Professional Documents

Culture Documents

Agile Financial Times September 2013

Uploaded by

Agile Financial TechnologiesCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Agile Financial Times September 2013

Uploaded by

Agile Financial TechnologiesCopyright:

Available Formats

ARTICLE CASE STUDY

Bancassurance in

Middle East &

Africa

Powering Sidra

Capital

Agile

FINANCIAL TIMES

September

2013

SOLUTION OVERVIEW

Agilis Investment

Management

Wealth Management

in the Middle East

AGILIS

INSURANCE SUITE

General Insurance

Life Insurance

Pension & Annuities

Takaful

Broking

BancAssurance

Micro Insurance

AGILIS

BANKING SUITE

Agilis Treasury Management

Agilis BancAssurance

Agilis Lending Suite

Loan Crgnaton

Loan Managomont

Loan Cooton

^gs Crodt Montorng

Agilis Bank Agency Management

Agilis Branchless Banking

Agilis BPM Suite (DMS & Workflow)

Agilis BI: 1-Key Agile

AGILIS INVESTMENT

MANAGEMENT SUITE

Wealth Management

Fund Management

^ssot Managomont

1ranslor ^gony

Financial Planning

BancAssurance

AGILIS UNIVERSAL

MICROFINANCE

Customor / Mombor Croup Managomont

Shares & Savings Management

Covornmont onolt Lsbursomont Managomont

Donor Management

Loan Crgnaton, Cooton Managomont

lod Cporatons and Mobo anlng

Treasury Management

Crodt katng and ksl Managomont

Financial Accounting

Jambo!

As we write this issue focused on wealth

management, we hear of the attack on the

Westgate mall in Nairobi, a place we know so

well and visit for that rich cuppa Kenyan

Highlands tea or Mount Kenya coffee.

We want to dedicate this edition to this true

City of Wealth - Nairobi. Yes, Nairobi, that has

trumped the vile forces with its wealth of courage, solidarity and

resilience. Always the melting pot of cultures and ethnicities, it emerges

even stronger as the world pays tribute to its cornucopia of human

values.

Coming to the more empirical side of wealth, we bring you the latest

investment management trends & regulatory changes in the Middle

East, the current global bastion of unitized opulence. A dynamic place

that nipped any hint of recession in the bud and is exploding with a

wealth of ideas, new world order strategies with the right measure of

new regulatory norms.

So Karibu to the new chapter in the management of wealth in myriad

forms - some that feed the belly and some others, that feed the soul.

Asante Sana. Be Agile!

Shefali Khera

Chief Marketing Officer & Business Head

We would love to hear from you on info@agile-ft.com

PS:

Key to the rich Kiswahili lexicon:

Jambo = Hello

Karibu = Welcome

Asante Sana = Thank you very much

CONTENTS

Editors Note

NEWS 4

Global Financial Markets

Update

COVER STORY 6

Wealth Management

in the Middle East

CASE STUDY 10

Powering Sidra Capital

ARTICLE 13

Bancassurance in

Middle East & Africa

SOLUTION OVERVIEW 16

Agilis Investment

Management

September 2013

across the region without registering a separate entity and

getting approvals from another regulator. The East African

Securities Exchanges Association (Easea), which brings

together the regions stock exchanges and Kenyas Central

Depository and Settlements Corporation (CDSC), has

already adopted a back office automated system that is in use

in Kenya, as the standard for all market intermediaries in the

region. After its full adoption, it is expected to facilitate

access to all securities in the region and Internet trading.

Chinese Economic Data Points to End of

Slowdown

Recent economic data from China suggest that the economy

could be stabilizing. Factory output in July rose 9.7 percent

year-on-year, ahead of expectations and up from the

previous months figure of 8.9 percent. Consumer prices

held steady in July, rising 2.7 percent from a year earlier,

matching the rate in June. The government has set a target

of 7.5 percent for 2013, the lowest rate of expansion in

more than two decades. Chinese exports and imports grew

more than expected in July, posing a sharp recovery from the

previous month. Chinese exports rose 5.1 percent compared

with a year earlier while imports gained 10.9 percent.

Absa, Barclays Africa Deal Approved

Absa Groups acquisition of Barclays African business has

been approved by regulators. The deal will come into effect

on July 31 and will see Barclays holding 62.3% of the newly

renamed Barclays Africa through the issue of 129.5-million

ordinary shares by Absa, with a value of R18.3 bn (USD

Western Union Launches Mobile Money Service

in Nigeria

Western Union has partnered with an African payment

processing specialist, eTranzact, to launch a mobile money

service in Nigeria, with the objective of boosting financial

inclusion and provide a more convenient means of money

transfer for Nigerians, and the entire Africa. Nigeria mobile

phone penetration rate stands at 70.64 percent, as of June

2013, according to figures provided by Informas World

Cellular Information Service. In contrast, just 21 percent of

the countrys population has a bank account, according to

the World Bank. The financial service company hopes to

bridge this divide by providing users with a mobile platform

to pay bills, purchase merchandizes online, top up mobile

credit and make third party transfers.

East African Stock Markets Push for Multi-

currency IPOs

Securities and stock market intermediaries across the five-

member East African Community are now planning to

introduce multi-currency denominated initial public

offerings (IPO) and single licences for stockbrokers and

investment banks as reforms to integrate the regions capital

markets begin. This will ensure investor protection against

high exchange rates. The Nairobi Securities Exchange

(NSE), Uganda Securities Exchange (USE), Dar es Salaam

Stock Exchange (DSE), Rwanda Stock Exchange (RSE) and

Kenyas CDSC have also put forth a proposal for a single

stockbroker licence. The licence will allow market

intermediaries from any country to source for business

4

NEWS

Global

Financial

Markets

Update

A Round-up of Recent Happenings

1.86 bn). Absa will be renamed as Barclays Africa starting

August 2 in the rest of Africa except in South Africa where

it will remain Absa. The deal, first announced in 2012, was

delayed by the complexities of regulatory approval in

Botswana, Ghana, Kenya, Mauritius, the Seychelles, South

Africa, Tanzania, Uganda and Zambia.

Abraaj Group Sells Investment in Ghanas HFC

Bank

Dubai-based Abraaj Group has sold its stake in Ghanas

HFC Bank Limited to Republic Bank Limited (RepBank), an

independent Caribbean bank. The Abraaj Group, through

one of its funds, acquired its initial stake in HFC in 2010 and

made an additional investment in 2012. During Abraajs

investment, HFC has become one of the leading domestic

banks in Ghana and remained strongly capitalised.

According to a statement by the Abraaj Group, the bank

currently has 27 branches across Ghana, and is working to

open additional branches.

Dubai Group Exits Bank Islam

Dubai Group has sold its 30.5 percent stake in Malaysias

Bank Islam to BIMB Holdings Bhd for USD 550 million.

BIMB Holdings, which currently owns 49 percent of Bank

Islam will pay USD 884 million towards full control of

Malaysias oldest and largest standalone Islamic bank, in a

deal that will help it expand in a rapidly growing sector.

Dubai Group had acquired a 40 percent stake in Bank Islam

for USD 224 million in October 2006 but the stake was

diluted to 30.5 percent in 2009 after a capital increase that

the group did not participate in.

Kenyas CBA Launches Suites for Premium

Banking Market

Commercial Bank of Africa (CBA) has launched an

exclusive premier banking suites that targets wealthy citizens.

The move, which is a bid to gain grounds in the Kenyan

premium banking market, targets salaried individuals with a

net income of Sh300,000 (USD 3,400) and those running

current accounts with a minimum balance of Sh1 million

(USD 11,000). It will provide customers will longer banking

hours as well as multi-currency credit cards. Customers will

also enjoy discounts at selected retail outlets, while having

access to executive airport lounges around the world.

Mutual & Federal Buys Agricolas Insurance

Book

Mutual & Federal, the short-term insurance firm owned by

Old Mutual Group has acquired the insurance book of

specialised crop underwriting manager Agricola for an

undisclosed amount.The deal will see Mutual & Federal rank

in the top three when it comes to providing insurance to

farmers in South Africa. Santam and Absa are the other two

top insurers in crop farming.

Credit Squeeze in Asia Worst Since Financial

Crisis

Bank lending conditions in emerging Asian nations have

tightened the most since the global financial crisis, according

to the latest survey from the Institute of International

Finance (IIF). The report shows the region`s headline index

falling to a reading of 45.7, below the key 50-level that

divides easing and tightening territory and its lowest level

since the beginning of the survey in 2009. Asia also showed

the tightest lending conditions of global emerging regions.

The report cites three principal factors for Asia`s strained

credit conditions: deteriorating domestic funding conditions,

high non-performing loans as well as declining loan demand.

The survey questioned 133 banks across Latin America,

Europe, Asia and the Middle East- Africa region and Asia`s

headline figure of 45.7 was the lowest. Latin America was

second-worst at 47.6 while Africa and the Middle East had

the best result at 52.9.

Bermuda Signs AIFMD Cooperation Agreement

with European Member States

The Bermuda Monetary Authority has signed the co-

operation agreement with European Union (EU) Member

States in relation to the Alternative Investment Funds

Managers Directive (AIFMD). This means that new and

existing Bermuda-based funds and fund managers can

continue to seamlessly conduct business with the European

market.

Dubai Launches New Centre for Islamic

Banking

Sheikh Hamdan Bin Mohammed bin Rashid Al Maktoum,

Crown Prince of Dubai and chairman of Dubai Executive

Council, has launched the Dubai Centre for Islamic Banking

and Finance as a first step to establishing Dubai as the

worlds capital for Islamic economy, in collaboration with

the Hamdan Bin Mohammed e-University. The new centre

will provide support to the initiative through three academic

programmes on human resources development, scientific

research and community service. The centre will also play a

vital role in widening access to Islamic banking and finance

education to the wider community.

5

NEWS

6

Global Cues Support Growth from Developing Markets

The World Wealth Report 2013 pegs aggregate global investable wealth at USD

46.2 trillion in 2012, an increase of 10 percent over 2011. This suggests a revival

trend, after the tarnishing effects of the financial crisis. In the next few years,

wealth creation is expected to be led by fast growing developing nations on

account of high savings and GDP growth. Asia Pacific (excluding Japan) is

expected to surpass North America as the largest wealth market.

Globally, common themes emerge for companies providing wealth management

that include among others an ever increasing regulatory burden; a complex

operating environment; varied customer expectations, especially with regards to

wealth preservation vs. growth; and changing demographics across the world.

Effectively, these are setting the stage for greater risk management and more

tailored solutions. The pressure on profitability is inevitable even as cost control

is a priority for firms.

The Middle-East Wealth Management Landscape

The Middle East has often been regarded as a region for long term growth as

prosperity continues to rise on the back of high oil prices. Close to two percent

The Middle East is becoming

an increasingly competitive

market for wealth management

as both regional and

international banks are

expanding their suite of

offerings, while tackling unique

and evolving regulatory

challenges. The creation of a

distinctive value proposition for

customers will be an imperative

in the competitive market in

future, and investing in the right

technology and infrastructure

will play a very strong role in

creating that differentiation.

Wealth

Management in

the Middle East

7

COVER STORY

of the global HNWI investable wealth is held in the Middle East and this is

expected to increase 6.8 percent annually up to 2015. The High Net Worth

Income (HNWI) population grew by 8.1 percent in the Middle East region

over the previous year.

Though regarded as one region, the Middle East is a diverse market with Saudi

Arabia accounting for about 40 percent of the total wealth pool, followed by

the UAE, Kuwait and Qatar with close to 22, 15 and 12 percent share of

HNWI wealth, respectively.

Offshore Over Onshore

Statistics suggest that currently about two-thirds of the assets in the Middle

East are still booked offshore. This is among the highest in terms of

proportion among developing regions globally, suggesting relatively low

sophistication in terms of onshore investment options. Sovereign Wealth

Funds (SWFs) account for 88 percent of existing investable assets and 74

percent of new assets in the Middle East.

The appetite for onshore investments is improving, as markets open up and

newer instruments are getting added. Onshore investments provide a great

opportunity for local and international banks alike. A good example is that of

Shariah funds, which have the potential for strong performance due to a

shortage of mainstream investment products in the region.

Evolving Regulatory Environment

The post-crisis world has seen a large number of new regulations coupled with

strengthening of existing ones, such as the Markets in Financial Instruments

Derivative II and Undertakings for Collective Instruments in Transferable

Securities IV and V. In addition to changes from standard international

financial regulation, most financial institutions in the Middle East have to deal

with sanction regimes of individual countries, especially relating to anti money

laundering (AML/CFT).

Furthermore, taxation and corruption initiatives such as the US Foreign

Account Tax Control Act (FATCA), the US Foreign Corrupt Practices Act and

the UK Bribery Act transcend boundaries and have to be complied with in

offshore transactions. Such legislations have inevitably become a part of firms

risk management and client on-boarding processes.

Customer Expectations

Cultural dynamics play an important role in private banking in the region, as

entrepreneurs and family business owners dominate non-oil GDP in the

Middle East. The needs of this class of investors are more complex, i.e.

revolving around family and business ownerships, as opposed to

straightforward cash or credit based products. Moreover, as the younger

generation takes over family businesses, their demands centre around

digitalization, greater transparency and a larger bouquet of offerings. The

younger generation is also more digital-savvy and has a higher tendency to

resort to social networking and other digital media for investment comparisons

and related advice.

A survey published as a part of the World Wealth Report reveals that a larger

percentage of HNWIs in the Middle East, as compared to the global average,

would pay more to do business with a firm with a solid reputation.

Potential

opportunities in

the Middle East

region stem from

an evolving

landscape and

changing customer

requirements.

Opening up of

markets in a

number of

economies is

allowing more

instruments for

investment as well

as bringing in

overseas

investments.

The Road Ahead

Potential opportunities in the Middle East region stem from

an evolving landscape and changing customer requirements.

Opening up of markets in a number of economies is

allowing more instruments for investment as well as

bringing in overseas investments. For example in Bahrain,

recent guidelines have made it possible to offer overseas

domiciled funds to investors in Bahrain, subject to necessary

approvals. In Saudi Arabia, a gradual opening up of the

market is expected soon, which will likely bring in foreign

funds beyond equity swaps and ETFs.

As customers become more demanding and business is less

sticky, full service providers have a clear advantage in future

by targeting a higher wallet share from each individual

customer. Both local/regional and international firms are

starting to build capabilities towards providing the entire

range of wealth management services to clients through a

single window, whether as producers or as distributors.

Moreover, it is increasingly being recognized that a single

window may not mean a single relationship manager, but

rather a team of professionals who can take care of all the

needs of the customer.

Automation by way of deploying a comprehensive

8

COVER STORY

Flavour of Recent Changes and Evolving Opportunities Within Some Countries in the Region

9

COVER STORY

investment management software that would encompass CRM, front, mid and

back office capabilities including financial planning, portfolio management and

performance measurement would allow wealth managers to achieve greater

consistency and eliminate inefficiencies, giving them more time to focus on

their clients.

Business dynamics in the Middle East are driving investments in people,

processes and technology. The McKinsey Report on Private Banking shows

large productivity differences between relationship managers in the GCC

region. According to the study, the top performing relationship managers in

the GCC region are on an average four times more productive than those in

the bottom quartile of performance, based on parameters of net new money

and revenue per manager.

Consistent productivity improvements mandate a highly integrated effort

including a healthy infusion of resources, infrastructure and technology. A

large number of local/regional firms in the Middle East have been undertaking

middle and back-office transformations that will enable significant cost savings

in future.

Larger firms are also investing in technology optimization in the customer

interface that will allow better communication with the client. Digitalization

can improve communication and empower a customer with more information

and decision making capabilities. It also meets the demand for greater

transparency. Cost per transaction can reduce significantly, with the relation

manager intervening only for advice and trouble-shooting. However

automation will not eliminate the need for talent. Hiring experienced wealth

managers and providing effective training to all levels of staff will still be

mandatory to success.

Overall, the dynamic business drivers mandate building an increasingly agile

organization that can be responsive to business demands and client

requirements.

As the younger

generation takes

over family

businesses, their

demands centre

around

digitalization,

greater

transparency and a

larger bouquet of

offerings; they are

also more digital-

savvy and have a

higher tendency to

resort to social

networking and

other digital media

for investment

comparisons and

related advice.

10

CASE STUDY

Based in Dubai International Financial Centre (DIFC) and

regulated by Dubai Financial Services Authority (DFSA), the

company provides bespoke solutions with the core objective

to accumulate, preserve and enhance clients wealth, both

personal and corporate.

The companys services include:

Dealing in Investment as Agent

Advising on Investments, Financial Products or Credit

Arranging Credit or Deals in Investments

Arranging Custody

Project Background

While most other companies in the DIFC operate as either

referral or representative agents, Sidra Capital planned to

embark on a relatively new omnibus model. Through this

model, the clients wealth management requirements would

be met through a single bank account and a single custody

account. All individual customer accounts would be

segregated from this one central account.

Sidra Capital naturally had some unique expectations from

any end-to-end technology platform that they would select.

Sidra needed a solution that was flexible and reliable and

that would take care of all functions starting from client

on-boarding to reporting.

The solution was critical to demonstrate the capability to

win the license from DFSA in a strictly regulated

environment.

Powering

Sidra Capital

Read why Agile FT was chosen as the

preferred technology partner...

Sidra Capital (DIFC) Limited is

a fully owned subsidiary of

Group Sidra LLC - a

conglomerate having focus in

socio-economic developments of

value enhancing in the private

arena in the MENA region.

11

CASE STUDY

Supplier Selection

Sidra Capital conducted a thorough due diligence on a dozen

leading software solutions in the investment technology

space, using stringent evaluation criteria across front, mid

and back-office functions including the ability for the

software to manage investments across various asset classes

including equities, money markets, debt, derivatives and

structured instruments.

Sidra Capital chose Agile FTs Agilis Investment

Management Suite (IMS) for what CEO Ajay Arora calls its

Double S edge of Service and Security. It was a perfect

match as service and security are of paramount importance

to Sidra Capital and we need to ensure the highest levels for

our customers and regulators. We found that Agile FT stood

by the same values in its organization and its software

solutions, says Arora.

Agilis IMS, the solution by Agile was selected based on its

capabilities to deliver on Sidras unique requirements. Agile

was competitive on the cost parameters and also scored

highly on Sidras other requirements of service and security.

Implementation

The entire implementation was done in just six weeks owing

to the clarity in objectives of the Sidra Capital Core Team

Can you give us an overview of Sidra Capitals

business model?

Sidra Capital was established around a year back and

received its license in March 2013 as a Category-3

DFSA-regulated entity. Being a relatively new entrant,

we had to ensure that our business model was different

from that adopted by other players. The most prevalent

business model are the referral model (in which the

client has to register with multiple financial services

providers with the attendant burden of multiple KYC

compliance instances) and the representative office

model (in which the assets are held through the main

office overseas and only the customer acquisition and

management process takes place at the client location).

Our business model, which incidentally was a first for

the DFSA, is an omnibus model wherein for each

customer we have one bank account and one custodian

account. This custodian account is funded by the client

based on the advice given by Sidra Capital and the

resultant mutual agreement, and is then used to execute

a variety of deals based on the mandate. The technology

that we have deployed from Agile Financial

Technologies allows us to manage multiple asset classes

for a single client, and give a segregated real-time view

of the portfolio to the client. This business model

ensures minimum operational efforts for the client, a

high degree of granularity in terms of portfolio

visibility and the ability to get a true single view of our

client. The technology allows us to handle the entire

process ourselves, right from client on-boarding to

accounting and reporting. At a startup level, I believe we

are the first in the region to have this kind of business

model.

What services does Sidra Capital provide?

We have three business verticals - investment banking,

family office and corporate finance. While investment

banking and corporate finance are services needed by

companies, our family office services are needed by

individuals.

Which is your target customer segment?

Our target audience is primarily entrepreneurs, who

have corporate needs to scale up their business to

greater heights, and who will, at some point, need our

family office services to manage and grow their personal

wealth. While we have not kept any particular

restrictions on geographical focus, the majority of our

customers are from the Middle East & Africa (MENA)

region, especially in the sub-USD 50 million bracket.

Our wider attempt in the near future will be to promote

the growth of a vibrant capital market specifically for

small and medium enterprises who can then tap those

resources as their business grows rather than relying

solely on debt funding. I believe that any country which

wants to do well economically has to ensure a strong

capital market in which there is active participation by

small and medium enterprises.

In conversation with

Ajay Arora, CEO, Sidra Capital.

12

CASE STUDY

together with the robustness and flexibility of the Agilis IMS system. Moreover

the complete deployment process was carried out remotely by Agile FTs

strong Development Centre in India. The implementation time of six weeks

also includes training which was entirely completed in just four days, again

remotely with Agiles team situated in India.

Kalpesh Desai, CEO, Agile FT adds, Sidra Capitals leadership team is

extremely focused and were clear on what they wanted to accomplish from

both a go-to-market and from a regulatory compliance process. The

implementation process which was completed in record time is an example of

exemplary teamwork across both enterprises.

Business Benefits

It was only after the project was implemented that Sidra was able to

demonstrate the capabilities required to win a license from the DFSA. Agiles

solution Agilis IMS helped Sidra comply with all the requirements laid down

by auditors, compliance and regulatory bodies and therefore acquire the license

to start its operations.

The deployment of Agilis IMS at Sidra Capital lays down a strong technology

platform that enables Sidra Capital to pursue the omnibus business model in

relation to the advisory provided to family offices for both Wealth Creation

and Wealth Preservation. It also fulfils Investment Banking, Corporate Finance

as well as Family Office needs of both corporates and entrepreneurs.

Agilis IMS has automated the entire end-to-end operations in Sidra Capital,

from, client onboarding, KYC, wealth management, security controls,

compliance, and reporting to accounting.

Conclusion

Sidra Capital seeks to offer a hassle-free alternative to investors to tap capital

markets. Agilis IMS has empowered Sidra Capital to ensure exemplary service

levels and security to its clients, whilst enabling it to meet the stringent

compliance and audit requirements of DFSA.

The technology

platform from

Agile FT was

instrumental in

preparing us for

our regulatory

license approval

from the Dubai

Financial Services

Authority.

- Ajay Arora,

CEO, Sidra Capital

(L-R) Ajay Arora, CEO, Sidra Capital (DIFC) Limited; Shefali Khera, Chief Marketing Officer &

Business Head, Agile FT; Kalpesh Desai, CEO, Agile FT.

13

ARTICLE

Bancassurance

in Middle East

& Africa

Business imperatives to consider while

deploying technology

The bancassurance model is capable of bringing huge

benefits not only to banks and insurance companies but also

to customers through lower costs and greater credibility

typically attached to banks.

In the Middle East and Africa too, bancassurance is picking

up as a cost-effective channel for reaching out to the mass

market as well as to cross sell insurance products to the high-

income segments.

The traditional drivers for increasing insurance penetration

through bancassurance are in place -

rising GDP and income levels driving demand for

insurance products;

developing insurance sector in the mass market as well as

high income segments;

rising penetration of compulsory insurance such as

motor and health;

growth of Takaful or Shariah compliant insurance.

Besides these drivers, there are strong economic and

financial sector cues that support the growth of

bancassurance as a strong channel for insurance distribution

in the region in the near future:

Evolving Regulatory Frameworks

The growth of bancassurance requires a regulatory

environment conducive to fostering investments and

protecting consumer interests. As governments and

regulatory agencies in several countries are now taking

Developing countries all over

the world have been

experiencing strong growth in

bancassurance, a model in which

a bank distributes the products

of an insurance company. The

biggest reason for this is that

insurance penetration is lower

than the banking penetration,

which presents a distribution

opportunity to tap previously

uncovered customer segments.

cognizance of the opportunity provided by bancassurance,

there is likely to be significant traction in the coming years.

A clear example of the correlation between a nurturing

environment and bancassurance development can be seen in

Morocco, where there has been significant growth after

bancassurance in life insurance was formally allowed in

2005. Banks in Morocco are seeking to become one-stop

providers of retail financial services and bancassurance plays

a critical role in that strategy. An estimated 25 percent of

premiums are accounted through bancassurance, a

proportion that has seen a huge rise since the government

opened doors in 2005.

Variety of Operating Models Being Explored

Though bancassurance as a concept started in Europe with

the full integration model, there have since been several

different kinds of approaches to bancassurance.

In the Middle East and Africa, local and regional banks are

often owned by large financial consortiums that also own

insurance companies. This structure makes it possible to

create fully integrated bancassurance operations which allow

insurance companies complete control over the channel and

also a high deal of flexibility to introduce products

customized to various customer segments of the banks.

With several banks looking to become one-stop providers of

financial products in the Middle East and Africa, the

distribution arrangement is also gaining popularity. In this

operating model, the bank ties up with one or more

insurance companies to simply act as an intermediary and

earn commissions on the sale of insurance products. Some

advantages of the fully integrated or joint venture driven

bancassurance may be lost in this type of a partnership

especially in a non exclusive tie-up. However, it entails

relatively lower time-to-market and much lower capital

requirements.

Customer Segmentation and Focus on

Distribution

On the one hand, the insurance companys mandate is to be

able to provide customized, flexible products that are closely

integrated with the banks business. On the other hand, the

growth potential for banks lies in cross-selling the range of

insurance products to different customers across retail,

corporate and private banking segments.

For leveraging the channel effectively, banks need to focus

on two aspects: a variety of distribution methods from over

the counter sales by front line managers to specialist

advisors that deal with specific customer segments with

more advanced needs. This calls for strong customer

segmentation capabilities so as to target the right products at

the right segment. For example, simple mass-market

insurance products linked to banking accounts can be sold

over the counter. However, in the case of more complex

products associated with high net worth (HNW) individuals,

the lead would most likely be transferred to a specialist

advisor trained to deal with HNW customers.

Product Distribution Trends

So far, the Bancassurance channel in the region has been by

and large more popular for life insurance products. Non-life

products have been limited to motor or travel insurance so

14

ARTICLE

Bancassurance Related Regulation in Some of the MENA Countries

far. However, banks have been slowly integrating general

insurance products into the bancassurance distribution as

well.

Distributing Islamic banking or Takaful products (often

called BancaTakaful) is gaining popularity in the Middle East

as banks may tie up with providers of Takaful products

instead of conventional insurance products. HSBC Bank

and EmiratesNBD have been setting up subsidiaries for

Takaful products and have been leading this trend.

Region-specific products such as funeral insurance and

microinsurance through bancassurance are also picking up.

At Standard Chartered, Africa, for example, 60 percent of

individual life insurance sales are made up of funeral

insurance covers.

Strategies for Bancassurance Success

Leveraging bancassurance will require a thorough

understanding of the processing requirements and

challenges from various operating models. Automation in

the value chain will derive from this operating model and in

turn mandate what technologies need to be deployed.

These challenges and requirements will also differ based on

what products are likely to be distributed through the

arrangement.

For example, life and pension products often require greater

compliance and customer information compared to motor

or theft insurance. The bancassurance architecture will have

to take this into consideration.

Customer expectations from retail banking have seen a huge

rise in recent years. When the same customers buy insurance

from banks, they are bound to apply similar standards to

insurance products sold through the same banks.

Front end technologies which offer the customer greater

control, bring transparency and convenient access will have

to be implemented along with the bancassurance strategy.

Incorporating point-of-sales service through integration

with banking functions can be one way in which to achieve

this.

Currently, technology is being applied mainly to direct sales.

However, not many banks are interfacing directly with the

insurance company to sell policies using the insurance

companys web platforms. Pre-underwritten products sold

through such platforms would bring significant ease to the

process. Tele-underwriting or linking to the insurance

companys underwriting systems can enable printing of

policies directly at the bank.

Finally, technology should allow the necessary flexibility to

support a value chain that will be able to leverage resources

from both the bancassurance partners. Customers will gain

the most when their demands are kept at the forefront of

such strategies.

15

ARTICLE

Operating Models for Bancassurance

Focus Areas for Bancassurance Success

Underwriting

Sales support

Lead generation

Training

Technology

Agilis

Investment

Management

A proven and robust end-to-end

technology platform.

16

SOLUTION OVERVIEW

With decreasing margins and increasing customer demands,

investment managers are being forced to think of new

service and distribution models to overcome these

challenges, and it is imperative for them to have access to the

best technology possible.

The Agilis Investment Management Solution is an

integrated suite of products which provide a seamless

technology experience across financial planning, wealth

management, fund management (including asset

management and transfer agency operations), pension funds

administration and custody, bancassurance, and capital

markets.

The solution enables institutions to manage the wealth of its

clients and in the process create more wealth for them.

With a deep understanding that financial institutions need to

go the extra mile to enhance client relationships, the Agilis

Investment Management Solution provides a unique

platform that gives a 360 view of each investor to enable

superior management. There is a strong focus on

relationship management features as well as those related to

regulatory compliance, especially know your customer

(KYC) norms.

Asset management companies and investment managers

need a multi-currency, integrated asset management solution

that is pre-designed to automate the complete investment

management operations. The Agilis Investment

Management Solution manages and controls all asset classes

ranging from Equity, Fixed Income (including Sukuks),

Money Market, Derivatives, Real Estate and Alternative

Though the global financial

crisis resides firmly in the past,

the investment management

industry is still feeling its impact

and continues to be faced with

significant challenges. These

challenges may be attributed to

increasing instability on the

political front globally, combined

with a slew of new and complex

regulatory requirements and

depletion in customer

confidence.

17

SOLUTION OVERVIEW

Investments among others. It automates the complete

process right from pre-deal analytics, order management,

deal capture, position management, valuation, bank account

management, reconciliation, accounting to NAV generation.

The software is intuitive, interactive and provides real-time

information.

The solution also has a powerful risk management module

for maintaining limits and tracking exposure for regulatory

and internal compliance. It is designed to monitor and

administer all portfolios on investment allocation rules as

per regulatory as well as internal investment guidelines. In

case of Islamic investment, adherence to Shariah principles

is provided for. The limit checks are configured as online or

offline, hard or soft based on user requirements. Built in

security alerts warn fund managers, risk managers and other

users in advance in case of any event that is beyond set

parameters. The solution enables asset managers to

innovate, scale up operations and deliver superior

performance through the robust, flexible and powerful tools

available.

Sophisticated analytical tools are available for fund managers

to perform Simulation and Security-level analysis (duration,

convexity and yield to put/call) at the touch of a button.

These analytics equip the users with powerful information

even before the deal takes place (that is at the Pre-Deal

stage). The manager can thus take informed decisions.

Simulation enables the users to view the impact of their

proposed trades on each of their portfolios, the underlying

limits and predicted performance vis--vis a benchmark or a

model portfolio.

The solution has built-in flexibility to cater to specific

workflows of an organization for instance where an order

mandate can originate from a fund managers desk and flow

direct to the dealing room or where a chief dealer may want

a single-step order processing or where complete STP with

the broker may be desired.

All post-deal functions such as Corporate Actions,

Valuation, Banking, Settlement, Accounting and NAV

calculation is taken care of in the solution. The solution is

intuitively built to cater to various types of asset classes in

multiple currencies. The system is able to offer calculations

in both WAC as well as in the First in First Out [FIFO]

method. It also provides for accurate accrual calculations on

both a fixed and floating basis. Another key feature of the

system is the ability to define portfolio level policy for

straight line and constant yield. The software is capable of

comparing the positions as they exist with the funds

custodian and reporting any exceptions.

Portfolio managers need to track and measure various

important metrics for a wide range of funds under

management. Agilis Investment Management simplifies

portfolio valuation using sound portfolio wise policies. The

software uses multiple valuation methods for internal and

regulatory compliance. Built into the system is also a

performance monitoring module that has performance

indicators and compliance mechanisms for management of

assets. The software performs factsheet and attribution

analysis as well as evaluates risk parameters on the entire

portfolio or individual scrips using industry standard

practices including Beta, Sharpes Ratio and Treynors Ratio.

The solution has a robust integration engine which has the

capability of interfacing with third party systems and

comparing feeds with the master data resident in the system.

The third party systems include Custodian system from

leading banks including Citibank, Deutsche Bank and

HSBC; Core Banking solutions or Central General Ledger

[GL]/ERP Systems; Equity Trade Interfaces and Market

Price Feeds from Bloomberg and Reuters.

The banking and accounting module helps the fund

managers to track appropriation, payments and receipts and

provide a comprehensive and reconciled view of the

accounts. The accounting engine can also be configured to

generate vouchers and accounting statements as required by

the customers.

The solution also has a

powerful risk management

module for maintaining

limits and tracking exposure

for regulatory and internal

compliance.

18

SOLUTION OVERVIEW

Most important in this process is a feature where straight-through-processing

of transactions are possible for confirmation of automatic trades and

reconciliations. Deal reporting to the custodian and fund accountant is also

system generated. The system also has the ability to generate a periodic cash-

flow report as well as projections which is vital for the liquidity of the fund

management process.

The solution ably supports pension fund administration and custody including

setup of the fund and custody, registration of employers and employees,

contributions and monthly collection, commuted value, retirement and death

benefits, retirement annuity, attached unit linked funds, and calculation of

taxes and bonus.

The bancassurance module in the solution allows creation and maintenance of

comprehensive profiles of clients as well as Insurance companies and

branches. It is geared to manage a banks insurance business ranging from

assigning revenue targets to its channels to tracking incentive eared by the sales

staff and ultimately total commissions eared by the bank. The system allows

business transactions to be recorded from the banks branch offices with built-

in secure and controlled access rights.

The system allows creation of individual and corporate clients and captures

the essential underwriting details required to generate a proposal. Mass mailing

and policy reminder facilities are available to remind customers about

upcoming renewals well before the expiry date.

The module also enables the bank to create insurance company profiles

including the attachment of specific products to each insurance company. It

provides the facility to import policies directly by interfacing with the

insurance companies database as well as to compare different insurance

products from various insurance companies across multiple parameters.

The system effectively allows for the reconciliation of proposal data with the

issued policy date between the bank and the insurance company. This ensures

that there is no gap, and that the insurance company has processed all the

proposals that have been generated by the bank.

The solution provides for definition of business sources such as bank

employees, brokers, consultants and tele-marketers. It also enables the

definition and monitoring of targets and remuneration for each source of

business and supports the management on finding out the most productive

and profitable source.

Sales commission, incentive, brokerage and consulting fees can be calculated

either as percentage or on a fixed fee basis for all sources of business.

The solution provides for issue of renewal notice to clients well in time before

the renewals are due, as well as endorsements with or without change of

premium. In addition to the front end staff using it, this functionality is also

useful for back office bank employees to calculate commissions and charges

with the insurance company.

Agilis Investment Management allows for easy administration of users

through a centralized console. Every user has a secure login id to the system

and access to the system is defined based on his/her function, role and status

in the organisation. It also has the ability to intuitively generate a variety of

reports that are required by different executives in the management from time-

to-time.

Agilis Investment

Management

simplifies portfolio

valuation using

sound portfolio

wise policies. The

software uses

multiple valuation

methods for

internal and

regulatory

compliance.

AGILE FT IN THE NEWS...

Agile Financial Technologies

has won a contract to deploy Agilis

Core General Insurance software

for THI Insurance, Zimbabwe's

most trusted and recognized insurer

with a history of 75 years of

experience in providing tobacco

hail and windstorm cover to both

large and small scale tobacco

growers. THI Insurance is a

subsidiary of Tetrad Holdings

Limited, whose other operations

include Banking, Asset

Management, Microfinance,

Mining and Property management.

THI Insurance is now expanding

it's product offering to include

property and casualty, marine,

engineering, aviation, accident,

credit, travel, liability, crop,

livestock and motor insurance.

With this expansion plan in mind,

THI Insurance sought to identify a

reliable software product and

provider to partner with them in the

automation of their business

functions and zeroed in on Agile

FT's Agilis General Insurance

Software as it's technology

platform of choice, after an

extensive evaluation of various

software solutions.

"Over the last 75 years, THI

Insurance has been a trusted

insurance provider to the tobacco

and agricultural sector and we are

now expanding our horizon to

cover other niche insurance

products in Zimbabwe and the

region. Taking into account our

growth plans, we wanted to ensure

that we had a dependable general

insurance system to automate our

existing operations and allow us to

offer our customers short term

insurance solutions more

efficiently. After reviewing

solutions from various vendors, we

chose Agilis Core General

Insurance as it is not only feature-

rich but also offers us scalability as

well," says Hamish MacLean,

Managing Director, THI Insurance.

"As part of this deployment,

we will also be implementing

Agilis Portals to extend a web

based presence covering our

agents, brokers and customers. We

are confident that Agilis Core

General Insurance will help us

streamline our operations, enhance

our business processes and help our

growth and expansion plans," adds

Amon Rupiya, Head Of Operations

- (General Insurance).

Agilis is entirely web-based

and ensures quick, accurate and

easy access to information by

employing a modular and

parametric approach to the

management of insurance business

and deploying it enterprise wide. In

addition to the core operational

efficiencies that Agilis brings in,

THI Insurance will also be able to

leverage Agile FT's mobility

solutions and web portals to

automate agents and brokers.

THI Insurance Selects Agilis Core General Insurance

Software For Scalability and Growth

Agile Financial Technologies

has signed a contract with Zambia's

Focus General Insurance (FGI) to

deploy its general insurance

solution - Agilis Core General

Insurance. Agile FT's integrated

comprehensive insurance solution

will cover FGI's entire business

cycle from underwriting and claims

management to reinsurance and

accounting in addition to helping

the company streamline its

business processes and increase

operational efficiency.

According to Issac Gunda,

Managing Director of Focus

General Insurance, "In our quest to

meet the changing needs of our

marketplace as well as to meet our

company's strategic objectives, we

were looking to implement a

comprehensive core insurance

software, which would not only

automate our day to day tasks, but

would also provide mobility and

accessibility to our brokers, agents

and customers. The solution also

needed to be scalable, where it

could easily be integrated with new

technologies to aid our future

growth and expansion in the

region. After thoroughly reviewing

a number of solutions from

different vendors, we found that

Agilis Core General Insurance

came closest to meeting all of our

requirements."

Focus General Insurance Ltd

(FGI) was licensed by the Pension

and Insurance Authority on 1

January 2013 to offer a wide range

of structured general insurance

products in the Zambian market.

The company offers a wide range

of structured general insurance for

both commercial insurance

products and retail/personal

insurance products. Currently

operating only in Zambia, FGI

plans to expand its business and

reach across the African continent

in the near future.

Zambia's Focus General Insurance To

Deploy Agilis Core General Insurance

Solution To Fuel Growth And Efficiency

Agile Financial Technologies

has been ranked amongst the top

10 promising Banking, Financial

Services and Insurance (BFSI)

software solutions providers by

CIO Review magazine. Agile FT

was selected for its excellence in

delivering top-notch software

solutions to BFSI companies, its

innovative approach towards

customers and its achievements

over the last few years.

Christo Jacob, Managing

Editor, CIO Review, says, "Agile

Financial Technologies has been

on our radar since their selection

in 2013's 10 Most Promising

BFSI Software and Solution

Providers and we are happy to

showcase them this year due to

their continuing excellence in

delivering top-notch solutions to

the BFSI Sector. Agile FT's

solutions continued to break new

ground within the past year

benefiting its customers around

the globe and we're excited to

have them featured as one of the

Most Promising BFSI Solution

providers."

Over the last few years,

Agile FT has emerged as a

leading provider of enterprise

software to the banking, financial

services and insurance sectors,

with a growing customer

community of leading banks,

insurance companies, investment

management firms and financial

institutions across 20 countries.

The company's focus has been to

continuously enhance the core

functionality of their already

strong product offerings in

insurance, investment

management and capital markets,

lending and bancassurance. Agile

FT has recently introduced

mobile apps that would allow

their customers' insurance agents

to automate their mobile field

force and agents and provide a

360 degree sales and service

capability.

CIO Review Ranks Agile Financial

Technologies Amongst Top 10 Most Promising

BFSI Software Solutions Providers

www.agile-ft.com

Views expressed in this publication do not necessarily represent the views of Agile FT and the information contained herein is only a brief synopsis of the issues discussed herein. Agile FT makes

no representation as regards the accuracy and completeness of the information contained herein and the same should not be construed as legal, business or technology advice. Agile FT, the authors and

publishers, shall not be responsible for any loss or damage caused to any person on account of errors or omissions.

SOUTH ASIA

Agile Financial Technologies Pvt Ltd

Tex Centre, N Wing, 3rd Floor

Chandivili, Andheri (E)

Mumbai 400 072

Tel : +91.22.425.01200

Fax: +91.22.425.01234

Email: info@agile-ft.com

EUROPE, MIDDLE EAST & AFRICA

Agile FinTech FZ-LLC

808-A,Business Central Towers

Dubai Internet City,

Dubai, UAE

Tel: +971.4.433.1825

Fax:+971.4.435.5709

Email: info@agile-ft.com

ASIA PACIFIC

Agile Financial Technologies PTE Ltd.

20 Cecil Street, #14-01

Equity Plaza,

Singapore 049705

Tel : +65-6438 8887

Fax: +65-6438 2436

Email: info@agile-ft.com

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Weather Prediction Using Machine Learning TechniquessDocument53 pagesWeather Prediction Using Machine Learning Techniquessbakiz89No ratings yet

- Saeed Sentence Relation and Truth (Summary)Document11 pagesSaeed Sentence Relation and Truth (Summary)Mohammad Hassan100% (1)

- Full Download Bontragers Textbook of Radiographic Positioning and Related Anatomy 9th Edition Lampignano Test BankDocument36 pagesFull Download Bontragers Textbook of Radiographic Positioning and Related Anatomy 9th Edition Lampignano Test Bankjohn5kwillis100% (22)

- Agile Financial Times - September 2014Document20 pagesAgile Financial Times - September 2014Agile Financial TechnologiesNo ratings yet

- Emea Policy Administration Systems 2013 Life, Annuities, Pension, and Health Abcd Vendor ViewDocument20 pagesEmea Policy Administration Systems 2013 Life, Annuities, Pension, and Health Abcd Vendor ViewAgile Financial TechnologiesNo ratings yet

- Technology - The Backbone of An Insurance Company (Article in Premium Magazine, October 2012)Document4 pagesTechnology - The Backbone of An Insurance Company (Article in Premium Magazine, October 2012)Agile Financial TechnologiesNo ratings yet

- Agilis Investment Management & Agilis BancAssurance Featured in Bankers M.E. June 2013Document1 pageAgilis Investment Management & Agilis BancAssurance Featured in Bankers M.E. June 2013Agile Financial TechnologiesNo ratings yet

- Premium Feb 2014 - BancAssuranceDocument2 pagesPremium Feb 2014 - BancAssuranceAgile Financial TechnologiesNo ratings yet

- Financial Institutions and Social MediaDocument2 pagesFinancial Institutions and Social MediaAgile Financial TechnologiesNo ratings yet

- Interview in The Policy Magazine - June 2012 - The UAE Insurance Report 2012Document2 pagesInterview in The Policy Magazine - June 2012 - The UAE Insurance Report 2012Agile Financial TechnologiesNo ratings yet

- Agile FT - Insurance Technology Trends 2010Document31 pagesAgile FT - Insurance Technology Trends 2010Agile Financial TechnologiesNo ratings yet

- Agile Financial Times August 2009 EditionDocument20 pagesAgile Financial Times August 2009 EditionAgile Financial TechnologiesNo ratings yet

- Agile Financial Times July 09 EditionDocument20 pagesAgile Financial Times July 09 EditionAgile Financial TechnologiesNo ratings yet

- Agile Financial Times October 2009 EditionDocument20 pagesAgile Financial Times October 2009 EditionAgile Financial TechnologiesNo ratings yet

- MicroFinance - Impact On The Indian Market by Kalpesh Desai in The Financial Express - Micro Finance World July 09Document2 pagesMicroFinance - Impact On The Indian Market by Kalpesh Desai in The Financial Express - Micro Finance World July 09Agile Financial Technologies100% (2)

- Banking Technology Trends - Interview by Kalpesh Desai, CEO of Agile FT, With ExpressComputers IndiaDocument1 pageBanking Technology Trends - Interview by Kalpesh Desai, CEO of Agile FT, With ExpressComputers IndiaAgile Financial TechnologiesNo ratings yet

- Agile Financial Times - June 2009 EditionDocument24 pagesAgile Financial Times - June 2009 EditionAgile Financial Technologies100% (8)

- Agile Financial Times - April 2009 EditionDocument20 pagesAgile Financial Times - April 2009 EditionAgile Financial Technologies100% (1)

- Outlook For Takaful in IndiaDocument24 pagesOutlook For Takaful in IndiaAgile Financial Technologies100% (1)

- Diamonds in The Dust - Cover Story - 4Ps Business and Marketing Jun 2009Document1 pageDiamonds in The Dust - Cover Story - 4Ps Business and Marketing Jun 2009Agile Financial TechnologiesNo ratings yet

- Agile Financial Times May09 EditionDocument24 pagesAgile Financial Times May09 EditionAgile Financial Technologies100% (22)

- Benson Ivor - The Zionist FactorDocument234 pagesBenson Ivor - The Zionist Factorblago simeonov100% (1)

- EE - 2014-2 - by WWW - LearnEngineering.inDocument41 pagesEE - 2014-2 - by WWW - LearnEngineering.inprathap kumarNo ratings yet

- PCZ 1503020 CeDocument73 pagesPCZ 1503020 Cedanielradu27No ratings yet

- Family Planning MethodsDocument20 pagesFamily Planning MethodsRoel Marcial100% (2)

- Industrial RevolutionDocument2 pagesIndustrial RevolutionDiana MariaNo ratings yet

- GMDSSDocument1 pageGMDSSRahul rajeshNo ratings yet

- Title - Dating Virtual To Coffee Table Keywords - Dating, Application BlogDocument3 pagesTitle - Dating Virtual To Coffee Table Keywords - Dating, Application BlogRajni DhimanNo ratings yet

- Manual ML 1675 PDFDocument70 pagesManual ML 1675 PDFSergio de BedoutNo ratings yet

- Fortigate System Admin 40 Mr2Document115 pagesFortigate System Admin 40 Mr2KhaleelNo ratings yet

- An Overview of Marketing - Week 1Document7 pagesAn Overview of Marketing - Week 1Jowjie TVNo ratings yet

- Addpac AP1000 DSDocument2 pagesAddpac AP1000 DSEnrique RamosNo ratings yet

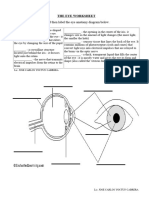

- The Eye WorksheetDocument3 pagesThe Eye WorksheetCally ChewNo ratings yet

- Burj Khalifa: Engineer Abdul MananDocument29 pagesBurj Khalifa: Engineer Abdul MananabdulmananNo ratings yet

- Baumer Tdp02 Tdpz02 Ds enDocument4 pagesBaumer Tdp02 Tdpz02 Ds enQamar ZiaNo ratings yet

- JurnalDocument12 pagesJurnalSandy Ronny PurbaNo ratings yet

- Traulsen RHT-AHT Reach in Refrigerator WUT Glass DoorDocument2 pagesTraulsen RHT-AHT Reach in Refrigerator WUT Glass Doorwsfc-ebayNo ratings yet

- How To Prepare Adjusting Entries - Step-By-Step (2023)Document10 pagesHow To Prepare Adjusting Entries - Step-By-Step (2023)Yaseen GhulamNo ratings yet

- Revised Exam PEDocument3 pagesRevised Exam PEJohn Denver De la Cruz0% (1)

- University Grading System - VTUDocument3 pagesUniversity Grading System - VTUmithilesh8144No ratings yet

- Homelite 18V Hedge Trimmer - UT31840 - Users ManualDocument18 pagesHomelite 18V Hedge Trimmer - UT31840 - Users ManualgunterivNo ratings yet

- Sheridan Specialized Building Products LLC - Queue Solutions Commercial Proposal by SeQure TechnologiesDocument6 pagesSheridan Specialized Building Products LLC - Queue Solutions Commercial Proposal by SeQure Technologiessailesh psNo ratings yet

- Abhishek Parmar: Personal DetailsDocument2 pagesAbhishek Parmar: Personal DetailsabhishekparmarNo ratings yet

- Chemistry For Changing Times 14th Edition Hill Mccreary Solution ManualDocument24 pagesChemistry For Changing Times 14th Edition Hill Mccreary Solution ManualElaineStewartieog100% (50)

- 60 Plan of DepopulationDocument32 pages60 Plan of DepopulationMorena Eresh100% (1)

- P4 Science Topical Questions Term 1Document36 pagesP4 Science Topical Questions Term 1Sean Liam0% (1)

- School of Management Studies INDIRA GANDHI NATIONAL OPEN UNIVERSITY Proforma For Approval of Project Proposal (MS-100)Document12 pagesSchool of Management Studies INDIRA GANDHI NATIONAL OPEN UNIVERSITY Proforma For Approval of Project Proposal (MS-100)Pramod ShawNo ratings yet

- Hydrotest Test FormatDocument27 pagesHydrotest Test FormatRähûl Prätäp SïnghNo ratings yet