Professional Documents

Culture Documents

OostEuropa Q2 08

Uploaded by

vvkguptavoonnaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

OostEuropa Q2 08

Uploaded by

vvkguptavoonnaCopyright:

Available Formats

Consumer Index

Europanel Newsletter - Eastern Europe Quarter 2 | 2008

Consumer Index

Welcome to the Q2 2008 Consumer Index, designed to keep you up-to-date with the latest FMCG and trade channels trends across 11 Eastern European countries. This edition is also available for 9 Western and Northern European countries as well as the United States. Please use the details shown below if you have any comments or questions.

Total FMCG Trends % value changes

RUSSIA

MAT Q2 08 vs. MAT Q2 07 Q2 08 vs. Q2 07

6.6

10.3

POLAND CZECH REPUBLIC

15.8

14.3

18.3

24.4

UKRAINE SLOVAKIA

38.8

5.2

4.1

24.2

As seen in the Western European countries, the increasing prices of basic foods and commodities is having a significant impact throughout the Eastern European economies. Many shoppers are trying to be more careful with their spending and they also seem to be shopping less often. Although more traditional channels remain important, in most countries the modern retail channel continues to develop. As a result of this and the economic situation, Private Label also continues to develop throughout the region. Packaged Grocery and Chilled Foods performed consistently well across the region, compared with last year, with Packaged Grocery displaying double digit growth in almost all cases (Slovakia being the only exception). Weaker performances were registered in Personal Care, Home Care and Soft Drinks. Down-trading and poor weather is likely to have impacted on these categories.

HUNGARY

5.3

6.2

21.6

0.5

2.8

6.8

13.4

11.0

18.6

23.0 15.3

20.2

CROATIA

BOSNIA & HERZEGOVINA

SERBIA

BULGARIA

ROMANIA

Inside this issue:

Total Europe Shopping Behaviour Trade Channel and Category Trends: - Bosnia - Bulgaria - Croatia - Czech Republic - Hungary - Poland - Romania - Russia - Serbia - Slovakia - Ukraine - Source & Definitions p.1 p.2 p.3 p.4 p.5 p.6 p.7 p.8 p.9 p.10 p.11 p.12 p.13

For more information, please contact:

Europanel Westgate London W5 1UA United Kingdom

Tel: +44 (0) 20 8967 4560 info@europanel.com www.europanel.com

2008 Europanel GIE

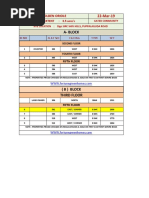

Bosnia & Herzegovina Quarter 2 2008

Consumer Index

Bosnia & Herzegovina - Category Trends

% changes vs. previous year - in value

Q3 07

Total FMCG Chilled Foods Packaged Grocery

0.7

Q4 07

5.8

Q1 08

7.3

Q2 08

13.4

-1.7

15.6

1.0

13.8

1.7

9.5

14.2

29.1

The positive evolution of FMCG, partly due to price increases, was driven by the Packaged Grocery category and, to a lesser extent, Chilled Foods. Almost all categories within Packaged Grocery increased, especially Edible Oil, UHT (long-life) Milk and Instant Coffee. The growth of Chilled Foods was mostly driven by dairy categories, such as Fresh Milk, Milk Desserts, Butter, Margarine and Cheeses. Although most analysed categories have grown since last year, Personal Care was the exception within which almost all categories declined. However, decreased expenditure on Facial Care, Shower and Bath products, Tooth Paste and Shampoo contributed the most. Within Soft Drinks, only CSD faced a slight drop in value. Cleaning products, Air Fresheners and Fabric Softeners have shown the most positive evolution in the Home Care category.

Alcohol

16.0

-4.6

1.8

1.6

Soft drinks Personal Care Home Care

-4.6

1.0

4.5

4.9

-0.5

-4.4

-3.1

-3.3

0.2

0.1

4.8

1.9

The growth of the FMCG market is a result of shoppers spending more per trip, the increase of which outweighed the slight drop in frequency of purchase.

13.0

Bosnia & Herzegovina - Trade Channels Trends

value share 2005-2007 - % changes vs. previous year

13.6

17.0

Hypermarkets continued to increase their market share, as did Supermarkets. The retailers contributing the most to the growth of Hypermarkets and Supermarkets were Bingo, Konzum and Mercator as they attracted more shoppers following their advertising campaigns. Despite loss of share for small grocers and traditional stores, which are part of Other trade channels, they remain the most popular trade channels in Bosnia, accounting for more than half of the FMCG retail market.

Q4 07

Q1 08

Q2 08

20.8

22.2 23.7

Total FMCG

5.8

7.3

13.4

66.2

64.1

Hypermarkets

59.3

17.0

-4.4

15.4

Supermarkets

2005 2006 2007

6.8

22.1

16.2

Hypermarkets Supermarkets Other

Other

3.0

5.1

11.7

Europanel | info@europanel.com Westgate | London | W5 1UA | United Kingdom Tel: +44 (0) 20 8967 4560 | www.europanel.com

2008 Europanel GIE

Bulgaria Quarter 2 2008

Consumer Index

Bulgaria - Category Trends

% value changes vs. previous year - in value

Q3 07

Total FMCG 7.7

Q4 07

7.7

Q1 08

22.8

Q2 08

23.0

Food Price Index

Chilled Foods Packaged Grocery

+21.7%

+21.9 %

+22.1%

+24.5%

8.3

10.6

27.2

24.7

8.2

9.4

25.1

32.0

Alcohol

12.7

5.0

22.4

8.5

Household consumption continued to grow in terms of value, driven by the record level of inflation (consumer prices increased by 14.5% compared with the previous quarter). Another major factor was the increase of net wages following the implementation of the lower tax rate (10%) which encouraged households to spend. Furthermore, despite the credit crisis and pessimistic economic forecasts, official statistics registered considerable growth in GDP for the first time since Quarter 3 2004. However, during the last quarter, the FMCG market declined in volume, especially Chilled Foods (mainly in Yellow Cheese and Fresh Milk), Home Care (Cleaners and Dish Washing) and Personal Care (Hair, Skin and Oral Care).

Soft Drinks

26.5

14.5

22.8

18.9

Personal Care

-2.5

-1.7

9.2

8.2

Homecare

-12.1

-7.4

11.3

7.2

Average prices increased by more than 24% compared with the same quarter last year. This was particularly noticeable for Cooking Oil (+90%), Fresh Milk (+60%), Skin Care (+43%) and Yellow Cheese (+36%).

Existing retailers continued to develop. For example, Picadilly (owned by the Serbian retailer Delta) has positioned itself in newly opened shopping malls in Veliko Tarnovo and in Lovech, while the local retailer Fantastiko opened a supermarket close to the southern quarters of Sofia. Carrefour is preparing to open soon in Bourgas (on the Black Sea) and, later on, in Sofia and other major cities. Kaufland also continued to grow by opening new stores both in the capital and in the countryside. The share of Private Label also increased although it still only accounted for 2.4% share of spend. People shopped more often than the same period last year but spent less per trip, a direct consequence of higher income and price increases.

Bulgaria - Trade Channel Trends

value shares 2004-2007 - % changes vs. previous year

15.0 0.0 3.7

17.2 0.0 3.9

18.2 1.4 3.4

19.3 4.4 3.1

Q4 07

Q1 08

Q2 08

Total FMCG

7.7

22.8

23.0

44.0 46.5 46.9 46.7

Hyper & Superm arket

22.4

40.8

33.5

Discounters

91.8

146.1

95.7

1.4 1.4 1.2 1.1 35.8 31.0 29.0

Cash & Carry

-12.6

8.1

-5.2

25.4

2004

2005

2006

2007

Hyper/ Supermarkets Discounters Cash & Carry Small Grocery Shops Street Vendors + open markets Other

Sm all Grocery Shops Street Vendors + open m arkets Other

5.2

13.9

14.4

6.2

2.1

9.7

-5.1

14.6

25.2

Europanel | info@europanel.com Westgate | London | W5 1UA | United Kingdom Tel: +44 (0) 20 8967 4560 | www.europanel.com

2008 Europanel GIE

Croatia Quarter 2 2008

Consumer Index

Croatia - Category Trends

% changes vs. previous year - in value

Q3 07

Total FMCG -3.9

Q4 07

-4.6

Q1 08

7.8

Q2 08

2.8

Chilled Foods Packaged Grocery

-9.0

-1.0

-9.9

-10.7

Overall the FMCG market value has increased since the same period in 2007 but not across all categories. Packaged Grocery segment showed the most intensive growth compared with last year as almost all measured categories display a positive trend following price increases.

18.5

-5.1

-13.0

15.0

Alcohol

2.7

5.4

13.1

1.1

The increased spend on Personal Care was driven by Facial Care, Hair Colorants, Depilatories, Shower and Bath products. The Pet Food category continued to grow at a high rate, although slower than recent periods, as more and more households use pet food instead of leftovers.

Soft drinks

2.3

2.5

11.5

-4.9

Personal Care

-1.2

-11.1

19.5

4.0

Home Care

-1.8

3.1

20.5

-1.1

Apart from Margarine and Butter, all categories contributed to the fall in value of Chilled Foods. Spend on Soft Drinks also fell as CSD, Mineral Water and Fruit Juices declined, while Iced Tea was only category to develop positively.

Pet Foods 21.1

22.2

17.4

11.8

The poor performance of Home Care was largely due to the decline of Fabric Softeners, Hand Dishwashing products, Toilet Cleaners, Air Fresheners and Cleaning products. FMCG spend in Hypermarkets far outstripped the market average as the channel continued to open new stores, thus attracting new shoppers. This seems to have been to the detriment of Supermarkets. Lidl, the only discounter present in Croatia, further improved its market share. Shoppers spent more per trip than the same period last year (+22%), counterbalancing a significant drop in frequency of purchase.

Croatia - Trade Channel Trends

value shares 2005-2007 - % changes vs. previous year

13.6

15.5

16.9

Q4 07

Q1 08

Q2 08

32.4

31.7

31.9

Total FMCG

-4.6

7.8

2.8

0.2

2.7

Hypermarkets

54.0 52.6

48.5

-0.3

8.7

10.5

Supermarkets

2005 2006 2007

-0.9

18.0

-3.4

Hypermarkets Supermarkets Discounters Other

Other

-12.3

-0.3

2.1

Europanel | info@europanel.com Westgate | London | W5 1UA | United Kingdom Tel: +44 (0) 20 8967 4560 | www.europanel.com

2008 Europanel GIE

Czech Republic Quarter 2 2008

Consumer Index

Czech Republic - Category Trends

% changes vs. previous year - in value

Q3 07

FMCG 11.1

Q4 07

19.0

Q1 08

18.8

Q2 08

14.3

Food Price Index

+2.5%

+9.3%

+11.4%

+10.1%

Chilled Foods

23.0

32.9

44.4

38.4

The Czech economy continued a relatively stable level of growth. The rate of inflation decreased from 7.4% in the first quarter to 5.8% in July 2008, still higher than the Czech National Bank was aiming to achieve and above the predicted level. The unemployment rate has risen up to 5.3% in comparison to 4.7% in the first quarter.

Trends have remained similar to those seen last quarter. Private Label has increased its share 10.3 Alcohol 19.9 -2.2 -2.3 considerably as prices have risen in most food categories. The most Soft Drinks 2.8 17.2 -3.8 16.2 significant change was in frozen potato products where Private Label Personal Care -0.7 -1.1 -14.0 -20.7 prices increased by 91% compared with 2Q 2007. Other significant Home Care 12.1 13.3 17.1 12.7 increases were seen, for example, in: Cooking Fat and Edible Oil, UHT Milk, Fresh Milk and Light Duty Detergents. One exception to this increasing trend was, for example, Hand and Body Multi-Purpose Care, where the decrease in price was 32%.

Packaged Grocery 10.9 18.7

22.7

21.8

The Soft Drinks category declined in both value and volume. Most cold beverages declined rapidly but category performance was driven by bottled water which declined the most as Czech households switched from bottled water to tap water. Hypermarkets and Supermarkets continued to show strong growth, Supermarkets up 30% on Q2 last year. Tesco supermarket expanded its share, partly thanks to new store openings (by June, the retailer had 101 stores). Having bought Delvita in June 2007, the remodeling of the supermarkets was completed in June 2008 and Billas share stabilized at 8%. Cash and Carry (Makro) has declined following the introduction of a new pricing system, making the prices higher and therefore less attractive. Furthermore, members are also restricted to spend limits that have been imposed. The growth of supermarkets could be explained by the growing share of Private Label (+4ppt on same period last year) as extended ranges were recently introduced.

Czech Republic - Trade Channel Trends

value shares 2004-2007 - % changes vs. previous year

Q4 07

30.0 31.9 34.4 34.3

Q1 08

Q2 08

Total FMCG

21.5

19.0

18.8

14.3

19.1

16.8

17.5

Hypermarkets

19.2

26.6

16.9

19.6 2.5 21.7 0.3

4.4

Supermarkets

21.8 2.2 20.6 0.3

4.1

28.5

25.1

29.6

21.0 2.9 19.8 0.2

4.8

21.8 3.0 18.9 0.2

4.4

Discounters

22.0

16.7

5.5

Cash & Carry Small Grocery Shops Street Vendors+open markets Other

-10.1

24.9

27.7

-5.3

2004

2005 2006

2007

13.9

16.2

18.8

Hypermarkets Supermarkets Discounters Cash & Carry Small Grocery Shops Street Vendors + open markets Other

9.1

-21.2

39.1

-39.6

-26.6

Europanel | info@europanel.com Westgate | London | W5 1UA | United Kingdom Tel: +44 (0) 20 8967 4560 | www.europanel.com

2008 Europanel GIE

Hungary Quarter 2 2008

Consumer Index

Hungary - Category Trends

% changes vs. previous year - in value

Q3 07

Total FMCG

1.7

Q4 07

8.0

Q1 08

5.0

Q2 08

6.2

Price increases affected most of the categories and in particular chilled foods and packaged grocery which have both decreased in volume but increased in value (especially in the case of milk (21%) and edible oil (82%). Frozen Foods growth has been fuelled by the price rise in ice cream (10%) and frozen vegetables (15%). Alcohol decreased in both volume and value, especially beer which has the main share of the alcohol market. This is mainly due to the loss of buyers within the beer market and the price increase. Soft Drinks decreased as well in value and volume mainly because the frequency of purchase decreased on carbonated soft drinks, fruit juice, mineral water and soda water.

Food Price Index

Chilled Foods Packaged Grocery Frozen Foods Alcohol Soft Drinks Personal Care Home Care Pet Foods

+10.5 %

1.2 1.3

+12.7 %

9.5 9.5

+13.4 %

7.9 8.5

+13.6%

10.0 10.1 5.4 -1.3

-2.7 -1.5 6.6 -2.5

18.3 2.9 7.8

-0.8 -0.5 4.4

-5.8

3.1

1.6 16.2

-6.8 -0.1

-0.5 4.7

1.1

2.6 17.0

25.3

Pet Foods spectacular growth is fuelled by Private Label volume and value growth, which are driven by increased frequency and price increases. Private Label share has increased in volume mainly because consumers see it as an easier alternative to make savings. Private label prices have increased by 20% in Q2 compared with the same period last year which also fuelled the value growth.

Hungary - Trade Channel Trends

Supermarkets remain a key player in the trade growth, driving value and volume. Driven by new store openings the market share of supermarkets increased by 2% points in Q1 08 vs. Q4 07 (from 15% to 17%), and the channel kept its market share at the same level in Q2 08. Market share of Discounters decreased as well as turnover in absolute terms. Lidl showed continuing signs of growth, as value and volume share were both up by 47% at but Profi, Plus and Penny Market lost share. In April 2008 the first Hungarian Aldi store opened, it now has 24 shops open in Hungary, however its penetration is far behind Lidl when it first opened in 2004 as its market share remains below 0.5% in June 2008.

value shares 2004-2007 - % changes vs. previous year

23.9

25.0

25.6

26.7

Total FMCG

Q4 07

8.0

Q1 08

5.0

Q2 08

6.2

13.4

13.4

14.1

13.9

Hyperm arkets 14.9

6.7

3.5

19.6 4.0

20.8 3.7

22.1 3.6

23.6

Superm arkets 12.1

17.4

22.8

3.3

Discounters 10.9

-1.7

4.2

31.1

29.3

27.1

25.0

Cash & Carry 12.1

1.6

0.7

1.8 6.2 2004

1.6 6.3 2005

1.2 6.2 2006

1.1 6.5 2007

Sm all Grocery Shops -4.6

1.5

2.0

Hypermarkets Supermarkets Discounters Cash & Carry Small Grocery Shops Street Vendors + open Other markets

Street Vendors + -8.8 Open Markets Other 12.9

-5.1

4.2

13.9

9.7

The value share of Hypermarkets fell by 2.5% in the FMCG market, however Interspar and Auchan represented a significant growth of value and volume share within this channel.

Europanel | info@europanel.com Westgate | London | W5 1UA | United Kingdom Tel: +44 (0) 20 8967 4560 | www.europanel.com

2008 Europanel GIE

Poland Quarter 2 2008

Consumer Index

Poland - Category Trends

% changes vs. previous year - in value

Q3 07

Total FMCG 11.9

Q4 07

13.0

Q1 08

23.7

Q2 08

24.4

Food Price Index

+4.1%

+7.0 %

+7.4 %

+6.7 %

Chilled Foods

9.6

13.9

24.1

27.2

Chilled Food was the fastest growing category in value terms in the latest quarter (+27%) with buyers purchasing the category more often (+2% on Q2 07) and spending more per trip (+12%). Packaged Grocery also grew at +27% compared with last year as shoppers purchased the category more often (+5%), spent more per trip (+9%) and their loyalty increased. Personal Care had the slowest rate of growth but still achieved +12% compared with last year despite a drop in frequency of purchase. Comparing the food categories with Home Care and Personal Care, food categories saw a higher increase in absolute value as a result of different levels of inflation.

Packaged Grocery

19.5

15.2

25.7

28.6

Soft Drinks

-5.4

3.4

23.1

17.4

Personal Care

7.1

5.8

12.6

12.4

Home Care

24.1

21.3

25.0

21.4

All channels increased in terms of value, but the biggest change was in Discounters (+44%) and Hypermarkets (+35%). Discounters recruited buyers faster than other channels (+4p.p.), at the same time as increasing buying frequency (+10%) and basket size (+12%). The value of Private Label products increased by 43%, recruiting new buyers and shoppers purchasing Private Label more frequently (+11%).

Poland - Trade Channel Trends

value shares 2004-2007 - % changes vs. previous year

17.3 18.8 19.4 19.9

Q4 07

16.2 15.7 15.8 16.9

Q1 08

Q2 08

Total FMCG

13.0

23.7

24.4

14.0 1.7

15.2 1.8

17.2 1.6

17.5 1.7

Hypermarkets

18.3

40.0 19.5

35.1

Supermarkets

38.9 37.5 35.4 34.3

16.1

20.3

Discounters

14.2

38.0 30.1

44.0

2.8 8.9 2004

2.6 8.4 2005

2.3 8.4 2006

2.1 7.8 2007

Cash & Carry Small Grocery Shops Street Vendors+open markets Other

5.8

34.2

11.2

13.0 5.9

13.3

Hypermarkets Supermarkets Discounters Cash & Carry Small Grocery Shops Street Vendors + open markets Other

1.8 2.6

16.2

13.0

14.9

Europanel | info@europanel.com Westgate | London | W5 1UA | United Kingdom Tel: +44 (0) 20 8967 4560 | www.europanel.com

2008 Europanel GIE

Romania Quarter 2 2008

Consumer Index

Romania - Category Trends

% changes vs. previous year - in value

Q3 07

Total FMCG 19.2

Q4 07

23.2

Q1 08

23.8

Q2 08

20.2

The second quarter of 2008 ended with an increase in FMCG value of 20.2% compared with the same period a year ago. The most dynamic markets in terms of sales were: Packaged Grocery (Edible Oil, Mayonnaise, Chocolate Tables & Bars, Chocolate Cream, Wafers, Pasta) and Personal Care (Face Creams, Hair Care, Deodorants).

42.3

Food Price Index

+5.6 %

+9.6 %

+10.5 %

+12.0 %

Chilled Foods Packaged Grocery

21.2

18.8

14.2

14.6

9.1

21.1

30.8

Alcohol

20.9

27.0

25.3

7.3

The increasing prices of raw materials remain the main influential factor. Although Soft Drinks and Home Care registered small growth rates compared with Q2 2007, categories such as Toilet Cleaners, Water Softeners, Windows Cleaners, Toilet Blocks, Fabric Softeners and Juices showed significant increase.

Soft Drinks

29.3

28.3

25.7

17.6

Personal Care

19.4

20.6

19.5

22.2

Home Care

30.7

29.2

28.9

17.6

NB: Romania chart based on local currency.

Modern trade now covers around 40% of total FMCG expenditure and Hypermarkets and Discounters are maintaining their performance. Due to regional expansion, Kaufland continues to be the most successful retailer followed by Carrefour, Cora and Real in terms of value shares. The rapidly growing value share of Real is also based on the number of stores opened during last year. The share held by small traditional outlets within total trade remained stable at around 42%. The average amount spent per shopping trip by Romanian households increased by 22.5% compared with the same period last year, influenced by the increase in prices and volume purchased. As a result of the fast development of modern trade, Private Label accounts for almost 4% of total value sales and has registered strong growth rates for food and beverage segments.

Romania - Trade Channel Trends

value shares 2005-2007 - % changes vs. previous year

2.0 15 16 1.6 4.1 3.7 4.1 14.7 5.2 3.5

Total FMCG

7.7 14.8

Q4 07

23.2

Q1 08

23.8

Q2 08

20.2

Hyperm arkets

115.4

72.6

51.1

52.4 48.8 44.7

Superm arkets

16.1

12.6

20.9

Discounters

77.9

71.0

61.3

5.7 17.4

4.6 15.2

3.8 13.4 2007

Cash & Carry Sm all Grocery Shops Street Vendors + open m arkets Other

-9.4

-3.0

-27.5

9.8

12.0

8.8

2005

2006

Hypermarkets Supermarkets Discounters Cash & Carry Small Grocery shops Street Vendors + open markets Other

6.2

2.8

2.7

8.1

28.1

32.7

NB: Romania chart based on local currency.

Europanel | info@europanel.com Westgate | London | W5 1UA | United Kingdom Tel: +44 (0) 20 8967 4560 | www.europanel.com

2008 Europanel GIE

Russia Quarter 2 2008

Consumer Index

Russia - Category Trends

% changes vs. previous year - in value

Q3 07

Total FMCG -1.9

Q4 07

6.2

Q1 08

11.8

Q2 08

10.3

In Q2 2008 Total FMCG recorded a growth rate of 10.3% when compared with the same period last year due to an increase in frequency of purchase, while trip size remained fairly stable. The fastest growing categories were Chilled Foods, Packaged Grocery and Frozen Foods. Chilled Foods, Cheese Spreads, Milk Drinks and Kefir (natural yoghurt drinks) continued to grow, as well as Frozen Fruit and Canned Vegetables. There was a slight decline in Soft Drinks driven by a carbonated drinks.

Food Price Index

Fresh Foods Chilled Foods Packaged Grocery Frozen Foods Alcohol Soft Drinks Personal Care Home Care Pet Foods

+8.8%

0.1 -4.7 -3.1 -5.2 -7.2 2.9 8.8 0.1 5.3

+14.7 %

2.7 6.5 10.2 8.8 6.7 -1.3 0.4 10.7 20.6

+17.8%

8.0 14.8 12.0 24.5 12.2 1.5 7.6 13.6 32.0

+21.4 %

5.5 15.0 14.4 14.2 2.8 -2.6 0.5 9.3 17.6

Private Labels share remained small and stable, seemingly not posing a threat to branded products at this stage.

Modern Trade channels continued to increase their share, to the detriment of Street Vendors and Open Markets. The fastest growing channels in Q2 2008 were Cash & Carry, Supermarkets and Discounters. Cash & Carry increased mainly thanks to the growth of local chain Lenta and Metro, an international chain. Mergers and acquisitions have become more commonplace in the Russian retail market. Auchan acquired fourteen Ramstore hypermarkets at the end of 2007, all of which have already had their signs converted to Auchan. Also, the largest Russian Retailer, X5 Retail Group purchased local player Karusel. Magnit, the largest local discounter, is developing its multi-format chain, opening hypermarkets and continuing their regional expansion.

Russia - Trade Channel Trends

value shares 2004-2007 - % changes vs. previous year

0.7 4.0 4.1 0.3 1.3 4.9 5.5 0.4 2.6 6.9 6.0 0.5 3.6 9.2 9.2 0.8

Q4 07

Q1 08

11.8

Q2 08

Total FMCG

6.2

10.3

35.1

35.5

33.7 32.0

Hyperm arkets

31.3

16.1

17.0

Superm arkets

27.5 25.0 21.2 18.4

32.4

24.6

22.2

Discounters

58.2

33.8

26.5

28.3

27.5

29.2

26.8

Cash & Carry

38.9

18.3

31.9

2004

2005

2006

2007

Sm all Grocery Shops Street Vendors+open -12.8 m arkets Other -3.9

8.6

17.1

14.4

Hypermarkets Supermarkets Discounters Cash & Carry Small Grocery Shops Street Vendors + open markets Other

-7.0

-4.1

6.4

4.6

Europanel | info@europanel.com Westgate | London | W5 1UA | United Kingdom Tel: +44 (0) 20 8967 4560 | www.europanel.com

2008 Europanel GIE

Serbia Quarter 2 2008

Consumer Index

Serbia - Category Trends

% changes vs. previous year - in value

Q3 07

Total FMCG

The inflation rate is significant, backed up with political instability after parliamentary elections.

Q2 08

18.6

Q4 07

8.2

Q1 08

12.0

3.1

Chilled Foods

6.0

14.1

29.6

43.5

Packaged Grocery

As the local currency is also appreciating, retail prices remain very high. Therefore, purchasing power is decreasing and many categories face a decline even if their value is growing. Most affected by price increase were agricultural and food products. Consequently, Chilled Foods followed by Packaged Grocery had the highest percentage change versus the previous year. Amongst them Dairy Products, Edible Oil, Margarine, Mayonnaise, Tomato Puree, Ketchup, Instant Coffee and Wafers were increasing the most in value.

4.0

10.6

12.6

16.2

Alcohol

7.8

7.2

3.3

12.1

Soft Drinks

7.6

2.4

7.8

8.0

Personal Care

1.8

8.2

-1.6

10.5

Home Care

-3.2

-4.2

-0.5

7.1

Market share of Top 10 retailers finally exceeded 30%. Most retailers continue expanding their networks by opening new outlets (Idea, Tu, Rodi c C'n'C...). Market leader Delta continues abroad, announcing openings in Ukraine and Albania.

Serbia - Trade Channel Trends

value shares 2005-2007 - % changes vs. year g previous p y

4.5 16.4 1.8 3.1 5.5

Total FMCG

4.9 18.4

4.8

Q4 07

19.2

Q1 08

Q2 08

8.2

12.0

18.6

Hyperm arkets

4.0

25.4

31.8

66.5

63.4

59.9

Superm arkets

2.1

32.5

42.4

Cash & Carry

114.7

21.6

34.4

2.9 8.0 2005

2.3 8.0 2006

2.5 8.0 2007

Sm all Grocery Shops Street Vendors+open m arkets

4.7

2.5

6.8

Hypermarkets Supermarkets Cash & Carry Small Grocery Shops Street Vendors + open markets Other

17.6

52.2

63.1

Other

9.1

10.3

18.6

Europanel | info@europanel.com Westgate | London | W5 1UA | United Kingdom Tel: +44 (0) 20 8967 4560 | www.europanel.com

10

2008 Europanel GIE

Slovakia Quarter 2 2008

Consumer Index

Slovakia - Category Trends

% changes vs. previous year - in value

Q3 07

Total FMCG

Q4 07

5.7

Q1 08

9.7

Q2 08

4.1

1.5

Food Price Index

Chilled Foods Packaged Grocery

+2.5%

4.5

+6.8%

7.3

+7.3%

11.6

+8.6%

7.9

1.8

8.2

9.5

6.0

Price increases continued in Q2 2008; average prices of FMCG categories grew by 14% compared with the same period last year. Chilled Foods, with the fastest growth rate, was driven mainly by fresh and hard cheeses and milk desserts, as new buyers were attracted to the categories, purchasing more frequently and spending more per trip. Spending on Packaged Grocery increased, due to chocolate bars, noodles, pralines, but mostly edible oils, which had the highest price growth (>30%). On the other hand ground and bean coffee continued losing to instant variants. Soft Drinks declined both in value and volume terms, caused by lower buying frequency.

Alcohol

-4.9

-2.4

15.7

1.2

Soft Drinks Personal Care Home Care

-3.1

-4.1

8.8

-4.6

7.0

12.2

4.7

4.1

8.4

10.5

-0.5

-0.3

Pet Foods

-20.7

6.9

16.7

-0.7

Private Label represented almost 27% of FMCG market value (almost 16% more than the same period last year) and experienced growth of 20% this quarter caused by significant price increases. Edible Oil, Milk Desserts, Hard Cheese, Yoghurt, Wafers and Processed Cheese marked the fastest value growth.

As the market share held by Hypermarkets stabilised, Supermarkets and Discounters continued to gain, mainly from traditional grocers although the latter still represent more than a quarter of FMCG outlets. The trend of shopping less often but spending more per trip also continued. Local channel Coop Jednota remained the biggest retail chain (almost 24% share) followed by Tesco, who along with Lidl and Billa increased their share of the market. Lidl in particular gained new buyers as it increased the number of its outlets; now over 90. In terms of number of outlets, Lidl reached number two, behind Coop Jednota which has over 2,400 outlets.

Slovakia - Trade Channel Trends

value shares 2004-2007 - % changes vs. previous year

20.2

22.2

24.0

25.5

Q4 07

Q1 08

Q2 08

26.1

Total FMCG

23.0

5.7 17.5 7.0

9.6

4.1

23.6

23.8

Hyperm arkets

12.8

2.2

8.0 3.4

11.6 2.3

13.0 2.3

13.6 2.5

Superm arkets

15.0

10.3

34.3

33.1

Discounters

11.2

24.6

22.0

29.9

27.7

Cash & Carry

20.6

19.1

-7.3

0.2 7.8 2004

0.1 7.5 2005

0.1 7.1 2006

0.1 6.8 2007

Sm all Grocery Shops Street Vendors + open m arkets Other

-4.5

-2.0

-6.0

Hypermarkets Supermarkets Discounters Cash & Carry Small Grocery Shops Street Vendors + open markets Other

52.6* -12.1

35.1*

-8.9

-4.5

0.8

*Please note the Street Vendors and open markets only represent 0.1% Q2 2008

Europanel | info@europanel.com Westgate | London | W5 1UA | United Kingdom Tel: +44 (0) 20 8967 4560 | www.europanel.com

11

2008 Europanel GIE

Ukraine Quarter 2 2008

Consumer Index

Ukraine - Category Trends

% changes vs. previous year - in value

Q3 07

Total FM CG Fresh Foods Chilled Foods Packaged Grocery Frozen Foods Alcohol

15.0 9.1

Q4 07

16.6

Q1 08

30.9

Q2 08

38.8

All FMCG markets except Soft drinks increased in value during Q2 2008, caused partly by the inflation (almost by 30% in Q2 2008 compared with Q2 2007) and also expanded consumption. Thus along with price increase, a slight volume growth was observed for Frozen Food. Among Packaged Grocery, soluble and ground coffee as well as pralines had positive volume and value dynamics. However, the value growth on Chilled Food was mainly due to price increases on dairy products. As for Home Care, key drivers for its growth were detergents for automatic laundry. The Soft Drinks consumption decrease is mainly explained by the households need to economize on non-essential products, soft drinks being perceived as such.

6.7

11.0

31.1

38.4

15.7

24.5

40.1

42.0

8.4

19.5

31.8

44.9

42.2

44.9

31.3

45.3

11.2

23.8

7.4

Soft Drinks Personal Care Home Care

5.5

21.4

19.8

22.2

-5.2

17.1

16.4

25.1

11.1

23.5

27.9

35.3

The average weight of purchase grew significantly mainly due to the increased purchase frequency. It can be assumed that taking into account price increases, Ukrainian consumers prefer to spend less money per trip but could not avoid spending more overall. Expenditure dynamics were positive for all trade channels, although almost all of them lost share to the benefit of Street Vendors and Open Markets in the short term. The market share of this channel reached almost 50% repeating the seasonal trend in Q2 2007 and Q2 2006. Tendency among consumers to purchase more at the Street Vendors and Open Markets along with the growing expenditures trend for discounters and C&C could be the evidence of the saving habits of Ukrainians under the conditions of inflation. Private Label value share has increased very slightly but is still too small to be analysed across all categories separately.

Ukraine - Trade Channel Trends

value shares 2004-2007 - % changes vs. previous year

g

7.4 0.3 1.3 13.2 9.2

1.1 1.4

11.1 1.3 1.7 12.8

11.7 1.7 1.6 12.2

Total FMCG

Q4 07

Q1 08

Q2 08

12.9

16.6

30.9

38.8

Superm arkets

25.8

40.0

54.5

55.3

52.6

49.9

50.2

Discounters 57.1

83.0

80.1

Cash & Carry

19.0

54.7

70.0

22.6

22.9

23.3

22.6

Sm all Grocery Shops Street Vendors + open m arkets 10.1

35.7

43.3

2004

2005

2006

2007

Supermarkets Discounters Cash & Carry Small Grocery Shops Street Vendors + open markets Other

17.2

26.1

34.2

Other

11.6

27.6

34.2

Europanel | info@europanel.com Westgate | London | W5 1UA | United Kingdom Tel: +44 (0) 20 8967 4560 | www.europanel.com

12

2008 Europanel GIE

Source & Definitions

Consumer Index

Methodology A Consumer Panel is a permanent, syndicated and representative sample of consumers, who provide ongoing details of the FMCG they purchase. Using the diary methodology, each panel member records the details of every item they purchase. Sample sizes: Russia: 7,000 HHs; Poland: 5,000 HHs; Ukraine: 5,000 HHs; Czech Republic: 2,000 HHs; Hungary: 2,000 HHs; Bulgaria: 2,500 HHs; Romania: 2,200 HHs; Croatia:1,500 HHs; Slovakia: 1,500 HHs; Serbia: 1,500 HHs; Bosnia&Herzegovina: 1,000 HHs

Categories Universe: FMCG: Fast Moving Consumer Goods (includes foods, personal care and home care; excludes clothes, white goods etc...) Categories: Fresh Foods: fresh fish, fresh meat, fresh poultry/game, fresh fruit, vegetables, salads Chilled Foods: chilled deli products, chilled dairy products, chilled bakery products Packaged Grocery: bread, biscuits, canned goods, hot beverages, packet breakfast, pickles, sauces, condiments, savoury carbohydrates and snacks, home cooking ingredients, take home confectionery and savouries Soft Drinks: carbonated soft drinks, chilled drinks and mineral water Home Care: softeners, detergents and rinse conditioners Personal Care: bathroom toiletries, hair care, healthcare, oral care, other toiletries

Food price index: Average based on Eurostat Food Prices Indices Key Country Facts: Country Bulgaria Bosnia & Herzegowina Croatia Czech Republic Hungary Poland Romania Russia Federation Serbia (2005) Slovakia Ukraine Individual Population (in 000s) 2006 est. 7,680 3,900 4,439 10,349 10,051 38,115 21,680 142,221 7,498 5,400 46,424 Number of Households (in 000s) 2005 2,908 1,114 1,477 4,423 3,811 13,350 7,320 52,700 2,521 1,900 18,200 GDP per Capita (2007 est.) $11,800 $6,600 $15,500 $24,400 $19,500 $16,200 $11,100 $14,600 $7,700 $19,800 $6,900

Source: CIA World Fact Book

Europanel | info@europanel.com Westgate | London | W5 1UA | United Kingdom Tel: +44 (0) 20 8967 4560 | www.europanel.com

13

2008 Europanel GIE

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Quotation For 2050 PDFDocument1 pageQuotation For 2050 PDFvvkguptavoonnaNo ratings yet

- Quotaion For 2275 PDFDocument1 pageQuotaion For 2275 PDFvvkguptavoonnaNo ratings yet

- Golden OrioleDocument2 pagesGolden OriolevvkguptavoonnaNo ratings yet

- Being Part of An Open Source Community: Ramindu DeshapriyaDocument7 pagesBeing Part of An Open Source Community: Ramindu DeshapriyavvkguptavoonnaNo ratings yet

- Sea Food Consumption & Prices - Page 54-60 - NielsenDocument140 pagesSea Food Consumption & Prices - Page 54-60 - NielsenvvkguptavoonnaNo ratings yet

- Shri Saibaba Sansthan Trust, Shirdi: Online Services AcknowledgementDocument2 pagesShri Saibaba Sansthan Trust, Shirdi: Online Services AcknowledgementvvkguptavoonnaNo ratings yet

- No Nly .: Statement of Encumbrance On PropertyDocument1 pageNo Nly .: Statement of Encumbrance On PropertyvvkguptavoonnaNo ratings yet

- How Java Professionals Can Tap Into The Largest E-Commerce OpportunityDocument26 pagesHow Java Professionals Can Tap Into The Largest E-Commerce OpportunityvvkguptavoonnaNo ratings yet

- FY15 Virtusa Corporation Annual ReportDocument140 pagesFY15 Virtusa Corporation Annual ReportvvkguptavoonnaNo ratings yet

- KGS Research - Assistant ManagerDocument4 pagesKGS Research - Assistant ManagervvkguptavoonnaNo ratings yet

- Jim Beam in AustraliaDocument3 pagesJim Beam in AustraliavvkguptavoonnaNo ratings yet

- Ecommerce Business in India - 2014 To 2015 ReportDocument4 pagesEcommerce Business in India - 2014 To 2015 ReportSivakumar VeerappanNo ratings yet

- IT Industry Performance Annual Review: 2007-08: Press ConferenceDocument33 pagesIT Industry Performance Annual Review: 2007-08: Press ConferencevvkguptavoonnaNo ratings yet

- Global Headquarters: North America - SalesDocument10 pagesGlobal Headquarters: North America - SalesvvkguptavoonnaNo ratings yet

- ICT Inntegration in M&ADocument14 pagesICT Inntegration in M&AvvkguptavoonnaNo ratings yet

- Brand Name Pack Size Price Price Per KG Source: LifesaversDocument1 pageBrand Name Pack Size Price Price Per KG Source: LifesaversvvkguptavoonnaNo ratings yet

- A C Choksi: Marico LimitedDocument0 pagesA C Choksi: Marico LimitedvvkguptavoonnaNo ratings yet

- Millwardbrown Perspectives 2008-2009Document221 pagesMillwardbrown Perspectives 2008-2009vvkguptavoonnaNo ratings yet

- UK IRI Sales Various Categories 2005Document3 pagesUK IRI Sales Various Categories 2005vvkguptavoonnaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Vocabulary + Grammar Unit 3 Test ADocument3 pagesVocabulary + Grammar Unit 3 Test AОстап Галишич50% (2)

- Area 2 PCOG LECTURE CARBS TO LIPIDS PDFDocument172 pagesArea 2 PCOG LECTURE CARBS TO LIPIDS PDFMishella OconNo ratings yet

- The Rules of The Cancer Patient Diet and Dr. Hammer GNMDocument71 pagesThe Rules of The Cancer Patient Diet and Dr. Hammer GNMshivapuja100% (1)

- VELVEX-Light White Oil / White Mineral Oils (Technical)Document4 pagesVELVEX-Light White Oil / White Mineral Oils (Technical)Varadrajan jothiNo ratings yet

- Hhwpart1 OdtDocument7 pagesHhwpart1 OdtRajesh GuptaNo ratings yet

- Ultimate Gift 1Document4 pagesUltimate Gift 1Ayushman KaulNo ratings yet

- Bizu Catering Studio - Wedding Plated Package 2017Document10 pagesBizu Catering Studio - Wedding Plated Package 2017Philip EvardoneNo ratings yet

- Mississippi Mud Cake RecipeDocument1 pageMississippi Mud Cake RecipeGundesalvusNo ratings yet

- Latihan Soal Bahasa Inggris Pts Semester 1Document4 pagesLatihan Soal Bahasa Inggris Pts Semester 1William V Govert SglNo ratings yet

- Jurnal Pendidikan Biologi, Biologi, Dan Ilmu Serumpun: ProlifeDocument11 pagesJurnal Pendidikan Biologi, Biologi, Dan Ilmu Serumpun: ProlifeOtnellNo ratings yet

- Auburn Trader - October 5, 2011Document12 pagesAuburn Trader - October 5, 2011GCMediaNo ratings yet

- Grimaldi's Luna Park 2018 Mother's Day MenuDocument2 pagesGrimaldi's Luna Park 2018 Mother's Day MenuJBPucciNo ratings yet

- 2005 Pectinolytic Enzymes Secreted by Yeasts From Tropical FruitsDocument7 pages2005 Pectinolytic Enzymes Secreted by Yeasts From Tropical FruitsMarcelina Mendoza SalazarNo ratings yet

- Case Study On MitticoolDocument14 pagesCase Study On MitticoolSushant AnandNo ratings yet

- Marine Shrimp HatcheryDocument16 pagesMarine Shrimp HatcheryRajNo ratings yet

- Com Med CompiledDocument90 pagesCom Med Compiledbharati adhikariNo ratings yet

- McDonalds Case StudyDocument20 pagesMcDonalds Case StudyAnkita Dharod100% (1)

- Cot 2-Cook and Present Meat DishesDocument7 pagesCot 2-Cook and Present Meat DishesShee PenNo ratings yet

- Biniyam and Yemarnesh Business PlanDocument37 pagesBiniyam and Yemarnesh Business PlanAzanaw Demsie100% (1)

- Cran-Max 2008-Web-SiteDocument17 pagesCran-Max 2008-Web-SiteSeulean BogdanNo ratings yet

- Diy Hydroponic Design PlansDocument25 pagesDiy Hydroponic Design Plansabenitech100% (13)

- Pr2 DefenseDocument26 pagesPr2 DefenseAphol Joyce Bilale MortelNo ratings yet

- In The United States, 2003-2012: Escherichia Coli O157 OutbreaksDocument9 pagesIn The United States, 2003-2012: Escherichia Coli O157 OutbreaksJavier NietoNo ratings yet

- Choose The Correct OptionDocument6 pagesChoose The Correct OptionFederico RojasNo ratings yet

- (Entrepreneurship) : Nabua National High School San Miguel Nabua, Camarines SurDocument8 pages(Entrepreneurship) : Nabua National High School San Miguel Nabua, Camarines Surmhyrela roncedNo ratings yet

- Modals of Ability, Posibility and PermissionDocument6 pagesModals of Ability, Posibility and PermissionsabamNo ratings yet

- Summer MenuDocument1 pageSummer Menusupport_local_flavorNo ratings yet

- Tiger Time Level 2 SB Unit 2 SML - CopiarDocument10 pagesTiger Time Level 2 SB Unit 2 SML - CopiarmariaNo ratings yet

- Cambridge International Phrasal VerbsDocument7 pagesCambridge International Phrasal Verbsbabuin10% (2)

- RottweilerDocument8 pagesRottweilerDevang ShuklaNo ratings yet