Professional Documents

Culture Documents

Tax

Uploaded by

Niks DujaniyaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax

Uploaded by

Niks DujaniyaCopyright:

Available Formats

Tax Planning & Personal Investment

Customer Value

Customer Value

Tax Planning

To a great extent, tax planning needs to be customized to the individual. Each individual is strongly advised to consult with a qualified tax planner to ensure taxation is minimized. Tax dollars saved, especially early in a career, and allowed to experience the effect of compounding returns can generate a sizable nest egg at the end of a career. The following general comments regarding tax planning are intended only to prepare an individual for further discussions with a personal tax planner. Tax planning for veterinary practitioners is necessary at two levels:

1. Practice Tax Planning 2. Personal Tax Planning

Practice Tax Planning Presently in Ontario veterinary practices can operate as either a sole proprietorship or as a partnership. However, it is expected that veterinary practices in Ontario will soon be allowed to incorporate. Incorporation does have advantages that will be discussed. Sole Proprietorship/Partnership In the case of a partnership or sole proprietorship, the owners share of the net income from the practice is regarded as business income and taxed at the appropriate personal tax rate. There is strong motivation to minimize the net income of the practice through such techniques as: employing family members expensing personal benefits through the practice expensing capital purchases These strategies to minimize tax must be kept to a level that is not likely to attract attention from Revenue Canada. Owners must also be aware that, if audited, the taxes saved through these strategies may have to be paid.

1 The Layers of Veterinary Financial Success

Customer Value

A practice operating as a sole proprietorship or partnership experiences a significant disadvantage, compared to an incorporated practice, in the repayment of debt and the purchase of assets. Capital expenses and payment of debt principal must be done with after-tax dollars left in the practice. In the case of an incorporated practice that experiences a tax rate of approximately 22%, every pre-tax dollar of net income becomes $.78 with which to purchase assets or pay debt principal. In the non-incorporated practice, net income will be taxed at the personal marginal tax rate. In Ontario, the upper marginal tax rate is presently 49%. Thus, every dollar of pretax net income taxed at the upper personal marginal tax rate equates to only $.51. Non-incorporated practices must purchase assets or service debt principal with $.51, compared to $.78 for incorporated practices. This difference of $.27 on every dollar of pretax net income has little effect on mature practices that have insignificant debt and modest capital expenditures. However, the young or recently purchased practice that is heavily burdened with debt can retire principal at a much faster rate when incorporated. A practice operating as a sole proprietorship or partnership may experience a further disadvantage at the time of sale. Non-incorporated practices must sell the assets of the practice. If the practice has appreciated in value during the period of ownership, there will be a significant tax burden. In contrast, incorporated practices may sell the equity, rather than the assets. In the sale of equity, the appreciated practice value is regarded as a capital gain from an active Canadian Corporation. This capital gain may be included in an individuals lifetime $500,000 capital-gains exemption. The owner may avoid significant tax if the lifetime capital-gains exemption has not already been used.

2 The Layers of Veterinary Financial Success

Customer Value

Incorporated Practices The discussion of taxation of sole proprietorships and partnerships outlined advantages that incorporated practices experience in retiring debt principal and in purchasing assets. It was further outlined that an owner of an incorporated practice may also experience tax advantages through the sale of equity rather than the sale of assets. However, the following disadvantages of incorporated practices must be borne in mind: the purchaser of equity purchases all outstanding legal liabilities of the purchased corporation the purchaser of equity experiences a tax disadvantage because of the lack of assets to depreciate. The liability transfer can generally be reduced with the implementation of a purchase agreement that leaves such liabilities with the vendor. In most instances, there will be little financial compensation to the purchaser. However, the tax disadvantage to the purchaser of equity must be offset with a lower practice price than would be appropriate if purchasing assets. The purchaser is purchasing an after-tax cash flow. Without assets to depreciate, a greater tax burden will reduce the cash flow to an equity purchaser. The price must naturally be reduced to compensate the purchaser for these reduced cash flows. In general, the vendor selling equity will still benefit at a reduced price, as the tax savings generally exceed the price reduction. Each practice situation will be different, and thus each owner will need customized advice. Practice owners are well-advised to do annual tax planning with their tax advisors. It should not be assumed that the accountant who prepares an annual tax return is doing the forward thinking necessary to minimize taxes in the future. Specific time should be regularly set aside to discuss and formulate tax strategies.

3 The Layers of Veterinary Financial Success

Customer Value

Personal Tax Planning

Personal tax strategies must be customized to an even greater extent than those for the practice. However, it is far beyond the scope of this article to discuss endless tax strategies. In general, the benefit of having compounded returns grow free of tax, as is possible in retirement, educational, and some life-insurance plans, should not be underestimated. At approximately a 50% personal marginal tax rate, the investment will grow almost twice as fast if sheltered from taxation. As with practice tax planing, one should spend time with a tax advisor, on a regular basis, to formulate personal tax strategies.

Personal Investment

As each individual will have a different adversity to risk and different expectations of appropriate rates of return, personal investment advice must be done on an individual basis. Investment strategies should be updated regularly to accommodate both personal and general economic conditions. The goal through practice life is to generate enough after-tax dollars to provide a suitable lifestyle and allow the investment of adequate funds that will create wealth sufficient to allow a comfortable retirement at a reasonable age. Each practitioner is personally responsible for expending those energies necessary in both the professional and business domains to reach the goal.

4 The Layers of Veterinary Financial Success

You might also like

- Prasanna Resume 2016NEWDocument2 pagesPrasanna Resume 2016NEWNiks DujaniyaNo ratings yet

- Comprehensive Industry Document On Coffee Processing IndustryDocument76 pagesComprehensive Industry Document On Coffee Processing IndustryepebeNo ratings yet

- Consumer CaseDocument6 pagesConsumer CaseNiks DujaniyaNo ratings yet

- Amul CompanyDocument55 pagesAmul CompanyNiks Dujaniya100% (1)

- Corrected SynopsisDocument7 pagesCorrected SynopsisNiks DujaniyaNo ratings yet

- Homeware Products 15 PagesDocument19 pagesHomeware Products 15 PagesNiks DujaniyaNo ratings yet

- Hotel Management Power Point Presentation .Document20 pagesHotel Management Power Point Presentation .Niks DujaniyaNo ratings yet

- LG Company ProjectDocument54 pagesLG Company ProjectNiks Dujaniya75% (12)

- Book 1Document5 pagesBook 1Niks DujaniyaNo ratings yet

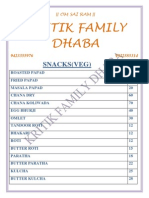

- Kritik Family Dhaba: Snacks (Veg)Document6 pagesKritik Family Dhaba: Snacks (Veg)Niks DujaniyaNo ratings yet

- Resume: Name Swapnil Balaram Sakpal Father Name AddressDocument1 pageResume: Name Swapnil Balaram Sakpal Father Name AddressNiks DujaniyaNo ratings yet

- Bio Datasimple12Document1 pageBio Datasimple12Niks DujaniyaNo ratings yet

- Research Meth.Document31 pagesResearch Meth.Niks DujaniyaNo ratings yet

- Sangeeth VargheseDocument20 pagesSangeeth VargheseNiks DujaniyaNo ratings yet

- SamsungDocument19 pagesSamsungNiks Dujaniya100% (1)

- Budgetary Control of IndiaDocument30 pagesBudgetary Control of IndiaNiks DujaniyaNo ratings yet

- Balance Sheet of Cadbury IndiaDocument1 pageBalance Sheet of Cadbury IndiaNiks Dujaniya100% (1)

- Marketing in BankingDocument59 pagesMarketing in BankingNiks Dujaniya100% (1)

- Personal Investment and Taxes PlanningDocument28 pagesPersonal Investment and Taxes PlanningNiks DujaniyaNo ratings yet

- SamsungDocument19 pagesSamsungNiks Dujaniya100% (1)

- TelecommunicationsDocument3 pagesTelecommunicationsNiks DujaniyaNo ratings yet

- BCT Annual Report 2011 FinalDocument29 pagesBCT Annual Report 2011 FinalNiks DujaniyaNo ratings yet

- New Project Report CadburyDocument66 pagesNew Project Report CadburypriyapangamNo ratings yet

- K.M.E.S College of EducationDocument11 pagesK.M.E.S College of EducationNiks DujaniyaNo ratings yet

- Personal Investment and Taxes PlanningDocument28 pagesPersonal Investment and Taxes PlanningNiks DujaniyaNo ratings yet

- Corporate Tax PlanningDocument21 pagesCorporate Tax Planninggauravbpit100% (3)

- Tax PlanningDocument8 pagesTax PlanningRaunak BhadaniNo ratings yet

- Bio Datasimple12Document1 pageBio Datasimple12Niks DujaniyaNo ratings yet

- Indian Money MarketDocument33 pagesIndian Money MarketNiks DujaniyaNo ratings yet

- The Role of Development Banks in The Twenty First CenturyDocument30 pagesThe Role of Development Banks in The Twenty First CenturyNiks DujaniyaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Concept of Commercial Banks of Nepa1Document8 pagesConcept of Commercial Banks of Nepa1vanvunNo ratings yet

- Winter 2014, CISC101, Assignment 1Document2 pagesWinter 2014, CISC101, Assignment 1qingmui100% (1)

- Electronic Payment (EP) Account Agreement: Things To Know Before You BeginDocument4 pagesElectronic Payment (EP) Account Agreement: Things To Know Before You BeginandryNo ratings yet

- Working Capital and The Financing Decision: Discussion QuestionsDocument35 pagesWorking Capital and The Financing Decision: Discussion QuestionsBlack UnicornNo ratings yet

- Book IV Civil Code (Codal)Document164 pagesBook IV Civil Code (Codal)reseljanNo ratings yet

- Bear Stearns RMBS Residuals PrimerDocument48 pagesBear Stearns RMBS Residuals PrimerBrad Samples100% (1)

- Espinocilla v. Bagong Tanyag Homeowners' Assn., Inc. (529 SCRA 654)Document2 pagesEspinocilla v. Bagong Tanyag Homeowners' Assn., Inc. (529 SCRA 654)Void LessNo ratings yet

- Definition of TermsDocument5 pagesDefinition of TermsRaffy RodriguezNo ratings yet

- Financial Management Capitalization P-2Document12 pagesFinancial Management Capitalization P-2api-3747098100% (2)

- Company Registration - How To Register A Company in IndiaDocument3 pagesCompany Registration - How To Register A Company in Indiasri_iasNo ratings yet

- Financial AccountingDocument103 pagesFinancial AccountingDaniel HunksNo ratings yet

- Property Location Within Abroa D Within Outside Withi N Outside Real Properties X X Personal Properties Tangible X X Intangible X X XDocument4 pagesProperty Location Within Abroa D Within Outside Withi N Outside Real Properties X X Personal Properties Tangible X X Intangible X X XMarie Tes LocsinNo ratings yet

- Invoice: Dadlaw House, 3 Thasos Street P.O.BOX 22360 Nicosia, Cyprus Tax Reg. No: 12268654D VAT Reg. No: 10268654BDocument2 pagesInvoice: Dadlaw House, 3 Thasos Street P.O.BOX 22360 Nicosia, Cyprus Tax Reg. No: 12268654D VAT Reg. No: 10268654BSvetlana MitrovicNo ratings yet

- Financial Planning Tute AnswersDocument11 pagesFinancial Planning Tute AnswersJason DaiNo ratings yet

- Economics Notes - Economy-Part 2 - TNPSCDocument4 pagesEconomics Notes - Economy-Part 2 - TNPSCnimbus2050No ratings yet

- The Great American Credit Collapse Pt2Document7 pagesThe Great American Credit Collapse Pt2auroradogNo ratings yet

- Fin Mar-Chapter9Document2 pagesFin Mar-Chapter9EANNA15No ratings yet

- Financing Current AssetsDocument9 pagesFinancing Current Assetspbelim100% (1)

- NVCA 2019 YearbookDocument72 pagesNVCA 2019 YearbookJun ChenNo ratings yet

- Premium Chart - Reliance Health Super Top UpDocument12 pagesPremium Chart - Reliance Health Super Top UpSamba Siva RaoNo ratings yet

- Angel Investment Firms: Financial Services and Institutions Presented by Smita Mishra Slide 1 ofDocument5 pagesAngel Investment Firms: Financial Services and Institutions Presented by Smita Mishra Slide 1 ofSmita MishraNo ratings yet

- Joint Venture 1Document11 pagesJoint Venture 1Clif Mj Jr.100% (4)

- Home Assignment 3Document3 pagesHome Assignment 3AUNo ratings yet

- 360 Global Wine Company TSIXQDocument5 pages360 Global Wine Company TSIXQsoulpatch_85No ratings yet

- CH 14Document74 pagesCH 14fulmanti deviNo ratings yet

- BusinessLaw MB012 QuestionDocument41 pagesBusinessLaw MB012 QuestionAiDLoNo ratings yet

- Project Report (Avinash Singh)Document24 pagesProject Report (Avinash Singh)avinash singh80% (10)

- Camella Homes - Gensan - House Models by Real Estate Agent, Debbie R. GuiangDocument15 pagesCamella Homes - Gensan - House Models by Real Estate Agent, Debbie R. GuiangDebbie Delos Reyes GuiangNo ratings yet

- Quiz Discontinued OperationDocument2 pagesQuiz Discontinued OperationRose0% (1)

- Section 3 - SwapsDocument49 pagesSection 3 - SwapsEric FahertyNo ratings yet