Professional Documents

Culture Documents

On The Origin and Evolution of The Word Inflation

Uploaded by

Paolo100%(2)100% found this document useful (2 votes)

263 views5 pagesOn the Origin and Evolution of the Word Inflation by Michael F. Bryan Federal Reserve Bank of Cleveland

Inflation, a term that first referred to a condition of the currency and later to a condition of money, is now commonly used to describe prices. This shift in meaning seems to have originated in an unfortunate—but perhaps inevitable —sequence of events. By referring to inflation as a condition of “too much money,” economists were forced to struggle with the operational issue of “how much is too much?” The quantity theory offered a clear answer to that question: Too much money is an increase in the money stock that is accompanied by a rise in the general price level. In other words, an inflated money supply will reveal itself through its effect on the price level. When Keynesian economic theory challenged the direct link between money and the price level, inflation lost its association with money and came to be chiefly understood as a condition of prices. Without being tied to the money supply, any price increase seems to have an equal claim to the word inflation. Indeed, today we regularly read reports of a seemingly endless variety of “inflations.” When the word is used as a description of the price level, an antiinflation policy can easily be characterized as being against any price increase, including higher wages! This is simply not the case. An anti-inflation strategy is concerned with a particular type of price increase—a rise in the general price level stemming from excessive money creation. When viewed in this light— the light provided by the word’s original meaning—a zero-inflation objective for the central bank becomes a much more sensible goal.

Original Title

On the Origin and Evolution of the Word Inflation

Copyright

© Attribution Non-Commercial No-Derivs (BY-NC-ND)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentOn the Origin and Evolution of the Word Inflation by Michael F. Bryan Federal Reserve Bank of Cleveland

Inflation, a term that first referred to a condition of the currency and later to a condition of money, is now commonly used to describe prices. This shift in meaning seems to have originated in an unfortunate—but perhaps inevitable —sequence of events. By referring to inflation as a condition of “too much money,” economists were forced to struggle with the operational issue of “how much is too much?” The quantity theory offered a clear answer to that question: Too much money is an increase in the money stock that is accompanied by a rise in the general price level. In other words, an inflated money supply will reveal itself through its effect on the price level. When Keynesian economic theory challenged the direct link between money and the price level, inflation lost its association with money and came to be chiefly understood as a condition of prices. Without being tied to the money supply, any price increase seems to have an equal claim to the word inflation. Indeed, today we regularly read reports of a seemingly endless variety of “inflations.” When the word is used as a description of the price level, an antiinflation policy can easily be characterized as being against any price increase, including higher wages! This is simply not the case. An anti-inflation strategy is concerned with a particular type of price increase—a rise in the general price level stemming from excessive money creation. When viewed in this light— the light provided by the word’s original meaning—a zero-inflation objective for the central bank becomes a much more sensible goal.

Copyright:

Attribution Non-Commercial No-Derivs (BY-NC-ND)

Available Formats

Download as PDF, TXT or read online from Scribd

100%(2)100% found this document useful (2 votes)

263 views5 pagesOn The Origin and Evolution of The Word Inflation

Uploaded by

PaoloOn the Origin and Evolution of the Word Inflation by Michael F. Bryan Federal Reserve Bank of Cleveland

Inflation, a term that first referred to a condition of the currency and later to a condition of money, is now commonly used to describe prices. This shift in meaning seems to have originated in an unfortunate—but perhaps inevitable —sequence of events. By referring to inflation as a condition of “too much money,” economists were forced to struggle with the operational issue of “how much is too much?” The quantity theory offered a clear answer to that question: Too much money is an increase in the money stock that is accompanied by a rise in the general price level. In other words, an inflated money supply will reveal itself through its effect on the price level. When Keynesian economic theory challenged the direct link between money and the price level, inflation lost its association with money and came to be chiefly understood as a condition of prices. Without being tied to the money supply, any price increase seems to have an equal claim to the word inflation. Indeed, today we regularly read reports of a seemingly endless variety of “inflations.” When the word is used as a description of the price level, an antiinflation policy can easily be characterized as being against any price increase, including higher wages! This is simply not the case. An anti-inflation strategy is concerned with a particular type of price increase—a rise in the general price level stemming from excessive money creation. When viewed in this light— the light provided by the word’s original meaning—a zero-inflation objective for the central bank becomes a much more sensible goal.

Copyright:

Attribution Non-Commercial No-Derivs (BY-NC-ND)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 5

October 15, 1997

Federal Reserve Bank of Cleveland

On the Origin and Evolution

of the Word Inflation

by Michael F. Bryan

Inflation is the process of making central bank—and one solution—a less

addition to currencies not based on a expansive money growth rate. But as a

Today, we commonly hear about dif-

commensurate increase in the production condition of the price level, which may

ferent kinds of inflation. Indeed, the

of goods. have originated from a variety of things

word inflation is often used synony-

—Federal Reserve Bulletin (1919) (including a depreciating dollar, rising

mously with “price increase.” But

labor costs, bad weather, or a number of

there is also a different, more spe-

Most prominent among these inflationary factors other than “too much money”),

cific, definition of inflation —a rise

forces were a drop in the exchange rate the solution to—and the prudence of—

in the general price level caused by

of the dollar, a considerable increase in eliminating inflation is much less clear.

an imbalance between the quantity

labor costs, and severe weather.

■ Value, Money, and Currency of money and trade needs. This

—Federal Reserve Bulletin (1978)

“inflation” has but one origin —the

I smiled at myself at the sight of all this

F or many years, the word inflation was

not a statement about prices but a condi-

money. “Oh, drug,” said I, aloud, “What

central bank. It is the latter defini-

tion that drives many of those advo-

art thou good for? Thou art not worth to cating an anti-inflation policy for the

tion of paper money—a specific de- me, no not the taking off the ground. One Federal Reserve, and that more

scription of a monetary policy. Today, of these knives is worth all this heap.” closely conforms with the word’s

inflation is synonymous with a rise in —Daniel Defoe (1719) original meaning.

prices, and its connection to money is Robinson Crusoe

often overlooked.

The classical economists, by which I

Consider the opening quotations, taken refer to the generation writing around the

from Federal Reserve Bulletins spanning time that Adam Smith’s The Wealth of

a period of almost 60 years. The first de- Nations was published in 1776, were

fines inflation as a condition of the cur- very exact in defining economic terms,

rency, while the latter makes no reference because they were constructing a lan-

to money. Indeed, it would seem that in guage on which an emerging science was

1978, inflation was about many things being built. Among their first contribu-

other than excessive money growth. tions was to make explicit the distinction

between “real” and “nominal” prices.

This Economic Commentary considers

the origin and uses of the word inflation A good’s real price, or value, was defined

and argues that its definition was a casu- as the effort required to produce it, while

alty in the theoretical battle over the con- its nominal, or money, price was said to

nection between money growth and the be its cost in money alone (fixed in terms

general price level. What was once a of gold or some other precious metal).

word that described a monetary cause According to this view, the value of

now describes a price outcome. This goods is anchored by the laws of nature

shift in meaning has complicated the —the effort of labor—but their nominal

position of anti-inflation advocates. As a price fluctuates with the availability of

condition of the money stock, an inflat- the precious metal, and the laws of the

ing currency has but one origin—the sovereign, that define a nation’s money.

ISSN 0428-1276

The real price of everything…is the expanded the number of continental the predictable effect of propping up the

toil and trouble of acquiring it. The bills of credit more than 40-fold, and, “value” of Greenback dollars, or driving

same real price is always of the same to make matters worse, the states had down the Greenback price of goods.

value; but on account of the variations issued their own paper monies in a simi-

in the value of gold and silver, the same lar magnitude.5 In 1781, a dollar in Restoring the purchasing power of

nominal price is sometimes of very paper was worth less than two cents in Greenbacks worked in favor of creditors,

different values. gold coin.6 since it meant they would be repaid in a

—Adam Smith (1776)1 currency that had greater purchasing

By the early nineteenth century, econo- power than would otherwise have been

Although the classical economists sup- mists were careful to distinguish among the case. But of course, what worked to

posed that fluctuations in the money three sources of a change in the “cost” of the advantage of creditors worked to the

price of goods can have temporarily dis- goods—changes in value, referring to disadvantage of debtors, who found their

ruptive influences on the economy (such the real resource cost of a good, changes dollar liabilities rising in value. Debtor

as producing capricious redistributions in money prices, caused largely by fluc- groups, predominantly farmers, advo-

of wealth between parties bound by con- tuations in the metallic content of money, cated “inflating the Greenback” as a

tracts with fixed money prices), in the and depreciation of the currency, caused means of easing the debt burdens of bor-

end, these changes merely serve to alter by a change in the quantity of currency rowers and perhaps helping to redistrib-

the scale by which value is measured. relative to the metal that constitutes a ute income from the eastern to the west-

They do not alter values or have any nation’s money. The latter distinction ern constituencies. In the election of

long-term consequences. The idea that would become a focal point in American 1868, the Democratic party endorsed the

changes in the quantity of money affect political economy. “Ohio Idea,” which proposed that war

only the money price of goods, not their debts be repaid with Greenbacks unless

value, was championed by many of the ■ Inflation of the Currency otherwise stipulated.10 These predomi-

early classical economists, most notably The era between the mid-1830s and the nantly western Democrats became

David Hume. The theory was more rig- Civil War—a period economists refer to known as “Inflationists.”

orously developed in the early twentieth as the “free banking era”—saw a prolif-

century by American economist Irving eration of banks. Along with these in- Despite the election of Republican can-

Fisher, and has come to be known as the stitutions came “bank notes,” a private didate Ulysses S. Grant to the presi-

“quantity theory of money.” paper currency redeemable for a specific dency, Inflationist sentiment carried con-

amount of metal. That is, if the issuing siderable influence in Congress. The

If the history of commercial banking bank had it. At times, banks did not have movement was given further support by

belongs to the Italians and of central enough gold or silver to satisfy all of the Supreme Court decision of 1870,

banking to the British, that of paper their claims. Bank notes, like the public which reversed an earlier ruling and

money issued by a government belongs notes that preceded them, also tended to declared that the issuance of paper

indubitably to the Americans. depreciate. It is during this period that money as “legal tender” was constitu-

—John Kenneth Galbraith (1975) the word inflation begins to emerge tional. In 1874, Congress passed the

in the literature, not in reference to “Inflation Bill,” which provided for the

To these early economists, the word

something that happens to prices, but additional issuance of $14 million in

money almost always referred to a metal-

as something that happens to a paper Greenbacks. President Grant vetoed the

lic coin.2 But the first generation of

currency.7 measure and resumed bond redemption

economists following Adam Smith in the

in terms of coin.

nineteenth century was very interested in

The astonishing proportion between the

paper money, since this form of payment The idea that the government can “cre-

amount of paper circulation represent-

had become popular in the burgeoning ate value” by issuing a paper money

ing money, and the amount of specie

American colonies.3 The colonies of- and merely stating that it is of value is

actually in the Banks, during the past

fered a large variety of paper currencies, in direct conflict with the quantity theo-

few years, has been a matter of serious

virtually all of which were conspicuous ry of money— and it was a subject of

concern … [This] inflation of the cur-

by their “overproduction” and their sub- considerable scorn (as the Thomas Nast

rency makes prices rise.8

sequent rapid loss of purchasing power. cartoon reprinted on page 3 so perfectly

—From the Bee (1855) 9

illustrates).

The Continental Congress issued a paper During the Civil War, both the federal

note to help finance the American Revo- and the confederate governments issued ■ Price Inflation

lution, and these “bills of credit” became paper currency to help finance expendi- The term inflation was initially used to

a circulating medium.4 In 1775, Con- tures. The federal government author- describe a change in the proportion of

gress issued $6 million of the new cur- ized the issue of $450 million of a paper currency in circulation relative to the

rency and urged the states to impose money called “Greenbacks,” and at amount of precious metal that consti-

taxes for its ultimate redemption. The war’s end, President Johnson authorized tuted a nation’s money. By the late nine-

taxes were never raised, however, and the Treasury to repay these notes with teenth century, however, the distinction

larger continental issues were author- gold. This reduced the outstanding between “currency” and “money” was

ized. By the end of 1779, Congress had Greenbacks by about 20 percent and had becoming blurred.

Many current controversies about infla-

tion are due not to conflicting ideas but

to conflicting uses of the same word.

When a nation has too much money, it is

said to have inflation: that is about as

near as we can come to an accepted def-

inition of the term. As to what constitutes

having too much money, there is not

agreement … If we use the term inflation

to denote any increase in the volume of

money that is accompanied by a rise in

the general price-level, we confine our-

selves to a definite and logical use of the

term, and one that directs attention at

once to the practical monetary problem

with which business is to-day chiefly

concerned.

—William Trufant Foster and

Waddill Catchings (1923)

Economists appear to have reached a

definitional crossroads during the first

several decades of the twentieth century.

Presumably, because they could be cer-

tain of the “excessiveness” of the circu-

lating medium only by its effect on the

price level, the notions of an inflated

currency and prices became inextricably

linked.

Consider the following quotations, from

works published by the same economist

at two different times during this period:

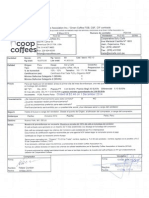

Milk tickets for babies, in place of milk

…inflation occurs when, at a given price

Illustration by Thomas Nast for David A. Wells, Robinson Crusoe’s Money; or the Remarkable level, a country’s circulating media —

Financial Fortunes and Misfortunes of a Remote Island Community, New York: Harper and

Brothers, 1876, p. 97. cash and deposit currency — increase

relatively to trade needs. (Emphasis in

original.)

—Edwin Walter Kemmerer (1918)

It has been rather the fashion with politi- At the turn of the century, economists

Inflation exists in a country whenever

cal economists to refuse the name Money tended to refer to any circulating medium

the supply of money and of [circulating]

to any medium of exchange which is not as money, and any change in the circulat-

bank deposits…increases, relatively

“a material recompense or equivalent.” ing medium relative to trade needs as an

to the demand for media of exchange,

…For myself, I can see no valid objec- inflation of money. But this shift in

in such a way as to bring about a rise

tion to the scientific acceptance of the meaning introduced another problem.

in the general price level. (Emphasis

popular term, Paper Money. The pres- Although it is easy to determine the

added.)

ence of the word paper so far qualifies amount of currency relative to the stock

—Edwin Walter Kemmerer (1934)

and explains the word money, as to show of a precious metal, how does one know

that a material recompense or equivalent when the amount of the circulating

is not meant. medium exceeds “trade needs”?

—Francis A. Walker (1883)

In the earlier definition, inflation is Linking inflation to the price level ■ Conclusion

something that happens to the circulat- proved to be another important turning “That’s a great deal to make one word

ing media at a given price level; in the point for the word. With the publication mean,” Alice said in a thoughtful tone.

later definition, an inflating currency is of John Maynard Keynes’ General “When I make a word do a lot of work

defined to exist when it produces a rise Theory in 1936, an assault on the quan- like that,” said Humpty Dumpty, “I

in the general price level, as suggested tity theory of money commenced, and it always pay it extra.”

by the quantity theory. What originally dominated macroeconomic thought for —Lewis Carroll (1872)

described a monetary cause came to de- the next 40 years. By appealing to the Through the Looking Glass

scribe a price effect. belief that resources could be regularly Inflation, a term that first referred to

and persistently underemployed—an a condition of the currency and later

To the quantity theorists, this shift in idea given support by the worldwide to a condition of money, is now com-

emphasis may have had little direct con- depression of the time—Keynesian monly used to describe prices. This shift

sequence, since it is unlikely they could theory challenged the necessary con- in meaning seems to have originated in

have seen an important distinction nection between the quantity of money an unfortunate—but perhaps inevitable

between these two ideas. Of course, and the general price level. Moreover, —sequence of events. By referring to

increasing the quantity of currency rela- it suggested that aggregate price in- inflation as a condition of “too much

tive to “trade needs” could have but one creases could originate from factors money,” economists were forced to

effect—to make prices rise. And a ris- other than money. struggle with the operational issue of

ing price level could have but one ori-

“how much is too much?” The quantity

gin—an increase in the quantity of In addition to separating the price level

theory offered a clear answer to that

money relative to its demand! from the money stock, the Keynesian

question: Too much money is an in-

revolution in economics appears to have

Still, some economists attempted to crease in the money stock that is accom-

separated the word inflation from a con-

maintain the distinction between a rise panied by a rise in the general price

dition of money and redefined it as a

in the price level that originated from level. In other words, an inflated money

description of prices. In this way, infla-

the “creation” of additional currency supply will reveal itself through its

tion became synonymous with any price

relative to trade, and one that resulted effect on the price level. When Keynes-

increase. Indeed, Keynes spoke about

from a decrease in trade for a given sup- ian economic theory challenged the

different “types” of inflation, including

ply of money. It was the former, not the direct link between money and the price

income, profit, commodity, and capital

latter, that caused problems for econo- level, inflation lost its association with

inflation. Today, little distinction is made

mies whose trade was conducted via money and came to be chiefly under-

between a price increase and inflation,

paper money. stood as a condition of prices.

and we commonly hear reports of ener-

gy inflation, medical care inflation, and Without being tied to the money supply,

Just as we can increase the size of a even wage inflation. Some go so far as any price increase seems to have an

balloon either by pumping in more air, to argue that the monetary definition equal claim to the word inflation. In-

or by decreasing the outside pressures, forces the word to take on too specific deed, today we regularly read reports of

…we can increase prices either by a meaning: a seemingly endless variety of “infla-

pumping more dollars into the monetary

tions.” When the word is used as a

circulation, or by decreasing the pres- Even if we agree that an inflationary sit- description of the price level, an anti-

sure of the work that money has to per- uation is to be taken to imply something inflation policy can easily be character-

form. It seems best, however, not to about prices, precise definitions vary … ized as being against any price increase,

extend the term inflation to cover fail- Part of the difficulty here is that defini- including higher wages! This is simply

ures to reduce the money in circulation tions of the more popular variety such not the case. An anti-inflation strategy is

when prices begin to rise. Such an as “too much money chasing too few concerned with a particular type of price

extension of the use of the term would goods,” not only purport to define infla- increase—a rise in the general price

be at variance with its derivation, and tion, but also imply something more level stemming from excessive money

would, moreover, leave the term less about particular inflationary processes. creation. When viewed in this light—

definitely applicable to the actual, cur- —R. J. Ball (1964) the light provided by the word’s original

rent monetary problems of the world.

meaning—a zero-inflation objective for

—William Trufant Foster and the central bank becomes a much more

Waddill Catchings (1923)11

sensible goal.

■ Footnotes 8. This is the earliest reference to inflation

1. The idea that value is fixed by labor in the Federal Reserve Bank of Cleveland’s

effort, called the “labor theory of value,” is library. The Oxford English Dictionary

Michael F. Bryan is an assistant vice presi-

now generally discredited by economists. shows the earliest reference to be from D.D.

Barnard (1838): “The property pledge can dent and economist at the Federal Reserve

Still, we make clear distinctions between a

good’s real cost and its money cost. have no tendency whatever to prevent an Bank of Cleveland. The author would like to

inflation of the currency.” acknowledge Jim Damask and J. Huston

2. Western economists of the time were cer- McCulloch for providing some early refer-

tainly aware of paper money. Chinese notes 9. Gold and the Currency: Specie Better

ences. He also thanks David Altig, Joseph

called “chao” were known to have been used than Small Bills, Boston: Evans and

Plumber, 1855. Haubrich, and Peter Rupert for helpful com-

as early as the ninth century (they were also

said to have depreciated rapidly in value). ments and suggestions.

10. However, “sound money man” Horatio The views stated herein are those of the

3. A common lament in the New World was Seymour, the reluctant Democratic candi- author and not necessarily those of the Fed-

that paper money was necessary because of a date for the presidency in 1868, is said to

eral Reserve Bank of Cleveland or of the

lack of metallic coins. have indicated that if elected, he would not

support the plan. Board of Governors of the Federal Reserve

4. Some historians note that the decision to System.

issue continental currency was made in the 11. Similar in spirit are the following:

conventions that occurred prior to the estab- Economic Commentary is available elec-

lishment of the Continental Congress. … we must distinguish between inflation and tronically through the Cleveland Fed’s site on

the rise in prices. The one is not necessarily

the World Wide Web: http://www.clev.frb.org.

5. See Charles J. Bullock, Essays on the synonymous with the other … An alteration

Monetary History of the United States, New We also offer a free online subscription serv-

in the general price level accordingly means

York: Macmillan, 1990, pp. 64–5. a change in the relation between goods on ice to notify readers of additions to our Web

the one hand and money on the other. Obvi- site. To subscribe, please send an email mes-

6. The French also issued a paper money— ously, however, such a change in the relation sage to econpubs-on@clev.frb.org.

“assignats”—around the time of their Revo- may be ascribable, in its origin, to either of

lution, with a similar result: They, too,

the two elements, the goods or the money.

rapidly lost their purchasing power. The

French experience with paper money gave —Edwin R.A. Seligman (1921)

rise to the saying, “After the paper money

Either the rise in prices might be due to the

machine comes the guillotine.”

scarcity of goods or it might be due to the

7. Bank notes were taxed out of existence superabundance of money, but as a matter of

by an act of Congress in 1865. actual historical fact it is, so far as I know,

universally true … that it is the change in the

money that makes the changes in the value of

the money, and not changes in the goods.

—Irving Fisher (1923)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- NIH Image Fractal Macro For Computing Surface Fractal Parameters.Document9 pagesNIH Image Fractal Macro For Computing Surface Fractal Parameters.PaoloNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hurst MDocument2 pagesHurst MPaoloNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- 16.2000.EJP391 Ondansetron modulates pharmacodynamic effects of ketamine on electrocardiographic signals in rhesus monkeys. Authors: DePetrillo PB, Bennett AJ, Speers d'A, Sumi S, Shoaf SE, Karimullah K, Higley JDDocument7 pages16.2000.EJP391 Ondansetron modulates pharmacodynamic effects of ketamine on electrocardiographic signals in rhesus monkeys. Authors: DePetrillo PB, Bennett AJ, Speers d'A, Sumi S, Shoaf SE, Karimullah K, Higley JDPaoloNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- 25.2003.AA38 Serotonin Tansporter Polymorphism and Differences in Alcohol Consumption in A College Student Population. Authors: Herman AI, Philbeck JW, Vasilopoulos NL, DePetrillo PBDocument5 pages25.2003.AA38 Serotonin Tansporter Polymorphism and Differences in Alcohol Consumption in A College Student Population. Authors: Herman AI, Philbeck JW, Vasilopoulos NL, DePetrillo PBPaoloNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- 09.1993.CBR26 Derivation of A Scale-Independent Parameter Which Characterizes Genetic Sequence Comparisons. Authors: Paolo B. DePetrillo and Atul J. ButteDocument24 pages09.1993.CBR26 Derivation of A Scale-Independent Parameter Which Characterizes Genetic Sequence Comparisons. Authors: Paolo B. DePetrillo and Atul J. ButtePaoloNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Inhibition of Rat PC12 Cell Calpain Activity by Glutathione, Oxidized Glutathione and Nitric OxideDocument4 pagesInhibition of Rat PC12 Cell Calpain Activity by Glutathione, Oxidized Glutathione and Nitric OxidePaoloNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- 27.AJMG133B Serotonin transporter promoter polymorphism and monoamine oxidase type A VNTR allelic variants together influence alcohol binge drinking risk in young women. Authors: Herman AI, Kaiss KM, Ma R, Philbeck JW, Hasan A, Dasti H, DePetrillo PBDocument5 pages27.AJMG133B Serotonin transporter promoter polymorphism and monoamine oxidase type A VNTR allelic variants together influence alcohol binge drinking risk in young women. Authors: Herman AI, Kaiss KM, Ma R, Philbeck JW, Hasan A, Dasti H, DePetrillo PBPaoloNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- 20.2001.EJP433 Initial Alcohol Exposure Results in Decreased Heart Rate Variability in Ethanol-Naive Rhesus Monkeys. Authors: Bennett AJ, Sponberg AC, Graham T, Suomi SJ, Higley JD, DePetrillo PBDocument4 pages20.2001.EJP433 Initial Alcohol Exposure Results in Decreased Heart Rate Variability in Ethanol-Naive Rhesus Monkeys. Authors: Bennett AJ, Sponberg AC, Graham T, Suomi SJ, Higley JD, DePetrillo PBPaolo100% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- 21.2002.BP63 Ritonavir Inhibition of Calcium-Activated Neutral Proteases. Authors: Wenshuai Wan, Paolo B. DePetrilloDocument4 pages21.2002.BP63 Ritonavir Inhibition of Calcium-Activated Neutral Proteases. Authors: Wenshuai Wan, Paolo B. DePetrilloPaoloNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 18.2001.EJP427 The Time-Course of Electrocardiographic Interbeat Interval Dynamics in Alcoholic Subjects After Short-Term Abstinence. Authors: Karimullah K, George DT, DePetrillo PBDocument7 pages18.2001.EJP427 The Time-Course of Electrocardiographic Interbeat Interval Dynamics in Alcoholic Subjects After Short-Term Abstinence. Authors: Karimullah K, George DT, DePetrillo PBPaoloNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- 15.1999.CBM29 Determining The Hurst Exponent of Fractal Time Series and Its Application To Electrocardiographic Analysis. Authors: DePetrillo PB, Speers D'a, Ruttiman UEDocument14 pages15.1999.CBM29 Determining The Hurst Exponent of Fractal Time Series and Its Application To Electrocardiographic Analysis. Authors: DePetrillo PB, Speers D'a, Ruttiman UEPaoloNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Dynamics of Energy Systems and The Logistic Substitution Model - Marchetti and Nakicenovic (Part 2 of 2)Document38 pagesThe Dynamics of Energy Systems and The Logistic Substitution Model - Marchetti and Nakicenovic (Part 2 of 2)PaoloNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- 17.2000.JNM103 Surface fractal computation and its application to immunofluorescent histochemical studies of calpain and calpastatin in PC12 cells. Authors: DePetrillo PB, Yang Q, Rackoff J, SanMiguel A, Karimullah K.Document7 pages17.2000.JNM103 Surface fractal computation and its application to immunofluorescent histochemical studies of calpain and calpastatin in PC12 cells. Authors: DePetrillo PB, Yang Q, Rackoff J, SanMiguel A, Karimullah K.PaoloNo ratings yet

- The Dynamics of Energy Systems and The Logistic Substitution Model - Marchetti and Nakicenovic (Part 1 of 2)Document44 pagesThe Dynamics of Energy Systems and The Logistic Substitution Model - Marchetti and Nakicenovic (Part 1 of 2)PaoloNo ratings yet

- 14.1999.ACER23 Effects of Alcohol Use and Gender On The Dynamics of EKG Time-Series Data. Authors: DePetrillo PB, White KV, Liu M, Hommer D, Goldman DDocument6 pages14.1999.ACER23 Effects of Alcohol Use and Gender On The Dynamics of EKG Time-Series Data. Authors: DePetrillo PB, White KV, Liu M, Hommer D, Goldman DPaoloNo ratings yet

- Society As A Learning System - Cesare MarchettiDocument17 pagesSociety As A Learning System - Cesare MarchettiPaoloNo ratings yet

- Applications of Monte Carlo/Quasi-Monte Carlo Methods in Finance: Option PricingDocument12 pagesApplications of Monte Carlo/Quasi-Monte Carlo Methods in Finance: Option PricingPaolo100% (2)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Transdisciplinary Unifying Implications of Circadian Findings in The 1950sDocument61 pagesTransdisciplinary Unifying Implications of Circadian Findings in The 1950sPaolo100% (2)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Pricing Complex Options Using A Simple Monte Carlo SimulationDocument7 pagesPricing Complex Options Using A Simple Monte Carlo SimulationPaolo100% (2)

- Evidence of Fueling of The 2000 New Economy Bubble by Foreign Capital Inflow: Implications For The Future of The US Economy and Its Stock MarketDocument41 pagesEvidence of Fueling of The 2000 New Economy Bubble by Foreign Capital Inflow: Implications For The Future of The US Economy and Its Stock MarketPaolo100% (2)

- Are Investors Moonstruck? Lunar Phases and Stock ReturnsDocument44 pagesAre Investors Moonstruck? Lunar Phases and Stock ReturnsPaolo100% (2)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- 10 12: A Check On The Earth-Carrying Capacity of ManDocument11 pages10 12: A Check On The Earth-Carrying Capacity of ManPaolo67% (3)

- Global Cooling Is HereDocument10 pagesGlobal Cooling Is HerePaoloNo ratings yet

- A Garret Lisi - An Exceptionally Simple Theory of EverythingDocument31 pagesA Garret Lisi - An Exceptionally Simple Theory of Everythingmicropat100% (4)

- The Coming Kondratieff Crash - Rent-Seeking, Income Distribution & The Business CycleDocument9 pagesThe Coming Kondratieff Crash - Rent-Seeking, Income Distribution & The Business CyclePaolo100% (2)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Behavior of Gold Under InflationDocument23 pagesBehavior of Gold Under InflationPaolo100% (2)

- Claim Form For InsuranceDocument3 pagesClaim Form For InsuranceSai PradeepNo ratings yet

- Google SWOT 2013Document4 pagesGoogle SWOT 2013Galih Eka PutraNo ratings yet

- 1-Loanee Declaration PMFBYDocument2 pages1-Loanee Declaration PMFBYNalliah PrabakaranNo ratings yet

- Notices, Circulars and MemoDocument11 pagesNotices, Circulars and MemoSaloni doshiNo ratings yet

- Customer Profitability in A Manufacturing Firm Bizzan ManufactuDocument2 pagesCustomer Profitability in A Manufacturing Firm Bizzan Manufactutrilocksp SinghNo ratings yet

- I Ifma FMP PM ToDocument3 pagesI Ifma FMP PM TostranfirNo ratings yet

- 01-9 QCS 2014Document8 pages01-9 QCS 2014Raja Ahmed HassanNo ratings yet

- PsychographicsDocument12 pagesPsychographicsirenek100% (2)

- H4 Swing SetupDocument19 pagesH4 Swing SetupEric Woon Kim ThakNo ratings yet

- Supply Chain Management: Session 1: Part 1Document8 pagesSupply Chain Management: Session 1: Part 1Safijo AlphonsNo ratings yet

- TVSM 2004 2005 1ST InterimDocument232 pagesTVSM 2004 2005 1ST InterimMITCONNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Max232 DatasheetDocument9 pagesMax232 DatasheetprincebahariNo ratings yet

- TCS Connected Universe Platform - 060918Document4 pagesTCS Connected Universe Platform - 060918abhishek tripathyNo ratings yet

- Competitive Shopping AssignmentDocument5 pagesCompetitive Shopping Assignmentapi-456889565No ratings yet

- Βιογραφικά ΟμιλητώνDocument33 pagesΒιογραφικά ΟμιλητώνANDREASNo ratings yet

- Article. IFRS 15Document66 pagesArticle. IFRS 15Anonymous JqimV1ENo ratings yet

- Allen Solly (Retail Managemant Project Phase 1) (Chandrakumar 1501009)Document9 pagesAllen Solly (Retail Managemant Project Phase 1) (Chandrakumar 1501009)Chandra KumarNo ratings yet

- New Ideas, Technologies To Support "Build, Build, Build": Position PaperDocument8 pagesNew Ideas, Technologies To Support "Build, Build, Build": Position PaperCloudKielGuiangNo ratings yet

- IQA QuestionsDocument8 pagesIQA QuestionsProf C.S.PurushothamanNo ratings yet

- A Casestudy On Sap BW Aspects in Divestiture Project of A Large Automotive CustomerDocument11 pagesA Casestudy On Sap BW Aspects in Divestiture Project of A Large Automotive CustomerBryan AdamsNo ratings yet

- QMS PrinciplesDocument5 pagesQMS PrinciplesShankar AsrNo ratings yet

- Gestion de La Calidad HoqDocument8 pagesGestion de La Calidad HoqLuisa AngelNo ratings yet

- PEA144Document4 pagesPEA144coffeepathNo ratings yet

- Econ 201 MicroeconomicsDocument19 pagesEcon 201 MicroeconomicsSam Yang SunNo ratings yet

- ABCDocument18 pagesABCRohit VarmaNo ratings yet

- Expertise in trade finance sales and distributionDocument4 pagesExpertise in trade finance sales and distributionGabriella Njoto WidjajaNo ratings yet

- Green Supply Chain Management PDFDocument18 pagesGreen Supply Chain Management PDFMaazNo ratings yet

- Ghuirani Syabellail Shahiffa/170810301082/Class X document analysisDocument2 pagesGhuirani Syabellail Shahiffa/170810301082/Class X document analysisghuirani syabellailNo ratings yet

- Resilia OverviewDocument25 pagesResilia OverviewNoor Kareem100% (1)

- Manage Greenbelt Condo UnitDocument2 pagesManage Greenbelt Condo UnitHarlyne CasimiroNo ratings yet