Professional Documents

Culture Documents

PHL Audited Interim Results For The Twelve Months Ended 30 Jun 13 PDF

Uploaded by

Business Daily ZimbabweOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PHL Audited Interim Results For The Twelve Months Ended 30 Jun 13 PDF

Uploaded by

Business Daily ZimbabweCopyright:

Available Formats

The Directors are pleased to present the

Consolidated Statement of Financial Position

As at 30 June 2013 30 June 2013 audited US$ 30 June 2012 audited US$

Supplementary Information (continued)

5. Statement of compliance The financial statements from which the press release has been extracted conform with International Financial Reporting Standards (IFRS), as issued by the International Accounting Standards Board (IASB). The financial statements have been prepared in compliance with the Zimbabwe Companies Act (Chapter 24:03). 6. Currency of reporting The financial statements are expressed in United States Dollars which is the Group's presentation and functional currency. 7. Accounting policies Accounting policies are consistent with those used in the previous year with no significant impact arising from new and revised International Standards applicable for the period ended 30 June 2013. 8. Audit Opinion The Group auditors Ernst & Young, Chartered Accountants Zimbabwe have expressed an unqualified audit opinion on the consolidated interim financial statements. The signed consolidated interim financial statements for the 12 months period ended 30 June 2013 are available for inspection at the Company's registered office. 9. Operating segments The following tables present revenue and profit information about the Group's operating segments for the twelve months ended 30 June 2013. Twelve months ended 30 June 2013 Crocodiles Revenue External customer 30 June 2013 External customer 30 June 2012 711 780 800 000 6 344 752 7 856 532 10 027 779 1 323 062 287 837 11 638 678 19 495 210 57 353 307 4 016 698 4 016 698 3 400 000 914 377 192 400 470 170 4 976 947 8 993 645 42 297 846 Results Segment profit 30 June 2013 30 June 2012 There was no inter-segment revenue in the period. The following tables presents asset and liabilities of the Group's operating segments as at 30 June 2013. Crocodiles Alligators Consolidated 4 253 085 57 353 307 42 297 846 9 288 954 9 288 954 17 940 708 17 940 708 Alligators Consolidated 1 765 036 1 765 036 11 053 990 11 053 990 17 940 708 17 940 708

Audited Interim Results for Padenga Holdings Limited

for the twelve months ended 30 June 2013

Financial Highlights

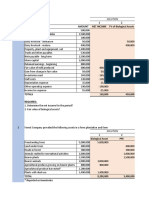

All figures in US$ Group Summary Revenue Operating (loss) / profit before depreciation and amortisation Profit before taxation Profit attributable to shareholders Cash (utilised in) /generated by operations Capital expenditure Net assets Share Performance Basic earnings per share (cents) Diluted earnings per share (cents) Dividends declared and paid during the year (cents) Dividends declared and paid since reporting date (cents) Market price per share - 30 June (cents) Number of shares in issue at 30 June Market capitalisation (US$) 2013 11 053 990 (521 936) 7 066 128 4 651 676 (1 520 264) 2 331 231 37 858 097 2012 17 940 708 5 382 124 4 613 157 3 422 947 4 141 589 881 162 33 304 201

ASSETS Non-current assets Property, plant and equipment Goodwill Intangible assets Biological assets Current assets Biological assets Inventories Current tax asset Trade and other receivables Cash and cash equivalents Total assets EQUITY AND LIABILITIES Capital and reserves Share capital Share premium Retained earnings Equity attributed to equity holders of the parent Non- controlling interest Total shareholders' equity Non-current liabilities Interest bearing borrowings Non-interest bearing borrowings Deferred tax liabilities Current liabilities Short-term interest bearing borrowings Trade and other payables Provisions Current tax payable

14 445 615 969 174 64 502 1 532 771 17 012 062 30 497 146 1 341 845 657 655 5 433 368 2 411 232 40 341 245 57 353 307

13 148 923 1 396 403 14 545 326 17 018 414 906 473 8 071 785 1 755 848 27 752 520 42 297 846

0.86 0.63 0.86 0.63 0.16 0.16 0.16 6.90 4.50 541 593 440 541 593 440 37 369 947 24 371 705

54 159 27 004 245 10 011 601 37 070 005 788 092 37 858 097

54 159 27 004 245 6 245 797 33 304 201 33 304 201

Commentary

YEAR - END CHANGE As flagged at the release of the Companys interim six months results in March that regulatory approvals were being sought to change the companys year-end from June to December, the necessary approvals were subsequently obtained. The current financial year will therefore run for eighteen months to December 2013. These results being reported on are therefore the audited interim results for the twelve months to June 2013. FINANCIAL Zimbabwe Operation Culling was deliberately deferred in this operation in order to harvest the skins at the point in the season when they are at their best quality wise rather than culling them prematurely in order to meet year-end reporting deadlines. This was in response to the fact that the business was losing opportunity by harvesting skins that were at the most two or three months away from being optimal for the premium market. The financial advantages gained from materially improving the proportion of skins that are eventually sold to the very high end luxury market more than offsets the costs of carrying the crop that much longer. The operation sold 15,026 skins by the 30th June 2013 out of the seasons target of 43,000 skins. The remainder of the skins will be culled and sold in the six months to December 2013. The operation recorded an operating loss of $3,051,292 and a profit before tax of $5,666,677. Included in this result is a fair value adjustment on our livestock of $9,051,088 compared to a prior year adjustment of $1,170,271. This arises from the fact that there were significantly more crocodiles of cull-able age on the ground at 30 June 2013 compared to the prior year, (99,588 crocs vs. 66,329 prior year). This was a consequence of the delayed culling and will be realized in turnover by the revised year-end of 31st December 2013. Alligator Operation At Lone Star Alligator Farms in the United States of America, turnover of $1,724,341 was recorded from the sale of 7,882 alligator skins in November 2012. The operation recorded a profit before tax of $1,399,451 in the period under review. Consolidated Results The profit attributed to shareholders for the period under review increased by 36% to $4,651,676 against $3,422,947 for prior year. The Group recorded turnover of $11,053,990, made an operating loss of $2,007,985 and a profit before tax of $7,066,128 in the twelve months to 30 June 2013. These results are wholly in line with the strategy to delay culling in order to deliver the best quality skins possible to the market. OPERATIONS Zimbabwe Operation A desire to satisfy the ever increasing demand for quality skins as well as to meet the exact skin size profile requested by our market prompted the decision to extend the traditional production period. The onset of culling was deferred to mid-May and by the end of June 15,026 crocodiles had been culled representing 35% of the annual target of 43,000 skins. The focus has been on culling animals that are guaranteed to meet the quality standards of our premium market and this is reflected in the grading results achieved to date. Revised quality tolerances announced by our market at the beginning of the season have materially advanced the quality standards aimed for and it is particularly gratifying to be able to achieve these on the skins sold to date. The sizes and skin quality of animals still in the pens provides comfort that the seasons target will be achieved by late October/early November. Alligator Operation At Lone Star Alligator Farm in the United States of America, focus was on the construction of new production barns in anticipation of the significant expansion in livestock numbers planned for this year. Barns to house an initial total of 30,000 alligators were completed subsequent to the period end. Land was purchased for a captive breeder project which will start in earnest next year. A new alligator skinning facility was constructed in Delcambre, Louisiana which will facilitate skinning of alligators harvested from the wild and also provide service slaughters for farmed alligators from third parties as well as Lone Stars own farmed animals. A new meat processing plant was constructed in Winnie, Texas. These facilities started operating at the end of August 2013. Capital expenditure on these projects totalled $1.2 million. PROSPECTS Demand for quality skins in both markets remains exceptionally strong. Changes to our culling strategy will ensure that we produce quality skins to satisfy this demand and improve on skins proceeds achieved within the Zimbabwe business. With the period of transition over, we anticipate to produce improved returns for our shareholders. Production is anticipated to increase significantly at Lone Star in 2014 and this will further result in increased profitability going forward. DIVIDEND The delay in culling detailed above has meant an increase in working capital demands for the business and it is consequently deemed inappropriate to declare a dividend at this time. A K Calder CHAIRMAN 9 September 2013

4 142 468 3 422 947

1 246 694 -

5 389 162 3 422 947

Total liabilities Total equity and liabilities

Operating assets 30 June 2013 30 June 2012 Operating liabilities 30 June 2013 30 June 2012

53 100 222 42 297 846

Consolidated Statement of Changes in Equity

For the twelve months ended 30 June 2013 Share Capital audited US$ Balance at 1 July 2012 Non-controlling interest arising on acquisition of subsidiary Profit for the period Dividends paid Dividends paid by subsidiary Balance at 30 June 2013 54 159 Share Premium audited US$ 27 004 245 Retained Earnings audited US$ 6 245 797 Non Controlling Interest audited US$ -

15 570 252 8 993 645

3 924 958 -

19 495 210 8 993 645

TOTAL audited US$ 33 304 201

Classification of the segments is based on the type of biological assets. Lone Star has been consolidated for the first time after acquisition in July 2012 and it specialises in alligator farming hence there are no comparatives for the last twelve months. 30 June 2013 US$ 10. Capital expenditure for the year Capital expenditure commitment Authorized but not yet contracted 11. Future lease commitments Payable within one year Payable between two and five years Payable after five years The capital expenditure will be financed from the Group's own resources and borrowing facilities. 12. Depreciation and amortisation 1 486 049 10 027 779 1 356 626 3 400 000 2 331 231 2 265 620 2 265 620 83 500 334 000 334 000 751 500 30 June 2012 US$ 881 162 1 472 000 1 472 000 83 500 334 000 417 500 835 000

54 159

27 004 245

4 651 676 (885 872) 10 011 601

342 607 737 486 (292 000) 788 092 Non Controlling Interest audited US$ -

342 607 5 389 162 (885 872) (92 000) 37 858 097

For the twelve months ended 30 June 2012 Share Capital audited US$ Balance at 1 July 2011 Profit for the period Dividends paid Balance at 30 June 2012 54 159 54 159 Share Premium audited US$ 27 004 245 27 004 245 Retained Earnings audited US$ 3 701 889 3 422 947 ( 879 039) 6 245 797

TOTAL audited US$ 30 760 293

13. Interest bearing debt 3 422 947 ( 879 039) 33 304 201

Consolidated Statement of Cash Flows

For the Twelve Months Ended 30 June 2013 30 June 2013 audited US$ Cash (utilised in) / generated from operating activities Interest paid Taxation paid Net cash (utilised in) / generated from operations Cash flow from investing activities Net cash outflow from investing activities Net cash flow before financing activities (1 520 264) ( 387 910) ( 476 737) (2 384 911) 30 June 2012 audited US$ 4 141 589 ( 582 612) (1 078 455) 2 480 522

14. Business combinations Acquisition of Lone Star Alligator Farms On 1 July 2012, the Group acquired a 50% stake in Lone Star Alligator Farms, an unlisted Company based in Texas (United States of America) that specializes in alligator farming. The Group acquired the stake in Lone Star Alligator Farms because the investment affords the Group the opportunity to diversify into commercial production of an alternate species to the Nile crocodile currently being produced, namely alligators. Revenue is envisaged to grow by 302% from $1.2m in 2012 to $4.9m in 2014. The revenue included in the consolidated statement of comprehensive income since June 12 contributed by Lone Star Alligator Farms was $1765 036 and also contributed profit of $1 246 694 over the same period. Assets acquired and liabilities assumed The fair value of the identifiable assets and liabilities of Lone Star Alligator Farms as at the date of acquisition were: Fair value recognised on acquisition US$ Assets Property, plant and equipment Biological assets Other current assets Total Liabilities Long term loans Current liabilities Total liabilities Net assets Non-controlling interest (50% of net assets fair value) Total net assets acquired Goodwill arising on acquisition Purchase consideration transferred Purchase consideration is split as follows: Paid in cash (Funded by means of an offshore loan) Deferred Consideration ** 481 956 212 571 730 633 1 425 160

(2 556 599) (6 119 382)

( 986 287) 615 195

Consolidated Statement of Comprehensive Income

For the Twelve Months Ended 30 June 2013 6 mths ended 30 June 2013 unaudited US$ Revenue Other operating income Net operating costs Operating profit /(loss) before depreciation and amortisation Depreciation and amortisation Operating profit before interest and fair value adjustments Fair value adjustments on biological assets Fair value adjustments on meat Profit before interest and tax Interest payable Profit before tax Income tax expense Profit for the period Other comprehensive income Total comprehensive income for the period Profit for the period attributable to: Equity holders of the parent Non-controlling interest Earnings per share (cents) Basic earnings per share Diluted earnings per share 8 840 607 44 656 (6 720 345) 6 mths ended 30 June 2012 unaudited US$ 17 925 625 11 876 (8 233 957) 12 mths ended 30 June 2013 audited US$ 11 053 990 56 445 (11 632 370) 12 mths ended 30 June 2012 audited US$ 17 940 708 19 698

Cash flow from financing activities Increase in borrowings - new loans - repayments Dividends paid by holding company by subsidiaries to non-controlling shareholders Net cash inflow generated / (utilised) in financing activities

6 774 766 10 746 179 (3 971 413) (1 177 872) (885 872) (292 000) 5 596 894 655 384 1 755 848 2 411 232

514 187 10 539 861 (10 025 674) (879 041) (879 041) (364 854) 1 129 382 626 466 1 755 848

571 413 168 534 739 947 685 213 (342 607) 342 607 969 174 1 311 780

(12 578 282) Net increase in cash and cash equivalents

2 164 917 ( 787 621)

9 703 544 ( 679 761)

(521 936) (1 486 049)

5 382 124 (1 356 626)

Cash and cash equivalents at the beginning of the period Cash and cash equivalents at the end of the period

600 000 711 780

** The deferred consideration will be paid off using future dividends to be received from the acquired business. The deferred consideration of $1m has been discounted to the present value at an interest rate of 12% payable after 3 years. The Group has started consolidating Lone Star financials this year from 1 July 2012 as the acquisition of Lone Star was concluded in the period. The results are incorporated in the financial statements as at 30 June 2013. The Group has control over the subsidiary by owning a 50% stake and also has explicit authority to control the finance and operations portfolios of the business by agreement with the shareholders. The non-controlling interest was measured at the proportionate share of the acquiree's identifiable net assets. 15. Earnings per share Basic earnings basis The calculation is based on the profit attributable to equity holders of the parent and the weighted average number of ordinary shares in issue for the year. Fully diluted earnings basis The calculation is based on the profit attributable to equity holders of the parent and the weighted average number of ordinary shares in issue after adjusting to assume conversion of share options not yet exercised and convertible instruments. There were no instruments with a dilutive effect at the end of the period. 16. Contingent liabilities The Group had no contingent liabilities at 30 June 2013. 17. Events after reporting period There have been no significant adjusting or non-adjusting events after the reporting date at the time of issuing this press release.

1 377 296 8 774 652 56 331 10 208 279 (410 987) 9 797 292 (2 379 874) 7 417 418 7 417 418

9 023 783 (160 966) 12 045 8 874 862 (412 760) 8 462 102 (2 188 019) 6 274 083 6 274 083

(2 007 985) 9 487 292 56 331 7 535 638 (469 510) 7 066 128 (1 676 967) 5 389 162 5 389 162

4 025 498 1 158 226 12 045 5 195 769 (582 612) 4 613 157 (1 190 210) 3 422 947 3 422 947

Cash And Cash Equivalents Made up as follows: Bank balances and cash Short-term investments

2 259 856 151 376 2 411 232

1 755 848 1 755 848

Supplementary Information

1. Corporate Information The Company is incorporated and domiciled in Zimbabwe. 2. Change in year end The Group has changed its financial year end from the 12 months starting 1 July - 30 June to 1 January - 31 December. The results for the period ending 31 December 2013 will be incorporating a trading period of 18 months. 3. Change in Annual General Meeting date The last Annual General Meeting was held on the 30th of November 2012. It was indicated in the 2012 annual report that the next Annual General Meeting would be held in November 2013. This is no longer feasible due to the change in year-end date mentioned above. Approval was obtained from the relevant regulatory authority to defer the Companys Annual General Meeting to a date not later than 31st May 2014. 4. Basis of preparation The financial statements are based on the statutory records that are maintained under the historical cost basis, except for biological assets that have been measured at fair value.

6 679 932 737 486 7 417 418 1.23 1.23

6 274 083 6 274 083 1.16 1.16

4 651 676 737 486 5 389 162 0.86 0.86

3 422 947 3 422 947 0.63 0.63

Directors: Ken Calder (Chairman)*, Anne Madzara*, Themba Sibanda*, Gary Sharp (Chief Executive Officer), Oliver Kamundimu (Chief Financial Officer), Michael Fowler (Executive Director) * Non Executive

You might also like

- CONDOLENCE SUPPLEMENT: High Profile Deaths Rise As Covid-19 Surges in ZimbabweDocument16 pagesCONDOLENCE SUPPLEMENT: High Profile Deaths Rise As Covid-19 Surges in ZimbabweBusiness Daily ZimbabweNo ratings yet

- Ramaphosa Integrity CommissionDocument3 pagesRamaphosa Integrity CommissionJanice HealingNo ratings yet

- Letter of Demand - Khosa V Minister of Defence and OthersDocument6 pagesLetter of Demand - Khosa V Minister of Defence and OthersMail and Guardian100% (1)

- Fifa Law 11 OffsideDocument37 pagesFifa Law 11 OffsideBusiness Daily ZimbabweNo ratings yet

- In Defence of Zimbabwe Medical ProfessionDocument2 pagesIn Defence of Zimbabwe Medical ProfessionBusiness Daily ZimbabweNo ratings yet

- Zimbabwe Monetary Policy February 2019Document3 pagesZimbabwe Monetary Policy February 2019Business Daily ZimbabweNo ratings yet

- Omega Sibanda Linked Company Fights ChildlineDocument49 pagesOmega Sibanda Linked Company Fights ChildlineBusiness Daily ZimbabweNo ratings yet

- Fifa Law 11 OffsideDocument37 pagesFifa Law 11 OffsideBusiness Daily ZimbabweNo ratings yet

- Public Debt DocumentDocument5 pagesPublic Debt DocumentBusiness Daily ZimbabweNo ratings yet

- HZ - Final Response To Fedex Re SuspensionDocument9 pagesHZ - Final Response To Fedex Re SuspensionNtombi MlangeniNo ratings yet

- Final Report To ParliamentDocument10 pagesFinal Report To ParliamentBusiness Daily ZimbabweNo ratings yet

- SA Home Affairs Department Lose 4,616 Permanent Residence ApplicationsDocument176 pagesSA Home Affairs Department Lose 4,616 Permanent Residence ApplicationsBusiness Daily Zimbabwe67% (3)

- Zimbabwe Bond Notes ProgrammeDocument2 pagesZimbabwe Bond Notes ProgrammeBusiness Daily Zimbabwe100% (1)

- Competition Commission Prosecutes Banks Currency Traders For CollusionDocument2 pagesCompetition Commission Prosecutes Banks Currency Traders For CollusionBusiness Daily ZimbabweNo ratings yet

- Contributing Towards Ending Poverty in Zimbabwe - Monthly UpdateDocument4 pagesContributing Towards Ending Poverty in Zimbabwe - Monthly UpdateBusiness Daily ZimbabweNo ratings yet

- Simbisa BrandsDocument2 pagesSimbisa BrandsBusiness Daily Zimbabwe100% (1)

- Zimbabwe 2017 Monetary Policy Statement FinalDocument80 pagesZimbabwe 2017 Monetary Policy Statement FinalBusiness Daily Zimbabwe100% (1)

- The Zimbabwe Industrial Revolution Plan: For The Church Created by Hannington MubaiwaDocument20 pagesThe Zimbabwe Industrial Revolution Plan: For The Church Created by Hannington MubaiwaBusiness Daily ZimbabweNo ratings yet

- RBZ Monetary Policy Statement January 2016Document99 pagesRBZ Monetary Policy Statement January 2016Business Daily ZimbabweNo ratings yet

- Jessie Fungayi Majome Vs ZBC The Constitutional Court JudgementDocument16 pagesJessie Fungayi Majome Vs ZBC The Constitutional Court JudgementJessie Fungayi MajomeNo ratings yet

- Newsletter August For MailingDocument4 pagesNewsletter August For MailingBusiness Daily ZimbabweNo ratings yet

- Vacancies With AIDS HealthCare Foundation - Mpilo and ParirenyatwaDocument1 pageVacancies With AIDS HealthCare Foundation - Mpilo and ParirenyatwaBusiness Daily Zimbabwe100% (1)

- 2016 LGE ResultsDocument16 pages2016 LGE ResultsBusiness Daily ZimbabweNo ratings yet

- Zimbabwe Economic Update ReportDocument36 pagesZimbabwe Economic Update ReportBusiness Daily Zimbabwe100% (1)

- Results Summary - All Ballots: Party Name Ward PR DC 40%Document10 pagesResults Summary - All Ballots: Party Name Ward PR DC 40%Business Daily ZimbabweNo ratings yet

- Zimbabwe 2015 Mid-Term Fiscal PolicyDocument274 pagesZimbabwe 2015 Mid-Term Fiscal PolicyBusiness Daily Zimbabwe100% (1)

- Zimbabwe's Draft Computer Crime and Cybercrime Bill Laymans Draft July 2013Document28 pagesZimbabwe's Draft Computer Crime and Cybercrime Bill Laymans Draft July 2013Business Daily ZimbabweNo ratings yet

- Zimbabwe 2015 Mid-Term Fiscal PolicyDocument274 pagesZimbabwe 2015 Mid-Term Fiscal PolicyBusiness Daily Zimbabwe100% (1)

- Mujuru Party Manifesto - Full TextDocument2 pagesMujuru Party Manifesto - Full TextBusiness Daily ZimbabweNo ratings yet

- Lovemore Majaivana and The Township Music of ZimbabweDocument38 pagesLovemore Majaivana and The Township Music of ZimbabweBusiness Daily ZimbabweNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- A Study On Financial Performance Analysis of-ACC CementsDocument28 pagesA Study On Financial Performance Analysis of-ACC Cements99873037260% (1)

- Q1'21 Shareholder LetterDocument20 pagesQ1'21 Shareholder LetterMohd Shazali Bin HamidNo ratings yet

- TFIN52 1 SummaryDocument18 pagesTFIN52 1 SummaryLearn.onlineNo ratings yet

- As-11 The Effects of Changes in Foreign Exchange RatesDocument21 pagesAs-11 The Effects of Changes in Foreign Exchange RatesDipen AdhikariNo ratings yet

- Proforma Report PT Nusantara Infrastructure TBK (Meta) 30jun2022 - Fullset-ReDocument25 pagesProforma Report PT Nusantara Infrastructure TBK (Meta) 30jun2022 - Fullset-ReCindy CinintyaNo ratings yet

- Focus On Personal Finance 5th Edition Kapoor Solutions ManualDocument23 pagesFocus On Personal Finance 5th Edition Kapoor Solutions ManualDeanPetersrpmik100% (16)

- East Coast Yachts Ratios AnalysisDocument6 pagesEast Coast Yachts Ratios AnalysisSpatiha Pathmanaban67% (3)

- Upfl Annual Report 2015 - tcm1267 503874 - en PDFDocument84 pagesUpfl Annual Report 2015 - tcm1267 503874 - en PDFZaib HassanNo ratings yet

- Assignment 1Document21 pagesAssignment 1siddhant jainNo ratings yet

- SHRMDocument10 pagesSHRMArya Akbani100% (1)

- Business Combinations: Advantages Disadvantages T Y E PDocument1 pageBusiness Combinations: Advantages Disadvantages T Y E PPrincessNo ratings yet

- UNI 20230306154519093616 781498 uniROC IpayobDocument7 pagesUNI 20230306154519093616 781498 uniROC IpayobxidaNo ratings yet

- Summer Training Report: Working Capital ManagementDocument73 pagesSummer Training Report: Working Capital ManagementanilkavitadagarNo ratings yet

- IAS 41 - Determine Net Income and Fair Value of Biological AssetsDocument2 pagesIAS 41 - Determine Net Income and Fair Value of Biological Assetslet me live in peaceNo ratings yet

- Intacc ReviewerDocument2 pagesIntacc ReviewerCassandra CeñidoNo ratings yet

- Company Analysis SAPMDocument19 pagesCompany Analysis SAPMtincu_01No ratings yet

- OperationDocument4 pagesOperationRyan SanchezNo ratings yet

- Group Project & Presentation InstructionsDocument7 pagesGroup Project & Presentation InstructionsftnNo ratings yet

- Surya NepalDocument13 pagesSurya NepalanishabatajuNo ratings yet

- Financial Accounting Mock Exam Multiple Choice QuestionsDocument4 pagesFinancial Accounting Mock Exam Multiple Choice QuestionsGeeta LalwaniNo ratings yet

- SOP on Disposing of Fixed AssetsDocument7 pagesSOP on Disposing of Fixed AssetsJoy RoyNo ratings yet

- Brand valuation methodology guideDocument2 pagesBrand valuation methodology guidekhanrock247No ratings yet

- A Guide To Solving Accounting Problems in Income TaxDocument3 pagesA Guide To Solving Accounting Problems in Income TaxMargery BumagatNo ratings yet

- Business Plan Natural Uganda LTD/ Manufacture of Charcoal BriquettesDocument32 pagesBusiness Plan Natural Uganda LTD/ Manufacture of Charcoal Briquettesivojaliso1100% (1)

- P3.5 Different Forms of Business CombinationDocument8 pagesP3.5 Different Forms of Business CombinationAgnes CahyaNo ratings yet

- Statement of Financial PositionDocument8 pagesStatement of Financial PositionKaye LiwagNo ratings yet

- UBA Ghana 2021 Q3 Financial StatementsDocument1 pageUBA Ghana 2021 Q3 Financial StatementsFuaad DodooNo ratings yet

- Sap Fi Business Blueprint Questionnaire SampleDocument203 pagesSap Fi Business Blueprint Questionnaire SampleMayureshAmbekar100% (2)

- Financial Statement Analysis Report of Sukhjit StarchDocument68 pagesFinancial Statement Analysis Report of Sukhjit StarchSharn GillNo ratings yet

- Excel Academy of CommerceDocument2 pagesExcel Academy of CommerceHassan Jameel SheikhNo ratings yet