Professional Documents

Culture Documents

Compass September 2013

Uploaded by

SonnyZHCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Compass September 2013

Uploaded by

SonnyZHCopyright:

Available Formats

September 2013

Compass

Seismic shifts, the Great Unwind, and looking through to the other side US CapEx: reasons for optimism The US economy: a view from the drivers seat Bet on the consumer? Real Estate: caution and opportunity in a (not so) recovering asset class

Wealth and Investment Management Global Research & Investments

Wealth and Investment Management Global Research & Investments

Contents

The geology of markets Seismic shifts, the Great Unwind, and looking through to the other side 2 3

The geology of the markets ........................................................................................... 3 and the resulting tremors ............................................................................................... 4 On sale, with attractive valuations and potential returns ........................................... 5 Fairly priced, so mark time amid volatility ....................................................................... 6 For sale, with more selling pressure ahead ..................................................................... 6 Bargains in the making (todays dog, tomorrows darling)......................................... 6 Why selling municipal bonds now might not make sense ............................... 7 US CapEx: reasons for optimism 8

Business confidence is rising .............................................................................................. 9 Demand for business credit is growing ........................................................................... 9 Return on equity remains greater than the cost of it .................................................10 Job gains drive higher capital expenditures, eventually .............................................10 The US economy: a view from the drivers seat 11

Perfectly correlated and a leading indicator .................................................................11 Keep on trucking .................................................................................................................12 Tracking the rails .................................................................................................................12 I think I can, I think I can ................................................................................................15 Bet on the consumer? 16

The trends favoring increased consumer activity .......................................................16 The combined result of encouraging trends ................................................................18 Risks on the horizon, place your bets .............................................................................19 Real Estate: caution and opportunity in a (not so) recovering asset class 20

Cyclicality is a key attribute of real estate .....................................................................20 For rent: single family homes ...........................................................................................21 A step before foreclosure: buying non-performing loans ..........................................22 Tactical Asset Allocation Review Interest rates, bond yields, and commodity and equity prices in context* Barclays key macroeconomic projections Global Investment Strategy Team 24 26 28 29

COMPASS September 2013

Wealth and Investment Management Global Research & Investments

The geology of markets

Dear clients and colleagues, The new Fall line-up being offered to investors presents an interesting mix of viewing. The long-running drama that is the path of economic growth around the world remains a primetime staple. A few classics the debt ceiling and the ability of Washington to reach timely and effective decisions on such issues as the budget are likely to be a compelling mini-series. Syria will likely represent breaking news. Finally, a new reality show life in a world of tapering quantitative easing is soon launching.

Hans Olsen, CFA

+1 212 526 4695

hans.olsen@barclays.com

In this issue of Compass, we offer our take on how these developments will affect the opportunity set for investors, both near-term and into 2014. In Seismic shifts, the Great Unwind, and looking through to the other side, we look at the three financial tectonic plates currently in motion: the beginning of the end of quantitative easing; the budget and debt ceiling battles set to commence in Washington; and, the developing (as of this writing) geopolitical situation in Syria. These are likely to visit renewed volatility upon markets and investors this fall. Given these challenges, it is helpful to look under these plates to the economic mantle, by understanding the drivers of economic and profit growth that, longer-term, are likely to sustain the economy, and perhaps even toggle its trajectory to a more durable path.

In US CapEx: reasons for optimism, we examine the drivers of capital expenditures, and factors that may increase this activity so critical to our commercial and economic well-being. We sharpen the focus on transportation trends, which have historically been leading indicators of economic well-being, in The US economy: a view from the drivers seat. We answer the question, Bet on the consumer?, with cautious optimism.

And we explore an interesting source of return in Real Estate: caution and opportunity in a (not so) recovering asset class non performing loans. This builds on one of our favorite themes: exploiting a lack of capital in a market that needs it. As with other investments weve highlighted in this vein, the returns favor the opportunist. Four years into the recovery from the Great Recession, investors have enjoyed few periods of calm yet returns across some assets have been significant for those prepared to endure the turbulence. Indeed, as we contemplate the period ahead, we expect more of the same. We hope you enjoy this edition of Compass and, as always, welcome your feedback. Hans F. Olsen, CFA Chief Investment Officer, Americas

COMPASS September 2013

Wealth and Investment Management Global Research & Investments

Seismic shifts, the Great Unwind, and looking through to the other side

Hans Olsen, CFA

+1 212 526 4695 hans.olsen@barclays.com

There are three financial tectonic plates in motion which will likely be the source of market tremors in the months ahead. Indeed, the grinding of these plates has the potential to pulverize those unfortunate enough to find themselves caught at the intersection of these forces. If past is prologue, things will work out fine, but the path to the other side will be rough. The geology of the markets

The first plate in motion is the beginning of the end of the Federal Reserves quantitative easing (QE) program, which has pumped $85 billion a month into the government bond and agency markets for the past 12 months. The consensus view holds that the beginning of the Great Unwind will commence this month after the central banks September meeting. Investors have been anticipating this: Yields have jumped over a full percentage point since Chairman Bernanke revealed his thinking in May. Bond market volatility has risen substantially as the anticipated change in Fed stance moves closer to reality (Figure 1). 1

Three financial tectonic plates in motion: quantitative easing, fiscal battles, and geopolitical conflict

The second plate is the political wrangling over the budget and debt ceiling that is set to begin in Washington. The federal governments fiscal new year begins on October 1st and the debt ceiling will have to be raised sometime during the fourth quarter in order for the government to remain in operation. 2 As it now stands, there is no agreement on an actual fiscal 2014 budget, or even on its potential size or priorities. Positions of the opposing parties have hardened to such an extent that the willingness necessary to find workable compromises is about as prevalent as a rare earth mineral. The third plate is geopolitical and, as it often does, involves the Middle East. Potential military action against Syria could expand the countrys civil war to neighboring states, several of which are on unstable footings. Of the three plates pushing against each other, this one appears least likely to exert durable pressure on financial markets. The ubiquity of strife in the region is not new, and markets are more accustomed to looking past the attendant uncertainty.

US stock volatility, as measured by the VIX, has also risen, but less dramatically and has come down from its highs of 18-20 in late June. 2 The Treasury indicated that its extraordinary measures will be exhausted by mid-October, effectively rendering the federal government unable to pay all of its bills and creating a queue of entities waiting to be paid. COMPASS September 2013 3

Wealth and Investment Management Global Research & Investments

Figure 1: Bond market volatility has risen substantially

Move Index (Bond Market Volatility) 120 110 100 90 80 70 60 50 40 Jan Feb Mar Apr May Jun Jul Aug

Figure 2: Federal deficit % of GDP

Budget Deficit as a % of GDP 4% 2% 0% -2% -4% -6% -8% -10% -12% 1973 1983 1993 2003 2013 2023 Estimated

Source: Bloomberg as of August 2013

Source: Congressional Budget Office as of May 2013

and the resulting tremors The investing landscape this autumn need not be as treacherous as it appears

Combine these forces with this years strong US equity returns and conditions seem ripe for a proper correction. A market propelled more by cheap money than the healthy lift of rising sales and earnings is increasingly vulnerable to reassessment by investors, similar to the rethink this summer in fixed income and emerging markets. However, the investing landscape this autumn need not be as treacherous as it appears. First, a return to market-based rather than central-bank driven interest rates is a return to a healthy state of play. The distortions that quantitative easing has created must ultimately be corrected for growth and asset price appreciation to be durable. And across capital markets, this is beginning to happen as evidenced by flagging emerging market debt and equity markets, and sizeable money flows out of bond funds. Second, there are underlying trends that are potentially supportive of a more durable and stronger rate of growth than weve seen in the US recovery to date, as we cover in the following articles. Third, the federal budget and debt ceiling debates need not be disruptive as the countrys fiscal health is moving in the right direction. Higher taxes and lower spending aided by a growing economy have combined to shrink the deficit from 7.0% of GDP in 2012 to the forecasted 4.0% this year. 3 To be sure, tax revenues were lifted by income pulled into 2012 ahead of the 2013 tax hikes; however, the tax increases and the sequestration-driven cuts are durable and will help to move the deficit to the historical average of roughly 3% of GDP. Yes, more action will be needed from Congress, but the size of the problem is smaller now than it was two years ago, giving legislators the benefit of operating from a position of strength. Unfortunately, Congress looks set to grab defeat from the jaws of victory, as any deal appears elusive and very messy at best. Together with the other tectonic plates, such dysfunction could sap the will of a

Congressional Budget Office Baseline Projections. May 2013. 4

COMPASS September 2013

Wealth and Investment Management Global Research & Investments

Figure 3: Ratio of European Large Cap stocks price to EBITDA (P/E) to the S&P 500 stocks P/E is at a discount vs. historical norm

% 100% 90% 80% 70% 60% 50% 40% 03 04 05 06 07 08 09 10 11 12 Relative Price to EBITDA - Eurostoxx 50 vs S&P 100 10 year average 70% 61%

Figure 4: Ratio of European Large Cap stocks price-tobook to the S&P 500 stocks price-to-book is at a discount vs. historical norm

% 75% 70% 65% 60% 55% 50% 45% 40% 03 04 05 06 07 08 09 10 11 12 Relative Price to Book - Eurostoxx 50 vs S&P 100 10 year average

Source: Bloomberg as of August 2013

63% 54%

Source: Bloomberg as of August 2013

relatively fragile business community to invest in their businesses an activity needed to prolong and deepen the economic recovery of the last several years and dampen the native optimism of the US consumer, who has propelled much of the recovery so far. Given this state of play, in which the shifting tectonic plates reposition, a review of the landscape for investors is in order.

On sale, with attractive valuations and potential returns

Large European companies in the heart of the Eurozone continue to represent a compelling opportunity set (compared to their US counterparts) as they trade at discounts below historical norms (Figures 3 and 4). A catalyst for these stocks has emerged as the Eurozone economy shows signs of stirring. Our belief had been that higher stock prices in this bloc would emanate from lower interest rates due to an enduring recession; however, economic growth will have the same impact risk appetite for undervalued stocks will rise. 4

European, US small-/ mid-cap and private equity offer potential opportunities

In the US, small and mid-capitalization stocks continue to be attractive on the operating fundamentals: Their sales are growing at twice the pace of large companies. 5 While performance of these companies has been impressive this year, rising over 19% and making them susceptible to skittishness-induced profit-taking, their operating results support their enduring favor with investors. 6

We think it premature to call an end to the Eurozones recession. The growth recently reported is very uneven driven as it is by Germany and France, the two largest economies in the bloc. We want to see several quarters of growth with broader participation of the countries in the monetary union before we join the chorus of those claiming the recession has ended. 5 Source: Bloomberg, as of September 2013. Q2 2013 sales growth: Russell 2500 3.2% vs. S&P 500 1.4%. 6 Source: Bloomberg Russell 2500 Indexs 19.5% total return from January 1 September 3, 2013. COMPASS September 2013 5

Wealth and Investment Management Global Research & Investments

Private equity directed at exploiting broken and dislocated markets in the aftermath of the financial crisis appears to be one of the most attractive opportunities in terms of the potential return on offer relative to the risk taken. While the capital commitments are long and the liquidity low, the potential risk-adjusted returns argue in favor of making a place for this type of investment as a cornerstone of a portfolio.

Fairly priced, so mark time amid volatility

Large US companies, having risen nearly 17% through early September, appear fairly priced. 7 Earnings growth this year of 3.3% priced at a price/earnings multiple of 15.0 suggests that these companies will mark time through year-end but with considerable volatility price churn as investors deal with movement of the three plates in the weeks ahead. 8 While 2014 earnings estimates look encouraging, they may be a mirage given the long-established pattern of downward revisions. Buying markets based on consensus guesstimates for 2014 is, at this juncture, an exercise in hope over experience.

For sale, with more selling pressure ahead

Developed government bonds have performed as expected poorly as markets have anticipated the beginning of the end of quantitative easing; investment grade corporate bonds have suffered a similar fate. Both have suffered as their prices were badly distorted by investors desperate search for yield in the face of central bank-repressed interest rates. The Great Unwind is also pulling money from emerging debt and equity markets. Weak performance has only been exacerbated since the Fed Chairman announced the advent of tapering in June. Commodities prices, frustrated by weak growth in China and rising interest rates, have been a standout in terms of their poor performance, although gold and oil have enjoyed periodic rallies as geopolitical conflicts have driven investors to these crisis investments.

Bargains in the making (todays dog, tomorrows darling)

As prices swing in the face of these tectonic shifts, new opportunities are developing that merit watching. Markets of rapidly growing economies are being painted with the same brush as those that are struggling. Equity valuations in places such as Indonesia and Singapore are becoming increasingly attractive as the BRIC 9 trade of the past decade cracks, casting a pall over all developing markets. Once interest rates settle into their elevated state, emerging market debt will similarly merit a fresh look. Commodities, too, will deserve a second chance once the question of Chinas growth is answered. A wellestablished feature of markets is that todays dog will be tomorrows darling. Meanwhile, investors will be well served by being highly discriminating in their choices.

7 8

Source: Bloomberg. S&P 500 Index total return from January 1 - September 3, 2013. Source: Bloomberg. S&P 500 Q2 earnings growth and forward price-to-earnings ratio, as of September 3, 2013. 9 Brazil, Russia, India and China COMPASS September 2013 6

Wealth and Investment Management Global Research & Investments

Why selling municipal bonds now might not make sense

Given the sharp rise in yields this year, investors are understandably wondering what to do with their municipal bonds. For anyone holding intermediate (7-10 years) or long (10+ years) maturity municipal bonds, seeing unrealized price declines of 7% or more creates a powerful temptation to sell out and transition into shorter maturities, which are less sensitive to interest rate changes. With further yield increases likely (although uncertain, as is the size and timing of any rate change), it is worth examining why that strategy could be a mistake for bonds held in separately managed or brokerage accounts. Consider the following scenario, shown below. An investor holds a municipal bond allocation as ballast to the risks of equities and for more attractive yield generation than cash. Assume this investor paid $125,180 in September 2012 for an 8-year AA municipal bond whose par value is $100,000. The coupon was 5% of the par value; the yield was 1.63% of the purchase price. 10 September 2013: After one year, yields have risen 115 basis points, causing a 6.97% decline in the bond's price to $116,452, for a loss in principal value of $8,728. However, the investor has also received a coupon payment of $5,000. If the bond were sold today, the investor would incur a loss of $3,728. But is that a necessary course of action? 2014-2015: Lets further assume that the investor opts to hold the bond through to Sept. 2015. For our illustration, lets assume yields have continued to rise: +50 basis points in 2014 and +50 basis points again in 2015 11. Over the total three-year holding period, the bond's time to maturity has shortened from eight years at purchase to five years by Sept. 2015 so its sensitivity to interest rate changes has fallen, slowing the rate of price decline. By Sept. 2015, the market price of the bond is $110,987 (for a principal value decline of $14,193). However, the investor has received three coupon payments of $5,000, for a total of $15,000. If the investor were to sell now, the value of the coupons cash flow has offset the price decline. 12 Further, the investor can invest the proceeds in other municipal bonds that are now offering higher yields.

Investor buys in Sept 2012. September 2012 Bond: 8-yr AA Municipal bond Purchase Price: Par: Coupon (% of Par): Yield (% of Purchase Price): Years to maturity: If bond was sold today September 2013 Yields have risen 115 bp since purchase $125,180 Market Price: $100,000 Loss in Principal Value: 5% Coupon Received: 1.63% Return if sold: 8 years Years to maturity: If bond was held 'til 2015 September 2015 Yields rise another 50 bp in 2014 and again in 2015* $110,987 $(14,193) $15,000 $807 5 years $ 116,452 Market Price: $(8,728) Loss in Principal Value: $5,000 Cumulative Coupon Received: $(3,728) Return if sold: 7 years Years to maturity:

*This is for illustrative purposes and does not reflect the actual performance of any investment. Barclays does not guarantee favorable investment outcomes. Nor does it provide any guarantee against investment losses. Source: Barclays Wealth and Investment Management

unless theyre held in a mutual fund

The conclusion may be somewhat different for an investor who owns municipal bonds through a mutual fund. As municipal bond yields rise and their prices fall, the value of a municipal bond mutual funds shares decline. These mark-to-market losses typically prompt an increase in investor redemptions. To meet these demands, portfolio managers sell some of the funds holdings, triggering a capital gains tax liability in cases where the securities were purchased at a lower price because yields were higher at the time. 13 The investor who remains in the fund then faces a potential double whammy at year end: a loss in value on their mutual fund shares and a tax bill for the capital gains. Municipal bond investors should be actively evaluating their holdings along multiple risk and return dimensions before making any sell or hold decision.

10 11

Our scenario is a simplified one, intended to isolate only on the implications of yield changes. The total return scenario could improve if our assumed 100 bp rise in yields over 2014/2015 proves excessive. As of August 30, the yield on five-year AA municipal bonds was only 75 bp below its 10-year historical average of 2.42%. Source: MMD, monthly data 9/1/2003 7/29/2013 12 And the investor has the opportunity to use some of the capital loss for tax loss harvesting purposes. 13 Municipal bond yields were higher than they are today as recently as 19 months ago. COMPASS September 2013 7

Wealth and Investment Management Global Research & Investments

US CapEx: reasons for optimism

David Motsonelidze

+1 212 412 3805 david.motsonelidze@barclays.com

Business investment spending tends to generate more durable and higher quality economic growth. It usually leads to more jobs, sparking a virtuous cycle of higher consumer spending, increased corporate sales, and often higher equity prices. Examining the factors that foster capital expenditure, we find reasons to be optimistic about a continuing increase in this critical driver of output.

As we highlighted in our May edition of Compass, US business investment as a percentage of corporate profits has remained at historically low levels in this recovery: 55% compared to the long-term average of 85% (Figure 1). Arguably, it is one reason this recovery has been relatively tepid. 14 Indeed, its link to growth of the nations output is evident in Figure 2, which shows changes in CapEx and corporate sales. When companies anticipate greater demand for their products, they bolster their ability to satisfy it, which tends to require higher capital investment. With other drivers of higher economic output tapped out (such as increased government spending or looser monetary policy), we check in on CapEx. A constellation of conditions seem to favor continuing increases in business investment, providing reasons for optimism.

Figure 1: US capital expenditures as a percent of corporate profits (1951-2013)

160% 140% 120% 100% 80% 60% 40% 20% 0% 51 56 61 66 71 76 81 86 91 96 01 06 11 CapEx as % of Corporate Profits Long Term Average (since 1951)

Source: Bloomberg as of March 2013

Figure 2: YoY growth US CapEx vs. S&P 500 Index sales per share

30% 20% 10%

85% 0% 55% -10% -20% -30% 2005 2006 2007 2008 2009 2010 2011 2012 2013 CapEx YoY % S&P 500 Trailing 12 month Sales Growth Per Share YoY %

Source: Bloomberg as of June 2013. Note: Capital Goods New Orders Nondefense Ex Aircrafts and Parts is used as a measure of CapEx.

14

John Maynard Keynes highlighted the drivers of output in a 1933 New York Times editorial: an increase of output cannot occur unless by the operation of one or other of three factors. Individuals must be induced to spend more out of their existing incomes; or the business world must be induced, either by increased confidence in the prospects or by a lower rate of interest, to create additional current incomes in the hands of their employees, which is what happens when either the working or the fixed capital of the country is being increased; or public authority must be called in aid to create additional current incomes through the expenditure of borrowed or printed money. COMPASS September 2013 8

Wealth and Investment Management Global Research & Investments

Figure 3: CEO confidence is subject to sharper swings than in the past

CEO Confidence Index* 80 70 60 50 40 30 20 80 84 88 92 96 00 04 08 12

Figure 4: Small business confidence remains well below its pre-crisis averages

Small Business Optimism Index 110 105 100 95 90 85 80 80 84 88 92 96 00 04 08 12

*A reading above 50 indicates that US CEOs feel positive about the future of the nation's economy. Source: Conference Board and Strategas Research, as of August 2013. June 2013 is the latest data available.

Source: NFIB, as of August 2013. Latest survey data available is for July 2013.

Business confidence is rising

Entrepreneurs and corporate captains faith in the future has recovered from its record low in 2009, and has been steadily increasing since late 2012. The Conference Boards Measure of CEO Confidence Index is now within its normal long-term historical range (Figure 3), while the National Federation of Independent Businesses (NFIB) Small Business Optimism Index is at a 67-month high (Figure 4). At the same time, business confidence appears more susceptible to uncertainty than in the past. The CEO Confidence Index has had six double-digit quarterly swings in the past three years almost half the number over the preceding 35 years (excluding the crisis). Small business optimism, meanwhile, remains notably below its long-term historical average.

Will the animal spirits return to levels conducive to greater business investment spending?

Demand for business credit is growing

Large and small businesses have been seeking more loans for commercial and industrialization purposes. In fact, demand for loans by medium and large enterprises is at a 6-month high, according to the Federal Reserve, while small business demand is at an 8-year high. The increased appetite for credit likely reflects both heightened confidence and a more positive outlook for sales, industry prospects, and the overall economy. The percentage of small businesses viewing the next three months as a good time to expand is at its highest since early 2012. 15 Similar readings from CEOs the percent who anticipate an improvement in economic conditions or in their industries over the next six months are the highest theyve been in 15 months. 16

15

Source: NFIB Small Business Economic Trends, August 2013. Outlook for expansion, highest since January 2012 (pg 5). 16 Source: The Conference Board Measure of CEO Confidence quarterly releases. COMPASS September 2013 9

Wealth and Investment Management Global Research & Investments

Figure 6: When return on equity net of its cost is positive, YoY capital expenditures tend to grow

CapEx YoY, % 30 20 10 0 -10 -20 -30 93 95 97 99 01 03 05 07 09 11 13 Capex YoY %, LHS Spread % (S&P 500 Return on Equity - Cost of Equity), RHS

Source: Bloomberg as of June 2013. Note: Capital Goods New Orders Nondefense Ex Aircrafts and Parts is used as a measure of CapEx. Data is quarterly.

Figure 7: Capital spending follows employment growth. Continued jobs growth bodes well for CapEx

CapEx YoY % 30 20 10 0 -10 -20 -30 -40 93 95 97 99 01 03 05 07 09 11 13 CapEx YoY %, LHS Nonfarm Payrolls YoY % 4 3 2 1 0 -1 -2 -3 -4 -5 -6 Nonfarm Payrolls YoY %, RHS

Spread, % 16 11 6 1 -4 -9

Source: Bloomberg as of July 2013. Note: Capital Goods New Orders Nondefense Ex Aircrafts and Parts is used as a measure of CapEx. Data is monthly.

Return on equity remains greater than the cost of it The growing spread between return on equity capital and its cost should support higher CapEx

As Figure 6 illustrates, the difference, or spread, between the cost of equity capital and its return, remains positive. While it has been positive during most of the recovery, the recent uptick is encouraging. When the spread is positive, CapEx has historically tended to grow because profitable investment opportunities requiring capital exist so businesses are more likely to put capital to work.

Job gains drive higher capital expenditures, eventually

As the labor market improves further, business investment should also continue to increase. In our May Compass, we highlighted the gap that had emerged between growth in jobs and in capital expenditures. As wed anticipated and is evident in Figure 7, CapEx has been rising, narrowing this gap. We would expect this trend to continue since companies cannot increase staffing without ultimately investing in new equipment or computers or employee productivity is likely to continue to decline. So what could derail this positive trend, so critical for more sustainable, higher quality economic growth? Based on what has stymied confidence and CapEx thus far in this recovery policy uncertainty, higher oil prices and geopolitical conflict (see Seismic shifts, page 4). The signs suggesting business investment may continue rising and finally break out to a level consistent with higher growth are encouraging. We will be watching this closely.

COMPASS September 2013

10

Wealth and Investment Management Global Research & Investments

The US economy: a view from the drivers seat

Laura Kane, CFA

+1 212 526 2589 laura.kane@barclays.com

A vast network of highways and railways lies at the heart of the nations economy, facilitating daily the transfer of goods from producers to American consumers. As freight carriers operating on this network have direct, day-to-day experience of economic activity, we look down the USs road to recovery from their vantage point. Perfectly correlated and a leading indicator

Economic growth is the lifeblood of the transportation industry as the almost perfect (99%) correlation between US industrial production and domestic truck tonnage the weight of freight that trucks carry monthly in Figure 1 attests. The industrys utility as a leading indicator for the US economy is borne out by the Transportation Services Freight Index (TSI Freight), which measures US truck, air, rail, water and pipeline activity. Researchers at the Bureau of Transportation Statistics found that over a three decade period, index declines preceded economic slowdowns by an average of four to five months and in the case of the Great Recession, by 18 months 17 (Figure 2). With the Federal Reserve signaling that the US economy may be resilient enough to withstand a reduction in stimulus, and with business and consumer confidence continuing to rise, the probability of a slowdown seems remote. To understand where

Freight carriers have first-hand experience of the countrys daily economic activity and its trends

Figure 1: Nearly perfect correlation: YoY changes in US industrial production and US trucking freight volume

YoY Growth (%) 15% 10% 5% 0% -5% -10% -15% -20% Sep-07 Sep-08 Sep-09 Sep-10 Sep-11 Sep-12

Figure 2: TSI Freight Indexs economic downturn predictive capacity decline prior to Great Recession

TSI Freight Index Value 113 110 107 104 101 98 2001

Start of Great Recession*

2003 2005 2007 2009 2011 2013

Truck Tonnage*

Industrial Production

TSI Freight Index (12 mo rolling avg)

*American Trucking Association (ATA) Tonnage Index. Truck Tonnage is the weight of freight that trucks carry monthly. Source: Bloomberg, Federal Reserve, ATA, as of July 2013

*The National Bureau of Economic Research defines the most recent recession as the period between December 2007 and June 2009. Source: Bureau of Transportation Statistics, National Bureau of Economic Research, as of June 2013

17

Possible explanations for the longer lead time before the Great Recession include the 2005-2006 rise in fuel costs, the magnitude of the downturn, and the housing/ financial crisis that triggered it. COMPASS September 2013 11

Wealth and Investment Management Global Research & Investments

the US economy and financial markets may go from here, its helpful to look at domestic transportation trends. Trucking and railway companies directly touch producers as well as intermediate and end consumers of the products they move. We examine freight carrier activity for real time insights into the health of the economy and sources of momentum that may drive the next leg of the recovery.

Keep on trucking Trucking transportation data suggests reasons for a positive near-term outlook

Trucking data suggests reasons for a positive near-term outlook. Truck tonnage reached a record high in June, and freight carriers seem to have confidence that volumes will persist, based on their planned equipment orders and hiring. Close to two thirds of trucking carriers now plan to place orders for new vehicles in the next three months, compared to just over 40% a year ago, according to the CKCVR Fleet Sentiment survey. 18 Some of this increased demand stems from the need to replace aging trucks. The deferral by freight carriers of new heavy truck purchases has resulted in the average age of their fleets increasing by more than 15% since 2006. In addition to replacement demand, 48% of respondents said they were planning to order new equipment to expand capacity. That figure is up from 41% in the second quarter of this year. Truck transportation employment has also been picking up, indicating truck operators anticipate continued high volumes. It rose by 6,300 jobs in July, more than offsetting the prior two months declines, which suggests that truck-related production is likely to accelerate in the second half of 2013. These trends are supportive of continued GDP expansion. The upticks in planned equipment purchases and hiring, in particular, are positive for capital spending, an important driver of durable economic growth (see US CapEx: reasons for optimism on page 8).

Tracking the rails

Railway transportation data provides a glimpse into whats currently driving the economy. The American Association of Railroads reports weekly carload volumes by product type for North Americas largest railroads. Year-to-date growth reveals various pockets of strength in the US economy today and, by extrapolation, potential sources of growth tomorrow (Figure 3).

The shale energy boom

Train carloads of crude oil have grown exponentially since 2008

Over the past five years, there has been a dramatic surge in the production of domestic crude oil due to technological advances in drilling for oil in shale rock. The shale energy revolution, with its potential to provide independence from foreign oil, will be an important source of job creation, business investment and economic growth in the coming years. Existing pipeline capacity is insufficient to handle the burgeoning supply from this shale energy boom, so railroads are filling the need. In 2008, the largest US railroads carried just 9,500 carloads of crude oil. By the end of 2012, this number had exploded to nearly

18

Percent of truck fleets planning to place orders for new trucks: 64.6% as of date vs. 41.1% in the Q3 2012. Source: CKCVR Fleet Sentiment survey, as of August 2013. COMPASS September 2013 12

Wealth and Investment Management Global Research & Investments

Figure 3: Changes in train carload volumes by product this year

YoY Growth (%) YTD Petroleum Products Building Products* Intermodal Chemicals Automotive Industrial Bulk** Coal Agricultural All Other -20% -1.2% -3.9% -6.8% -8.2% -10% 0% 10% 20% 30% 40% 4.6% 3.5% 2.2% 1.0% 32.2%

Carload volume increases point to two key drivers of economic growth: energy and housing

*Lumber and Wood products, Metal Products, Sand/Gravel, Stone, Clay and Glass Products **Minerals, Ore, Scrap Metal, Primary Forest, Pulp & Paper Source: Association of American Railroads, as of August 17, 2013

234,000 carloads. And the momentum has continued this year with carloads of petroleum products having grown by 32%. To keep up with the boom, railroads are making the needed capital investment, suggesting their confidence in continued growth. Deliveries of tank cars have spiked and are forecast to continue growing. 19 Orders for freight cars 80% of which were for tank cars nearly doubled in the first quarter of 2013, up almost 92% from a year ago. 20

The recovery in housing

Railroad data suggests that recent softness in monthly home sales should be temporary

As the US housing market continues on the path to recovery, carloads of building products, such as lumber, are up 4.6% year-to-date. More important, theyve not shown any signs of slowing despite the spike in 30-year mortgage rates since May. In fact, from May 1to August 17 this year, carloads of building products grew 5.4% versus a year ago. 21 The railroad data suggests that recent softness in monthly home sales should be temporary, which isnt surprising when one considers that homebuilder confidence is at record highs, mortgage rates are still low relative to history, and housing starts remain 58% below their prior peak in 2005 (Figure 4). Continued housing market strength will lend support to improving consumer confidence and spending (as we discuss in Bet on the consumer? on page 17).

Consumer spending on bigger-ticket items

Strength in the transportation of automobile parts and building products, compared to weakness in other categories, points to an interesting and recent dichotomy in the spending habits of US consumers. Their discretionary dollars are being spent not on clothing or dining out, but on more expensive durable items that are in need of replacement, such as cars and home improvement products. This dichotomy is confirmed by retail sales numbers, with motor vehicles and building materials topping

19 20

American Rail Car Industries, via Bloomberg Industries, as of August 2013 Railway Supply Institute via Bloomberg Industries, as of June 2013 21 Association of American Railroads, as of August 17, 2013 COMPASS September 2013 13

Wealth and Investment Management Global Research & Investments

Figure 4: New privately owned housing starts

Housing Starts (Millions) 3.0 2.5 2.0 1.5 1.0 0.5 0.0 59 65 71 77 83 89 95 01 07 13 New Privately Owned Housing Starts

Figure 5: YoY growth/decline in retail sales by category (May July 2013)

YoY Retail Sales Growth (%) by Category Motor Vehicle 11.1% Building Materials 9.6% E-Commerce 9.9% Misc Store Retailers 7.4% Apparel 4.2% Dining 4.0% Home Furnishing 3.3% Gas Stations 2.6% Health and Personal Care 1.5% Dining 3.0% Sports & Hobby 1.6% General Merchandise Stores 1.0% Electronics and Appliance 0.3% -4.8% Department Stores -6% 0% 6% 12%

Source: Bloomberg, as of August 2013.

Source: US Census Bureau, as of July 2013.

May-July growth (Figure 5), and by Home Depots and Lowes impressive second-quarter earnings results as compared to the disappointing results of apparel and discount retailers, such as Macys or Walmarts. So far this year, carload volumes of automotive products are up 1%, even after very strong growth in 2012. They appear to be continuing their upward trend (Figure 6), supported by sales that are still below the pre-recession annual average (Figure 7). The recovery in housing prices along with robust stock market returns has not only given consumers the confidence to buy new cars, it has also bolstered the demand for light trucks from home servicing professionals, such as contractors, electricians and landscapers. In fact, for the past five consecutive months, light trucks sales have exceeded passenger car sales. 22

Figure 6: US auto and light truck sales

Light Vehicles, Millions 18 17 16 15 14 13 12 11 10 1995 10.2 1998 2001 2004 2007 14.8 13.5 12.4 11.1 2010 2013 17.0 15.9 16.1 15.7 16.2 17.9 17.6 17.7 16.6 15.8 15.2

Figure 7: Automotive volumes: recession vs. today

Number of Carloads 30,000 25,000

17.0 16.7

15.4

20,000 15,000 10,000 5,000 1 4 7 10 13 16 19 22 25 28 31 34 37 40 43 46 49 52 Week

2009 2012 2013

Light Vehicles include cars and light trucks. Source: Bloomberg, as of July 2013. 2013 is the average monthly Seasonally Adjusted Annual Rate (SAAR) through July.

22

Source: Association of American Railroads, as of August 17, 2013

Source: Bloomberg, as of July 2013. 14

COMPASS September 2013

Wealth and Investment Management Global Research & Investments

I think I can, I think I can

Transportation trends this year, particularly in truck tonnage, support the notion of positive momentum in the US economy. A more confident consumer is spending on bigger-ticket durable items in need of replacement, such as cars and appliances. Keeping a close tab on freight volumes may help give investors insight into which sectors may outperform as pent-up demand for cars and home goods is satisfied, and more of consumers discretionary dollars go to purchase retail merchandise and services. Similarly, as business confidence improves, we should see an increase in spending on replacement and growth capital. Transportation industry capital expenditures will be particularly important to watch, as this may be one of the first sectors to see the significant pickup in investment spending we anticipate. Finally, as transportation trends indicate, the housing recovery and shale energy revolution should remain sources of longer term growth.

COMPASS September 2013

15

Wealth and Investment Management Global Research & Investments

Bet on the consumer?

Kristen Scarpa

+1 212 526 4317 kristen.scarpa@barclays.com

As 2013 began, the American consumer the largest driver of US output faced headwinds: higher taxes, continuing high unemployment, and uncertainty about the direction of government policy. Today, its clear that the consumer has adjusted to a higher tax rate and is benefiting from rising employment. But does this key economic actor have enough confidence to drive the next phase of US growth?

US GDP grew 2.5% in the second quarter, bringing the post-recession average to 2.2%, well below the 4.3% typical of recoveries since 1947. 23 With economic growth notably weaker than it has been historically and corporate earnings expected to pick up materially in the fourth quarter, the question on many investors minds is: What might drive an increase in both economic and earnings growth in the second half of this year? The American consumers activity is responsible for over 70% of GDP. Consumption, like the overall economy, has been growing more slowly than it has in the past. But as we head into the fall, a confluence of positive factors seem to favor a marked uptick in consumer activity though risks remain on the horizon (See Seismic shifts, the Great Unwind, and looking through to the other side, page 4.)

The American consumers activity is responsible for over 70% of US GDP

The trends favoring increased consumer activity

More jobs, higher wages

As of August, US unemployment had fallen from a peak of 10.0% in October of 2008 to a six-year low of 7.3%. Not only do more Americans have jobs, but their average hourly earnings have been trending up since late 2012, so those who are gainfully employed are making more money (Figure 1). Wage data has tended to move in long cycles, suggesting that this uptrend is likely to be sustained. In addition, low inflation and rising nominal wages have kept real earnings stable, enabling consumers to retain their purchasing power. Taken together, these trends imply that American consumers have more cash available to spend than they have had in recent years.

Lower debt service

With lower debt service, consumers have more disposable income

Household debt service, the ratio of debt payments to disposable personal income, has been falling steadily over the past five and half years. As of the first quarter, the ratio was 10.5% only a bit higher than the record low of 10.3% in the fourth quarter of 2012 (Figure 2). With lower debt service, consumers have more disposable income available, which, if used primarily for purchasing goods and services instead of savings, could lead to a higher rate of consumption.

23

Source: Bloomberg as of Q2 2013 16

COMPASS September 2013

Wealth and Investment Management Global Research & Investments

Figure 1: Average hourly earnings are now trending upward after a five-year downtrend

Average Nonfarm Hourly Earnings YoY SA, % 5

Figure 2: Ratio of US household debt service to disposable income is near its all-time low

Debt Service Ratio, % 15 14 13

12

2

11 10 1980 1984 1988 1992 1996 2000 2004 2008 2012

Source: Bloomberg as of July 2013 Household Debt Service Ratio the ratio of debt payments to disposable personal income.

1 1985

1989

1993

1997

2001

2005

2009

2013

Source: Bloomberg as of August 2013

Increased wealth

Household net worth, defined as assets minus liabilities, has also been increasing (Figure 3). The value of a households assets is largely driven by equity and home prices. Equity markets have exceeded their 2008 highs with the S&P 500 returning an average of 16% per year since the beginning of 2009, replenishing the wealth lost during the financial crisis. Home prices have also been on the mend. After falling nearly 34% between mid-2006 and early 2012, the S&P/Case-Shiller Home Price Index is up almost 16% from its post-recession low. Since mid-2012, home prices have posted consistent year-over-year gains, rising at an average rate of 7% (Figure 4). In June, the most recent month for which data is available, they grew an impressive 12%.

Figure 3: US households net worth increases as equity prices (S&P 500 Index) rise

S&P 500 Index Value 1,800 1,600 1,400 1,200 1,000 800 600 400 200 0 1999 2001 2003 2005 2007 2009 2011 2013 Household Net Worth - Trillions, USD 80 70 60 50 40 30 20 10 0 Household Net Worth (RHS)

Figure 4: and as housing prices rise, as they have since last year based on the S&P/Case-Shiller Index

S&P /Case-Shiller Home Price YoY, % 20 10 0 -10 -20 -30 2007

S&P 500 Index (LHS)

2008

2009

2010

2011

2012

2013

Source: Bloomberg as of August 2013. Past performance does not guarantee future results. An investment cannot be made directly in a market index. COMPASS September 2013

Source: Bloomberg as of June 2013

17

Wealth and Investment Management Global Research & Investments

Figure 5: Consumer confidence is near six-year highs

Index Value 120 100 80 60 40 20 2005

Figure 6: which has been improving retail sales

%, YoY 10 8 6 4 2 0 -2 -4 -6 -8 -10 -12 2008

2006

2007

2008

2009

2010

2011

2012

Conference Board Consumer Confidence U. of Michigan Consumer Confidence

Source: Bloomberg as of August 2013

2009

2010

2011

2012

2013

Retail Sales

Source: Bloomberg as of July 2013

Annual Average

The combined result of encouraging trends

Improving confidence, strengthening retail sales

The combined result of employment gains, wage increases, lower debt burdens, the housing recovery, and stock market gains is consumer confidence near a six-year high (Figure 5). Confident consumers tend to spend more of their discretionary income; less confident consumers tend to stockpile income as savings. Consumers are currently saving 4.4% of their disposable personal income, slightly below the average of 5.1% since the end of the recession in July 2009. Their increased confidence is also evident in improving retail sales. Year-over-year sales in May, June and July have each exceeded the previous years average (Figure 6).

Translation to higher sales and earnings growth

The uptick in retail sales, particularly of durable goods, is underpinned by robust confidence and suggests a resurgence in consumer spending that could fuel increased

Figure 7: Consumer confidence vs S&P 500 Index per-share YoY sales growth

Increases in consumer confidence tend to lead sales growth by one quarter

S&P 500 Sales Per Share YoY, % 20 15 10 5 0 -5 -10 -15 -20 2008 2009 2010

University of Michigan Consumer Confidence Index 90 85 80 75 70 65 60 55 50 45 2011 2012 2013

S&P 500 Sales Per Share YoY%, LHS

University of Michigan Consumer Confidence, RHS

Source: Bloomberg as of August 2013, University of Michigan Consumer Confidence is a quarterly average, one quarter forward. COMPASS September 2013 18

Wealth and Investment Management Global Research & Investments

revenues and earnings for companies in the second half of 2013. Historically, increases in consumer confidence have tended to lead to sales growth of S&P 500 companies by about one quarter (Figure 7). In that light, the increase in confidence over the past six months is likely to drive revenue increases in the next six months. Anyone paying attention to earnings expectations knows we need this. The consensus estimate forecasts a 1.9% growth in third-quarter S&P 500 aggregate earnings and a whopping 9.0% in fourth-quarter earnings, according to Bloomberg.

Risks on the horizon, place your bets

The relatively encouraging picture painted for consumer spending is not without risks. The combined impact of lower equity prices and a stalled housing recovery, prompted by higher interest rates, would definitely weigh on consumer confidence. Similarly, some combination of acute policy uncertainty, triggered by gridlock in Washington, higher oil prices sapping disposable income, and prolonged market volatility would surely undermine consumer optimism. If these risks are largely avoided, then based on the evidence, wed bet on the consumer to drive economic and sales growth that is worthy of extra attention.

COMPASS September 2013

19

Wealth and Investment Management Global Research & Investments

Real Estate: caution and opportunity in a (not so) recovering asset class

Seth Katz

+1 212 526 2801 seth.katz@barclays.com

Investment opportunities exist across real estate cycles. Two particular approaches currently warrant investor attention. Cyclicality is a key attribute of real estate

John Kenneth Galbraith noted in The Great Crash, 1929, As protection against financial illusion or insanity memory is far better than law. Unfortunately, memory often fades and mans connection with the past grows ever more tenuous and subject to the wishful thinking that conditions nowadays are different from those of the past. This unfortunate circumstance has occurred with worrying frequency in real estate, the asset class arguably most prone to severe cycles. The twentieth century had a number of boom and bust real estate cycles, starting with the Great Depression during which real estate prices fell in excess of 30%. 24 This crisis was followed by the real estate run-up of the late 1970s that culminated in the savings and loan debacle of 1986-1995 during which more than 1,000 thrifts with assets exceeding $500 billion failed. 25 Most recently, of course, was the cycle beginning in 1996 and culminating in the Great Recession during which prices increased at unprecedented rates in the commercial and residential markets and ultimately descended from their peaks in a great deleveraging that rattled the United States economy. Real estate resonates with investors due to the simple fact that we wake every day surrounded by bricks and mortar. The assets tangibility puts it within everyones reach, and owners and renters alike are subject to the markets whims. The most recent real estate boom and bust is most easily summarized in two parts: (i) banks too aggressively expanding lending without maintaining rigorous underwriting standards, oversight, and controls; and (ii) borrowers taking on more leverage than they could afford to repay and more risk than they initially anticipated. According to the Federal Deposit Insurance Corporation (FDIC), real estate secured loans issued by financial institutions insured by the agency increased by 101% from 2000-2008 (from $2.4 trillion to $4.8 trillion). Upon sensing the storm ahead in 2007, these institutions reserved almost $727 billion for loan and lease losses through 2011, with reserve rates higher for those institutions with more distressed loan portfolios. Over 400 institutions with $671 billion in assets failed in this timeframe, consequently losing the FDICs Deposit Insurance Fund close to $88 billion. 26 In retrospect, residential mortgage exposure caused the most distress within the largest institutions, while commercial real estate (CRE) lending represented an outsized cause for smaller institutions failure.

24

The twentieth century had a number of boom and bust real estate cycles, starting with the Great Depression during which real estate prices fell in excess of 30%

25 Source: FDIC Banking Review, The Cost of the Savings and Loan Crisis: Truth and Consequences, December 2000, Timothy Curry and Lynn Shibut. 26 Source: Office of Inspector General of the FDIC, Report to Congress, Comprehensive Study on the Impact of the Failure of Insured Depository Institutions, January 2013.

Gongloff

Source: The Wall Street Journal, Housing Shocker: Home Prices Still Falling, May 31, 2011, Mark

COMPASS September 2013

20

Wealth and Investment Management Global Research & Investments

For rent: single family homes Tantalizingly depressed home prices combined with historically low homeownership rates supported the own-torent thesis

The cratering of the US real estate market predictably engendered opportunities for investors willing to wade into the morass. The market for buying distressed bank-owned single family properties (REO real estate owned) and converting them to rentals became highly relevant as a consequence of tantalizingly depressed home prices combined with homeownership rates at their lowest levels in nearly 20 years (65.2% as of June 30, 2013). 27 Investments in these homes bought from banks and other owners historically were the domain of individuals and small operators for whom the intricate underwriting and maintenance required for each property was scalable in small numbers. Interestingly, over the last couple years, the market for buying these assets has seen a startling confluence of Main Street and Wall Street targeting the same properties. Whereas the single family home-buying strategy previously didnt scale appropriately from a capital efficiency and maintenance perspective for large pools of capital, massive amounts of institutional funding currently flows into the space. For example, two large players, The Blackstone Group and Colony Capital, bought over 40,000 homes between them with aggregate capital invested exceeding $5 billion. 28 This activity has warped recent transaction data suggesting increased home transaction volume. RadarLogic, a real estate analytics company, presented data as of March 2013 on 25 metro areas across the US that shows institutional investors accounting for 12% of home purchases, which is 300 basis points higher than the prior year. Without this increase, the number of home purchases actually declined on a yearly basis. 29 Institutional investors competing for housing stock are playing integral roles in the dramatically rebounding valuations of homes across markets that suffered most in the downturn. The percentage of buyers that these groups represent in Las Vegas, Charlotte, Phoenix, and Miami is 19%, 21%, 26%, and 30%, respectively 30 while almost 50% of all home purchases in Tampa and 31% of purchases in southern California have been with cash, a hallmark of the institutional buyer. 31 The aforementioned purchase activity has buoyed prices; Phoenix, Las Vegas and Atlanta, for example, have seen asking prices rise 25%, 18%, and 14%, respectively. Rents, however, are not rising in line with prices: Phoenix rents increased only 1.3% from a year earlier while Atlanta rents barely increased, and Las Vegas rents actually decreased by 1.7%. 32 The time period for institutional buyers from home acquisition to rental has elongated as they must hire contractors, renovate and acquire tenants. According to Reuters in May 2013, about half of the 55,000 homes acquired by institutional investors remain without tenants. The portent of a glut of homes for rent combined with dramatic rebounds in home prices supported by neither proportional rent increases nor comparable local economic growth rates is troubling and points to the

http://www.census.gov/housing/hvs/files/currenthvspress.pdf Sources: The Motley Fool, Housing: The Good, the Bad, and the Ugly, August 14, 2013, Marie Palumbo. The New York Times, Behind the Rise in House Prices, Wall Street Buyers, June 3, 2013, Nathaniel Popper. 29 Source: Forbes, Homebuyers Beware! Short-Term Money and Investors Dominate the Real Estate Market, June 13, 2013, Agustino Fontevecchia. 30 Sources: Bloomberg News, Blackstone Crowds Housing Market as Rental Gains Slow, March 18, 2013, John Gittelsohn and Prashant Gopal; The Motley Fool, see footnote 5 above. 31 Sources: Charlotte Observer, Big Investment Groups Buying Up Charlotte Homes, July 13, 2013, Andrew Dunn and Deon Roberts; The Wall Street Journal, Investors Pile Into Housing, This Time as Landlords, March 25, 2013, Nick Timiraos. Note: Southern California data is for the month of March 2013. 32 Source: Bloomberg News, see footnote 7 above.

28 27

Home prices are higher but rents have not increased proportionally

COMPASS September 2013

21

Wealth and Investment Management Global Research & Investments

possibility of a future institutional sell-off. As Yale economics professor Robert Shiller said, Betting on home appreciation is not a sure thing. Right now we have the Fed with a massive subsidy to the housing market, but you cant have a housing recovery without a jobs recovery. 33

A step before foreclosure: buying non-performing loans An alternative to REO is buying non-performing loans, which have higher barriers to entry and significant present and expected dealflow

An alternative to buying REO homes is to purchase non-performing loans (NPLs) from banks. In contrast to buying single family homes, NPL acquisition has high barriers to entry due to the financial wherewithal required to purchase loan pools and the overhead necessary to properly service, restructure and work-out loans, preferably before they move into foreclosure and become REO. An NPL buyer purchases bank loans at a discount and then modifies the terms of the lending agreement with the commercial or residential property owner, hoping that the loan once again performs and can be sold to another investor seeking performing paper. While the REO market becomes more heated, the NPL opportunity continues to have ample dealflow in a less competitive environment. As the table below exhibits, CRE loans comprise over 10% of the combined balance sheet of the United States 7,190 banks as of December 2012. According to Ernst & Young, $164 billion of distressed loans fall within this grouping, with the bulk of the problem residing within small regional banks. These banks historically had a disproportionately high allocation to CRE loans (25% as of December 2012) which contributed integrally, as noted earlier, to many of them being shuttered by the FDIC. 34

Figure 1: Commercial Real Estate (CRE) loans on US bank balance sheets

Banks 7,190 total banks Top 100 banks Remaining banks Total assets US$14.5 trillion US$11.5 trillion US$3.0 trillion Commercial Real Estate loans US$1.5 trillion US$755 billion US$760 billion % of balance sheet 10.4% 6.6% 25.3%

Source: Federal Deposit Insurance Corporation (FDIC) as of 12/31/12

Sales of NPLs reached $26 billion in 2011 largely as a consequence of FDIC sales and diminished to roughly $15 billion in 2012 as the economy continued to improve. 35 Despite a trailing off of FDIC NPL sale activity, a number of factors will influence continued offloading of NPLs by banks. Improved financial conditions are encouraging banks to sell underperforming paper as the rest of their respective balance sheets gain strength. As Deloitte writes in its 2013 CRE outlook, Lenders are focusing on permanent resolutions of distressed loans versus modifications/extensions, driven by higher commercial property prices and increased refinancing options. 36 This statement is seconded by Fitch Ratings which finds that with a more benign economic environment, banks are likely to pursue more bulk sales of distressed loans this year and next and that higher earnings have given banks the freedom to properly mark down and sell

Source: Reuters, Special Report: Cheap money bankrolls Wall Streets bet on housing, May 2, 2013, Matthew Goldstein. 34 Source: Flocking to Europe: Ernst & Young 2013 non-performing loan report 35 Ibid. 36 Deloitte University Press, US Commercial Real Estate Outlook: Top Ten Issues in 2013 March 6, 2013, Bob OBrien, Surabhi Sheth and Saurabh Mahajan. COMPASS September 2013 22

33

Wealth and Investment Management Global Research & Investments

troubled assets and absorb the corresponding losses. 37 Despite currently less precarious market conditions, past missteps remain likely to haunt banks in the near future and further contribute to NPL sale volume. In addition to challenged loans, banks and CMBS servicers expect a flood of loans maturing over the next few years that, to be refinanced, will require more equity albeit based on property values far lower than in 2006-2007 when many of these loans were first underwritten. The resulting equity shortfall, estimated at about $100 billion annually over the next few years, probably will result in more NPLs on lenders books. 38

Figure 2: Upcoming CRE debt maturities

$bn

Banks and CMBS servicers expect a flood of loans maturing over the next few years that will require refinancing

400 300 200 100 0 2015 2013 2014 Commercial Banks, Savings Institutions GSEs & Federally Related Mortgage Pools* 2016 2017 Insurance Companies CMBS** 2018

*GSEs: Government Sponsored Enterprises, i.e. Federal National Mortgage Association (Fannie Mae), Federal Home Loan Mortgage Corporation (Freddie Mac), Federal Deposit Insurance Corporation (FDIC), Federal Housing Administration (FHA) **CMBS: Commercial Mortgage Backed Securities. CMBS maturities are estimated to reach roughly $50 billion in 2014, $90 billion in 2015 and, in 2016 and 2017, almost $130 billion, according to Ernst & Young Source: Federal Reserve, FDIC, Barclays Research

The years leading up to and including the Great Recession once more demonstrated real estates sometimes harsh cyclicality. The drastic fall in property valuations across the US generated various investment opportunities, including the purchase of REO properties and NPLs. Investors should focus on options with high barriers to entry and strong dealflow prospects. Perhaps most important, recalling Galbraiths statement quoted earlier, investors ought not let their memory of the not-so-distant bubble fade.

Real estate-related investments may not be suitable for every investor and pose risks related to overall and specific economic conditions as well as risks related to individual property, credit, and interest rate fluctuations. For more information, talk to your Investment Representative.

37 38

Referenced in Flocking to Europe: Ernst & Young 2013 non-performing loan report Ibid. 23

COMPASS September 2013

Wealth and Investment Management Global Research & Investments

Tactical Asset Allocation Review

Two major themes have driven our tactical allocation this year: (1) a bias towards Developed Markets Equities above all other asset classes as they have offered attractive valuation and the most compelling return potential; and (2) a deliberate retreat from, and rotation within, fixed income because of valuation concerns and in anticipation of higher rates in favor of cash. We are underweight Short-maturity, Investment Grade and Emerging Markets Bonds, and neutral weight Developed Government Bonds (where we recommend a low strategic allocation) and high yield debt (Figures 1 and 3). Our views on Commodities also dimmed recently in light of a sustained slowdown in China and no expected pullback in supply; our reduction in July to underweight from neutral in this asset class was made in favor of cash. Since early June, we have maintained an overweight in cash. This reserve will enable us to capitalize on opportunities likely to emerge as tectonic plates rattle markets. Despite the seismic shifts likely to spark significant price churn this fall namely the unwinding of quantitative easing, fiscal debates in Washington, DC, and the impact of geopolitical conflict in the Middle East we still favor Developed Markets Equities. Volatility is likely in the near term, but the catalysts for growth in the longer term are there. Within this asset class, however, the relative opportunities have shifted, as we outline in Seismic shifts on page 4. We remain neutral on Emerging Markets Equities because opportunities in certain rapidly-growing economies exist; however, we view active management as imperative in this asset class. We are also neutral Alternative Trading Strategies; the price swings likely in markets this fall should provide opportunities for this asset class. Finally, we remain neutral on Real Estate as REITs are fairly priced and yield spreads over Treasuries are below historical norms.

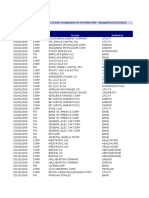

Figure 1: Strategic Asset Allocation (SAA) and Tactical Asset Allocation (TAA) by risk profile: asset class 39

Low Asset class Cash and Short-maturity Bonds Developed Government Bonds Investment Grade Bonds High Yield and Emerging Markets Bonds Developed Markets Equities Emerging Markets Equities Commodities Real Estate Alternative Trading Strategies SAA 46.0% 8.0% 6.0% 6.0% 16.0% 3.0% 2.0% 2.0% 11.0% TAA 48.0% 8.0% 4.0% 4.0% 19.0% 3.0% 1.0% 2.0% 11.0% Medium Low SAA 17.0% 7.0% 9.0% 10.0% 28.0% 6.0% 4.0% 3.0% 16.0% TAA 19.0% 7.0% 7.0% 8.0% 32.0% 6.0% 2.0% 3.0% 16.0% Moderate SAA 7.0% 4.0% 7.0% 11.0% 38.0% 10.0% 5.0% 4.0% 14.0% TAA 10.0% 4.0% 5.0% 8.0% 43.0% 10.0% 2.0% 4.0% 14.0% Medium High SAA 3.0% 2.0% 4.0% 10.0% 45.0% 14.0% 6.0% 6.0% 10.0% TAA 7.0% 2.0% 2.0% 8.0% 49.0% 14.0% 2.0% 6.0% 10.0% SAA 2.0% 1.0% 2.0% 8.0% 50.0% 18.0% 5.0% 7.0% 7.0% High TAA 6.0% 1.0% 0.0% 6.0% 53.0% 18.0% 2.0% 7.0% 7.0%

Source: Barclays Wealth and Investment Management, As first published on 11 July 2013. Red indicates where our TAA is slightly underweight our SAA. Green indicates where our TAA is slightly overweight our SAA. Neutral weights are shown in black.

39

The recommendations made for your actual portfolio will differ from any asset allocation or strategies outlined in this document. The model portfolios are not available to investors since they represent investment ideas, which are general in nature and do not include fees. Your asset allocation will be customized to your preferences and risk tolerance and you will be charged fees. You should ensure that your portfolio is updated or redefined when your investment objectives or personal circumstances change. Our Strategic Asset Allocation (SAA) models offer a baseline mix of assets that, if held on average over a five-year period, will in our view provide the most desirable combination of risk and return for an investors degree of Risk Tolerance. They are updated annually to reflect new information and our changing views. Our Tactical Asset Allocation (TAA) tilts these five-year SAA views, incorporating small tactical shifts from one asset class to another, to account for the prevailing economic and political environment and our shorter-term outlook. For more on our SAA and TAA, please see our Asset Allocation at Barclays white paper and the February 2013 edition of Compass. COMPASS September 2013 24

Wealth and Investment Management Global Research & Investments

Figure 2: Year-to-date returns and TAA weightings for key asset and regional sub asset classes (by weighting)

Year To Date Asset Class Total Return US USSmid SmidCap CapEquities Equities US LargeCap Equities US Large Cap Equities 19.1% 16.7% 8.6% 3.6% 2.8% 0.1%

Figure 3: SAA, TAA and tilts with key regional sub asset classes (Moderate Risk Profile)

Asset Class (including key regional sub asset classes) Cash & Short Maturity Bonds Cash Short Maturity Bonds Developed Government Bonds US Government Bonds Investment Grade Bonds US Investment Grade Bonds High Yield & Emerging Markets Bonds Recommended Allocation SAA 7% 0% 7% 4% 4% 7% 7% 11% 5% 6% 38% 12% 5% 5% 10% 10% 5% 4% 4% 14% 3.5% 3.5% 3.5% 3.5% TAA 10% 7% 3% 4% 4% 5% 5% 8% 5% 3% 43% 13% 9% 16% 5% 10% 10% 2% 4% 4% 14% 3.85% 4.2% 4.2% 1.75% Tilt SAA vs. TAA +3% +7% -4% 0% 0% -2% -2% -3% 0% -3% +5% +1% +4% 0% 0% 0% 0% -3% 0% 0% 0% +.35% +.70% +.70% -1.75%

Overweight

Event Driven Strategies* Event Driven Strategies* Relative Value Strategies* Relative Value Strategies* Global Macro Strategies* Global Macro Strategies* Cash Cash

Non-US Developed Markets Equities US High Yield Bonds

8.1% 2.7% -0.4% -2.7% -10.2%

US High Yield Bonds Emerging Markets Bonds Developed Markets Equities US Large Cap Equities US Smid Cap Equities Developed Private Equity Emerging Markets Equities Emerging Markets Equities Commodities Real Estate Developed Public Real Estate Alternative Trading Strategies Global Macro Strategies Relative Value Strategies Event Driven Strategies Managed Futures

Neutral

US Developed Public Real Estate US Government Bonds Emerging Markets Equities

Non-US Developed Markets Equities 16%

Short-maturity Bonds Short Maturity Bonds

0.1% -3.3% -4.6% -6.2% -9.8%

Underweight

US Investment Grade Bonds US Investment Grade Bonds Managed Futures* Managed Futures* Commodities Commodities Emerging Markets Bonds Emerging Markets Bonds

Red = TAA is slightly underweight the SAA. Green = TAA is slightly overweight the SAA. Source: Bloomberg as of August 30, 2013 unless otherwise noted. Diversification does not guarantee against losses. Past performance is not an indication of future performance.

Red = TAA is slightly underweight the SAA. Green = TAA is slightly overweight the SAA. Source: Barclays Wealth and Investment Management, Americas Investment Committee. As first published on 6 September 2013.

*Returns as of July 31, 2013 for: Global Macro Strategies, Relative Value Strategies, Event Driven Strategies and Managed Futures. Note to Figure 2: We consider private equity to be part of the overall Developed Markets Equities allocation; however, as a reliable performance index is not available, it has been excluded from year-to-date returns/TAA weightings bar chart above. Total Returns in Figure 2 are as of 30 August 2013 unless otherwise noted and represented by the following indices: Cash and Short-maturity Bonds: Cash by Barclays 3-6 month T-bills; Short-maturity Bonds by Barclays 1-3 Year US Treasury; Developed Government Bonds: US Government Bonds by Barclays US Treasury; Investment Grade Bonds: US Investment Grade Bonds by Barclays US Aggregate Corporate; High-Yield and Emerging Markets Bonds: US High Yield Bonds by Barclays US Corporate High Yield; Emerging Markets Bonds by JP Morgan GBI-EM Total Return Diversified; Developed Markets Equities: US Large Cap Equities by Russell 1000 Index; US Smid Cap Equities by Russell 2500 Index; Non-US Developed Markets Equities by MSCI EAFE Net Return; Emerging Markets Equities by MSCI EM; Commodities by DJ UBS Commodity TR Index; US Developed Public Real Estate: by FTSE NAREIT US ALL Equity REITs; Alternative Trading Strategies (*see note above): Relative Value Strategies by HFRI Relative Value Index; Event Driven Strategies by Dow Jones CS Event Driven Index; Managed Futures by Dow Jones CS Managed Futures Index. The benchmark indices are used for comparison purposes only and this comparison should not be understood to mean that there will necessarily be a correlation between actual returns and these benchmarks. It is not possible to invest in these Indices; they are not subject to any fees or expenses. It should not be assumed that investment will be made in any specific securities that comprise the indices. The volatility of the indices may be materially different than that of the hypothetical portfolio.

COMPASS September 2013

25

Wealth and Investment Management Global Research & Investments

Interest rates, bond yields, and commodity and equity prices in context*

Figure 1: Short-term interest rates (global)

Nominal Yield Level 3 Months (%) 9 8 7 6 5 4 3 2 1 0 Dec-90 Dec-94 Dec-98 Global Government one standard deviation Source: FactSet, Barclays Dec-02 Dec-06 Dec-10 10-year moving average

Figure 2: Government bond yields (global)

Nominal Yield Level (%) 10 9 8 7 6 5 4 3 2 1 Jan-87 Jan-92 Global Treasury Jan-97 Jan-02 Jan-07 Jan-12 10-year moving average

one standard deviation

Source: FactSet, Barclays

Figure 3: Inflation-linked real bond yields (global)

Real Yield Level (%) 4.0 3.5 3.0 2.5 2.0 1.5 1.0 0.5 0.0 -0.5 Dec-96 Dec-99 Dec-02 Inflation Linked one standard deviation Dec-08 Dec-05 Dec-11 10-year moving average

Figure 4: Inflation-adjusted spot commodity prices

Real Prices (1991=100) 340 310 280 250 220 190 160 130 100 70 Jan-91 Jan-95 Jan-99 DJ UBS Commodity one standard deviation Jan-03 Jan-07 Jan-11 10-year moving average

Source: Bank of America Merrill Lynch, Datastream, FactSet, Barclays

Source: Datastream, Barclays

Figure 5: Government bond yields: selected markets

Nominal Yield Level (%) 5.0 4.5 4.0 3.5 3.0 2.5 2.0 1.5 1.0 0.5 Global US one standard deviation UK Germany Current 10-year average Japan

Figure 6: Global credit and emerging market yields

Nominal Yield Level (%) 12 10 8 6 4 2 Investment High Yield Hard Currency Local Currency Grade EM EM one standard deviation Current 10-year average

Source: FactSet, Barclays *Monthly data with final data point as of COB 27 August 2013. COMPASS September 2013

Source: FactSet, Barclays

26

Wealth and Investment Management Global Research & Investments

Figure 7: Developed stock market, forward PE ratio

PE (x) 26 24 22 20 18 16 14 12 10 8 Dec-99 Dec-05 Dec-11 Dec-87 Dec-93 MSCI The World Index 10-year moving average one standard deviation Source: MSCI, IBES, FactSet, Datastream, Barclays

Figure 8: Emerging stock market, forward PE ratio

PE (x) 28 26 24 22 20 18 16 14 12 10 8 6 Dec-87 Dec-93 Dec-99 MSCI Emerging Markets one standard deviation

Dec-05 Dec-11 10-year moving average

Source: MSCI, IBES, FactSet, Datastream, Barclays

Figure 9: Developed world dividend and credit yields

Yield (%) 8 7 6 5 4 3 2 1 Jan-04 Jan-07 Jan-10 Jan-13 Global Investment Grade Corporates Yield Developed Markets Equity Dividend Yield Source: MSCI, IBES, FactSet, Datastream, Barclays 0 Jan-01

Figure 10: Regional quoted-sector profitability

Return on Equity (%) 19 17 15 13 11 9 7 5 3 World USA UK Eu x UK Japan Pac x JP one standard deviation Current 10-year average EM

Source: MSCI, IBES, FactSet, Datastream, Barclays

Figure 11: Global stock markets: forward PE ratios

PE (x) 23 21 19 17 15 13 11 9 World USA UK Eu x UK Japan Pac x JP one standard deviation Current 10-year average EM

Figure 12: Global stock markets: price/book value ratios

PB (x) 2.8 2.4 2.0 1.6 1.2 0.8 World USA UK Eu x UK Japan Pac x JP one standard deviation Current 10-year average EM

Source: MSCI, IBES, FactSet, Datastream, Barclays

Source: MSCI, IBES, FactSet, Datastream, Barclays

COMPASS September 2013

27

Wealth and Investment Management Global Research & Investments

Barclays key macroeconomic projections

Figure 1: Real GDP and Consumer Prices (% YoY)

Real GDP 2012 Global Advanced Emerging United States Euro area Japan United Kingdom China Brazil India Russia 3.2 1.5 5.0 2.8 -0.5 2.0 0.2 7.8 0.9 5.1 3.4 2013 2.8 0.9 4.8 1.4 -0.4 1.7 1.3 7.4 2.3 5.0 2.3 2014 3.7 1.9 5.5 2.3 1.3 1.5 2.2 7.4 2.7 6.2 3.5 2012 2.9 1.8 4.7 2.1 2.5 -0.1 2.8 2.6 5.4 7.5 5.1 Consumer prices 2013 2.6 1.4 4.6 1.7 1.5 0.2 2.7 2.6 6.3 5.6 6.6 2014 3.0 1.9 4.8 2.2 1.3 2.4 2.5 3.5 5.6 5.5 5.6

Source: Barclays Research, Global Economics Weekly, 23 August 2013. Note: Arrows appear next to numbers if current forecasts differ from that of the previous week by 0.2pp or more for annual GDP and by 0.2pp or more for Inflation. Weights used for real GDP are based on IMF PPP-based GDP (5yr centred moving averages). Weights used for consumer prices are based on IMF nominal GDP (5yr centred moving averages).

Figure 2: Central Bank Policy Rates (%)

Official rate % per annum (unless stated) Fed funds rate ECB main refinancing rate BoJ overnight rate BOE bank rate China: 1y bench. lending rate Brazil: SELIC rate India: Repo rate Russia: Overnight repo rate Forecasts as at end of Current 0-0.25 0.50 0.10 0.50 6.00 8.50 7.25 5.50 Q3 13 0-0.25 0.50 0-0.10 0.50 6.00 9.00 7.25 5.25 Q4 13 0-0.25 0.50 0-0.10 0.50 6.00 9.25 7.00 5.25 Q1 14 0-0.25 0.50 0-0.10 0.50 6.00 9.25 6.75 5.00 Q2 14 0-0.25 0.50 0-0.10 0.50 6.00 9.25 6.50 5.00

Source: Barclays Research, Global Economics Weekly, 23 August 2013. Note: Rates as of COB 22 August 2013.

COMPASS September 2013

28

Wealth and Investment Management Global Research & Investments

Global Investment Strategy Team