Professional Documents

Culture Documents

Generics Brazil

Uploaded by

khattabmOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Generics Brazil

Uploaded by

khattabmCopyright:

Available Formats

www.focusreports.

net

SPONSORED SUPPLEMENT

Brazil Report

Generics on the Go

D espite the tradiiinnal consumer

preference tor branded and

branded generics products, and

iliL- key role pliiyed by doctors as mnrkei

use in earlier years but not of laie. "The

government should advertise more to the

public as to make them understand gener-

ics are cheaper and as efficient as branded

iiiUekeepers, the non-branded generics products." Finotii notes.

sector remain.s the market's iksiest-grow-

ing segment. The generics sector's share of According to Carlos Alexandre Geyer,

the Brazilian market reached 10.26% in president of Aianac, Brazil's oldest state-

the 12 months ending May 2006. with owned phannaceutical company, and a

annually adjusted growth estimated at strong supporter of '"similares." drug

31.3%. The güveniment has launched a counterfeiting and falsification had

number of high-profile initiatives to pro- become serious issues by the end of the

mote off-patent, bioequivalent medicines 1990s, resulting in the establishment of the

in recent years-not all of which have been Odinir Finotti Federal Parliamentary Investiij;ui\i'

successful, largely due to the continued Committee. The

presence of so-called 'similar' medicines by CMED, However, due to market com- committee has had a

(non-equivaleni copies of local origin). petition, generics price reductions are in two-fold effect: on

fact higher-43'3f- on average and reaching the one hand, it has

The Hegemony of "Similares'* 70-80'ii- in some cases. Such price reduc- helped to identify

tions have been an important driver for and solve these criti-

Indeed, despite government efforts and the consumer purchases; it's estimated that cal problems and on

growth of the generics segment, sales of generics were responsible for saving the other hand, it

similares still lop those of branded drugs US 1.3bn for Brazilian consumers over the helped draft a gener-

and branded generics "Similares" sales last five years. A noteworthy achievement, ics legislation .

represent almost 90% of the total market especially considering how most of the

lor locally manufactured drugs. country's low income population doesn't "Nevertheless, the Carlos Alexandre

Geyer

Meanwhile, the branded market witnessed receive any reimbursements for medicine path chosen by the

negative growth in 2002 but has experi- purchases. Generics have started to impact government was a wrong one. It decided

enced slow growth over the last few years. access to medicines in Brazil, especially in to discourage the use of copy medicines

(similares) in order to promote generics."

Geyer notes. "Hence, the strong Brazilian

campaign for generics created a discom-

Brazil's generic market is exceptionally fort about copies." In Geyer's view, there

poncentrated with 80% of the market is no future in Brazil for small and medi-

um-si/ed companies that produce non-

dominated by only four players. branded generics: "The Brazilian scale is

very big and demands big companies. The

only way for smaller companies to sur-

vive would be to consolidate a brand. The

Branded pharmaceuticals continue to ben- the treatment of chronic diseases. Market same phenomenon occurs in sophisticated

efit from being the first choice of medical data show that the total sales for sub- nuukels where smaller companies look

professionals but in recent years generics stances such as atenolol, metformin and for busines.s niches.

manufacturers' targeting of pharmacies has sinvastatin-for hypertension, diabetes, and

affected branded phannaceuticLiI sales to cholesterol control-have increased up to Generics: the Players

some extent. Similares manufacturers lSO'i'r over a four-year period.

claim that generics manufacturers use Brazil's generics market is exceptionally

unfair competition policies that are hurting "The generics business is a very exciting concentrated, with 10 companies account-

ihe similares industry. one," says Odinir Finotti, president of Pro ing tor 9^7c of the market, .^.nd 80*"^^ of the

Genéricos. "1 Just regret that the market is dominated by only four players:

Brazilian law requires generics prices to Government is not doing enough work lo EMS. Euroiarnia, Medley, and Ache

be at lea.st 35% lower than reference drug promote it." He says that the government Biosintetica.

piices, and the prices must be preapproved had done good work in promoting generics EMS, generics pioneer. The distinction

S 1 2 FOCUS REPORTS OCTCeEH 2007

www.focusreports.net

SPONSORED SUPPLEMENT

Brazil Report

between generics and branded medicines

is of no real conseqtience to EMS, Brazil's

number-one phannaceutical company. "1

believe (hat there are no issues in acting in

bt>th segments because we have bioequiv-

alence, which proves that we produce sale

and quality drugs.

Generics are very new in Brazil. At the

beginning, it was dilTicult lo position

generics because there were a meaningful

number of doctors that didn't want to pre-

scribe generics. Today, resistance to pre-

scribid*; generic^ has diminished but, still,

branded generics or similares medicines

arc I'iir much stronger than generics." .says

Telma Salles, international affairs manag-

er of EMS. Although generics have helped

EMS achieve it.s position in Ihe market-

place, their branded products have been

highly successful as well.

President Lula da Silva (left) visiting EMS' plant in May 2007

The choice of generics. if il helped achiev-

ing Ihis out.'^tiuiding progression of EMS. developed countries such as the US and month,s before the patent expired since we

was not ihe only key for its .success, EMS Gemiany. We are able to demonstrate that had an agreement wiih Abbott, and this

is indeed increasing in both segments. One our products are safe iind efficient." launch was an absolute success and helped

of the highlights of EMS's brand portfolio us achieve fantastic results."

is its line oí branded producís from the Medley, a reliable partner. One company

Sigma Pharma lab. which ranks sixth in thai may be able to challenge EMS's mar- The company has just secured a comarkci-

doctor preferences; in all. EMS öfters a ket dominance is Medley. Medley has ing agreement with Bayer lo launch

portfolio of l,5fK) medicines that are very jumped from 28 in 2()()() to third place in Vivanza. highlighting its status as a reli-

popular among doctors. able partner for MNCs. Yamamoto

explains: "Even though we are in the

Moreover, the company is considered the generics business, we ;ibsolutely respect

leading pioneer of the generics market; patents. In our ca.se we believe that we do

EMSs state-of-the-art R&D center a very good job at comarketing innovative

employs approximately 200 scientists who products, and. at the same time, we can

ait? constantly working on drug develop- also perform very well in the generics seg-

ment and allow EMS to launch five new ment. Being in both businesses shouldn't

products per month. "We bet on our posi- be a conflict. Large pharma companies

tion of pioneers in the generics segment. like Sandoz arc recognizing that there is

As you know, in thegcneric segment, lo be room for both products in the same house,

the tirsi in is essL'nii:il for success," says and Ihat is exactly what we are doing

Salles. here."

Thelma Salles

In 2(K)7. President Lula de Silva inaugu- While Medley is currently focusing on the

rated EMS'.s new facility: EMS invested 2006, has grown an average 25 to 30 per- Brazilian market, it also seeks to penetrate

U$5() million in the facility. "This new cent annually, and has beaten production olher Lalin American markets. For exam-

extension gives us the possibility to con- records in the generics sector "We have a ple, ihe company exports its products to

siderably increase our production capacity. very good production capacity, an excel- Mexico, where some are licensed to local

As the market grows and EMS continues lent portfolio and sales team. All these fac- partners who market them there?; Medley

its healthy performance, we will have the tors put together make us a successful is following ihe same strategy in Peru.

production capacity to supply the national cotiipany," notes Jairo Yamatnoto. CEO of Regarding ils future development.

demands and other markets," Salles says. Medley. "A.s for our last year's perform- YamamoU) emphasizes the company's core

The technology we use to manufacture our ance, we had very good results thanks to values: "In our industry, it is very impor-

products is exactly the same thai is used in Sibutramine. We launched ihis product six tant to build a go(xl image because we are

S 1 3 FOCUS REPORTS OCTOSEN 2007

wvwv.focusreports.net

SPONSORED SUPPLEMENT

Brazil Report

looking ufier Ihe for the same indication. Billi says. "We see you will certainly lag behind. Our position

hejilth of the peo- generics as a necessity. Our company is to emphasize developing products with

ple. We want to needs to be present in the generics seg- aggregated value, and we want to offer dif-

grow but at the ment and do all the necessary efforts to be ferentiated products."

same time, we want competitive. Nevertheless it is very impor-

to be sustainable. tant for us lo be present in the branded Biolab is curretitly the leader in 'sitnilares'

Being sustainable generics segment. Our principal focus it to for cardiology, with more than l.l percent

sLimmarize.s our market our branded products to doctors."* market share; ha.s strong and sustainable

iiuitto 'Proudly performance in the OBGYN area, ranking

Cleiton Marques Medley"". Determined to continue forging ahead. sixth in Brazil in this market segment and

Eurttfarma is also building a new industri- operates one of the most modem ptant.s in

t>un>farma started al complex in Sao Paulo that is expected to the pharmaceutical industry today.

ill 1*172 by produc- be one of the most modem facilities of its

ing drugs tor both kind in Latin America. Billi believes the Ache Biosintetica. Number-three ranking

local and niultina- new state-of-the-art facility will enable the Ache holds the distinction of having the

• ^^ ^^^^^ tional companies. company to have both a production and only lOO-percetit-made-in-Bra/il drug

P I ^ H j ^ ^ ^ H I Ttien. it bought a export hub within Brazil. Atid to further product. Achelan. which is made out of

^^^^^^^H small lab and start- their research capabilities. Eurofamia has herbal ingredients. Ache, like Biolab. is

! partnered with Biulab tu establish a new more focused on similares than generics:

ed U) produce and

sell drugs. company. Incremciitha, "We had three however, the company bought Biosintetica

Maurizio Bllli According to main objectives: join our capacities to in 2002 to enhance its generics business.

Maurizio Billi. president of Eurofamia: develop new products, divide costs, and in "The success story of the company has

"The generics law was very beneficial for the future get stronger." Biili explains. been built through acquisitions. Now ihat

local producers like us because it forced we are going listed, we are planning to buy

ihc companies to improve the quality stan- Grupo Castro Marques (Biolab). more companies here in Brazil and really

dards. It made us leam how to develop Cleiton de Castro Marques, CEO of consolidate our success in the country,"

t]iKiiiU' products. Moreover, the Brazilian Biolab bas this take on his company's part- explains Jose Ricardo, president of Ache.

generics law is very rigorous, therefore the nership with Eurofamia: "This deal was a In Ache's case, consolidation effttrts do not

companies that wanted to succeed in this great idea because, with this company exclude intemaiional expansion through

segment had to force themselves to Incrementha. we are fully focused on con- partnerships. Ache now ranks number one

upgrade and get equipped io make gener- stant research and developinent.This focus company in Mercosur (an economic com-

ics. This was a big learning step." has given results, and over the one-year munity that includes Bta/il, Argentina.

period of time since its establishment, we Paraguay and Uruguay), "We have just

have already registered three pnxlucts to partnered with Mexican Silanes for R&D

The company has moved forward: Today

undergo clinical trials and we are looking synergies. We also have as a partner the

it is in both market segments, generics and

forward to their approval in the near biggest company in Argentina and one in

branded, producing both types of products

future. From 2008 Venezuela. We will soon try to enter the

onwards, we will European and the US markets, always

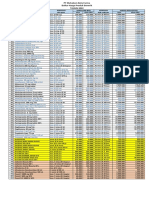

EVOLUTION OF THE GENERIC MARKET

be able to launch through partners." he adds.

around 15 prod-

UNITS ucts per year, Germany's Merck may be the only multi-

05/2005 05/2006 05/2007 always improv- national to date to have succeeded in

ing," Marques Brazil's competitive generics field. In

Generic Market 135,855.862 170,961,819 212.109.452 believes innova- 2002. the company decided to introduce

tion is the key to its generics portfolio in Brazil, which

Market Share 10,12 % 12,23 % 14,45 % success: "We proved to be a good decision. "We are very

believe R&D is a pleased at our results because today we

must to keep our rank seven anumg Ihe ttvenill industry, and

DOLLARS growing pace the most important thing is that we man-

05/2005 05/2006 05/2007 because if you aged to position ourselves in the generics

are not able to market despite the fact the four main play-

Generic Market 527.166.173 851.274.798 1.220.919,710 invest in R&D ers are national. Our seventh position is

and offer the mar- not bad at all in a market where national

Market Share 8,13 % 9,54 % 1 1 .60 "n ket pniducts with players are getting very strong." notes

aggregated value. Gerd Bauer, president of Merck Brazil.

Source IMS Meatm

S 1 5 FOCUS REPORTS

You might also like

- Protecting Profits PaymentsDocument3 pagesProtecting Profits PaymentskhattabmNo ratings yet

- Legal GenericideDocument9 pagesLegal GenericidekhattabmNo ratings yet

- EnantiomerDocument6 pagesEnantiomerkhattabmNo ratings yet

- 2ry Patent For ProtectionDocument14 pages2ry Patent For ProtectionkhattabmNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- SAQ - OxytocinDocument3 pagesSAQ - Oxytocinanaeshkl100% (1)

- (Doi 10.1016/j.ijpharm.2015.01.022) T. Loftsson - Excipient Pharmacokinetics and ProfilingDocument7 pages(Doi 10.1016/j.ijpharm.2015.01.022) T. Loftsson - Excipient Pharmacokinetics and ProfilingRia DeviNo ratings yet

- Update StokDocument41 pagesUpdate Stokdiniaiiu26No ratings yet

- CMDH 172 2010 03 2023 - Tracking Table Article 5 FOR WEBSITEDocument22 pagesCMDH 172 2010 03 2023 - Tracking Table Article 5 FOR WEBSITEAissaNo ratings yet

- Terminology in PharmacologyDocument31 pagesTerminology in PharmacologySaminathan Kayarohanam100% (2)

- RANITIDINE - Ranitidine Hydrochloride Injection, Solution: Page 1 of 9Document9 pagesRANITIDINE - Ranitidine Hydrochloride Injection, Solution: Page 1 of 9Nur Syamsiah LaisaNo ratings yet

- Cyclo DextrinDocument2 pagesCyclo Dextrinraghuraj75No ratings yet

- Rencana Kebutuhan Obat Tahun 2022 PKM RayaDocument16 pagesRencana Kebutuhan Obat Tahun 2022 PKM RayaFitriyani RafifNo ratings yet

- (New) Renbut Januari Season 2 2024Document201 pages(New) Renbut Januari Season 2 2024klinik silvimedikaNo ratings yet

- Module 8 - Group 3Document16 pagesModule 8 - Group 3MEDECIELO MELONo ratings yet

- IVIVCDocument5 pagesIVIVCRahul MayeeNo ratings yet

- Career in PharmacyDocument18 pagesCareer in PharmacyDhachina Moorthi100% (1)

- Report - 11 Jul 2020Document4 pagesReport - 11 Jul 2020Shreedhar KadkolNo ratings yet

- CH 13 Part 2 Pharmacophores Post-2Document22 pagesCH 13 Part 2 Pharmacophores Post-2ZainNo ratings yet

- Daftar Harga Produk Generik 2022 New (DITEMPEL)Document1 pageDaftar Harga Produk Generik 2022 New (DITEMPEL)Ade IrawanNo ratings yet

- EM3, Stock Des Médicaments, Clinique MobileDocument92 pagesEM3, Stock Des Médicaments, Clinique MobileTINAJEANNo ratings yet

- Non Clinical Drug DevelopmentDocument75 pagesNon Clinical Drug DevelopmentalexNo ratings yet

- ETIKET BOX OBAT PATEN Box BesarDocument5 pagesETIKET BOX OBAT PATEN Box Besarbabas basriNo ratings yet

- Computer-Aided Drug Design by Dev Bukhsh SinghDocument308 pagesComputer-Aided Drug Design by Dev Bukhsh SinghUday UppalNo ratings yet

- Detail Sertifikat TKDN Obat ObatanDocument116 pagesDetail Sertifikat TKDN Obat Obatannakes puskesmas Kecamatan Cempaka PutihNo ratings yet

- NURSING PHARMACOLOGY REVIEWDocument13 pagesNURSING PHARMACOLOGY REVIEWRikka Calnea Tabuzo100% (3)

- RA ComparisonDocument8 pagesRA ComparisonJennifer AdvientoNo ratings yet

- Pharmacology - PDFDocument41 pagesPharmacology - PDFTanaka KobayashiNo ratings yet

- Dispensing, Incompatibilities and Adverse Drug Reactions Answer Key - RED PADocument17 pagesDispensing, Incompatibilities and Adverse Drug Reactions Answer Key - RED PAArk Olfato ParojinogNo ratings yet

- Students Practical Training Report Project As Per PCI NormsDocument82 pagesStudents Practical Training Report Project As Per PCI NormsAakif Anjum100% (1)

- Controlled Drug Delivery SystemDocument43 pagesControlled Drug Delivery Systemsukanya100% (1)

- Subject: Clinical Pharmacokinetics &pharmacotherapeutic Drug MonitoringDocument7 pagesSubject: Clinical Pharmacokinetics &pharmacotherapeutic Drug MonitoringLiana Vaal CierciNo ratings yet

- 001 Introduction To PharmacologyDocument29 pages001 Introduction To Pharmacologynancy alsharuNo ratings yet

- Biosans LifecareDocument17 pagesBiosans LifecareLORD'S E PHARMACYNo ratings yet

- Introduction To Clinical Research by SathDocument19 pagesIntroduction To Clinical Research by SathVignesh GaneshNo ratings yet