Professional Documents

Culture Documents

SX40 Leaflet

Uploaded by

Pradeep KannanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SX40 Leaflet

Uploaded by

Pradeep KannanCopyright:

Available Formats

INDEX OF INDIA

Key Features About

SX40 is the flagship Index of MCX-SX. A free float based index of 40 large cap - liquid stocks representing diversified sectors of the economy. SX40 is designed to measure the economic performance with better representation of various industries and sectors based on ICB, leading global Industry Classification system from FTSE. The Index is devised to oer cost-eective support for investment and structured products such as index futures and option, index portfolio, exchange traded funds, Index funds, etc.

Superior return & risk adjusted return A unique Index of India benchmarking global best practices of index designing Better Reflection of the Organised Sector in the Economy through enhanced industry representation using ICB of FTSE Rule based, transparent & replicable Industry capping eliminates industry bias and enhances Index stability Lower churning rate Low cost for funds (MFs, ETFs) construction and maintenance Low tracking error for passive portfolio management (MFs, ETFs etc)

Objective SX40 is designed to be a performance benchmark and to provide for ecient investment and risk management instrument. It would also help in structuring passive investment vehicles. Investability Free-float weighted to bolster ecient investability. Transparency Index rules are overseen by an independent index committee comprising of leading investment industry professionals, academicians, and financial experts. The Committee also monitors constituent liquidity to ensure ecient portfolio trading while keeping index turnover to a minimum. Complete details of these guidelines, including the criteria for index additions and removals, policy statements, and research papers are freely and transparently available in public domain. These guidelines provide complete transparency and fairness. Availability Calculated and disseminated based on real time basis.

Selection Criteria

Underlying stocks must have a positive net-worth The stock must have free float of at least 10% & within top 100 liquid companies Industry capping at 20% ()2% band Fast Entry for companies with better free float market cap and liquidity Top 40 companies meeting above criteria constitute SX40

www.mcx-sx.com

INDEX OF INDIA

Performance

Index Returns (%) FY 2010-11 FY 2011-12 FY 2012-13* 2010 2013* SX40 11.7 -8.8 14.2 16.3 Nifty Sensex 11.1 -9.2 14.0 15.0 10.9 -10.5 14.3 13.5

125 120 115 110 105 100 95 90 85 Apr10 Aug-10 Dec-10 Apr-11 Aug-11 Dec-11 Apr-12 Aug-12 Dec-12

SX40

NIFTY

SENSEX

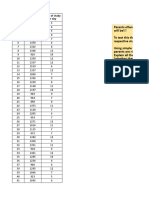

Constituents

ACC Ltd. Ambuja Cements Ltd. Asian Paints Ltd. Bajaj Auto Ltd. Bharat Petroleum Corp Ltd. Bharti Airtel Ltd. BHEL Cairn India Ltd. Cipla Ltd. Coal India Ltd. Dr. Reddy's Laboratories Gail (India) Ltd. HCL Technologies Ltd. HDFC Bank Ltd. HDFC Ltd. Hero Motocorp Ltd. Hindalco Industries Ltd. Hindustan Unilever Ltd. ICICI Bank Ltd. Infosys Ltd. ITC Ltd. Jaiprakash Associates Ltd. Jindal Steel & Power Ltd. Larsen & Toubro Ltd. Lupin Ltd. Mahindra & Mahindra Ltd. Maruti Suzuki India Ltd. Ntpc Ltd. Oil and Natural Gas Corp. Power Grid Corp. Ltd. Reliance Industries Ltd. Sun Pharmaceuticals Ind. Tata Consultancy Serv Ltd. Tata Motors Ltd. Tata Power Co Ltd. Tata Steel Ltd. Titan Industries Ltd. United Spirits Ltd. Wipro Ltd. Zee Entertainment Ltd.

Industry Weights (%)* Basic Materials Consumer Goods Consumer Services Financials Health Care Industrials Oil & Gas Technology Telecommunications Utilities

Index Characteristics (%)

Quick Facts SX 40 4.7 18.2 0.7 22.0 5.1 14.8 14.8 14.2 2.4 3.1 SX40 9.4 62.4 Nifty 4.6 14.7 0.0 29.4 4.9 15.5 13.1 12.7 2.1 3.1 Nifty 8.8 57.4 Sensex 5.9 17.2 0.0 26.4 4.5 12.0 14.7 14.2 2.7 2.5 Sensex 10.3 67.8

Index Universe: Large Cap companies No. of Companies: 40 Index Launch: February 11, 2013 Base Date: March 31, 2010 Base Value:10,000 Currency: Indian Rupee Index Basket Recasting: Semi-Annually Minor Share Issuance adjustment: Monthly

Weight of the largest constituent* Top 10 Holding* International Practices Parameters Minimum Free Float Liquidity Review Minor Share Issuance adjustment Free Float Change Industry Cap Industry Classification

*As on January 31, 2013

SX-40 10%

International Practices FTSE-25%, CAC 20%, S&P 500- 50%

NSE 10% Impact cost Monthly

Within Top 100 NIKKEI: Turnover as Liquidity Monthly DAX, FTSE: QTRLY, 10% and above changed else annual, Nasdaq, S&P 500 Qtrly if less than 5% TSX &various variants of other Indices STOXX/ FTSE, NASDAQ, NYSE, LSE, Kuwait SE, SGX, Taiwan SX

Semi-Annually Quarterly, Half yearly, Annual, Need Based Semi-Annually

20% ICB

No Internal

Exchange Square, Suren Road, Andheri (E), Mumbai - 400 093 Tel.: +91-22-6731 9000 Fax: +91-22-6731 9004 Email: index@mcx-sx.com

Disclaimer: All the information in the brochure, including, but not limited to, characters, data, charts and tables (hereinafter referred to as information) are properties of MCX-SX Stock Exchange Ltd. (hereinafter referred to as MCX-SX) except brands names and logos if any belonging to other persons. The contents of this documentare solely for informationalpurposes. It is not intended to be used as trading advice by anybody and should not in any way be treated as a recommendation to trade. While the information in the document has been compiled from sources believed to be reliable and in good faith, recipients and audience of this document may note that the contents thereof including text, graphics, links or other items are provided without warranties of any kind. MCX Stock Exchange Ltd.(MCX-SX) expressly disclaims any warranty as to the accuracy, correctness, reliability, timeliness, merchantability or fitness for any particular purpose and shall not be liable for any damage or loss of any kind, howsoever caused as a result (direct or indirect) of the use of the information or data contained in this document.The charts and graphs may reflect hypothetical historical performance. All information presented prior to the index inception date is back-tested. Back-tested performance is not actual performance, but is hypothetical. SX-40 and the SX40 logo are proprietary trademarks of MCX-SX.

You might also like

- MSCI International Factsheet 0410Document2 pagesMSCI International Factsheet 0410Kim CampbellNo ratings yet

- CNX Bank IndexDocument3 pagesCNX Bank IndexNidhi AgarwalNo ratings yet

- MOSt Shares M50 ETF RatingDocument4 pagesMOSt Shares M50 ETF RatingYogi173No ratings yet

- ProjectDocument80 pagesProjectShameem AnwarNo ratings yet

- CNX Nifty JRDocument4 pagesCNX Nifty JRsachinhs7No ratings yet

- L&T Tech Services IPO AnalysisDocument4 pagesL&T Tech Services IPO Analysislokesh38No ratings yet

- Morning Star Report 20141103125737Document1 pageMorning Star Report 20141103125737saiyuvatechNo ratings yet

- EM Equal Weighted FactsheetDocument2 pagesEM Equal Weighted FactsheetRoberto PerezNo ratings yet

- Methodology Document of NIFTY Sectoral Index Series: January 2020Document16 pagesMethodology Document of NIFTY Sectoral Index Series: January 2020Sumit KhatanaNo ratings yet

- Technical Report 27th December 2011Document5 pagesTechnical Report 27th December 2011Angel BrokingNo ratings yet

- Itc - Technical Analysis FulllDocument25 pagesItc - Technical Analysis Fulllc60236930No ratings yet

- Summer Training Report Analysis of Broking Firm FunctioningDocument64 pagesSummer Training Report Analysis of Broking Firm Functioningaerisingh3412No ratings yet

- Comparative analysis of stock brokersDocument38 pagesComparative analysis of stock brokersPoonam NandaNo ratings yet

- Bse FunctionsDocument41 pagesBse FunctionsSree LakshmiNo ratings yet

- National Stock Exchange of India LTD.: October 2018Document5 pagesNational Stock Exchange of India LTD.: October 2018bestdealsNo ratings yet

- Daily Equity ReportDocument4 pagesDaily Equity ReportNehaSharmaNo ratings yet

- Portfolio ManagementDocument43 pagesPortfolio ManagementNiket DattaniNo ratings yet

- Method Nifty 1D RateDocument8 pagesMethod Nifty 1D RateGeneralmailNo ratings yet

- Technical Report 4th January 2012Document5 pagesTechnical Report 4th January 2012Angel BrokingNo ratings yet

- Press Release: 4 June 2018Document2 pagesPress Release: 4 June 2018osdiabNo ratings yet

- Abhishek JainDocument46 pagesAbhishek JainSunil JainNo ratings yet

- India Uninterruptible Power Supply Market PDFDocument140 pagesIndia Uninterruptible Power Supply Market PDFSachin JainNo ratings yet

- A World of Intelligent InvestingDocument7 pagesA World of Intelligent Investinglux8564517No ratings yet

- History of Indian Stock ExchangesDocument5 pagesHistory of Indian Stock ExchangesapuoctNo ratings yet

- AxiataDocument21 pagesAxiatasalihin 4646No ratings yet

- "A Comparative Study of Nse &bse": A Project Report ONDocument56 pages"A Comparative Study of Nse &bse": A Project Report ONShailendra Bhatt0% (2)

- Market Outlook: Dealer's DiaryDocument4 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Technical Report 25th October 2011Document5 pagesTechnical Report 25th October 2011Angel BrokingNo ratings yet

- Trade Nivesh 26.09.2016Document8 pagesTrade Nivesh 26.09.2016Sayli SayliNo ratings yet

- Technical Report 28th February 2012Document5 pagesTechnical Report 28th February 2012Angel BrokingNo ratings yet

- India Index Services & Products Ltd. (IISL)Document4 pagesIndia Index Services & Products Ltd. (IISL)Trinadh Kumar GuthulaNo ratings yet

- Maximising wealth through non-SLR investmentsDocument78 pagesMaximising wealth through non-SLR investmentsSanchita NaikNo ratings yet

- Tata Communications (VIDSAN) : Data Segment Highly Margin AccretiveDocument3 pagesTata Communications (VIDSAN) : Data Segment Highly Margin AccretivevikkediaNo ratings yet

- Price To Book Value Stocks 161008Document2 pagesPrice To Book Value Stocks 161008Adil HarianawalaNo ratings yet

- Cisco Case StudyDocument10 pagesCisco Case Studywillie.erasmus7023No ratings yet

- Risk Management Through Derivative in Indian Stock MarketDocument29 pagesRisk Management Through Derivative in Indian Stock MarketHimanshu RastogiNo ratings yet

- Sharekhan Top Mutual Fund Picks May 2015Document14 pagesSharekhan Top Mutual Fund Picks May 2015Siddhant PardeshiNo ratings yet

- Fundcard MiraeAssetEmergingBluechipRegular 2014feb26Document4 pagesFundcard MiraeAssetEmergingBluechipRegular 2014feb26Yogi173No ratings yet

- Blue Diamond Group 10Document33 pagesBlue Diamond Group 10guptak09No ratings yet

- National Stock Exchange of India (NSE): Key Facts and Major IndicesDocument47 pagesNational Stock Exchange of India (NSE): Key Facts and Major IndicesTarun Kumar ThakurNo ratings yet

- Presented By, Rashi Antony Appu Marks John Hariharan. KDocument48 pagesPresented By, Rashi Antony Appu Marks John Hariharan. Kkhariharan100% (1)

- Tata Elxsi LTD: General OverviewDocument9 pagesTata Elxsi LTD: General Overviewakanksha morghadeNo ratings yet

- Investor Presentation (Company Update)Document43 pagesInvestor Presentation (Company Update)Shyam SunderNo ratings yet

- Daily Derivatives: December 17, 2015Document3 pagesDaily Derivatives: December 17, 2015choni singhNo ratings yet

- Project Report On Ulip & Mutual FundDocument55 pagesProject Report On Ulip & Mutual FundGovind BhakuniNo ratings yet

- A Project Report On Equity Analysis On Indian IT Sector DasdDocument101 pagesA Project Report On Equity Analysis On Indian IT Sector DasdRamawatar Tawaniya100% (1)

- Stock MarketDocument12 pagesStock MarketMuhammad Saleem SattarNo ratings yet

- Method Nifty Thematic IndicesDocument16 pagesMethod Nifty Thematic IndicesAkshay keerNo ratings yet

- Technical Report 26th March 2012Document5 pagesTechnical Report 26th March 2012Angel BrokingNo ratings yet

- Axis Equity Growth: Investment ObjectiveDocument1 pageAxis Equity Growth: Investment ObjectivepeterNo ratings yet

- Technical Report 19th January 2012Document5 pagesTechnical Report 19th January 2012Angel BrokingNo ratings yet

- Sharekhan's Top Equity Mutual Fund Picks: April 20, 2012Document4 pagesSharekhan's Top Equity Mutual Fund Picks: April 20, 2012rajdeeppawarNo ratings yet

- News Title - MCX SX-ShihabDocument12 pagesNews Title - MCX SX-ShihabAnitha ChandranNo ratings yet

- Technical Report 29th November 2011Document5 pagesTechnical Report 29th November 2011Angel BrokingNo ratings yet

- Financial MarketsDocument99 pagesFinancial MarketsPiyush ShahNo ratings yet

- Technical Report 9th March 2012Document5 pagesTechnical Report 9th March 2012Angel BrokingNo ratings yet

- NSE NIFTY Correlation Sector IndexesDocument11 pagesNSE NIFTY Correlation Sector IndexesSAI VAKANo ratings yet

- Hotel Sector Fund and IndexDocument18 pagesHotel Sector Fund and IndexShubham SuryavanshiNo ratings yet

- BaminiDocument2 pagesBaminiPradeep KannanNo ratings yet

- CITY UNION BANK APPOINTS JUNIOR OFFICERDocument5 pagesCITY UNION BANK APPOINTS JUNIOR OFFICERPradeep KannanNo ratings yet

- Goaty Elai PK ATM 325 314 321 277Document23 pagesGoaty Elai PK ATM 325 314 321 277Pradeep KannanNo ratings yet

- QNDocument1 pageQNPradeep KannanNo ratings yet

- BankDocument1 pageBankPradeep KannanNo ratings yet

- CWE PO MT II Thrid Allotment MessageDocument2 pagesCWE PO MT II Thrid Allotment MessagePradeep KannanNo ratings yet

- CDC UP Risk Management Practices GuideDocument7 pagesCDC UP Risk Management Practices GuidePoli MarkovaNo ratings yet

- 002 DimensionsDocument9 pages002 DimensionsPradeep KannanNo ratings yet

- IBPSDocument2 pagesIBPSPradeep KannanNo ratings yet

- QnsDocument1 pageQnsPradeep KannanNo ratings yet

- Cost DriversDocument2 pagesCost DriversPradeep KannanNo ratings yet

- TQM Concepts and PrinciplesDocument56 pagesTQM Concepts and PrinciplesPradeep Kannan0% (1)

- PKDocument2 pagesPKPradeep KannanNo ratings yet

- CANBANK FACTORS LTD Job Notification - Multiple VacanciesDocument5 pagesCANBANK FACTORS LTD Job Notification - Multiple VacanciesCareerNotifications.comNo ratings yet

- Public Sector BanksDocument8 pagesPublic Sector BanksPradeep KannanNo ratings yet

- Sample Placement Paper Question TCSDocument5 pagesSample Placement Paper Question TCSNimisha NigamNo ratings yet

- Best College Survey 2013 - Business Management QuestionnaireDocument14 pagesBest College Survey 2013 - Business Management QuestionnairePradeep KannanNo ratings yet

- EntrepreneurDocument3 pagesEntrepreneurPradeep KannanNo ratings yet

- GKDocument8 pagesGKPradeep KannanNo ratings yet

- BdaDocument1 pageBdaPradeep KannanNo ratings yet

- Worksocial: New Approach Blends Data, Process and Collaboration For Better, Faster Decision-MakingDocument107 pagesWorksocial: New Approach Blends Data, Process and Collaboration For Better, Faster Decision-MakingPradeep KannanNo ratings yet

- Or CT ResultsDocument2 pagesOr CT ResultsPradeep KannanNo ratings yet

- SL No Date Comment: TotalDocument2 pagesSL No Date Comment: TotalPradeep KannanNo ratings yet

- PI TimingsDocument12 pagesPI TimingsPradeep KannanNo ratings yet

- Mobile BankingDocument81 pagesMobile BankingPradeep Kannan0% (1)

- C Ampus Store Manage M e NT - C On Te XT Diagram: Depatment Official Store InchargeDocument1 pageC Ampus Store Manage M e NT - C On Te XT Diagram: Depatment Official Store InchargePradeep KannanNo ratings yet

- Mobile BankingDocument81 pagesMobile BankingPradeep Kannan0% (1)

- Ch11 Mini Case Student TemplateDocument3 pagesCh11 Mini Case Student TemplatePradeep KannanNo ratings yet

- 0764 IPX Voice 220-00 (System Specifications) V1-3 2012-04-02Document41 pages0764 IPX Voice 220-00 (System Specifications) V1-3 2012-04-02Pradeep KannanNo ratings yet

- No! If Products Are Identical, The Traditional Cost System Would Do at Least As Good of A Job and Sometimes BetterDocument4 pagesNo! If Products Are Identical, The Traditional Cost System Would Do at Least As Good of A Job and Sometimes BetterCyra Laine SolitoNo ratings yet

- RTG CPR CargoContainersandCubeHotelsDocument5 pagesRTG CPR CargoContainersandCubeHotelsMatt V100% (1)

- Reactive PowerDocument177 pagesReactive PowerSalih Ahmed ObeidNo ratings yet

- IPM Bit TechnologyDocument70 pagesIPM Bit Technologyamin peyvandNo ratings yet

- FARE DISPLAY Codes - GalileoDocument4 pagesFARE DISPLAY Codes - GalileoXzxxzNo ratings yet

- Chapter 1 UpdatedDocument55 pagesChapter 1 UpdatedFLORELY LUNANo ratings yet

- Iv. Learning Phases and Learning Activities I. Introduction (Time Frame: Day1)Document4 pagesIv. Learning Phases and Learning Activities I. Introduction (Time Frame: Day1)Maria Elaine De Castro100% (1)

- UTI Scam: Robbery Through Other Means: What Is The UTI ?Document3 pagesUTI Scam: Robbery Through Other Means: What Is The UTI ?Joseph JenningsNo ratings yet

- 22509mcq MergedDocument166 pages22509mcq MergedharshNo ratings yet

- The Economics of European Imperialism by Alan HodgartDocument100 pagesThe Economics of European Imperialism by Alan HodgartIgor GustavoNo ratings yet

- Articles of PartnershipDocument10 pagesArticles of PartnershipMi KeeNo ratings yet

- TH Food Chain JSC (TH True Milk) : Meeting AgendaDocument2 pagesTH Food Chain JSC (TH True Milk) : Meeting AgendaVy Pham Nguyen KhanhNo ratings yet

- Img 20230625 0002Document1 pageImg 20230625 0002van souNo ratings yet

- Request For Quotation: (This Is Not An Order)Document1 pageRequest For Quotation: (This Is Not An Order)Julio CruzNo ratings yet

- Negotiable instruments types and implicationsDocument5 pagesNegotiable instruments types and implicationsAlexis KingNo ratings yet

- G and L Series DatasheetDocument6 pagesG and L Series DatasheetFilipeNo ratings yet

- Xiamen AirlinesDocument8 pagesXiamen Airlinesgsach11100% (1)

- Build The Tango: by Hank BravoDocument57 pagesBuild The Tango: by Hank BravoMarceloRossel100% (1)

- Study Hours vs SAT ScoresDocument8 pagesStudy Hours vs SAT ScoresOmar Fahim Khan 1911758030No ratings yet

- Map of Eucalyptus Ballah Piling: Section: A - ADocument3 pagesMap of Eucalyptus Ballah Piling: Section: A - ABURDWAN COMMUNITYNo ratings yet

- 2.3.8 PracticeDocument5 pages2.3.8 PracticeKyrieSwerving100% (5)

- Contemporary Corporate Finance International Edition 12th Edition Mcguigan Test BankDocument35 pagesContemporary Corporate Finance International Edition 12th Edition Mcguigan Test Bankbyronrogersd1nw8100% (21)

- HHCBDocument845 pagesHHCBVân LêNo ratings yet

- Solar Power All ContractsDocument9 pagesSolar Power All ContractsintangiblegiftsofficialNo ratings yet

- Car Sale AgreementDocument3 pagesCar Sale AgreementMike Kuria MuchokiNo ratings yet

- SANS1200GDocument19 pagesSANS1200GNiyazudeen VakilNo ratings yet

- 18156-Article Text-62319-1-10-20220619Document13 pages18156-Article Text-62319-1-10-20220619Diego YauriNo ratings yet

- 26052340SBDs Cardiac Monitor Syringe PumpDocument40 pages26052340SBDs Cardiac Monitor Syringe Pumpbbraun peshawarNo ratings yet

- TYB - Practical Questions - Final PDFDocument321 pagesTYB - Practical Questions - Final PDFChandana RajasriNo ratings yet

- Valencia CDP 2017-2022ADocument136 pagesValencia CDP 2017-2022AMPDC ValenciaNo ratings yet