Professional Documents

Culture Documents

CAIR-F 2007 Articles of Incorp (Ex. 10 To Ex. A - OCR)

Uploaded by

Tim CavanaughOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CAIR-F 2007 Articles of Incorp (Ex. 10 To Ex. A - OCR)

Uploaded by

Tim CavanaughCopyright:

Available Formats

003412

P

r

o

d

u

c

e

d

S

u

b

j

e

c

t

t

o

P

r

o

t

e

c

t

i

v

e

O

r

d

e

r

Case 1:09-cv-02030-CKK Document 163-12 Filed 06/17/13 Page 89 of 185

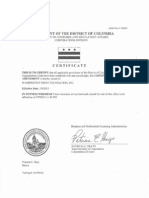

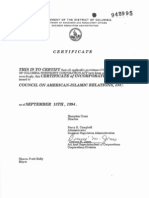

GOVERNMENT OF THE DISTRICTOF COLUMBIA

DEPARTMENT OF CONSUMER AND REGULATORY AFFAIRS

* * *

C E R T IF I C A T E

THIS IS TO CERTIFY that all applicable provisions of the District of Cotumbia

NonProfit Corporation Act have been complied with and accordingly, this

CERTIFICATE OF IN CORPORA T/ON is hereby issUed to:

CAIR-FOUNDATION, INC.

IN WITNESS WHEREOF I have hereunto set my hand and caused the seal of this

office to be affixed as of the 15th day of February, 2005.

thony A. Williams

1v1ayor

Patrick J. Canavan

Acting Director

John T. Drann

Administrator

and Professional L7nsing Administration

,, ) . t k/

.. :y / f.

/ tlf2tt/!!L c/

Patricia E. Grays . /// - '

Superintendent of Corporations-,

Corporations Division

Attachment

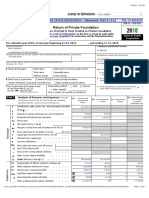

Application for Recognition of

Exemption under Section 501.(c)3

of the Internal Revenue Code

CArR-Foundation, Inc.

(EIN: 77-06467s;6)

003413

P

r

o

d

u

c

e

d

S

u

b

j

e

c

t

t

o

P

r

o

t

e

c

t

i

v

e

O

r

d

e

r

Case 1:09-cv-02030-CKK Document 163-12 Filed 06/17/13 Page 90 of 185

TO:

ARTICLES OF INCORPORATION

OF

CUR- FOUNDATION, INC.

Depmiment of Consumer and Regulatory Affairs

Business Regulation Division

Corporation Division

Washington, D.C. 20001

.--'

!

i

~ . = L ' - ... _

I._, L .......J .....'

We, the undersigned natural persons of the age twenty-one years or more,

acting as incorporators of a corporation under the NON-PROFIT CORPORATION_ ACT

(D.C. Code 2001 edition, Title 29, Chapter 3), adopt the following Articles of

Incorporation:

FIRST:

SECOND:

THIRD:

The name of the corporation is CAIR- FOUNDATION, INC.

The period of duration is perpetual.

The purposes for which the corporation is organized are as follows:

The corporation is organized exclusively for educational and charitable

purposes within the meaning of section 501 ( c )(3) of the Internal Revenue

Code of 1986 as novv in effect or as may hereafter be amended ("the

Code"). The purpos.es for which the corporation is organized are to

combat prejLidice and discrimination against Muslims in the United States;

to preserve, protect and promote civil rights of Muslims in the United

States; and to educate the American public about the Islamic faith and its

history and the problems of discrimination against Muslim citizens in the

United States; and for related purposes.

In fm1herance thereof, the corporation may receive property by gift,

bequest or devise, invest and reinvest the same, and apply theincome and

principal thereof, as the board of directors may from time to 'time

determine, and engage in any lawful act or activity for which corporations

may be organized under the District of Columbia Nonprofit Corporation

Act.

In furtherance of its corporate purposes, the corporation shall have all the

general powers enumerated in section 29-301.05 ofthe District of

Columbia Nonprofit Corporation Act as now in effect or as may hereafter

be amended, together with the power to solicit grants and contributions for

such purposes.

Attachment

Application for Recognition of

Exemption under Sectionso1(c)3

of :the Internal Revenue Code

CAIR-Foundation, Inc.

(H'TJI..T. ,..,,.,_,...;:;.,.;:;....,.,.;:;.)

003414

P

r

o

d

u

c

e

d

S

u

b

j

e

c

t

t

o

P

r

o

t

e

c

t

i

v

e

O

r

d

e

r

Case 1:09-cv-02030-CKK Document 163-12 Filed 06/17/13 Page 91 of 185

FOURTH:

FIFTH:

SIXTH:

2

The corporation shall have no members.

There shall be at least three directors who shall be elected or appointed as

provided by the bylaws of the corporation.

. .

Provisions for the regulation of internal iffairs of the corporation,

including provisions for distribution of assets on dissolution or final

liquidation, are as follows:

A. No part of the net earnings of the corporation shall inure to the benefit

of, or be distributable to, its officers, trustees, directors or any other

private person, except that the corporation shall be authorized and

_ empowered to pay reasonable compensation for services rendered to or

for the corporation and to make payments and distributions in

furtherance of the purposes set forth in Article THIRD hereof

B. No substantial part of the activities of the corporation shall consist of

carrying on of propaganda or otherwise attempting to influence

legislation, and the corporation shall not participate or intervene in any

political campaign (including the publishing or distribution of

statements) on behalf of or in opposition to any candidate for public

office. Notwithstanding any other provision of these Articles of

Incorporation, the corporation shall not directly or indirectly carry on

any other activities not permitted to be carried on (i) by a corporation

exempt frorri federal income tax under section 501 ( c )(3) ofthe Code,

or the corresponding section of any future federal tax code, or (ii) by a

corporation, contributions to which are deductible .under section

170( c)(2) of the Code or the corresponding section of any future

federal tax code.

C. Upon dissolution of the corporation, assets shall be distributed for one

or more exempt purposes within the meaning of section 501( c )(3 )'the

Code, or the corresponding section of any future federal tax code, or

shall be distributed to the federal government, or to a state or local

government, for a public purpose. Any such assets not so disposed of.

shall be disposed of by a court of competent jurisdiction in the District

of Columbia, exclusively for such purposes or to such organization or

organizations, as said court shall determine, which are organized and

operated exclusively for such purposes.

SEVENTH: The address, including street and number, of the initial registered office is

is CAIR Foundation, 50 E Street, SE Suite 200, Washington, DC 20003

the name of the registered agent at such address is

n r,-,,,,. i<t.:f""'l

- I l _..--......_ -J' - I

EIGHTH: The number of directors constituting the initial board of directors is three

and the riames and addresses, including street and number of the persons

Attachment .

Application for Recognition of

Exemption under Section 501(c)3

of the Internal Revenue Code

CAIR-Foundati.on, Inc.

(EIN: 77-0646756)

003415

P

r

o

d

u

c

e

d

S

u

b

j

e

c

t

t

o

P

r

o

t

e

c

t

i

v

e

O

r

d

e

r

Case 1:09-cv-02030-CKK Document 163-12 Filed 06/17/13 Page 92 of 185

NINTH:

\\ho are to serve as the initial directors until the first annual meeting or

unti [ their successors are elected and qualified are:

Ahmad Al-Akhras

Parvez Ahmed

Khalid Iqbal

Address

.A. t\.

Itt

1311 Lee yme Marie Circle

Columbus OH 4323fi. A A

12346 Winter Pine Court

Jacksonville, FL 32225

453 New Jersey Ave S.E.

Washington DC 20003

The name and address, including street and number, of each incorporator

is as follows:

Ahmad Al-Akhras

Parvez Ahmed

Khalid Iqbal

Address

A>rr\L A-A'

1311 Lee Marie Circle

/

Columbus OH A A .

12346 Winter Pine Court

Jacksonville, FL 32225

453 New Jersey Ave S.E.

Washington DC 20003

Attachment

Application for Recognition of

Exemption under Section 501(c)3

of the Internal Revenue Code

CAIR-Foundation, Inc.

(EIN: 77-0646756)

003416

P

r

o

d

u

c

e

d

S

u

b

j

e

c

t

t

o

P

r

o

t

e

c

t

i

v

e

O

r

d

e

r

Case 1:09-cv-02030-CKK Document 163-12 Filed 06/17/13 Page 93 of 185

4

) ss:

L ?,;, . , .c, , a Notary Public in and for

-' ; . ,._ , hereby certify that on the_ day of

200, 'Ahmad AJ-Akhras appeared before me and signed the foregoing document as an

incorporator, and avened that the statements therein contained are true.

1 l

(Notary Seal)

NotarfPublic

My commission expires: ____ ::_- __

ss:

I, ( !-t "-'0 '{ l,c T; A o \1 , a Notary Public in and foLthe (;2L:_

c,;111\ ;:_ t r rG:.'i<.i'vA , hereby certify that on theRda,y Parvez

Ahmed appeared before me and signed the foregoihgdb"t'Gment as an' incorporator, and

avened that the statements therein contained are:Jfr'i:i:e .

. / ... /

/ /

;ttz ' vz._ __ _

(Notary Seal)

. Notary/fublic _../

/ . - \..__.,...-./

.. , OF,-lClAL SEAL

r ..

!<

1

. ;:; Gandy Settaay

' ' I ;::-1

Commission # DO 009,, ,5

My Commission Expires March 14,2005

My commission expires: \'-1.1\(L. \\j-'(ico . .r

) ss:

---------------------

. . I, , a Notary P.ublic in and the J . ..

"- , hereby certJ.fy that on the) 7 day of'-' 200r [D

Thalid Iqbal appeared before me and signed the foregomg document as an incorporator, ?_........,

. and averred that the statements are true. _

1

.

(Notary Seal) '-

. N6tary Public . '

i

I

My commission expires: ___________ __

Attachment

Application for Recognition of

Exemption under Section 501(c)3

of the Internal Revenue Code

CAIR-Foundation, Inc.

(EIN: 77-064675 6

You might also like

- WTF Incorporation Docs (DCRA File Re WTF Fka CAIR-An As of 6.18.13 - OCRDocument7 pagesWTF Incorporation Docs (DCRA File Re WTF Fka CAIR-An As of 6.18.13 - OCRTim CavanaughNo ratings yet

- CAIR Inc Last - Confidential - Filing 2007Document7 pagesCAIR Inc Last - Confidential - Filing 2007Tim CavanaughNo ratings yet

- CAIR-F 2013 IRS Reinstatement (Ex. 10 To Ex. A - OCR)Document4 pagesCAIR-F 2013 IRS Reinstatement (Ex. 10 To Ex. A - OCR)Tim CavanaughNo ratings yet

- Hassan Shibly's Facebook NotesDocument22 pagesHassan Shibly's Facebook NotesAmericans for Peace and ToleranceNo ratings yet

- Fifteenth Congress of The Federation of OSEA Thirteenth MeetDocument4 pagesFifteenth Congress of The Federation of OSEA Thirteenth MeetKaylee SteinNo ratings yet

- Loan Application FormDocument1 pageLoan Application FormGrely FernandezNo ratings yet

- Common Transaction SlipDocument3 pagesCommon Transaction SlipGyan Swaroop TripathiNo ratings yet

- Petition For Cancellation of Meowingtons MarkDocument24 pagesPetition For Cancellation of Meowingtons MarkTHROnline100% (1)

- U.S. Customs Form: CBP Form 3299 - Declaration For Free Entry of Unaccompanied ArticlesDocument2 pagesU.S. Customs Form: CBP Form 3299 - Declaration For Free Entry of Unaccompanied ArticlesCustoms FormsNo ratings yet

- 2020 Democratic Party Platform Recommendations by Muslim CoalitionDocument18 pages2020 Democratic Party Platform Recommendations by Muslim CoalitionMuslims DelegatesNo ratings yet

- Junior Chamber Philippines ManualDocument31 pagesJunior Chamber Philippines ManualGilbert MendozaNo ratings yet

- City of Toronto Application Seeking Leave To Appeal at The Supreme Court of CanadaDocument39 pagesCity of Toronto Application Seeking Leave To Appeal at The Supreme Court of CanadaToronto StarNo ratings yet

- Beneficiary Change FormDocument4 pagesBeneficiary Change FormervinishereNo ratings yet

- 501 (C) 3 LetterDocument2 pages501 (C) 3 LetterspearmintnycNo ratings yet

- Amanat Claim FormDocument9 pagesAmanat Claim FormSharonWaxmanNo ratings yet

- 5:13-cv-00982 #25Document379 pages5:13-cv-00982 #25Equality Case FilesNo ratings yet

- Account Opening FormDocument3 pagesAccount Opening FormJoseph VJNo ratings yet

- Cibil Combo Report: Search InformationDocument13 pagesCibil Combo Report: Search InformationKAMLESH DEWANGANNo ratings yet

- AuditDocument36 pagesAuditStewart BellNo ratings yet

- I-9 Form CompletionDocument1 pageI-9 Form Completionchris mcwilliamsNo ratings yet

- Bdo Service Slip Final 1Document1 pageBdo Service Slip Final 1Ivy Maril De Guzman-ViernesNo ratings yet

- 10000016619Document160 pages10000016619Chapter 11 Dockets100% (1)

- Alpha NewsDocument3 pagesAlpha Newscrichert30No ratings yet

- D R F. L Iso M S J C N - 3:10 - 0257-JSW sf-3008082Document410 pagesD R F. L Iso M S J C N - 3:10 - 0257-JSW sf-3008082Equality Case FilesNo ratings yet

- Barack Obama Foundation Irs Determination Letter July 21 2014Document1 pageBarack Obama Foundation Irs Determination Letter July 21 2014Jerome CorsiNo ratings yet

- A17 0769Document3 pagesA17 0769Xavier GomezNo ratings yet

- KRA tax compliance certificate for Kevin Owino OlangDocument1 pageKRA tax compliance certificate for Kevin Owino OlangMosena TechWorksNo ratings yet

- Court DocumentsDocument64 pagesCourt DocumentsAnonymous DeZm0ZLptONo ratings yet

- COR Letter To Etrade 2Document1 pageCOR Letter To Etrade 2janiceshellNo ratings yet

- Smith V Cash Money OrderDocument26 pagesSmith V Cash Money OrderTHROnlineNo ratings yet

- 8th Wonder On Lake Superior LLCDocument3 pages8th Wonder On Lake Superior LLCDuluth News TribuneNo ratings yet

- 2018 NoVo 990Document80 pages2018 NoVo 990Noam Blum100% (1)

- U20082061596Document7 pagesU20082061596Thomas Muhammad100% (1)

- F.S. C. Miller UCC DOC #2000043135Document12 pagesF.S. C. Miller UCC DOC #2000043135Alfred on Gaia100% (4)

- Pac Rep Founding DocumentsDocument10 pagesPac Rep Founding DocumentsL. A. PatersonNo ratings yet

- Alan Kirchhoff Colorado BankruptcyDocument41 pagesAlan Kirchhoff Colorado BankruptcyThe Dallas Morning NewsNo ratings yet

- Canal Corp IPCDocument5 pagesCanal Corp IPCRick KarlinNo ratings yet

- Articles of Incorporation MainstreetDocument8 pagesArticles of Incorporation MainstreetSophia PeronNo ratings yet

- Art of IncDocument11 pagesArt of IncTeena Post/LaughtonNo ratings yet

- United States v. Oklahoma City Retailers Association, 331 F.2d 328, 10th Cir. (1964)Document6 pagesUnited States v. Oklahoma City Retailers Association, 331 F.2d 328, 10th Cir. (1964)Scribd Government DocsNo ratings yet

- FEC Complaint Against Paige KreegelDocument27 pagesFEC Complaint Against Paige KreegelPeter SchorschNo ratings yet

- Nonprofit Disclosure 093019Document67 pagesNonprofit Disclosure 093019KayNo ratings yet

- OPPT: Individual UCC DEMAND BANK UNFREEZE TemplateDocument4 pagesOPPT: Individual UCC DEMAND BANK UNFREEZE TemplateAmerican Kabuki100% (3)

- Debt Collector Disclosure StatementDocument5 pagesDebt Collector Disclosure StatementBhakta Prakash94% (16)

- TaxDocument21 pagesTaxSheila ConsulNo ratings yet

- Credit Repair Letter This Is An Attempt To Validate A DebtDocument7 pagesCredit Repair Letter This Is An Attempt To Validate A DebtZIONCREDITGROUP89% (9)

- LCCR Q & R 013910-14083 Questionnaire and Response Dated 10/12/2001Document96 pagesLCCR Q & R 013910-14083 Questionnaire and Response Dated 10/12/2001LCCR AdminNo ratings yet

- 15-7682 Floyd Kephart and New City Development Docs Part 1 PDFDocument17 pages15-7682 Floyd Kephart and New City Development Docs Part 1 PDFRecordTrac - City of OaklandNo ratings yet

- Clay Nutting, TBD Fest LawsuitDocument8 pagesClay Nutting, TBD Fest LawsuitCapital Public RadioNo ratings yet

- Commissioner Sharon Barnes Sutton and Judy Brownlee Ethics Complaint and Amendment - Doc.2Document67 pagesCommissioner Sharon Barnes Sutton and Judy Brownlee Ethics Complaint and Amendment - Doc.2Viola DavisNo ratings yet

- Attack The Debt CollectorDocument9 pagesAttack The Debt CollectorMichael Peterson97% (32)

- Aff of Fact All Loans PrepaidDocument2 pagesAff of Fact All Loans PrepaidTitle IV-D Man with a plan100% (14)

- TDS Group Sued by Former RepDocument66 pagesTDS Group Sued by Former RepScott Dauenhauer, CFP, MSFP, AIFNo ratings yet

- Cert of Inc - Nonstock CorpDocument3 pagesCert of Inc - Nonstock CorpompaintsNo ratings yet

- Crafton v. DoesDocument29 pagesCrafton v. DoesVenkat BalasubramaniNo ratings yet

- Ucc Demand Summons CourtDocument13 pagesUcc Demand Summons CourtApril ClayNo ratings yet

- Решение суда хищение акций ОкеанDocument7 pagesРешение суда хищение акций ОкеанannaetkinaNo ratings yet

- Jean-Francois Labrie Lien FREEMANDocument7 pagesJean-Francois Labrie Lien FREEMANRadio-CanadaNo ratings yet

- Sec Form DDocument5 pagesSec Form DPando DailyNo ratings yet

- Sample Preliminary ReportDocument10 pagesSample Preliminary ReportAidyl Rain SimbulanNo ratings yet

- Unsealed Yee AffidavitDocument137 pagesUnsealed Yee Affidavitjeremybwhite100% (1)

- MRC Letter To Gov Martin OmalleyDocument1 pageMRC Letter To Gov Martin OmalleyTim CavanaughNo ratings yet

- Citizen Petition From Sabra Dipping Co LLCDocument11 pagesCitizen Petition From Sabra Dipping Co LLCAnonymous 2NUafApcVNo ratings yet

- Council of Economic Advisers: Year in Review Economic BriefingDocument22 pagesCouncil of Economic Advisers: Year in Review Economic BriefingThe White HouseNo ratings yet

- Feb 2014 Donor LetterDocument4 pagesFeb 2014 Donor LetterTim CavanaughNo ratings yet

- Buffett AbortionDocument54 pagesBuffett AbortionTim CavanaughNo ratings yet

- Mid-Mar Enrollment Report 3-10-14Document29 pagesMid-Mar Enrollment Report 3-10-14Tim CavanaughNo ratings yet

- Timeline Dismantle Immigration EnforcementDocument16 pagesTimeline Dismantle Immigration EnforcementTim CavanaughNo ratings yet

- Ulbricht Criminal ComplaintDocument39 pagesUlbricht Criminal ComplaintbrianrbarrettNo ratings yet

- Laurie Cum Bo JewsDocument3 pagesLaurie Cum Bo JewsTim CavanaughNo ratings yet

- Warning: Graphic Content: USPIS Statement of FactsDocument3 pagesWarning: Graphic Content: USPIS Statement of Factskballuck1No ratings yet

- Median Obamacare SubsidiesDocument3 pagesMedian Obamacare SubsidiesTim CavanaughNo ratings yet

- Grand Jury Subpoena To DOA - 20130107 - 115259Document4 pagesGrand Jury Subpoena To DOA - 20130107 - 115259Tim CavanaughNo ratings yet

- Wastebook 2013Document177 pagesWastebook 2013Caroline MayNo ratings yet

- Rice STOP ResolutionDocument4 pagesRice STOP ResolutionCaroline MayNo ratings yet

- Exchange Enrollment Flow ChartDocument1 pageExchange Enrollment Flow ChartTim CavanaughNo ratings yet

- Awad Hammad, NihadDocument163 pagesAwad Hammad, NihadTim CavanaughNo ratings yet

- CAIR 1994 Articles of Incorp (DCRA File Re WTF Fka CAIR-An As of 6.18.13 - OCR)Document6 pagesCAIR 1994 Articles of Incorp (DCRA File Re WTF Fka CAIR-An As of 6.18.13 - OCR)Tim CavanaughNo ratings yet

- FCC Wheeler 2Document20 pagesFCC Wheeler 2Tim CavanaughNo ratings yet

- Ex. 2 To Ex. ADocument33 pagesEx. 2 To Ex. ATim CavanaughNo ratings yet

- NRSC Landrieu FlyerDocument2 pagesNRSC Landrieu FlyerTim CavanaughNo ratings yet

- Awad Hammad, NihadDocument163 pagesAwad Hammad, NihadTim CavanaughNo ratings yet

- QHP CMS Agreement For 2014-1Document9 pagesQHP CMS Agreement For 2014-1Tim CavanaughNo ratings yet

- Awad Hammad, NihadDocument163 pagesAwad Hammad, NihadTim CavanaughNo ratings yet

- Awad Hammad, NihadDocument163 pagesAwad Hammad, NihadTim CavanaughNo ratings yet

- Awad Hammad, NihadDocument163 pagesAwad Hammad, NihadTim CavanaughNo ratings yet

- Introduction to Derivatives MarketsDocument37 pagesIntroduction to Derivatives MarketsMichael Thomas JamesNo ratings yet

- 2012-2013 PNHA Tables - 2Document9 pages2012-2013 PNHA Tables - 2Juan CarlosNo ratings yet

- United Nations / Uaag LedgerDocument46 pagesUnited Nations / Uaag LedgerOlubayode OlowofoyekuNo ratings yet

- The Dynamics of International Business NegotiationsDocument6 pagesThe Dynamics of International Business NegotiationsRavi GaubaNo ratings yet

- Financial Reporting and Analysis QuestionsDocument16 pagesFinancial Reporting and Analysis QuestionsPareshNo ratings yet

- Reclassification AdjustmentsDocument3 pagesReclassification AdjustmentsRanilo HeyanganNo ratings yet

- PrabhakarDocument91 pagesPrabhakaransari naseem ahmadNo ratings yet

- Internship Report 2020Document45 pagesInternship Report 2020Naomii HoneyNo ratings yet

- SSRN Id2741701Document18 pagesSSRN Id2741701Jad HajjdeebNo ratings yet

- Onion Cold StorageDocument4 pagesOnion Cold StoragezhyhhNo ratings yet

- Statement of Purpose - MS in EconomicsDocument2 pagesStatement of Purpose - MS in EconomicsVishal KuthialaNo ratings yet

- Tests for Deducting Business ExpensesDocument2 pagesTests for Deducting Business ExpensesCalagui Tejano Glenda JaygeeNo ratings yet

- Small BusinessDocument11 pagesSmall BusinessSaahil LedwaniNo ratings yet

- ABC analysis inventory classificationDocument10 pagesABC analysis inventory classificationSunnyPawarȜȝNo ratings yet

- Cost of Capital Calculations for Preference Shares, Bonds, Common Stock & WACCDocument5 pagesCost of Capital Calculations for Preference Shares, Bonds, Common Stock & WACCshikha_asr2273No ratings yet

- Republic V International Communications CorpDocument2 pagesRepublic V International Communications CorpAky RemonteNo ratings yet

- Advanced Bank MamagementDocument43 pagesAdvanced Bank MamagementKarur KumarNo ratings yet

- Personal FinanceDocument259 pagesPersonal Financeapi-3805479100% (4)

- PAN Deductee Name Section Code Employee Ref No (Optional) : Deductee Details Deduction DetailsDocument15 pagesPAN Deductee Name Section Code Employee Ref No (Optional) : Deductee Details Deduction DetailsSandeep ModhNo ratings yet

- 2019 Mid-Semester Mock Exam SolutionDocument11 pages2019 Mid-Semester Mock Exam SolutionMichael BobNo ratings yet

- What Is Mutual FundDocument5 pagesWhat Is Mutual FundAnupama GunjyalNo ratings yet

- The Rise and Fall of Global Trust Bank CaseDocument3 pagesThe Rise and Fall of Global Trust Bank CasemohitNo ratings yet

- LU20 - Tax StrategyDocument56 pagesLU20 - Tax StrategyAnil HarichandreNo ratings yet

- Estate Planning for Mr. Barry RichDocument1 pageEstate Planning for Mr. Barry RichKaityNo ratings yet

- Basic Budgeting Tips Everyone Should KnowDocument2 pagesBasic Budgeting Tips Everyone Should KnowharissonNo ratings yet

- Summer Internship Nasir FinalDocument10 pagesSummer Internship Nasir FinalKanishq BawejaNo ratings yet

- Civil Procedure CasesDocument32 pagesCivil Procedure CasesLois DNo ratings yet

- Statement 20140508Document2 pagesStatement 20140508franraizerNo ratings yet

- Clarkson Lumber Company Operating ExpensesDocument7 pagesClarkson Lumber Company Operating Expensespawangadiya1210No ratings yet