Professional Documents

Culture Documents

Department of Labor: 2004 10 06 17FLSA NA Unearned Vacation

Uploaded by

USA_DepartmentOfLaborOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Department of Labor: 2004 10 06 17FLSA NA Unearned Vacation

Uploaded by

USA_DepartmentOfLaborCopyright:

Available Formats

U.S.

Department of Labor

Employment Standards Administration

Wage and Hour Division

Washington, D.C. 20210

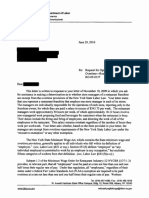

October 6, 2004 FLSA2004-17NA

Dear Name*,

This is in response to your question regarding the application of the Fair Labor Standards Act (FLSA) to

the vacation policy of one of your clients. Under your client’s plan, employees earn paid vacation hours

each pay period. The longer the employee works for the firm, the more vacation hours are earned. The

employer permits employees to take up to two weeks of advanced vacation prior to accruing vacation

hours. An employee who takes vacation prior to accrual incurs a negative leave balance that is reduced

as the employee continues to accrue vacation. If the employee leaves the company before he or she has

accrued sufficient vacation time to correct this negative leave balance, your client deducts the amount of

the unearned vacation time from the employee’s final paycheck. You ask whether this is permissible if the

deduction reduces the employee’s rate of pay below the minimum wage in the final paycheck.

You have identified two sources that you are concerned appear to provide conflicting advice on such a

situation. The Wage and Hour Division (WHD) Opinion Letter No. 834 (10/11/84) that you cite states, in

part, that “[i]t has been our longstanding position that where an employer makes a loan or an advance of

wages to an employee, the principal may be deducted from the employee’s earnings even if such

deduction cuts into the minimum wage or overtime pay due the employee under the FLSA.”

You also cite the BNA Wage and Hour Manual at 91:512, which deems improper employer attempts to

deduct money for losses, such as damage to employer equipment. This, however, may be viewed more

properly as an employer expense of doing business, not as a bona fide employee loan.

The position expressed in the WHD Opinion Letter may be applied to your client’s situation. Employees

have presumably been informed in advance of the unearned vacation time policy: the employer will

deduct from their pay the cost of such vacation time if they leave the company prior to earning sufficient

vacation time to eliminate the vacation deficit. If this is the case, the amount of wages advanced as paid

vacation time falls into the same category as a bona fide loan or cash advance to which the employee

has voluntarily agreed. As such, the employer may deduct the amount advanced for the vacation hours

from the employee’s final paycheck, regardless of whether overtime hours were worked in the final week

or whether the deduction brings the employee’s pay below the applicable minimum wage. See Field

Operations Handbook 30c10; opinion letters dated March 20, 1998 and November 16, 1977 (enclosed).

The employer may not, however, make any assessment for administrative costs or charge any interest

payment that brings the employee below the minimum wage. Moreover, the hourly rate of pay deducted

from the final paycheck must be the rate the employee was paid at the time of the advanced paid

vacation, rather than a higher rate of pay the employee may earn at the time he or she leaves

employment with your client. Please be aware, however, that although such a deduction may be

permissible under the FLSA, there may be state statutes under which such a deduction would not be

permitted.

This opinion is based exclusively on the facts and circumstances described in your request and is given

on the basis of your representation, explicit or implied, that you have provided a full and fair description of

all the facts and circumstances which would be pertinent to our consideration of the question presented.

Existence of any other factual or historical background not contained in your request might require a

different conclusion than the one expressed herein. You have represented that this opinion is not sought

by a party to pending private litigation concerning the issue addressed herein. You have also represented

that this opinion is not sought in connection with an investigation or litigation between a client or firm and

the Wage and Hour Division or the Department of Labor.

Working to Improve the Lives of America's Workers Page 1 of 2

U.S. Department of Labor

Employment Standards Administration

Wage and Hour Division

Washington, D.C. 20210

We trust that the above information is responsive to your inquiry.

Sincerely,

Barbara R. Relerford

Office of Enforcement Policy

Fair Labor Standards Team

Enclosures

* Note: The actual name(s) was removed to preserve privacy in accordance with 5 U.S.C. 552 (b)(7).

Working to Improve the Lives of America's Workers Page 2 of 2

You might also like

- Fact Sheet #17G: Salary Basis Requirement and The Part 541 Exemptions Under The Fair Labor Standards Act (FLSA)Document3 pagesFact Sheet #17G: Salary Basis Requirement and The Part 541 Exemptions Under The Fair Labor Standards Act (FLSA)Benjamin JonesNo ratings yet

- Sample Notice of Claim and Conference - California Labor CommissionerDocument4 pagesSample Notice of Claim and Conference - California Labor CommissioneranthonyzallerNo ratings yet

- 90K Unpaid Wages Order for Kelowna Construction CompanyDocument8 pages90K Unpaid Wages Order for Kelowna Construction CompanyShivani JatakiyaNo ratings yet

- Termination of Employment Letter Template RedundancyDocument4 pagesTermination of Employment Letter Template RedundancyArlene BedayoNo ratings yet

- Termination of Employment Letter Template RedundancyDocument4 pagesTermination of Employment Letter Template RedundancyDorina BarburăNo ratings yet

- Davao Fruits Corporation vs ALUDocument5 pagesDavao Fruits Corporation vs ALUKate DomingoNo ratings yet

- Employment Contract Template CanteensDocument6 pagesEmployment Contract Template CanteensAngeline TacosNo ratings yet

- Issues in Financial Accounting 16th Edition Henderson Solutions ManualDocument27 pagesIssues in Financial Accounting 16th Edition Henderson Solutions Manualcomplinofficialjasms100% (24)

- Local Notices v8 9-20-2018Document13 pagesLocal Notices v8 9-20-2018Katherine EcheverriaNo ratings yet

- Explanation Letter. EspenillaDocument5 pagesExplanation Letter. EspenillaRalph Christian Lusanta FuentesNo ratings yet

- Article - So You Have To Downsize - 2008 - MEGDocument4 pagesArticle - So You Have To Downsize - 2008 - MEGsimmi2768No ratings yet

- How To Compute Separation Pay in The PhilippinesDocument6 pagesHow To Compute Separation Pay in The Philippinesronaldodigma0% (1)

- Legal Memorandum (Labor-Company Loans and Car Plans) PDFDocument8 pagesLegal Memorandum (Labor-Company Loans and Car Plans) PDFRon QuintoNo ratings yet

- Pismo U Prvom Licu TemplateDocument6 pagesPismo U Prvom Licu TemplateIsmar BorcakNo ratings yet

- New California Employment Laws Present More ChallengesDocument3 pagesNew California Employment Laws Present More ChallengesSan Fernando Valley Bar AssociationNo ratings yet

- 50 Questions ReviewerDocument29 pages50 Questions ReviewerAbraham Marco De GuzmanNo ratings yet

- 5 Manggagawa NG Komunikasyon Sa Pilipinas V PLDTDocument4 pages5 Manggagawa NG Komunikasyon Sa Pilipinas V PLDTRebecca LongNo ratings yet

- Deo Madrid - Employment Letter - 2023-01-13Document7 pagesDeo Madrid - Employment Letter - 2023-01-13SlainNo ratings yet

- WEPPA Article - Allan Nackan - Farber Financial Group - REVISED May 2009Document4 pagesWEPPA Article - Allan Nackan - Farber Financial Group - REVISED May 2009anackanNo ratings yet

- Walling v. Harnischfeger Corp., 325 U.S. 427 (1945)Document11 pagesWalling v. Harnischfeger Corp., 325 U.S. 427 (1945)Scribd Government DocsNo ratings yet

- 5.6.a Producers Bank of The Philippines VS NLRCDocument2 pages5.6.a Producers Bank of The Philippines VS NLRCRochelle Othin Odsinada Marqueses100% (2)

- Letter of Engagement Template For Hiring New Employees - Full-Time/part-TimeDocument7 pagesLetter of Engagement Template For Hiring New Employees - Full-Time/part-Timelums770No ratings yet

- On The WHD Website at WWW - Dol.gov/agencies/whd/fmlaDocument4 pagesOn The WHD Website at WWW - Dol.gov/agencies/whd/fmlaknackkayNo ratings yet

- HIGA LOA - Other Than Managerial - FINAL - July 14Document25 pagesHIGA LOA - Other Than Managerial - FINAL - July 14Yejira KionNo ratings yet

- Employment LawDocument11 pagesEmployment LawAdedotun OmonijoNo ratings yet

- Separation PayDocument9 pagesSeparation PaylofrancocaNo ratings yet

- Davao Fruits Corp Vs ALUDocument4 pagesDavao Fruits Corp Vs ALUtengloyNo ratings yet

- Producers Bank vs. NLRC Case DigestDocument2 pagesProducers Bank vs. NLRC Case DigestlamadridrafaelNo ratings yet

- Dominguez & Paderna Law Offices For Petitioners. The Solicitor General For Public RespondentsDocument66 pagesDominguez & Paderna Law Offices For Petitioners. The Solicitor General For Public RespondentsBonito BulanNo ratings yet

- PNB vs. PNB Emplyees AssociationDocument3 pagesPNB vs. PNB Emplyees Associationtalla aldoverNo ratings yet

- Auto Bus Transport Systems Vs BautistaDocument3 pagesAuto Bus Transport Systems Vs BautistaRal CaldiNo ratings yet

- Week 6 Reading Comprehension QuestionsDocument9 pagesWeek 6 Reading Comprehension QuestionsCasey YakabuskiNo ratings yet

- Letter of Engagement Template For Hiring New Employees - Full-Time/part-TimeDocument7 pagesLetter of Engagement Template For Hiring New Employees - Full-Time/part-TimeShoaib AkramNo ratings yet

- Can You Make An Employee Pay For Damage To Company PropertyDocument3 pagesCan You Make An Employee Pay For Damage To Company PropertyCheri HoNo ratings yet

- Employing Casuals.: A Quick Guide For Australian EmployersDocument19 pagesEmploying Casuals.: A Quick Guide For Australian EmployersJoel JamesNo ratings yet

- United States v. Quality Stores, Inc., 134 S. Ct. 1395 (2014)Document18 pagesUnited States v. Quality Stores, Inc., 134 S. Ct. 1395 (2014)Scribd Government DocsNo ratings yet

- Termination of Employment Letter Template RedundancyDocument6 pagesTermination of Employment Letter Template RedundancyBill PaparounisNo ratings yet

- 02 Equitable V SadacDocument38 pages02 Equitable V SadacATRNo ratings yet

- Termination of Employment Letter Template RedundancyDocument7 pagesTermination of Employment Letter Template RedundancyTracy Anne BaybayanNo ratings yet

- Letter of Appointment JobDocument5 pagesLetter of Appointment Jobk_malviyaOO7No ratings yet

- NY Restaurant Manager Overtime ExemptionDocument5 pagesNY Restaurant Manager Overtime Exemptionadfsh-1No ratings yet

- Generic Employment ContractDocument6 pagesGeneric Employment Contractpyrelight83No ratings yet

- Please Sign DocuSign Tandem Diabetes CareDocument64 pagesPlease Sign DocuSign Tandem Diabetes CareMyah SandovalNo ratings yet

- Chartered Bank Employees Association vs. OpleDocument3 pagesChartered Bank Employees Association vs. Oplemichelle zatarainNo ratings yet

- PNB Vs PNB Employees Assn, 115 SCRA 507Document3 pagesPNB Vs PNB Employees Assn, 115 SCRA 507Ronel Jeervee MayoNo ratings yet

- DHANESWAR 3 177315 Appointment LetterDocument7 pagesDHANESWAR 3 177315 Appointment Letterabhishekyadav735No ratings yet

- Payroll Dictionary of Payroll and HR TermsDocument28 pagesPayroll Dictionary of Payroll and HR TermsMarkandeya ChitturiNo ratings yet

- Torio-Sese, Alyssa Joy. Salaries Part1Document3 pagesTorio-Sese, Alyssa Joy. Salaries Part1Alyssa joy TorioNo ratings yet

- The Contents of An Employment ContractDocument6 pagesThe Contents of An Employment ContractAntony MwangiNo ratings yet

- PNB V PEMA - DigestDocument3 pagesPNB V PEMA - DigestClarice Joy SjNo ratings yet

- OfferDocument6 pagesOfferMohd Tufail (ALEX)No ratings yet

- Types of Employee Termination in the PhilippinesDocument10 pagesTypes of Employee Termination in the PhilippinesLhenNo ratings yet

- Stealth Canexpress Logistics - JOB Fraud - Https://stealthcanexpress - Ca - ScamerDocument2 pagesStealth Canexpress Logistics - JOB Fraud - Https://stealthcanexpress - Ca - ScamerLive Influences Digital Marketing AgencyNo ratings yet

- Hawkinge Employment ContractDocument7 pagesHawkinge Employment ContractMadalina Maria MNo ratings yet

- Appointment Letter 1Document14 pagesAppointment Letter 1anskhanNo ratings yet

- FAMILY MEMBER Notice of Eligibility Rights & Resp Template (WH-381 Exp 6.2023)Document4 pagesFAMILY MEMBER Notice of Eligibility Rights & Resp Template (WH-381 Exp 6.2023)Alex DanielNo ratings yet

- 233 - 238Document12 pages233 - 238John Carlo DizonNo ratings yet

- Textbook of Urgent Care Management: Chapter 15, Human Resources Overview: Key Labor and Employment IssuesFrom EverandTextbook of Urgent Care Management: Chapter 15, Human Resources Overview: Key Labor and Employment IssuesNo ratings yet

- Textbook of Urgent Care Management: Chapter 21, Employment Contracts and CompensationFrom EverandTextbook of Urgent Care Management: Chapter 21, Employment Contracts and CompensationNo ratings yet

- The CYA Guide to Payroll and HRThe CYA Guide to Payroll and HRFrom EverandThe CYA Guide to Payroll and HRThe CYA Guide to Payroll and HRNo ratings yet

- Department of Labor: Generalprovision 6 28 07Document6 pagesDepartment of Labor: Generalprovision 6 28 07USA_DepartmentOfLaborNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Department of Labor: Dst-Aces-Cps-V20040617Document121 pagesDepartment of Labor: Dst-Aces-Cps-V20040617USA_DepartmentOfLaborNo ratings yet

- Department of Labor: YouthworkerDocument1 pageDepartment of Labor: YouthworkerUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: Yr English GuideDocument1 pageDepartment of Labor: Yr English GuideUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: Dst-Aces-Cps-V20040123Document121 pagesDepartment of Labor: Dst-Aces-Cps-V20040123USA_DepartmentOfLaborNo ratings yet

- Department of Labor: Aces CPDocument36 pagesDepartment of Labor: Aces CPUSA_DepartmentOfLabor100% (2)

- Department of Labor: Stop2stickerDocument1 pageDepartment of Labor: Stop2stickerUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: BookmarkDocument2 pagesDepartment of Labor: BookmarkUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: Stop1stickerDocument1 pageDepartment of Labor: Stop1stickerUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: Stop2sticker6Document1 pageDepartment of Labor: Stop2sticker6USA_DepartmentOfLaborNo ratings yet

- Department of Labor: YouthRulesBrochureDocument12 pagesDepartment of Labor: YouthRulesBrochureUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: Forkliftsticker6Document1 pageDepartment of Labor: Forkliftsticker6USA_DepartmentOfLaborNo ratings yet

- Department of Labor: Stop1sticker6Document1 pageDepartment of Labor: Stop1sticker6USA_DepartmentOfLaborNo ratings yet

- Department of Labor: ForkliftstickerDocument1 pageDepartment of Labor: ForkliftstickerUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: LindseyDocument1 pageDepartment of Labor: LindseyUSA_DepartmentOfLaborNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Department of Labor: Niosh Recs To Dol 050302Document198 pagesDepartment of Labor: Niosh Recs To Dol 050302USA_DepartmentOfLaborNo ratings yet

- Department of Labor: JYMP 8x11 2Document1 pageDepartment of Labor: JYMP 8x11 2USA_DepartmentOfLaborNo ratings yet

- Department of Labor: Niosh Letter FinalDocument3 pagesDepartment of Labor: Niosh Letter FinalUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: 20040422 YouthrulesDocument1 pageDepartment of Labor: 20040422 YouthrulesUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: JYMP 11x17 3Document1 pageDepartment of Labor: JYMP 11x17 3USA_DepartmentOfLaborNo ratings yet

- Department of Labor: Final ReportDocument37 pagesDepartment of Labor: Final ReportUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: ln61003Document2 pagesDepartment of Labor: ln61003USA_DepartmentOfLaborNo ratings yet

- Department of Labor: KonstaDocument1 pageDepartment of Labor: KonstaUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: YouthConstructDocument1 pageDepartment of Labor: YouthConstructUSA_DepartmentOfLaborNo ratings yet

- Department of Labor: JYMP 8x11 3Document1 pageDepartment of Labor: JYMP 8x11 3USA_DepartmentOfLaborNo ratings yet

- Department of Labor: JYMP 11x17 2Document1 pageDepartment of Labor: JYMP 11x17 2USA_DepartmentOfLaborNo ratings yet

- Department of Labor: JYMP 8x11 1Document1 pageDepartment of Labor: JYMP 8x11 1USA_DepartmentOfLaborNo ratings yet

- Department of Labor: JYMP 11x17 1Document1 pageDepartment of Labor: JYMP 11x17 1USA_DepartmentOfLaborNo ratings yet

- Lamb vs. Phipps, G.R. No. 7806, July 12, 1912Document1 pageLamb vs. Phipps, G.R. No. 7806, July 12, 1912Elaine Belle Ogayon100% (1)

- B B Beach Gives Pope A Gold Medal PDFDocument5 pagesB B Beach Gives Pope A Gold Medal PDFEnrique Bernedo0% (1)

- Python Pour Hackers - BootcampDocument46 pagesPython Pour Hackers - BootcampLorem IpsumNo ratings yet

- The Legend of Incest on a Small Vagrant WorldDocument5 pagesThe Legend of Incest on a Small Vagrant WorldBorisav92No ratings yet

- Suit For Money RecoveryDocument12 pagesSuit For Money RecoveryBHUSARAPU AYYANNANo ratings yet

- Path of The Assassin v04 (Dark Horse)Document298 pagesPath of The Assassin v04 (Dark Horse)Francesco CapelloNo ratings yet

- Undertaking, Release and Quitclaim: FilipinoDocument1 pageUndertaking, Release and Quitclaim: FilipinoFlorante MollenoNo ratings yet

- School Climate QuestionnaireDocument1 pageSchool Climate QuestionnaireAnna-Maria BitereNo ratings yet

- Deepak Wadhwa Vs Aeroflot - CATDocument4 pagesDeepak Wadhwa Vs Aeroflot - CATatifsjc2790No ratings yet

- AMSCO Chapter 26 NotesDocument3 pagesAMSCO Chapter 26 NotesMelissa Nunez92% (13)

- Highlights From Pope Francis' Remarks at The United NationsDocument3 pagesHighlights From Pope Francis' Remarks at The United NationsSteve HerroNo ratings yet

- Apache HelicoptersDocument19 pagesApache HelicoptersSrinidhi Ramachandra AcharyaNo ratings yet

- The John Joan CaseDocument9 pagesThe John Joan CaseDiane DuranNo ratings yet

- What Are The Key Features of The US Political System?Document11 pagesWhat Are The Key Features of The US Political System?Yuvraj SainiNo ratings yet

- Civil Procedure CasesDocument10 pagesCivil Procedure CasesRam BeeNo ratings yet

- Essay - The Downfall of The Iroquois ConfederacyDocument2 pagesEssay - The Downfall of The Iroquois ConfederacyAsep Mundzir100% (1)

- Hilado, Bacaro and Rustia CasesDocument9 pagesHilado, Bacaro and Rustia CasesdollyccruzNo ratings yet

- BREEDEN InvestigationDocument113 pagesBREEDEN InvestigationMitchRyalsNo ratings yet

- Aglipay vs. Ruiz Case DigestDocument1 pageAglipay vs. Ruiz Case DigestLouwell QuilangNo ratings yet

- Hindu LawDocument8 pagesHindu LawSARIKANo ratings yet

- Kenya Childrens Act No 8 of 2001Document193 pagesKenya Childrens Act No 8 of 2001Mark Omuga100% (1)

- United States v. Neyaunteu Stallings, A.K.A. "Coolio", Milton Lucas, Richard Allen Hepburn, A.K.A. "Al", Walter L. Johnson, A.K.A. "Walt", United States of America v. Eusebio Phelps, A.K.A. "Ebbie", United States of America v. Alex Session, 463 F.3d 1218, 11th Cir. (2006)Document4 pagesUnited States v. Neyaunteu Stallings, A.K.A. "Coolio", Milton Lucas, Richard Allen Hepburn, A.K.A. "Al", Walter L. Johnson, A.K.A. "Walt", United States of America v. Eusebio Phelps, A.K.A. "Ebbie", United States of America v. Alex Session, 463 F.3d 1218, 11th Cir. (2006)Scribd Government DocsNo ratings yet

- Specific Relief Amendment Act 2018 An AnalysisDocument5 pagesSpecific Relief Amendment Act 2018 An AnalysisHeet DoshiNo ratings yet

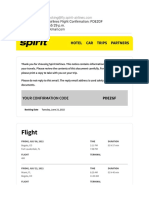

- Modified Spirit Airlines Flight Confirmation PDEZGFDocument7 pagesModified Spirit Airlines Flight Confirmation PDEZGFASTRIDH CHACONNo ratings yet

- The Bloods Gang: A Concise OverviewDocument6 pagesThe Bloods Gang: A Concise OverviewMax NjoroNo ratings yet

- SpecPro OutlineDocument7 pagesSpecPro OutlineCautious LotharioNo ratings yet

- CorpLaw 2014 Outline and CodalDocument73 pagesCorpLaw 2014 Outline and CodalNori LolaNo ratings yet

- Gregory Alan Smith Wire Fraud Guilty PleaDocument2 pagesGregory Alan Smith Wire Fraud Guilty PleaKHOUNo ratings yet

- Zoo Theme PowerPoint TemplatesDocument23 pagesZoo Theme PowerPoint Templatesl i m e sNo ratings yet

- ObliconDocument12 pagesObliconagent_rosNo ratings yet