Professional Documents

Culture Documents

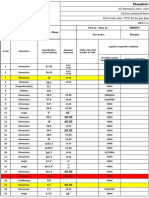

Example CK Risk Register Format

Uploaded by

Tissa1969Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Example CK Risk Register Format

Uploaded by

Tissa1969Copyright:

Available Formats

CLEMENT KEYS

Example Risk Register Format

March 2008

Risk Heading

Previous Risk Rating Jan 08

Impact (Financial & Reputation) (A) 1-3

Probability (B) 1-3

Total Risk (Mar Revised Risk 08) Grade Mar 08 = (A x B)

Current Controls

Further mitigating actions required to minimise risks

Responsibility & Timeframe (where applicable)

Sources of Assurance / KPIs

Strategic & Governance Failure to comply with the requirements of the Annotated Combined Code / make incorrect statements of compliance / fail to disclose non-compliance. Combined code compliance mapped by Implementation of identified actions to address non compliance in Reviews performed in conjunction with Internal and External Auditors to specific areas. Collation and regular update of supporting documentation Chief Executive (Continuing - annual formal internal audit to supporting evidence. asscertain position, monitor compliance and subsequent action plan. Combined Requirement for External audit to review with respect to compliance. Disclosure of all areas of non compliance in review) code mapped to supporting evidence to demonstrate and evidence compliance. specific elements as part of annual audit. the annual report.

Failure to maintain an appropriately balanced and skilled board. Financial

Chairman & Chief Executive (March 2008). Annual board review of performance The board has recently performed a skills audit to identify current skills, desired Development of board appraisal processes. Seek new members in Recruitment exercise to commence upon (December meeting). Corporate Governance skills and hence determine shortfalls. accordance with identified shortfall - legal. review by Internal Audit provider. completion.

Failure of budgetary control environment to monitor and manage the financial position of the Society.

Established annual budget setting and approval process. Devolved budgetary control environment requiring proactive response to identified variances. Monthly circulation of management accounts to Board members. Quarterly management accounts prepared and reported to Board.

Finance Director (monthly)

Management accounts prepard in a timely manner following month end (10 working days). Board papers issued in timely manner for consideration (target 10 working days prior to meeting).

Investments fail to perform as expected resulting in loss of expected income and impacting upon financial stability. Operational Failure of business continuity appropriately respond to disaster. frameworks to

Regular investment management reports and actuary review. Risk based Investment committee to be fully appraised of all significant Investment Committee & Finance Director Stock Broker, Cash funds intermediary, Investment strategy and policy. Strict management of control bands and credit developments. Committee to meet at least quarterly with advisers present (quarterly) Actuarial Function Holder. risk, capital adequacy regularly assessed Introduced new process for back up and retention of IT System data. Perform disaster recovery test to ascertain the effectiveness of Chief Executive & IT Manager (June 2008) Document imaging system in place to reduce the volume of paperwork held. arrangements and indentify areas of further development. Documented policies and procedures. Regular staff meetings to deal with generic employment issues and Appraisal and development programme in place for all staff, aligned to training working environment. Maintain a watching eye over the local job market Senior Management Team (quarterly reporting) and pay awards. to ensure salaries remain competitive. On job training and reference materials (policies and procedures) in place to Continuous development and documentation of all policies and systems. guide staff in the correct performance of their duties. Process of compliance Introduction of induction training and refresher courses for infrequent Training & Development Manager users. checks and reconciliations in place. Segregation of duties.

IT DR Provider & Internal Audit.

Failure to retain staff of sufficient quantity and quality to achieve the Society's objectives.

Internal Audit.

Failure to effectively administer member accounts leads to financial or reputational loss.

Effective internal reporting, Internal Audit & Training Schedule.

MIS system fails to provide adequate and effective reports upon which to manage the Society and support the decision making processes. Information Technology Failure to hold data in a secure environment leading to unauthorised access to personal or confidential information, corruption or loss.

Society is aware of the limitations of the current MIS system. Internal controls Development of new/updated member system to facilitate greater user Chief Executive & IT Manager (Continuing) have been developed around the current system. and reporting functionality.

Effective internal reporting & Internal Audit.

Appropriate operating system and application controls in place over electronic Planned framework of staff training on the importance of basic IT security IT Manager (June 2008) information. Appropriate back up procedures in place. controls. IT Manager to monitor compliance with IT policies.

IT DR Provider & Internal Audit.

Page 1 of 1

You might also like

- Automotive Quality Management Systems A Complete Guide - 2020 EditionFrom EverandAutomotive Quality Management Systems A Complete Guide - 2020 EditionNo ratings yet

- Are We Doing Well SlidesDocument10 pagesAre We Doing Well SlidessahajNo ratings yet

- 04 The Six Sigma MethodologyDocument53 pages04 The Six Sigma Methodologychteo1976No ratings yet

- Quality Management System Process A Complete Guide - 2020 EditionFrom EverandQuality Management System Process A Complete Guide - 2020 EditionNo ratings yet

- Histogram Box Plot Statistics AdaptiveBMSDocument13 pagesHistogram Box Plot Statistics AdaptiveBMSashutoshrvNo ratings yet

- Cmmi Documentation For Maturity Level 2Document8 pagesCmmi Documentation For Maturity Level 2Hamid HamidNo ratings yet

- FMEA Facilitator Thought-Starter QuestionsDocument5 pagesFMEA Facilitator Thought-Starter QuestionsvikeshmNo ratings yet

- Continuous Improvement Toolkit: A3 ThinkingDocument60 pagesContinuous Improvement Toolkit: A3 ThinkingAmit Kumar SinghNo ratings yet

- Risk Register (OGF HSEQ 002) R5Document9 pagesRisk Register (OGF HSEQ 002) R5sarge18No ratings yet

- Current State of Quality in The Automotive Industry: Scott Gray Director, Quality Products and Services, AIAGDocument26 pagesCurrent State of Quality in The Automotive Industry: Scott Gray Director, Quality Products and Services, AIAGSelvaraj SNo ratings yet

- Operations Management (OPM530) C10 Project ManagementDocument30 pagesOperations Management (OPM530) C10 Project Managementazwan ayopNo ratings yet

- Fmea Chart 70kb PDFDocument1 pageFmea Chart 70kb PDFmike gamerNo ratings yet

- SMM598 Six Sigma For Managers May June 2Document12 pagesSMM598 Six Sigma For Managers May June 2MickloSoberanNo ratings yet

- Template Bus ScenarioDocument5 pagesTemplate Bus ScenarioChettamilsNo ratings yet

- Industrial Solutions, Inc: Lean Assessment ScorecardDocument5 pagesIndustrial Solutions, Inc: Lean Assessment Scorecardrgrao85No ratings yet

- The 8-D System: Awareness of Problem Choose/Verify Corrective ActionsDocument3 pagesThe 8-D System: Awareness of Problem Choose/Verify Corrective ActionsAtul SharmaNo ratings yet

- Gaurav Pathak CV Opex 20.11.2022Document2 pagesGaurav Pathak CV Opex 20.11.2022Abhishek KumarNo ratings yet

- Homologation and Self-CertificationDocument10 pagesHomologation and Self-CertificationAli Raza Virk100% (1)

- Warm-Up - Day 2: Place Self Others Team Purpose AgendaDocument85 pagesWarm-Up - Day 2: Place Self Others Team Purpose AgendaSanjeev SharmaNo ratings yet

- TQM - 601 Module 12 - Quality Method PDCA and PDSADocument17 pagesTQM - 601 Module 12 - Quality Method PDCA and PDSA512781No ratings yet

- Welcome - Day 1 2012: Failure Mode and Effects AnalysisDocument63 pagesWelcome - Day 1 2012: Failure Mode and Effects AnalysisKaya Eralp AsanNo ratings yet

- First Time Quality: SAP Course #: 62006505Document65 pagesFirst Time Quality: SAP Course #: 62006505MickloSoberanNo ratings yet

- Process Improvement Simplified: A How-to-Book for Success in any OrganizationFrom EverandProcess Improvement Simplified: A How-to-Book for Success in any OrganizationNo ratings yet

- How To Calculate Sigma Level For A ProcessDocument9 pagesHow To Calculate Sigma Level For A ProcessmaherkamelNo ratings yet

- Understanding, Knowledge, and Awareness of ISO 9001:2015: November 4, 2019Document103 pagesUnderstanding, Knowledge, and Awareness of ISO 9001:2015: November 4, 2019Hisar SimanjuntakNo ratings yet

- Failure Mode and Effect Analysis (FMEA)Document23 pagesFailure Mode and Effect Analysis (FMEA)Parandhaman GRNo ratings yet

- 3L and 5 Why Presentation - MKGDocument70 pages3L and 5 Why Presentation - MKGMukesh GuptaNo ratings yet

- Supply Chain Risk Management A Complete Guide - 2021 EditionFrom EverandSupply Chain Risk Management A Complete Guide - 2021 EditionNo ratings yet

- Design Review Based On Failure Mode 1-Day Workshop by TetrahedronDocument2 pagesDesign Review Based On Failure Mode 1-Day Workshop by TetrahedrontetrahedronNo ratings yet

- Schneider Production System: The Global Specialist in Energy ManagementDocument16 pagesSchneider Production System: The Global Specialist in Energy ManagementAmrNo ratings yet

- 434 MFRDocument10 pages434 MFRHarsh JindalNo ratings yet

- Difference Between Rework & Repair As Per IATF 16949?: by - Arun Kumar SharmaDocument19 pagesDifference Between Rework & Repair As Per IATF 16949?: by - Arun Kumar SharmaDanang Widoyoko100% (1)

- Fmea Methodology For Quality Improvement in Sheet Metal Industry IJERTV5IS010123Document5 pagesFmea Methodology For Quality Improvement in Sheet Metal Industry IJERTV5IS010123DanistergladwinNo ratings yet

- Optimizing Purchasing Processes Saves 1 MillionDocument4 pagesOptimizing Purchasing Processes Saves 1 MillionMargara PerezNo ratings yet

- Paynter Chart With CCARDocument11 pagesPaynter Chart With CCARKhushboo RajNo ratings yet

- Business Continuity and Disaster Recovery Job DescriptionsDocument13 pagesBusiness Continuity and Disaster Recovery Job DescriptionsRheddxymonneNo ratings yet

- 36-Pmp Toolkit Complete Final 14 Aug 2014 2Document181 pages36-Pmp Toolkit Complete Final 14 Aug 2014 2JoeYeshitellaNo ratings yet

- LdssDocument240 pagesLdssrichardlovellNo ratings yet

- Risk Assessment Tool: (Use This Tool To Analyze Potential Risks in Your Work Area.)Document5 pagesRisk Assessment Tool: (Use This Tool To Analyze Potential Risks in Your Work Area.)desurkarbNo ratings yet

- Work Breakdown StructureDocument7 pagesWork Breakdown Structurerajdeepsingh16No ratings yet

- Workshop ON Managing Operational Risk: Javed Ahmed Risk Manager Meezan Bank LTDDocument44 pagesWorkshop ON Managing Operational Risk: Javed Ahmed Risk Manager Meezan Bank LTDharisamanNo ratings yet

- Standard Reaction Plan To Abnormal Situation: Restart ProcessDocument1 pageStandard Reaction Plan To Abnormal Situation: Restart ProcessDeepak kumarNo ratings yet

- ZED PresentationDocument13 pagesZED PresentationSatbir SinghNo ratings yet

- KRA Setting: Deepak BhararaDocument26 pagesKRA Setting: Deepak BhararaDeekhsha KherNo ratings yet

- DMAC - IntroductionDocument12 pagesDMAC - IntroductionIgor GulidaNo ratings yet

- Agile Models PresentationDocument47 pagesAgile Models PresentationRaúlNo ratings yet

- OPM3 CMMI ComparisonDocument4 pagesOPM3 CMMI ComparisonDaniel WentzelNo ratings yet

- S. No. Parameters Illustrative Description: 1 Test AutomationDocument39 pagesS. No. Parameters Illustrative Description: 1 Test AutomationSP 2014No ratings yet

- UntitledDocument47 pagesUntitledFrank Dongmo100% (1)

- Tuv Rheinland Training Schedule 2017Document19 pagesTuv Rheinland Training Schedule 2017ramnathNo ratings yet

- Balance Scorecard For Finance DepttDocument10 pagesBalance Scorecard For Finance DepttVeenu SharmaNo ratings yet

- 10d Troubleshooting Crude HeatersDocument15 pages10d Troubleshooting Crude HeatersTissa1969No ratings yet

- 09 Heater InstrumentationDocument17 pages09 Heater InstrumentationTissa1969No ratings yet

- 07b BurnersDocument16 pages07b BurnersTissa1969No ratings yet

- 10a-Field Evaluation of Heaters ModDocument24 pages10a-Field Evaluation of Heaters ModTissa1969No ratings yet

- Fuel Science and Combustion TechnologyDocument32 pagesFuel Science and Combustion TechnologyTissa1969No ratings yet

- Medical OrdinanceDocument46 pagesMedical OrdinanceTissa19690% (1)

- 45 PDFDocument1 page45 PDFTissa1969No ratings yet

- Union Carbide Plant Closed After Leak: October 19, 2000, Thursday, United Press InternationalDocument1 pageUnion Carbide Plant Closed After Leak: October 19, 2000, Thursday, United Press InternationalTissa1969No ratings yet

- Plant Layout ConsiderationsDocument36 pagesPlant Layout ConsiderationsTissa1969No ratings yet

- GAPS Plant LayoutDocument11 pagesGAPS Plant Layoutvb_pol@yahooNo ratings yet

- Professional Safety Experience Update FormDocument2 pagesProfessional Safety Experience Update FormTissa1969No ratings yet

- SystemsDocument25 pagesSystemsTissa1969No ratings yet

- Practical Advanced Process ControlDocument24 pagesPractical Advanced Process ControlTissa1969No ratings yet

- Fundamental of AIMSDocument5 pagesFundamental of AIMSTissa1969No ratings yet

- MMM BookDocument78 pagesMMM BookTissa1969No ratings yet

- Spirax Sarco Design of Fluid Systems 2Document66 pagesSpirax Sarco Design of Fluid Systems 2mahonde100% (2)

- IFSB-6 (December 2008) - enDocument37 pagesIFSB-6 (December 2008) - enZakkaNo ratings yet

- P7 Summary Notes (2017 - 08 - 11 15 - 36 - 51 Utc)Document150 pagesP7 Summary Notes (2017 - 08 - 11 15 - 36 - 51 Utc)SajidZiaNo ratings yet

- Chapter-2: Audit of Cash and Marketable SecuritiesDocument27 pagesChapter-2: Audit of Cash and Marketable Securitiesbikilahussen100% (1)

- Avanti 2010Document141 pagesAvanti 2010Jupe JonesNo ratings yet

- Multiple Choice Question Ch-20 B) Financial StandardDocument2 pagesMultiple Choice Question Ch-20 B) Financial StandardSourabh MandalNo ratings yet

- CFO Chief Operating Officer in Minneapolis ST Paul MN Resume William HansenDocument3 pagesCFO Chief Operating Officer in Minneapolis ST Paul MN Resume William HansenWilliamHansenNo ratings yet

- Completing The AuditDocument7 pagesCompleting The AudityebegashetNo ratings yet

- Chapter 6 BA4Document4 pagesChapter 6 BA4Keziah PuyodNo ratings yet

- Chapter 4Document22 pagesChapter 4Rafael GarciaNo ratings yet

- Representation LetterDocument6 pagesRepresentation LetterehlayzaaNo ratings yet

- MalversationDocument6 pagesMalversationJona Addatu100% (1)

- Berne Declaration PDFDocument19 pagesBerne Declaration PDFHenry Anibe Agbonika INo ratings yet

- How Does Internal Auditing Maintain Its Independence and ObjectivityDocument2 pagesHow Does Internal Auditing Maintain Its Independence and Objectivitysomnathsingh_hydNo ratings yet

- Introduction of Jva Concepts UnitDocument18 pagesIntroduction of Jva Concepts Unitkumarr84100% (1)

- p4 LSBF by ACCA ReloadedDocument350 pagesp4 LSBF by ACCA ReloadedBrandy Cook100% (1)

- Trial Balance Errors & Rectification 1Document21 pagesTrial Balance Errors & Rectification 1Manju NathNo ratings yet

- COST ACCOUNTING-Allocation of Joint Cost (Quiz With Answers)Document9 pagesCOST ACCOUNTING-Allocation of Joint Cost (Quiz With Answers)Alex Comeling100% (1)

- CAF 08 Chapter 4 MindMapDocument3 pagesCAF 08 Chapter 4 MindMapArslan AhmadNo ratings yet

- AssignmentDocument5 pagesAssignmentJC NicaveraNo ratings yet

- Auditing Theory Review Course Pre-Board Exam - Answer KeyDocument11 pagesAuditing Theory Review Course Pre-Board Exam - Answer KeyROMAR A. PIGANo ratings yet

- Iamselfassessmentmethodologyplusv12pdf PDFDocument24 pagesIamselfassessmentmethodologyplusv12pdf PDFSushayan HunsasukNo ratings yet

- Segment Reporting - LaganDocument2 pagesSegment Reporting - LaganBry LgnNo ratings yet

- Audit Report (EN) Berehiv - 2021Document12 pagesAudit Report (EN) Berehiv - 2021Vladimir SenyukNo ratings yet

- Muniz CV - GM Supply ChainDocument4 pagesMuniz CV - GM Supply ChainRukhshinda MeharNo ratings yet

- Auditing Reviewer 3 Auditing Reviewer 3Document4 pagesAuditing Reviewer 3 Auditing Reviewer 3Ryan PedroNo ratings yet

- What Led To The Eventual Collapse of Enron Under Lay and Skilling?Document15 pagesWhat Led To The Eventual Collapse of Enron Under Lay and Skilling?Ananya MNo ratings yet

- Basel IIDocument5 pagesBasel IIcozycapNo ratings yet

- Paper H.V. (Honours) Corporate Accounting & Reporting MODULE I - 50 MarksDocument12 pagesPaper H.V. (Honours) Corporate Accounting & Reporting MODULE I - 50 MarkssangkitaNo ratings yet

- ElocutionDocument12 pagesElocutionDevansh ShahNo ratings yet

- Manual On Non-Bank InstitutionsDocument888 pagesManual On Non-Bank InstitutionsFatima BagayNo ratings yet