Professional Documents

Culture Documents

Masters in Business Administration: Cohort: MBEA/09A/PT Year 1 MBA/09A/PT Year 1

Uploaded by

Chamil Suranga SilvaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Masters in Business Administration: Cohort: MBEA/09A/PT Year 1 MBA/09A/PT Year 1

Uploaded by

Chamil Suranga SilvaCopyright:

Available Formats

Masters in Business Administration

Cohort: MBEA/09A/PT Year 1 MBA/09A/PT Year 1

Examinations for 2009 2010 Semester I / 2009 Semester II

MODULE: STRATEGIC MANAGEMENT

MODULE CODE: OPS 5601 Duration: 3 Hours Reading time: 15 Minutes Instructions to Candidates:

1. Answer ALL questions. 2. Always start a new question on a fresh page. 3. Total Marks: 100

This question paper contains 5 questions and 8 pages. Page 1 of 8

SSDTSemI/09-10

ANSWER ALL QUESTIONS

Read the Case Study below and answer all the questions that follow: Introduction An interesting development in the South African airline industry was the introduction of kulula.com, a low-fares airline, which forms part of the Comair/ British Airways group. Comair Limited started in 1946 and signed a franchise with British Airways in 1997 to use the British Airways brand name in South and southern Africa. Currently the Comair/British Airways group flies between Johannesburg, Cape Town, Durban, Port Elizabeth, Lusaka, Harare, Windhoek and Victoria Falls. The directors of Comair realised in that there was a gap in the market for a low-fares airline, especially after the demise of various airlines catering for this segment such as Sun Air. kulula.com was introduced in August 2001 with a limited number of flights daily between Johannesburg and Cape Town. Passengers suddenly had a drastically cheaper option to fly between Johannesburg, Cape Town and Durban. Airfares of R400 per one-way trip between Johannesburg and Cape Town rocked the established airlines such as South African Airways, starting a price war with customers being the main beneficiaries.

The mission of kulula.com kulula.com's mission statement is not the run-of-the-mill statement that you find in the annual report of most companies. It reflects something of the corporate culture of the airline. The mission statement is irreverent and humourous reflecting the image of a down-to-earth company. The mission of kulula.com reads as follows:

Mission statement of kulula.com To our superhero customers and staff we dream of being:

The easiest around this means we must constantly provide the easiest way to book, the easiest way to pay, and above all, be the easiest to afford. Simple we don't complicate things. We don't use high-and-mighty language and overly wordy descriptions. We get to the point and that's that. Totally honest this means we tell it like it is. We're not shy of being straight Page 2 of 8

SSDTSemI/09-10

and down-to-earth. There is no bullshit. There are no hidden costs. What you see is what you get.

Great fun we help people lighten up. Smiles and jokes are free. We always want to be genuinely friendly and provide the right environment for our staff's natural talent to shine.

Safe and professional at no time is our dedication compromised. Our most important principle is 'safety first'. Inspirational wherever possible, we provide our staff with the best opportunities to develop their skills, and take their abilities to new heights in the service of our customers.

Today we are an airline, tomorrow, who knows? Nothing is impossible. But wherever our customers see the kulula.com brand, they can expect these values.

Services offered by kulula.com kulula.com offers two services to its customers: flights between the major destinations in South Africa and car rental. The logo of kulula.com flights includes the slogan:

Now anyone can fly, thereby appealing to the widest possible target market. The kulula.com/cars service was launched in August 2002. The two services complement one another. When passengers buy a return air ticket from kulula.com they may also rent a car at R165 per day (including unlimited mileage, standard insurance waivers, airport surcharge and VAT). kulula.com also offers a reasonably-priced shuttle service to and from the airport.

Competition in the low-fares market At the beginning of 2004 a new competitor entered the South African market with the promise of the same low prices as kulula.com. This entry contributed to the general overcapacity problem of the market, which some observers say will only be solved by the bankruptcy of one or more of the airlines. Despite that, kulula.com launched the acquisition of four McDonnel-Douglas 82 airplanes in January 2004 with an up to 30% slash in fares to the destinations Cape Town, Port Elizabeth, George and Page 3 of 8

SSDTSemI/09-10

Durban. The executive director of kulula.com, Novick explained the 30% cheaper rates (e.g. the airfare between Johannesburg and Durban is R199 one-way) as due to the savings on the new airplanes, which are 30% cheaper to operate than the older Boeings 737-300s.

The role of price elasticity of demand The fundamental theory of price elasticity of demand provides an economic explanation why passengers are interested in flying with kulula.com and why kulula.com is in a position to charge these low fares. The price elasticity of demand refers to the percentage change in the quantity demanded from a change in the price. If a decline of 50% in the price results in an increase in demand of 100%, we say that the price is elastic within the price range. This is the price principle being followed by kulula.com in its assault on the South African market.

What is further of interest is the fact that kulula.com is following the same strategy as some of the now famous European and American airlines such as Ryanair and Southwest Airlines.4 These two airlines are following a powerful combination of low airfares and good service to win the hearts and minds of passenger) and can be described as value-based players in the airline industry.

Value-based players' competitive edges The power of value-based companies are centred in two areas, namely having a cost advantage in the airline industry and in the relentless way in which this cost advantage is pursued while their second strength is based on the potency of the shift in consumer perceptions regarding the quality of the service that they offer. These two aspects will now be discussed in greater detail:

Cost advantage Ryanair, for instance, charges lower fares by departing from lower-cost airports (e.g. departing from Gerona which is 60km from Barcelona while the national carriers depart from the Barcelona city airport), utilising aircraft more optimally by flying them more hours a day, keeping labour cost low, distributing tickets online and providing no in-flight frills. In South Africa the trend of utilising secondary airports is still in its Page 4 of 8

SSDTSemI/09-10

infancy with Lanseria now being positioned as an alternative to Johannesburg airport. The financial and operational performance of Ryanair during the period 1998 to 2002 is depicted in Table below:

Year Net Profit (US Dollars, in millions) Net Margin

2002 134.84

2001 94.86

2000 74.72

1999 61.18

1998 52.35

24.09%

21.43%

19.59%

19.25%

19.63%

Operational Statistics Passengers (in millions) Passenger load factor 11.1 81.2% 7.4 71% 5.5 67% 4.9 71.5% 4.0 72%

Novick, the CEO of kulula.com states that they 'sweat the assets (airplanes)' flying six sectors a day on the route Johannesburg to Cape Town utilising the planes 12 to 14 hours a day.' kulula.com furthermore does not have additional services that cost money such as frequent-flyer programmes, offering meals onboard, pre-seating customers and paying commission to travel agents and tour operators. Southwest airlines in the USA is following the same approach and the cost advantage of Southwest Airlines is explained in the excerpt below.

The cost advantage of Southwest Airlines Low costs have given Southwest Airlines in the USA the competitive advantage of having the America's lowest fares. This advantage has created a phenomenon known in the airline industry as the 'Southwest effect'. Airports served by Southwest have lower average fares than those that are not because competitors feel compelled to match Southwest's fares.

A shift in the quality perceptions that they offer Although passengers flying with Ryanair cannot reserve seats in advance, the quality gap between Ryanair and British Airways (the official UK carrier) is perceived to be narrow, regarding aspects such as service, convenience and the buying experience. Similarly, in South Africa Novick, CEO of kulula.com, states that safety standards are Page 5 of 8

SSDTSemI/09-10

non-negotiable and that kulula has a strong customer base and a strong brand. kulula.com also won the ACSA-Airports Company's award for best domestic airline in 2002 strengthening the positive quality perception of customers.

Value-based airlines attract large numbers of passengers with the winning combination of low prices and 'good enough' quality. With the large number of passengers these airlines obtain economies of scale, which translates into superior productivity increases, something which is unattainable by traditional airlines. The graph below indicates the lower cost per available seat mile of Ryanair and Southwest, which is Ryanair's business model counterpart in the USA.

30

25

20

US Cent

15

Series1

10

0 Ryanair EU Average Airline SouthWest US Average

Cost per available seat mile of Ryanair and Southwest Airlines (2002 in American cents)

As can been seen both Southwest and Ryanair have a major advantage regarding cost-per-available-seat-mile (in both instances more than 30%). With this saving they can offer the cheapest possible fares, thereby generating above-average customer loyalty as well as profitability, which in turn generates a virtuous cycle whereby the company can charge even lower fares, open up more routes, and stimulate even Page 6 of 8

SSDTSemI/09-10

more traffic.

Another reason for the success of Southwest lies in the treatment of the personnel of the airline.10 Management believes that when employees are treated well, they will treat customers well, creating a beneficial situation for all stakeholders. This does not mean that the personnel get fat pay cheques. In fact, Southwest Airlines wages are generally lower that those of competitors but the company sweetens the deal by making stock options available to employees, enabling them to benefit from the airlines' financial success. What further endears Southwest to its employees is a nolayoff policy, even in the darkest days after September 11 (the bombing of the World Trade Centre in the USA). kulula.com is following the same approach as Southwest Airlines in as far as it keeps employees happy by giving them the freedom to perform their jobs to the best of their abilities.

Summary The aviation industry in South Africa was for decades monopolised by the state carrier South African Airways. The earlier introduction of no-frill airlines was not a success for various factors. However, it would seem that the most recent cut-price airlines are providing more stringent competition to the state carrier and other national carriers. Only time will tell if kulula.com will be as successful as its European and American counterparts in this respect.

Source: Cant, M and Machado, M (2005). Marketing Success Stories (5th Edition). Cape Town: Oxford University Press.

Page 7 of 8

SSDTSemI/09-10

ANSWER ALL QUESTIONS QUESTION 1: (20 MARKS)

Discuss the value chain as an aid to the process of identifying distinctive organizational capabilities using kulula.com as example. Use relevant theory to support your discussion.

QUESTION 2: (20MARKS)

Critically analyse the external environmental factors impacting upon the operations of kulula.com?

QUESTION 3: (20 MARKS)

Utilise Porters Five Forces Model to analyse the competition faced by low-fare airlines in Southern Africa with particular reference to kulula.com.

QUESTION 4: (20MARKS)

With particular reference to Porters model of the Five Generic Compe titive Strategies, evaluate the strategy adopted by kulula.com to compete in the airline business.

QUESTION 5: (20 MARKS)

In the last year kulula.com has experienced a drop in sales and market share. As the Marketing Executive of the airline, what recommendations will you make to the Board of Directors to improve sales and recover market share. Use relevant theory to support your arguments.

***END OF QUESTION PAPER***

Page 8 of 8

SSDTSemI/09-10

You might also like

- Analysis of EasyJet and Indian Low Cost Airlines StrategiesDocument14 pagesAnalysis of EasyJet and Indian Low Cost Airlines StrategiesNitika MishraNo ratings yet

- Shashank Yadvendra (19035322) MBA Sheffield Hallam UniversityDocument23 pagesShashank Yadvendra (19035322) MBA Sheffield Hallam Universityshashankyadav100% (2)

- Ryanair's Competitive Advantages: Last Update:15.Sep.2009Document22 pagesRyanair's Competitive Advantages: Last Update:15.Sep.2009Minar Uz ZamanNo ratings yet

- Ryan Airways: To Shannon SirDocument11 pagesRyan Airways: To Shannon SirDeepak NainaniNo ratings yet

- Ryanair For Business StrategyDocument2 pagesRyanair For Business StrategyBruna Aldegheri67% (3)

- Chapter1 AnswDocument104 pagesChapter1 AnswSara SmithNo ratings yet

- Strategy RyanairDocument10 pagesStrategy RyanairNandini BusireddyNo ratings yet

- Low Cost Carrier Swot AnalysisDocument3 pagesLow Cost Carrier Swot AnalysisSuprim ShresthaNo ratings yet

- Module 5 Foreign Exchange MarketDocument19 pagesModule 5 Foreign Exchange MarketjinalNo ratings yet

- Ryanair Industry Analysis - A Case StudyDocument21 pagesRyanair Industry Analysis - A Case StudyAnkona MondalNo ratings yet

- CH 2 Analyzing The External Environment of The FirmDocument24 pagesCH 2 Analyzing The External Environment of The FirmAshok SakNo ratings yet

- International Trade and Factor-Mobility TheoryDocument25 pagesInternational Trade and Factor-Mobility Theory9667802447No ratings yet

- Manual For Regulation For Foreign Exchange TransactionsDocument86 pagesManual For Regulation For Foreign Exchange TransactionsKiwi SorianoNo ratings yet

- Easy JetDocument16 pagesEasy JetEshwarya PathakNo ratings yet

- Economic Analysis of The Airline IndustryDocument14 pagesEconomic Analysis of The Airline Industrylightknight91No ratings yet

- RyanairDocument7 pagesRyanairJoão CaladoNo ratings yet

- Airline Industry in Germany 1208567927863620 8 PDFDocument17 pagesAirline Industry in Germany 1208567927863620 8 PDFTai BausekaliNo ratings yet

- Applying The Value Grid Model in Airline IndustryDocument11 pagesApplying The Value Grid Model in Airline IndustryKarim AdamNo ratings yet

- Rolls Royce Mind The GapDocument25 pagesRolls Royce Mind The Gapmarketfolly.comNo ratings yet

- Global Strategy-Review of Airline IndustryDocument8 pagesGlobal Strategy-Review of Airline IndustrySimrit ManihaniNo ratings yet

- SWOT Ryanair Air-ScoopDocument6 pagesSWOT Ryanair Air-Scooptushar_02No ratings yet

- Common Airline Business ModelsDocument12 pagesCommon Airline Business ModelsGianne Sebastian-LoNo ratings yet

- Competitive Strategy Creating Competitive AdvantageDocument45 pagesCompetitive Strategy Creating Competitive AdvantageRaghuveer Reddy AnnamNo ratings yet

- Lufthansa Annual ReportDocument264 pagesLufthansa Annual ReportrichardvpNo ratings yet

- The 4Ps of InnovationDocument9 pagesThe 4Ps of Innovationpavie raja100% (1)

- McKinsey's 7S Model in Relation To European AirlinesDocument7 pagesMcKinsey's 7S Model in Relation To European AirlinesTutu BanjaNo ratings yet

- Singapore International Airlines - Strategy With Smile PDFDocument19 pagesSingapore International Airlines - Strategy With Smile PDFNikita SinhaNo ratings yet

- The Importance of Concession Revenues in The PrivatizationDocument14 pagesThe Importance of Concession Revenues in The PrivatizationRodrigo SantosNo ratings yet

- Challenges of Implementing World Class Manufacturing Techniques in Zimbabwe Zimwara and MbohwaDocument12 pagesChallenges of Implementing World Class Manufacturing Techniques in Zimbabwe Zimwara and MbohwaFatimah KhanNo ratings yet

- Employees Come FirstDocument4 pagesEmployees Come FirstLeonWilfanNo ratings yet

- Technical AspectDocument13 pagesTechnical AspectAurea RuedaNo ratings yet

- Expansion Strategy For Spirit Airlines - Yesenia AlvarezDocument88 pagesExpansion Strategy For Spirit Airlines - Yesenia Alvarezyesse411jecmNo ratings yet

- Ryanair Strategy Report: Daniel Geller Brendan Folan Brian Shain April 19, 2013Document28 pagesRyanair Strategy Report: Daniel Geller Brendan Folan Brian Shain April 19, 2013suongxuongnui100% (2)

- Progress and Development of Information and Communication Technologies in HospitalityDocument19 pagesProgress and Development of Information and Communication Technologies in HospitalityDiana KudosNo ratings yet

- AirbusDocument2 pagesAirbusapi-221421240No ratings yet

- The West Jet CaseDocument3 pagesThe West Jet CasewebersimNo ratings yet

- Low Cost Strategy 040405Document40 pagesLow Cost Strategy 040405Ranjan JosephNo ratings yet

- Management Accounting AssignmentDocument15 pagesManagement Accounting AssignmentHarish FernandoNo ratings yet

- Analysis of Strategic Alliance As A Source of Competitive Ad PDFDocument86 pagesAnalysis of Strategic Alliance As A Source of Competitive Ad PDFMariam MassaȜdehNo ratings yet

- International ManagementDocument2 pagesInternational ManagementpalsNo ratings yet

- A Case On: Presented By, Group - 6Document26 pagesA Case On: Presented By, Group - 6logeshkounderNo ratings yet

- Chapter 3 Governmental Legal System PDFDocument23 pagesChapter 3 Governmental Legal System PDFViola carini100% (1)

- Ryan AirDocument8 pagesRyan Airstopnaggingme0% (1)

- Rolls Royce SWOT AnalysisDocument1 pageRolls Royce SWOT Analysisbeat_nmmNo ratings yet

- For Airlines: Click To Edit Master Subtitle StyleDocument6 pagesFor Airlines: Click To Edit Master Subtitle Stylebibliophile21No ratings yet

- Southwest's Generic Competitive StrategyDocument4 pagesSouthwest's Generic Competitive StrategyTayyaba AyeshaNo ratings yet

- Air LinesDocument63 pagesAir LinesRehman SixTnineNo ratings yet

- Recasting FS ExampleDocument23 pagesRecasting FS ExampleDzaky MaulidanNo ratings yet

- Deccan ProjectDocument17 pagesDeccan ProjectShukla JineshNo ratings yet

- Airline Simulation SWOTDocument1 pageAirline Simulation SWOTJohn PickleNo ratings yet

- Modeling Applications in The Airline Industry Ch1Document17 pagesModeling Applications in The Airline Industry Ch1Abhinav GiriNo ratings yet

- Unit 2 - JetBlue Case Study - Part 1Document5 pagesUnit 2 - JetBlue Case Study - Part 1Thảo HiềnNo ratings yet

- 03 - Low Cost ArlineDocument45 pages03 - Low Cost ArlineYeow Chong TohNo ratings yet

- The Impact of Low-Cost Carriers PDFDocument16 pagesThe Impact of Low-Cost Carriers PDFSohaib EjazNo ratings yet

- Qantas DataDocument31 pagesQantas DataChip choiNo ratings yet

- Group CorporateStrategyDocument25 pagesGroup CorporateStrategyKhai EmanNo ratings yet

- MODULE 8 - The Foreign Exchange MarketDocument6 pagesMODULE 8 - The Foreign Exchange Marketkarloncha4385No ratings yet

- Case Study of AirlineDocument6 pagesCase Study of AirlineAmjed YassenNo ratings yet

- Chapter 1 PID - Youssef AliDocument15 pagesChapter 1 PID - Youssef Alianime brandNo ratings yet

- Diploma in Financial Management: Project Db2, Incorporating Subject Areas - Financial Strategy - Risk ManagementDocument7 pagesDiploma in Financial Management: Project Db2, Incorporating Subject Areas - Financial Strategy - Risk ManagementMatthew Lewis0% (1)

- How To Set Up Advanced G/L Account Determination: All CountriesDocument18 pagesHow To Set Up Advanced G/L Account Determination: All CountriesChamil Suranga SilvaNo ratings yet

- Special Notice Additionof Implementation AgreementDocument1 pageSpecial Notice Additionof Implementation AgreementChamil Suranga SilvaNo ratings yet

- Lesson: Outlining The Functional Capabilities of SAP Sales CloudDocument1 pageLesson: Outlining The Functional Capabilities of SAP Sales CloudChamil Suranga SilvaNo ratings yet

- A Quick Bootcamp For Becoming Undefeatable: by Robin SharmaDocument27 pagesA Quick Bootcamp For Becoming Undefeatable: by Robin SharmaChamil Suranga SilvaNo ratings yet

- People'S Republic of China Forestry Outlook StudyDocument86 pagesPeople'S Republic of China Forestry Outlook StudyChamil Suranga SilvaNo ratings yet

- Gliricidia GliricidiaDocument18 pagesGliricidia GliricidiaChamil Suranga SilvaNo ratings yet

- Strategic Framework UnileverDocument19 pagesStrategic Framework UnileverChamil Suranga Silva0% (1)

- Leadership and Decision-Making in Team-Based Organizations: A Model of Bounded Chaotic Cycling in Emerging System StatesDocument32 pagesLeadership and Decision-Making in Team-Based Organizations: A Model of Bounded Chaotic Cycling in Emerging System StatesChamil Suranga SilvaNo ratings yet

- Google Case StudyDocument3 pagesGoogle Case StudyChamil Suranga Silva0% (2)

- Emerging Markets Case Studies Collection: Emerald Case Study: Garuda Indonesia: To Becoming A Distinguished AirlineDocument34 pagesEmerging Markets Case Studies Collection: Emerald Case Study: Garuda Indonesia: To Becoming A Distinguished AirlineChamil Suranga SilvaNo ratings yet

- International Finance SummerDocument45 pagesInternational Finance SummerChamil Suranga SilvaNo ratings yet

- Ecuador: A Case StudyDocument22 pagesEcuador: A Case StudyChamil Suranga SilvaNo ratings yet

- Management - Leadership The Overview: Public Administrati0N Admimistrator Manager LeaderDocument20 pagesManagement - Leadership The Overview: Public Administrati0N Admimistrator Manager LeaderChamil Suranga SilvaNo ratings yet

- CH 04 Personality and Consumer BehaviorDocument16 pagesCH 04 Personality and Consumer BehaviorChamil Suranga Silva100% (2)

- Spotlight OnDocument5 pagesSpotlight OnChamil Suranga SilvaNo ratings yet

- Chapter 1 The Investment SettingDocument81 pagesChapter 1 The Investment SettingAhmed hassanNo ratings yet

- Aptitude StigenDocument3 pagesAptitude StigenMonisha VishwanathNo ratings yet

- Group3 - M&A - Presentation FinalDocument72 pagesGroup3 - M&A - Presentation FinalUtkarsh SengarNo ratings yet

- Correct Mark 1.00 Out of 1.00: DirectDocument13 pagesCorrect Mark 1.00 Out of 1.00: DirectRuth Abrogar71% (7)

- The Impact of Inflation On The Students and Staff at South East Asia Institute of Trade and Technnology Legazpi 1Document19 pagesThe Impact of Inflation On The Students and Staff at South East Asia Institute of Trade and Technnology Legazpi 1cathleenNo ratings yet

- Segmentation and TargetingDocument14 pagesSegmentation and TargetingimadNo ratings yet

- Swot Analsis of 7upDocument17 pagesSwot Analsis of 7upChirag Arora33% (3)

- Location of Enterprise and Steps in Setting SSIDocument44 pagesLocation of Enterprise and Steps in Setting SSImurugesh_mbahit100% (2)

- Departmental Accnts-Jk ShahDocument3 pagesDepartmental Accnts-Jk ShahAnandhu KrishnanNo ratings yet

- Cost AccountingDocument28 pagesCost Accountinglove_oct22100% (1)

- Math PTDocument3 pagesMath PTPauline LavillaNo ratings yet

- PerfettiDocument20 pagesPerfettiAparna Monga100% (1)

- Guide To Measuring Procurement SavingsDocument19 pagesGuide To Measuring Procurement SavingsSaif Ali Momin100% (1)

- Axitrader Ebook1 7 Lessons Forex Market Types v2 PDFDocument18 pagesAxitrader Ebook1 7 Lessons Forex Market Types v2 PDFem00105No ratings yet

- Literature ReviewDocument2 pagesLiterature ReviewPatel MehulNo ratings yet

- LessonPlan PDFDocument9 pagesLessonPlan PDFvlabrague6426No ratings yet

- Performance Evaluation of Biomass Fired Dryer For Copra Drying A Comparison With Traditional Drying in Subtropical Climate 2157 7110.1000294Document5 pagesPerformance Evaluation of Biomass Fired Dryer For Copra Drying A Comparison With Traditional Drying in Subtropical Climate 2157 7110.1000294my_khan20027195No ratings yet

- Inferior Goods-A Product That's Demand Is Inversely Related To Consumer Income. in Other WordsDocument5 pagesInferior Goods-A Product That's Demand Is Inversely Related To Consumer Income. in Other WordsJasmine AlucimanNo ratings yet

- TB Incremental AnalysisDocument41 pagesTB Incremental AnalysisBusiness MatterNo ratings yet

- Mathematics of Investment - Mr. NogralesDocument55 pagesMathematics of Investment - Mr. NogralesatlasNo ratings yet

- Export Costing Sheet For Breakbulk ShipmentsDocument15 pagesExport Costing Sheet For Breakbulk ShipmentssizwehNo ratings yet

- Cost of CapitalDocument74 pagesCost of CapitalHarnitNo ratings yet

- Quiz 5Document7 pagesQuiz 5Rauf pervaizNo ratings yet

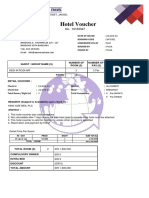

- Hotel Voucher: in - Out Price Night Sub TotalDocument1 pageHotel Voucher: in - Out Price Night Sub Totaldedi enggoNo ratings yet

- Online GroceryDocument12 pagesOnline Groceryapi-17368481100% (2)

- Kingfisher Fina1lDocument35 pagesKingfisher Fina1lsylvia456No ratings yet

- SAP Controlling TcodesDocument2 pagesSAP Controlling Tcodesvalis73No ratings yet

- How To Calculate Net Profit For Managerial RemunerationDocument3 pagesHow To Calculate Net Profit For Managerial Remunerationsonika7No ratings yet

- Ch01 Introduction To Business Combinations and The Conceptual FrameworkDocument51 pagesCh01 Introduction To Business Combinations and The Conceptual Frameworkmariko1234100% (1)

- Chapter 27 Section 27.1Document20 pagesChapter 27 Section 27.1alejandroNo ratings yet