Professional Documents

Culture Documents

REVENUE REGULATIONS NO. 3-2013 Issued On February 14, 2013 Prescribes The Use of

Uploaded by

crazykid12345Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

REVENUE REGULATIONS NO. 3-2013 Issued On February 14, 2013 Prescribes The Use of

Uploaded by

crazykid12345Copyright:

Available Formats

REVENUE REGULATIONS NO.

3-2013 issued on February 14, 2013 prescribes the use of electronic Official Register Books (eORB) System by manufacturers of cigarettes, cigars and cigarette papers, including traders/dealers of whole leaf tobacco and partially manufactured leaf tobacco. For purposes of enrollment in the eORB System, all manufacturers of cigarettes, cigars and cigarette papers, including traders/dealers of whole leaf tobacco and partially manufactured leaf tobacco (i.e., L-3, L3R, L and L6), shall initially file with the Chief, Excise Large Taxpayers Field Operations Division a written request for access to the system, together with a duly notarized Board Resolution, in case the taxpayer is a juridical entity, or an affidavit, in case of a sole proprietor, stating, among others, the names of its representatives authorized to register and maintain a user account, either as an encoder or as an authorized officer, in the system. For this purpose, an encoder authorized by the taxpayer to finalize an encoded transaction shall be required to be enrolled in the system, which can be accessed thru the eORB icon in the BIR website (www.bir.gov.ph). After completion of the enrollment process, the taxpayers authorized officer and/or encoder shall receive an email notification validating the email account provided. In the initial use of the eORB System, the synchronization process of data shall be undertaken by the authorized officer and encoder in order that all the functionalities of the system can be utilized. Thereafter, this process shall be initiated regularly in order to have an updated reference values in the database of the taxpayers installed system. In order to gain access into the system, the authorized officer shall create encoder user accounts and authorized officer user account using the User Management module of the system under which assessment numbers assigned to the designated encoders and authorized officer of the excise taxpayer shall be subject to approval by the BIR. The authorized officer shall be responsible for the activation and deactivation of user accounts, including the finalization of each encoded transaction, as well as the generation and submission of the eORB Forms. The encoders shall not be allowed to create other user accounts nor submit the ORB Forms. For expediency on the part of the excise taxpayer, encoding of transactions of the taxpayer operations can be made off-line, without the need of connecting to the eORB System: Provided, however, That, for purposes of initially generating the eORB Forms, whether by the taxpayer or by the BIR, there is a need to finalize the encoded transactions and, therefore, the proper connection with the eORB System shall be made. All excise taxpayers who are covered by the eORB System shall transmit automatically the duly accomplished eORB Forms within five (5) calendar days immediately after the end of the month of operation. Any amendment in the entries of the ORBs that have been submitted by the authorized officer of the excise taxpayer shall be made anytime within the year of the taxpayers operations but not later than January 31 of the immediately succeeding year of the taxpayers operations: Provided, however, That amendments shall be made only once for each reference document: Provided, finally, That every amendment shall be subject to the approval of the Chief, Excise LT Field Operations Division through an email notification. In cases where a taxpayers own computerized accounting system has the capability to automatically generate and print the ORBs, the taxpayer shall coordinate with the BIR for purposes of determining the manner on how the taxpayer can submit the ORB electronically through the eORB System. The submission of ORB to the BIR through external storage facilities such as, but not limited to, magnetic disks, memory sticks or cards, external hard drives, etc. shall not be allowed. The BIR shall be immediately notified in writing, for purposes of re-evaluation and approval, prior to any change or enhancement of the computerized accounting system that will affect any transaction covered by the eORB System.

The preparation of manual ORBs and submission of transcripts thereof to the BIR shall be terminated upon effectivity of the Regulations: Provided, however, that all transactions engaged by all concerned excise taxpayers beginning February 1, 2013 shall already be encoded into the eORB System with the duly accomplished eORB Form for the month of February, 2013 transmitted, through the eORB homepage thereof, on or before March 5, 2013: Provided, further, That, for purposes of expediency, the eORB System shall be initially implemented for use by the major tobacco industry players identified by the BIR and a proper prior notice shall be issued for the implementation thereof to the other tobacco industry players.

You might also like

- EServices ReportDocument18 pagesEServices ReportMaine QuiniquiniNo ratings yet

- RMC No. 72-2018Document8 pagesRMC No. 72-2018Larry Tobias Jr.No ratings yet

- BIR Legal Summit 10.24.2018Document30 pagesBIR Legal Summit 10.24.2018Maricris MendozaNo ratings yet

- RMC No 45-2014Document2 pagesRMC No 45-2014Cenon Marco MoperaNo ratings yet

- 63728rmo12 12Document3 pages63728rmo12 12rheign plantasNo ratings yet

- Revenue Memorandum Order No. 15-2018: Bureau of Internal RevenueDocument15 pagesRevenue Memorandum Order No. 15-2018: Bureau of Internal Revenuebayot limNo ratings yet

- 157.registration of Computerized Accounting Systems by Large Taxpayers - jfd.08.19.2010Document2 pages157.registration of Computerized Accounting Systems by Large Taxpayers - jfd.08.19.2010Stephanie Mariz KhanNo ratings yet

- RR 18 2012Document5 pagesRR 18 2012JA LogsNo ratings yet

- Eeds Trader GuideDocument39 pagesEeds Trader GuideNagrani PuttaNo ratings yet

- 87493v16n4 High ResDocument9 pages87493v16n4 High ResErlene CompraNo ratings yet

- 1 RR 7-2009Document5 pages1 RR 7-2009JoyceNo ratings yet

- Income Taxation: Electronic Record Keeping RequirementsDocument4 pagesIncome Taxation: Electronic Record Keeping RequirementsMarc Darrell Masangcay OrozcoNo ratings yet

- RMO No. 5-2002Document13 pagesRMO No. 5-2002lantern san juanNo ratings yet

- 68120RR 1-2013Document6 pages68120RR 1-2013Allan AlcantaraNo ratings yet

- Accreditation of Printers For ATP (RR 15-2012)Document5 pagesAccreditation of Printers For ATP (RR 15-2012)Romer Lesondato67% (3)

- Revenue Regulations No. 9-2001Document6 pagesRevenue Regulations No. 9-2001Anonymous GMUQYq8No ratings yet

- 68120RR 1-2013 PDFDocument6 pages68120RR 1-2013 PDFandrew estimoNo ratings yet

- Sub.: Procedure For Electronic Filing of Central Excise and Service Tax Returns and For Electronic Payment of Excise Duty and Service Tax. Sir/madamDocument13 pagesSub.: Procedure For Electronic Filing of Central Excise and Service Tax Returns and For Electronic Payment of Excise Duty and Service Tax. Sir/madambiko137No ratings yet

- E Document Framework - GST IndiaDocument16 pagesE Document Framework - GST IndiakannanNo ratings yet

- Revised Concept Papere RegistrationDocument3 pagesRevised Concept Papere RegistrationayanNo ratings yet

- Updated e Invoice FAQs v6Document24 pagesUpdated e Invoice FAQs v6SurajNo ratings yet

- E InvoicingDocument4 pagesE Invoicingvaddepallyanil goudNo ratings yet

- Cus Procedure + STRDocument19 pagesCus Procedure + STRsureshNo ratings yet

- Keeping Books of Accounts Through A CASDocument2 pagesKeeping Books of Accounts Through A CASCkey ArNo ratings yet

- RMC 69-2020 POS Cancellation New RequirementDocument2 pagesRMC 69-2020 POS Cancellation New RequirementGreyNo ratings yet

- 15711rr04 11Document16 pages15711rr04 11Sy HimNo ratings yet

- Sales Tax - 03Document6 pagesSales Tax - 03Bilal ShaikhNo ratings yet

- P A G E: 4. Dissolution, Merger or Consolidation of Juridical PersonsDocument4 pagesP A G E: 4. Dissolution, Merger or Consolidation of Juridical PersonsRizabergNo ratings yet

- Rmo 13-2003 Prescribing The Use of Bir Printed ReceiptsDocument4 pagesRmo 13-2003 Prescribing The Use of Bir Printed ReceiptsremoveignoranceNo ratings yet

- Rmo 32-05Document8 pagesRmo 32-05nathalie velasquezNo ratings yet

- Final E-InvoicingDocument4 pagesFinal E-InvoicingCA Ishu BansalNo ratings yet

- Bir - Webinar - New RegistrantsDocument107 pagesBir - Webinar - New RegistrantsEdward Gan100% (1)

- Public Notice 59Document16 pagesPublic Notice 59Shreyansh ShreyNo ratings yet

- REVENUE MEMORANDUM CIRCULAR NO. 14-2015 Issued On April 6, 2015 PrescribesDocument1 pageREVENUE MEMORANDUM CIRCULAR NO. 14-2015 Issued On April 6, 2015 PrescribesGdares YakitNo ratings yet

- Issuance of Electronic Letter of AuthorityDocument3 pagesIssuance of Electronic Letter of AuthorityAatDeskHelperNo ratings yet

- E ServicesDocument52 pagesE ServicesRheneir MoraNo ratings yet

- RR No. 11-2018Document2 pagesRR No. 11-2018Cmrls0005No ratings yet

- Revenue Regulations No. 11-2004 SUBJECT: Rules and Regulations On The Accreditation, Registration and Use of CashDocument0 pagesRevenue Regulations No. 11-2004 SUBJECT: Rules and Regulations On The Accreditation, Registration and Use of Cashsj_adenipNo ratings yet

- Operations Memo 2016-04-01Document7 pagesOperations Memo 2016-04-01Renniel DimalantaNo ratings yet

- 6.tax UpdatesDocument131 pages6.tax UpdatesfrancklineNo ratings yet

- E-Invoicing ConceptDocument12 pagesE-Invoicing ConceptMohit GuptaNo ratings yet

- RMC No. 15-2021Document1 pageRMC No. 15-2021nathalie velasquezNo ratings yet

- RR 17-2006 (Taxi Meter)Document28 pagesRR 17-2006 (Taxi Meter)Axel MendozaNo ratings yet

- Revenue Memorandum Order No. 9-2021: Quezon CityDocument11 pagesRevenue Memorandum Order No. 9-2021: Quezon CityJocelGrandeNo ratings yet

- E InvoicingDocument20 pagesE Invoicingpawan dhokaNo ratings yet

- RR 8 - 2022wwwDocument10 pagesRR 8 - 2022wwwKC AtinonNo ratings yet

- 51 GST Flyer Chapter17Document7 pages51 GST Flyer Chapter17Deepa VishwakarmaNo ratings yet

- GST eInvoiceSystemDetailedOverviewDocument12 pagesGST eInvoiceSystemDetailedOverviewYours YoursNo ratings yet

- Tax Update RR 18-2012Document32 pagesTax Update RR 18-2012johamarz6245No ratings yet

- Rmo 28-07Document31 pagesRmo 28-07nathalie velasquezNo ratings yet

- Bir Updates - GacpaDocument38 pagesBir Updates - GacpaAngelo GasatanNo ratings yet

- Bir Ruling 047-2013Document8 pagesBir Ruling 047-2013Ar Yan SebNo ratings yet

- Digest of Revenue Issuances April 2015Document4 pagesDigest of Revenue Issuances April 2015RolDeejNo ratings yet

- 29133rmo 10-2006Document15 pages29133rmo 10-2006Denzel Edward CariagaNo ratings yet

- Sales TaxDocument4 pagesSales TaxSara NaeemNo ratings yet

- Rmo No. 22 2016 PDFDocument6 pagesRmo No. 22 2016 PDFjtf1898No ratings yet

- RMO No. 12-2012Document11 pagesRMO No. 12-2012PatOcampo100% (1)

- Trade Circular 07 2015Document1 pageTrade Circular 07 2015RAHULCHOW1No ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Overcurrent CoordinationDocument93 pagesOvercurrent CoordinationKumar100% (1)

- An Over View of Andhra Pradesh Water Sector Improvement Project (APWSIP)Document18 pagesAn Over View of Andhra Pradesh Water Sector Improvement Project (APWSIP)gurumurthy38No ratings yet

- A Survey On Multicarrier Communications Prototype PDFDocument28 pagesA Survey On Multicarrier Communications Prototype PDFDrAbdallah NasserNo ratings yet

- Time-Dependent Deformation of Shaly Rocks in Southern Ontario 1978Document11 pagesTime-Dependent Deformation of Shaly Rocks in Southern Ontario 1978myplaxisNo ratings yet

- Danh Sach Khach Hang VIP Diamond PlazaDocument9 pagesDanh Sach Khach Hang VIP Diamond PlazaHiệu chuẩn Hiệu chuẩnNo ratings yet

- Kayako Support Suite User Manual PDFDocument517 pagesKayako Support Suite User Manual PDFallQoo SEO BaiduNo ratings yet

- MWG Installation 7.6.2 IG INSTALLATION 0516 en - PDDocument64 pagesMWG Installation 7.6.2 IG INSTALLATION 0516 en - PDjbondsrNo ratings yet

- CBC Building Wiring Installation NC IIDocument72 pagesCBC Building Wiring Installation NC IIFaysbuk KotoNo ratings yet

- Salem Telephone CompanyDocument4 pagesSalem Telephone Company202211021 imtnagNo ratings yet

- SettingsDocument3 pagesSettingsrusil.vershNo ratings yet

- Prevalence of Peptic Ulcer in Patients Attending Kampala International University Teaching Hospital in Ishaka Bushenyi Municipality, UgandaDocument10 pagesPrevalence of Peptic Ulcer in Patients Attending Kampala International University Teaching Hospital in Ishaka Bushenyi Municipality, UgandaKIU PUBLICATION AND EXTENSIONNo ratings yet

- We Move You. With Passion.: YachtDocument27 pagesWe Move You. With Passion.: YachthatelNo ratings yet

- B.ST Case Study Class 12Document214 pagesB.ST Case Study Class 12Anishka Rathor100% (1)

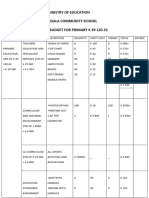

- Ministry of Education Musala SCHDocument5 pagesMinistry of Education Musala SCHlaonimosesNo ratings yet

- Between:-Mr. Pedro Jose de Vasconcelos, of Address 14 CrombieDocument2 pagesBetween:-Mr. Pedro Jose de Vasconcelos, of Address 14 Crombiednd offiNo ratings yet

- Different Software Life Cycle Models: Mini Project OnDocument11 pagesDifferent Software Life Cycle Models: Mini Project OnSagar MurtyNo ratings yet

- Unit 13 - Business Hotels and Sales ConferencesDocument24 pagesUnit 13 - Business Hotels and Sales ConferencesMiguel Angel Escoto CanoNo ratings yet

- Te 1569 Web PDFDocument272 pagesTe 1569 Web PDFdavid19890109No ratings yet

- Principles of SOADocument36 pagesPrinciples of SOANgoc LeNo ratings yet

- Intro S4HANA Using Global Bike Solutions EAM Fiori en v3.3Document5 pagesIntro S4HANA Using Global Bike Solutions EAM Fiori en v3.3Thăng Nguyễn BáNo ratings yet

- Surface CareDocument18 pagesSurface CareChristi ThomasNo ratings yet

- YeetDocument8 pagesYeetBeLoopersNo ratings yet

- PPB 3193 Operation Management - Group 10Document11 pagesPPB 3193 Operation Management - Group 10树荫世界No ratings yet

- Bill Swad's Wealth Building Strategies - SwadDocument87 pagesBill Swad's Wealth Building Strategies - Swadjovetzky50% (2)

- LICDocument82 pagesLICTinu Burmi Anand100% (2)

- Pthread TutorialDocument26 pagesPthread Tutorialapi-3754827No ratings yet

- Test Bank For American Corrections Concepts and Controversies 2nd Edition Barry A Krisberg Susan Marchionna Christopher J HartneyDocument36 pagesTest Bank For American Corrections Concepts and Controversies 2nd Edition Barry A Krisberg Susan Marchionna Christopher J Hartneyvaultedsacristya7a11100% (30)

- Microeconomics: Production, Cost Minimisation, Profit MaximisationDocument19 pagesMicroeconomics: Production, Cost Minimisation, Profit Maximisationhishamsauk50% (2)

- Ver Notewin 10Document5 pagesVer Notewin 10Aditya SinghNo ratings yet

- Millionaire Next Door QuestionsDocument7 pagesMillionaire Next Door Questionsapi-360370073No ratings yet