

- 9 Mutual FundsDocument32 pages9 Mutual FundsarmailgmNo ratings yet

- Welcome To: AMFI Mutual Fund Testing ProgramDocument279 pagesWelcome To: AMFI Mutual Fund Testing ProgramswadeshsarangiNo ratings yet

- Derivatives and Risk ManagementDocument30 pagesDerivatives and Risk Managementkashan khanNo ratings yet

- NISM Series v-A-Mutual Fund Distributors Workbook - 2020Document341 pagesNISM Series v-A-Mutual Fund Distributors Workbook - 2020prachiNo ratings yet

- Dr. Sharan Shetty PHD (Banking & Finance) Mba (Finance) B. Com (Hons)Document54 pagesDr. Sharan Shetty PHD (Banking & Finance) Mba (Finance) B. Com (Hons)Nagesh Pai MysoreNo ratings yet

- Stock ValuvationDocument30 pagesStock ValuvationmsumanraoNo ratings yet

- Chapter - Ii Review of Literature Working Capital Management Meaning and Definition of Working CapitalDocument9 pagesChapter - Ii Review of Literature Working Capital Management Meaning and Definition of Working CapitalDavid jsNo ratings yet

- More On Models and Numerical ProceduresDocument42 pagesMore On Models and Numerical ProceduresUtkarsh GoelNo ratings yet

- Fintree CFA LI 2018 Curriculum ChangesDocument2 pagesFintree CFA LI 2018 Curriculum ChangesMohamed GamalNo ratings yet

- PROJECT REPORT-1814511 (Ankita Saini)Document64 pagesPROJECT REPORT-1814511 (Ankita Saini)Ankit KumarNo ratings yet

- Money & MoreDocument31 pagesMoney & MoreMaulik ShahNo ratings yet

- What Are Financial RatiosDocument6 pagesWhat Are Financial Ratiosmichelle dizon100% (1)

- MBA Project Report of ICFAI Distance Learning ProgramsDocument4 pagesMBA Project Report of ICFAI Distance Learning ProgramsPrakashB144No ratings yet

- GRP 1 Financial-Market-Intro-TypesDocument34 pagesGRP 1 Financial-Market-Intro-TypesXander C. PasionNo ratings yet

- MBA Finance Verses MarketingDocument2 pagesMBA Finance Verses Marketingsachin_chawlaNo ratings yet

- International Financial Management - Mgt645Document11 pagesInternational Financial Management - Mgt645meetpalNo ratings yet

- Prashant Sawant MBA CFPDocument3 pagesPrashant Sawant MBA CFPpsawant77No ratings yet

- Fixed and Flexible BudgetDocument17 pagesFixed and Flexible Budgetkamal dewaniNo ratings yet

- SAPM Assignment For MBADocument2 pagesSAPM Assignment For MBARahul AroraNo ratings yet

- It Is A Stock Valuation Method - That Uses Financial and Economic Analysis - To Predict The Movement of Stock PricesDocument24 pagesIt Is A Stock Valuation Method - That Uses Financial and Economic Analysis - To Predict The Movement of Stock PricesAnonymous KN4pnOHmNo ratings yet

- Income under the head "Profits & Gain of Business or ProfessionDocument56 pagesIncome under the head "Profits & Gain of Business or ProfessionNiraj Kumar SinhaNo ratings yet

- NISM CPFA Mock Test at WWW - MODELEXAM.INDocument2 pagesNISM CPFA Mock Test at WWW - MODELEXAM.INSRINIVASANNo ratings yet

- Portfolio Management Banking SectorDocument133 pagesPortfolio Management Banking SectorNitinAgnihotri100% (1)

- Corporate ValuationDocument6 pagesCorporate Valuationvedaant lakhotiaNo ratings yet

- Valuation of Forward ContractDocument13 pagesValuation of Forward ContractVaidyanathan RavichandranNo ratings yet

- Financial Performance Impact on Stock PricesDocument14 pagesFinancial Performance Impact on Stock PricesMuhammad Yasir YaqoobNo ratings yet

- Pass 4 Sure NotesDocument76 pagesPass 4 Sure NotesNarendar KumarNo ratings yet

- CFP - Module 1 - IIFP - StudentsDocument269 pagesCFP - Module 1 - IIFP - StudentsmodisahebNo ratings yet

- Financial Management Objectives and DecisionsDocument8 pagesFinancial Management Objectives and DecisionsKabeer BhatiaNo ratings yet

- Samnidhy Faq'sDocument4 pagesSamnidhy Faq'sSourav DharNo ratings yet

- Working Capital Assessment of Eicher Motors LTDDocument8 pagesWorking Capital Assessment of Eicher Motors LTDAkhilesh Shukla GMPE 2018 BatchNo ratings yet

- International Financial Management: Balance of Payments and Foreign Exchange ReservesDocument48 pagesInternational Financial Management: Balance of Payments and Foreign Exchange ReservesBigbi KumarNo ratings yet

- Cloud Fundamentals CourseDocument5 pagesCloud Fundamentals CourseFahad RabbaniNo ratings yet

- WFO Solution BrochureDocument4 pagesWFO Solution BrochureFahad RabbaniNo ratings yet

- Email To UIT DirectorDocument1 pageEmail To UIT DirectorFahad RabbaniNo ratings yet

- TCS Interview GuideDocument10 pagesTCS Interview GuideFahad RabbaniNo ratings yet

- Fahad Rabbani - Financial Modeling Assignment 1Document8 pagesFahad Rabbani - Financial Modeling Assignment 1Fahad RabbaniNo ratings yet

- Adding Getformula To Your SpreadsheetDocument1 pageAdding Getformula To Your SpreadsheetFahad RabbaniNo ratings yet

- Test 1Document2 pagesTest 1Fahad RabbaniNo ratings yet

- Black Magic and Demons (Easy Cure)Document71 pagesBlack Magic and Demons (Easy Cure)Miyan Sahab Rahmania Fareedi71% (7)

- Product Update - IP Office Release 8.1 PDFDocument60 pagesProduct Update - IP Office Release 8.1 PDFFahad RabbaniNo ratings yet

- Pakistani Business Communication InsightsDocument4 pagesPakistani Business Communication InsightsFahad RabbaniNo ratings yet

- Client List of Karachi Region: # Client Site / Location Site Type Solution Type CriticalityDocument42 pagesClient List of Karachi Region: # Client Site / Location Site Type Solution Type CriticalityFahad RabbaniNo ratings yet

- Thesis Tracer StudyDocument130 pagesThesis Tracer StudyGie Nelle Dela Peña88% (8)

- News Articles ArchivesDocument32 pagesNews Articles ArchivesMichael BrooksNo ratings yet

- CV Loek Hopstaken English 2014 PDFDocument8 pagesCV Loek Hopstaken English 2014 PDFLoek HopstakenNo ratings yet

- TVL Animation q1 m1Document13 pagesTVL Animation q1 m1Jayson Paul Dalisay Datinguinoo100% (1)

- EntrepPrelim Long QuizDocument3 pagesEntrepPrelim Long QuizGelli NancaNo ratings yet

- Lecture 3 Capturing The Entrepreneurial Orientation of The FirmDocument13 pagesLecture 3 Capturing The Entrepreneurial Orientation of The FirmAMAL WAHYU FATIHAH BINTI ABDUL RAHMAN BB20110906No ratings yet

- Berklee Online Degree and Course CatalogDocument111 pagesBerklee Online Degree and Course CatalogDaniel MunteanNo ratings yet

- ME - III Year SyllabusDocument70 pagesME - III Year SyllabusDavid KiranNo ratings yet

- Practical Research 1 Title Proposal FINALDocument26 pagesPractical Research 1 Title Proposal FINALKevin RegioNo ratings yet

- Electronics Product Assembly and Servicing NC II CG PDFDocument57 pagesElectronics Product Assembly and Servicing NC II CG PDFJonathan Marc Fule Castillo100% (1)

- EDM Minor 2 Notes PDFDocument42 pagesEDM Minor 2 Notes PDFहर्ष वर्धन गुप्ताNo ratings yet

- Books Catalog September 2021Document75 pagesBooks Catalog September 2021djénéba doumbiaNo ratings yet

- The Micro Credit Sector in South Africa - An Overview of The History, Financial Access, Challenges and Key PlayersDocument9 pagesThe Micro Credit Sector in South Africa - An Overview of The History, Financial Access, Challenges and Key PlayerstodzaikNo ratings yet

- 50+ Indian Entrepreneur Success Stories - Rags To RichesDocument12 pages50+ Indian Entrepreneur Success Stories - Rags To RichesKammila MNo ratings yet

- 1213AV ECA Concept Note Food Security WomenDocument4 pages1213AV ECA Concept Note Food Security WomenAbass GblaNo ratings yet

- Entrepreneur Interviews Reveal InsightsDocument6 pagesEntrepreneur Interviews Reveal InsightsVerra Myza AratNo ratings yet

- Apple by Steve Jobs:: What Is An Entrepreneur?Document5 pagesApple by Steve Jobs:: What Is An Entrepreneur?Abdullah ghauriNo ratings yet

- POM 1 To 5 UNIT NOTESDocument151 pagesPOM 1 To 5 UNIT NOTESlingeshNo ratings yet

- 14 Chapter-4 Competency PDFDocument32 pages14 Chapter-4 Competency PDFJasy HazarikaNo ratings yet

- Women Empowerment, Entrepreneurship, and Capacity DevelopmentDocument15 pagesWomen Empowerment, Entrepreneurship, and Capacity DevelopmentJananiNo ratings yet

- Female Entrepreneurial Leadership FactorsDocument31 pagesFemale Entrepreneurial Leadership FactorsJose M. ChecoNo ratings yet

- Entrepreneurship Mba 802 Pp8 Financing The BusinessDocument25 pagesEntrepreneurship Mba 802 Pp8 Financing The BusinessfrancisNo ratings yet

- Reluctant EntrepreneurDocument7 pagesReluctant EntrepreneurAmina IqbalNo ratings yet

- Statement of PurposeDocument1 pageStatement of PurposeFirstnaukriNo ratings yet

- Factors Affecting EntrepreneurshipDocument7 pagesFactors Affecting Entrepreneurshipmanish hamalNo ratings yet

- 221-14 McCasland - Responsive Information For ReleaseDocument142 pages221-14 McCasland - Responsive Information For ReleaseLouis McCaslandNo ratings yet

- Outcomes Based Education (OBE) Constructive Alignment: Educ 221 (Contemporary Teaching Strategies)Document6 pagesOutcomes Based Education (OBE) Constructive Alignment: Educ 221 (Contemporary Teaching Strategies)Mella Mae GrefaldeNo ratings yet

- Fonseca Wang 2022 - How Much Do Small Businesses Rely On Personal CreditDocument51 pagesFonseca Wang 2022 - How Much Do Small Businesses Rely On Personal CreditsreedharbharathNo ratings yet

- Role of Entrepreneur in The Economic DevelopmentDocument6 pagesRole of Entrepreneur in The Economic Developmentsheikhirshad100% (2)

- Scheme For Financing The Schedule Tribes Entrepreneurs in JharkhandDocument10 pagesScheme For Financing The Schedule Tribes Entrepreneurs in JharkhandUttamJainNo ratings yet

- Scary Smart: The Future of Artificial Intelligence and How You Can Save Our WorldFrom EverandScary Smart: The Future of Artificial Intelligence and How You Can Save Our WorldRating: 4.5 out of 5 stars4.5/5 (54)

- The Bitcoin Standard: The Decentralized Alternative to Central BankingFrom EverandThe Bitcoin Standard: The Decentralized Alternative to Central BankingRating: 4.5 out of 5 stars4.5/5 (41)

- Mastering Large Language Models: Advanced techniques, applications, cutting-edge methods, and top LLMs (English Edition)From EverandMastering Large Language Models: Advanced techniques, applications, cutting-edge methods, and top LLMs (English Edition)No ratings yet

- Dealers of Lightning: Xerox PARC and the Dawn of the Computer AgeFrom EverandDealers of Lightning: Xerox PARC and the Dawn of the Computer AgeRating: 4 out of 5 stars4/5 (88)

- Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent MoneyFrom EverandDigital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent MoneyRating: 4 out of 5 stars4/5 (51)

- The Corporate Startup: How established companies can develop successful innovation ecosystemsFrom EverandThe Corporate Startup: How established companies can develop successful innovation ecosystemsRating: 4 out of 5 stars4/5 (6)

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumFrom EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumRating: 3 out of 5 stars3/5 (12)

- Artificial Intelligence: A Guide for Thinking HumansFrom EverandArtificial Intelligence: A Guide for Thinking HumansRating: 4.5 out of 5 stars4.5/5 (30)

- Generative AI: The Insights You Need from Harvard Business ReviewFrom EverandGenerative AI: The Insights You Need from Harvard Business ReviewRating: 4.5 out of 5 stars4.5/5 (2)

- AI Superpowers: China, Silicon Valley, and the New World OrderFrom EverandAI Superpowers: China, Silicon Valley, and the New World OrderRating: 4.5 out of 5 stars4.5/5 (398)

- The Master Algorithm: How the Quest for the Ultimate Learning Machine Will Remake Our WorldFrom EverandThe Master Algorithm: How the Quest for the Ultimate Learning Machine Will Remake Our WorldRating: 4.5 out of 5 stars4.5/5 (107)

- Blood, Sweat, and Pixels: The Triumphant, Turbulent Stories Behind How Video Games Are MadeFrom EverandBlood, Sweat, and Pixels: The Triumphant, Turbulent Stories Behind How Video Games Are MadeRating: 4.5 out of 5 stars4.5/5 (335)

- How to Do Nothing: Resisting the Attention EconomyFrom EverandHow to Do Nothing: Resisting the Attention EconomyRating: 4 out of 5 stars4/5 (421)

- Who's Afraid of AI?: Fear and Promise in the Age of Thinking MachinesFrom EverandWho's Afraid of AI?: Fear and Promise in the Age of Thinking MachinesRating: 4.5 out of 5 stars4.5/5 (12)

- Make Money with ChatGPT: Your Guide to Making Passive Income Online with Ease using AI: AI Wealth MasteryFrom EverandMake Money with ChatGPT: Your Guide to Making Passive Income Online with Ease using AI: AI Wealth MasteryNo ratings yet

- Seo: The Ultimate Search Engine Optimization Guide for Marketers and EntrepreneursFrom EverandSeo: The Ultimate Search Engine Optimization Guide for Marketers and EntrepreneursRating: 4.5 out of 5 stars4.5/5 (121)

- AI Money Machine: Unlock the Secrets to Making Money Online with AIFrom EverandAI Money Machine: Unlock the Secrets to Making Money Online with AINo ratings yet

- Data-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseFrom EverandData-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseRating: 3.5 out of 5 stars3.5/5 (12)

- Artificial Intelligence: The Insights You Need from Harvard Business ReviewFrom EverandArtificial Intelligence: The Insights You Need from Harvard Business ReviewRating: 4.5 out of 5 stars4.5/5 (104)

- Build: An Unorthodox Guide to Making Things Worth MakingFrom EverandBuild: An Unorthodox Guide to Making Things Worth MakingRating: 5 out of 5 stars5/5 (121)

- The E-Myth Revisited: Why Most Small Businesses Don't Work andFrom EverandThe E-Myth Revisited: Why Most Small Businesses Don't Work andRating: 4.5 out of 5 stars4.5/5 (707)

- Eric Ries’ The Lean Startup How Today's Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses SummaryFrom EverandEric Ries’ The Lean Startup How Today's Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses SummaryRating: 4.5 out of 5 stars4.5/5 (11)

- 100+ Amazing AI Image Prompts: Expertly Crafted Midjourney AI Art Generation ExamplesFrom Everand100+ Amazing AI Image Prompts: Expertly Crafted Midjourney AI Art Generation ExamplesNo ratings yet