Professional Documents

Culture Documents

Icici Bank & Bank of Madura - Pre Merger S.N0 Particulars Icici Bank of Madura

Uploaded by

Leno MathewOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Icici Bank & Bank of Madura - Pre Merger S.N0 Particulars Icici Bank of Madura

Uploaded by

Leno MathewCopyright:

Available Formats

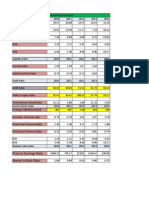

ICICI BANK & BANK OF MADURA PRE MERGER

S.N0

Particulars

ICICI

Bank of Madura

1999

2000

1999

2000

1.

Debt Equity ratio

1.19

0.58

1.27

0.85

2.

Advances to total assets

0.302

0.303

0.323

0.315

3.

Capital adequacy ratio (%)

11.06

19.64

14.25

15.83

4.

Current ratio

6.57

6.36

4.93

4.34

5.

Return on capital employed

(%)

11.91

9.44

9.68

11.36

6.

Total advances to deposits

0.35

0.37

0.40

0.39

7.

Return on total assets (%)

10.74

9.32

9.06

8.81

8.

Earnings per share

3.72

5.21

25.1

37.51

9.

Price earnings ratio

7.37

49.90

2.31

2.69

10.

Liquid asset to total deposit

0.251

0.254

0.38

0.44

11.

Liquid assets to total

advances

0.72

0.69

0.97

1.15

BANK OF BARODA AND BAREILLY CORPORATION BANK PRE MERGER

S.N0

Particulars

Bank of Baroda

Bareilly Corporation Bank

1997

1998

1997

1998

0.7

0.42

0.33

0.02

1.

Debt Equity ratio

2.

Advances to total assets

0.403

0.401

0.28

0.30

3.

Capital adequacy ratio (%)

11.8

12.05

2.95

3.56

4.

Current ratio

2.63

4.12

9.85

7.83

5.

Return on capital employed

(%)

8.06

14.31

7.94

26.55

6.

Total advances to deposits

0.472

0.470

0.28

0.30

7.

Return on total assets (%)

7.5

7.87

7.3

7.14

8.

Earnings per share

10.66

15.37

0.48

1.82

9.

Price earnings ratio

8.44

6.8

10.

Liquid asset to total deposit

0.32

0.33

0.46

0.28

11.

Liquid assets to total

advances

0.67

0.70

1.67

0.92

STATE BANK OF SAURASTRA AND STATE BANK OF INDIA PRE MERGER

S.N0

Particulars

State Bank of India

State Bank of Saurastra

2007

2008

2007

2008

1.

Debt Equity ratio

1.79

1.49

1.25

1.46

2.

Advances to total assets

0.60

0.58

0.589

0.573

3.

Capital adequacy ratio (%)

12.34

13.54

12.78

12.34

4.

Current ratio

1.73

1.6

2.29

4.36

5.

Return on capital

employed (%)

6.13

6.73

3.49

4.43

6.

Total advances to deposits

0.78

0.78

0.701

0.757

7.

Return on total assets (%)

6.02

5.15

5.75

8.

Earnings per share

83.91

103.94

27.85

10.83

9.

Price earnings ratio

11.83

15.38

10.

Liquid asset to total

deposit

0.17

0.18

0.079

0.150

11.

Liquid assets to total

advances

0.22

0.23

0.112

0.199

ORIENTAL BANK OF COMMERCE AND GLOBAL TRUST BANK LTD PRE

MERGER

S.N0

Particulars

Oriental Bank of

Commerce

Global Trust Bank ltd

2002

2003

2002

2003

1.

Debt Equity ratio

0.52

0.56

0.8

123.29

2.

Advances to total assets

0.44

0.46

0.40

0.38

3.

Capital adequacy ratio (%)

10.99

14.04

11.21

4.

Current ratio

4.19

4.29

9.14

9.68

5.

Return on capital employed

(%)

15.65

16.23

-16.54

-77.21

6.

Total advances to deposits

0.50

0.53

0.46

0.38

7.

Return on total assets (%)

8.9

8.53

5.77

1.71

8.

Earnings per share

16.65

23.16

3.32

9.

Price earnings ratio

2.33

2.77

7.94

10.

Liquid asset to total deposit

0.16

0.12

0.20

0.23

11.

Liquid assets to total

advances

0.31

0.23

0.44

0.56

CENTURION BANK AND BANK OF PUNJAB PRE MERGER

S.N0

Particulars

Centurion Bank

Bank of Punjab

2004

2005

2004

2005

1.

Debt Equity ratio

7.96

2.34

0.82

0.79

2.

Advances to total assets

0.46

0.49

0.46

0.47

3.

Capital adequacy ratio (%)

7.49

21.42

12.64

9.23

4.

Current ratio

3.63

3.6

3.59

4.47

5.

Return on capital employed

(%)

-68.3

5.61

8.32

-15.86

6.

Total advances to deposits

0.51

0.62

0.54

0.54

7.

Return on total assets (%)

4.63

4.89

5.63

2.9

8.

Earnings per share

0.25

3.44

9.

Price earnings ratio

59.8

6.85

10.

Liquid asset to total deposit

0.17

0.17

0.20

0.20

11.

Liquid assets to total

advances

0.32

0.27

0.37

0.37

ICICI BANK POST MERGER

S.N0

Particulars

ICICI

2001

2002

1.

Debt Equity ratio

0.92

8.94

2.

Advances to total assets

0.36

0.44

3.

Capital adequacy ratio (%)

11.57

11.44

4.

Current ratio

3.31

1.83

5.

Return on capital employed (%)

8.7

0.8

6.

Total advances to deposits

0.43

1.44

7.

Return on total assets (%)

6.69

2.97

8.

Earnings per share

7.96

11.52

9.

Price earnings ratio

20.78

10.76

10.

Liquid asset to total deposit

0.17

0.34

11.

Liquid assets to total advances

0.39

0.24

BANK OF BARODA POST MERGER

S.N0

Particulars

Bank of Baroda

1999

2000

1.

Debt Equity ratio

0.17

0.53

2.

Advances to total assets

0.38

0.42

3.

Capital adequacy ratio (%)

13.3

12.1

4.

Current ratio

3.76

5.7

5.

Return on capital employed (%)

9.78

13.22

6.

Total advances to deposits

0.44

0.48

7.

Return on total assets (%)

0.7

0.91

8.

Earnings per share

14

16.47

9.

Price earnings ratio

3.25

2.75

10.

Liquid asset to total deposit

0.34

0.27

11.

Liquid assets to total advances

0.76

0.56

STATE BANK OF INDIA POST MERGER

S.N0

Particulars

State Bank of India

2009

2010

1.

Debt Equity ratio

1.45

1.56

2.

Advances to total assets

0.56

0.60

3.

Capital adequacy ratio (%)

12.97

12

4.

Current ratio

1.87

1.67

5.

Return on capital employed (%)

7.15

6.07

6.

Total advances to deposits

0.73

0.79

7.

Return on total assets (%)

7.21

6.6

8.

Earnings per share

139.76

140.65

9.

Price earnings ratio

7.63

14.78

10.

Liquid asset to total deposit

0.20

0.16

11.

Liquid assets to total advances

0.27

0.21

ORIENTAL BANK OF COMMERCE POST MERGER

S.N0

Particulars

Oriental Bank of Commerce

2004

2005

1.

Debt Equity ratio

0.41

0.41

2.

Advances to total assets

0.48

0.47

3.

Capital adequacy ratio (%)

14.47

9.21

4.

Current ratio

3.22

6.32

5.

Return on capital employed (%)

19.59

17.61

6.

Total advances to deposits

0.55

0.53

7.

Return on total assets (%)

9.01

5.54

8.

Earnings per share

34.99

37.29

9.

Price earnings ratio

8.60

8.34

10.

Liquid asset to total deposit

0.14

0.20

11.

Liquid assets to total advances

0.24

0.37

CENTURION BANK OF PUNJAB POST MERGER

S.N0

Particulars

Centurion Bank of Punjab

2006

2007

1.

Debt Equity ratio

0.29

0.78

2.

Advances to total assets

0.58

0.60

3.

Capital adequacy ratio (%)

12.52

11.05

4.

Current ratio

2.04

1.28

5.

Return on capital employed (%)

9.3

7.73

6.

Total advances to deposits

0.70

0.76

7.

Return on total assets (%)

6.2

5.85

8.

Earnings per share

0.62

0.77

9.

Price earnings ratio

42.82

48.77

10.

Liquid asset to total deposit

0.14

0.10

11.

Liquid assets to total advances

0.20

0.13

You might also like

- SEJAL Annual Report Analysis (Mentoring)Document13 pagesSEJAL Annual Report Analysis (Mentoring)Shivam JadhavNo ratings yet

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachFrom EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachRating: 3 out of 5 stars3/5 (3)

- Analysis of Financial StatemnentsDocument17 pagesAnalysis of Financial StatemnentsMuneeb KhalidNo ratings yet

- Mangalore Refinery and Petrochemicals LimitedDocument16 pagesMangalore Refinery and Petrochemicals Limitedsheetal ghugareNo ratings yet

- AFS TablesDocument2 pagesAFS TablesFaiza MurtazaNo ratings yet

- Amity School of Business Amity University, Noida, Uttar PradeshDocument11 pagesAmity School of Business Amity University, Noida, Uttar PradeshGautam TandonNo ratings yet

- Punjab National Bank: BSE: 532461 - NSE: PNB - ISIN: INE160A01014 - Banks - Public SectorDocument7 pagesPunjab National Bank: BSE: 532461 - NSE: PNB - ISIN: INE160A01014 - Banks - Public Sectorsheph_157No ratings yet

- Research Paper On Working Capital Management Made by Satyam KumarDocument3 pagesResearch Paper On Working Capital Management Made by Satyam Kumarsatyam skNo ratings yet

- Kbank enDocument356 pagesKbank enchead_nithiNo ratings yet

- C C C I CC C C !"#$ $#!%& !!'# (!) !$%! !!'# (C! !# !!'# (!) !$%! !!'# (C! !# + + ,& ,-,., &Document11 pagesC C C I CC C C !"#$ $#!%& !!'# (!) !$%! !!'# (C! !# !!'# (!) !$%! !!'# (C! !# + + ,& ,-,., &csmankooNo ratings yet

- Voltas Limited: Annual Report Analysis For The Years 2019-2021 Company Taken As Comparison - Johnson Controls - HitachiDocument8 pagesVoltas Limited: Annual Report Analysis For The Years 2019-2021 Company Taken As Comparison - Johnson Controls - HitachiAmmar PresswalaNo ratings yet

- Lists of Banks and Address: Address No. Name of The Bank Location TelephoneDocument37 pagesLists of Banks and Address: Address No. Name of The Bank Location TelephoneGetu TadesseNo ratings yet

- Previous Years: Canar A Bank - in Rs. Cr.Document12 pagesPrevious Years: Canar A Bank - in Rs. Cr.kapish1014No ratings yet

- Bank Credit AnalysisDocument1 pageBank Credit AnalysisbhuvaneshkmrsNo ratings yet

- Gul Ahmad Textiles LimitedDocument3 pagesGul Ahmad Textiles LimitedmadihaNo ratings yet

- Ho Chi Minh Securities Corporation: Financial AnalysisDocument26 pagesHo Chi Minh Securities Corporation: Financial AnalysisNgọc Dương Thị BảoNo ratings yet

- Axis BankDocument123 pagesAxis BankKajal HeerNo ratings yet

- Key Financial Ratios of Bharat Heavy Electricals - in Rs. Cr.Document6 pagesKey Financial Ratios of Bharat Heavy Electricals - in Rs. Cr.Virangad SinghNo ratings yet

- Financial Ratios of Federal BankDocument35 pagesFinancial Ratios of Federal BankVivek RanjanNo ratings yet

- Investment Banking Assignment by MadihaDocument3 pagesInvestment Banking Assignment by MadihamadihaNo ratings yet

- OSIMDocument6 pagesOSIMKhin QianNo ratings yet

- Hindalco Case StudyDocument21 pagesHindalco Case StudyShrey KashyapNo ratings yet

- Financial Analysis of Olympic Industries LimitedDocument5 pagesFinancial Analysis of Olympic Industries LimitedরাসেলআহমেদNo ratings yet

- Tosrifa Industries Limited: Statement of Ratio AnalysisDocument24 pagesTosrifa Industries Limited: Statement of Ratio AnalysisMohammad Sayad ArmanNo ratings yet

- Financial Analysis of Apollo Hospitals: Presented By: Imran Mohammad Rather 2010MBE09Document19 pagesFinancial Analysis of Apollo Hospitals: Presented By: Imran Mohammad Rather 2010MBE09Vishal GuptaNo ratings yet

- Financial Ratio AnalysisDocument3 pagesFinancial Ratio AnalysisRizwan AhmadNo ratings yet

- Finance Departrment 1Document5 pagesFinance Departrment 1Vansh RanaNo ratings yet

- CIMB FinancialStatement12 PDFDocument382 pagesCIMB FinancialStatement12 PDFEsplanadeNo ratings yet

- Hindustan Unilever LTD.: Trend AnalysisDocument7 pagesHindustan Unilever LTD.: Trend AnalysisAnkitaBansalNo ratings yet

- Financial Analysis of Cherat Cement Company LimitedDocument18 pagesFinancial Analysis of Cherat Cement Company Limitedumarpal100% (1)

- Fortis HealthcareDocument3 pagesFortis HealthcareAnant ChhajedNo ratings yet

- Ho Chi Minh Securities Corporation: Financial AnalysisDocument27 pagesHo Chi Minh Securities Corporation: Financial AnalysisNgọc Dương Thị BảoNo ratings yet

- A Fundamental Analysis of The PerformanceDocument10 pagesA Fundamental Analysis of The PerformanceVictor DasNo ratings yet

- Debt Equity Ratio:: Capital Adequacy Ratio (CAR)Document4 pagesDebt Equity Ratio:: Capital Adequacy Ratio (CAR)rathnakotariNo ratings yet

- MBA FM - 3102 Security Analysis and Portfolio ManagementDocument6 pagesMBA FM - 3102 Security Analysis and Portfolio ManagementAsh KoulNo ratings yet

- Ratio Analysis of Dutch Bangla Bank LimitedDocument6 pagesRatio Analysis of Dutch Bangla Bank LimitedSafiur_AIUBNo ratings yet

- RatiosDocument10 pagesRatiossakthiNo ratings yet

- TV3 AnalysisDocument3 pagesTV3 AnalysishotransangNo ratings yet

- Eibl 2003Document65 pagesEibl 2003mukarram123No ratings yet

- Retail Company With Simple DCFDocument51 pagesRetail Company With Simple DCFJames Mitchell100% (1)

- Valuation Index GroupDocument2 pagesValuation Index Groupbaongan23062003No ratings yet

- Bank Credit Analysis 2Document1 pageBank Credit Analysis 2bhuvaneshkmrsNo ratings yet

- Assignment FM StarbucksDocument13 pagesAssignment FM StarbucksAmirah AzmiNo ratings yet

- Investment Valuation Ratios Years Mar-19 Mar-18 Mar-17 Mar-16 Mar-15Document4 pagesInvestment Valuation Ratios Years Mar-19 Mar-18 Mar-17 Mar-16 Mar-15honey08priya1No ratings yet

- Yinguangxia Events: - China'S Enron EventsDocument11 pagesYinguangxia Events: - China'S Enron EventsMohammed I. AzamNo ratings yet

- Merged Income Statement and Balance Sheet of Pacific Grove Spice CompanyDocument9 pagesMerged Income Statement and Balance Sheet of Pacific Grove Spice CompanyArnab SarkarNo ratings yet

- Analysis of Audited Financial Statements of San Miguel Corporation 2021Document28 pagesAnalysis of Audited Financial Statements of San Miguel Corporation 2021Marquez, Jazzmine K.No ratings yet

- Price To Earnings Ratio Market To Book RatioDocument1 pagePrice To Earnings Ratio Market To Book RatiojaiviyaiNo ratings yet

- Key Financial Ratios of NTPC: - in Rs. Cr.Document3 pagesKey Financial Ratios of NTPC: - in Rs. Cr.Vaibhav KundalwalNo ratings yet

- Case Study On Financial Risk AnalysisDocument6 pagesCase Study On Financial Risk AnalysisolafedNo ratings yet

- 1.inroduction: Working Capital Management Refers To A Company's ManagerialDocument7 pages1.inroduction: Working Capital Management Refers To A Company's Managerialmaa digitalxeroxNo ratings yet

- Axis RatioDocument5 pagesAxis RatiopradipsinhNo ratings yet

- Submitted By: Parth D. DalalDocument43 pagesSubmitted By: Parth D. Dalalrahulshah86No ratings yet

- Ratio Analysis & Assesment of Working Capital Requirements Mrs. Basanti Bai MaavashkarDocument1 pageRatio Analysis & Assesment of Working Capital Requirements Mrs. Basanti Bai MaavashkarVijay HemwaniNo ratings yet

- SRN: Sachem D Name: PES1PG20MB272: Profile of The CompanyDocument8 pagesSRN: Sachem D Name: PES1PG20MB272: Profile of The CompanySachin D SalankeyNo ratings yet

- Case Study of Tata MotorsDocument6 pagesCase Study of Tata MotorsSoumendra RoyNo ratings yet

- Unit: Million VND: Working CapitalDocument12 pagesUnit: Million VND: Working CapitalThảo LinhNo ratings yet

- Financial Statement Analysis Session 1Document31 pagesFinancial Statement Analysis Session 1Vignan MadanuNo ratings yet

- MArcentile Bank Full Review AssignmentDocument5 pagesMArcentile Bank Full Review AssignmentJonaed Ashek Md. RobinNo ratings yet

- Income Statement and Finance TopicsDocument1 pageIncome Statement and Finance TopicsLeno MathewNo ratings yet

- What'SCost AccountingDocument4 pagesWhat'SCost AccountingLeno MathewNo ratings yet

- Threat of New EntrantsDocument3 pagesThreat of New EntrantsLeno MathewNo ratings yet

- Managing StressDocument2 pagesManaging StressLeno MathewNo ratings yet

- Bargaining Power of SuppliersDocument1 pageBargaining Power of SuppliersLeno MathewNo ratings yet

- Bargaining Power of BuyersDocument1 pageBargaining Power of BuyersLeno MathewNo ratings yet

- Rivalry Among Existing FirmsDocument1 pageRivalry Among Existing FirmsLeno MathewNo ratings yet

- How A Math Genius Hacked OkCupid To Find True Love - Wired ScienceDocument23 pagesHow A Math Genius Hacked OkCupid To Find True Love - Wired ScienceLeno MathewNo ratings yet

- Economy First Cut - Inflation Sept-2013Document4 pagesEconomy First Cut - Inflation Sept-2013Leno MathewNo ratings yet

- Rivalry Among Existing FirmsDocument1 pageRivalry Among Existing FirmsLeno MathewNo ratings yet

- 25 Hilarious Memes Every Indian Engineer Identifies WithDocument15 pages25 Hilarious Memes Every Indian Engineer Identifies WithLeno MathewNo ratings yet

- Laser Fusion Experiment Extracts Net Energy From Fuel - Nature News & CommentDocument4 pagesLaser Fusion Experiment Extracts Net Energy From Fuel - Nature News & CommentLeno MathewNo ratings yet

- Thread, A Low-Power Network For The Smart HomeDocument5 pagesThread, A Low-Power Network For The Smart HomeLeno MathewNo ratings yet

- Old Spice CaseDocument15 pagesOld Spice CaseLeno MathewNo ratings yet

- MEV2Document6 pagesMEV2Leno MathewNo ratings yet

- Camelsmodeling 12735547516095 Phpapp02Document31 pagesCamelsmodeling 12735547516095 Phpapp02Azka AdeelNo ratings yet

- Final Project Report On CAMELS ModelDocument65 pagesFinal Project Report On CAMELS ModelLeno MathewNo ratings yet

- Twenty Retention Tools For Curbing AttritionDocument8 pagesTwenty Retention Tools For Curbing AttritionSzilvia SzalaiNo ratings yet

- Bibliography: Gyan Management, Vol.2, No.1Document1 pageBibliography: Gyan Management, Vol.2, No.1Leno MathewNo ratings yet

- Alumni CellDocument1 pageAlumni CellLeno MathewNo ratings yet

- HotelsDocument8 pagesHotelsLeno MathewNo ratings yet

- 2011 CIVITAS Benefit JournalDocument40 pages2011 CIVITAS Benefit JournalCIVITASNo ratings yet

- Nobels Ab1 SwitcherDocument1 pageNobels Ab1 SwitcherJosé FranciscoNo ratings yet

- Criminal Law Notes First YearDocument12 pagesCriminal Law Notes First YearShella Hannah Salih100% (3)

- Cambodia vs. RwandaDocument2 pagesCambodia vs. RwandaSoksan HingNo ratings yet

- 2022-01-07 Market - Mantra - 070122Document9 pages2022-01-07 Market - Mantra - 070122vikalp123123No ratings yet

- Pratical Venue Letter ICT 417 ParticalDocument2 pagesPratical Venue Letter ICT 417 ParticalCh MusaNo ratings yet

- ManeDocument2 pagesManeMukesh Manwani100% (2)

- DILG Resources 2011216 85e96b8954Document402 pagesDILG Resources 2011216 85e96b8954jennifertong82No ratings yet

- Combinepdf PDFDocument487 pagesCombinepdf PDFpiyushNo ratings yet

- Tale of Education Policy in BangladeshDocument13 pagesTale of Education Policy in BangladeshSammi bithyNo ratings yet

- Memorial On Behalf of AppellentDocument16 pagesMemorial On Behalf of Appellenttopperslibrary001No ratings yet

- Adjusting Entries - Sample Problem With AnswerDocument19 pagesAdjusting Entries - Sample Problem With AnswerMaDine 19100% (3)

- Exclusion Clause AnswerDocument4 pagesExclusion Clause AnswerGROWNo ratings yet

- United Capital Partners Sources $12MM Approval For High Growth Beverage CustomerDocument2 pagesUnited Capital Partners Sources $12MM Approval For High Growth Beverage CustomerPR.comNo ratings yet

- Directions: Answer The Following Questions. Write Your Final Answer in Simplest Form. 1Document1 pageDirections: Answer The Following Questions. Write Your Final Answer in Simplest Form. 1chad lowe villarroyaNo ratings yet

- Cpa Review School of The Philippines ManilaDocument2 pagesCpa Review School of The Philippines ManilaAljur Salameda50% (2)

- Audit of A Multi-Site Organization 1. PurposeDocument4 pagesAudit of A Multi-Site Organization 1. PurposeMonica SinghNo ratings yet

- Bus Ticket Invoice 1465625515Document2 pagesBus Ticket Invoice 1465625515Manthan MarvaniyaNo ratings yet

- Aeris Product Sheet ConnectionLockDocument2 pagesAeris Product Sheet ConnectionLockGadakNo ratings yet

- Passive Voice, Further PracticeDocument3 pagesPassive Voice, Further PracticeCasianNo ratings yet

- Student Profile Guide G TuDocument5 pagesStudent Profile Guide G TuumeshNo ratings yet

- FM09-CH 27Document6 pagesFM09-CH 27Kritika SwaminathanNo ratings yet

- WiFi LoAs Submitted 1-1-2016 To 6 - 30 - 2019Document3 pagesWiFi LoAs Submitted 1-1-2016 To 6 - 30 - 2019abdNo ratings yet

- Business Plan V.3.1: Chiken & Beef BBQ RestaurantDocument32 pagesBusiness Plan V.3.1: Chiken & Beef BBQ RestaurantMohd FirdausNo ratings yet

- Insurance ServicesDocument25 pagesInsurance Servicesjhansi saiNo ratings yet

- (John J. Miletich) Homicide Investigation An Intr PDFDocument314 pages(John J. Miletich) Homicide Investigation An Intr PDFCarl Radle100% (1)

- Nursing Cadre 0Document20 pagesNursing Cadre 0lspardhan55No ratings yet

- El Kanah-The Jealous GodDocument12 pagesEl Kanah-The Jealous GodspeliopoulosNo ratings yet

- Muhammad Al-MahdiDocument13 pagesMuhammad Al-MahdiAjay BharadvajNo ratings yet

- Guide 7000 - Application For Permanent Residence - Federal Skilled Worker ClassDocument62 pagesGuide 7000 - Application For Permanent Residence - Federal Skilled Worker ClassIgor GoesNo ratings yet