Professional Documents

Culture Documents

FRB Eligible Sites

Uploaded by

JimmyVielkindOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FRB Eligible Sites

Uploaded by

JimmyVielkindCopyright:

Available Formats

Find My Municipality

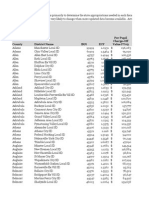

Fiscal Eligibility Based on Statutory Criteria

Sorted by Name *Average Full Value Property Tax Rates (eligible if above 6.823) 2.77 7.61 4.96 7.48 2.99 1.52 5.77 2.10 1.71 10.55 14.98 5.38 6.08 5.92 4.37 4.50 1.69 0.70 7.67 16.44 5.07 7.72 4.27 7.75 7.20 18.83 7.75 7.73 2.07 3.77 8.95 2.20 2.93 9.19 7.58 6.94 2.04 9.43 2.73 2.62 8.89 11.83 14.64 4.46 6.36 6.50 8.35 6.95 11.39 3.97 3.92 6.78 4.26 2.17 2.96 3.81 6.56 4.02 1.89 4.50 3.30 6.35 1.56 2.38 3.99 11.43 11.89 7.31 1.78 3.67 1.85 5.92 *Missing Tax Levy Data (used to calculate full value tax rates) *Average Fund Balance Percentages (eligible if below 5%) 8.81% 105.05% 90.08% 40.65% 60.13% 132.09% 13.50% 7.39% 107.33% 7.44% 13.74% 39.82% 64.61% 77.19% 74.03% 76.64% 70.15% 151.56% 36.07% 80.06% 52.79% 22.22% 28.97% 162.67% 8.99% 21.32% 65.07% 174.04% 52.38% 30.98% 54.05% 109.55% 23.54% 0.80% 23.72% 104.93% 64.06% 23.54% 48.62% 134.45% 27.75% 33.14% 39.59% 9.30% 31.72% 45.07% 14.78% 56.33% 57.65% 70.17% 127.33% 113.07% 65.26% 264.63% 66.49% 161.84% 27.98% 172.02% 10.92% 18.04% 84.48% 66.08% 47.43% 66.17% 171.81% 57.85% *Missing Annual Financial Reports (used to calculate fund balance percentage) Automatically Fiscally Eligible No Yes No No Yes No No No No No Yes Yes No No No No No No No Yes Yes No Yes No Yes Yes Yes Yes Yes No No No Yes No No Yes No Yes No No No No Yes No Yes No No No Yes No Yes No No No No No No No No No No No No No No No No Yes No Yes No No No No

Name of Municipality 1 2 3 4 6 5 7 8 9 10 11 14 12 13 16 15 17 18 19 20 22 21 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 40 39 41 42 43 44 46 45 47 48 50 49 52 51 53 54 55 56 57 58 59 60 61 62 63 65 64 66 67 68 69 70 71 72 73 74 Adams Adams Addison Addison Afton Afton Airmont Akron Alabama Albany Albany Albion Albion Albion Alden Alden Alexander Alexander Alexandria Alexandria Bay Alfred Alfred Allegany Allegany Allegany Allen Alma Almond Almond Altamont Altmar2 Altona Amboy Amenia Ames Amherst Amity Amityville Amsterdam Amsterdam Ancram Andes Andover Andover Angelica Angelica Angola Annsville Antwerp Antwerp Arcade Arcade Arcadia Ardsley Argyle Argyle Arietta Arkport Arkwright Asharoken Ashford Ashland Ashland Athens Athens Atlantic Beach Attica Attica Auburn Augusta Aurelius Aurora Aurora Ausable

Class Town Village Town Village Village Town Village Village Town County City Village Town Town Village Town Town Village Town Village Village Town County Town Village Town Town Town Village Village Village Town Town Town Village Town Town Village Town City Town Town Town Village Village Town Village Town Village Town Village Town Town Village Town Village Town Village Town Village Town Town Town Village Town Village Town Village City Town Town Town Village Town

County Jefferson Jefferson Steuben Steuben Chenango Chenango Rockland Erie Genesee Albany Albany Orleans Orleans Oswego Erie Erie Genesee Genesee Jefferson Jefferson Allegany Allegany Allegany Cattaraugus Cattaraugus Allegany Allegany Allegany Allegany Albany Oswego Clinton Oswego Dutchess Montgomery Erie Allegany Suffolk Montgomery Montgomery Columbia Delaware Allegany Allegany Allegany Allegany Erie Oneida Jefferson Jefferson Wyoming Wyoming Wayne Westchester Washington Washington Hamilton Steuben Chautauqua Suffolk Cattaraugus Chemung Greene Greene Greene Nassau Wyoming Wyoming Cayuga Oneida Cayuga Erie Cayuga Clinton

2008, 2009, 2010, 2011, 2012

2011, 2012

2008, 2009, 2010, 2011, 2012

2008, 2009, 2010, 2011, 2012 2012

2012

2012

2008, 2009, 2010,

2012

2012

*Data supplied by the Office of the State Comptroller

1 of 22

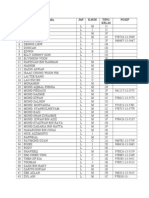

Fiscal Eligibility Based on Statutory Criteria

Sorted by Name *Average Full Value Property Tax Rates (eligible if above 6.823) 1.42 4.67 11.88 7.49 3.23 5.72 4.05 2.56 3.19 6.99 4.65 6.60 1.26 3.62 7.54 6.11 2.44 1.58 10.02 4.98 2.17 10.08 2.48 3.25 10.90 3.01 6.72 3.20 1.48 2.10 13.14 2.16 4.76 4.89 2.18 12.03 1.50 4.48 2.77 6.00 3.54 5.45 6.76 2.48 3.02 4.62 4.23 3.22 2.99 4.31 20.94 7.21 7.83 5.16 10.85 2.54 6.61 2.96 4.57 3.50 15.50 11.21 0.49 5.29 7.08 0.97 5.23 4.42 9.44 10.13 8.37 7.01 5.89 *Missing Tax Levy Data (used to calculate full value tax rates) *Average Fund Balance Percentages (eligible if below 5%) 99.60% 62.50% 26.47% 62.07% 35.15% 48.90% 21.29% 32.87% 33.81% 50.32% 16.27% 15.97% 73.98% 527.31% 35.60% 66.46% 124.03% 126.86% 20.19% 173.22% 23.46% 56.63% 138.00% 1.27% 19.75% 35.47% 52.28% 28.77% 19.03% 53.76% 20.15% 74.93% 4.42% 33.07% 117.74% 35.98% 79.45% 52.73% 75.82% 76.10% 238.13% 146.01% 206.57% 47.01% 23.07% 102.81% 43.29% 84.41% 92.06% 32.97% 55.87% 115.14% 10.53% 100.03% 60.92% 99.32% 53.81% 134.07% 94.94% 31.00% 53.42% 121.81% 29.45% 43.61% 126.91% 108.88% 51.36% 139.42% *Missing Annual Financial Reports (used to calculate fund balance percentage) Automatically Fiscally Eligible No No Yes Yes No No No No No No No No No No Yes No No No Yes No No Yes No No Yes No Yes No No No No Yes No No No Yes Yes No No No No No No No No No No No No No No No Yes Yes No Yes No No No No No Yes Yes No No Yes No No No Yes Yes Yes Yes No

Name of Municipality 75 76 78 77 79 80 81 82 83 84 85 86 87 88 89 91 90 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 126 125 127 128 129 130 131 132 133 134 135 137 136 138 139 141 140 142 143 144 145 146 147 148 Austerlitz Ava Avoca Avoca Avon Avon Babylon Babylon Bainbridge Bainbridge Baldwin Baldwinsville Ballston Ballston Spa Bangor Barker Barker Barneveld Barre Barrington Barton Batavia Batavia Bath Bath Baxter Estates Bayville Beacon Bedford Beekman Beekmantown Belfast Belle Terre Bellerose Bellmont Bellport Belmont Bemus Point Bennington Benson Benton Bergen Bergen Berkshire Berlin Berne Bethany Bethel Bethlehem Big Flats Binghamton Binghamton Birdsall Black Brook Black River Blasdell Bleecker Blenheim Bloomfield Blooming Grove Bloomingburg Bolivar Bolivar Bolton Bombay Boonville Boonville Boston Bovina Boylston Bradford Brandon Brant Brasher

Class Town Town Village Town Town Village Town Village Town Village Town Village Town Village Town Village Town Village Town Town Town City Town Town Village Village Village City Town Town Town Town Village Village Town Village Village Village Town Town Town Town Village Town Town Town Town Town Town Town Town City Town Town Village Village Town Town Village Town Village Village Town Town Town Village Town Town Town Town Town Town Town Town

County Columbia Oneida Steuben Steuben Livingston Livingston Suffolk Suffolk Chenango Chenango Chemung Onondaga Saratoga Saratoga Franklin Niagara Broome Oneida Orleans Yates Tioga Genesee Genesee Steuben Steuben Nassau Nassau Dutchess Westchester Dutchess Clinton Allegany Suffolk Nassau Franklin Suffolk Allegany Chautauqua Wyoming Hamilton Yates Genesee Genesee Tioga Rensselaer Albany Genesee Sullivan Albany Chemung Broome Broome Allegany Clinton Jefferson Erie Fulton Schoharie Ontario Orange Sullivan Allegany Allegany Warren Franklin Oneida Oneida Erie Delaware Oswego Steuben Franklin Erie St. Lawrence

2012 2012 2011, 2012

2008, 2009, 2010, 2011, 2012

2012

2012

2012

*Data supplied by the Office of the State Comptroller

2 of 22

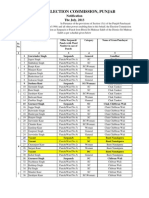

Fiscal Eligibility Based on Statutory Criteria

Sorted by Name *Average Full Value Property Tax Rates (eligible if above 6.823) 3.63 4.44 3.00 9.99 2.42 6.66 2.29 3.47 0.80 2.40 10.58 7.21 2.55 6.77 2.79 1.56 3.68 6.93 5.03 1.67 3.60 2.61 2.89 4.45 11.95 7.01 4.83 7.59 7.85 3.03 5.87 6.09 5.21 4.52 9.18 2.96 4.76 6.57 3.03 7.12 0.96 6.44 6.43 9.73 6.09 4.84 2.01 3.20 11.15 1.46 6.24 1.97 12.61 9.85 5.37 5.26 12.59 4.55 2.99 10.60 4.89 1.15 3.49 6.87 5.18 3.29 6.46 9.86 3.45 8.42 4.74 5.97 *Missing Tax Levy Data (used to calculate full value tax rates) *Average Fund Balance Percentages (eligible if below 5%) 28.20% 13.91% 48.96% 51.78% 3.00% 118.10% 201.74% 26.86% 104.05% 16.47% 30.51% 38.19% 79.28% 4.14% 149.53% 28.91% 44.27% 52.35% 142.41% 37.57% 177.35% 62.73% 174.11% 96.49% 205.57% 82.49% 100.13% 91.18% 170.42% 61.57% 43.41% 89.29% 49.46% 74.34% 36.69% 15.11% 73.28% 73.50% 19.64% 43.56% 12.55% 29.37% 39.30% 47.49% 35.52% 143.79% 131.83% 39.57% 60.08% 72.37% 27.89% 14.75% 37.19% 20.47% 47.41% 61.02% 338.59% 66.59% 25.40% 40.43% 62.30% 38.00% 61.96% 86.69% *Missing Annual Financial Reports (used to calculate fund balance percentage) Automatically Fiscally Eligible No No No No No No Yes No No No Yes Yes No No No No Yes Yes No No No No No No Yes No Yes No Yes Yes No No No No No Yes No No No No No No No No Yes No No No No Yes No No No Yes Yes No No Yes No No No No No No No Yes No No No No No Yes No No

Name of Municipality 149 150 152 151 153 154 155 156 157 158 159 160 161 162 163 164 165 166 168 167 169 170 171 172 173 174 175 176 177 178 179 180 181 182 183 185 184 186 187 188 189 190 191 192 193 194 195 196 197 199 198 200 201 202 203 205 204 206 207 208 209 210 212 211 213 214 215 216 217 218 219 220 221 223 Brewster Briarcliff Manor Bridgewater Bridgewater Brighton Brighton Brightwaters Bristol Broadalbin Broadalbin Brockport Brocton Bronxville Brookfield Brookhaven Brookville Broome Broome Brownville Brownville Brunswick Brushton Brutus Buchanan Buffalo Burdett Burke Burke Burlington Burns Busti Butler Butternuts Byron Cairo Caledonia Caledonia Callicoon Cambria Cambridge Cambridge Camden Camden Cameron Camillus Camillus Campbell Canaan Canadice Canajoharie Canajoharie Canandaigua Canandaigua Canaseraga Canastota Candor Candor Caneadea Canisteo Canisteo Canton Canton Cape Vincent Cape Vincent Carlisle Carlton Carmel Caroga Caroline Carroll Carrollton Carthage Cassadaga Castile

Class Village Village Village Town Town Town Village Town Town Village Village Village Village Town Town Village County Town Village Town Town Village Town Village City Village Town Village Town Town Town Town Town Town Town Village Town Town Town Town Village Town Village Town Town Village Town Town Town Village Town City Town Village Village Village Town Town Town Village Town Village Village Town Town Town Town Town Town Town Town Village Village Village

County Putnam Westchester Oneida Oneida Franklin Monroe Suffolk Ontario Fulton Fulton Monroe Chautauqua Westchester Madison Suffolk Nassau Broome Schoharie Jefferson Jefferson Rensselaer Franklin Cayuga Westchester Erie Schuyler Franklin Franklin Otsego Allegany Chautauqua Wayne Otsego Genesee Greene Livingston Livingston Sullivan Niagara Washington Washington Oneida Oneida Steuben Onondaga Onondaga Steuben Columbia Ontario Montgomery Montgomery Ontario Ontario Allegany Madison Tioga Tioga Allegany Steuben Steuben St. Lawrence St. Lawrence Jefferson Jefferson Schoharie Orleans Putnam Fulton Tompkins Chautauqua Cattaraugus Jefferson Chautauqua Wyoming

2011, 2012 2012

2012

2009, 2010, 2011, 2012 2012

2010, 2011, 2012

2008, 2009, 2012

2012

2008, 2009, 2010, 2011, 2012

2010, 2011, 2012

2011, 2012 2011, 2012

*Data supplied by the Office of the State Comptroller

3 of 22

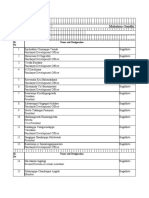

Fiscal Eligibility Based on Statutory Criteria

Sorted by Name *Average Full Value Property Tax Rates (eligible if above 6.823) 5.48 3.77 7.23 6.80 3.33 4.52 4.29 6.11 12.75 2.95 6.43 13.22 4.61 6.98 5.46 9.87 4.56 1.58 6.35 10.85 3.73 4.19 2.87 1.95 4.45 5.01 7.72 0.32 6.05 5.85 4.68 2.21 4.70 0.99 4.12 14.61 5.13 0.92 4.96 3.67 7.39 7.92 7.04 6.38 4.73 1.33 6.15 4.84 1.03 5.20 7.38 3.71 5.65 2.05 6.95 3.45 7.87 4.73 6.69 9.65 1.40 5.24 1.17 5.87 9.14 0.39 5.33 5.02 1.37 6.39 4.24 2.57 *Missing Tax Levy Data (used to calculate full value tax rates) *Average Fund Balance Percentages (eligible if below 5%) 118.75% 24.80% 143.81% 75.27% 14.76% 99.38% 176.04% -6.80% 37.10% 17.30% 29.13% 20.38% 32.15% 48.05% 91.42% 34.46% 56.66% 20.09% 26.49% 7.12% 76.48% 6.60% 30.53% 61.62% 34.45% 53.23% 90.91% 111.31% 113.93% 5.84% 66.94% 16.37% 26.40% 96.68% 45.52% 13.20% 147.66% 35.00% 43.44% 13.66% 14.40% 3.43% 22.65% 8.36% 15.74% 54.83% 45.43% 130.06% 24.79% 102.09% 73.97% 69.79% 23.68% 42.55% 24.06% 34.76% 25.28% 42.70% 104.24% 45.96% 15.96% 61.55% 154.75% 34.21% 8.12% 74.91% 31.28% 9.20% 17.56% *Missing Annual Financial Reports (used to calculate fund balance percentage) Automatically Fiscally Eligible No No Yes No No No No No Yes No No Yes No Yes No Yes No No No No No No No No No No No Yes No No No No No No No No No Yes No No No No Yes Yes Yes No No No No No No No Yes No No No Yes No Yes No No Yes No No No No No No No No No No No No

Name of Municipality 222 224 225 226 227 228 229 230 232 231 233 234 235 236 237 238 240 239 241 242 243 244 245 246 247 248 249 250 251 252 253 255 254 256 257 258 259 260 261 262 263 264 265 266 267 268 269 270 271 272 273 274 275 276 277 278 279 280 281 282 283 284 285 286 287 288 289 290 291 292 293 294 298 295 Castile Castleton-On-Hudson Castorland Catharine Catlin Cato Cato Caton Catskill Catskill Cattaraugus Cattaraugus Cayuga Cayuga Cayuga Heights Cayuta Cazenovia Cazenovia Cedarhurst Celoron Centerville Central Square Centre Island Champion Champlain Champlain Charleston Charlotte Charlton Chateaugay Chateaugay Chatham Chatham Chaumont Chautauqua Chautauqua Chazy Cheektowaga Chemung Chemung Chenango Chenango Cherry Creek Cherry Creek Cherry Valley Cherry Valley Chester Chester Chester Chesterfield Chestnut Ridge Chili Chittenango Churchville Cicero Cincinnatus Clare Clarence Clarendon Clarkson Clarkstown Clarksville Claverack Clay Clayton Clayton Clayville Clermont Cleveland Clifton Clifton Park Clifton Springs Clinton Clinton

Class Town Village Village Town Town Town Village Town Village Town County Village County Village Village Town Village Town Village Village Town Village Village Town Town Village Town Town Town Town Village Village Town Village County Town Town Town County Town County Town Town Village Town Village Town Town Village Town Village Town Village Village Town Town Town Town Town Town Town Town Town Town Town Village Village Town Village Town Town Village Village County

County Wyoming Rensselaer Lewis Schuyler Chemung Cayuga Cayuga Steuben Greene Greene Cattaraugus Cattaraugus Cayuga Cayuga Tompkins Schuyler Madison Madison Nassau Chautauqua Allegany Oswego Nassau Jefferson Clinton Clinton Montgomery Chautauqua Saratoga Franklin Franklin Columbia Columbia Jefferson Chautauqua Chautauqua Clinton Erie Chemung Chemung Chenango Broome Chautauqua Chautauqua Otsego Otsego Orange Warren Orange Essex Rockland Monroe Madison Monroe Onondaga Cortland St. Lawrence Erie Orleans Monroe Rockland Allegany Columbia Onondaga Jefferson Jefferson Oneida Columbia Oswego St. Lawrence Saratoga Ontario Oneida Clinton

2012

2011, 2012

2012

2008, 2009, 2010, 2011, 2012

2008, 2009,

2011, 2012

2012

*Data supplied by the Office of the State Comptroller

4 of 22

Fiscal Eligibility Based on Statutory Criteria

Sorted by Name *Average Full Value Property Tax Rates (eligible if above 6.823) 1.45 2.68 17.09 4.82 8.94 3.03 4.92 2.91 10.96 4.36 9.38 2.95 2.19 4.20 3.98 1.10 3.37 4.46 3.66 1.41 2.53 2.57 5.27 7.52 3.06 5.76 5.58 5.67 4.05 3.13 5.73 5.87 5.07 4.93 1.59 7.76 3.06 6.34 2.91 10.03 4.69 3.43 4.46 14.61 7.59 3.53 4.71 2.71 5.00 4.55 7.45 3.19 8.45 4.33 3.20 3.86 7.80 6.21 8.48 13.43 7.12 6.38 4.70 8.40 12.92 8.76 3.67 1.41 3.81 1.50 4.46 5.95 6.10 2.75 5 of 22 *Missing Tax Levy Data (used to calculate full value tax rates) *Average Fund Balance Percentages (eligible if below 5%) 36.97% 122.27% 115.65% 24.56% 23.05% 78.31% 178.44% 11.35% 83.25% 91.53% 17.32% 72.63% 66.37% 5.41% 162.44% 45.47% 74.57% 90.25% -30.22% 124.49% 82.38% 16.46% 158.45% 150.84% 55.75% 38.41% 42.91% 58.08% 28.49% 82.52% 23.21% 30.40% 27.79% 63.24% 32.81% 23.70% 113.94% 55.66% 95.13% 39.78% 133.17% 28.59% 6.12% 8.96% 11.89% 33.34% 36.11% 35.28% 61.29% 29.80% 142.29% 21.06% 22.99% 13.28% 45.21% 65.48% 39.29% 17.38% 32.64% 97.56% 76.54% 34.55% 118.33% 23.15% 49.95% 101.09% 185.05% 114.31% 13.02% 27.56% 80.28% 63.77% *Missing Annual Financial Reports (used to calculate fund balance percentage) Automatically Fiscally Eligible No No Yes No Yes No No No Yes No Yes No No No No No No No Yes No No No No Yes No No No No No No No No No No No Yes No No No Yes No No No Yes Yes No No No No No Yes No Yes No No No Yes No Yes Yes Yes No No Yes Yes Yes No No No No No No No No

Name of Municipality 297 296 299 300 302 301 303 304 306 305 307 308 309 310 311 312 313 314 315 316 317 318 319 320 321 322 323 324 325 326 327 328 329 330 331 332 333 335 334 336 337 338 339 341 340 342 343 344 345 346 347 348 349 350 352 351 353 354 355 356 357 358 360 359 362 361 363 364 365 366 367 368 369 370 Clinton Clinton Clyde Clymer Cobleskill Cobleskill Cochecton Coeymans Cohocton Cohocton Cohoes Colchester Cold Brook Cold Spring Colden Coldspring Colesville Collins Colonie Colonie Colton Columbia Columbia Columbus Concord Conesus Conesville Conewango Conklin Conquest Constable Constableville Constantia Cooperstown Copake Copenhagen Corfu Corinth Corinth Corning Corning Cornwall Cornwall-On-Hudson Cortland Cortland Cortlandt Cortlandville Cove Neck Coventry Covert Covington Coxsackie Coxsackie Crawford Croghan Croghan Croton-On-Hudson Crown Point Cuba Cuba Cuyler Danby Dannemora Dannemora Dansville Dansville Danube Darien Davenport Day Dayton De Kalb De Peyster De Ruyter

Class Town Town Village Town Village Town Town Town Village Town City Town Village Village Town Town Town Town Town Village Town County Town Town Town Town Town Town Town Town Town Village Town Village Town Village Village Village Town City Town Town Village City County Town Town Village Town Town Town Town Village Town Village Town Village Town Town Village Town Town Village Town Village Town Town Town Town Town Town Town Town Town

County Dutchess Clinton Wayne Chautauqua Schoharie Schoharie Sullivan Albany Steuben Steuben Albany Delaware Herkimer Putnam Erie Cattaraugus Broome Erie Albany Albany St. Lawrence Columbia Herkimer Chenango Erie Livingston Schoharie Cattaraugus Broome Cayuga Franklin Lewis Oswego Otsego Columbia Lewis Genesee Saratoga Saratoga Steuben Steuben Orange Orange Cortland Cortland Westchester Cortland Nassau Chenango Seneca Wyoming Greene Greene Orange Lewis Lewis Westchester Essex Allegany Allegany Cortland Tompkins Clinton Clinton Livingston Steuben Herkimer Genesee Delaware Saratoga Cattaraugus St. Lawrence St. Lawrence Madison

2012

2010, 2011, 2012

*Data supplied by the Office of the State Comptroller

Fiscal Eligibility Based on Statutory Criteria

Sorted by Name *Average Full Value Property Tax Rates (eligible if above 6.823) 4.96 7.14 1.90 3.95 7.16 3.17 2.29 5.88 2.37 8.62 3.78 7.00 5.21 10.78 8.48 3.02 2.35 6.06 7.39 3.97 7.38 2.79 4.85 5.94 14.06 3.30 2.31 11.10 6.60 3.22 3.75 2.76 11.82 14.92 2.43 5.65 1.51 0.24 7.51 7.38 2.38 2.70 6.32 1.80 1.80 3.14 1.31 6.37 13.33 0.00 4.28 15.70 2.11 2.25 2.68 2.58 6.31 0.75 5.54 10.27 5.01 3.38 2.12 1.50 5.72 5.07 4.76 16.89 1.61 4.73 1.29 1.93 10.80 3.20 6 of 22 *Missing Tax Levy Data (used to calculate full value tax rates) *Average Fund Balance Percentages (eligible if below 5%) 85.30% 62.63% 266.11% 15.84% 5.22% 23.18% 27.00% 78.80% 94.23% 50.18% 63.80% 58.84% 235.83% 20.01% 44.14% 58.36% 13.75% 23.82% 97.47% 13.71% 117.47% 68.59% 24.97% 11.14% 44.42% 31.72% 141.33% 159.17% 272.63% 48.11% 39.45% 298.74% 81.46% 10.90% 444.96% 62.55% 40.23% 46.41% 38.72% -17.36% -6.00% 19.06% 72.08% 81.70% 25.81% 14.66% 28.37% 27.99% 45.15% 80.71% 54.12% 41.96% 173.20% 223.29% 7.93% 32.88% 4.24% 54.00% 61.60% 114.79% 36.21% 59.49% 100.63% 66.23% 5.31% 13.98% 48.40% 39.00% 38.22% *Missing Annual Financial Reports (used to calculate fund balance percentage) Automatically Fiscally Eligible No Yes No No Yes No No No No Yes No Yes No Yes Yes No No No Yes No Yes No No No Yes No No Yes No No No No Yes Yes No No No No Yes Yes No No Yes Yes No No No No Yes No No Yes No No No No No No No Yes No Yes No No No No No Yes No No No No Yes No

Name of Municipality 371 372 373 374 375 376 377 378 379 381 380 382 383 384 386 385 387 388 389 390 392 391 393 394 395 396 397 398 400 399 401 402 403 404 405 406 407 408 409 410 411 412 413 414 415 416 417 418 420 419 421 422 423 424 425 426 427 428 429 430 431 433 432 435 434 436 437 438 439 440 441 442 443 444 De Ruyter Decatur Deerfield Deerpark Deferiet Delanson Delaware Delaware Delevan Delhi Delhi Denmark Denning Depew Deposit Deposit Dering Harbor DeWitt Dexter Diana Dickinson Dickinson Dix Dobbs Ferry Dolgeville Dover Dresden Dresden Dryden Dryden Duane Duanesburg Dundee Dunkirk Dunkirk Durham Dutchess Eagle Earlville East Aurora East Bloomfield East Fishkill East Greenbush East Hampton East Hampton East Hills East Nassau East Otto East Rochester East Rochester4 East Rockaway East Syracuse East Williston Eastchester Easton Eaton Eden Edinburg Edmeston Edwards Edwards Elba Elba Elbridge Elbridge Elizabethtown Ellenburg Ellenville Ellery Ellicott Ellicottville Ellicottville Ellington Ellisburg

3

Class Village Town Town Town Village Village County Town Village Village Town Town Town Village Village Town Village Town Village Town Town Town Town Village Village Town Town Village Village Town Town Town Village City Town Town County Town Village Village Town Town Town Town Village Village Village Town Village Town Village Village Village Town Town Town Town Town Town Town Village Village Town Village Town Town Town Village Town Town Town Village Town Town

County Madison Otsego Oneida Orange Jefferson Schenectady Delaware Sullivan Cattaraugus Delaware Delaware Lewis Ulster Erie Broome Delaware Suffolk Onondaga Jefferson Lewis Franklin Broome Schuyler Westchester Herkimer Dutchess Washington Yates Tompkins Tompkins Franklin Schenectady Yates Chautauqua Chautauqua Greene Dutchess Wyoming Chenango Erie Ontario Dutchess Rensselaer Suffolk Suffolk Nassau Rensselaer Cattaraugus Monroe Monroe Nassau Onondaga Nassau Westchester Washington Madison Erie Saratoga Otsego St. Lawrence St. Lawrence Genesee Genesee Onondaga Onondaga Essex Clinton Ulster Chautauqua Chautauqua Cattaraugus Cattaraugus Chautauqua Jefferson

2012

2012 2008, 2009, 2010, 2011, 2012

2011, 2012 2008, 2009, 2010, 2011, 2012

*Data supplied by the Office of the State Comptroller

Fiscal Eligibility Based on Statutory Criteria

Sorted by Name *Average Full Value Property Tax Rates (eligible if above 6.823) 1.64 1.62 16.51 3.19 12.73 6.29 15.15 4.10 9.47 3.31 1.80 7.52 3.60 2.20 1.08 4.21 10.66 5.49 4.96 2.44 7.56 3.33 4.50 6.00 8.87 8.18 7.92 3.37 2.79 9.96 4.39 6.72 4.22 2.19 8.91 2.16 2.93 7.75 3.20 7.54 4.74 3.74 1.12 0.90 5.65 7.60 4.97 1.69 4.29 3.33 2.44 7.83 10.15 3.49 7.20 9.30 5.85 10.85 4.75 1.81 4.44 4.60 4.79 9.27 5.91 6.28 4.61 9.13 7.53 3.82 3.25 10.82 3.03 *Missing Tax Levy Data (used to calculate full value tax rates) *Average Fund Balance Percentages (eligible if below 5%) 57.45% 57.07% 16.30% 44.75% 24.70% 10.63% 7.54% 187.58% 103.42% 7.67% 98.03% 49.27% 38.07% 43.47% 120.53% 44.88% 93.10% 37.79% 41.70% 23.13% 49.29% 41.66% 60.92% 38.94% 37.65% 357.14% 122.28% 78.70% 29.63% 86.51% 139.37% 34.82% -15.26% 20.43% 60.85% 54.73% 12.20% 33.44% 257.48% 37.42% 39.97% 119.07% 90.23% 109.86% 66.30% 31.51% 85.75% 75.91% 24.10% 43.70% 41.53% 86.38% 24.07% 85.45% 11.36% 37.36% 27.00% 65.12% 25.83% 33.18% 7.31% 65.12% 41.08% 61.50% 47.33% 7 of 22 *Missing Annual Financial Reports (used to calculate fund balance percentage) Automatically Fiscally Eligible No No Yes No Yes No Yes No Yes No No Yes No No No No No No No No No Yes No No No Yes Yes Yes No No Yes No No No No Yes Yes No Yes No Yes No No No No No Yes No No No No No Yes Yes No Yes Yes No Yes No No No No No Yes No No No Yes Yes No No No No

Name of Municipality 445 446 447 448 449 450 451 452 453 454 455 456 457 458 459 460 461 462 463 464 466 465 467 468 469 470 471 472 473 474 475 476 477 478 479 480 481 482 483 484 485 486 488 487 489 490 491 492 493 494 496 495 497 499 498 500 501 502 504 503 505 507 508 506 510 509 511 512 513 514 515 517 516 518 Ellisburg Elma Elmira Elmira Elmira Heights Elmsford Endicott Enfield Ephratah Erie Erin Erwin Esopus Esperance Esperance Essex Essex Evans Evans Mills Exeter Fabius Fabius Fair Haven Fairfield Fairport Falconer Fallsburg Farmersville Farmingdale Farmington Farnham Fayette Fayetteville Fenner Fenton Fine Fishkill Fishkill Fleischmanns Fleming Floral Park Florence Florida Florida Flower Hill Floyd Fonda Forestburgh Forestport Forestville Fort Ann Fort Ann Fort Covington Fort Edward Fort Edward Fort Johnson Fort Plain Fowler Frankfort Frankfort Franklin Franklin Franklin Franklin Franklinville Franklinville Fredonia Freedom Freeport Freetown Freeville Fremont Fremont French Creek

Class Village Town City Town Village Village Village Town Town County Town Town Town Town Village County Town Town Village Town Village Town Village Town Village Village Town Town Village Town Village Town Village Town Town Town Town Village Village Town Village Town Village Town Village Town Village Town Town Village Village Town Town Village Town Village Village Town Village Town County Town Village Town Village Town Village Town Village Town Village Town Town Town

County Jefferson Erie Chemung Chemung Chemung Westchester Broome Tompkins Fulton Erie Chemung Steuben Ulster Schoharie Schoharie Essex Essex Erie Jefferson Otsego Onondaga Onondaga Cayuga Herkimer Monroe Chautauqua Sullivan Cattaraugus Nassau Ontario Erie Seneca Onondaga Madison Broome St. Lawrence Dutchess Dutchess Delaware Cayuga Nassau Oneida Orange Montgomery Nassau Oneida Montgomery Sullivan Oneida Chautauqua Washington Washington Franklin Washington Washington Montgomery Montgomery St. Lawrence Herkimer Herkimer Franklin Franklin Delaware Delaware Cattaraugus Cattaraugus Chautauqua Cattaraugus Nassau Cortland Tompkins Sullivan Steuben Chautauqua

2012

2011, 2012 2011, 2012 2012

2011, 2012

2012

2012

2011, 2012 2009, 2010, 2011, 2012

2012

*Data supplied by the Office of the State Comptroller

Fiscal Eligibility Based on Statutory Criteria

Sorted by Name *Average Full Value Property Tax Rates (eligible if above 6.823) 11.89 16.58 4.49 4.40 7.28 6.06 7.24 4.01 3.78 1.59 1.24 0.00 6.23 1.80 6.64 7.26 5.35 9.84 14.61 6.38 3.12 18.04 0.84 1.15 7.83 4.68 2.86 2.11 6.18 1.34 5.04 3.31 1.16 6.42 6.56 8.41 3.37 20.31 0.68 6.11 2.52 3.10 12.21 13.33 3.15 3.72 6.13 9.76 9.15 3.44 2.29 4.82 2.83 4.41 7.42 11.03 0.00 3.13 1.70 4.14 6.50 1.12 5.02 1.86 4.35 2.27 9.77 2.69 8.18 5.61 3.74 7.43 5.87 8 of 22 *Missing Tax Levy Data (used to calculate full value tax rates) *Average Fund Balance Percentages (eligible if below 5%) 42.28% 12.81% 28.35% 77.23% 33.15% 75.82% 44.45% 134.94% 54.52% 107.59% 26.56% 391.61% 19.03% 52.91% 40.40% 22.72% 86.55% 17.15% 60.85% 84.86% 22.22% 192.94% 88.85% 60.59% 58.28% 27.71% 62.72% 81.79% 133.60% 171.48% 76.07% 31.72% -4.69% 34.57% 5.54% 28.64% 14.45% 150.55% 14.79% 16.95% 34.70% 38.62% 26.04% 62.09% 77.62% 58.92% 30.30% 5.20% 76.66% 46.47% 21.44% 34.39% 45.14% 52.01% 34.68% 93.22% 108.63% 13.69% 73.35% 125.76% 144.74% 44.45% 83.24% 31.84% 100.57% 23.01% 61.24% 13.25% 70.45% 29.80% 119.82% *Missing Annual Financial Reports (used to calculate fund balance percentage) Automatically Fiscally Eligible Yes Yes No No Yes No Yes No No No No No No No No No No Yes Yes No No Yes No No Yes No No No No No No No No Yes No Yes No Yes No No No No Yes Yes No No No No Yes Yes No No No No No Yes Yes No No No No No No No No No No Yes No No No No Yes No

Name of Municipality 519 521 520 522 523 524 525 526 527 528 529 530 531 532 533 534 535 536 537 539 538 540 541 542 543 544 545 546 547 548 549 550 551 552 553 554 555 556 557 559 558 560 561 562 563 564 565 566 567 569 568 570 571 572 573 574 576 575 577 578 579 580 581 582 583 584 585 587 586 588 589 590 592 591 Friendship Fulton Fulton Fulton Fultonville Gaines Gainesville Gainesville Galen Gallatin Galway Galway Garden City Gardiner Gates Geddes Genesee Genesee Genesee Falls Geneseo Geneseo Geneva Geneva Genoa Georgetown German German Flatts Germantown Gerry Ghent Gilbertsville Gilboa Glen Glen Cove Glen Park Glens Falls Glenville Gloversville Gorham Goshen Goshen Gouverneur Gouverneur Gowanda Grafton Granby Grand Island Grand View-On-Hudson Granger Granville Granville Great Neck Great Neck Estates Great Neck Plaza Great Valley Greece Green Island Green Island4 Greenburgh Greene Greene Greene Greenfield Greenport Greenport Greenville Greenville Greenwich Greenwich Greenwood Greenwood Lake Greig Groton Groton

Class Town City County Town Village Town Town Village Town Town Town Village Village Town Town Town County Town Town Village Town City Town Town Town Town Town Town Town Town Village Town Town City Village City Town City Town Village Town Town Village Village Town Town Town Village Town Village Town Village Village Village Town Town Village Town Town County Town Village Town Town Village Town Town Village Town Town Village Town Village Town

County Allegany Oswego Fulton Schoharie Montgomery Orleans Wyoming Wyoming Wayne Columbia Saratoga Saratoga Nassau Ulster Monroe Onondaga Genesee Allegany Wyoming Livingston Livingston Ontario Ontario Cayuga Madison Chenango Herkimer Columbia Chautauqua Columbia Otsego Schoharie Montgomery Nassau Jefferson Warren Schenectady Fulton Ontario Orange Orange St. Lawrence St. Lawrence Cattaraugus Rensselaer Oswego Erie Rockland Allegany Washington Washington Nassau Nassau Nassau Cattaraugus Monroe Albany Albany Westchester Greene Chenango Chenango Saratoga Columbia Suffolk Greene Orange Washington Washington Steuben Orange Lewis Tompkins Tompkins

2012

2012

2010, 2011, 2012

2012

*Data supplied by the Office of the State Comptroller

Fiscal Eligibility Based on Statutory Criteria

Sorted by Name *Average Full Value Property Tax Rates (eligible if above 6.823) 11.66 4.74 3.17 6.07 4.99 0.42 3.26 1.92 11.00 6.72 4.24 0.93 10.63 2.00 4.15 4.82 0.93 8.84 3.76 1.18 4.82 11.29 7.47 2.85 4.60 4.34 5.47 3.56 5.65 1.91 6.35 6.63 0.92 4.03 12.14 6.83 6.92 5.65 2.91 6.20 6.26 7.86 6.88 0.83 3.44 5.12 14.99 2.99 0.39 1.96 19.04 2.71 3.29 12.90 9.70 4.30 9.73 0.97 0.66 0.99 3.91 7.01 5.44 5.58 1.98 2.47 6.23 4.49 4.73 2.89 13.01 8.29 1.33 *Missing Tax Levy Data (used to calculate full value tax rates) *Average Fund Balance Percentages (eligible if below 5%) 53.87% 51.28% 30.38% 57.29% 53.89% 4.64% 349.20% 8.43% 84.40% 38.73% 40.14% 109.81% 28.45% 58.53% 111.77% 69.29% 77.29% 110.72% 47.61% 36.99% 27.14% 49.63% 20.68% 90.27% 87.54% 87.41% 84.48% 111.56% 12.06% 32.81% 59.33% 165.34% -0.82% 3.03% 123.17% 30.03% 48.03% 80.47% 98.34% 4.31% 38.11% 41.03% 30.27% 201.39% 44.59% 16.58% 33.68% 119.20% 168.24% 8.90% 26.80% 78.13% 93.73% 60.24% 180.64% 78.84% 53.32% 70.66% 10.43% 31.06% 148.14% 50.89% 48.51% 111.52% 98.87% 59.55% 63.34% 60.61% 62.87% 9 of 22 *Missing Annual Financial Reports (used to calculate fund balance percentage) Automatically Fiscally Eligible Yes No No No No No No No No Yes No No No Yes No No No No Yes No No No Yes Yes No No No No No No No No No Yes Yes No Yes Yes No No No Yes Yes Yes No No No Yes No No No Yes No No Yes No No Yes No No No No Yes No No No No No No No No Yes Yes No

Name of Municipality 593 594 595 596 597 598 599 600 601 603 602 604 605 607 606 608 610 609 611 612 613 614 615 616 617 618 619 620 621 622 623 624 625 627 626 628 629 630 631 632 633 634 636 635 637 638 639 641 640 642 643 646 644 645 648 647 649 650 651 652 653 654 655 656 657 658 659 660 661 662 663 664 666 665 Grove Groveland Guilderland Guilford Hadley Hagaman Hague Halcott Halfmoon Hamburg Hamburg Hamden Hamilton Hamilton Hamilton Hamlin Hammond Hammond Hammondsport Hampton Hamptonburgh Hancock Hancock Hannibal Hannibal Hanover Hardenburgh Harford Harmony Harpersfield Harrietstown Harriman Harrisburg Harrison Harrison Harrisville Hartford Hartland Hartsville Hartwick Hastings Hastings-On-Hudson Haverstraw Haverstraw Head Of The Harbor Hebron Hector Hempstead Hempstead Henderson Henrietta Herkimer Herkimer Herkimer Hermon Hermon Herrings Heuvelton Hewlett Bay Park Hewlett Harbor Hewlett Neck Highland Highland Falls Highlands Hillburn Hillsdale Hilton Hinsdale Hobart Holland Holland Patent Holley Homer Homer

Class Town Town Town Town Town Village Town Town Town Village Town Town County Village Town Town Village Town Village Town Town Town Village Town Village Town Town Town Town Town Town Village Town Village Town Village Town Town Town Town Town Village Village Town Village Town Town Village Town Town Town Village County Town Village Town Village Village Village Village Village Town Village Town Village Town Village Town Village Town Village Village Village Town

County Allegany Livingston Albany Chenango Saratoga Montgomery Warren Greene Saratoga Erie Erie Delaware Hamilton Madison Madison Monroe St. Lawrence St. Lawrence Steuben Washington Orange Delaware Delaware Oswego Oswego Chautauqua Ulster Cortland Chautauqua Delaware Franklin Orange Lewis Westchester Westchester Lewis Washington Niagara Steuben Otsego Oswego Westchester Rockland Rockland Suffolk Washington Schuyler Nassau Nassau Jefferson Monroe Herkimer Herkimer Herkimer St. Lawrence St. Lawrence Jefferson St. Lawrence Nassau Nassau Nassau Sullivan Orange Orange Rockland Columbia Monroe Cattaraugus Delaware Erie Oneida Orleans Cortland Cortland

2012

2012

2008,

2011, 2012 2012

2008, 2009,

*Data supplied by the Office of the State Comptroller

Fiscal Eligibility Based on Statutory Criteria

Sorted by Name *Average Full Value Property Tax Rates (eligible if above 6.823) 1.78 3.49 7.21 5.42 3.40 6.04 1.08 8.12 11.48 3.12 4.84 0.62 1.91 8.87 11.78 7.98 12.39 4.78 3.11 2.53 2.78 2.57 2.55 3.94 2.82 15.83 10.67 4.89 5.12 12.14 5.55 8.11 7.54 2.87 3.82 1.01 2.37 9.81 5.42 12.42 2.52 20.14 6.23 4.44 6.73 3.58 4.90 2.85 2.92 2.64 2.57 13.77 1.65 11.48 4.67 5.50 0.37 2.99 7.67 5.41 14.23 5.45 7.36 3.84 1.68 1.57 3.00 2.70 8.58 5.48 4.06 4.28 3.17 0.99 10 of 22 *Missing Tax Levy Data (used to calculate full value tax rates) *Average Fund Balance Percentages (eligible if below 5%) 44.52% 20.03% 79.73% 58.01% 69.53% 36.62% 137.03% 20.38% 52.11% 34.58% 61.93% 26.46% 35.61% 30.05% 60.78% 136.40% 184.06% 42.78% 80.67% 42.51% 11.92% 104.94% 106.52% 26.66% 8.98% 34.45% 16.93% 43.39% 68.64% 12.00% 16.45% 40.90% -3.77% 37.12% 59.79% 24.42% 73.63% 35.31% 9.75% 2.00% 260.03% 23.77% 22.05% 48.74% 40.73% 74.20% 68.01% 38.59% 7.50% 113.95% 72.45% 294.24% 42.47% 46.52% 13.59% 67.63% 38.26% 31.33% 50.07% 148.51% 19.93% 42.90% 25.27% 115.81% 12.51% 49.64% 54.58% 81.92% 10.70% 105.87% *Missing Annual Financial Reports (used to calculate fund balance percentage) 2012 Automatically Fiscally Eligible No No Yes No No No No Yes Yes No No No No Yes Yes Yes Yes No No No No No No No No Yes Yes No No Yes No Yes Yes No Yes No No Yes No No No Yes Yes No No No No No No No No Yes No No No No No No Yes No Yes No Yes No No No No No Yes No No No No No

Name of Municipality 667 668 669 670 671 672 673 674 675 676 678 677 679 680 681 682 683 684 686 685 687 688 689 690 691 692 693 694 695 696 697 698 699 700 701 702 703 704 706 705 707 708 709 710 711 712 713 714 715 716 717 718 720 719 721 722 723 724 725 726 727 728 729 730 731 732 733 734 735 736 737 738 739 740 Honeoye Falls Hoosick Hoosick Falls Hope Hopewell Hopkinton Horicon Hornby Hornell Hornellsville Horseheads Horseheads Hounsfield Howard Hudson Hudson Falls Hume Humphrey Hunter Hunter Huntington Huntington Bay Hurley Huron Hyde Park Ilion Independence Indian Lake Inlet Interlaken Ira Irondequoit Irvington Ischua Island Park Islandia Islip Italy Ithaca Ithaca Jackson Jamestown Jasper Java Jay Jefferson Jefferson Jeffersonville Jerusalem Jewett Johnsburg Johnson City Johnstown Johnstown Jordan Junius Kaser Keene Keeseville Kendall Kenmore Kensington Kent Kiantone Kinderhook Kinderhook Kings Point Kingsbury Kingston Kingston Kirkland Kirkwood Kiryas Joel Knox

Class Village Town Village Town Town Town Town Town City Town Village Town Town Town City Village Town Town Village Town Town Village Town Town Town Village Town Town Town Village Town Town Village Town Village Village Town Town Town City Town City Town Town Town County Town Village Town Town Town Village Town City Village Town Village Town Village Town Village Village Town Town Town Village Village Town City Town Town Town Village Town

County Monroe Rensselaer Rensselaer Hamilton Ontario St. Lawrence Warren Steuben Steuben Steuben Chemung Chemung Jefferson Steuben Columbia Washington Allegany Cattaraugus Greene Greene Suffolk Suffolk Ulster Wayne Dutchess Herkimer Allegany Hamilton Hamilton Seneca Cayuga Monroe Westchester Cattaraugus Nassau Suffolk Suffolk Yates Tompkins Tompkins Washington Chautauqua Steuben Wyoming Essex Jefferson Schoharie Sullivan Yates Greene Warren Broome Fulton Fulton Onondaga Seneca Rockland Essex Clinton Orleans Erie Nassau Putnam Chautauqua Columbia Columbia Nassau Washington Ulster Ulster Oneida Broome Orange Albany

2011, 2012

2012

2012

*Data supplied by the Office of the State Comptroller

Fiscal Eligibility Based on Statutory Criteria

Sorted by Name *Average Full Value Property Tax Rates (eligible if above 6.823) 4.95 6.54 2.73 18.70 4.13 1.87 5.21 0.79 3.21 5.52 4.17 6.01 7.04 7.52 9.43 2.11 1.21 9.06 4.82 0.35 2.84 5.42 0.71 1.69 10.03 1.95 1.06 10.74 5.68 0.84 0.26 6.57 3.40 2.28 8.16 3.54 4.03 8.04 1.54 5.57 2.36 3.08 5.47 13.44 7.48 4.14 5.24 11.08 3.17 1.68 7.65 4.40 5.75 3.87 3.19 18.72 3.26 6.44 9.48 10.50 3.73 1.34 7.49 4.45 4.72 2.63 5.63 14.29 6.44 7.85 1.96 5.35 3.24 7.79 11 of 22 *Missing Tax Levy Data (used to calculate full value tax rates) *Average Fund Balance Percentages (eligible if below 5%) 121.15% 51.88% 28.36% 29.65% 41.93% 11.50% 79.17% 30.37% 41.74% 39.35% 16.29% 34.81% 15.07% 22.63% 23.17% 113.14% 623.48% 149.66% 14.47% 71.47% 37.88% 60.38% 250.10% 30.97% 165.00% 27.68% 102.66% 172.15% 24.16% 315.09% 47.71% 175.94% 78.96% 7.07% 35.84% 100.43% 124.12% 1.60% 16.81% 47.65% 102.01% 97.49% 4.73% 47.11% 81.69% 122.94% 228.60% 152.68% 12.57% 174.82% 30.04% 57.60% 177.65% 4.20% 45.09% 31.23% 63.07% 49.37% 33.54% 133.00% 54.91% 73.51% 25.58% 21.50% 151.53% 9.44% 116.89% 57.13% 93.47% 25.73% 13.99% *Missing Annual Financial Reports (used to calculate fund balance percentage) Automatically Fiscally Eligible No No No Yes No No No No No No No No Yes Yes Yes No No Yes No No No No No No Yes No No Yes No No No No No No Yes No No Yes Yes No No No No Yes Yes No No Yes No No No No No No No Yes No No Yes Yes No No Yes No No No No Yes No Yes No No No Yes

Name of Municipality 741 742 743 744 745 746 747 748 749 750 751 752 753 754 755 756 757 758 759 760 761 762 763 765 764 766 767 768 769 770 771 772 773 774 775 776 777 778 779 781 780 782 783 785 784 786 787 788 789 790 791 792 793 794 795 796 797 798 799 800 801 802 804 803 805 806 807 808 809 810 811 812 813 814 Kortright La Fayette La Grange Lackawanna Lacona Lake George Lake George Lake Grove Lake Luzerne Lake Placid Lake Pleasant Lake Success Lakewood Lancaster Lancaster Lansing Lansing Lapeer Larchmont Lattingtown Laurel Hollow Laurens Laurens Lawrence Lawrence Le Ray Le Roy Le Roy Lebanon Ledyard Lee Leicester Leicester Lenox Leon Lewis Lewis Lewis Lewisboro Lewiston Lewiston Lexington Leyden Liberty Liberty Lima Lima Lincklaen Lincoln Lindenhurst Lindley Lisbon Lisle Lisle Litchfield Little Falls Little Falls Little Valley Little Valley Liverpool Livingston Livingston Livonia Livonia Lloyd Lloyd Harbor Locke Lockport Lockport Lodi Lodi Long Beach Long Lake Lorraine

Class Town Town Town City Village Town Village Village Town Village Town Village Village Town Village Town Village Town Village Village Village Town Village Village Town Town Town Village Town Town Town Town Village Town Town County Town Town Town Village Town Town Town Village Town Town Village Town Town Village Town Town Town Village Town City Town Town Village Village County Town Village Town Town Village Town City Town Town Village City Town Town

County Delaware Onondaga Dutchess Erie Oswego Warren Warren Suffolk Warren Essex Hamilton Nassau Chautauqua Erie Erie Tompkins Tompkins Cortland Westchester Nassau Nassau Otsego Otsego Nassau St. Lawrence Jefferson Genesee Genesee Madison Cayuga Oneida Livingston Livingston Madison Cattaraugus Lewis Essex Lewis Westchester Niagara Niagara Greene Lewis Sullivan Sullivan Livingston Livingston Chenango Madison Suffolk Steuben St. Lawrence Broome Broome Herkimer Herkimer Herkimer Cattaraugus Cattaraugus Onondaga Livingston Columbia Livingston Livingston Ulster Suffolk Cayuga Niagara Niagara Seneca Seneca Nassau Hamilton Jefferson

2012

2011, 2012

2012

*Data supplied by the Office of the State Comptroller

Fiscal Eligibility Based on Statutory Criteria

Sorted by Name *Average Full Value Property Tax Rates (eligible if above 6.823) 1.38 4.19 9.30 6.77 0.71 9.06 6.25 9.69 19.21 6.60 7.98 6.06 2.29 3.72 5.14 4.62 4.96 3.67 5.22 3.91 11.24 3.31 17.11 4.89 0.90 8.01 3.16 4.84 1.98 1.96 5.67 2.36 5.59 7.52 3.43 2.30 4.60 2.87 2.03 4.83 7.26 3.66 2.62 3.15 6.13 6.12 3.70 7.45 4.46 4.19 1.25 13.28 3.81 0.26 1.67 5.65 0.41 2.52 6.97 4.34 11.53 8.95 15.41 3.81 2.59 3.91 5.14 3.79 5.38 7.19 3.25 5.62 8.99 12 of 22 *Missing Tax Levy Data (used to calculate full value tax rates) *Average Fund Balance Percentages (eligible if below 5%) 62.78% 86.89% 114.61% 63.92% 48.41% 24.34% 29.20% 111.71% 43.01% 193.79% 237.31% 61.24% 49.55% 49.07% 109.56% 117.63% 150.39% 23.41% 95.63% 105.63% 33.14% 56.55% 44.42% 116.66% 63.16% 21.31% 33.11% 16.45% 22.25% 59.55% 95.20% 34.43% 22.62% 38.25% 10.55% 18.77% 47.40% 23.54% 51.14% 28.14% 113.79% 97.76% 87.28% 100.84% 28.01% 103.49% 152.35% 48.20% 47.19% 34.60% 23.68% 65.84% 17.94% 58.93% 42.03% 60.99% 97.56% 116.63% 46.79% 47.43% 53.93% 33.02% 47.48% 43.36% 31.20% 32.97% 77.40% *Missing Annual Financial Reports (used to calculate fund balance percentage) Automatically Fiscally Eligible No No Yes No No Yes No Yes Yes No Yes No No No No No No No No No Yes No Yes No No Yes No No No No No No No No No No No No No No No No No No No No No No Yes No No No Yes No No No No No No Yes No Yes No No No No No No No No No No No Yes

Name of Municipality 815 816 817 818 819 820 821 822 824 823 825 826 827 828 829 830 831 832 834 833 835 836 838 837 839 840 841 843 842 844 845 846 847 848 849 850 851 852 853 854 856 855 857 858 859 860 861 862 863 864 865 866 868 867 869 870 871 872 873 874 875 876 877 878 879 880 881 882 883 885 884 886 887 888 Louisville Lowville Lowville Lumberland Lyme Lynbrook Lyndon Lyndonville Lyons Lyons Lyons Falls Lyonsdale Lysander Macedon Macedon Machias Macomb Madison Madison Madison Madrid Maine Malone Malone Malta Malverne Mamakating Mamaroneck Mamaroneck Manchester Manchester Manheim Manlius Manlius Mannsville Manorhaven Mansfield Marathon Marathon Marbletown Marcellus Marcellus Marcy Margaretville Marilla Marion Marlborough Marshall Martinsburg Maryland Masonville Massapequa Park Massena Massena Mastic Beach1 Matinecock Maybrook Mayfield Mayfield Mayville Mc Donough McGraw Mechanicville Medina Menands Mendon Mentz Meredith Meridian Mexico Mexico Middleburgh Middleburgh Middlebury

Class Town Town Village Town Town Village Town Village Village Town Village Town Town Town Village Town Town County Village Town Town Town Village Town Town Village Town Village Town Town Village Town Town Village Village Village Town Town Village Town Village Town Town Village Town Town Town Town Town Town Town Village Village Town Village Village Village Town Village Village Town Village City Village Village Town Town Town Village Village Town Town Village Town

County St. Lawrence Lewis Lewis Sullivan Jefferson Nassau Cattaraugus Orleans Wayne Wayne Lewis Lewis Onondaga Wayne Wayne Cattaraugus St. Lawrence Madison Madison Madison St. Lawrence Broome Franklin Franklin Saratoga Nassau Sullivan Westchester Westchester Ontario Ontario Herkimer Onondaga Onondaga Jefferson Nassau Cattaraugus Cortland Cortland Ulster Onondaga Onondaga Oneida Delaware Erie Wayne Ulster Oneida Lewis Otsego Delaware Nassau St. Lawrence St. Lawrence Suffolk Nassau Orange Fulton Fulton Chautauqua Chenango Cortland Saratoga Orleans Albany Monroe Cayuga Delaware Cayuga Oswego Oswego Schoharie Schoharie Wyoming

2012

2010, 2011, 2012

2010, 2011, 2012

2008, 2009, 2010, 2012

2012

2011, 2012 2012

2012

*Data supplied by the Office of the State Comptroller

Fiscal Eligibility Based on Statutory Criteria

Sorted by Name *Average Full Value Property Tax Rates (eligible if above 6.823) 1.75 8.90 7.05 9.12 3.28 6.05 2.50 4.59 1.82 1.22 3.11 4.40 3.45 0.72 3.37 2.82 4.53 4.83 8.59 2.42 8.45 1.95 6.63 5.33 5.22 2.71 5.08 1.13 2.40 6.94 6.54 2.28 14.64 5.31 8.74 7.01 2.47 4.92 1.75 4.74 8.81 4.99 5.64 3.23 11.32 8.03 4.10 7.42 0.00 4.94 14.05 2.34 8.44 2.64 1.08 5.28 1.28 3.08 5.63 4.25 7.53 2.07 2.93 5.03 5.41 2.77 2.32 3.94 6.02 3.52 6.11 10.53 13 of 22 *Missing Tax Levy Data (used to calculate full value tax rates) *Average Fund Balance Percentages (eligible if below 5%) 39.88% 8.75% 92.44% 18.26% 44.64% 32.44% 47.86% 43.44% 74.11% 34.92% 53.12% 38.05% 55.89% 158.69% 138.18% 32.54% 12.92% 50.73% 51.42% -20.28% 35.98% 19.12% 98.22% 70.80% 0.82% 21.97% 31.53% 20.95% 104.08% 189.46% 19.53% 24.01% 58.38% 23.52% 127.72% 115.95% 78.14% 37.25% 65.22% 137.68% 43.94% 96.85% 15.54% 84.20% 32.92% 56.06% 40.48% 11.16% 26.92% 24.48% 16.90% 10.92% 46.17% 78.80% 17.72% 99.13% 65.78% 73.17% 32.65% 6.24% 33.14% 53.92% 17.01% 21.44% 69.32% 81.06% 21.26% 74.29% 28.06% 48.10% *Missing Annual Financial Reports (used to calculate fund balance percentage) Automatically Fiscally Eligible No Yes Yes Yes No No No No No No No No No No No No No No No Yes Yes Yes No No No Yes No No No No No Yes No No Yes No Yes Yes No No No No No No No No Yes Yes No Yes No No Yes No Yes No No No No No No No Yes No No No No No No No No No No Yes

Name of Municipality 889 890 891 892 893 894 895 897 896 898 899 900 901 902 903 904 905 906 907 908 909 910 911 912 913 914 916 915 917 918 919 920 922 921 923 924 925 926 927 928 929 930 931 932 933 934 935 936 937 939 938 940 941 942 943 944 945 946 947 948 949 950 951 952 953 954 955 956 957 958 959 960 961 962 Middlefield Middleport Middlesex Middletown Middletown Middleville Milan Milford Milford Mill Neck Millbrook Millerton Millport Milo Milton Mina Minden Mineola Minerva Minetto Minisink Minoa Mohawk Mohawk Moira Monroe Monroe Monroe Montague Montebello Montezuma Montgomery Montgomery Montgomery Monticello Montour Montour Falls Mooers Moravia Moravia Moreau Morehouse Moriah Morris Morris Morristown Morristown Morrisville Mount Hope Mount Kisco Mount Kisco4 Mount Morris Mount Morris Mount Pleasant Mount Vernon Munnsville Munsey Park Murray Muttontown Nanticoke Naples Naples Napoli Nassau Nassau Nassau Nelliston Nelson Nelsonville Neversink New Albion New Baltimore New Berlin New Berlin

Class Town Village Town City Town Village Town Village Town Village Village Village Village Town Town Town Town Village Town Town Town Village Town Village Town County Village Town Town Village Town County Village Town Village Town Village Town Town Village Town Town Town Town Village Town Village Village Town Village Town Town Village Town City Village Village Town Village Town Town Village Town County Town Village Village Town Village Town Town Town Town Village

County Otsego Niagara Yates Orange Delaware Herkimer Dutchess Otsego Otsego Nassau Dutchess Dutchess Chemung Yates Saratoga Chautauqua Montgomery Nassau Essex Oswego Orange Onondaga Montgomery Herkimer Franklin Monroe Orange Orange Lewis Rockland Cayuga Montgomery Orange Orange Sullivan Schuyler Schuyler Clinton Cayuga Cayuga Saratoga Hamilton Essex Otsego Otsego St. Lawrence St. Lawrence Madison Orange Westchester Westchester Livingston Livingston Westchester Westchester Madison Nassau Orleans Nassau Broome Ontario Ontario Cattaraugus Nassau Rensselaer Rensselaer Montgomery Madison Putnam Sullivan Cattaraugus Greene Chenango Chenango

2008, 2009, 2010, 2011, 2012

2010, 2011, 2012

2010, 2011, 2012

2008, 2009, 2010, 2011, 2012 2012

2008, 2009, 2010, 2011, 2012

*Data supplied by the Office of the State Comptroller

Fiscal Eligibility Based on Statutory Criteria

Sorted by Name *Average Full Value Property Tax Rates (eligible if above 6.823) 6.32 3.08 3.26 2.85 12.64 0.62 13.99 2.32 3.74 6.84 4.87 6.77 4.37 2.42 1.66 5.01 5.14 11.21 6.00 3.43 11.93 4.14 8.30 5.41 7.73 4.30 2.72 4.03 4.37 5.27 20.22 2.11 3.12 1.06 4.23 2.10 4.82 3.43 11.25 8.00 3.25 2.65 1.80 5.41 2.51 0.49 2.05 0.00 3.69 4.82 3.35 3.10 8.61 12.35 0.96 6.18 2.20 5.05 6.46 11.50 3.27 11.27 7.11 8.85 3.63 5.25 4.04 5.55 6.51 6.13 15.70 3.64 1.48 1.37 14 of 22 *Missing Tax Levy Data (used to calculate full value tax rates) *Average Fund Balance Percentages (eligible if below 5%) 34.30% 27.66% 6.95% 29.04% 83.74% 78.16% 16.00% 12.27% 51.08% 147.80% 37.97% 7.23% 52.09% 0.56% 13.20% 17.38% 27.41% 70.95% 82.61% 6.14% 33.95% 26.39% 33.75% 13.91% 69.19% 73.65% 66.13% 9.12% 23.49% 19.91% 62.34% 141.11% 127.58% 10.93% 1.93% 50.85% 14.93% 16.11% 79.06% 83.64% 78.84% 63.94% 2.13% 116.24% 97.38% 20.16% 312.04% 146.29% 96.84% 18.01% 19.61% 17.88% 123.00% 141.69% 67.82% 39.70% 19.15% 216.03% 35.97% 39.17% 53.92% 1.57% 38.54% 139.95% 48.76% 67.06% 89.90% 35.85% 61.59% 22.53% 3.47% *Missing Annual Financial Reports (used to calculate fund balance percentage) Automatically Fiscally Eligible No No No No Yes No Yes No No Yes No No No No Yes No No Yes No No Yes No Yes No Yes No No No No No Yes No No No No Yes No No Yes Yes No No No Yes No No No No No No No No Yes Yes No No No No No Yes No Yes Yes Yes Yes No No No No No Yes No No Yes

Name of Municipality 963 964 965 966 967 968 969 970 971 972 974 973 975 976 977 978 979 980 982 981 983 984 985 986 987 989 988 990 992 991 993 995 994 996 997 998 999 1000 1002 1001 1003 1004 1005 1006 1007 1008 1009 1010 1011 1012 1013 1014 1015 1016 1017 1018 1019 1020 1021 1022 1023 1024 1025 1026 1027 1028 1029 1030 1031 1032 1033 1034 1035 1036 New Bremen New Castle New Hartford New Hartford New Haven New Hempstead New Hudson New Hyde Park New Lebanon New Lisbon New Paltz New Paltz New Rochelle New Scotland New Square New Windsor New York Mills Newark Newark Valley Newark Valley Newburgh Newburgh Newcomb Newfane Newfield Newport Newport Newstead Niagara Niagara Niagara Falls Nichols Nichols Niles Niskayuna Nissequogue Norfolk North Castle North Collins North Collins North Dansville North East North Elba North Greenbush North Harmony North Haven North Hempstead North Hills North Hornell North Hudson North Norwich North Salem North Syracuse North Tonawanda Northampton Northport Northumberland Northville Norway Norwich Norwich Norwood Nunda Nunda Nyack Oakfield Oakfield Ocean Beach Odessa Ogden Ogdensburg Ohio Old Brookville Old Field

Class Town Town Town Village Town Village Town Village Town Town Village Town City Town Village Town Village Village Village Town City Town Town Town Town Village Town Town Town County City Village Town Town Town Village Town Town Village Town Town Town Town Town Town Village Town Village Village Town Town Town Village City Town Village Town Village Town City Town Village Town Village Village Town Village Village Village Town City Town Village Village

County Lewis Westchester Oneida Oneida Oswego Rockland Allegany Nassau Columbia Otsego Ulster Ulster Westchester Albany Rockland Orange Oneida Wayne Tioga Tioga Orange Orange Essex Niagara Tompkins Herkimer Herkimer Erie Niagara Niagara Niagara Tioga Tioga Cayuga Schenectady Suffolk St. Lawrence Westchester Erie Erie Livingston Dutchess Essex Rensselaer Chautauqua Suffolk Nassau Nassau Steuben Essex Chenango Westchester Onondaga Niagara Fulton Suffolk Saratoga Fulton Herkimer Chenango Chenango St. Lawrence Livingston Livingston Rockland Genesee Genesee Suffolk Schuyler Monroe St. Lawrence Herkimer Nassau Suffolk

2012

2012

2012

*Data supplied by the Office of the State Comptroller

Fiscal Eligibility Based on Statutory Criteria

Sorted by Name *Average Full Value Property Tax Rates (eligible if above 6.823) 3.38 13.83 3.74 2.68 3.92 5.49 0.59 8.60 3.04 4.12 5.72 3.38 3.60 6.97 1.65 7.77 5.56 9.19 4.84 1.71 9.28 6.47 4.59 0.55 3.61 9.24 10.58 1.92 8.38 2.86 8.93 4.67 2.77 3.35 4.02 5.95 5.41 1.38 0.49 5.02 12.24 8.29 6.09 3.12 13.43 2.38 3.94 14.20 3.01 2.85 15.02 2.45 3.69 6.97 11.79 5.65 1.24 2.57 4.81 6.60 4.52 3.63 2.73 4.30 6.16 1.20 2.48 4.47 6.82 6.16 0.50 5.96 0.75 3.00 15 of 22 *Missing Tax Levy Data (used to calculate full value tax rates) *Average Fund Balance Percentages (eligible if below 5%) 66.47% 19.15% 111.14% 64.56% 8.00% 43.45% 21.31% 74.22% 130.56% 11.41% 189.29% 37.00% 98.98% 31.72% 58.49% 76.22% 90.55% 207.27% 33.72% 66.91% 17.26% 211.29% 105.09% 76.09% 92.17% 16.68% 22.19% 76.70% 13.14% 34.68% 63.74% 10.21% 119.41% 84.15% 13.72% 26.30% 146.74% 235.60% 22.24% 64.14% 69.03% 52.97% 16.96% 130.68% 53.92% 4.53% 35.67% 25.65% 136.66% 79.56% 77.41% 21.52% 80.72% 226.50% 20.14% 100.47% 11.71% 75.81% 61.63% 27.66% 36.10% 35.27% 212.42% 15.38% 15.56% 27.39% 8.82% 26.14% 20.95% 258.66% 162.95% *Missing Annual Financial Reports (used to calculate fund balance percentage) Automatically Fiscally Eligible No Yes No No No No No Yes No No No No No No No No No Yes No No Yes No No No No Yes Yes No Yes No Yes No No No No No No No No No Yes Yes No No Yes No No Yes Yes No Yes No No Yes Yes No No No No No No No No No No No No No No No No No No No

Name of Municipality 1037 1038 1039 1040 1041 1042 1043 1044 1045 1046 1047 1048 1049 1050 1051 1052 1053 1054 1055 1056 1057 1058 1059 1060 1061 1062 1063 1064 1065 1066 1068 1067 1069 1071 1070 1072 1073 1074 1075 1076 1077 1079 1078 1080 1082 1081 1083 1084 1085 1086 1087 1088 1089 1090 1092 1091 1093 1094 1095 1096 1097 1098 1099 1100 1101 1102 1103 1104 1105 1107 1106 1108 1109 1110 Old Westbury Olean Olean Olive Oneida Oneida Oneida Castle Oneonta Oneonta Onondaga Onondaga Ontario Ontario Oppenheim Orange Orange Orangetown Orangeville Orchard Park Orchard Park Oriskany Oriskany Falls Orleans Orleans Orwell Osceola Ossian Ossining Ossining Oswegatchie Oswego Oswego Oswego Otego Otego Otisco Otisville Otsego Otsego Otselic Otto Ovid Ovid Owasco Owego Owego Oxford Oxford Oyster Bay Oyster Bay Cove Painted Post Palatine Palatine Bridge Palermo Palmyra Palmyra Pamelia Panama Paris Parish Parish Parishville Parma Patchogue Patterson Pavilion Pawling Pawling Peekskill Pelham Pelham Pelham Manor Pembroke Pendleton

Class Village City Town Town County City Village City Town County Town County Town Town County Town Town Town Town Village Village Village County Town Town Town Town Town Village Town City County Town Village Town Town Village County Town Town Town Village Town Town Village Town Town Village Town Village Village Town Village Town Village Town Town Village Town Town Village Town Town Village Town Town Town Village City Village Town Village Town Town

County Nassau Cattaraugus Cattaraugus Ulster Oneida Madison Oneida Otsego Otsego Onondaga Onondaga Ontario Wayne Fulton Orange Schuyler Rockland Wyoming Erie Erie Oneida Oneida Orleans Jefferson Oswego Lewis Livingston Westchester Westchester St. Lawrence Oswego Oswego Oswego Otsego Otsego Onondaga Orange Otsego Otsego Chenango Cattaraugus Seneca Seneca Cayuga Tioga Tioga Chenango Chenango Nassau Nassau Steuben Montgomery Montgomery Oswego Wayne Wayne Jefferson Chautauqua Oneida Oswego Oswego St. Lawrence Monroe Suffolk Putnam Genesee Dutchess Dutchess Westchester Westchester Westchester Westchester Genesee Niagara

2012 2008, 2009,

2012

*Data supplied by the Office of the State Comptroller

Fiscal Eligibility Based on Statutory Criteria

Sorted by Name *Average Full Value Property Tax Rates (eligible if above 6.823) 3.72 14.05 2.94 15.69 6.25 7.94 3.24 2.48 5.21 4.28 1.80 5.63 2.32 6.37 5.80 2.67 6.83 11.32 2.34 5.76 5.00 10.62 9.41 3.44 4.08 5.85 4.63 2.28 3.16 5.03 6.45 3.50 1.12 3.14 2.63 10.23 2.09 6.21 6.53 3.60 3.84 4.86 1.51 1.75 3.69 1.05 8.81 7.42 5.70 9.40 1.26 8.08 11.41 1.26 13.44 1.78 3.93 4.01 8.79 16.17 2.95 11.36 6.51 7.83 2.08 8.08 7.47 1.23 5.88 2.27 2.90 3.90 5.45 *Missing Tax Levy Data (used to calculate full value tax rates) *Average Fund Balance Percentages (eligible if below 5%) 26.36% 38.13% 61.62% 60.57% 163.02% 100.12% 54.21% 59.25% 83.03% 29.13% 103.30% 116.97% 80.26% 242.06% 1.04% 67.03% 61.21% 36.48% 11.32% 35.89% 106.86% 56.08% 70.03% 134.17% 13.99% 147.40% 60.08% 182.01% 179.50% 17.66% 56.72% 49.15% 71.37% 23.72% 26.66% 40.89% 26.49% 253.54% 82.08% 27.37% 81.64% 19.07% 39.26% 68.33% 47.72% 109.81% 24.66% 40.26% 57.90% 7.14% 21.93% 49.82% 61.67% 27.93% 41.71% 130.92% 74.93% 92.19% 25.10% 246.09% 76.35% -12.47% -10.33% 53.64% 87.42% 145.71% 235.23% 174.95% 48.55% 14.37% 55.37% 16.39% *Missing Annual Financial Reports (used to calculate fund balance percentage) Automatically Fiscally Eligible No Yes No Yes No Yes No No No No No No No No No Yes Yes Yes No No No Yes Yes No No No No No No No No No No No No No Yes No No No No No No No No No No Yes Yes No Yes No Yes Yes No Yes No No No Yes Yes No Yes Yes Yes No Yes Yes No No No No No No

Name of Municipality 1111 1112 1113 1115 1114 1116 1117 1118 1119 1120 1121 1123 1122 1124 1125 1126 1127 1128 1129 1130 1131 1132 1133 1134 1135 1136 1137 1139 1138 1140 1141 1142 1143 1144 1145 1147 1146 1148 1149 1150 1151 1153 1152 1154 1155 1156 1157 1158 1159 1160 1161 1162 1163 1164 1165 1166 1167 1168 1169 1170 1172 1171 1173 1175 1174 1176 1177 1178 1179 1180 1181 1182 1183 1184 Penfield Penn Yan Perinton Perry Perry Perrysburg Persia Perth Peru Petersburgh Pharsalia Phelps Phelps Philadelphia Philadelphia Philipstown Philmont Phoenix Piercefield Piermont Pierrepont Pike Pinckney Pine Plains Pitcairn Pitcher Pittsfield Pittsford Pittsford Pittstown Plainfield Plandome Plandome Heights Plandome Manor Plattekill Plattsburgh Plattsburgh Pleasant Valley Pleasantville Plymouth Poestenkill Poland Poland Pomfret Pomona Pompey Poquott Port Byron Port Chester Port Dickinson Port Henry Port Jefferson Port Jervis Port Leyden Port Washington North Portage Porter Portland Portville Portville Potsdam Potsdam Potter Poughkeepsie Poughkeepsie Pound Ridge Prattsburgh Prattsville Preble Preston Princetown Prospect Providence Pulaski

Class Town Village Town Village Town Town Town Town Town Town Town Village Town Town Village Town Village Village Town Village Town Town Town Town Town Town Town Village Town Town Town Village Village Village Town Town City Town Village Town Town Village Town Town Village Town Village Village Village Village Village Village City Village Village Town Town Town Town Village Village Town Town Town City Town Town Town Town Town Town Village Town Village

County Monroe Yates Monroe Wyoming Wyoming Cattaraugus Cattaraugus Fulton Clinton Rensselaer Chenango Ontario Ontario Jefferson Jefferson Putnam Columbia Oswego St. Lawrence Rockland St. Lawrence Wyoming Lewis Dutchess St. Lawrence Chenango Otsego Monroe Monroe Rensselaer Otsego Nassau Nassau Nassau Ulster Clinton Clinton Dutchess Westchester Chenango Rensselaer Herkimer Chautauqua Chautauqua Rockland Onondaga Suffolk Cayuga Westchester Broome Essex Suffolk Orange Lewis Nassau Livingston Niagara Chautauqua Cattaraugus Cattaraugus St. Lawrence St. Lawrence Yates Dutchess Dutchess Westchester Steuben Greene Cortland Chenango Schenectady Oneida Saratoga Oswego

2010, 2011, 2012

2008, 2009, 2010, 2011, 2012

2010, 2011, 2012

*Data supplied by the Office of the State Comptroller

16 of 22

Fiscal Eligibility Based on Statutory Criteria

Sorted by Name *Average Full Value Property Tax Rates (eligible if above 6.823) 3.33 1.20 3.13 4.73 2.02 1.71 4.79 8.40 8.29 4.58 3.72 9.86 4.62 1.93 0.41 9.21 3.49 2.24 3.41 13.42 3.95 5.01 1.65 3.55 10.41 3.29 10.19 8.21 6.02 1.52 5.59 6.07 5.82 5.45 1.62 8.35 7.36 8.06 2.28 1.39 5.19 4.58 1.43 13.18 6.29 2.68 8.36 3.55 4.95 5.18 1.73 1.35 8.14 4.77 4.77 3.94 5.96 7.53 4.49 9.09 7.59 11.56 2.95 3.35 2.64 0.07 2.85 4.49 3.74 1.36 2.55 0.08 10.88 *Missing Tax Levy Data (used to calculate full value tax rates) *Average Fund Balance Percentages (eligible if below 5%) 19.85% 22.18% 22.43% 16.21% 48.61% 32.03% 7.95% 25.14% 44.35% 28.32% 50.68% -4.56% 24.18% 213.55% 52.41% 105.22% 112.56% 5.84% 13.27% 104.16% 45.17% 47.58% 163.67% 63.61% 53.47% 68.13% 29.14% 71.59% 159.46% 54.42% 71.36% 185.36% 70.40% 29.95% 1090.82% 12.93% 64.12% -1.86% 39.85% 6.96% 55.06% 40.95% 222.36% 117.45% 120.01% 9.28% 5.25% 22.16% 42.34% 37.12% 44.70% 53.27% 33.02% 53.54% 32.86% 68.25% 124.40% 53.22% 23.51% 112.33% 44.64% 34.29% 24.25% 22.92% 33.15% 34.26% 161.21% 33.08% 17 of 22 *Missing Annual Financial Reports (used to calculate fund balance percentage) Automatically Fiscally Eligible No No No No No No No No Yes No No Yes Yes No No Yes No No No Yes No No No No Yes No Yes No No No No No No No No Yes Yes No Yes No Yes No No No No No No Yes No No No No No No No No No No Yes No Yes Yes Yes No No No No No No No No No No Yes

Name of Municipality 1185 1186 1187 1188 1189 1190 1191 1192 1193 1194 1195 1196 1198 1197 1199 1200 1202 1201 1203 1204 1205 1206 1207 1208 1209 1210 1211 1212 1213 1214 1216 1215 1217 1218 1219 1220 1221 1222 1223 1224 1225 1226 1227 1228 1229 1230 1231 1232 1233 1234 1235 1236 1237 1238 1239 1240 1241 1242 1243 1244 1245 1246 1247 1248 1249 1250 1252 1251 1253 1254 1255 1256 1257 1258 Pulteney Putnam Putnam Putnam Valley Queensbury Quogue Ramapo Randolph Rathbone Ravena Reading Red Creek Red Hook Red Hook Red House Redfield Remsen Remsen Rensselaer Rensselaer Rensselaer Falls Rensselaerville Rhinebeck Rhinebeck Richburg Richfield Richfield Springs Richford Richland Richmond Richmondville Richmondville Richville Ridgeway Riga Ripley Riverhead Riverside Rochester Rochester Rockland Rockland Rockville Centre Rodman Rome Romulus Root Rose Roseboom Rosendale Roslyn Roslyn Estates Roslyn Harbor Rossie Rotterdam Round Lake Rouses Point Roxbury Royalton Rush Rushford Rushville Russell Russell Gardens Russia Rutland Rye Rye Rye Brook Sackets Harbor Saddle Rock Sag Harbor Sagaponack Salamanca

Class Town County Town Town Town Village Town Town Town Village Town Village Village Town Town Town Village Town County City Village Town Town Village Village Town Village Town Town Town Village Town Village Town Town Town Town Village City Town County Town Village Town City Town Town Town Town Town Village Village Village Town Town Village Village Town Town Town Town Village Town Village Town Town Town City Village Village Village Village Village City

County Steuben Putnam Washington Putnam Warren Suffolk Rockland Cattaraugus Steuben Albany Schuyler Wayne Dutchess Dutchess Cattaraugus Oswego Oneida Oneida Rensselaer Rensselaer St. Lawrence Albany Dutchess Dutchess Allegany Otsego Otsego Tioga Oswego Ontario Schoharie Schoharie St. Lawrence Orleans Monroe Chautauqua Suffolk Steuben Monroe Ulster Rockland Sullivan Nassau Jefferson Oneida Seneca Montgomery Wayne Otsego Ulster Nassau Nassau Nassau St. Lawrence Schenectady Saratoga Clinton Delaware Niagara Monroe Allegany Ontario St. Lawrence Nassau Herkimer Jefferson Westchester Westchester Westchester Jefferson Nassau Suffolk Suffolk Cattaraugus

2012

2011, 2012

2012

2012

2012

2011, 2012

2012

*Data supplied by the Office of the State Comptroller

Fiscal Eligibility Based on Statutory Criteria

Sorted by Name *Average Full Value Property Tax Rates (eligible if above 6.823) 5.90 4.54 3.10 7.06 3.02 3.90 2.37 3.06 4.00 5.71 4.72 3.46 1.73 6.27 10.69 1.48 1.68 4.64 0.53 5.00 6.48 6.52 8.03 3.51 0.00 3.91 3.40 3.64 13.32 4.89 3.94 3.08 4.12 4.96 3.09 4.15 4.55 4.28 6.81 11.07 2.12 9.48 3.86 4.93 3.72 3.91 3.45 0.10 2.92 2.04 2.53 5.72 4.32 5.90 3.57 6.00 3.47 2.05 5.66 6.36 3.56 5.94 10.08 5.18 3.81 7.59 13.10 3.91 15.65 8.31 8.93 3.25 2.65 *Missing Tax Levy Data (used to calculate full value tax rates) *Average Fund Balance Percentages (eligible if below 5%) 66.15% 32.86% 48.95% 23.25% 51.77% 29.24% 98.52% 25.21% 14.60% 31.56% 59.34% 25.23% 130.92% 70.42% 47.41% 8.91% 85.59% 24.56% 260.38% 4.82% 5.69% 176.21% 47.04% 21.39% 85.96% 87.23% 15.81% 21.53% 51.19% 19.35% 62.67% 89.38% 46.84% 30.06% 110.92% 423.31% 53.98% 120.35% 28.26% 106.70% 121.49% 122.86% 32.18% 39.92% 57.25% 215.23% 189.08% 9.97% 344.34% 10.51% 53.25% 87.27% 77.32% 32.54% 55.62% 142.98% 154.99% 59.61% 56.18% 71.93% 177.15% 33.58% 64.38% 43.40% 86.90% 28.99% 25.74% 44.02% 2008, 2009, 2010, 2011, 2012 *Missing Annual Financial Reports (used to calculate fund balance percentage) Automatically Fiscally Eligible No No No Yes No No No No No No No No No No Yes No No No No Yes No No Yes No No No No No Yes No No No No No No No No No No No No Yes No No No No No No No No No No No No No No No No No No No No No No No No Yes Yes No Yes Yes Yes No No

Name of Municipality 1259 1261 1260 1262 1263 1264 1265 1266 1268 1267 1269 1270 1271 1272 1273 1274 1275 1276 1277 1278 1279 1280 1281 1283 1282 1284 1285 1286 1287 1288 1289 1290 1291 1292 1293 1294 1295 1296 1297 1298 1299 1300 1301 1302 1303 1304 1305 1307 1306 1308 1309 1310 1311 1312 1313 1314 1315 1316 1317 1319 1318 1320 1321 1322 1323 1324 1325 1327 1326 1328 1329 1330 1332 1331 Salamanca Salem Salem Salina Salisbury Saltaire Sand Lake Sands Point Sandy Creek Sandy Creek Sanford Sangerfield Santa Clara Saranac Saranac Lake Saratoga Saratoga Saratoga Springs Sardinia Saugerties Saugerties Savannah Savona Scarsdale Scarsdale4 Schaghticoke Schaghticoke Schenectady Schenectady Schodack Schoharie Schoharie Schoharie Schroeppel Schroon Schuyler Schuyler Schuyler Falls Schuylerville Scio Scipio Scotia Scott Scottsville Scriba Sea Cliff Sempronius Seneca Seneca Seneca Falls Sennett Seward Shandaken Sharon Sharon Springs Shawangunk Shelby Sheldon Shelter Island Sherburne Sherburne Sheridan Sherman Sherman Sherrill Shoreham Shortsville Sidney Sidney Silver Creek Silver Springs Sinclairville Skaneateles Skaneateles

Class Town Village Town Town Town Village Town Village Village Town Town Town Town Town Village County Town City Town Town Village Town Village Village Town Town Village County City Town County Town Village Town Town County Town Town Village Town Town Village Town Village Town Village Town Town County Town Town Town Town Town Village Town Town Town Town Village Town Town Town Village City Village Village Village Town Village Village Village Village Town

County Cattaraugus Washington Washington Onondaga Herkimer Suffolk Rensselaer Nassau Oswego Oswego Broome Oneida Franklin Clinton Franklin Saratoga Saratoga Saratoga Erie Ulster Ulster Wayne Steuben Westchester Westchester Rensselaer Rensselaer Schenectady Schenectady Rensselaer Schoharie Schoharie Schoharie Oswego Essex Schuyler Herkimer Clinton Saratoga Allegany Cayuga Schenectady Cortland Monroe Oswego Nassau Cayuga Ontario Seneca Seneca Cayuga Schoharie Ulster Schoharie Schoharie Ulster Orleans Wyoming Suffolk Chenango Chenango Chautauqua Chautauqua Chautauqua Oneida Suffolk Ontario Delaware Delaware Chautauqua Wyoming Chautauqua Onondaga Onondaga

2012

2012

2012

2012

2008, 2009, 2010, 2011, 2012

2011, 2012

*Data supplied by the Office of the State Comptroller

18 of 22

Fiscal Eligibility Based on Statutory Criteria

Sorted by Name *Average Full Value Property Tax Rates (eligible if above 6.823) 7.96 10.15 4.36 5.76 3.76 5.69 4.54 5.51 3.60 10.36 4.25 8.40 11.42 1.50 6.39 1.58 1.08 4.83 10.49 1.51 4.87 6.18 2.66 1.45 1.12 2.10 2.92 2.56 2.68 6.93 5.49 5.32 3.12 3.35 14.39 2.17 3.06 7.32 7.66 4.46 2.79 15.44 4.50 2.09 3.83 6.31 1.92 5.67 4.45 2.48 3.29 6.53 4.15 3.57 2.68 2.98 5.44 4.79 3.69 6.06 5.26 6.46 4.50 1.73 7.02 1.18 2.72 4.23 6.45 4.41 4.50 4.24 7.03 2.52 19 of 22 *Missing Tax Levy Data (used to calculate full value tax rates) *Average Fund Balance Percentages (eligible if below 5%) 38.75% 15.18% 35.45% 40.94% 129.85% 58.70% 50.73% 101.00% 76.92% 16.48% 0.31% 34.45% 243.44% 30.55% 96.12% 23.59% 34.31% 17.60% 22.42% 31.02% 95.82% 25.49% 34.23% 10.47% 22.48% 126.15% 87.94% 80.28% 45.02% 37.94% 77.63% 101.31% 26.41% 146.70% 268.47% 38.90% 70.38% 42.09% 58.72% 4.68% 61.95% 37.67% 40.05% 155.02% 39.83% 174.79% 53.47% 122.72% 22.21% 43.44% 25.43% 20.80% 49.51% 35.51% 56.31% 71.41% 81.01% 77.52% 32.84% 158.09% 76.58% 2.87% -5.96% 14.80% 48.03% 22.08% 43.61% 37.16% 35.14% 24.04% 71.67% *Missing Annual Financial Reports (used to calculate fund balance percentage) 2011, 2012 Automatically Fiscally Eligible No Yes No No No No No No No Yes No Yes Yes No No No No No Yes No No No No No No No No No No Yes No No No No Yes No No Yes Yes No No No Yes No No No No No No No No No No No No No No No No No No No No No Yes Yes No No No No No No Yes No

Name of Municipality 1333 1334 1335 1336 1337 1338 1340 1339 1341 1342 1343 1344 1345 1346 1347 1348 1349 1350 1351 1352 1353 1354 1355 1357 1356 1358 1359 1360 1361 1362 1363 1364 1365 1366 1367 1368 1369 1370 1371 1372 1373 1374 1375 1376 1377 1378 1379 1380 1381 1382 1383 1385 1384 1386 1387 1388 1389 1390 1391 1392 1393 1394 1395 1396 1397 1398 1399 1400 1401 1402 1403 1404 1405 1406 Sleepy Hollow Sloan Sloatsburg Smithfield Smithtown Smithville Smyrna Smyrna Sodus Sodus Sodus Point Solon Solvay Somers Somerset South Blooming Grove South Bristol South Corning South Dayton South Floral Park South Glens Falls South Nyack South Valley Southampton Southampton Southeast Southold Southport Spafford Sparta Speculator Spencer Spencer Spencerport Spring Valley Springfield Springport Springville Springwater St. Armand St. Johnsville St. Johnsville St. Lawrence Stafford Stamford Stamford Stanford Stark Starkey Stephentown Sterling Steuben Steuben Stewart Manor Stillwater Stillwater Stockbridge Stockholm Stockport Stockton Stony Creek Stony Point Stratford Stuyvesant Suffern Suffolk Sullivan Sullivan Summer Hill Summit Sweden Sylvan Beach Syracuse Taghkanic

Class Village Village Village Town Town Town Village Town Town Village Village Town Village Town Town Village Town Village Village Village Village Village Town Village Town Town Town Town Town Town Village Town Village Village Village Town Town Village Town Town Town Village County Town Town Village Town Town Town Town Town Town County Village Town Village Town Town Town Town Town Town Town Town Village County County Town Town Town Town Village City Town

County Westchester Erie Rockland Madison Suffolk Chenango Chenango Chenango Wayne Wayne Wayne Cortland Onondaga Westchester Niagara Orange Ontario Steuben Cattaraugus Nassau Saratoga Rockland Cattaraugus Suffolk Suffolk Putnam Suffolk Chemung Onondaga Livingston Hamilton Tioga Tioga Monroe Rockland Otsego Cayuga Erie Livingston Essex Montgomery Montgomery St. Lawrence Genesee Delaware Delaware Dutchess Herkimer Yates Rensselaer Cayuga Oneida Steuben Nassau Saratoga Saratoga Madison St. Lawrence Columbia Chautauqua Warren Rockland Fulton Columbia Rockland Suffolk Sullivan Madison Cayuga Schoharie Monroe Oneida Onondaga Columbia

2010, 2011, 2012

2012

*Data supplied by the Office of the State Comptroller

Fiscal Eligibility Based on Statutory Criteria

Sorted by Name *Average Full Value Property Tax Rates (eligible if above 6.823) 2.94 6.90 10.35 1.19 4.81 2.18 3.29 3.24 3.85 8.23 6.71 4.21 3.38 3.20 3.49 4.34 15.85 11.82 3.98 1.72 3.70 6.50 10.39 5.72 5.80 6.10 4.85 5.90 3.33 8.90 5.76 6.45 6.33 4.22 5.23 9.95 3.91 2.01 7.04 2.47 6.64 3.32 3.44 3.56 1.72 4.43 1.75 2.37 4.70 15.15 2.69 1.88 5.03 6.11 2.49 6.85 4.33 5.64 0.64 4.64 2.63 5.19 2.07 1.50 4.41 7.42 3.19 1.04 8.75 3.69 5.49 1.01 *Missing Tax Levy Data (used to calculate full value tax rates) *Average Fund Balance Percentages (eligible if below 5%) 13.13% 21.51% 165.50% 39.71% 84.80% 45.42% 122.97% 159.30% 125.79% 17.94% 19.78% 100.35% 18.20% 14.87% 45.38% 23.93% 29.35% 50.61% 51.87% 143.84% 54.11% 23.70% 67.53% 120.50% 7.21% 17.19% 41.61% 27.78% 13.36% 68.54% 80.97% 56.66% 117.45% 10.46% 25.85% 87.65% 26.99% 15.27% 67.95% 17.30% 61.30% 47.14% 61.68% 20.48% 31.64% 10.51% 141.83% 5.20% 39.27% 39.88% 36.38% 73.75% 60.63% 154.99% 19.62% 58.16% 82.58% 167.59% 41.34% 103.88% 54.14% 106.55% 129.90% 29.05% 47.20% 35.55% 54.72% 81.01% 103.39% *Missing Annual Financial Reports (used to calculate fund balance percentage) Automatically Fiscally Eligible No Yes Yes No No No No No No Yes No No No No No No Yes Yes No No No No Yes No No No No No No No Yes No No No No No Yes No No No No No No No No No No No No No Yes No No No No No Yes No No No No No No No No No Yes No No No Yes No No No

Name of Municipality 1407 1408 1409 1410 1411 1412 1413 1414 1415 1416 1417 1418 1419 1420 1421 1422 1423 1424 1425 1426 1427 1428 1429 1430 1431 1432 1434 1433 1435 1436 1437 1438 1439 1440 1441 1442 1443 1444 1445 1446 1447 1449 1448 1450 1451 1452 1453 1454 1455 1456 1457 1458 1459 1460 1461 1463 1462 1464 1465 1466 1467 1468 1469 1470 1471 1472 1473 1474 1475 1476 1477 1478 1479 1480 Tannersville Tarrytown Taylor Theresa Theresa Thomaston Thompson Throop Thurman Thurston Ticonderoga Tioga Tioga Tivoli Tompkins Tompkins Tonawanda Tonawanda Torrey Trenton Triangle Troupsburg Troy Trumansburg Truxton Tuckahoe Tully Tully Tupper Lake Tupper Lake Turin Turin Tuscarora Tusten Tuxedo Tuxedo Park Tyre Tyrone Ulster Ulster Ulysses Unadilla Unadilla Union Union Springs Union Vale Unionville Upper Brookville Upper Nyack Urbana Utica Valatie Valley Falls Valley Stream Van Buren Van Etten Van Etten Varick Venice Vernon Vernon Verona Vestal Veteran Victor Victor Victory Victory Vienna Village of The Branch Villenova Virgil Volney Voorheesville

Class Village Village Town Town Village Village Town Town Town Town Town County Town Village County Town City Town Town Town Town Town City Village Town Village Village Town Town Village Town Village Town Town Town Village Town Town County Town Town Village Town Town Village Town Village Village Village Town City Village Village Village Town Village Town Town Town Town Village Town Town Town Town Village Town Village Town Village Town Town Town Village

County Greene Westchester Cortland Jefferson Jefferson Nassau Sullivan Cayuga Warren Steuben Essex Tioga Tioga Dutchess Tompkins Delaware Erie Erie Yates Oneida Broome Steuben Rensselaer Tompkins Cortland Westchester Onondaga Onondaga Franklin Franklin Lewis Lewis Steuben Sullivan Orange Orange Seneca Schuyler Ulster Ulster Tompkins Otsego Otsego Broome Cayuga Dutchess Orange Nassau Rockland Steuben Oneida Columbia Rensselaer Nassau Onondaga Chemung Chemung Seneca Cayuga Oneida Oneida Oneida Broome Chemung Ontario Ontario Cayuga Saratoga Oneida Suffolk Chautauqua Cortland Oswego Albany

2012

2008, 2009, 2010, 2011, 2012

2012

2009, 2010, 2011, 2012

2009, 2010, 2011, 2012

2008, 2009, 2010, 2011, 2012

2012

*Data supplied by the Office of the State Comptroller

20 of 22

Fiscal Eligibility Based on Statutory Criteria

Sorted by Name *Average Full Value Property Tax Rates (eligible if above 6.823) 3.54 2.73 8.16 2.24 4.08 3.55 4.31 4.55 2.43 6.81 11.94 1.67 5.41 3.48 12.32 4.96 3.94 2.29 2.95 1.35 4.18 4.20 5.46 16.78 4.56 7.01 0.88 6.83 9.85 8.94 5.54 10.20 11.59 5.27 2.27 5.81 5.27 3.96 2.46 1.84 4.74 1.58 5.41 4.33 4.70 18.98 6.50 1.28 5.10 3.12 6.77 1.94 5.26 6.38 11.15 9.98 4.92 10.09 5.93 2.53 2.33 3.17 4.32 7.89 2.79 4.99 2.45 0.13 3.79 6.81 2.62 3.29 5.59 *Missing Tax Levy Data (used to calculate full value tax rates) *Average Fund Balance Percentages (eligible if below 5%) 60.75% 96.76% 3.81% 300.20% 14.47% 119.54% 67.84% -6.29% 9.53% 35.17% 9.62% 28.92% 6.96% 107.84% 16.19% 30.55% 17.22% 54.06% 9.14% 16.33% 35.70% 101.59% 33.48% 93.35% 44.02% 9.50% 82.36% 48.53% 10.98% 29.80% 40.40% 163.90% 31.88% 44.37% 59.44% 87.30% 61.30% 23.43% 59.06% 135.79% 47.03% 118.36% 28.85% 122.13% 33.23% 108.49% 88.87% 77.27% 18.22% 14.10% 22.97% 111.40% 55.58% 120.84% 52.25% 18.66% 9.22% 28.17% 81.56% 25.61% 127.34% 61.70% 13.16% 111.76% 72.74% 37.20% 341.17% 19.83% 68.90% 21 of 22 *Missing Annual Financial Reports (used to calculate fund balance percentage) Automatically Fiscally Eligible No No Yes No No No No No No Yes No Yes No No No Yes No No No No No No No No Yes No Yes No Yes Yes Yes No Yes Yes No No No No No No No No No No No No Yes No No No No No No No No Yes Yes No Yes No No No No No Yes No No No No No No No No No

Name of Municipality 1482 1481 1483 1484 1485 1486 1487 1488 1489 1490 1491 1492 1493 1494 1495 1497 1496 1499 1498 1500 1501 1502 1504 1503 1506 1505 1507 1508 1509 1510 1511 1512 1513 1514 1515 1516 1518 1517 1519 1520 1521 1522 1523 1524 1525 1526 1528 1527 1529 1530 1531 1532 1533 1534 1535 1536 1537 1538 1539 1540 1541 1542 1543 1544 1546 1545 1547 1548 1549 1550 1551 1552 1553 1554 Waddington Waddington Walden Wales Wallkill Walton Walton Walworth Wampsville Wappinger Wappingers Falls Ward Warren Warren Warrensburg Warsaw Warsaw Warwick Warwick Washington Washington Washingtonville Waterford Waterford Waterloo Waterloo Watertown Watertown Waterville Watervliet Watkins Glen Watson Waverly Waverly Wawarsing Wawayanda Wayland Wayland Wayne Wayne Webb Webster Webster Weedsport Wells Wellsburg Wellsville Wellsville Wesley Hills West Almond West Bloomfield West Carthage West Hampton Dunes West Haverstraw West Monroe West Seneca West Sparta West Turin West Union West Winfield Westbury Westchester Westerlo Western Westfield Westfield Westford Westhampton Beach Westmoreland Westport Westville Wethersfield Wheatfield Wheatland

Class Village Town Village Town Town Town Village Town Village Town Village Town County Town Town Village Town Village Town County Town Village Village Town Village Town City Town Village City Village Town Town Village Town Town Village Town County Town Town Town Village Village Town Village Village Town Village Town Town Village Village Village Town Town Town Town Town Village Village County Town Town Village Town Town Village Town Town Town Town Town Town

County St. Lawrence St. Lawrence Orange Erie Orange Delaware Delaware Wayne Madison Dutchess Dutchess Allegany Warren Herkimer Warren Wyoming Wyoming Orange Orange Washington Dutchess Orange Saratoga Saratoga Seneca Seneca Jefferson Jefferson Oneida Albany Schuyler Lewis Franklin Tioga Ulster Orange Steuben Steuben Wayne Steuben Herkimer Monroe Monroe Cayuga Hamilton Chemung Allegany Allegany Rockland Allegany Ontario Jefferson Suffolk Rockland Oswego Erie Livingston Lewis Steuben Herkimer Nassau Westchester Albany Oneida Chautauqua Chautauqua Otsego Suffolk Oneida Essex Franklin Wyoming Niagara Monroe

2012

2011, 2012 2008, 2009, 2010, 2011,

2012

2012

2012