Professional Documents

Culture Documents

P7int 2011 Dec Q PDF

Uploaded by

hiruspoonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

P7int 2011 Dec Q PDF

Uploaded by

hiruspoonCopyright:

Available Formats

Professional Level Options Module

Advanced Audit and Assurance (International)

Monday 5 December 2011

Time allowed Reading and planning: Writing:

15 minutes 3 hours

This paper is divided into two sections: Section A BOTH questions are compulsory and MUST be attempted Section B TWO questions ONLY to be attempted Do NOT open this paper until instructed by the supervisor. During reading and planning time only the question paper may be annotated. You must NOT write in your answer booklet until instructed by the supervisor. This question paper must not be removed from the examination hall.

The Association of Chartered Certified Accountants

Paper P7 (INT)

Section A BOTH questions are compulsory and MUST be attempted 1 (a) You are a manager in Maple & Co, responsible for the audit of Oak Co, a listed company. Oak Co manufactures electrical appliances such as televisions and radios, which are then sold to retail outlets. You are aware that during the last year, Oak Co lost several customer contracts to overseas competitors. However, a new division has been created to sell its products directly to individual customers via a new website, which was launched on 1 November 2011. You are about to commence planning the audit for the year ending 31 December 2011, and you have received an email from Holly Elm, the audit engagement partner. To: Audit manager From: Holly Elm, Audit partner Subject: Oak Co audit planning Hello (i) I would like you to start planning the audit of Oak Co. You need to perform a preliminary analytical review on the financial information and accompanying notes provided by Rowan Birch, the finance director of Oak Co. Using this information and the results of your analytical review, please prepare notes for inclusion in the planning section of the working papers, which identify and explain the principal audit risks to be considered in planning the final audit. Your notes should include any calculations performed. (23 marks)

(ii) Please also recommend the principal audit procedures which should be performed in respect of: (1) the recognition and measurement of the share-based payment plan, and (2) the classification of the new lease. Thank you. Financial information provided by Rowan Birch: Statement of comprehensive income (extract from management accounts) Note 11 months to 30 November 2011 $000 25,700 (15,420) 10,280 (6,200) 4,080 (1,500) 2,580 11 months to 30 November 2010 $000 29,300 (15,900) 13,400 (7,750) 5,650 (1,500) 4,150 (8 marks)

Revenue Cost of sales Gross profit Operating expenses Operating profit Finance costs Profit before tax 1

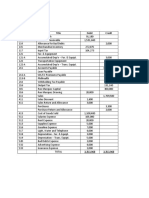

Statement of financial position Note ASSETS Non-current assets Property plant and equipment Intangible assets 30 November 2011 $000 90,000 1,250 91,250 1,800 4,928 100 6,828 98,078 30 November 2010 $000 75,750 75,750 1,715 4,815 2,350 8,880 84,630

2, 3 4

Current assets Inventory Trade receivables Cash and cash equivalents

Total assets EQUITY AND LIABILITIES Equity Share capital Revaluation reserve Retained earnings Total equity Non-current liabilities Long-term borrowings Provisions Finance lease payable 5 6 2

20,000 10,000 32,278 62,278 25,000 1,000 5,000 31,000 1,300 3,500 4,800 35,800 98,078

20,000 34,895 54,895 25,000 1,250 26,250 3,485 3,485 29,735 84,630

Current liabilities Bank overdraft Trade and other payables

Total liabilities Total equity and liabilities Notes: 1.

Oak Co established an equity-settled share-based payment plan for its executives on 1 January 2011. 250 executives and senior managers have received 100 share options each, which vest on 31 December 2013 if the executive remains in employment at that date, and if Oak Cos share price increases by 10% per annum. No expense has been recognised this year as Oak Cos share price has fallen by 5% in the last six months, and so it is felt that the condition relating to the share price will not be met this year end. On 1 July 2011, Oak Co entered into a lease which has been accounted for as a finance lease and capitalised at $5 million. The leased property is used as the head office for Oak Cos new website development and sales division. The lease term is for five years and the fair value of the property at the inception of the lease was $20 million. On 30 June 2011 Oak Cos properties were revalued by an independent expert. A significant amount has been invested in the new website, which is seen as a major strategic development for the company. The website has generated minimal sales since its launch last month, and advertising campaigns are currently being conducted to promote the site.

2.

3. 4.

[P.T.O.

5.

The long-term borrowings are due to be repaid in two equal instalments on 30 September 2012 and 2013. Oak Co is in the process of renegotiating the loan, to extend the repayment dates, and to increase the amount of the loan. The provision relates to product warranties offered by the company. The overdraft limit agreed with Oak Cos bank is $15 million.

6. 7.

Required: Respond to the email from the audit partner. Note: the split of the mark allocation is shown within the partners email. Professional marks will be awarded for the presentation and clarity of your answer. (2 marks) (31 marks)

(b) Maple & Co is suffering from declining revenue, and as a result of this, another audit manager has been asked to consider how to improve the firms profitability. In a conversation with you this morning he mentioned the following: We really need to make our audits more efficient. I think we should fix materiality at the planning stage at the maximum possible materiality level for all audits, as this would reduce the work we need to do. I also think we can cut the firms overheads by reducing our spending on training. We spend a lot on expensive training courses for junior members of the audit team, and on Continuing Professional Development for our qualified members of staff. We could also guarantee our clients that all audits will be completed quicker than last year. Reducing the time spent on each assignment will improve the firms efficiency and enable us to take on more audit clients. Required: Comment on the practice management and quality control issues raised by the audit managers suggestions to improve the audit firms profitability. (6 marks) (39 marks)

This is a blank page. Question 2 begins on page 6.

[P.T.O.

Willow Co is a print supplier to businesses, printing catalogues, leaflets, training manuals and stationery to order. It specialises in using 100% recycled paper in its printing, a fact which is promoted heavily in its advertising. You are a senior audit manager in Bark & Co, and you have just been placed in charge of the audit of Willow Co. The audit for the year ended 31 August 2011 is nearing completion, and the audit engagement partner, Jasmine Berry, has sent you an email: To: Audit manager From: Jasmine Berry, Audit partner Subject: Audit completion and other issues Willow Co Hello The manager previously assigned to the audit of Willow Co has been moved to another urgent assignment, so thank you for stepping in to take on the managers role this late in the audit. The audit report is due to be issued in two weeks time, and the audit senior has prepared a summary of matters for your consideration. I have been asked to attend a meeting with the audit committee of Willow Co tomorrow, so I need you to update me on how the audit has progressed. I am asking you to prepare briefing notes for my use in which you: (a) Assess the audit implications of the THREE issues related to audit work raised by the audit senior. Your assessment should consider the sufficiency of evidence obtained, explain any adjustments that may be necessary to the financial statements, and describe the impact on the audit report if these adjustments are not made. You should also recommend any further audit procedures necessary. (15 marks) (b) Explain the matters, other than the three issues related to audit work raised by the audit senior, which should be brought to the attention of the audit committee of Willow Co. (8 marks) Thanks

Summary of issues for managers attention, prepared by audit senior Materiality has been determined as follows: $800,000 for assets and liabilities $250,000 for income and expenses Issues related to audit work performed: (i) Audit work on inventory Audit procedures performed at the inventory count indicated that printed inventory items with a value of $130,000 were potentially obsolete. These items were mainly out of date training manuals. The finance director, Cherry Laurel, has not written off this inventory as she argues that the paper on which the items are printed can be recycled and used again in future printing orders. However, the items appear not to be recyclable as they are coated in plastic. The junior who performed the audit work on inventory has requested a written representation from management to confirm that the items can be recycled and no further procedures relevant to these items have been performed. (ii) Audit work on provisions Willow Co is involved in a court case with a competitor, Aspen Co, which alleges that a design used in Willow Cos printed material copies one of Aspen Cos designs which are protected under copyright. Our evidence obtained is a verbal confirmation from Willow Cos lawyers that a claim of $125,000 has been made against Willow Co, which is probable to be paid. Cherry Laurel has not made a provision, arguing that it is immaterial. Cherry refused our request to ask the lawyers to confirm their opinion on the matter in writing, saying it is not worth bothering the lawyers again on such a trivial matter. (iii) Audit work on current assets Willow Co made a loan of $6,000 to Cherry Laurel, the finance director, on 30 June 2011. The amount is recognised as a current asset. The loan carries an interest rate of 4% which we have confirmed to be the market 6

rate for short-term loans and we have concluded that the loan is an arms length transaction. Cherry has provided written confirmation that she intends to repay the loan by 31 March 2012. The only other audit work performed was to agree the cash payment to the cash book. Details of the loan made to Cherry have not been separately disclosed in the financial statements. Other issues for your attention: Property revaluations Willow Co currently adopts an accounting policy of recognising properties at cost. During the audit of non-current assets Willow Cos property manager said that the company is considering a change of accounting policy so that properties would be recognised at fair value from 1 January 2012. Non-current asset register The audit of non-current assets was delayed by a week. We had asked for the non-current asset register reconciliation to be completed by the client prior to commencement of our audit procedures on non-current assets, but it seems that the person responsible for the reconciliation went on holiday having forgotten to prepare the reconciliation. This happened on last years audit as well, and the issue was discussed with the audit committee at that time. Procurement procedures We found during our testing of trade payables that an approved supplier list is not maintained, and invoices received are not always matched back to goods received notes. This was mentioned to the procurement manager, who said that suppliers are switched fairly often, depending on which supplier is the cheapest, so it would be difficult to maintain an up-to-date approved supplier list. Financial controller Mia Fern, Willow Cos financial controller, owns a holiday home overseas. It appears that she offered the audit team free use of the holiday home for three weeks after the audit, as a reward for the teams hard work. She also bought lunch for the audit team on most days. Required: Respond to the partners email. Note: the split of the mark allocation is shown within the email. Professional marks will be awarded for the format and clarity of your answer. (2 marks) (25 marks) (23 marks)

[P.T.O.

Section B TWO questions ONLY to be attempted 3 You are a manager in the audit department of Beech & Co, responsible for the audits of Fir Co, Spruce Co and Pine Co. Each company has a financial year ended 31 July 2011, and the audits of all companies are nearing completion. The following issues have arisen in relation to the audit of accounting estimates and fair values: (a) Fir Co Fir Co is a company involved in energy production. It owns several nuclear power stations, which have a remaining estimated useful life of 20 years. Fir Co intends to decommission the power stations at the end of their useful life and the statement of financial position at 31 July 2011 recognises a material provision in respect of decommissioning costs of $97 million (2010 $110 million). A brief note to the financial statements discloses the opening and closing value of the provision but no other information is provided. Required: Comment on the matters that should be considered, and explain the audit evidence you should expect to find in your file review in respect of the decommissioning provision. (8 marks) (b) Spruce Co Spruce Co is also involved in energy production. It has a trading division which manages a portfolio of complex financial instruments such as derivatives. The portfolio is material to the financial statements. Due to the specialist nature of these financial instruments, an auditors expert was engaged to assist in obtaining sufficient appropriate audit evidence relating to the fair value of the financial instruments. The objectivity, capabilities and competence of the expert were confirmed prior to their engagement. Required: Explain the procedures that should be performed in evaluating the adequacy of the auditors experts work. (5 marks) (c) Pine Co Pine Co operates a warehousing and distribution service, and owns 120 properties. During the year ended 31 July 2011, management changed its estimate of the useful life of all properties, extending the life on average by 10 years. The financial statements contain a retrospective adjustment, which increases opening non-current assets and equity by a material amount. Information in respect of the change in estimate has not been disclosed in the notes to the financial statements. Required: Identify and explain the potential implications for the auditors report of the accounting treatment of the change in accounting estimates. (5 marks) (18 marks)

You are an audit manager in Cedar & Co, responsible for the audit of Chestnut Co, a large company which provides information technology services to business customers. The finance director of Chestnut Co, Jack Privet, contacted you this morning, saying: I was alerted yesterday to a fraud being conducted by members of our sales team. It appears that several sales representatives have been claiming reimbursement for fictitious travel and client entertaining expenses and inflating actual expenses incurred. Specifically, it has been alleged that the sales representatives have claimed on expenses for items such as gifts for clients and office supplies which were never actually purchased, claimed for business-class airline tickets but in reality had purchased economy tickets, claimed for non-existent business mileage and used the company credit card to purchase items for personal use. I am very worried about the scale of this fraud, as travel and client entertainment is one of our biggest expenses. All of the alleged fraudsters have been suspended pending an investigation, which I would like your firm to conduct. We will prosecute these employees to attempt to recoup our losses if evidence shows that a fraud has indeed occurred, so your firm would need to provide an expert witness in the event of a court case. Can we meet tomorrow to discuss this potential assignment? Chestnut Co has a small internal audit department and in previous years the evidence obtained by Cedar & Co as part of the external audit has indicated that the control environment of the company is generally good. The audit opinion on the financial statements for the year ended 31 March 2011 was unmodified. Required: (a) Assess the ethical and professional issues raised by the request for your firm to investigate the alleged fraudulent activity. (6 marks) (b) Explain the matters that should be discussed in the meeting with Jack Privet in respect of planning the investigation into the alleged fraudulent activity. (6 marks) (c) Evaluate the arguments for and against the prohibition of auditors providing non-audit services to audit clients. (6 marks) (18 marks)

[P.T.O.

(a) You are the manager responsible for the audit of Yew Co, a company which designs and develops aircraft engines. The audit for the year ended 31 July 2011 is nearing completion and the audit senior has left the following file note for your attention: I have just returned from a meeting with the management of Yew Co, and there is a matter I want to bring to your attention. Yew Cos statement of financial position recognises an intangible asset of $125 million in respect of capitalised research and development costs relating to new aircraft engine designs. However, market research conducted by Yew Co in relation to these new designs indicated that there would be little demand in the near future for such designs. Management has provided written representation that they agree with the results of the market research. Currently, Yew Co has a cash balance of only $125,000 and members of the management team have expressed concerns that the company is finding it difficult to raise additional finance. The new aircraft designs have been discussed in the chairmans statement which is to be published with the financial statements. The discussion states that developments of new engine designs are underway, and we believe that these new designs will become a significant source of income for Yew Co in the next 12 months. Yew Cos draft financial statements include profit before tax of $23 million, and total assets of $210 million. Yew Co is due to publish its annual report next week, so we need to consider the impact of this matter urgently. Required: Discuss the implications of the audit seniors file note on the completion of the audit and on the auditors report, recommending any further actions that should be taken by the auditor. (12 marks) (b) You are responsible for answering technical queries from other managers and partners of your firm. An audit partner left the following note on your desk this morning: (i) I am about to draft the audit report for my client, Sycamore Co. I am going on holiday tomorrow and want to have the audit report signed and dated before I leave. The only thing outstanding is the written representation from management I have verbally confirmed the contents with the finance director who agreed to send the representations to the audit manager within the next few days. I presume this is acceptable? (3 marks)

(ii) We are auditing Sycamore Co for the first time. The prior period financial statements were audited by another firm. We are aware that the auditors report on the prior period was qualified due to a material misstatement of trade receivables. We have obtained sufficient appropriate evidence that the matter giving rise to the misstatement has been resolved and I am happy to issue an unmodified opinion. But should I refer to the prior year modification in this years auditors report? (3 marks) Required: Respond to the audit partners comments. Note: the split of the mark allocation is shown within the question. (18 marks)

End of Question Paper

10

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Advanced Audit and Assurance (International) : Monday 3 June 2013Document9 pagesAdvanced Audit and Assurance (International) : Monday 3 June 2013hiruspoonNo ratings yet

- P7int 2011 Dec ADocument18 pagesP7int 2011 Dec AMohammed AlamoodiNo ratings yet

- P7int 2010 Jun ADocument17 pagesP7int 2010 Jun AFzr JamNo ratings yet

- Advanced Audit and Assurance (International) : Monday 11 June 2012Document10 pagesAdvanced Audit and Assurance (International) : Monday 11 June 2012hiruspoonNo ratings yet

- P7int 2013 Jun A PDFDocument17 pagesP7int 2013 Jun A PDFhiruspoonNo ratings yet

- December 2009 - AnswersDocument17 pagesDecember 2009 - AnswersmizarkoNo ratings yet

- P7int 2011 Jun ADocument16 pagesP7int 2011 Jun AShujaALONENo ratings yet

- P7int 2012 Dec QDocument10 pagesP7int 2012 Dec QGeta MeharyNo ratings yet

- P7int 2011 Jun QDocument10 pagesP7int 2011 Jun QAsiful IslamNo ratings yet

- ACCA P7 June 09 QuestionsDocument7 pagesACCA P7 June 09 Questionsre74530No ratings yet

- P7int 2008 Jun Q PDFDocument8 pagesP7int 2008 Jun Q PDFhiruspoonNo ratings yet

- Advanced Audit and Assurance (International) : Tuesday 8 June 2010Document7 pagesAdvanced Audit and Assurance (International) : Tuesday 8 June 2010Seng Cheong KhorNo ratings yet

- P7int 2009 Dec Q PDFDocument8 pagesP7int 2009 Dec Q PDFhiruspoonNo ratings yet

- P7int 2008 Jun A PDFDocument20 pagesP7int 2008 Jun A PDFhiruspoonNo ratings yet

- P7int 2007 Dec QDocument8 pagesP7int 2007 Dec QLibrariaTuturor LibrarieNo ratings yet

- December 2008 - AnswersDocument19 pagesDecember 2008 - AnswersmizarkoNo ratings yet

- P7int 2007 Dec ADocument18 pagesP7int 2007 Dec ATouseef AslamNo ratings yet

- P7int 2008 Dec Q PDFDocument7 pagesP7int 2008 Dec Q PDFhiruspoonNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Sabari Inn DRHPDocument283 pagesSabari Inn DRHPArpan Mehta SameerNo ratings yet

- Accounting 102 TermsDocument3 pagesAccounting 102 TermsAlfred MartinNo ratings yet

- Drills - Keep or DropDocument4 pagesDrills - Keep or DropKHAkadsbdhsgNo ratings yet

- Chapter 20: Audit of Other Accounts in The Statement of Profit or Loss and Comprehensive IncomeDocument9 pagesChapter 20: Audit of Other Accounts in The Statement of Profit or Loss and Comprehensive IncomeAnna TaylorNo ratings yet

- How To Use This Competency-Based Learning MaterialDocument29 pagesHow To Use This Competency-Based Learning Materialaldren cedamon0% (1)

- Abebe Kumela Internal AuditDocument19 pagesAbebe Kumela Internal Auditabebe kumelaNo ratings yet

- Final Examination Slip SEMESTER 1, 2021/2022 SESSION: Remarks No Category Credit Course Name Course Code GroupDocument2 pagesFinal Examination Slip SEMESTER 1, 2021/2022 SESSION: Remarks No Category Credit Course Name Course Code Groupzarif zakwanNo ratings yet

- Deloitte-A Roadmap To Accounting For Income Taxes (Nov2011)Document505 pagesDeloitte-A Roadmap To Accounting For Income Taxes (Nov2011)mistercobalt3511No ratings yet

- Chapter 1 AnswerDocument11 pagesChapter 1 Answerelainelxy2508No ratings yet

- BA 2802 - Principles of Finance Solutions To Problems For Recitation #1Document8 pagesBA 2802 - Principles of Finance Solutions To Problems For Recitation #1Eda Nur EvginNo ratings yet

- Class 14 ExampleDocument4 pagesClass 14 Exampledeepanshu guptaNo ratings yet

- Long Quiz 2Document8 pagesLong Quiz 2KathleenNo ratings yet

- Vale Annual ReportDocument255 pagesVale Annual Reportkrishnakant1No ratings yet

- Performance Evaluation in A Divisionalised OrganisationDocument12 pagesPerformance Evaluation in A Divisionalised Organisationmoza salimNo ratings yet

- Practice Multiple Choice Questions For First Test PDFDocument10 pagesPractice Multiple Choice Questions For First Test PDFBringinthehypeNo ratings yet

- EFA1 Exercise 2&3 SolutionDocument12 pagesEFA1 Exercise 2&3 SolutionDiep NguyenNo ratings yet

- Management Accounting764 eVyE8h3I7eDocument3 pagesManagement Accounting764 eVyE8h3I7eABHINAV AGRAWALNo ratings yet

- Trial Balance February 28, 20X1Document3 pagesTrial Balance February 28, 20X1Angelica MaeNo ratings yet

- Integrated Cloud Financial Accounting Cycle. How Artificial Intelligence, Blockchain, and XBRL Will Change The Accounting, Fiscal and Auditing PracticesDocument7 pagesIntegrated Cloud Financial Accounting Cycle. How Artificial Intelligence, Blockchain, and XBRL Will Change The Accounting, Fiscal and Auditing PracticesGMCPNo ratings yet

- Assumptions - : Cash Flow From Operations $ 0Document4 pagesAssumptions - : Cash Flow From Operations $ 0Krish HegdeNo ratings yet

- Particulars: Rs. RsDocument7 pagesParticulars: Rs. RsAnmol ChawlaNo ratings yet

- Ceasa WP3822Document89 pagesCeasa WP3822Poe TryNo ratings yet

- DundalkpcDocument26 pagesDundalkpcthestorydotieNo ratings yet

- PRTC Manufacturing Co.Document2 pagesPRTC Manufacturing Co.hersheyNo ratings yet

- PGDM I Semester I Management Accounting - 1 (Ma-1) : 1. Course ObjectiveDocument4 pagesPGDM I Semester I Management Accounting - 1 (Ma-1) : 1. Course Objectivecooldude690No ratings yet

- Accounting Yr 10 Chapter 3-5 QuizDocument8 pagesAccounting Yr 10 Chapter 3-5 QuizThin Zar Tin WinNo ratings yet

- Mas Chap 13Document23 pagesMas Chap 13Raz MahariNo ratings yet

- Final Exam ConceptualDocument8 pagesFinal Exam ConceptualJun GilloNo ratings yet

- Worksheet Untuk Aplikasi Pemeriksaan AkuntansiDocument14 pagesWorksheet Untuk Aplikasi Pemeriksaan AkuntansiFaisal AlparizziNo ratings yet

- Assessing and Responding To Fraud Risks: Concept Checks P. 281Document30 pagesAssessing and Responding To Fraud Risks: Concept Checks P. 281Eileen HUANGNo ratings yet