Professional Documents

Culture Documents

Ratios

Uploaded by

Noble S WolfeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ratios

Uploaded by

Noble S WolfeCopyright:

Available Formats

Ratios1

Financial Statements Lester M. Legette Trident University International

ACC501- Accounting for Decision Making Dr. Ralph Wayne Ezelle 06 February 2012

Ratios2

Having analyzed the financial reports for Abercrombie & Fitch, and Hennes & Mauritz, I have noticed that the two companies report their information very differently. There are some similarities and some differences. In this paper I will compare and contrast the difference between the Balance sheet and the Income statement. I will also be computing different ratios of the two companies, and giving my opinion on what the ratios are telling the analyst. Balance Sheet What components of stockholders equity does each of the companies disclose? Both companies mentioned above disclose their Retained Earnings. Retained earnings are the profit that is generated during a certain period. The company can either decide to pay it out as cash to shareholders, or retain the money and reinvest it in the business. (biginnersinvest n. d.) Do the companies have preferred stock shares outstanding? If so, what special features do these shares contain? Preferred Stock is a class of ownership in a corporation that has a higher claim on the assets and earnings than common stock. Preferred stock generally has a dividend that must be paid out before dividends to common stockholders and the shares usually do not have voting rights. (investopedia, n. d.). According to the balance sheets, neither of the two companies has preferred stock shares outstanding, although on the income statement A&F reported basic outstanding shares at 88,061, and diluted at 89,851. Do any of the companies report treasury shares? If so, do the companies disclose the reason for reacquiring the shares?

Ratios3

This is the portion of shares that a company keeps in their own treasury. Treasury stock may have come from a repurchase or buyback from shareholders; or it may have never been issued to the public in the first place. These shares don't pay dividends, have no voting rights, and should not be included in shares outstanding calculations. (investopedia, n. d.). Abercrombie & Fitch is the only company of the two that reports Treasury Stock; the company does not disclose the reason for reacquiring the shares. Income Statement What are the basic and diluted earnings per share for each company? In 2010 Abercrombie & Fitch reported their Basic earnings per share as $1.71, and their diluted earnings per share as $1.67. In 2010 H&M reported their earnings per share before and after dilution at11.29 SEK. Have the companies reported any discontinued operations for the last year? Neither of the two companies has reported any information from discontinued operations in 2010. Do the companies disclose any stock compensation plans? If so, are they reporting such plans under the fair value or intrinsic value methods? What was the value of compensation expense measured for any outstanding stock option plans? This Statement establishes financial accounting and reporting standards for stock-based employee compensation plans. Those plans include all arrangements by which employees receive shares of stock or other equity instruments of the employer or the employer incurs liabilities to employees in amounts based on the price of the employer's stock. Examples are

Ratios4

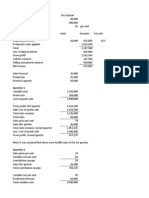

stock purchase plans, stock options, restricted stock, and stock appreciation rights. (Fasb n. d.). It does not appear that either of the two companies discloses any stock compensation plans. Financial Ratios Profitability ratios: Gross profit margin = Sales Revenue Cost of Goods sold Sales Revenue A&F 3,468,777 1, 256, 596 = 3,468,777 Net profit margin = Net Income Sales Revenue A&F 150,283 = 3,468,777 0.0433 H&M 18,681 = 126,966 0.1471 0.6377 H&M 126,966 -40,214 = 1.3167 126,966

Return on Stockholders Equity = Net income Available to Common Stockholders Stockholders Equity A&F 1,033__ = 0.0005 1,890,784 H&M 25,653 = 0.5807 44,172

Profibility ratios are a class of financial metrics that are used to assess a business's ability to generate earnings as compared to its expenses and other relevant costs incurred during a specific period of time. For most of these ratios, having a higher value relative to a competitor's ratio or the same ratio from a previous period is indicative that the company is doing well. (Investopedia, n. d.) In the computations above it appears that H& M is doing better than A&F, but keep in mind that H&M operated over 2,206

Ratios5

stores in 2010 whereas A&M only operated 1098. The story these ratios are telling analyst is that H & M is doing better of the two companies in the market and he should tell investors to invest in H&M.

Liquidity ratios: Current ratio = Current Assets Current Liabilities A&F 1,433,268 = 2.5646 558,851 H&M 40,932 = 2.9560 13,847 Quick Ratio = Current Assets- Inventory Current Liabilities A&F 1,433,268 310, 645 = 2.0088 558,851 H&M 40,932- 11,487 = 2.1264 13,847 Inventory turnover = Cost of goods sold Inventory A&F 1,256,596 = 0.0040 310,645 H&M -40,214 = 3.5008 11,487

Liquidity ratios are a class of financial metrics that is used to determine a company's ability to pay off its short-terms debts obligations. Generally, the higher the value of the ratio, the larger the margin of safety that the company possesses to cover short-term debts. (investopedia n. d.) According to figures H&M is in a better position to pay off short term debt. H&M Inventory turnover is three times greater than that of A&F. These figures are telling analyst that H&M is moving merchandise three times better than its competition and they have fewer liabilities.

Ratios6

Leverage Ratios Debt-to-assets = Total Debt Total Assets A&F 71,213 = 0.0252 2,821,866 H&M 3965__ = 0.0669 59,182

A&F Debt-to-equity = Total Debt Total Equity 71,213 = 1,827,917 0.0389

H&M

3965__= 0.0897 44,172

A&F Times-covered ratio = Profit before interest and Tax Total Interest Charges 2,212,181 = 657.99 3,362

H&M

68,269 = 9752.7 -7

Leverage ratios are any ratio used to calculate the financial leverage of a company to get an idea of the company's methods of financing or to measure its ability to meet financial obligations. There are several different ratios, but the main factors looked at include debt, equity, assets and interest expenses. When computing ratios I found the Balance sheet more informative only because most of the information that was required to compute was obtained from the balance sheet. I also found the sheet that provided the formulas in the Back ground reading material was very informative. The footnotes on the financial statements provide additional information in a company's financial

Ratios7

statements. The footnotes provide additional information that is left out of the main reporting documents. This is done mainly for the sake of clarity because these notes can be quite long, if they were included, and they would cloud the data reported in the financial statements. (investopedia n. d.)

Ratios8

References

Cengage Learning. (n.d.). Business Resources for Students: The Role of Financial Analysis. Retrieved November 15, 2011 from http://college.cengage.com/business/resources/casestudies/students/financial.htm Drake, P. (n.d.). Financial Ratio Analysis. Retrieved November 15, 2011 from http://educ.jmu.edu/~drakepp/principles/module2/fin_rat.pdf Mongiello, M. (2009). International Financial Reporting. Retrieved from http://bookboon.com/en/business/finance/basics-of-international-financial-reporting Walther, l. (2010). Principles of Accounting. Chapter 16. Retrieved November 15. 2011 from http://www.principlesofaccounting.com/

Retrieved January 21, 2012 from http://beginnersinvest.about.com/od/analyzingabalancesheet/a/retained-earnings.htm Retrieved January 21, 2012 from http://www.fasb.org/summary/stsum123.shtml Retrieved January 21, 2012 from http://www.investopedia.com/terms/p/preferredstock.asp

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Ekland DivisionDocument4 pagesEkland DivisionNoble S WolfeNo ratings yet

- AirplaneDocument4 pagesAirplaneNoble S WolfeNo ratings yet

- Garden of EdenDocument118 pagesGarden of Edensean lee100% (2)

- AbsorptionDocument2 pagesAbsorptionNoble S WolfeNo ratings yet

- TUI PaperDocument7 pagesTUI PaperNoble S WolfeNo ratings yet

- GuitarDocument8 pagesGuitarNoble S WolfeNo ratings yet

- Financial Statements Lester M. Legette Trident University InternationalDocument5 pagesFinancial Statements Lester M. Legette Trident University InternationalNoble S WolfeNo ratings yet

- Walmart Vs TargetDocument6 pagesWalmart Vs TargetNoble S WolfeNo ratings yet

- Flexible Budget 1Document1 pageFlexible Budget 1Noble S WolfeNo ratings yet

- Wal Mart AnnualDocument5 pagesWal Mart AnnualNoble S WolfeNo ratings yet

- BreakevenDocument4 pagesBreakevenNoble S WolfeNo ratings yet

- Absorption CostingDocument2 pagesAbsorption CostingNoble S WolfeNo ratings yet

- Pockett Company 31 Dec 2011 Balance Sheet: AssetsDocument2 pagesPockett Company 31 Dec 2011 Balance Sheet: AssetsNoble S WolfeNo ratings yet

- TUI PaperDocument7 pagesTUI PaperNoble S WolfeNo ratings yet

- Walmart Vs TargetDocument6 pagesWalmart Vs TargetNoble S WolfeNo ratings yet

- Wal Mart AnnualDocument5 pagesWal Mart AnnualNoble S WolfeNo ratings yet

- Lessons Learned From The Clinic1Document8 pagesLessons Learned From The Clinic1Noble S WolfeNo ratings yet

- Wal Mart AnnualDocument5 pagesWal Mart AnnualNoble S WolfeNo ratings yet

- Beginning Finished Goods Goods Available For SaleDocument2 pagesBeginning Finished Goods Goods Available For SaleNoble S WolfeNo ratings yet

- DesjardinsDocument4 pagesDesjardinsNoble S WolfeNo ratings yet

- Transfer PricingDocument4 pagesTransfer PricingNoble S WolfeNo ratings yet

- World ComDocument2 pagesWorld ComNoble S WolfeNo ratings yet

- DesjardinsDocument4 pagesDesjardinsNoble S WolfeNo ratings yet

- Assessment 1Document4 pagesAssessment 1Noble S WolfeNo ratings yet

- TUI PaperDocument7 pagesTUI PaperNoble S WolfeNo ratings yet

- Beginning Finished Goods Goods Available For SaleDocument2 pagesBeginning Finished Goods Goods Available For SaleNoble S WolfeNo ratings yet

- 34,000.00 $ 39,000.00 $ 55,000.00 $ Total Variable CostDocument1 page34,000.00 $ 39,000.00 $ 55,000.00 $ Total Variable CostNoble S WolfeNo ratings yet

- DesjardinsDocument4 pagesDesjardinsNoble S WolfeNo ratings yet

- Financial Statements Lester M. Legette Trident University InternationalDocument5 pagesFinancial Statements Lester M. Legette Trident University InternationalNoble S WolfeNo ratings yet

- ACC501 Mod 1 Case Financial StatementsDocument12 pagesACC501 Mod 1 Case Financial StatementsNoble S WolfeNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Delaware General Corporation Law of 1899 - 21 Del. Laws 273Document59 pagesDelaware General Corporation Law of 1899 - 21 Del. Laws 273JanetLindenmuthNo ratings yet

- Revised Corporation Code of The Philippines 16 - 24Document4 pagesRevised Corporation Code of The Philippines 16 - 24Nicki Lyn Dela CruzNo ratings yet

- Sahara Private PlacementDocument26 pagesSahara Private PlacementRahul MishraNo ratings yet

- Annual Report 2017 18 PDFDocument248 pagesAnnual Report 2017 18 PDFSACHIN GEORGE 1827726No ratings yet

- Cir Vs Procter and Gamble Philippine Manufacturing CorporationDocument4 pagesCir Vs Procter and Gamble Philippine Manufacturing CorporationRemson OrasNo ratings yet

- Preparing Effective Business Plans An Entrepreneurial Approach 2nd Edition Barringer Solutions ManualDocument14 pagesPreparing Effective Business Plans An Entrepreneurial Approach 2nd Edition Barringer Solutions ManualOrlaParksNo ratings yet

- Saroj ProposalDocument11 pagesSaroj ProposalSaroj SahNo ratings yet

- Module 013 Week005-Statement of Changes in Equity, Accounting Policies, Changes in Accounting Estimates and ErrorsDocument7 pagesModule 013 Week005-Statement of Changes in Equity, Accounting Policies, Changes in Accounting Estimates and Errorsman ibeNo ratings yet

- Working Paper EntriesDocument2 pagesWorking Paper EntriesRixer PrietoNo ratings yet

- Corporate Governance in NigeriaDocument20 pagesCorporate Governance in NigeriaNajar Rim0% (1)

- The Arab Bank - Governance and Ethics - FINALDocument26 pagesThe Arab Bank - Governance and Ethics - FINALHum92reNo ratings yet

- Corporate Governance BMFM 33132 Title: Successful of Ecoworld CompanyDocument16 pagesCorporate Governance BMFM 33132 Title: Successful of Ecoworld CompanyJoeaan TanNo ratings yet

- Financial Statement Analysis of Bank Al Falah and Habib Bank LimitedDocument47 pagesFinancial Statement Analysis of Bank Al Falah and Habib Bank Limitedammar123No ratings yet

- Business Exit Strategy - 1Document2 pagesBusiness Exit Strategy - 1SUBRATA MODAKNo ratings yet

- 3303 Ex 1 Review Key 2013Document4 pages3303 Ex 1 Review Key 2013yangpukimiNo ratings yet

- Corpo 12Document17 pagesCorpo 12Gabe BedanaNo ratings yet

- Summer Internship ReportDocument43 pagesSummer Internship Reportnikhil yadavNo ratings yet

- What Happened at Enron?: Ken Lay and Enron CorporationDocument22 pagesWhat Happened at Enron?: Ken Lay and Enron Corporationcarolin aldanaNo ratings yet

- KFC Holding (M) BHD: Share Split, Bonus and Free Warrants Issue - 23/6/2010Document3 pagesKFC Holding (M) BHD: Share Split, Bonus and Free Warrants Issue - 23/6/2010Rhb InvestNo ratings yet

- List of Shareholders - 2022-08-22T145355.581Document3 pagesList of Shareholders - 2022-08-22T145355.581Bhagwan BachaiNo ratings yet

- Akij GroupDocument4 pagesAkij GroupReaz RahmanNo ratings yet

- Securities and Exchange Commission: Sarbanes-Oxley ActDocument10 pagesSecurities and Exchange Commission: Sarbanes-Oxley ActLedayl MaralitNo ratings yet

- LT Emerging Business FundDocument2 pagesLT Emerging Business FundSankalp BaliarsinghNo ratings yet

- SEC Opinion Dated February 20, 1995Document3 pagesSEC Opinion Dated February 20, 1995ArvinNo ratings yet

- FINANCIAL STRATEGY Formulation of Financial Strategy - Module: 1Document28 pagesFINANCIAL STRATEGY Formulation of Financial Strategy - Module: 1arul kumarNo ratings yet

- SGX - Listed Singapore Edevelopment Appoints Mr. Vincent Lum and Mr. Cui Peng As Executive DirectorsDocument2 pagesSGX - Listed Singapore Edevelopment Appoints Mr. Vincent Lum and Mr. Cui Peng As Executive DirectorsWeR1 Consultants Pte LtdNo ratings yet

- SEC Lawsuit Against Elon MuskDocument23 pagesSEC Lawsuit Against Elon MuskFindLawNo ratings yet

- Foreign Institutional InvestorDocument14 pagesForeign Institutional InvestorDaniel Raj RichardNo ratings yet

- FinanceDocument2 pagesFinanceSabyasachi BosuNo ratings yet

- Cemco Holdings Vs National Life InsuranceDocument3 pagesCemco Holdings Vs National Life InsuranceRowena Gallego100% (2)