Professional Documents

Culture Documents

Commissioner of Internal Revenue Vs John Gotamco

Uploaded by

Honorio Bartholomew ChanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Commissioner of Internal Revenue Vs John Gotamco

Uploaded by

Honorio Bartholomew ChanCopyright:

Available Formats

Commissioner of Internal Revenue vs. John Gotamco & Sons, Inc.

and CTA Facts: The Republic of the Philippines and the World Health Organization (WHO) entered into a Host Agreement, which gives the International Organization privileges and immunities. Under the Host Agreement, it provides that, the Organization, its assets, income and other properties shall be exempt from all direct and indirect taxes, however, the Organization will not claim exemption from taxes which are for public utility services. WHO constructed a building for its offices, as well as other United Nations offices in Manila. John Gotamco & Sons, Inc. won the bid and awarded the construction contract. In 1958, WHO received an opinion from the Commissioner of the BIR, saying that the 3% contractors tax is an indirect tax on the assets and income of the WHO, the gross receipts derived by the contractor is exempt from tax in accordance with the Host Agreement. Subsequently, the CIR reversed his opinion and said that the 3% contractors tax is neither a direct nor an indirect tax on the WHO, but a tax primarily due from the contractor. WHO then issued a certification, stating that, contractors were informed that no tax or fees will be levied upon them for their work in connection with the construction of the building, as this will be considered as an indirect tax to the WHO. In 1961, CIR demanded the 3% contractors tax from Gotamco, plus surcharges on the gross receipts. Gotamco appealed to the CTA where it reversed the Commissioners decision. Issue: Whether Gotamco should pay the 3% contractors tax on gross receipts it realized from the construction of the WHO building. Ruling: The SC agrees with the CTA that, contractors tax is an indirect tax. Though it is payable by the contractor, it is the owner of the building that shoulders the burden of the tax because the same is shifted by the contractor to the owner as a matter of self-preservation. In the last analysis, it is the WHO that will pay the tax indirectly through the contractor and it certainly cannot be said that this tax has no bearing upon the WHO. The certification issued by the WHO, sought exemption of the contractor Gotamco from any taxes in connection with the construction of the WHO office building. The 3% contractors tax would be within this category and should be viewed as a form of an indirect tax on the Organization, as the payment thereof or its inclusion in the bid price would have meant an increase in the construction cost of the building.

MANZANO, Maria Angela C.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- San Antonio Police Department Police Report On The Arrest of Daniel Pentkowski.Document2 pagesSan Antonio Police Department Police Report On The Arrest of Daniel Pentkowski.David ClarkNo ratings yet

- Deed of Absolute Sale of Real Property in A More Elaborate Form PDFDocument2 pagesDeed of Absolute Sale of Real Property in A More Elaborate Form PDFAnonymous FExJPnC100% (2)

- Cruise Control System CcsDocument2 pagesCruise Control System CcsciroNo ratings yet

- Required Documents For EnrolmentDocument7 pagesRequired Documents For EnrolmentCamillus Carillo AngelesNo ratings yet

- AffidavitsDocument33 pagesAffidavitsHonorio Bartholomew ChanNo ratings yet

- A N S W e R SDocument14 pagesA N S W e R SHonorio Bartholomew ChanNo ratings yet

- Leg FormsDocument284 pagesLeg FormsHonorio Bartholomew ChanNo ratings yet

- Wills CasesDocument66 pagesWills CasesHonorio Bartholomew ChanNo ratings yet

- Trial Brief For The Expert WitnessDocument6 pagesTrial Brief For The Expert WitnessHonorio Bartholomew ChanNo ratings yet

- Trans PpoDocument5 pagesTrans PpoHonorio Bartholomew ChanNo ratings yet

- Insurance MidtermsDocument21 pagesInsurance MidtermsHonorio Bartholomew ChanNo ratings yet

- INTER Country AdoptionDocument1 pageINTER Country AdoptionHonorio Bartholomew ChanNo ratings yet

- 04 Umali Vs CADocument2 pages04 Umali Vs CAHonorio Bartholomew ChanNo ratings yet

- Neque Vitari Potest. Accident and Mitigating CircumstancesDocument7 pagesNeque Vitari Potest. Accident and Mitigating CircumstancesHonorio Bartholomew ChanNo ratings yet

- Federalisms of US and IndiaDocument3 pagesFederalisms of US and IndiaTanya TandonNo ratings yet

- Dawes and Homestead Act Webquest 2017Document4 pagesDawes and Homestead Act Webquest 2017api-262890296No ratings yet

- PVL2602 Assignment 1Document3 pagesPVL2602 Assignment 1milandaNo ratings yet

- KK PROFILING - MEMORANDUM CIRCULAR Guidelines - KK Profiling - June 08 1Document4 pagesKK PROFILING - MEMORANDUM CIRCULAR Guidelines - KK Profiling - June 08 1Cherie LerioNo ratings yet

- Stevens V University of Birmingham (2016) 4 All ER 258Document25 pagesStevens V University of Birmingham (2016) 4 All ER 258JYhkNo ratings yet

- Controlled Parking Zones Within Tower HamletsDocument1 pageControlled Parking Zones Within Tower Hamletsmoshkur.chowdhuryNo ratings yet

- RFQ Crane (MHE - DEMAG)Document6 pagesRFQ Crane (MHE - DEMAG)Agung Pandega PutraNo ratings yet

- Legal OpinionDocument8 pagesLegal OpinionFrancis OcadoNo ratings yet

- Rosalina Buan, Rodolfo Tolentino, Tomas Mercado, Cecilia Morales, Liza Ocampo, Quiapo Church Vendors, For Themselves and All Others Similarly Situated as Themselves, Petitioners, Vs. Officer-In-charge Gemiliano c. Lopez, JrDocument5 pagesRosalina Buan, Rodolfo Tolentino, Tomas Mercado, Cecilia Morales, Liza Ocampo, Quiapo Church Vendors, For Themselves and All Others Similarly Situated as Themselves, Petitioners, Vs. Officer-In-charge Gemiliano c. Lopez, JrEliza Den DevilleresNo ratings yet

- 15.05.2023-123m-Swift Gpi-Gts Gmbh-Harvest Profit - 230628 - 153120Document3 pages15.05.2023-123m-Swift Gpi-Gts Gmbh-Harvest Profit - 230628 - 153120MSFT2022100% (1)

- Audi A6 (4B) Headlight Aim Control (Dynamic Light)Document2 pagesAudi A6 (4B) Headlight Aim Control (Dynamic Light)Krasimir PetkovNo ratings yet

- Form - 28Document2 pagesForm - 28Manoj GuruNo ratings yet

- RIGHT AGAINST SELF INCRIMINATION-ReviewerDocument3 pagesRIGHT AGAINST SELF INCRIMINATION-ReviewerAnna Katrina QuanicoNo ratings yet

- 7 PDFDocument123 pages7 PDFGo GoNo ratings yet

- Farolan v. CTADocument2 pagesFarolan v. CTAKenneth Jamaica FloraNo ratings yet

- Midterm Org. ManagementDocument5 pagesMidterm Org. Managementnm zuhdiNo ratings yet

- DRAC Combined 07.04.2023Document39 pagesDRAC Combined 07.04.2023Ankit DalalNo ratings yet

- Business Law and Regulations 1Document4 pagesBusiness Law and Regulations 1Xyrah Yvette PelayoNo ratings yet

- TYBBI AuditDocument3 pagesTYBBI AuditNandhiniNo ratings yet

- 2 Multi-Realty Vs Makati TuscanyDocument21 pages2 Multi-Realty Vs Makati TuscanyLaura MangantulaoNo ratings yet

- FeeInformation BarclaysBasicAccountDocument2 pagesFeeInformation BarclaysBasicAccountkagiyir157No ratings yet

- Administering Payroll For The United StatesDocument332 pagesAdministering Payroll For The United StatesJacob WorkzNo ratings yet

- Certification: Barangay Development Council Functionality Assessment FYDocument2 pagesCertification: Barangay Development Council Functionality Assessment FYbrgy.sabang lipa city100% (4)

- Total Assets: Aktivitas Kas Aset Non Hutang Hut - Dijamin Kas Prioritas PenuhDocument16 pagesTotal Assets: Aktivitas Kas Aset Non Hutang Hut - Dijamin Kas Prioritas PenuhJunjung PrabawaNo ratings yet

- Iad Session 2 PQ Launch FinalDocument78 pagesIad Session 2 PQ Launch FinalShibu KavullathilNo ratings yet

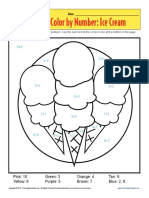

- Toan To Mau Addition Color by Number Ice CreamDocument2 pagesToan To Mau Addition Color by Number Ice CreamKelly阮泫妆No ratings yet