Professional Documents

Culture Documents

Daily Market Update 26.09.2013

Uploaded by

Randora LkOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Market Update 26.09.2013

Uploaded by

Randora LkCopyright:

Available Formats

Daily Market Update

26 September 2013

Today 5,786.16 3,219.09 87,152,362 920,233,459 267,345,227 34,072,171 16.46 2.20 Closed (Rs) 390.00 118.00 663.00 Closed (Rs) 3.80 2.40 170.00 Volume 1,285,891 48,790,125 1,012,741 501,506 186,396 No. of Crossings 1 1 3 2 1 Previous Day 5,783.62 3,205.48 71,905,095 582,782,536 285,447,706 173,576,205 16.45 2.20 Change (Rs) 18.80 2.00 10.50 Change (Rs) (0.10) (0.20) (2.00) Turnover 218,866,687 203,653,807 117,936,845 75,226,303 41,554,953 Change (%) 0.04 0.42 21.20 57.90 -6.34 -80.37 0.06 0.00 Change (%) 5.06 1.72 1.61 Change (%) -2.56 -7.69 -1.16 % 23.78 22.13 12.82 8.17 4.52

Tel: 0112131000 Website: www.ndbs.lk

Banks continue to see interest

High activity levels were witnessed in banking sector counters with multiple parcel trades seen in Sampath Bank, Commercial Bank and Hatton National Bank. The turnover topped Rs 920 Mn with both indices closing the day in green. Institutional interest was seen in Hemas Holdings and Lanka IOC. Meanwhile retail interest continued in Touchwood Investments and Central Investments & Finance.

Banks, Finance and Insurance sector became the top contributor to the market turnover (due to Sampath Bank, Commercial Bank and Hatton National Bank) and the sector index gained 0.18%. The share price of Sampath Bank dipped by Rs 2.00 (1.16%) to close at Rs 170.00 while the counters foreign holding increased by 459,500 shares. The share price of Commercial Bank gained Rs 2.00 (1.72%) to close at Rs 118.00 with the counters foreign holding increasing by 958,643 shares. The share price of Hatton National Bank closed flat at Rs 150.00. Land and Property sector was the second highest contributor (due to Touchwood Investments) and the sector index went up by 0.94%. The share price of Touchwood Investments went up by Rs 1.70 (51.52%) to close at Rs 5.00 with the counters foreign holding increasing by 279,117 shares. Diversified sector was also among the top turnover contributors for the day (due to John Keells Holdings) and the sector index gained 0.71%. The share price of John Keells Holdings lost Rs 1.40 (0.63%) to close at Rs 221.50 with the counters foreign holding increasing by 130,884 shares.

Turnover ASPI S&P SL20 (Indexed)

Indices

6,500 5,500

12,000 8,000 4,000 0 3-Jan-12 3-Jan-13

Bid (Closing) 10.00 11.03 11.30 11.52 11.70 Rs 24.558 Bn Rs 132.00 - 132.10 per US $

Positive Contributors Carson Cumberbatch Commercial Bank The Bukit Darah Negative Contributors Commercial Leasing & Finance Browns Investments Sampath Bank Top Turnover Contributors Sampath Bank Touchwood Investments Commercial Bank Hatton National Bank John Keells Holdings Company Sampath Bank Sampath Bank Hatton National Bank Commercial Bank Lanka IOC

4,500 3,500 2,500 3-Jan-11

Maturity 01-04-2014 15-07-2015 01-04-2016 15-07-2017 15-08-2018 Excess Liquidity Exchange Rate

Ask (Closing) 10.05 11.05 11.40 11.55 11.74

Volume Price 250,000 171.00 300,000 170.00 500,000 150.00 500,000 116.00 1,000,000 25.00 Source: Colombo Stock Exchange

Treasury Bill Rates (Primary Auction) Maturity Today 91 days 8.60 182 days 9.63 364 days 10.57

25/9/2013 Last Week Last Year 8.61 11.30 9.64 12.57 10.57 13.02 Source: MVS Money Brokers

Turnover Rs Mn.

ASPI S&P SL20 Volume (Shares) Turnover (Rs) Foreign Purchases (Rs) Foreign Sales (Rs) PER PBV

20,000 8,500 7,500 16,000

Disclaimer This document is based on information obtained from sources believed to be reliable, but NDB Securities (Pvt) Ltd., (NDBS) accepts no responsibility or makes no warranties or representations, express or implied, as to whether the information provided in this document is accurate, complete or up-to-date. Furthermore, no representation or warranty is made by NDBS as to the sufficiency, relevance, importance, appropriateness, completeness or comprehensiveness of the information contained herein for any specific purpose. Prices, opinions and estimates reflect our judgment on the date of original publication and are subject to change at any time without notice. NDBS reserves the right to change their opinion at any point in time as they deem necessary. There is no guarantee that the target price for the stock will be met or that predicted business results for the company will be met. NDBS accepts no liability whatsoever for any direct or consequential loss or damage arising from any use of these reports or their contents. References to tax are based on our understanding of current law and Inland Revenue practices, which may change from time to time. Any recommendation contained in this document does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. This document is for the information of addressee only and is not to be taken as substitution for the exercise of judgment by addressee. The information contained in any research report does not constitute an offer to sell securities or the solicitation of an offer to buy, or recommendation for investment in, any securities within Sri Lanka or any other jurisdiction. The information in any research report is not intended as financial advice. Moreover, none of the research reports is intended as a prospectus within the meaning of the applicable laws of any jurisdiction and none of the research reports is directed to any person in any country in which the distribution of such research report is unlawful. Past results do not guarantee future performance. NDBS cautions that any forward-looking statements in any research report implied by such words as anticipate, believe, estimate, expect, and similar expressions as they relate to a company or its management are not guarantees of future performance. The investments in undertakings, securities or other financial instruments involve risks. Any discussion of the risks contained herein should not be considered to be a disclosure of all risks or complete discussion of the risks which are mentioned. NDBS and its associates, their directors, and/or employees may have positions in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other financial services for these companies.

You might also like

- What Is A Purchasing SystemDocument7 pagesWhat Is A Purchasing SystemJerah JabicanNo ratings yet

- When To Sell A StockDocument28 pagesWhen To Sell A Stockguy_100% (1)

- IB Business Management HL NotesDocument10 pagesIB Business Management HL NotesNumfon ThamsirisupNo ratings yet

- Blaine Kitchenware Inc.Document13 pagesBlaine Kitchenware Inc.vishitj100% (4)

- Gamboa V Teves G.R. 176579Document2 pagesGamboa V Teves G.R. 176579Dino Bernard LapitanNo ratings yet

- SAP S/4HANA Finance 2021Document52 pagesSAP S/4HANA Finance 2021Brahim100% (2)

- Daily Market Update 21.10.2013Document2 pagesDaily Market Update 21.10.2013Randora LkNo ratings yet

- Daily Market Update 25.09.2013Document2 pagesDaily Market Update 25.09.2013Randora LkNo ratings yet

- Daily Market Update 02.10.2013Document2 pagesDaily Market Update 02.10.2013Randora LkNo ratings yet

- Daily Market Update: Indices Closed With Gains Foreign Sales Account For 51.9% of TurnoverDocument2 pagesDaily Market Update: Indices Closed With Gains Foreign Sales Account For 51.9% of TurnoverRandora LkNo ratings yet

- Daily Market Update 29.10.2014 PDFDocument2 pagesDaily Market Update 29.10.2014 PDFRandora LkNo ratings yet

- Banking Sector Continued To Elevate Turnover: Turnover Aspi S&P SL20 (Indexed)Document2 pagesBanking Sector Continued To Elevate Turnover: Turnover Aspi S&P SL20 (Indexed)Randora LkNo ratings yet

- Daily Market Update: Indices Closed With Gains Month Commences With GainsDocument2 pagesDaily Market Update: Indices Closed With Gains Month Commences With GainsRandora LkNo ratings yet

- Derivatives Report 29th March 2012Document3 pagesDerivatives Report 29th March 2012Angel BrokingNo ratings yet

- Equity Tips and Market Outlook For 19 OCtDocument7 pagesEquity Tips and Market Outlook For 19 OCtRani RaiNo ratings yet

- Daily News Letter 23oct2012Document7 pagesDaily News Letter 23oct2012Theequicom AdvisoryNo ratings yet

- Derivatives Report 26th April 2012Document3 pagesDerivatives Report 26th April 2012Angel BrokingNo ratings yet

- Daily-Sgx-Report by Epic Research Singapore 10 Dec 2013Document2 pagesDaily-Sgx-Report by Epic Research Singapore 10 Dec 2013Christopher HenryNo ratings yet

- Equity Tips and Market Analysis For 12 JulyDocument7 pagesEquity Tips and Market Analysis For 12 JulySurbhi JoshiNo ratings yet

- Daily Equtiy News Letter 11jan 2013Document7 pagesDaily Equtiy News Letter 11jan 2013Theequicom AdvisoryNo ratings yet

- Equity Analysis Equity Analysis - Daily DailyDocument7 pagesEquity Analysis Equity Analysis - Daily DailyTheequicom AdvisoryNo ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Head and Shoulders Broken: Punter's CallDocument5 pagesHead and Shoulders Broken: Punter's CallRajasekhar Reddy AnekalluNo ratings yet

- Derivatives Report, 13 February 2013Document3 pagesDerivatives Report, 13 February 2013Angel BrokingNo ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Equity Analysis Equity Analysis - Daily DailyDocument7 pagesEquity Analysis Equity Analysis - Daily Dailyapi-160037995No ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-196234891No ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Daily News Letter 22oct2012Document7 pagesDaily News Letter 22oct2012Theequicom AdvisoryNo ratings yet

- Derivatives Report, 31st May 2013Document3 pagesDerivatives Report, 31st May 2013Angel BrokingNo ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Equity Analysis Equity Analysis - Daily DailyDocument7 pagesEquity Analysis Equity Analysis - Daily DailyTheequicom AdvisoryNo ratings yet

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Document2 pagesSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069No ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Equity Analysis Equity Analysis - Daily DailyDocument7 pagesEquity Analysis Equity Analysis - Daily DailyTheequicom AdvisoryNo ratings yet

- Derivatives Report 11th April 2012Document3 pagesDerivatives Report 11th April 2012Angel BrokingNo ratings yet

- Derivatives Report 23rd September 2011Document3 pagesDerivatives Report 23rd September 2011Angel BrokingNo ratings yet

- Derivatives Report 12 Dec 2011Document3 pagesDerivatives Report 12 Dec 2011Angel BrokingNo ratings yet

- Equity Analysis Equity Analysis - Daily DailyDocument7 pagesEquity Analysis Equity Analysis - Daily Dailyapi-160037995No ratings yet

- Market Watch Daily 25.02.2014Document1 pageMarket Watch Daily 25.02.2014Randora LkNo ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Equity Analysis - DailyDocument7 pagesEquity Analysis - Dailyapi-198466611No ratings yet

- Derivatives Report 26 Oct 2012Document3 pagesDerivatives Report 26 Oct 2012Angel BrokingNo ratings yet

- Derivatives Report, 20 February 2013Document3 pagesDerivatives Report, 20 February 2013Angel BrokingNo ratings yet

- US Housing Data & Consumer ConfidenceDocument2 pagesUS Housing Data & Consumer Confidencer3iherNo ratings yet

- Derivatives Report, 27th May 2013Document3 pagesDerivatives Report, 27th May 2013Angel BrokingNo ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Derivatives Report 2nd April 2012Document3 pagesDerivatives Report 2nd April 2012Angel BrokingNo ratings yet

- Derivatives Report 31 Oct 2012Document3 pagesDerivatives Report 31 Oct 2012Angel BrokingNo ratings yet

- Derivatives Report 30-Aug-2012Document3 pagesDerivatives Report 30-Aug-2012Angel BrokingNo ratings yet

- Equity Analysis Equity Analysis - Daily DailyDocument7 pagesEquity Analysis Equity Analysis - Daily Dailyapi-146671334No ratings yet

- Bears in Control: Punter's CallDocument5 pagesBears in Control: Punter's CallUday Prakash SahuNo ratings yet

- Equity Analysis Equity Analysis - Daily DailyDocument7 pagesEquity Analysis Equity Analysis - Daily Dailyapi-160037995No ratings yet

- Derivatives Report 21 Nov 2012Document3 pagesDerivatives Report 21 Nov 2012Angel BrokingNo ratings yet

- Derivatives Report 09 Oct 2012Document3 pagesDerivatives Report 09 Oct 2012Angel BrokingNo ratings yet

- Derivatives Report, 14 March 2013Document3 pagesDerivatives Report, 14 March 2013Angel BrokingNo ratings yet

- Zztreasury Research - Daily - Global and Asia FX - April 29 2013Document2 pagesZztreasury Research - Daily - Global and Asia FX - April 29 2013r3iherNo ratings yet

- Derivatives Report 30th January 2012Document3 pagesDerivatives Report 30th January 2012Angel BrokingNo ratings yet

- Equity Market Analysis or Levels On 14th SeptemberDocument7 pagesEquity Market Analysis or Levels On 14th SeptemberTheequicom AdvisoryNo ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Daily News Letter 27dec2012Document7 pagesDaily News Letter 27dec2012Theequicom AdvisoryNo ratings yet

- Global Market Update - 04 09 2015 PDFDocument6 pagesGlobal Market Update - 04 09 2015 PDFRandora LkNo ratings yet

- Weekly Update 04.09.2015 PDFDocument2 pagesWeekly Update 04.09.2015 PDFRandora LkNo ratings yet

- Weekly Foreign Holding & Block Trade Update: Net Buying Net SellingDocument4 pagesWeekly Foreign Holding & Block Trade Update: Net Buying Net SellingRandora LkNo ratings yet

- Wei 20150904 PDFDocument18 pagesWei 20150904 PDFRandora LkNo ratings yet

- 03 September 2015 PDFDocument9 pages03 September 2015 PDFRandora LkNo ratings yet

- Press 20150831ebDocument2 pagesPress 20150831ebRandora LkNo ratings yet

- ICRA Lanka Assigns (SL) BBB-rating With Positive Outlook To Sanasa Development Bank PLCDocument3 pagesICRA Lanka Assigns (SL) BBB-rating With Positive Outlook To Sanasa Development Bank PLCRandora LkNo ratings yet

- Daily 01 09 2015 PDFDocument4 pagesDaily 01 09 2015 PDFRandora LkNo ratings yet

- Press 20150831ea PDFDocument1 pagePress 20150831ea PDFRandora LkNo ratings yet

- Global Market Update - 04 09 2015 PDFDocument6 pagesGlobal Market Update - 04 09 2015 PDFRandora LkNo ratings yet

- CCPI - Press Release - August2015 PDFDocument5 pagesCCPI - Press Release - August2015 PDFRandora LkNo ratings yet

- Sri0Lanka000Re0ounting0and0auditing PDFDocument44 pagesSri0Lanka000Re0ounting0and0auditing PDFRandora LkNo ratings yet

- Results Update Sector Summary - Jun 2015 PDFDocument2 pagesResults Update Sector Summary - Jun 2015 PDFRandora LkNo ratings yet

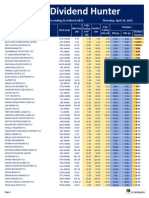

- Dividend Hunter - Apr 2015 PDFDocument7 pagesDividend Hunter - Apr 2015 PDFRandora LkNo ratings yet

- Earnings & Market Returns Forecast - Jun 2015 PDFDocument4 pagesEarnings & Market Returns Forecast - Jun 2015 PDFRandora LkNo ratings yet

- Earnings Update March Quarter 2015 05 06 2015 PDFDocument24 pagesEarnings Update March Quarter 2015 05 06 2015 PDFRandora LkNo ratings yet

- BRS Monthly (March 2015 Edition) PDFDocument8 pagesBRS Monthly (March 2015 Edition) PDFRandora LkNo ratings yet

- Results Update For All Companies - Jun 2015 PDFDocument9 pagesResults Update For All Companies - Jun 2015 PDFRandora LkNo ratings yet

- Dividend Hunter - Mar 2015 PDFDocument7 pagesDividend Hunter - Mar 2015 PDFRandora LkNo ratings yet

- Daily - 23 04 2015 PDFDocument4 pagesDaily - 23 04 2015 PDFRandora LkNo ratings yet

- Dividend Hunter - Mar 2015 PDFDocument7 pagesDividend Hunter - Mar 2015 PDFRandora LkNo ratings yet

- Microfinance Regulatory Model PDFDocument5 pagesMicrofinance Regulatory Model PDFRandora LkNo ratings yet

- GIH Capital Monthly - Mar 2015 PDFDocument11 pagesGIH Capital Monthly - Mar 2015 PDFRandora LkNo ratings yet

- CRL Corporate Update - 22 04 2015 - Upgrade To A Strong BUY PDFDocument12 pagesCRL Corporate Update - 22 04 2015 - Upgrade To A Strong BUY PDFRandora LkNo ratings yet

- Janashakthi Insurance Company PLC - (JINS) - Q4 FY 14 - SELL PDFDocument9 pagesJanashakthi Insurance Company PLC - (JINS) - Q4 FY 14 - SELL PDFRandora LkNo ratings yet

- N D B Securities (PVT) LTD, 5 Floor, # 40, NDB Building, Nawam Mawatha, Colombo 02. Tel: +94 11 2131000 Fax: +9411 2314180Document5 pagesN D B Securities (PVT) LTD, 5 Floor, # 40, NDB Building, Nawam Mawatha, Colombo 02. Tel: +94 11 2131000 Fax: +9411 2314180Randora LkNo ratings yet

- Chevron Lubricants Lanka PLC (LLUB) - Q4 FY 14 - SELL PDFDocument9 pagesChevron Lubricants Lanka PLC (LLUB) - Q4 FY 14 - SELL PDFRandora LkNo ratings yet

- The Morality of Capitalism Sri LankiaDocument32 pagesThe Morality of Capitalism Sri LankiaRandora LkNo ratings yet

- Weekly Foreign Holding & Block Trade Update - 02 04 2015 PDFDocument4 pagesWeekly Foreign Holding & Block Trade Update - 02 04 2015 PDFRandora LkNo ratings yet

- Daily Stock Watch 08.04.2015 PDFDocument9 pagesDaily Stock Watch 08.04.2015 PDFRandora LkNo ratings yet

- JPM Asia Pacific Equity 2013-12-17 1282304Document20 pagesJPM Asia Pacific Equity 2013-12-17 1282304HaMy Tran0% (1)

- Akun Impor PT Surya SejahteraDocument4 pagesAkun Impor PT Surya SejahteraDiana FransiscaNo ratings yet

- Principle of Business Past Paper 2017Document10 pagesPrinciple of Business Past Paper 2017Dark PlaceNo ratings yet

- Lu Ym Family Business Dispute Decided by RTCDocument22 pagesLu Ym Family Business Dispute Decided by RTCNicole Elena III Espina75% (4)

- New Issue MarketDocument15 pagesNew Issue Marketshivakumar NNo ratings yet

- Cost of CapitalDocument16 pagesCost of CapitalParth BindalNo ratings yet

- Namma Kalvi 12th Commerce Chapter 1 To 17 Study Material em 214296Document63 pagesNamma Kalvi 12th Commerce Chapter 1 To 17 Study Material em 214296Aakaash C.K.100% (2)

- TNT Franchise Fund Investor PresentationDocument26 pagesTNT Franchise Fund Investor PresentationScottNo ratings yet

- Indian Ins Titut e of Technology M Adras: (Sep'2016 - Present)Document1 pageIndian Ins Titut e of Technology M Adras: (Sep'2016 - Present)nishanthNo ratings yet

- GMO Equity Dislocation Strategy Review - 8-21Document4 pagesGMO Equity Dislocation Strategy Review - 8-21bharat005No ratings yet

- Fdi by MC Donald Presented by Tarun JhalaniDocument28 pagesFdi by MC Donald Presented by Tarun Jhalanikhandelwalmba0% (1)

- US and Canada Stock Returns and Volatility SpilloverDocument16 pagesUS and Canada Stock Returns and Volatility Spilloverjorge_gubNo ratings yet

- CJR Bahasa Inggris BisnisDocument14 pagesCJR Bahasa Inggris Bisnisrasvina mastariNo ratings yet

- CHAPTER 2 Part 2 Working CapitalDocument19 pagesCHAPTER 2 Part 2 Working CapitalMaria AngelaNo ratings yet

- Financial Analyst Assessment of Company Earnings Quality: Robert Bricker" Previts Robinson Stephen YoungDocument14 pagesFinancial Analyst Assessment of Company Earnings Quality: Robert Bricker" Previts Robinson Stephen Youngmelly amaliaNo ratings yet

- Illegal Electronic Investments in Trade Robot MissionsDocument9 pagesIllegal Electronic Investments in Trade Robot MissionsAlpha GrafikaNo ratings yet

- PES College of Engineering MBBS Strategic Management Model Question PaperDocument24 pagesPES College of Engineering MBBS Strategic Management Model Question PapernandishrajaNo ratings yet

- BBMF 3183 Strategic Financial Management: 13 Corporate ReorganizationsDocument22 pagesBBMF 3183 Strategic Financial Management: 13 Corporate ReorganizationsKarthina RishiNo ratings yet

- Cost of Capital InsightsDocument8 pagesCost of Capital InsightsfahdlyNo ratings yet

- Statement of Cash FlowsDocument20 pagesStatement of Cash FlowssshreyasNo ratings yet

- PRA Guidelines for Joint Venture AgreementsDocument28 pagesPRA Guidelines for Joint Venture AgreementsNeil Energyte BaldonadoNo ratings yet

- Chapter 25-Sources of FinanceDocument12 pagesChapter 25-Sources of Financesk001No ratings yet

- Stock Market of IndiaDocument37 pagesStock Market of IndiaSonia NarangNo ratings yet

- Corporate Life Cycles Impact Cash Flow and Accrual RelevanceDocument34 pagesCorporate Life Cycles Impact Cash Flow and Accrual Relevancedharmas13No ratings yet